Taxes, business licenses, employee insurance coverage membership, as well as the company’s commercial rental fees are some of the payments that a company or a business enterprise will need to provide regularly. These payments should be accompanied by the appropriate financial forms with the assistance of a professional accountant.

The forms are for indication of the financial accounting records and the company’s observation regarding their financial stability and the things they must do to meet their business vision and goals. One type of document which is deemed essential for any company is the operating statement form.

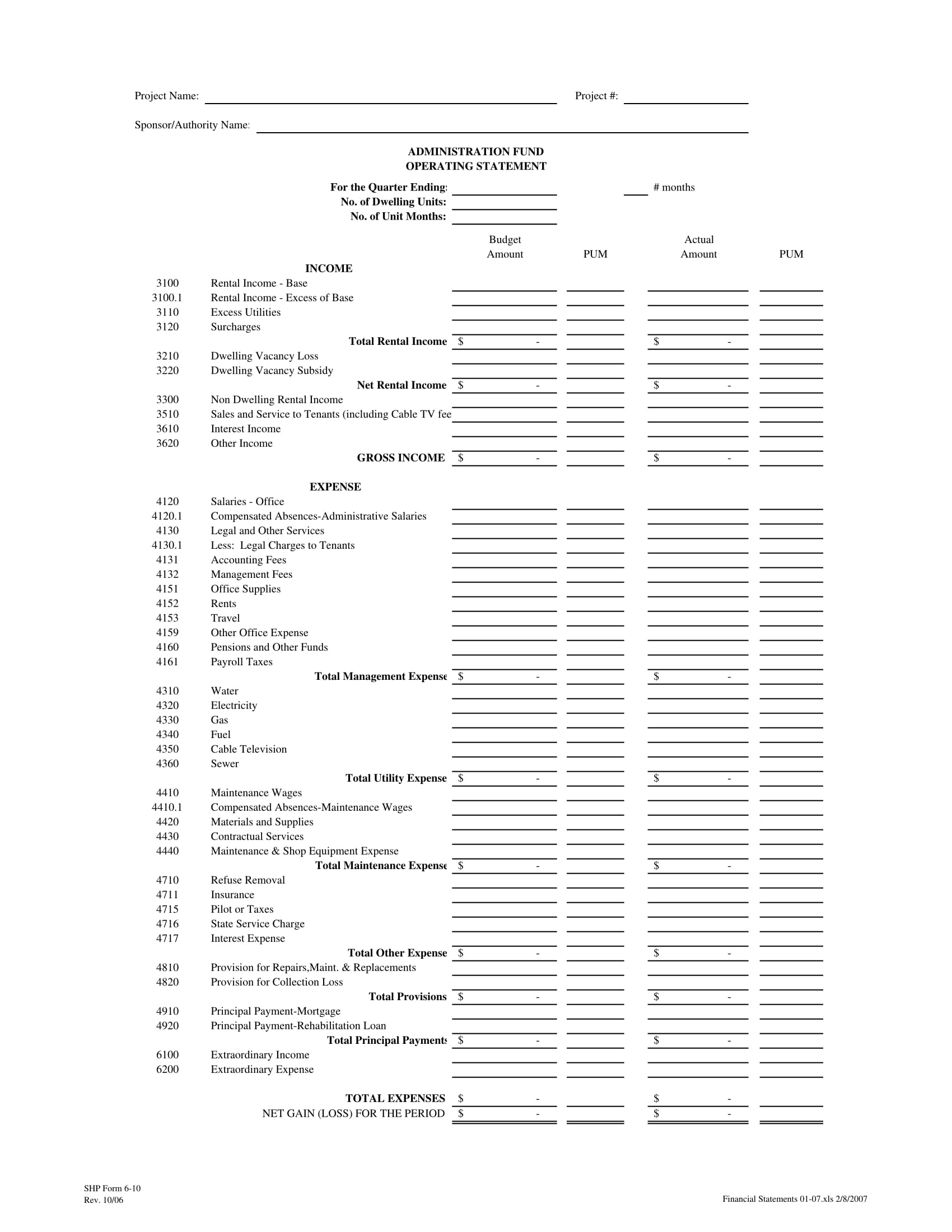

Administration Fund Operating Statement

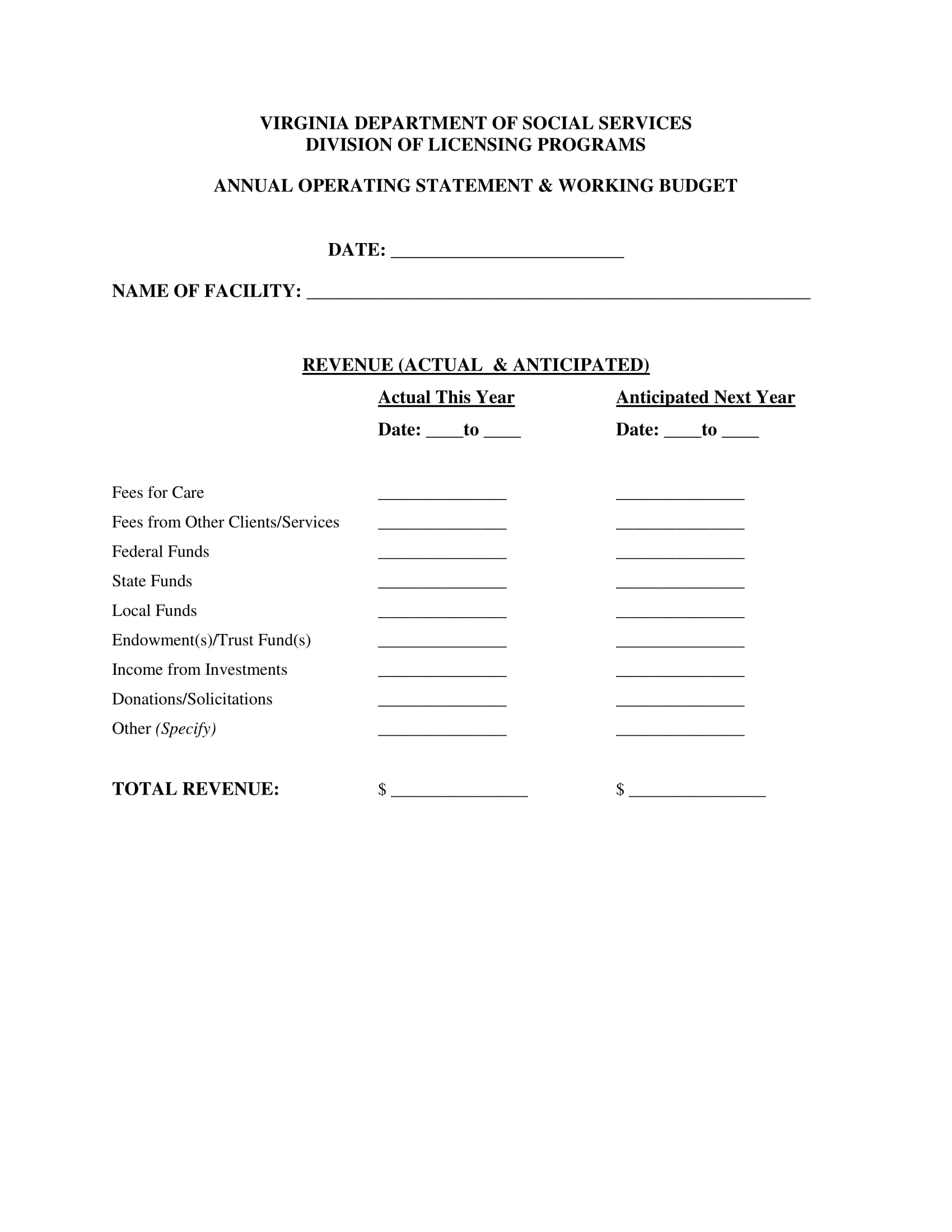

Annual Operating Statement Form

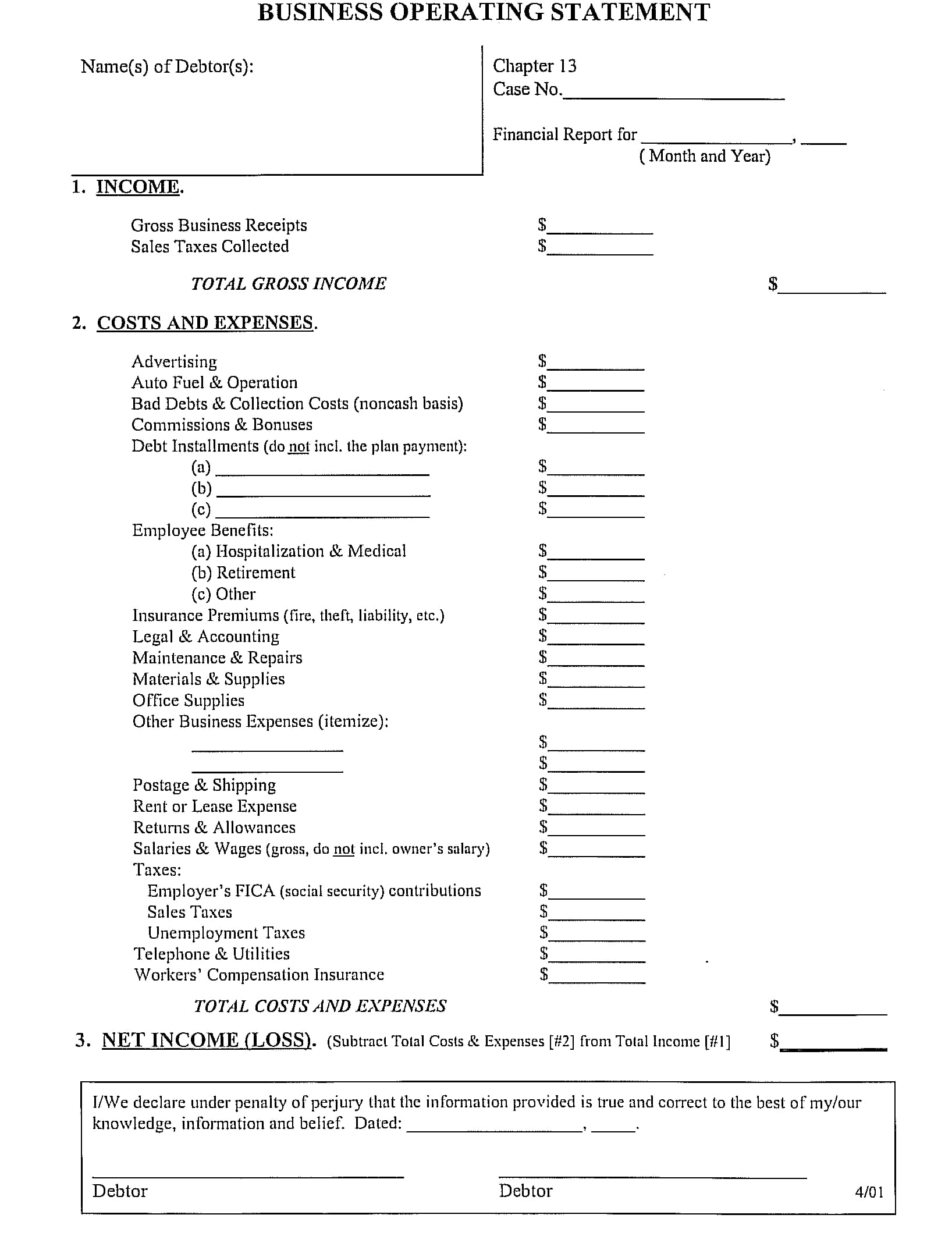

Business Operating Statement Form

What is an Operating Statement Form?

An operating statement form is a document which is highly similar to an income statement. However, it focuses on the funds of the company that is mainly used for sustaining the business and not for the other miscellaneous payments such as taxes and interest fees.

The investors of a company demand the presentation evaluation of this form as it will serve as proof and tool for financial security; that the money being invested will soon turn into a huge amount of profit. This statement form is also referred to as the “earnings before interests and taxes” document since it indicates what range of amounts are being excluded from the form.

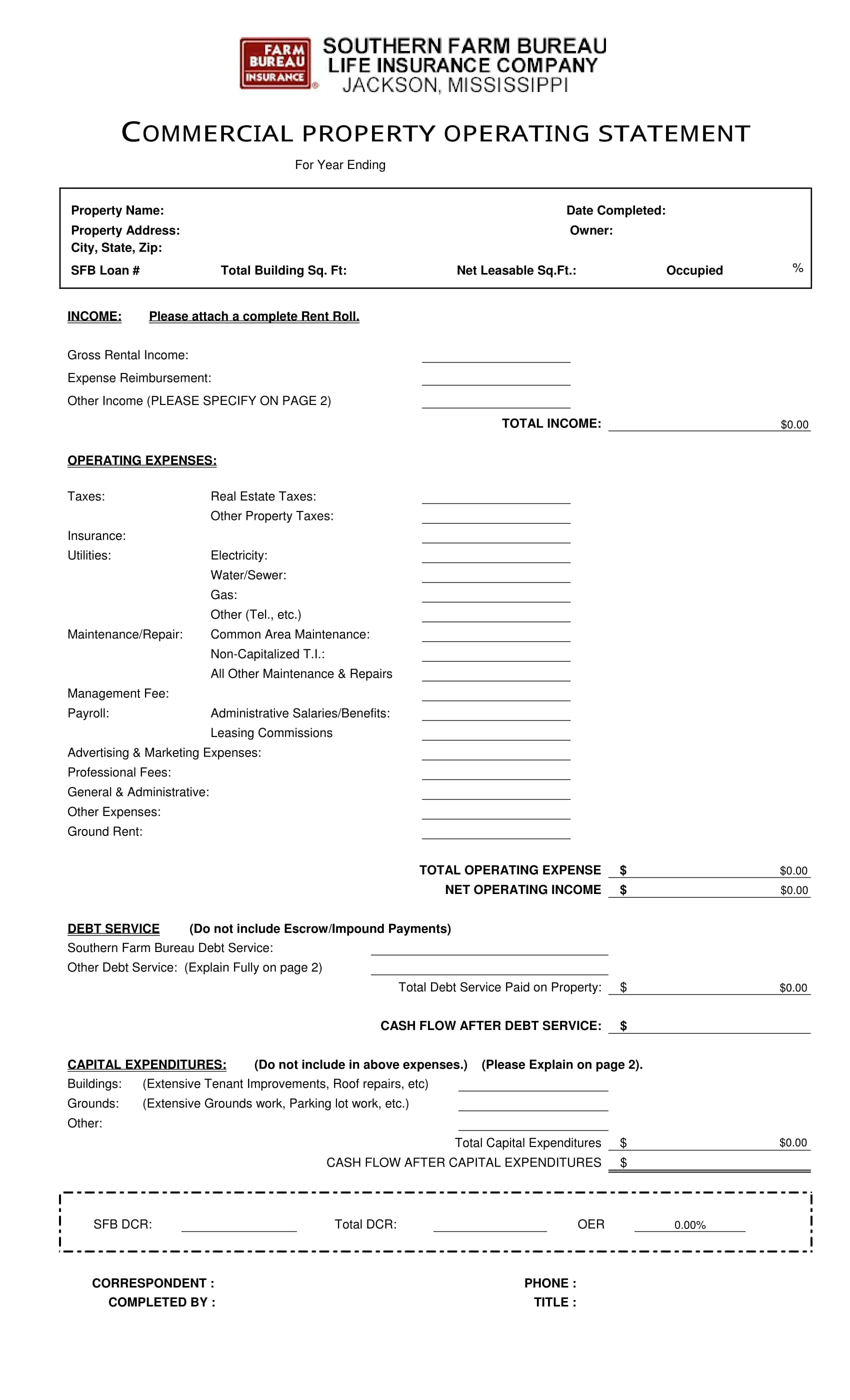

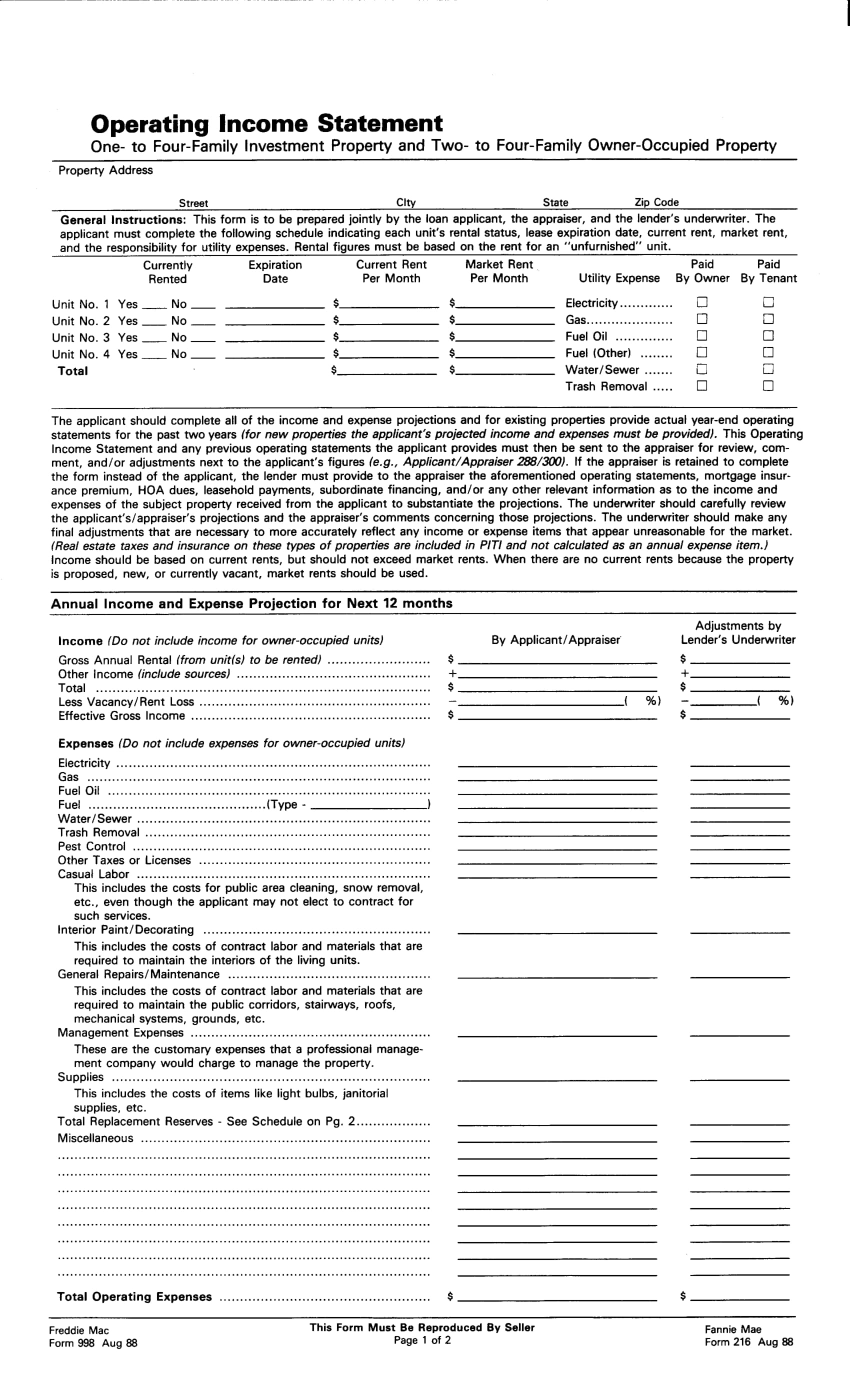

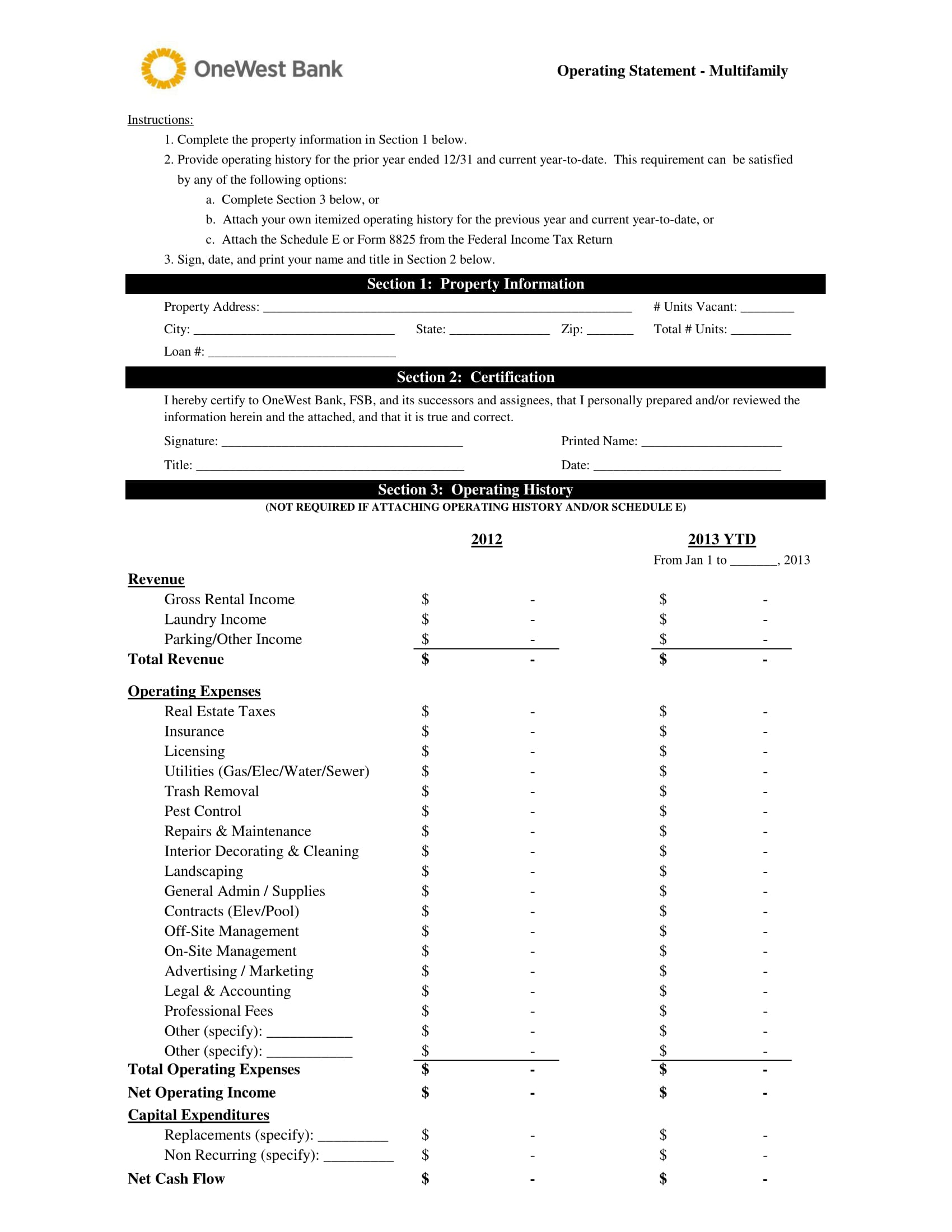

Commercial Property Operating Statement

Investment Operating Income Statement

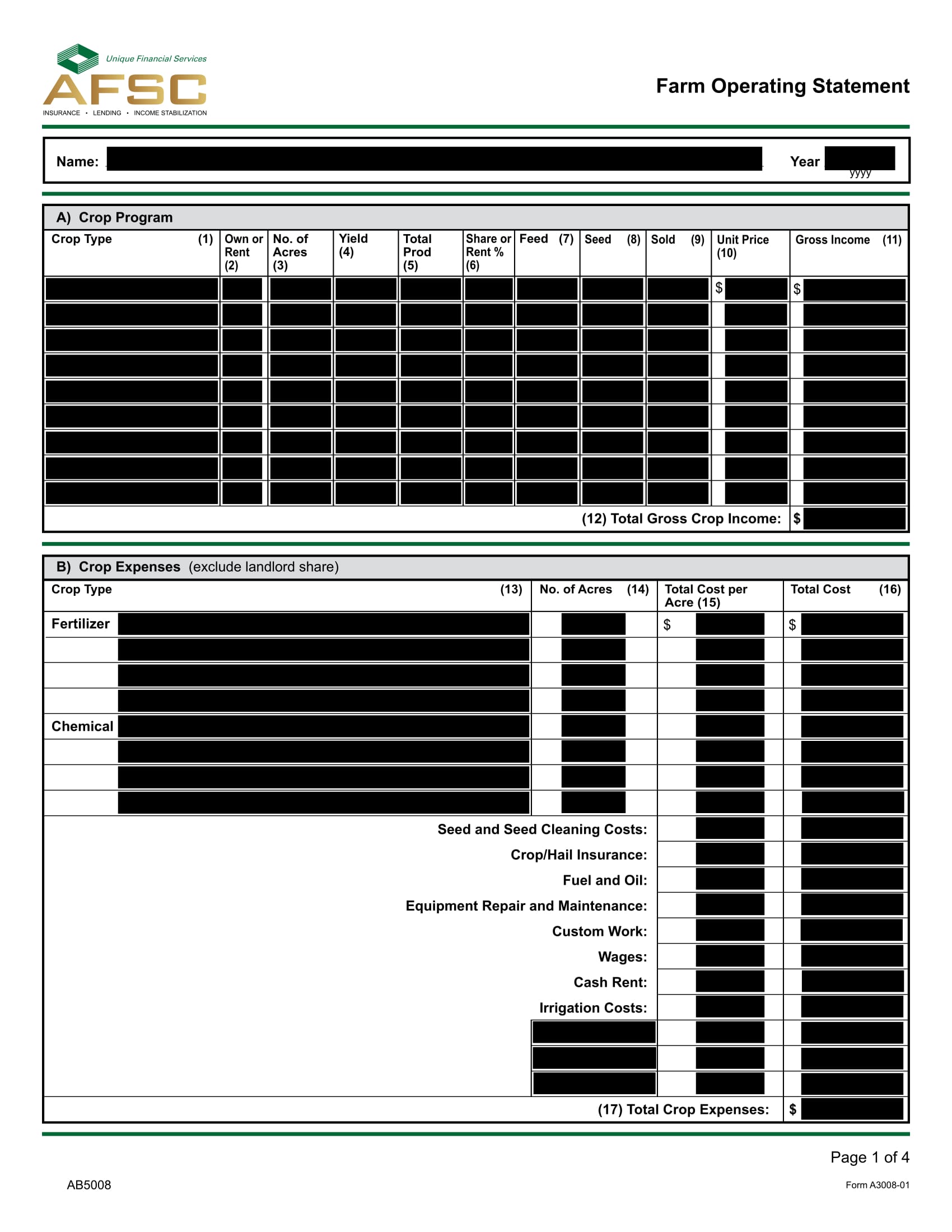

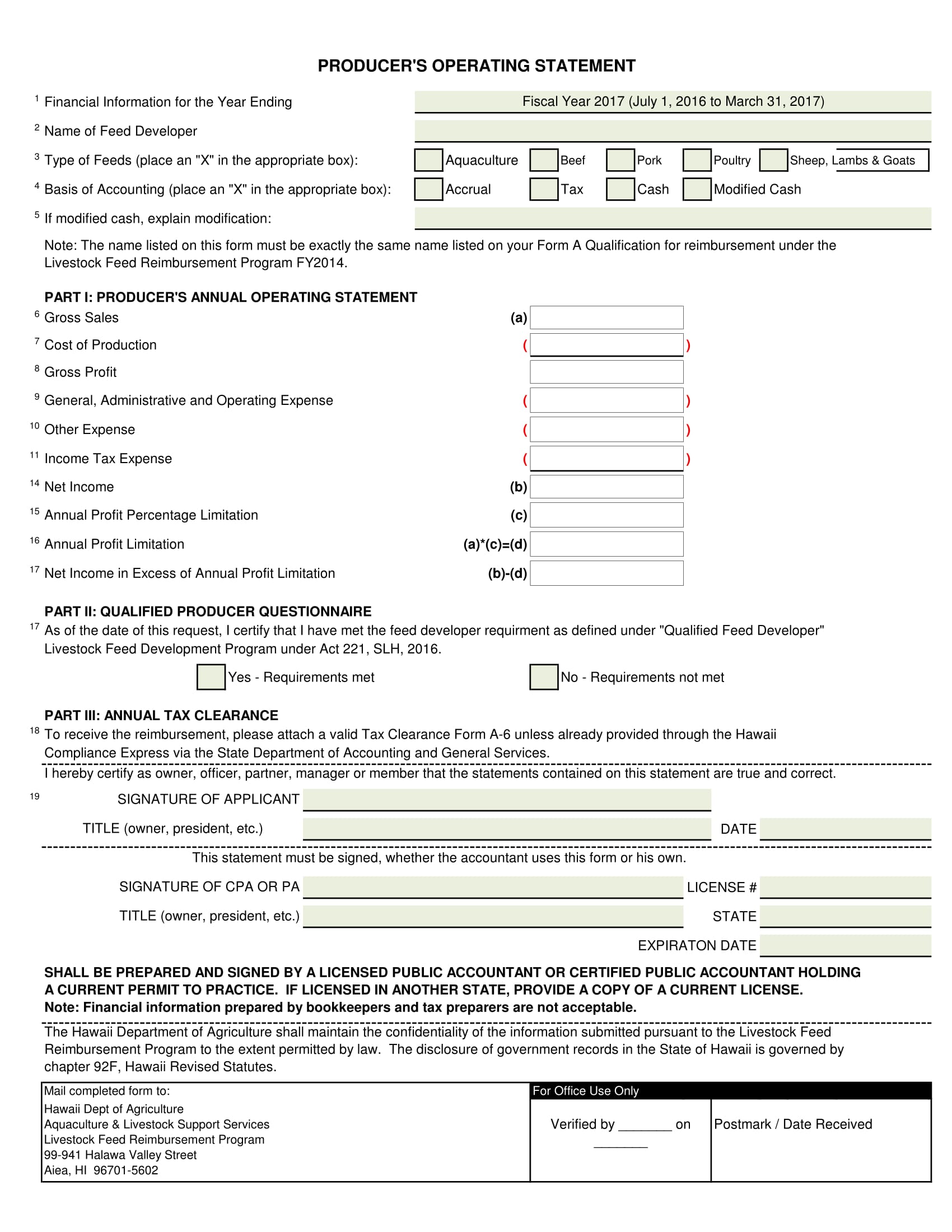

Farm Operating Statement Form

Why Use an Operating Statement Form?

Operating statement forms are important for any company and enterprise since it shows if a company is facing a financial problem or if it is profitable enough to prevent the business from heading to a closing. The analysis made in an operating statement form also determines the effectiveness of the managers and the people mandating the finances in the administration.

Mistakes in the daily decisions of the head officials such as matters that relate to their product proposal and service pricing in a company can become hindrances for the company to meet their daily goals and may affect the overall financial status once it has become notorious.

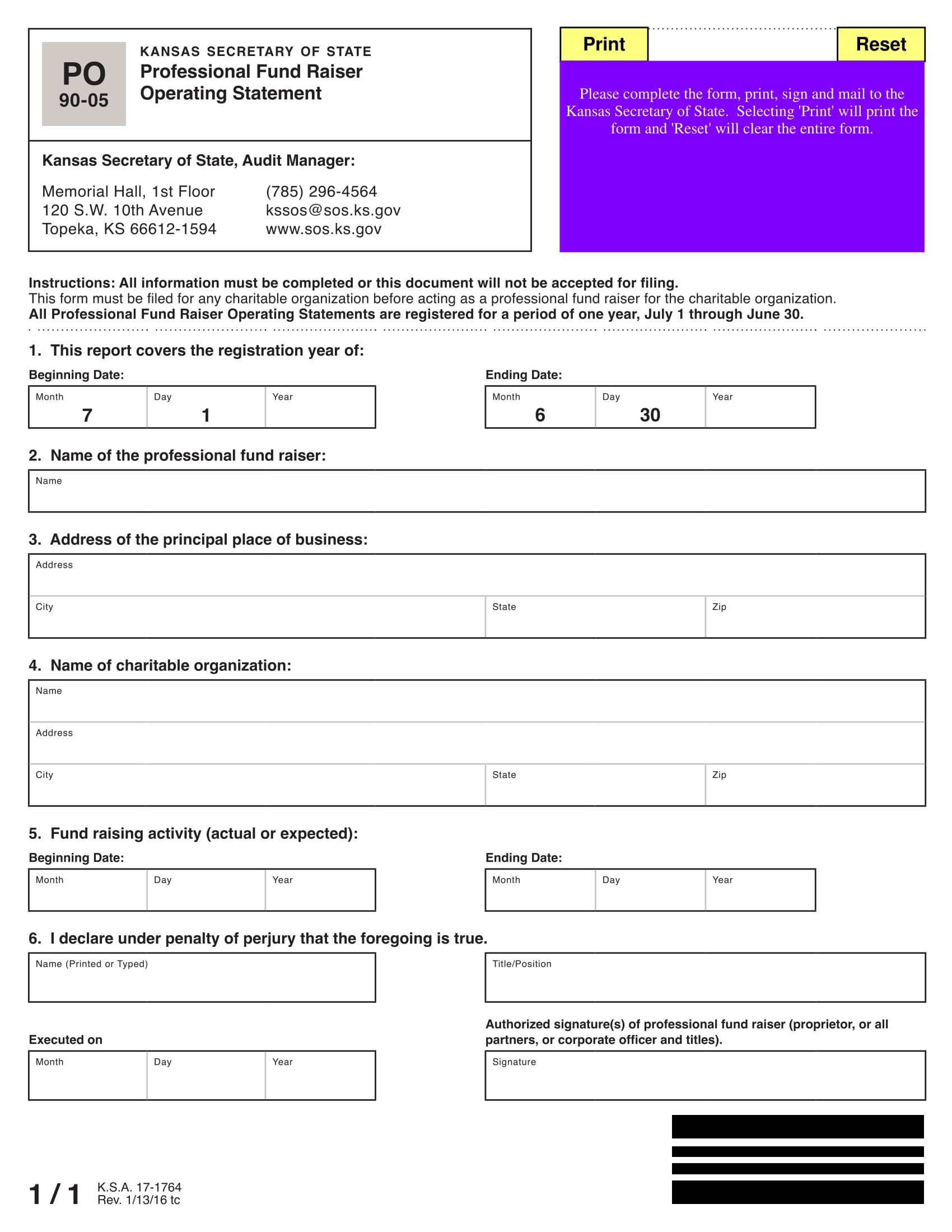

Fund Raiser Operating Statement Form

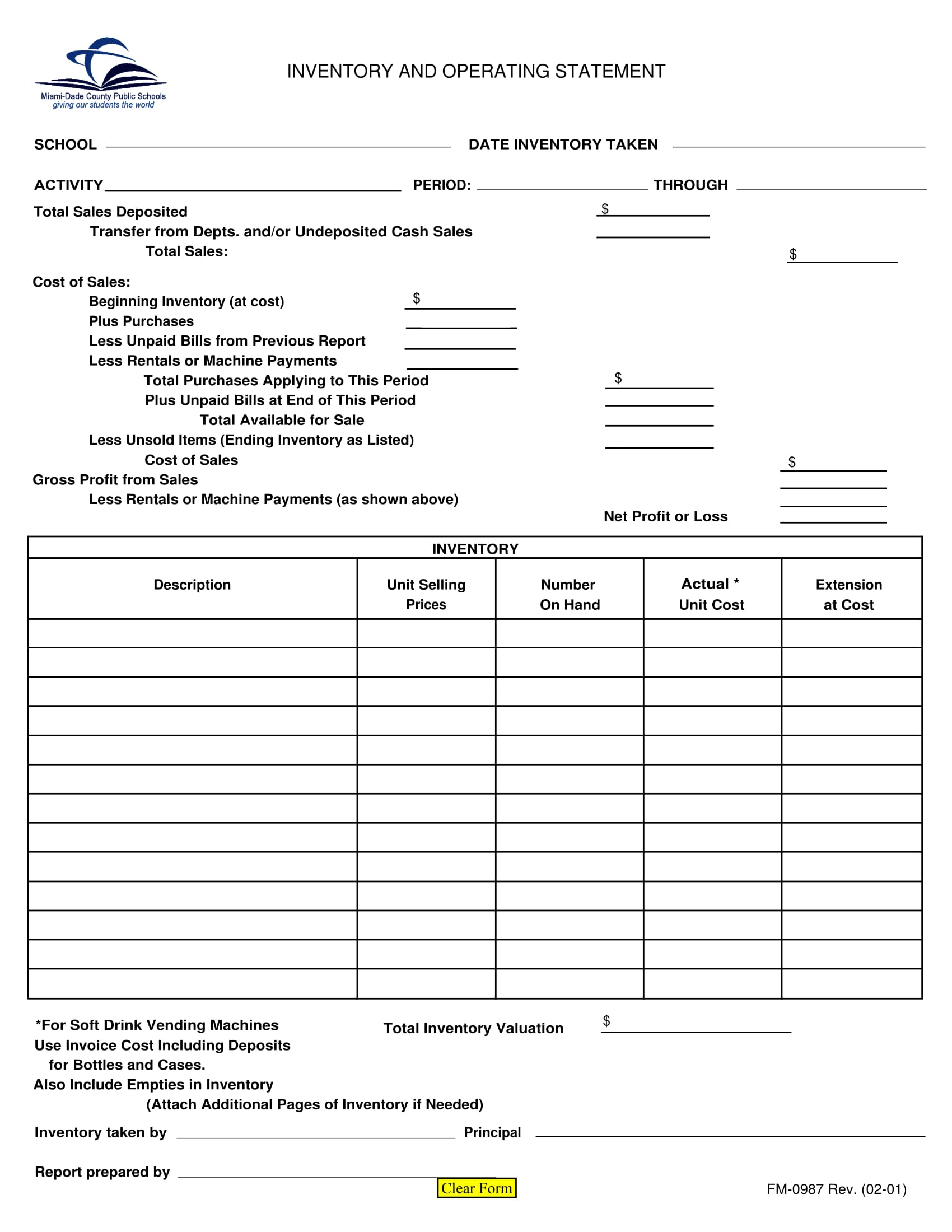

Inventory and Operating Statement Form

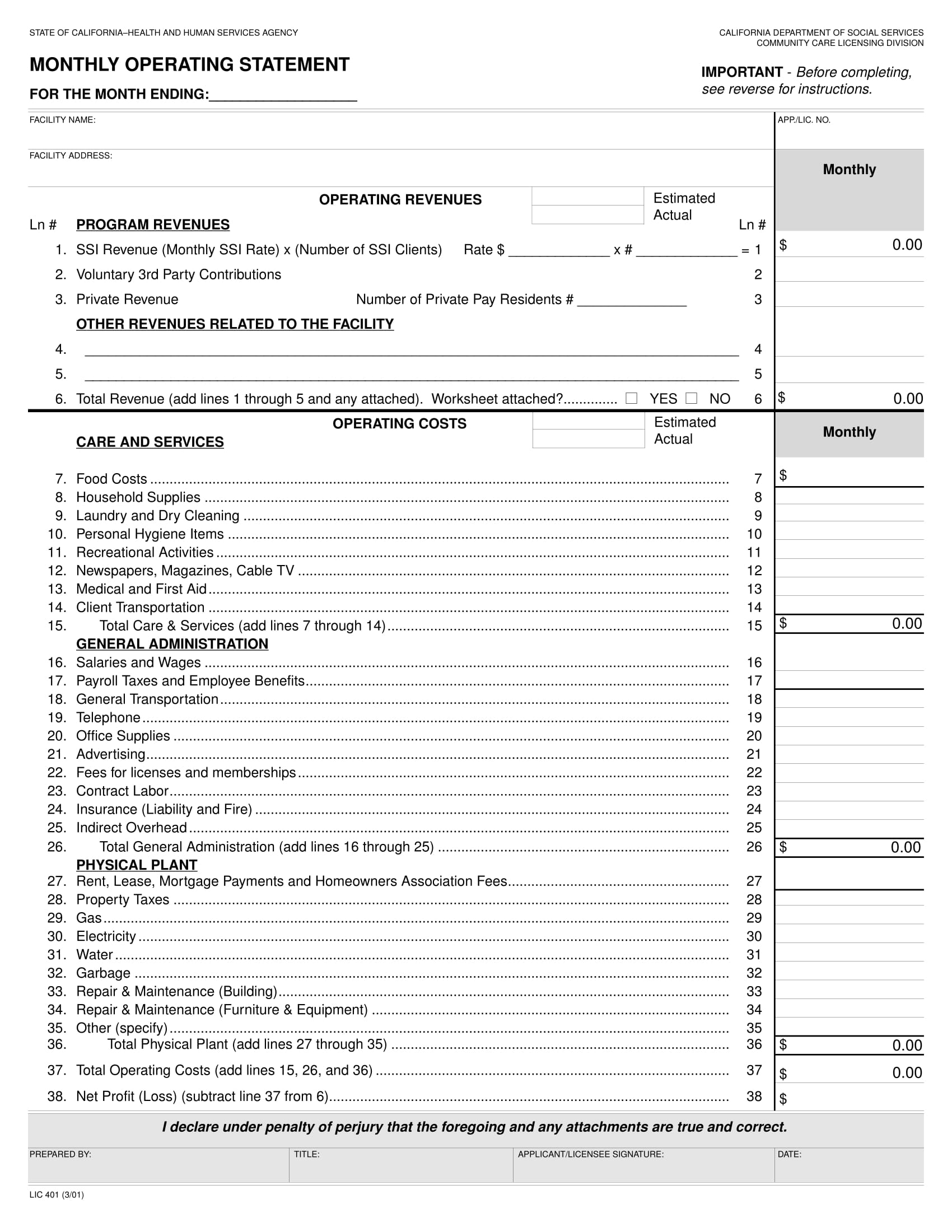

Monthly Operating Statement Form

Significant Areas in an Operating Statement Form

Operating statement forms may have varying arrangements and formats such as in a printed document or in an online form. However, every operating statement form deals with similar subjects and financial areas which are mainly the income and the expenditures of the company. Below are the significant areas that a user must assure to include or to present in the document:

Instructions

This section is vital since this is where the user is introduced with the general information of the form and how it can be completed. A list of who will be required to complete the form is also included along with the types of operating statement forms that each varying person needs for his or her business. The instructions guides the user to the different sections of the form as well as the definitions of the terms found on the document.

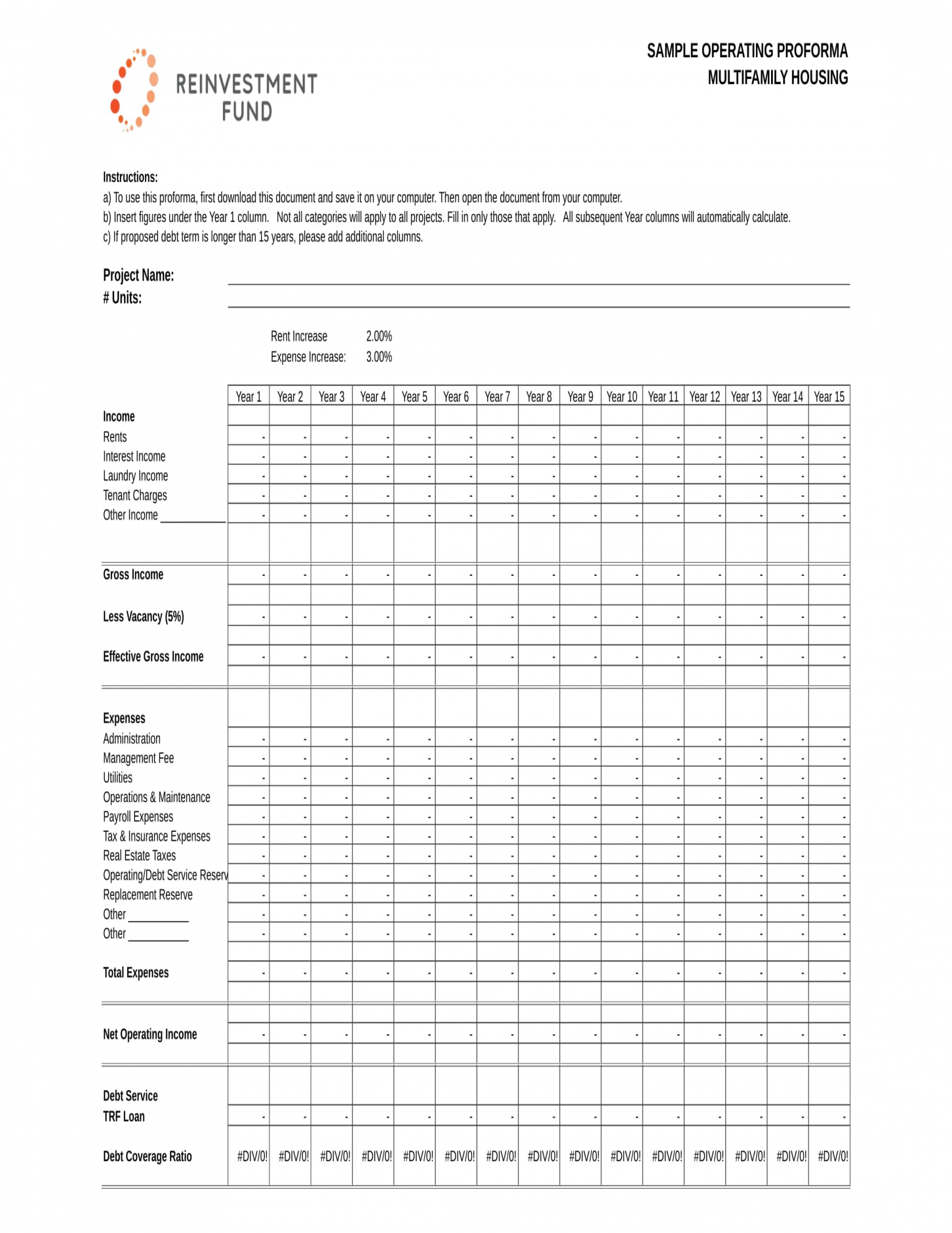

The Range of Time or Calculating Period

The financial calculating period depends on whether the form is used for a monthly statement record or for annual small business purposes. For monthly operating statement forms, the user must indicate the specific months wherein the financial records are being gathered. On the other hand, for annual operating statement forms, the user has to state both the month and the year when the statement was made, and when the financial observational feedback or analysis were created.

Company and Department Name

As a company has different departments who separately deals with the sales, management, finances and operations, it is essential that the user of the form specifically indicates what department is the subject of the form, and who will regulate the financial evaluation. These facility names are stated in the first area of the form where a block is allotted for the information as well as the application number provided by the authority who gave the form to the user.

Operating Revenues

This area refers to the income that the company clearance has. It can be separated in labels to assure that every inclusion and every type of revenue is written with the exact amount and details. Monthly rates and net sales amounts are examples of the financial aspects that need to be stated in this section.

Operating Costs

The costs can include the company funds and the financial amount that they have allocated for their clients and their staff such as their products and services. Additionally, this section also has the amount of the materials purchased for maintaining the company’s property and operating statement.

The staff and the employees, transportation costs, communication appliances and the company’s rental or commercial lease payments should also be written in this area to assure that any spent amount is not left unrecorded to inform the people involved in managing the company’s finances.

Estimated Actual

This is a single column which is allotted for the amounts for each label on the form such as the revenues and the costs. Although it indicates the estimated amounts of each expense, the user must conduct an estimate forms which is near the actual amount to avoid totals which are way beyond the exact numbers.

Declaration

This is the last section of the form which is also known as the signature block. The user of the form who is commonly the company’s accountant must write his or her name as the individual who prepared this business statement form along with his or her signature to certify that he or she stated facts on the company’s financial information.

Multifamily Operating Statement Form

Operating Proforma Statement Form

Tips for Using an Operating Statement Form

Gather sufficient data.

Before you start filling out any financial and business form, you must secure the right types of documents to assure that you will be writing facts on the form. Since you will be dealing with business-related matters, you can also ask the assistance of an authorized financial personnel, and you should acquire a permit application from the management that you will be using the business’s information for completing the form to avoid facing issues within the period of submission and evaluation.

Make a list.

The documents that you gathered aids you through the process of listing and separating the revenues from the costs. For a better list, create a sub-category where each item falls under to let you determine what types of expenditures caused the company to spend a high amount, and which among the items on the list ate up lesser finances.

Use the right document format.

Financial statement forms can be easily created and analyzed if it is stated in the right document format such as in a spreadsheet rather than in a word document. Although you can still obtain a computation with the word document format, a spreadsheet document provides you with formulas that can lessen your manual computation time. Sample statement forms in pdf formats caters you a better advantage than the word document as it allows you to include automated computations on each page.

Compare your statements annually.

Doing a comparison to your financial reports and statements is not only be beneficial to you, as the user, but it also aids the company in determining what needs to be changed for the next business year to assure that mistakes will not be repeated. For you to have an effective comparison, you must have a similar format and arrangement to each statement form that you created to ease up the process rather than looking through the whole document for a particular financial expenditure.

Keep your statement forms.

Regardless if you are making a company property statement form or if you are merely collecting financial data of your company, you need to record every document, and keep it in a place where the company documents are gathered. This prevents you from submitting a document called affidavit of loss in the event that the form has been misplaced and lost by you. Additionally, by reporting the forms to the authority, you will have a backup and can immediately locate the form whenever it is required and needed by the management.

Producer Operating Statement Form

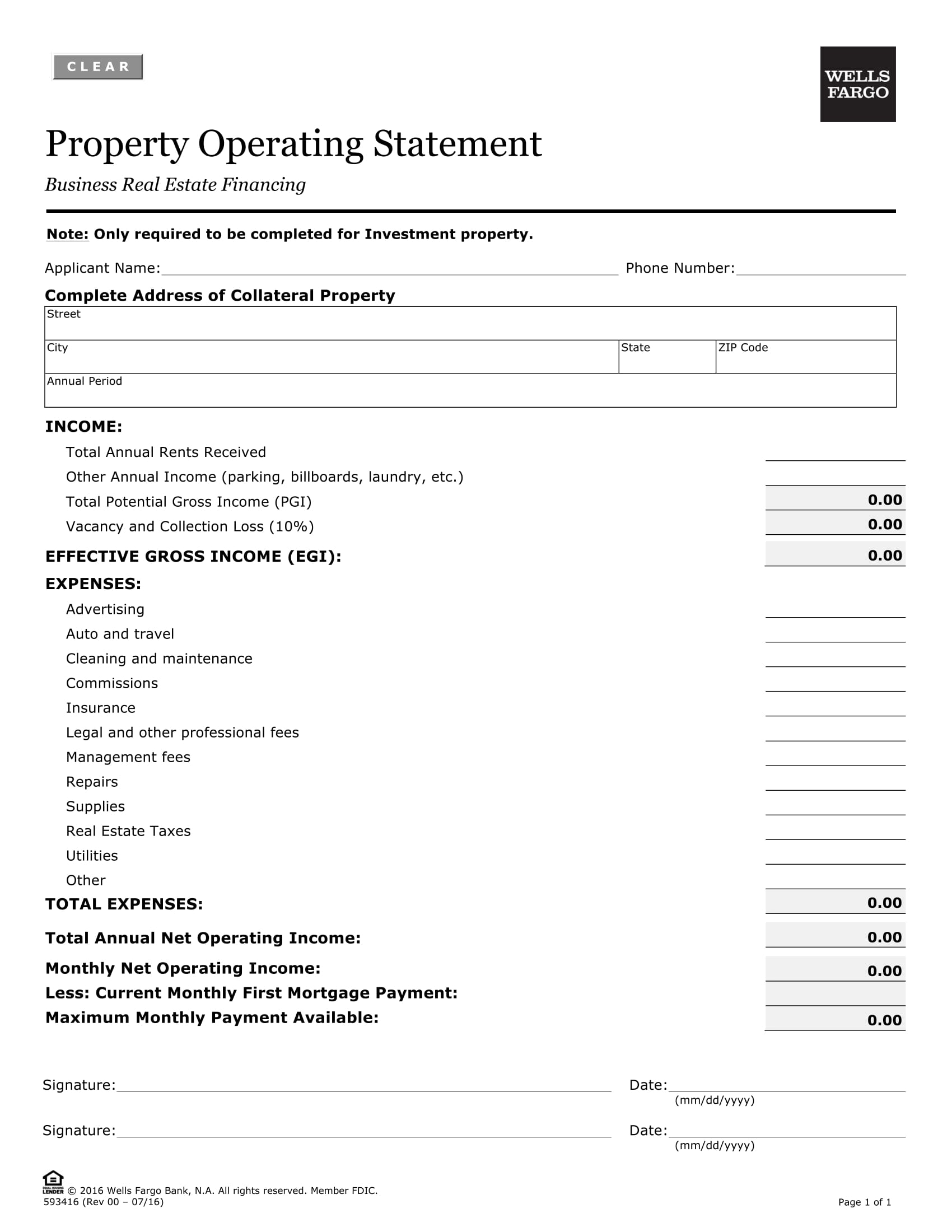

Property Operating Statement Form

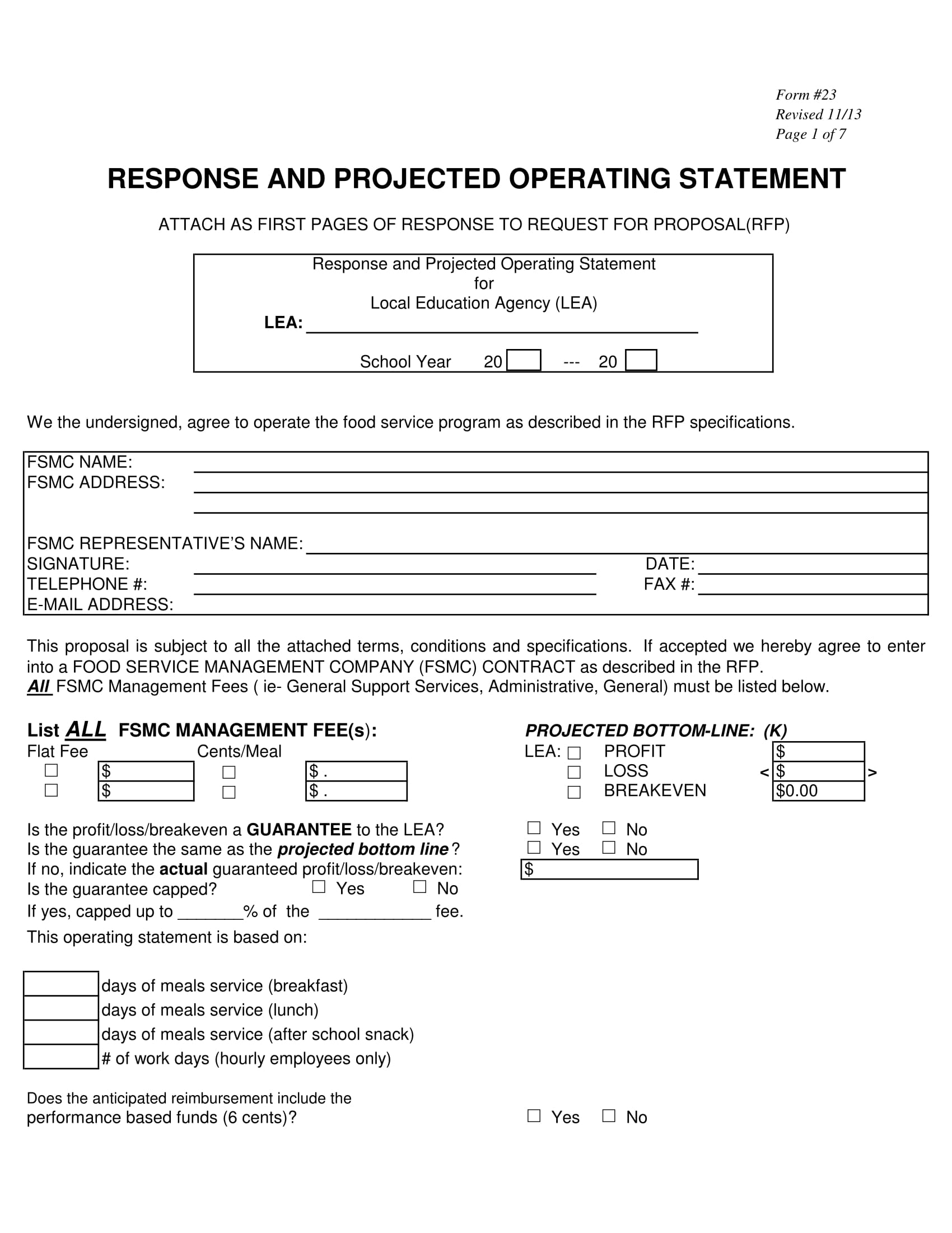

Response and Projected Operating Statement

How Often Must a Company Use an Operating Statement Form?

Varying companies use different strategies and action plans when it comes to handling finances. Nonetheless, an operating statement form can be used on a monthly and annual basis. Some companies use this financial statement form every quarter of a business year to assure that they are efficient in reaching their objectives.

Although most companies use the form annually, there is a huge advantage if a company is able to collect their financial information, and record the data on the statement document since it aids in seeing the earliest signs of faulty decisions before they affect the company’s overall state. The monthly budget and expense reports of the company are stated on the form and will soon be included in the annual statement which can sum up the financial decisions, identify errors, and help in proving the investors that the business of a company is stable especially for profit purposes.

Related Posts

-

Billing Statement Form

-

FREE 14+ Tax Statement Forms in PDF | MS Word

-

Closing Statement Form

-

Instructions for Other Uses Statement Of Claimant [ What Is, Uses, Instructions ]

-

Creating a Sources and Uses of Funds Statement [ What Is, Steps, Sources and Uses ]

-

10 Tips for Writing a Personal Statement

-

Writing a Small Business Vision Statement [ What Is, How To, Steps ]

-

FREE 10+ Sample Disclosure Statement Forms in MS Word | PDF

-

FREE 7+ Business Statement Forms in MS Word | PDF

-

What is a Contingent Statement? [ Importance, Components ]

-

FREE 12+ Sample Medical Statement Forms in PDF | MS Word

-

What is a Categorical Statement? [ How to, Importance, Components, Guidelines ]

-

FREE 7+ Profit and Loss Statement Forms in PDF

-

FREE 8+ Voluntary Statement Forms in MS Word | PDF

-

What are Financial Statement Forms? [ How to, Include, Functions, Importance ]