Business people are competitive by nature, and so is the world that they live in. Competitiveness is heavily ingrained in each fiber of their existence. Thus, it is also hard for business people not to know how their business did periodically. For them to be able to do that, business people often look into their business’s net and gross profit margins. And because of their competitive nature, they often measure their business’s performance by comparing their recent gross profit margin with the previous one. Profit margins are always expressed comprehensively in percentage form.

What is a Gross Profit Margin Form?

A Gross Profit Margin Form is a form that computes and shows a business’s gross profit for the period. A Gross Profit Margin Form are also used in order to determine a business’s performance recently by comparing it with the previous gross profit percentage. Gross profit margin is computed by subtracting the cost of goods sold from the number of net sales and in turn, divided by the number of net sales itself. Gross Profit Margin Forms are also used in preparing an income statement and are also an integral part of the accounting process.

FREE 5+ Gross Profit Margin Forms in Excel

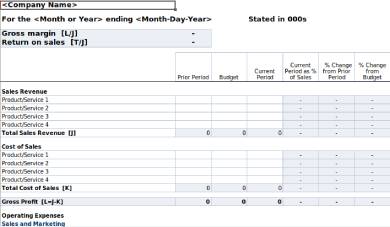

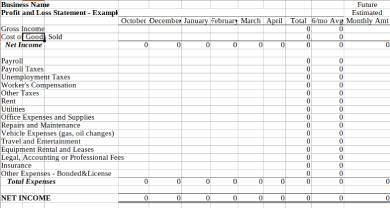

1. Yearly Gross Profit & Loss Statement Template

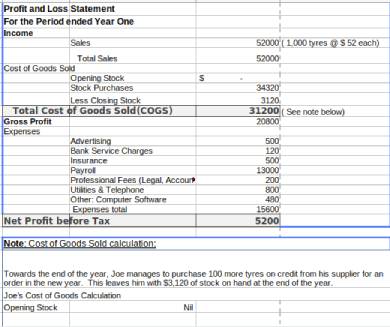

2. Generic Gross Profit and Loss Statement Form

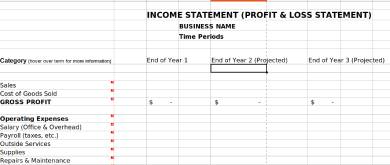

3. Periodic Gross Profit and Loss Statement Template

4. Gross Profit & Loss Statement Form

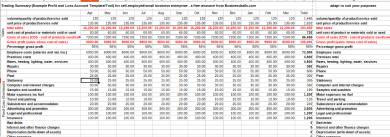

5. Sample Gross Profit & Loss Statement Form

6. Gross Profit & Loss Statement Form Sample

How to Compute the Gross Profit Margin

A financially healthy and well performing business is where business people derive their happiness from. That’s the main and only reason why they compute their business’s gross profit margin. Gross profit margins measures a business’s performance for a certain period. Gross profit margins are always expressed in percentage and profitability are determined by analyzing the constant rise or fall of the profit’s gross percentage. Before you can determine and analyze your business’s profitability, you must first learn how to compute your business’s gross profit margin. Gross profit computation follows this specific formula:

Gross Profit Margin = Net Sales – COGS (cost of goods sold) / Net Sales

To understand the components of the equation shown above, we will list down each components along with its respective definition below.

1. Net Sales

Net Sales are the amount of gross sales earned in a certain period minus the tax, allowance, and discounts. Net sales are earned by selling a business’s product or rendering the services they offer. Net sales are often reflected in sales reports from daily sales earned.

2. COGS (cost of goods sold)

COGS or the cost of goods sold are the direct or exworks cost of the goods sold by the manufacturer. This cost includes the cost of labor and materials used in producing the goods itself. COGS, however, exludes indirect expenses from distribution and salees force costs.

How to Make a Gross Profit Margin Form

Being the prudent businessman that you are, you are continually making sure that you know everything that’s going on in your business. Thus, you also want to be aware of how your business performs recently and how it will perform in the future. For you to do that, you periodically compute your Gross Profit Margins and compare it to the one your in-house accountant prepared. And since another accounting period is starting again, you also want to learn how to make a Gross Profit Margin Form of your own. Without further ado, listed down below are the steps on how to make a Gross Profit Margin Form.

Step 1. Gather Sales Receipts, Invoices, and Sales Reports

First, gather all the sales receipts, sales reports, and invoices from your sales records and files. Sales receipts, sales reports, and invoices contain all the information that you need in making your Gross Profit Margin Form. Make sure that each and every sales document is up to date.

Step 2. Choose a Gross Profit Margin Form Template

Secondly, Choose a Gross Profit Margin Form template from a wide selection of ready-made templates listed in this article. After choosing a ready-made Gross Profit Margin Form template, download the template to let you proceed in making a Gross Profit Margin Form right away. Making use of a ready-made template allows you to easily make a Gross Profit Margin Form quickly. Aside from a Gross Profit Margin Form, you may also want to download other financial forms for all your financial reporting needs.

Step 3. Edit the Gross Profit Margin Form Template

After choosing and downloading a Gross Profit Margin Form template from the list of samples in this article, proceed in editing the form right away. In editing the form, make sure to correctly type in the amount and figures in the corresponding rows and columns of the form itself. Also, use the equation provided by the preceding section for you to find the gross profit margin for the period. It is imperative that you complete the form as accurately as possible.

Step 4. Print the Finished Gross Profit Margin Form

After completely editing the Gross Profit Margin Form, you can now proceed in having your Gross Profit Margin Form printed using your office printer. It is also wise to store an electronic copy of the Gross Profit Margin Form as well. A printed version of the Gross Profit Margin Form allows you and your accountant to view and discuss its contents.

Step 5. Discuss the Contents of the Form with your Accountant

After printing your Gross Profit Margin Form, take it to your accountant’s office so you can discuss the contents of and results of your computation. Discussing the contents and computation results of your Gross Profit Margin Form allows you to have an expert opinion from your in-house accountant. You can also compare the results of your computation from the Gross Profit Margin computation your in-house accountant prepared for this accounting period.

Related Posts

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word

-

FREE 3+ Bank Loan Application Form and Checklist Forms in PDF

-

FREE 2+ Source Code License Agreement Forms in PDF

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 4+ Software Distribution Agreement Forms in PDF | MS Word

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 11+ Accounting Request Forms in PDF | Excel | MS Word

-

FREE 8+ Account Report Forms in PDF | MS Word | Excel