Unlock the secret to successful investing with our Investment Trading Journal Form guide. This comprehensive toolkit, enriched with practical examples, empowers investors to meticulously track trades, reflect on decisions, and refine strategies. Integrating Journal Form insights and the precision of an Investment Proposal Form, our guide is your blueprint to navigate the complexities of the market, ensuring informed, data-driven investment choices.

Download Investment Trading Journal Form Bundle

What is Investment Trading Journal Form? – Meaning

An Investment Trading Journal Form is a crucial tool for investors, designed to systematically record and analyze each trade. It helps in identifying profitable strategies, understanding market trends, and improving decision-making. Simple yet powerful, it’s akin to maintaining a Cash Receipt Journal Form, where every entry and its impact on the overall portfolio are carefully noted, providing a clear path to refine investment approaches and enhance financial outcomes.

What is the best Sample Investment Trading Journal Forms?

Investment Trading Journal

Date: _______________________

Trader Name: _______________________

Trade Number: _______________________

Trade Information

- Asset/Instrument: _______________________

- Market (e.g., Stock, Forex, Crypto): _______________________

- Buy/Sell: _______________________

- Entry Price: _______________________

- Exit Price: _______________________

- Volume/Quantity: _______________________

- Trade Type (e.g., Day Trade, Swing Trade): _______________________

Financials

- Gross Profit/Loss: _______________________

- Commissions/Fees: _______________________

- Net Profit/Loss: _______________________

Trade Setup

- Reason for Entry (e.g., Technical Analysis, News, Tip):

- Pre-Trade Analysis (e.g., Charts, Indicators Used):

- Risk/Reward Ratio: _______________________

- Stop Loss/Take Profit Levels: _______________________

Post-Trade Review

- Outcome (Profit/Loss): _______________________

- Trade Execution Review (Timing, Price, Volume):

- Did the trade follow your strategy? (Yes/No): _______________________

- What worked well?

- What could be improved?

- Emotional State (e.g., Confident, Anxious):

Additional Notes

- Market Conditions: _______________________

- External Factors Influencing Trade (e.g., Economic News, Global Events):

- Lessons Learned/Key Takeaways:

Instructions for Use:

- Fill out the form after each trade.

- Be honest and detailed in your responses.

- Regularly review your journal entries to identify patterns and areas for improvement.

- Use this information to refine your trading strategy and decision-making process.

Investment Trading Journal Format

-

Title:

Investment Trading Journal

-

Section 1: Trader Identification

- Name:

- Email:

- Date:

-

Section 2: Trade Details

- Instrument:

- Buy/Sell:

- Date of Trade:

- Entry Price:

- Exit Price:

- Quantity:

- Profit/Loss:

-

Section 3: Analysis

- Strategy Overview:

- Reason for Trade:

- Trade Reflections:

- Future Improvements:

-

Confirmation and Sign-off:

- Trader Confirmation Checkbox

- Signature and Date

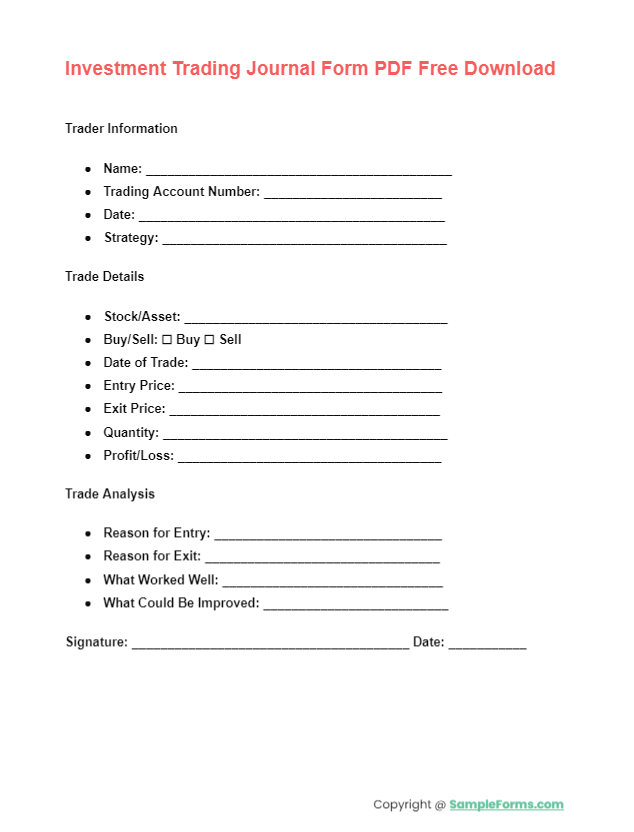

Investment Trading Journal Form PDF Free Download

Unlock your trading potential with our Investment Trading Journal Form PDF Free Download. This resource, akin to a Journal Review Form, helps investors systematically track and analyze their trades, fostering strategic decision-making and market insight. You may also see Property Feedback Form.

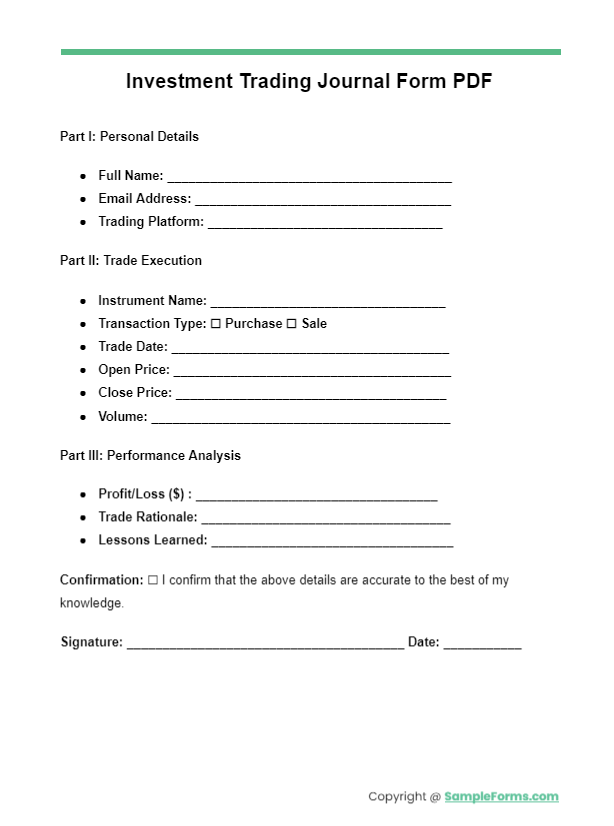

Investment Trading Journal Form PDF

The Investment Trading Journal Form PDF serves as an essential tool, similar to an Investment Agreement Form, for documenting investment strategies, trade outcomes, and market observations, enabling investors to refine their approaches for enhanced profitability. You may also see Property Evaluation Form.

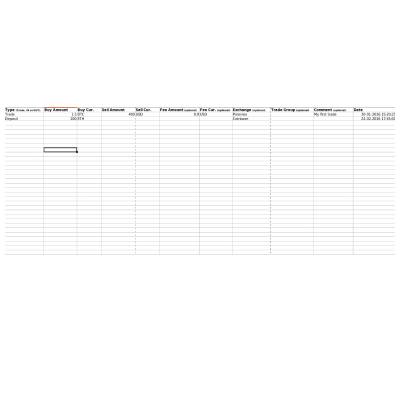

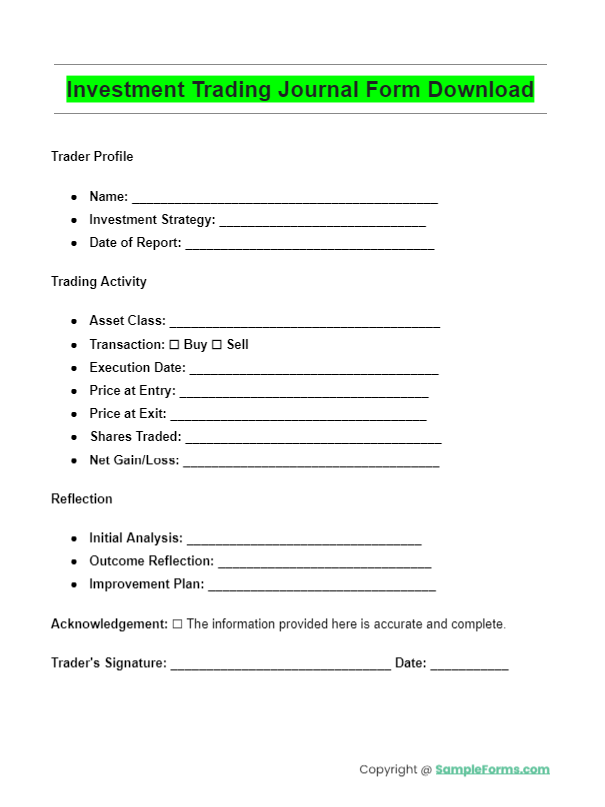

Investment Trading Journal Form Download

Start optimizing your trading strategy with our Investment Trading Journal Form Download. This digital tool, reflecting the structured approach of an Investment Proposal Form, assists in capturing key trading data, aiding in the continuous improvement of investment practices. You may also see Property Enquiry Form.

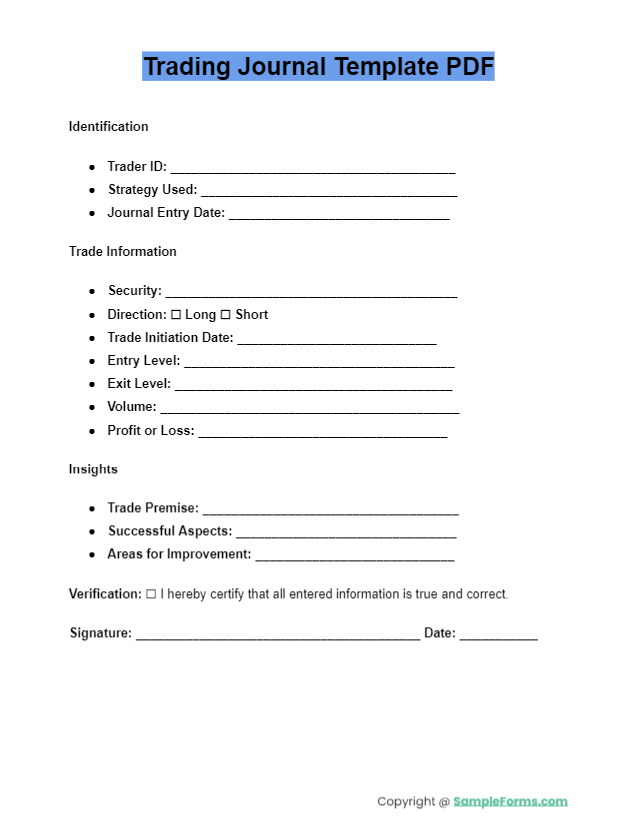

Trading Journal Template PDF

More Investment Trading Journal Form Samples

Stock Investment Trading Journal

Crypto Investment Trading Journal

Options Investment Trading Journal

Forex Investment Trading Journal

Bitcoin Investment Trading Journal

How do you Record a Trading Journal?

Recording a Trading Journal involves meticulous documentation of each trade to track performance and refine strategies. Start by:

- Choose Your Format: Whether a digital Business Form or traditional notebook, select a format that suits your trading style.

- Log Trade Details: For every trade, record the date, instrument, entry and exit points, reasons for the trade, and outcome.

- Reflect: Include a section for personal reflection, similar to a Business Evaluation Form, to jot down what worked, what didn’t, and why.

- Review Regularly: Set a schedule to review your journal, allowing you to adjust strategies based on past performances.

How do I make my own Trading Journal?

Creating your own Trading Journal can be a simple, personalized process:

- Decide on a Medium: Digital spreadsheets or physical journals are both great options. Consider incorporating elements from a Business Financial Statement Form for financial tracking.

- Determine Key Fields: Include essential information such as trade date, type, volume, entry/exit prices, and profit/loss.

- Add Analysis Sections: Implement areas for strategy notes and emotional responses to emulate a Property Information Form for detailed records.

- Customize for Needs: Tailor your journal to your trading approach, adding or removing fields as necessary.

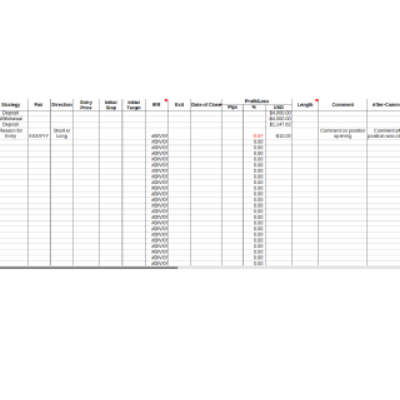

How do I make a Good Trading Journal in Excel?

Crafting a Good Trading Journal in Excel allows for detailed analysis and organization:

- Set Up Your Spreadsheet: Model your Excel journal on a Property Agreement Form structure, with clear sections for each trade’s details.

- Input Fields: Create columns for date, trade type, entry/exit points, strategy used, outcome, and notes on the trade’s execution and market conditions.

- Utilize Formulas: Like a Business Purchase Agreement Form, use Excel formulas to calculate profits, losses, and performance metrics automatically.

- Graphical Analysis: Incorporate charts and graphs to visually track your trading progress over time.

What does a Good Trading Journal Look Like?

A Good Trading Journal is comprehensive, structured, and reflective, akin to a thorough Restaurant Business Plan Form

- Organized Data: Clearly segmented sections for each trade, including strategy, outcome, and metrics.

- Analytical Insight: Not just numbers, but also personal insights, market analysis, and strategy evaluations.

- Continuous Learning: Areas for noting lessons learned, akin to feedback sections in a Property Statement Form, to facilitate growth.

- Performance Review: Summary sections to compile and review performance data periodically.

What is considered a Trade Journal?

A Trade Journal, similar in purpose to a Business Registration Form, is a detailed log used by traders to record and analyze all aspects of their trades:

- Documentation of Trades: It meticulously captures the specifics of each trade, including strategy, results, and market conditions.

- Strategic Analysis: Acts as a tool for reviewing strategies and adjusting them based on outcomes, much like revising a Business Agreement Form.

- Emotional Tracking: Includes reflections on the trader’s emotional state and its impact on trading decisions, facilitating personal and professional growth.

- Performance Metrics: Utilizes data from trades to measure success against goals, similar to evaluating properties using a Property Form.

Do you need a Trading Journal?

Yes, a Trading Journal is crucial for tracking your trading activities, analyzing decisions, and improving strategy over time, similar to maintaining a Business Proposal Form for clarity and direction.

How does a Trading Plan look like?

A Trading Plan outlines your strategies, risk management rules, and goals, structured similarly to a Business Consent Form, ensuring informed, disciplined trading decisions.

Is a Trade Journal a Journal?

Yes, a Trade Journal is a type of journal specifically designed for traders to record and analyze their trades, akin to a Business Declaration Form for transparency and self-assessment.

Why keep a Trading Journal?

Keeping a Trading Journal helps in refining strategies, tracking progress, and understanding market trends, acting as a Business Application Form does for evaluating and improving business processes.

Are Trade Journals Reliable?

Trade Journals are reliable as personal accountability tools for tracking trades and performance, but like any Business Partnership Agreement, their reliability depends on honest, accurate entries.

Does thinkorswim have a Trade Journal?

Thinkorswim does not have a built-in Trade Journal feature, but traders can use its extensive analysis tools to compile data for their own journals, complementing tools like a Business Partnership Agreement for strategic planning.

Related Posts

-

Balance Sheet Form

-

Accounts Receivable Ledger Form

-

FREE 5+ Petty Cash Register Samples in Excel | PDF

-

FREE 6+ Vendor Ledger Samples in PDF

-

Credit Debit Form

-

FREE 4+ Financial Audit Forms in PDF

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

Daily Cash Log

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF