Companies who knew the importance of working with invoices for business transactions are most likely to succeed in tracking their inventories. This is because an invoice is a type of tab which the company can present to their customers as a request for payments with regards to the customer’s purchases.

The difference between an invoice and receipt is minor since these two documents only differ on the specific timing in which they will be given to the customer. The invoice will be given before the customer will pay the bill, while the receipt will be supplied after the customer had paid.

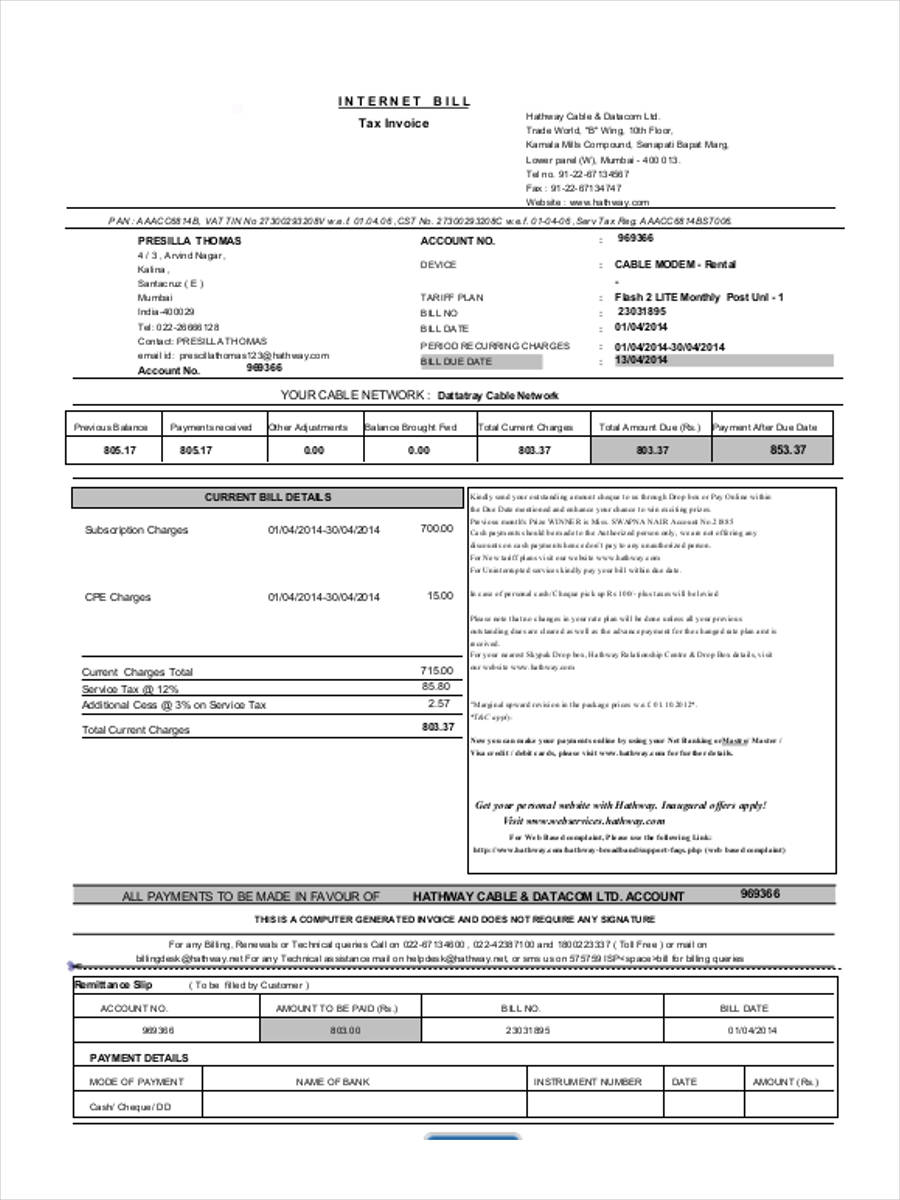

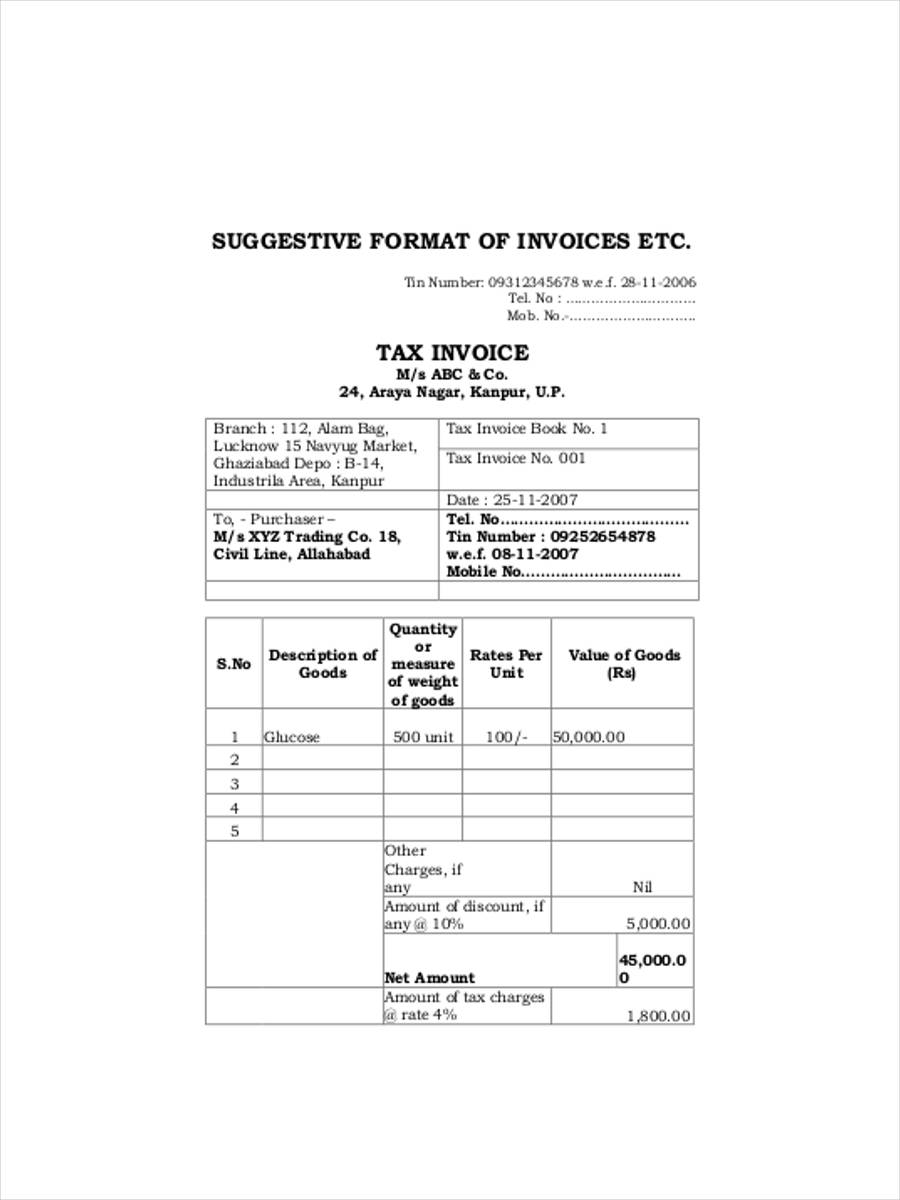

Tax Invoice Form Template

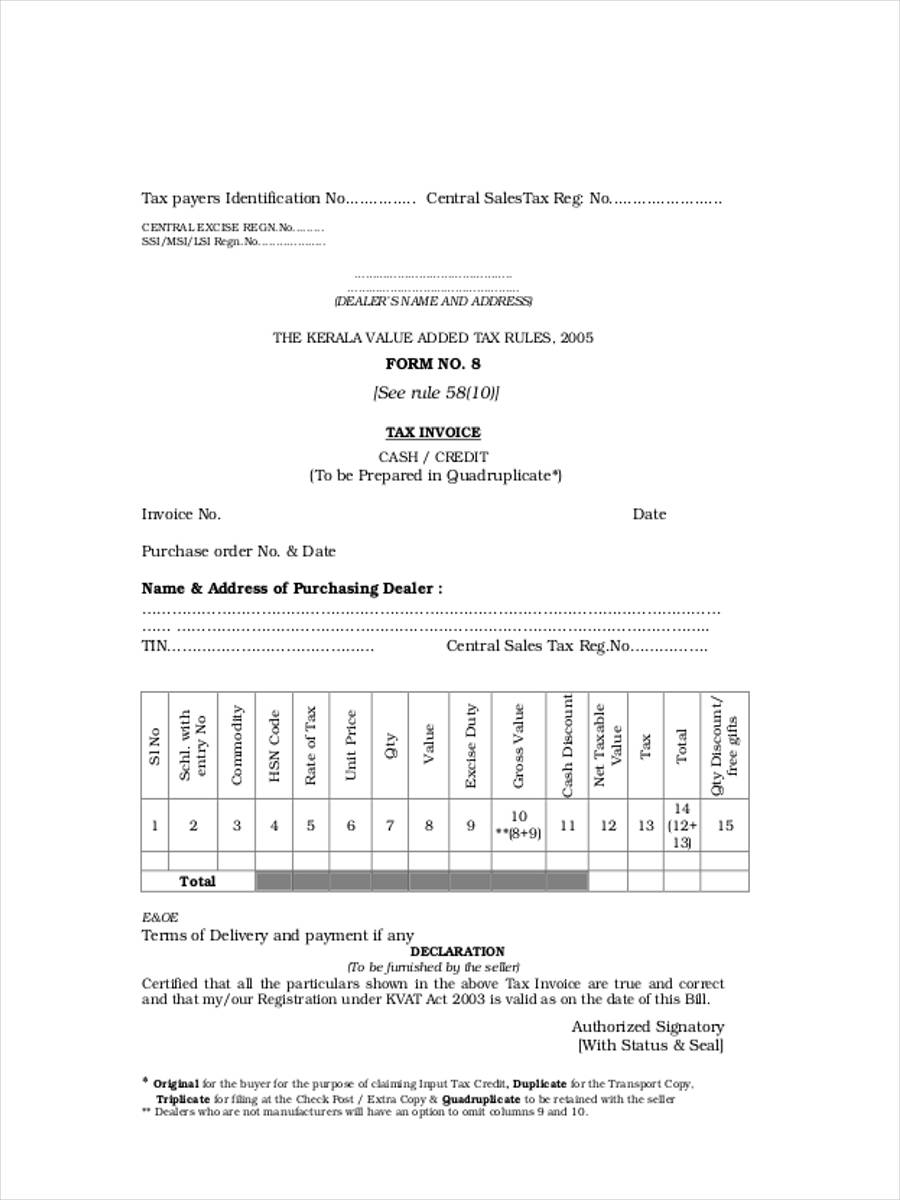

Commercial Tax Invoice

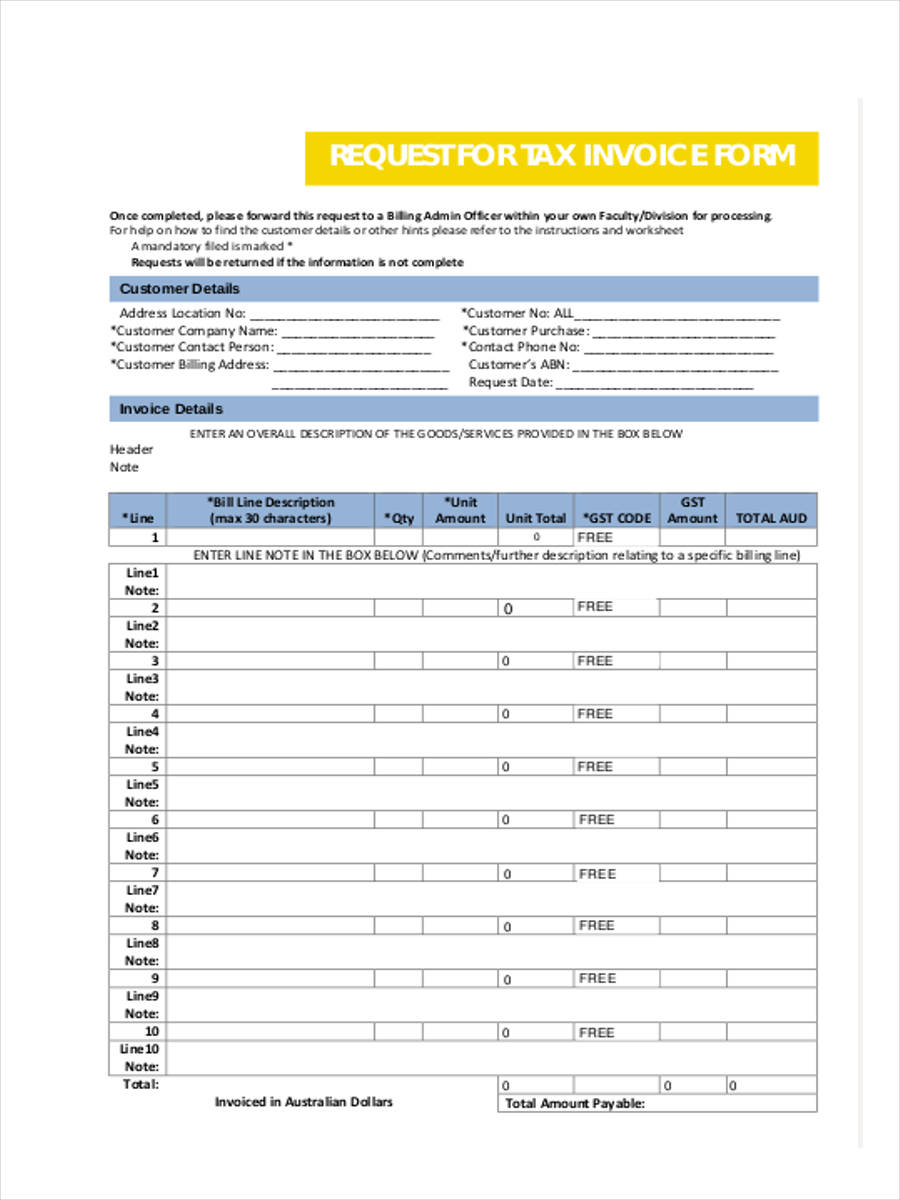

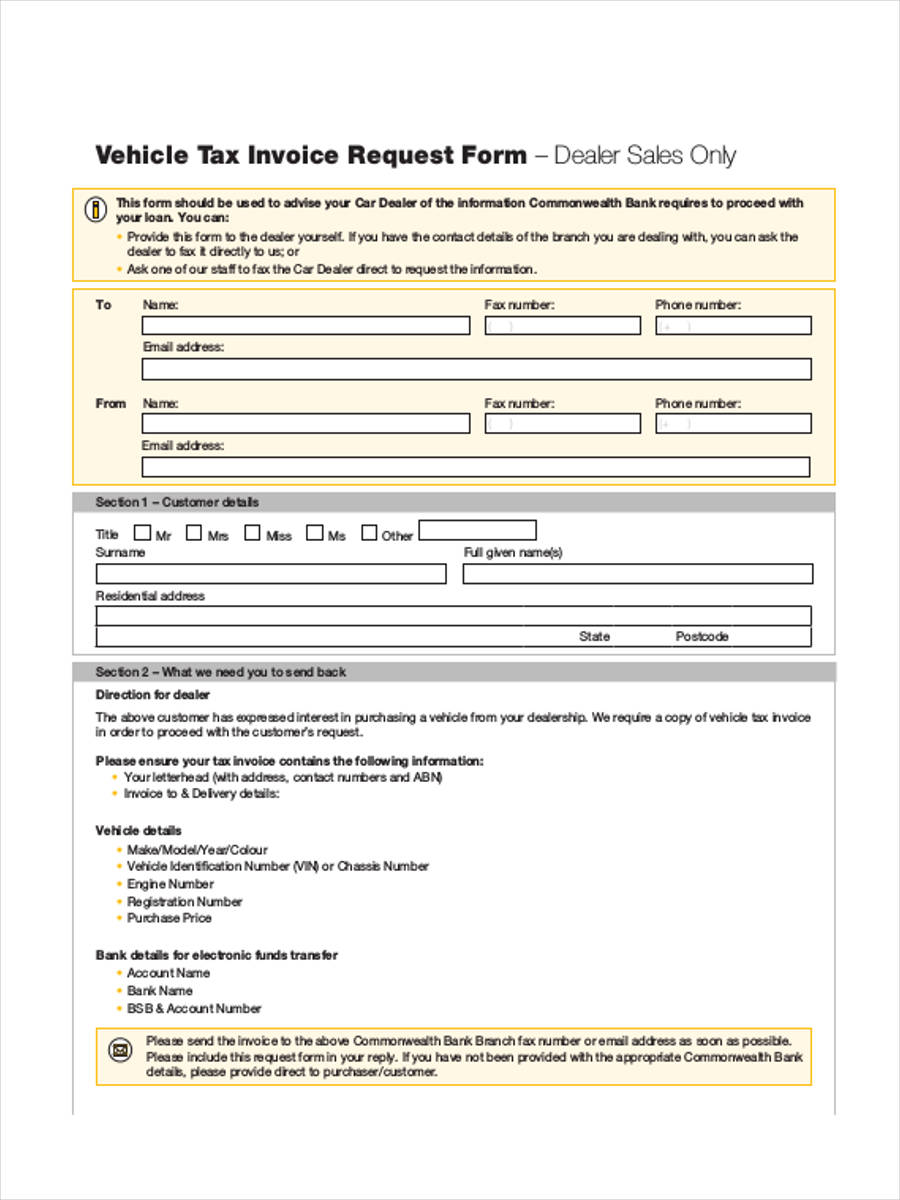

Tax Invoice Request Form

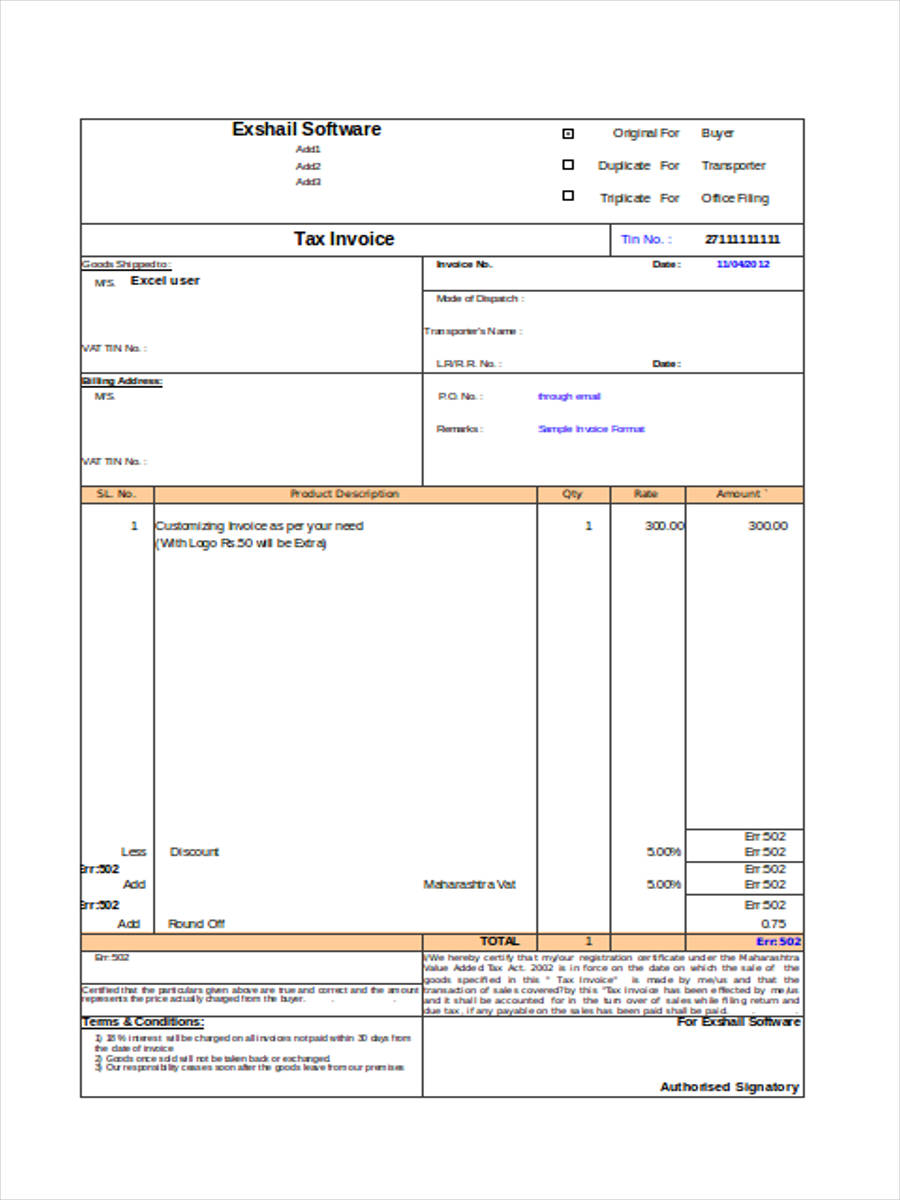

Tax Invoice in XLS

What Is a Tax Invoice?

Tax Invoices are documents which are issued for a transaction that involves two tax registered dealers as the seller and the buyer. Tax registered dealers are those whose annual gross turnovers are beyond the tax limits of a state.

These people are the ones responsible for paying the taxes associated with the purchases made by non-registered dealers. The invoice document will aid the dealers in acquiring an input tax credit. This tax invoice is also intended for indicating the purchased goods which are for resale and redistribution.

Taxes are also found on other invoice forms, such as a Contractor Invoice Form. This is to have the amount of taxes for the work and supplies as part of the payment breakdown for the customer.

How to Set out Tax Invoices and Invoices

In our Invoice Form Samples, you can compare that there are particular arrangements in any format. Listed below are some of the standards known by most users:

- The business and company names with details should be stated at the top.

- Invoice numbers and date issued should follow the names.

- The descriptions and prices with the taxable amount should be indicated in a table.

- Indications on which type of purchase have no taxes should be included.

- The final amount is required to be stated at the bottom.

Sales Tax Invoice

Vehicle Tax Invoice

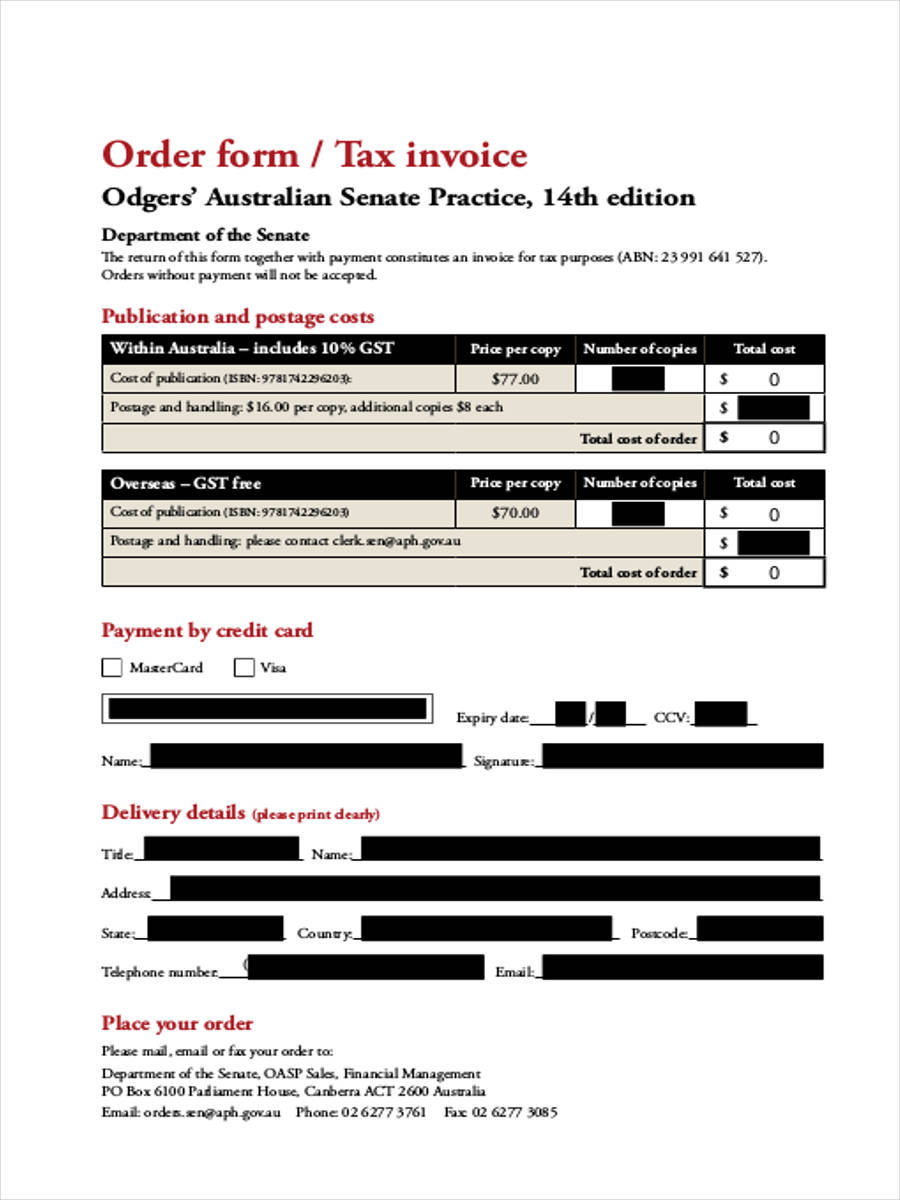

Order Form Tax Invoice

Difference Between Tax Invoice and Retail Invoice

Tax invoice and retail invoice are two different forms of invoice bills. One of the main difference that these forms have is who uses the form which refers to a registered dealer for the tax invoice, and a seller for the retail invoice. The objectives in using the invoices are also very far from each other, since a tax invoice is to allow the registered dealer to input tax credits, while the latter is to request the customer for a payment for his purchased goods.

A TIN or a Tax Identification Number is a vital section of a tax invoice compared to a retail invoice where it is fine that this TIN is not present on the form. Lastly, a tax invoice requires to be triplicated for documentation, while the retail invoice only needs to be duplicated for the seller and the buyer’s copy.

Furthermore, invoices are proven as important documents that gives an advantage to anyone who uses it, whether a seller, a buyer, or a dealer. Blank Invoice Forms are also helpful especially for business enterprises which have just started their company.

However, in choosing the type of invoice formats, whether an Automated Invoice Form, or an Invoice Forms in Excel, the users should be mindful in what sorts of information they will present and should focus on attaining easy readability for their customers.

Related Posts

-

FREE 9+ Sample Service Invoice Forms in MS Word | PDF

-

FREE 6+ Sample Rent Invoice Forms in PDF

-

FREE 7+ Sample Plumbing Invoice Forms in PDF | MS Word

-

FREE 6+ Sample Payment Invoice Forms in MS Word | PDF

-

FREE 6+ Sample Work Invoice Forms in PDF | MS Word

-

FREE 6+ Sample Job Invoice Forms in PDF | MS Word

-

FREE 9+ Sample Business Invoice Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Invoice Forms in PDF | MS Word | Excel

-

FREE 8+ Photography Invoice Samples in PDF | Excel

-

FREE 6+ Sample Graphic Design Invoice Forms in MS Word | PDF | MS Excel

-

FREE 9+ Sample Sales Invoice Form in MS Word | PDF | Excel

-

FREE 10+ Sample Contractor Invoice Forms in MS Word | PDF | Excel

-

FREE 9+ Invoice Request Forms in MS Word | PDF | Excel

-

FREE 4+ Photography Invoice Forms in PDF

-

FREE 6+ Vehicle Invoice Forms in MS Word | PDF