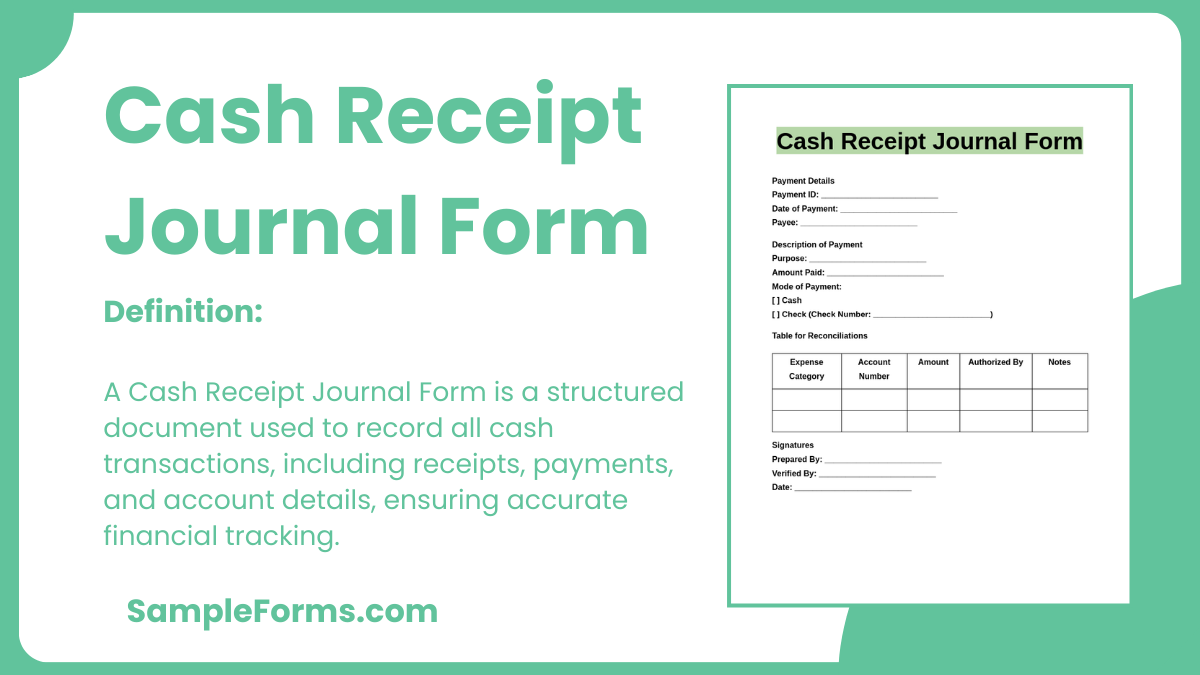

Managing financial transactions is crucial for any business. A Cash Receipt Journal Form is a structured tool for documenting incoming cash transactions. Combining elements of a Receipt Form and Journal Form, this form ensures accurate, organized, and transparent record-keeping. Whether for personal use or business accounting, these forms track payments, dates, and sources efficiently.

Download Cash Receipt Journal Form Bundle

What is Cash Receipt Journal Form?

A Cash Receipt Journal Form is a document designed to record incoming cash transactions in a structured and detailed manner. It typically includes sections for the payer’s details, amount, date, and purpose. The form aids in tracking payments efficiently while maintaining transparency in financial dealings. It is commonly used by businesses, accountants, and individuals for auditing and reporting purposes.

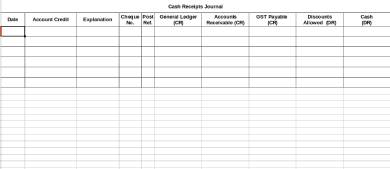

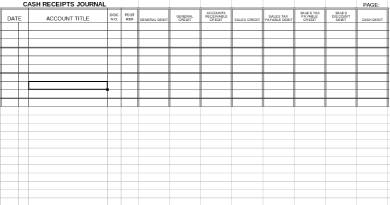

Cash Receipt Journal Format

Cash Receipt Details

Date of Transaction: __________________________

Receipt Number: __________________________

Payee Name: __________________________

Payment Purpose: __________________________

Amount Received: __________________________

Payment Mode

[ ] Cash

[ ] Check (Check Number: __________________________)

[ ] Bank Transfer (Reference Number: __________________________)

Account Allocation

Account Name: __________________________

Account Number: __________________________

Department/Branch: __________________________

Authorized Signatures

Received By (Name & Signature): __________________________

Verified By (Name & Signature): __________________________

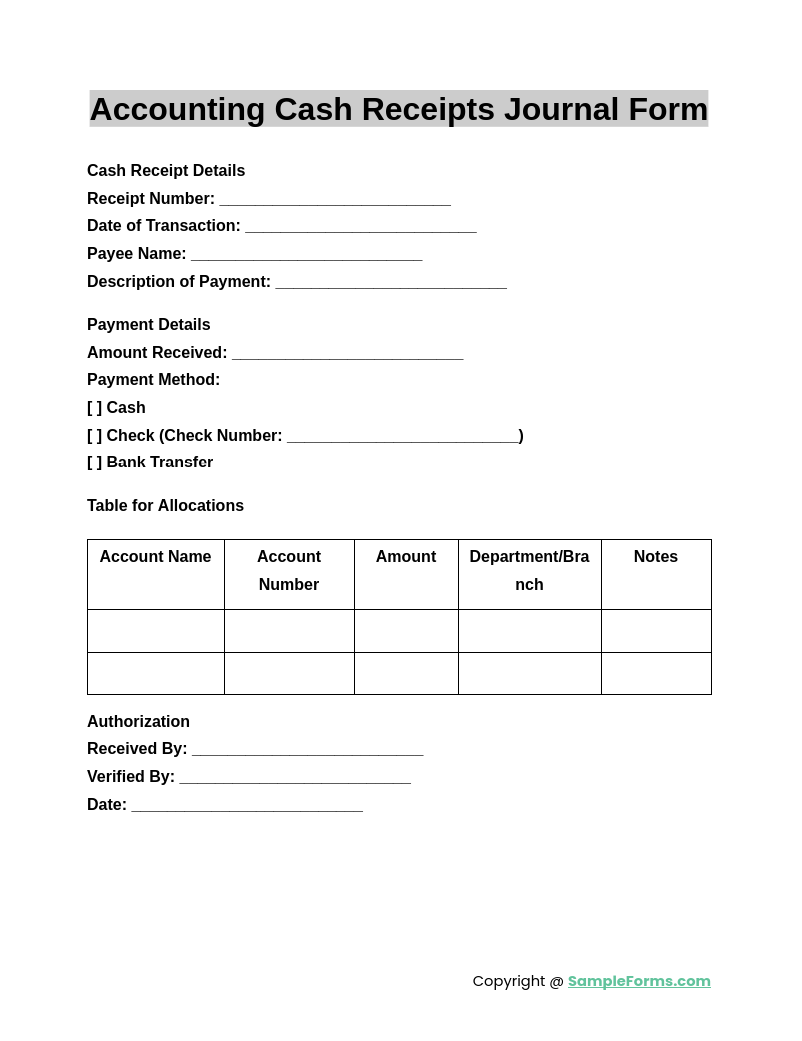

Accounting Cash Receipts Journal Form

An Accounting Cash Receipts Journal Form is essential for tracking all incoming payments in accounting. It consolidates transactions like customer payments, refunds, and deposits, ensuring accurate bookkeeping. Similar to a Payment Receipt Form, it captures the payer’s details, payment source, and date to maintain transparency in financial records.

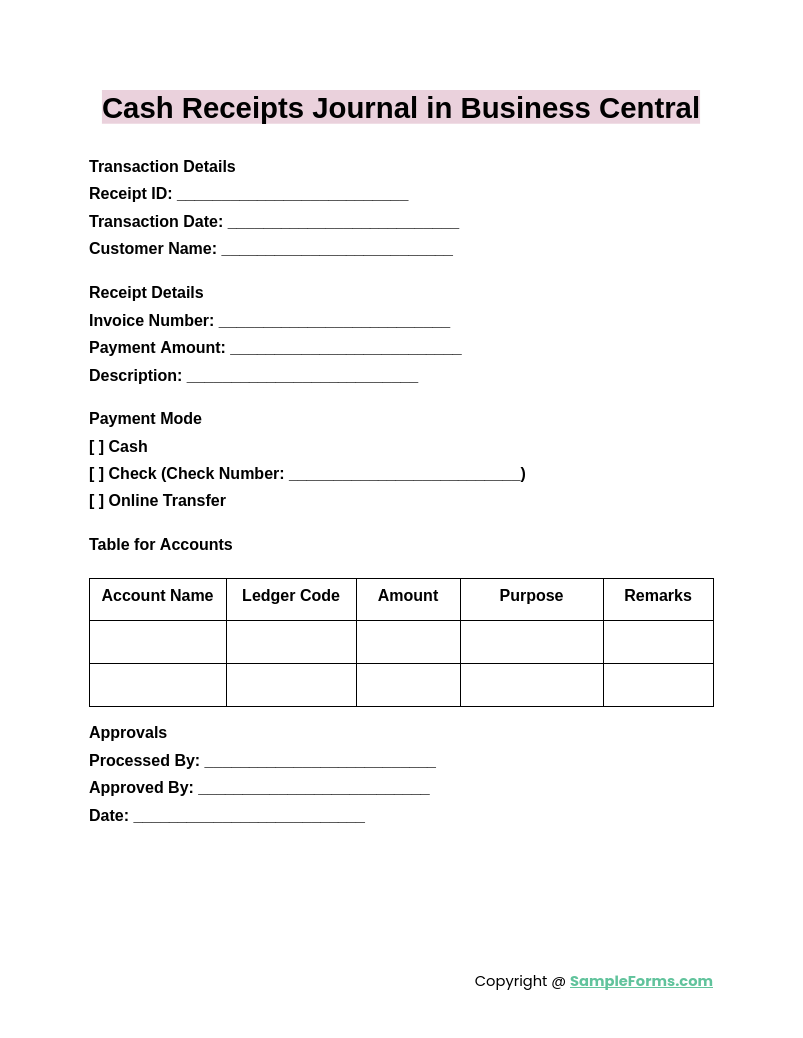

Cash Receipts Journal in Business Central

A Cash Receipts Journal in Business Central simplifies payment management within this software, providing a streamlined way to document cash transactions. It supports systematic reconciliation while functioning akin to a Restaurant Receipt Form, capturing customer payments for goods or services with clear itemized details.

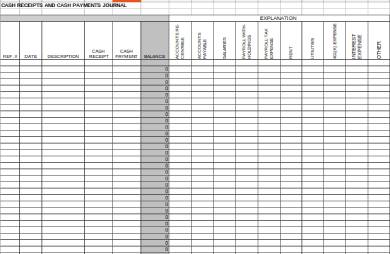

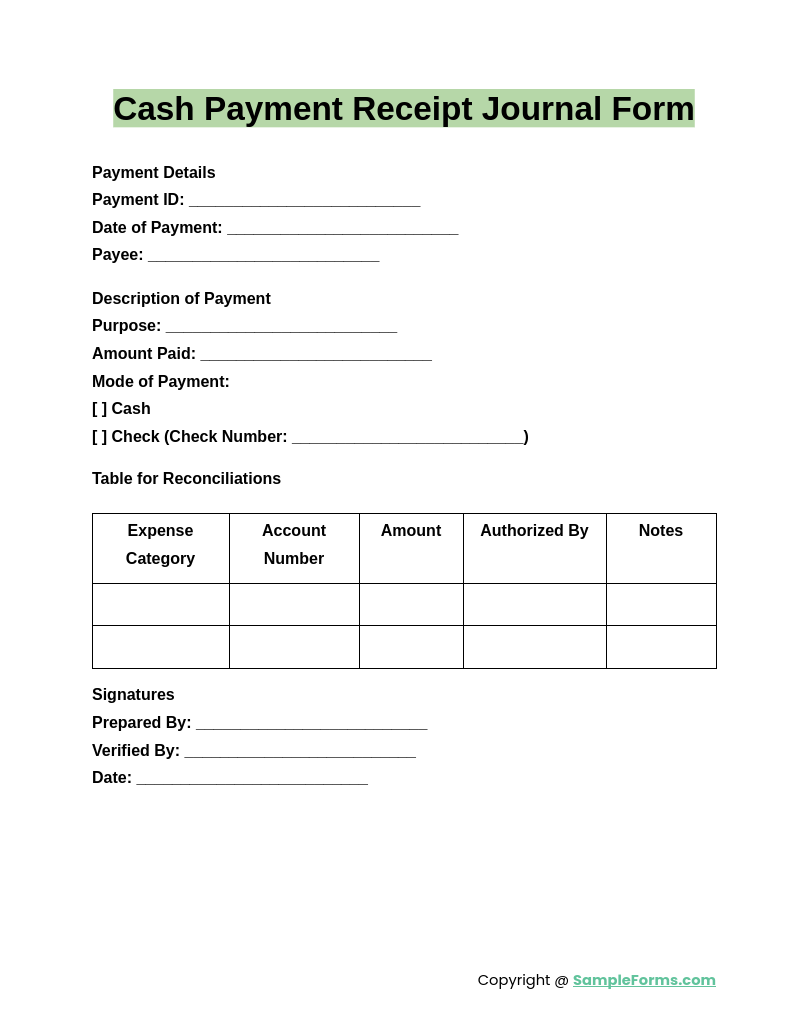

Cash Payment Receipt Journal Form

The Cash Payment Receipt Journal Form documents all cash inflows from payments received, ensuring clarity in cash management. Like a Rent Receipt Form, it records the payer, payment purpose, and amount, crucial for audits and compliance with financial reporting standards.

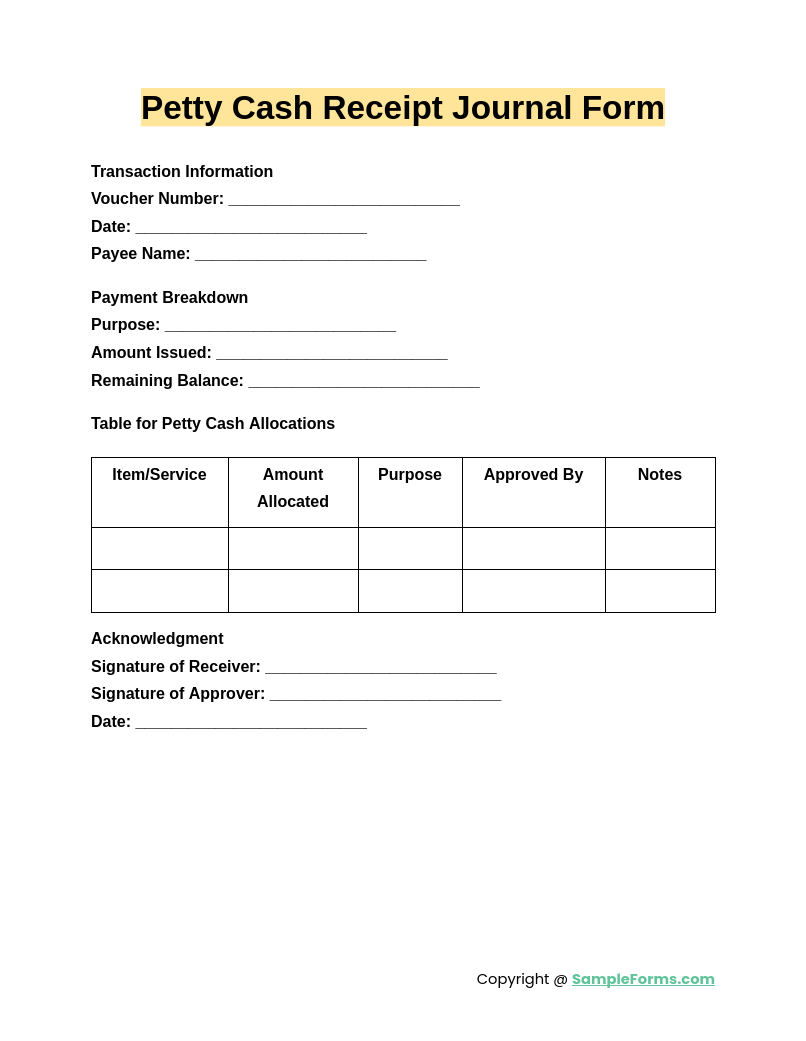

Petty Cash Receipt Journal Form

A Petty Cash Receipt Journal Form manages small, day-to-day cash expenses efficiently. This form provides a clear trail of minor transactions. Similar to a Hotel Receipt Form, it includes sections for payment reason, date, and amount, simplifying reimbursement and accountability.

Browse More Cash Receipts Journal Forms

1. Cash Receipts Journal Form Sample

2. Cash Receipts Journal Form Template

3. Cash Receipts Journal Entry Form Sample

4. Sample Journal for Cash Receipts

5. Cash Receipts and Disbursement Journal Form Sample

6. Template for Cash Receipts Journal Form

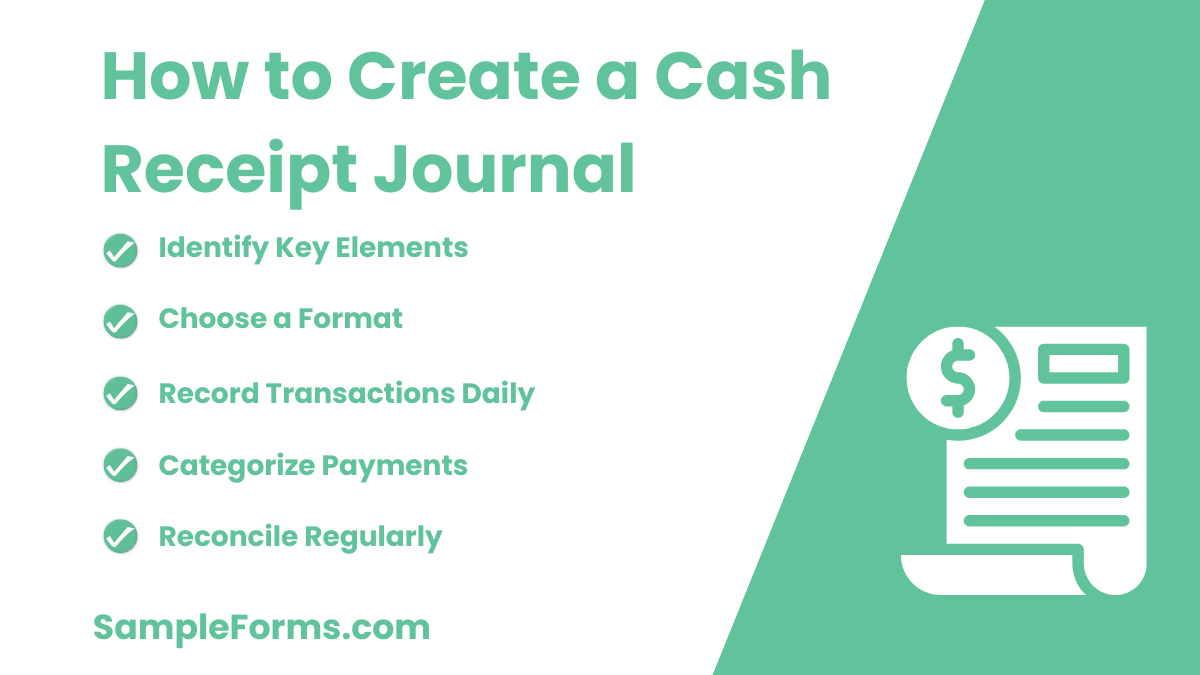

How do I create a cash receipts journal?

Creating a cash receipts journal ensures accurate tracking of incoming payments for better financial management. Follow these steps for a structured approach:

- Identify Key Elements: Include payer details, amount, payment date, and purpose, similar to a Cash Receipt Form layout.

- Choose a Format: Use digital tools or spreadsheets for easy data entry and tracking.

- Record Transactions Daily: Ensure all cash inflows are entered promptly to maintain accuracy.

- Categorize Payments: Differentiate between sales, donations, or other receipt types for better clarity.

- Reconcile Regularly: Cross-check the journal with bank statements for consistency and error detection.

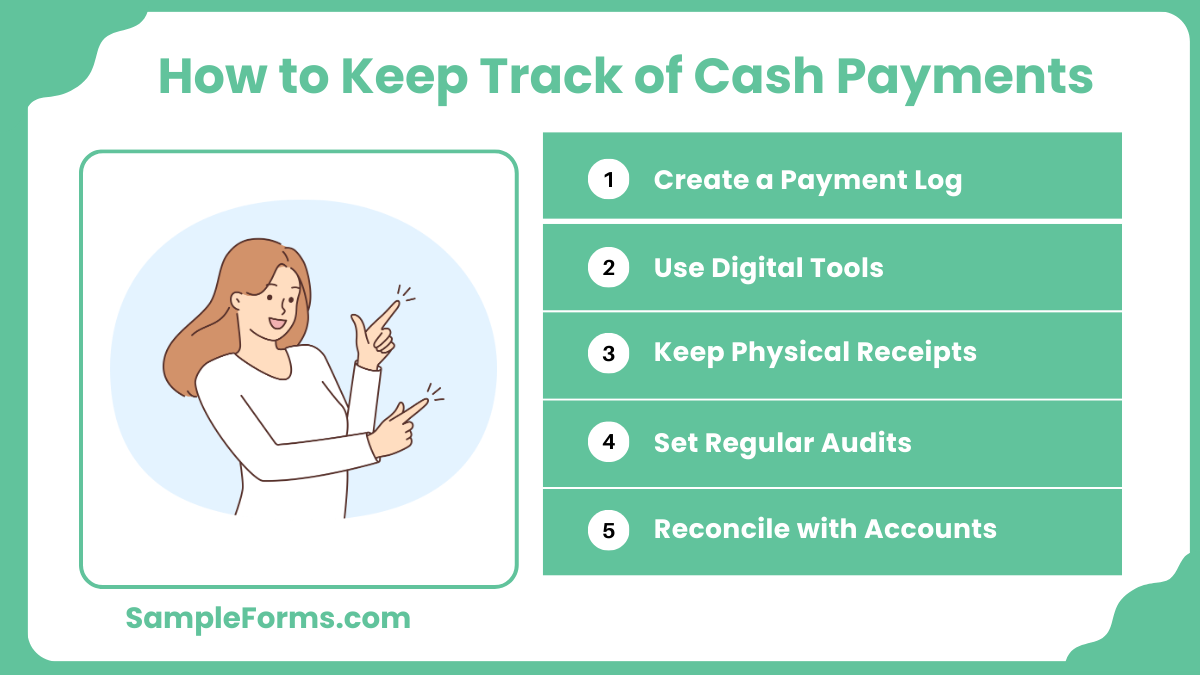

How to keep track of cash payments?

Keeping track of cash payments requires discipline and organization for effective cash flow management. Here’s how:

- Create a Payment Log: Document payment details, akin to a Sales Receipt Form.

- Use Digital Tools: Apps or software simplify tracking and data storage.

- Keep Physical Receipts: Retain copies for verification and auditing.

- Set Regular Audits: Periodic reviews ensure accuracy and compliance.

- Reconcile with Accounts: Align payment logs with overall financial records regularly.

How to do journal entries for beginners?

Journal entries are vital for accurate financial documentation. Beginners can follow these steps to master the basics:

- Understand Double-Entry Accounting: Know debit and credit rules, often reflected in a Purchase Receipt Form example.

- Start Simple: Begin with straightforward transactions to build confidence.

- Categorize Transactions: Separate into assets, liabilities, income, or expenses.

- Use Examples for Reference: Study common entries to understand the structure.

- Review Regularly: Ensure correctness by cross-checking with supporting documents.

How do you bullet journal if you can’t draw?

Bullet journaling without drawing focuses on functionality over aesthetics, making it accessible to everyone. Steps to create an effective journal:

- Use Minimalist Layouts: Simple grids or lists suffice, much like a Delivery Receipt Form design.

- Focus on Content: Highlight essential details instead of visual embellishments.

- Leverage Templates: Use pre-designed layouts available online.

- Prioritize Functionality: Structure the journal for usability, not appearance.

- Customize with Ease: Adjust layouts to fit your tracking or planning needs.

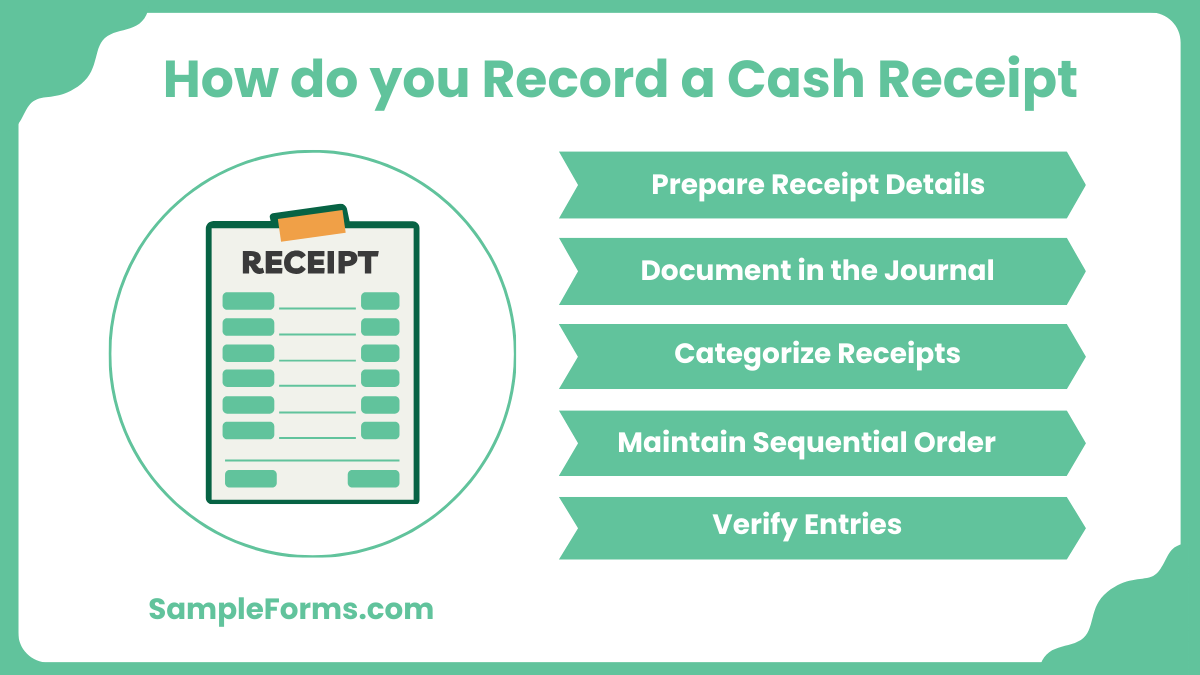

How do you record a cash receipt?

Recording a cash receipt involves systematic documentation to ensure all transactions are accounted for. The process includes:

- Prepare Receipt Details: Gather information like amount, payer, and purpose, mirroring a Donation Receipt Form.

- Document in the Journal: Enter the transaction in your cash receipts journal, including payment mode.

- Categorize Receipts: Assign categories like donations or sales for tracking purposes.

- Maintain Sequential Order: Ensure entries follow the transaction order to avoid confusion.

- Verify Entries: Regularly audit for discrepancies between journal and actual receipts.

What is the journal entry for cash receipts?

Cash receipts journal entries record cash inflows as debit to cash account and credit to the corresponding account. Referencing a Cash Receipt Form ensures accurate entry for audit purposes.

What are examples of cash receipts?

Examples of cash receipts include customer payments, interest income, and cash sales. Documenting them in a Receipt Book Form helps track all financial inflows effectively.

How do you enter a cash receipt?

Enter cash receipts in the journal by listing payer details, amount, and date. Referencing a Car Receipt Form streamlines this process for accuracy and completeness.

What is the journal entry for cash payment?

For cash payments, debit the expense account and credit cash account. Maintaining records in a Petty Cash Log ensures transparency in financial documentation.

Is a cash receipt the same as an account receivable?

No, a cash receipt is recorded upon payment, while accounts receivable reflect pending payments. Using a School Receipt Form confirms payments and avoids confusion.

Are cash receipts the same as revenue?

Cash receipts are actual inflows, while revenue includes earned amounts, whether paid or not. Tracking using a Contractor Receipt Form aids in clear financial distinction.

Which special journal is used to record only cash receipts?

A cash receipts journal exclusively records cash inflows. Reference tools like a Journal Review Form help ensure proper categorization and accuracy.

How to record cash receipts journal?

Record payee, amount, and receipt date in a structured journal. A Petty Cash Receipt Form can act as a reference for detailed entries.

Who signs a cash receipt?

Typically, the issuer or an authorized individual signs the cash receipt. Using an Asset Receipt Form ensures proper authorization and accountability.

How do you reconcile cash receipts?

Reconcile by matching journal entries with bank deposits and cash on hand. Tools like an Event Receipt Form assist in tracking discrepancies

The Investment Trading Journal Form complements various financial tracking tools like the Cash Receipt Journal Form. Together, they provide a comprehensive solution for documenting and analyzing transactions. Using this form ensures accurate record-keeping and simplifies reporting tasks. Incorporate it into your workflow to streamline financial management and maintain transparency in your accounts. Whether for personal finance or business transactions, the Cash Receipt Journal Form is an indispensable tool. Embrace its benefits today!

Related Posts

-

FREE 6+ Contribution Margin Forms in Excel

-

FREE 5+ Gross Profit Margin Forms in Excel

-

Balance Sheet Form

-

Accounts Receivable Ledger Form

-

FREE 6+ Vendor Ledger Samples in PDF

-

Credit Debit Form

-

FREE 4+ Financial Audit Forms in PDF

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF