Tax statement forms are commonly used whenever an individual will be filing his or her tax returns and when a business needs to be regularly reported to the state government. These forms have varying formats depending on the target user of each document such as students and their parents. Nonetheless, each form must only have factual data and not any type of assumption, as it can affect the records of the taxpayer.

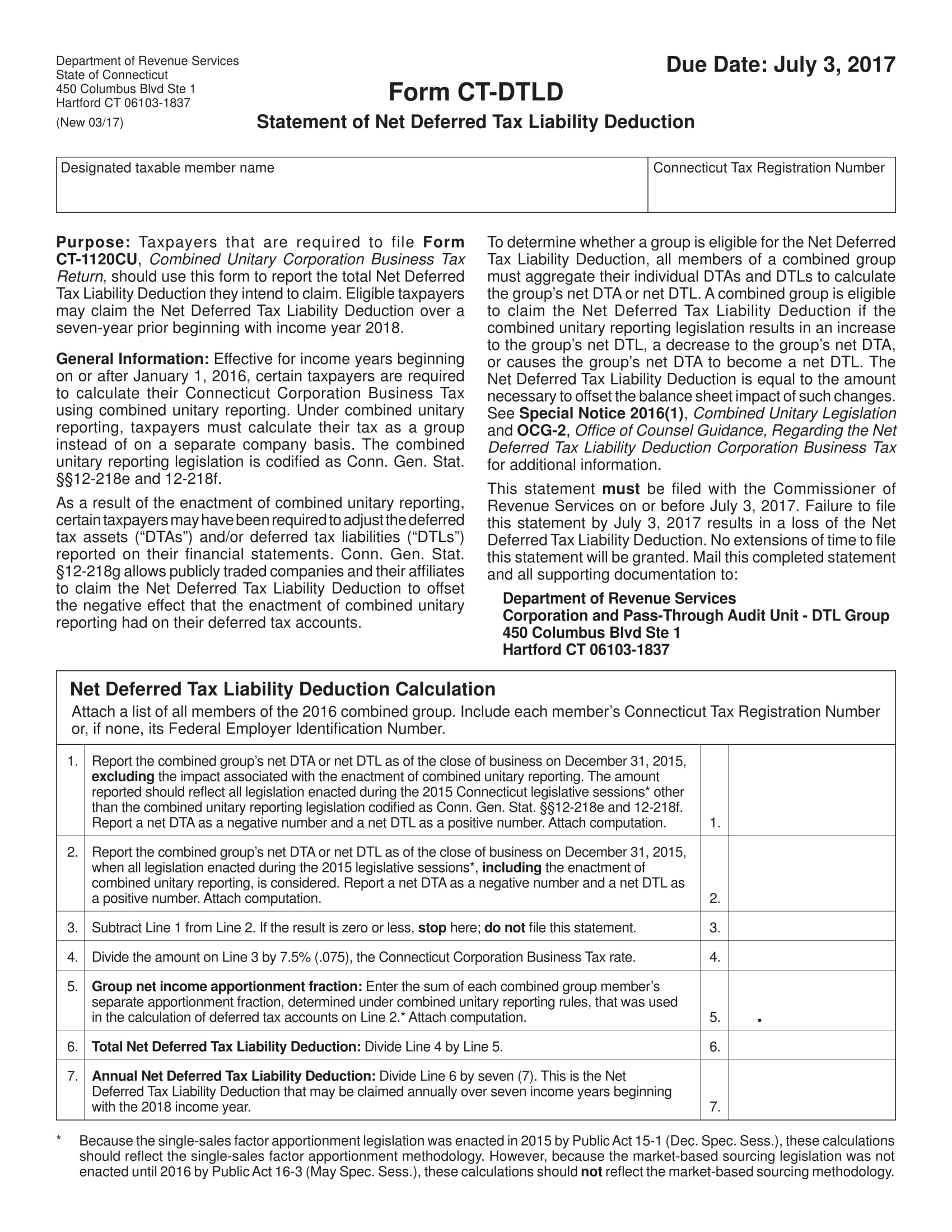

Tax Liability Statement Form

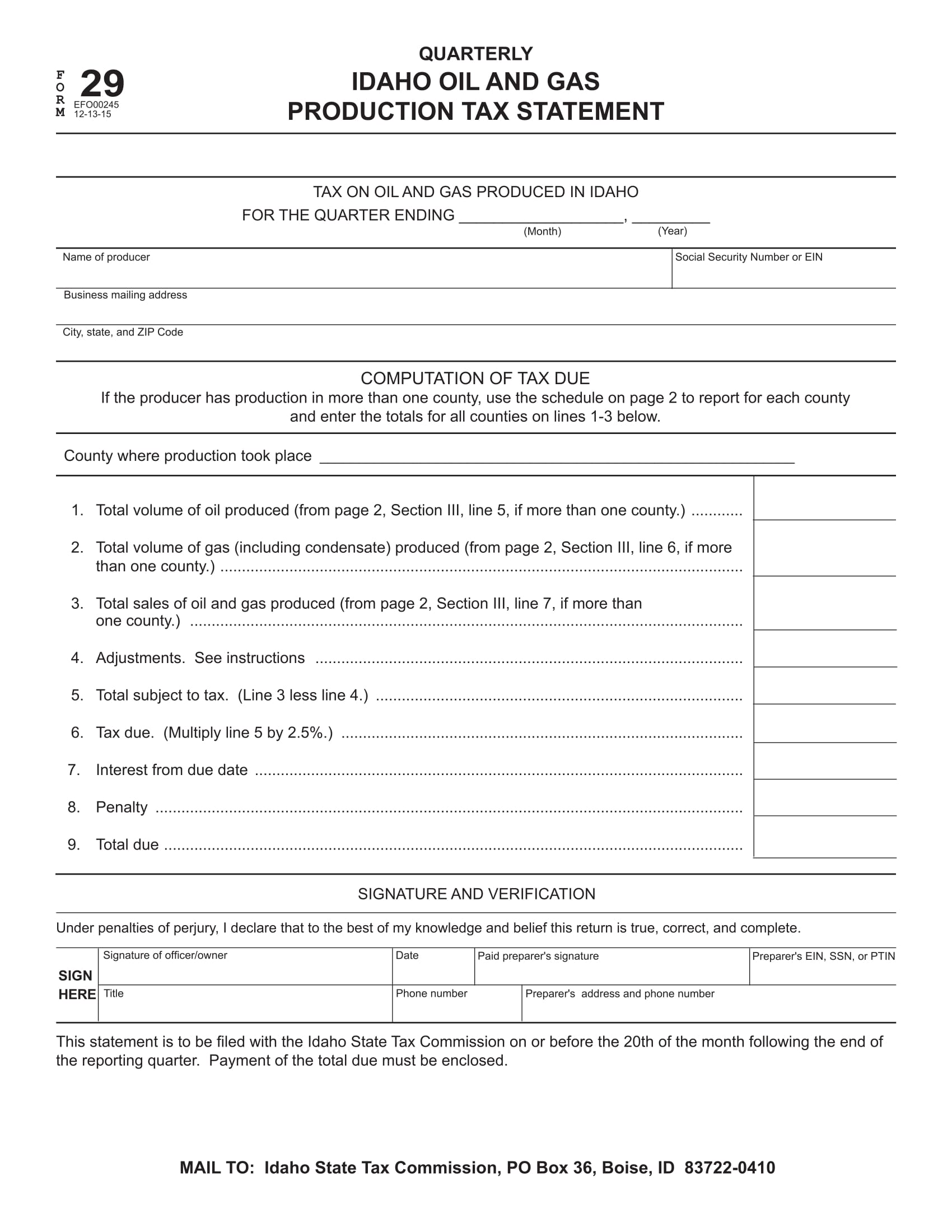

Gas Production Tax Statement Form

Who Will Use a Tax Statement Form?

Aside from taxpayers, there are other individuals who are required to use a tax form, and these types of people are listed below:

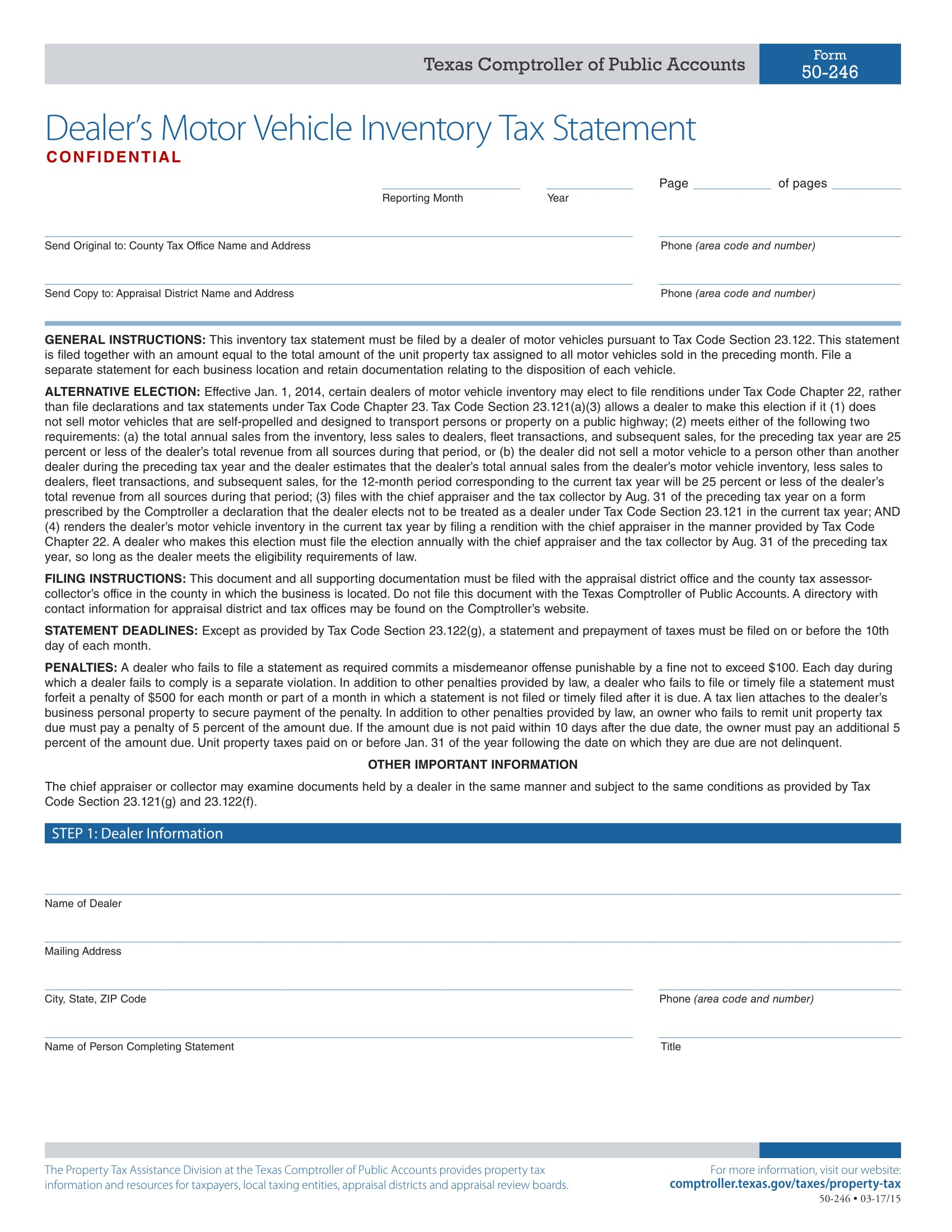

Motor vehicle dealers – As vehicle dealership is a business, the dealers and the owners of the business must file a vehicle inventory transfer tax statement form to the state regularly. The sum of the amounts of each unit property tax is the payment that should be enclosed with the form upon submission. In the event that a dealership business has various branches in a state, the owner has to file separate sheets of the statement form for individual stores to acquire a proper registration and to fully comply with the business tax laws.

Vehicle Inventory Tax Statement

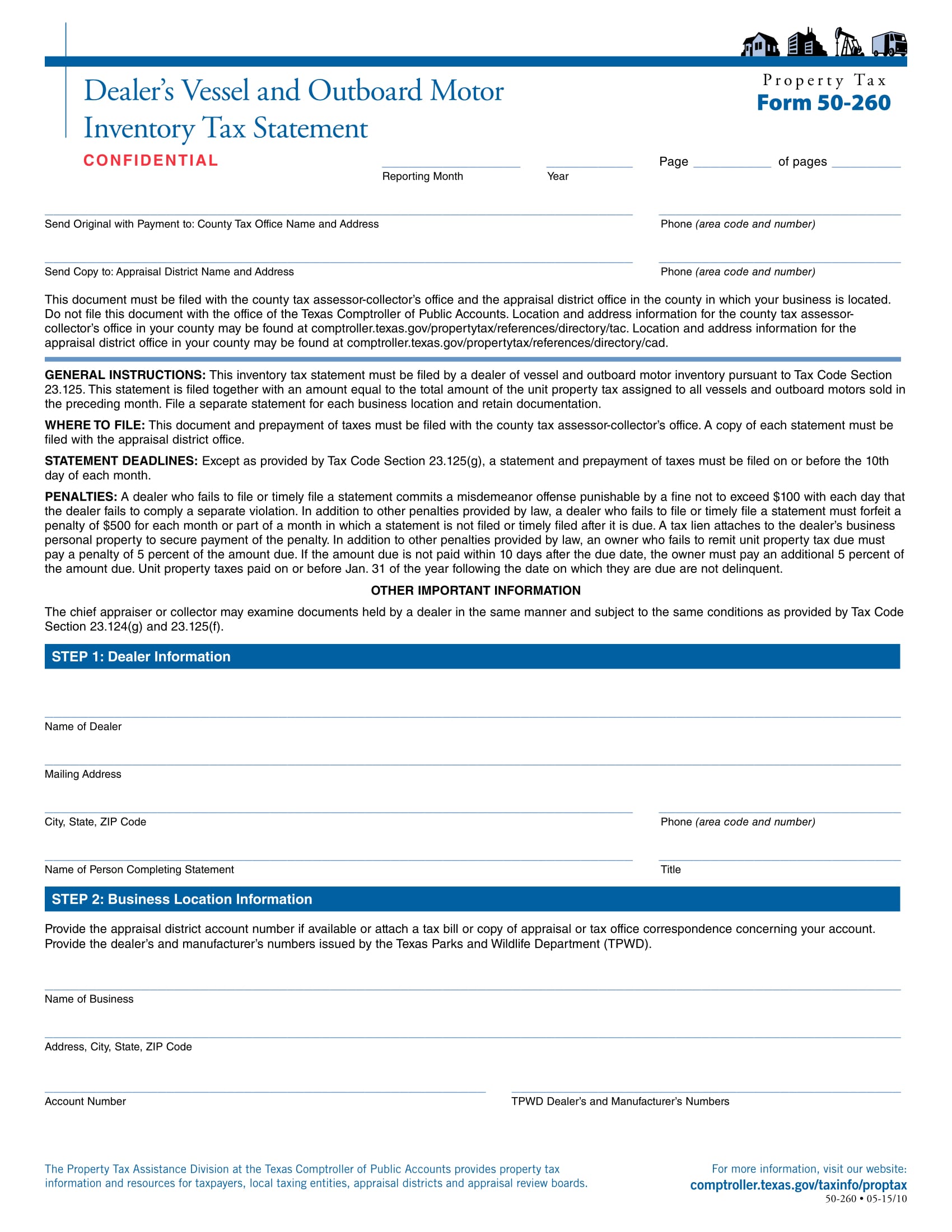

Vessel owners – Not only motor vehicle dealers and owners have to regularly file a tax statement for their properties but also those who sell vessels and outboard motors. With a vessel inventory tax statement form, the user is required to complete the sections which are mainly for the general information of the dealer and the location of the business.

The list of the vessels that the dealers and owners have with their descriptions and purchasers’ names, and the total amount of the nits which were sold in a particular month is also indicated. The user of the form who is the dealer or the vessel owner has to affix his or her signature verification after the sections along with his or her name and the date when the document was completed.

Motor Inventory Tax Statement

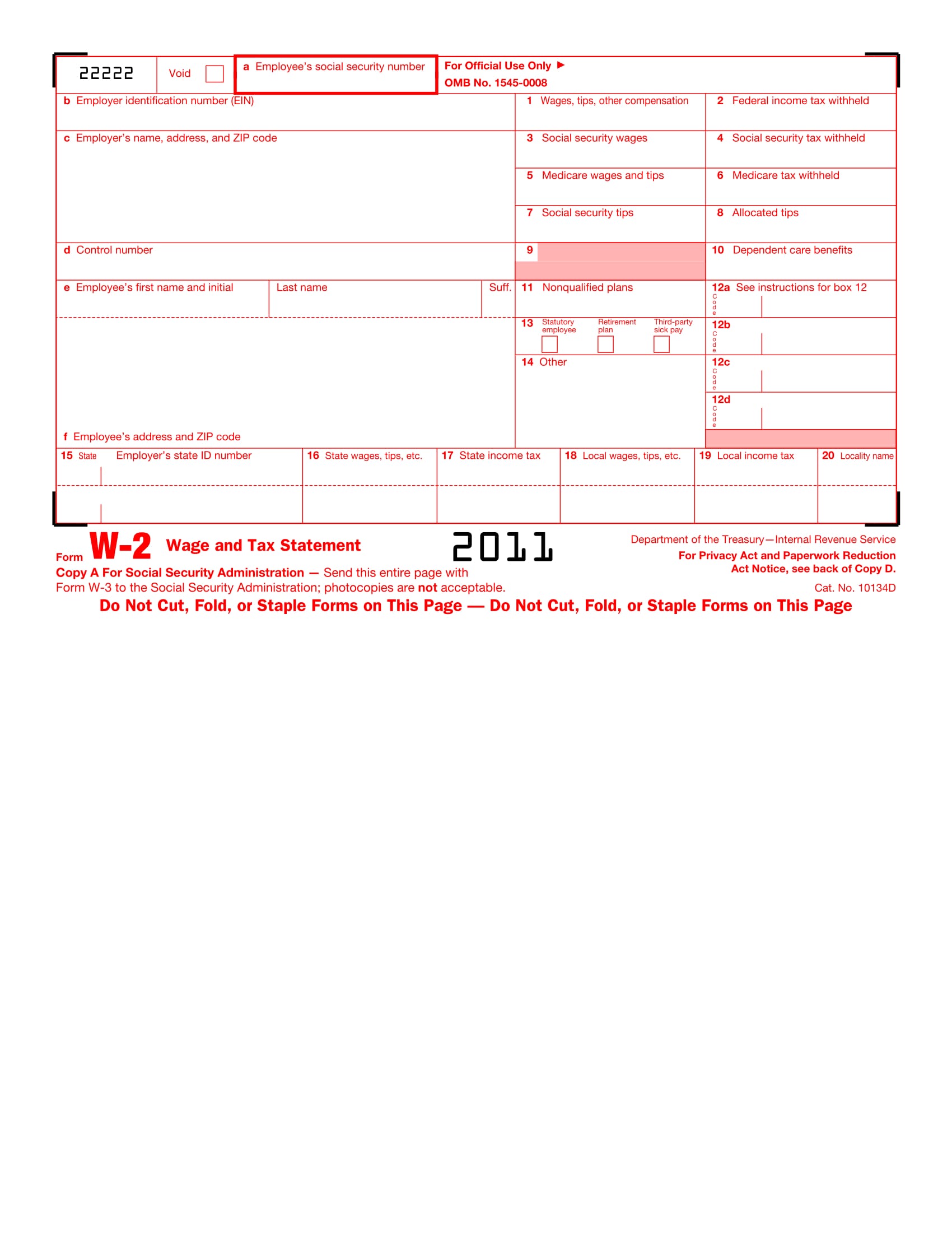

Employers and Employees – Although business owners are some of the people who will be submitting varieties of tax forms to the government, their employers and employees also need to supply information on a specific tax document which is known as a wage and tax statement form or W2 form.

This document has the employee’s social security number, the employer’s identification number, the personal data of the employee, as well as the details of the employee’s wages and salary amounts. If the employee is under an insurance verification coverage, the employer has to state the type of benefits that the employee will be receiving and have received during his or her employment.

Wage and Tax Statement Form

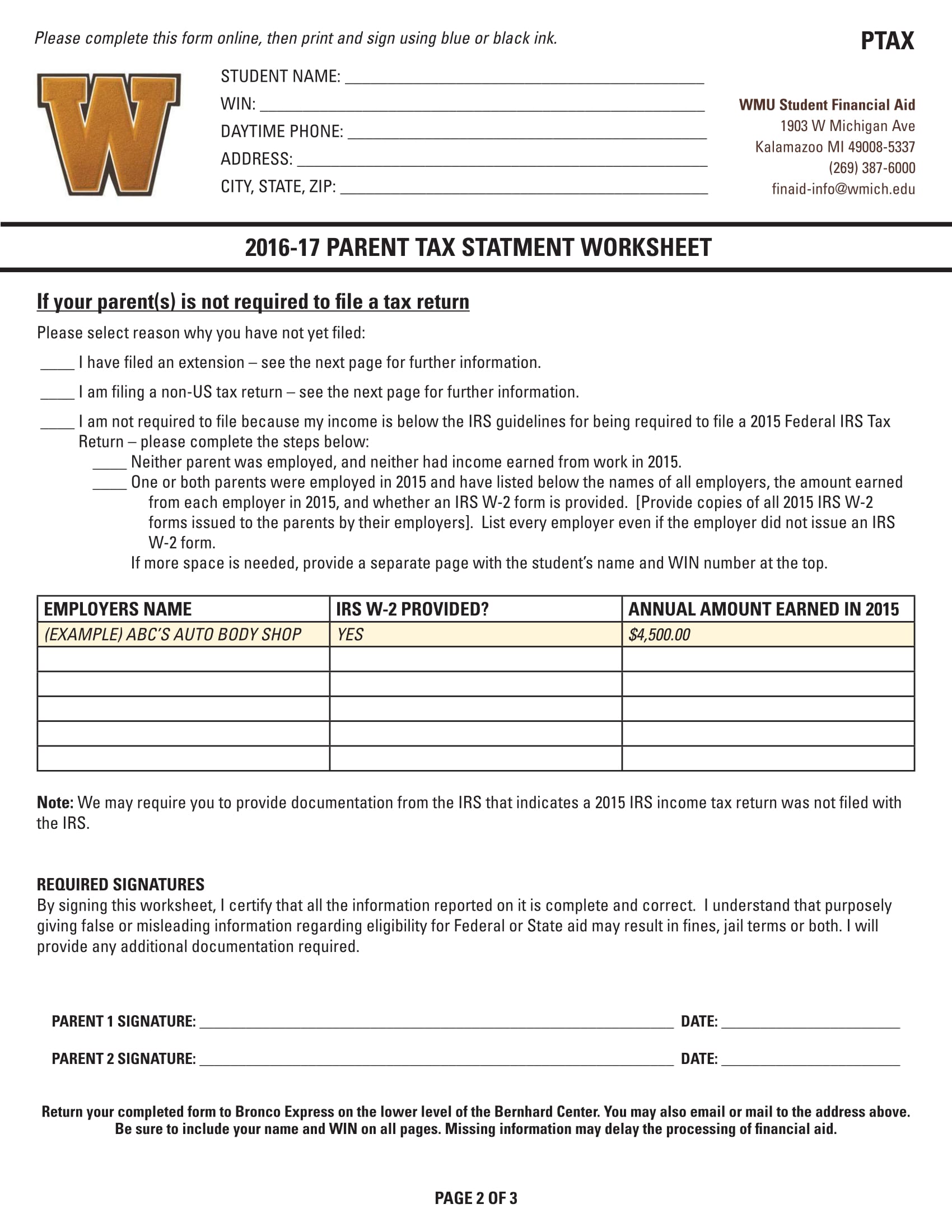

Parents – The student’s parents who filed a tax return and those who will be filing are required to use a parent tax statement form. Specifically, the document contains the reason why the parent was not able to file the tax return on time as well as his or her payroll tax information.

The parent’s employer’s name is also stated on the form along with the indication of whether the IRS W-2 was already provided and the annual amount that the parent earned in a year for the duration of his or her employment. Depending on the country or the state where the tax was filed, a parent may undergo an income verification to supply data for the tax filing process.

Parent Tax Statement Worksheet Form

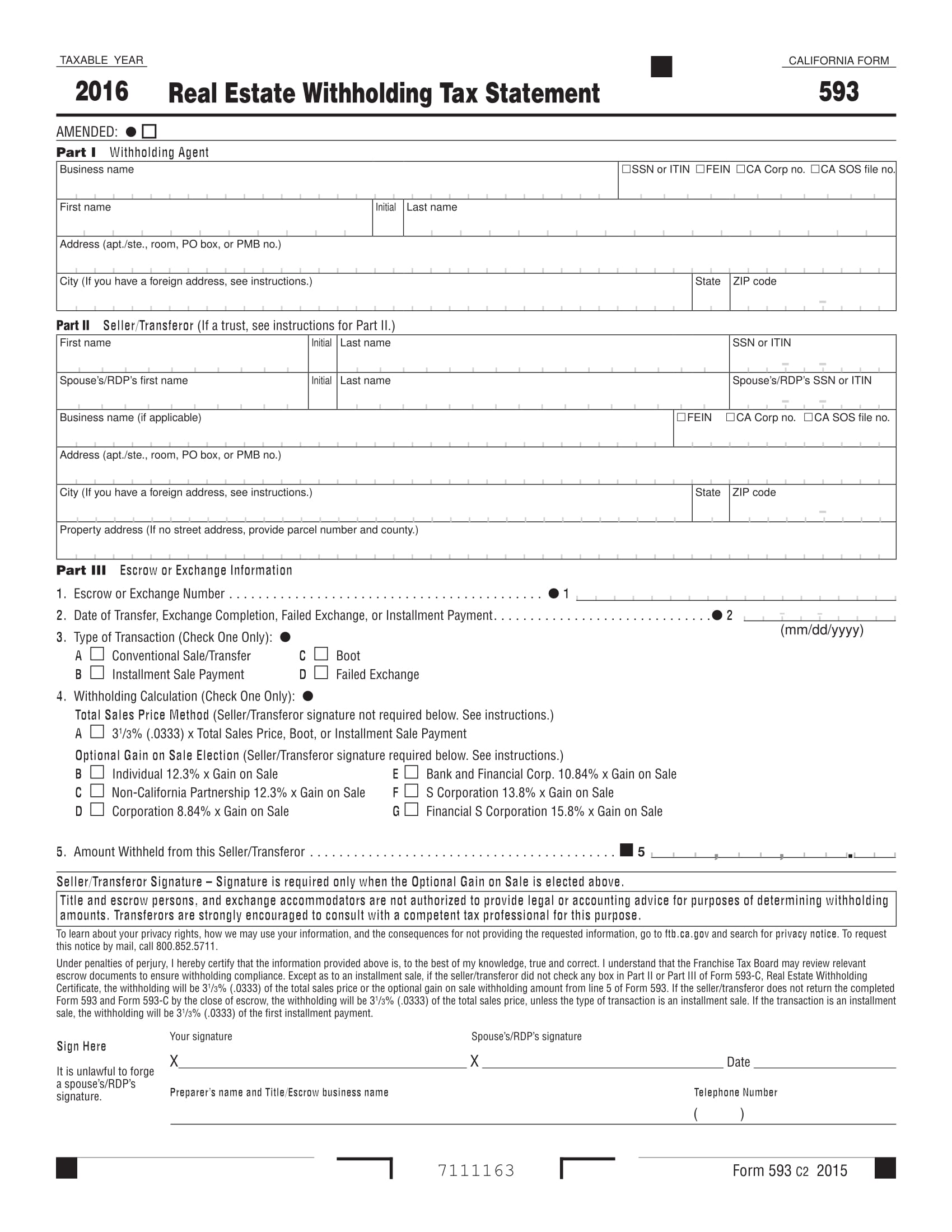

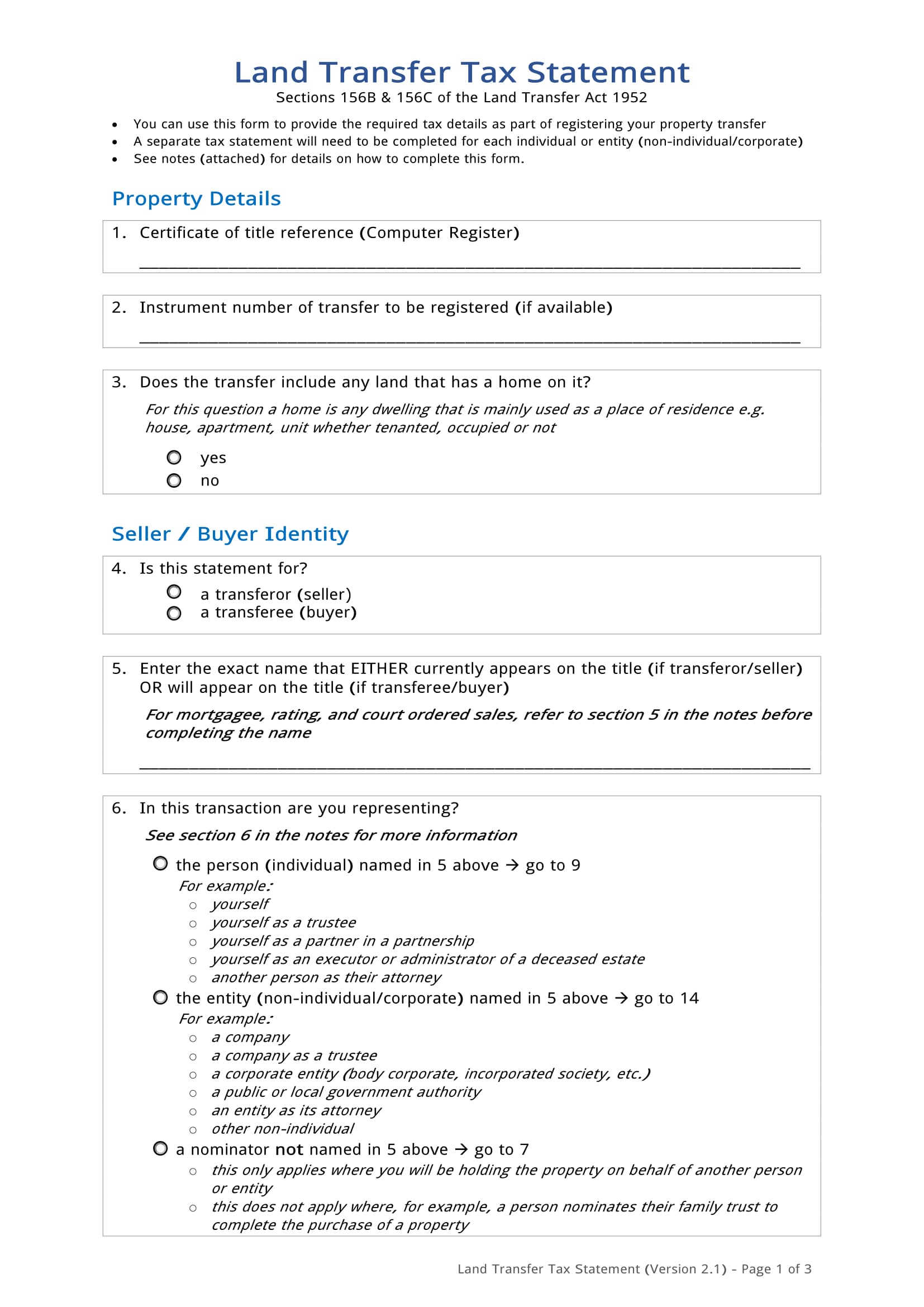

Real Estate Property Owners – Those who own huge real estate properties will be using a real estate tax statement forms. For property transfers, the owner needs to complete the form with the information of his or her property, the identification of the seller and the buyer, details of the tax, as well as sign the form with his or her signature.

This tax statement form has a set of questions to be answered by the owner which mainly deals with the relationship between the buyer and seller and to verify their identities for the authority. A statement guide is enclosed with the form to allow the user in being informed on how the form should be completed and the definitions of the terms used in the document.

Real Estate Withholding Tax Statement

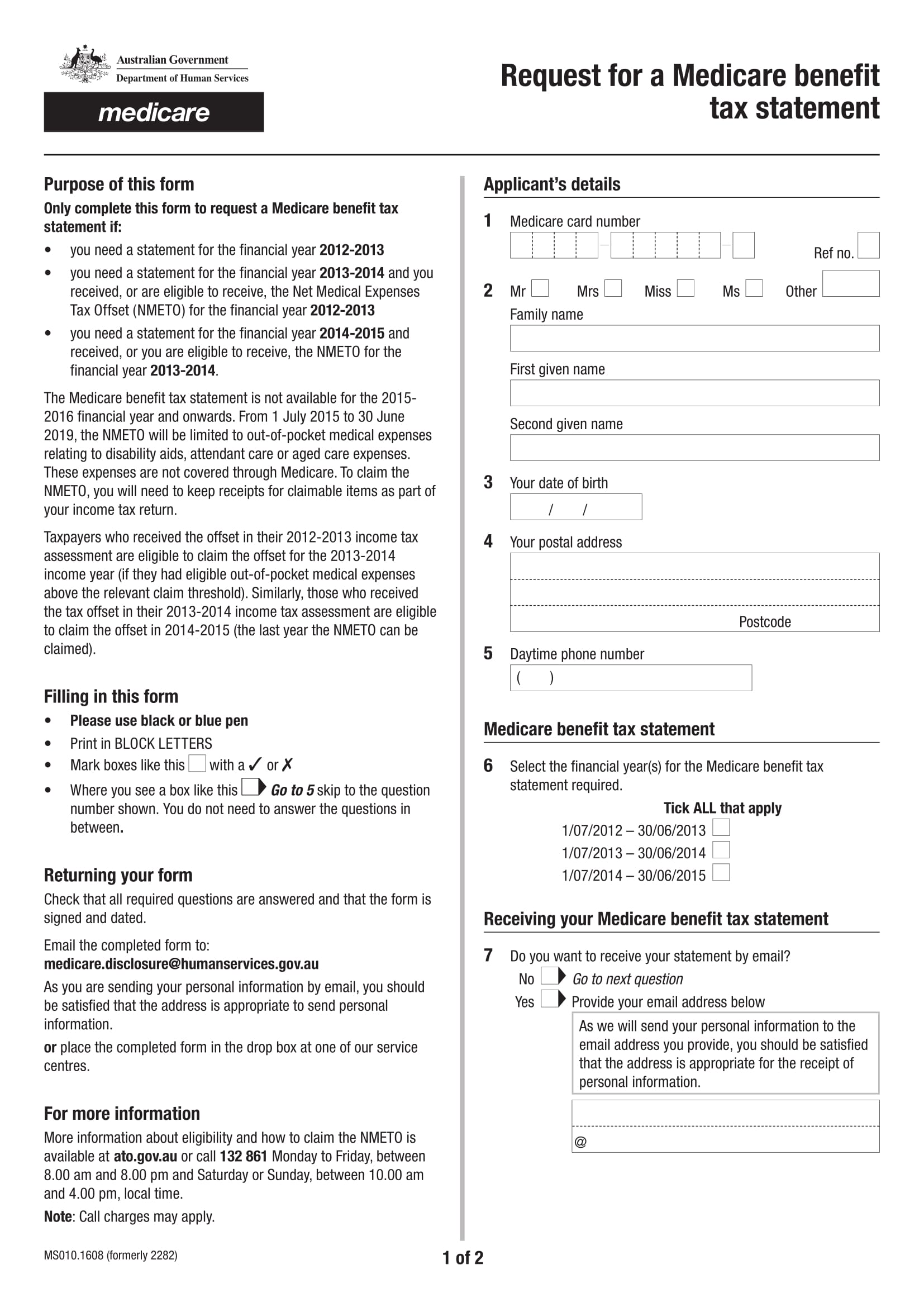

Insurance Holders – There are some people who are enrolled in a particular insurance proposal company who are receiving tax benefits upon their enrollment. With this, the insurance account holder must request for a benefit tax statement from his or her insurance company in order for him or her to acquire the tax exemptions and rewards.

A benefit tax statement request form contains the information of the applicant, a privacy notice, and an oath of declaration that the data has written on the form are actual facts. Since the insurance holder has beneficiaries under his or her name, he or she needs to state the individual names and identities of each beneficiary to include them in receiving a portion of the benefits.

Medicare Benefit Tax Statement Form

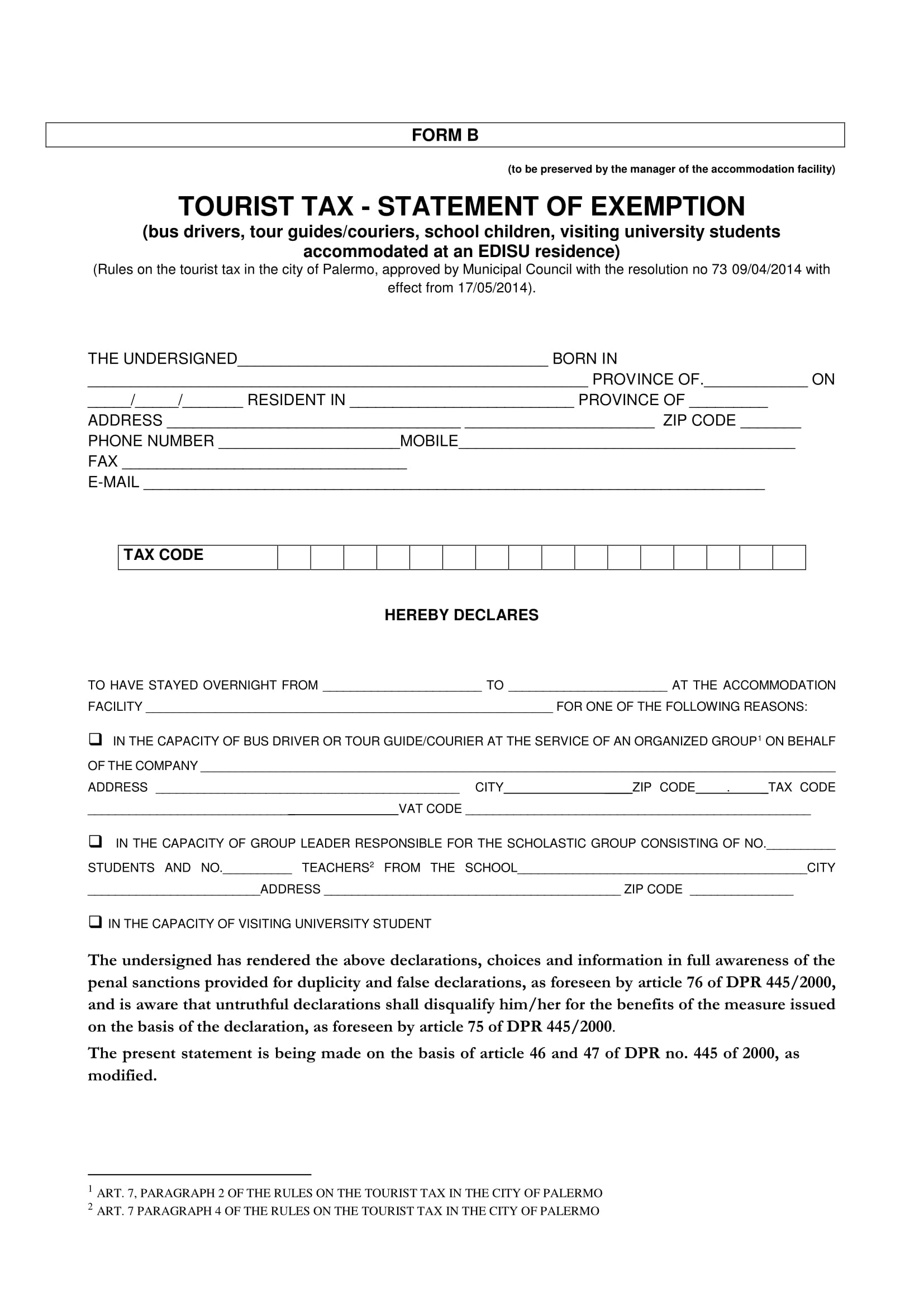

Tourists – Those who are residing in a country as aliens or tourists such as international students and employees should complete a tax statement of notice exemption form. This is a document which should be filled out with an attorney as it deals with legal terms and regulations. It mainly has a declaration is signed by the user of the form and a few data with regards to the tourist which can include his or her contact information and address where he or she is located in the country.

Tourist Tax Statement of Exemption

Five Types of Tax Statement Forms

Though tax statement forms can vary depending on each state and country, these five main statement forms are the most common documents that the population use:

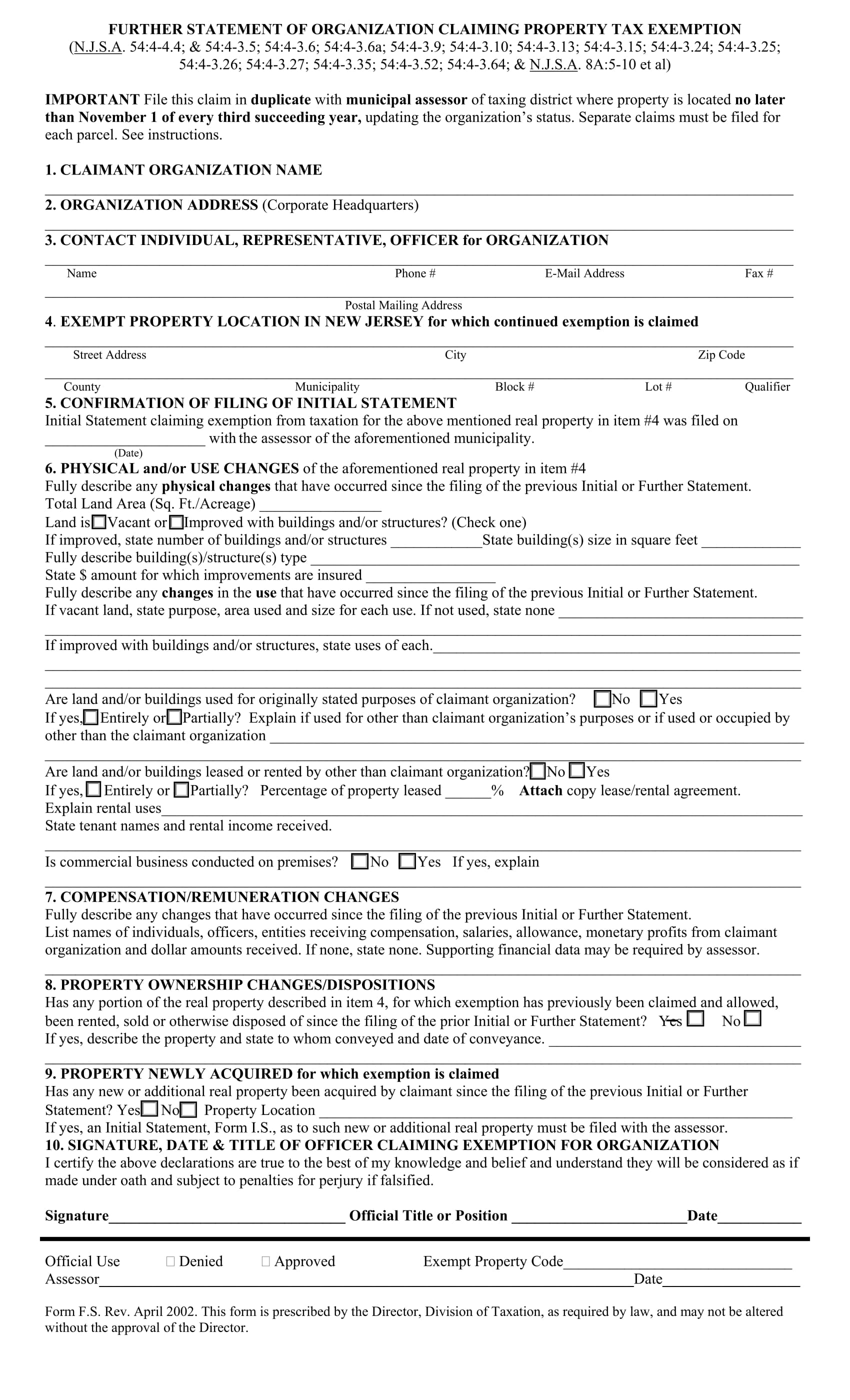

Tax Exemption Statement Form – When an individual receives a tax exemption, it means that his or her taxable income is deducted with a particular amount due to a legal reason such as having dependents in the family. A tax exemption statement form focuses on gathering the details of the exemption claimant, the compensation, and employment information as well as a set of instructions to aid the user in completing the form.

If the tax exemption is for a property claim form or ownership, then the user of the form has to indicate the details of his or her owned property and the reason why the possible changes occurred in the property. The official who will be evaluating the document has to state his or her decision on the form of whether he or she grants an approval or denies the need for the exemption.

Tax Exemption Statement Form

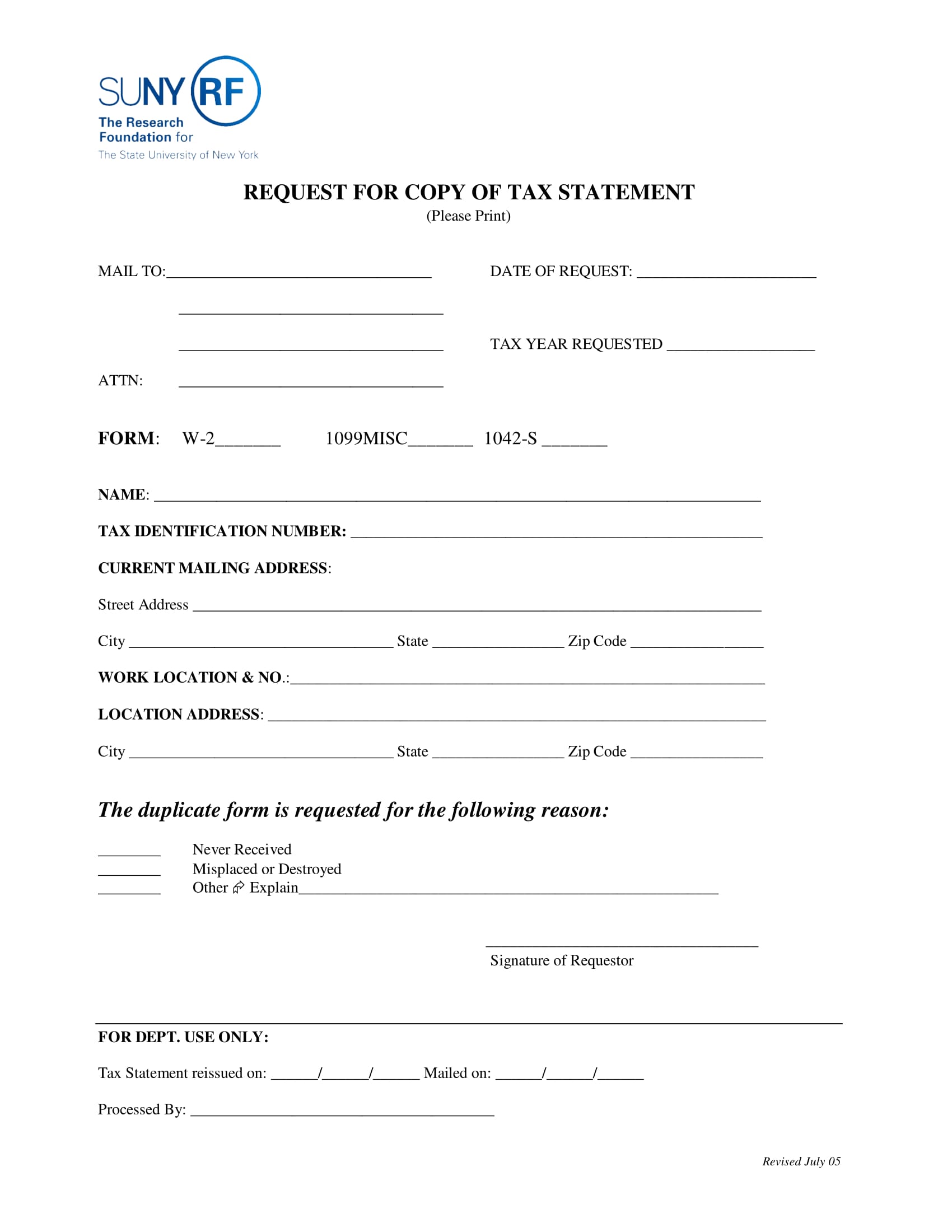

Tax Statement Copy Request Form – Requesting a tax statement form may take some time before the document is received by the recipient. However, the receiving party must assure that he or she had submitted a tax statement request form to the tax office in order to allow the authority to process his or her request.

The form contains the date when the request was made, the tax year of the request, the type of form which is requested for a copy, the mailing address of the recipient and the signature of the requestor. The bottom of the form states the date when the document was issued, sent and the name of the person who processed the request.

Tax Statement Copy Request Form

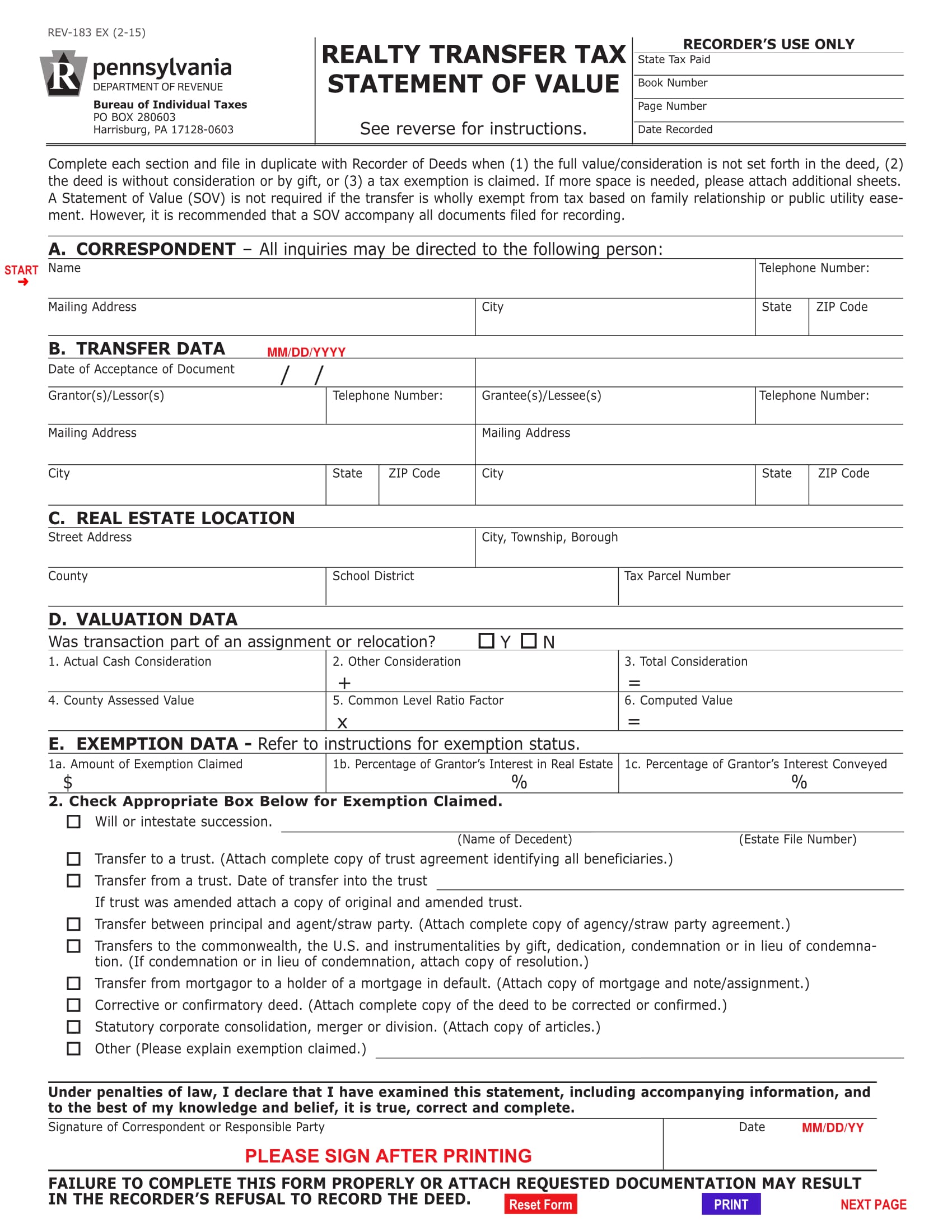

Tax Statement of Value Form – Recording the deed is one of the reasons why this form is used by the property owner and sellers. This form contains five sections which are allotted for the personal information of the correspondent, the details of the transferred data, the location of the real estate, valuation and the exemption of the data. The person who is completing the form has to check a box after the five sections which is for indicating his or her inquiry and the type of exemption that he or she will be claiming.

Tax Statement of Value Form

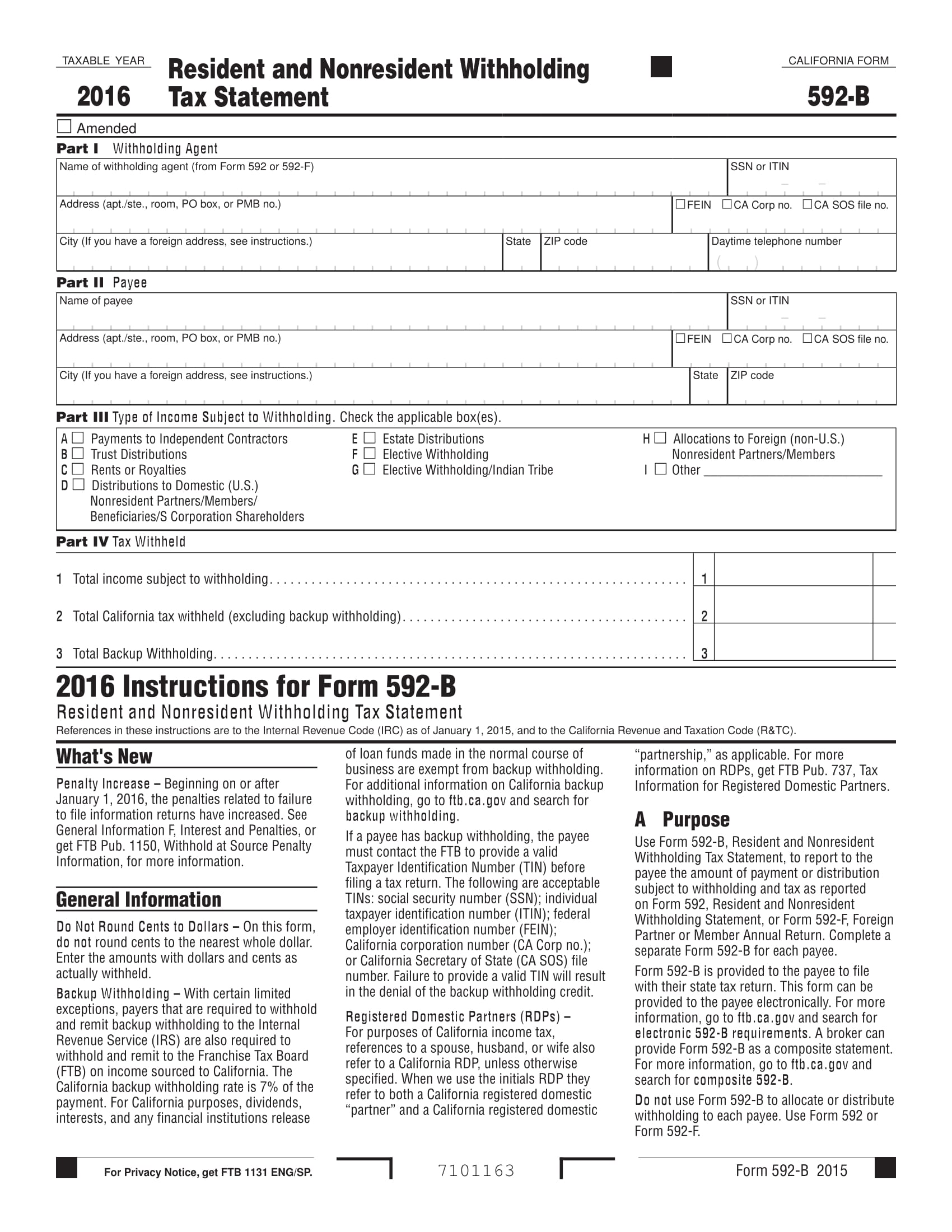

Withholding Tax Statement Form – A withholding tax refers to the amount which is required to be paid by the taxpayer that is associated with his or her income. With this, a withholding tax statement form serves a great use for this purpose. The identity of the withholding agent is included on the form along with the information of the payee.

As there are various income types that can be withheld by the government, the user has to specify his or her income type to assure that he or she will be paying the right taxes. The total income statement to be withheld, the amount of withheld and the backup withholding is also stated on the form. The purpose and general information of the document are enclosed within the form to promote an efficient understanding of why there is a need to complete the form.

Withholding Tax Statement Form

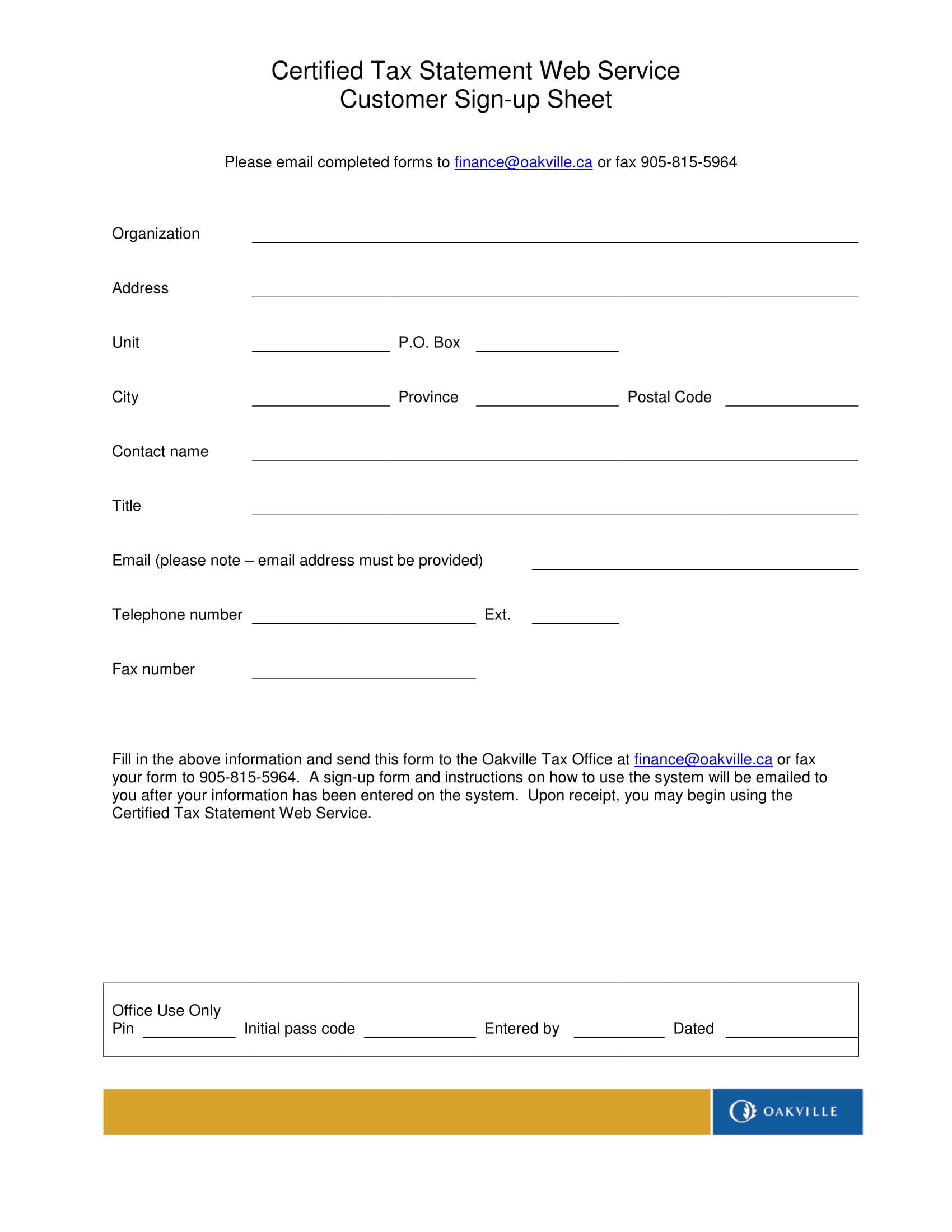

Tax Statement Customer Sign-Up Form – Government agencies who are dealing and managing the tax payments of their clients often use the internet nowadays for acquiring an easier transaction. A tax statement customer sign-up form is similar to an event sign up form, however, it focuses on the data and details of the client’s tax inquiries.

Additionally, it states the contact numbers and information of the client to allow the authority to call or reach the client whenever they need a verification for the tax invoice and needs of the client.

Tax Statement Customer Sign-Up Form

Land Transfer Tax Statement Form

The printable statement forms and the enlisted users of the documents are not limited to the aforementioned examples on this article as there are more types of tax forms to discover. However, any user of the form must be aware of his or her own tax details, rights and the type of document that he or she needs to use to avoid mistakes in his or her tax inquiries.

Related Posts

-

Billing Statement Form

-

Closing Statement Form

-

FREE 13+ Operating Statement Forms in PDF | MS Word

-

Instructions for Other Uses Statement Of Claimant [ What Is, Uses, Instructions ]

-

Creating a Sources and Uses of Funds Statement [ What Is, Steps, Sources and Uses ]

-

10 Tips for Writing a Personal Statement

-

Writing a Small Business Vision Statement [ What Is, How To, Steps ]

-

FREE 10+ Sample Disclosure Statement Forms in MS Word | PDF

-

FREE 7+ Business Statement Forms in MS Word | PDF

-

What is a Contingent Statement? [ Importance, Components ]

-

FREE 12+ Sample Medical Statement Forms in PDF | MS Word

-

What is a Categorical Statement? [ How to, Importance, Components, Guidelines ]

-

FREE 7+ Profit and Loss Statement Forms in PDF

-

FREE 8+ Voluntary Statement Forms in MS Word | PDF

-

What are Financial Statement Forms? [ How to, Include, Functions, Importance ]