Employment Forms are necessary in running a business. And whether you are self-employed or employed in the public or private sector, you would need Employment Expenses Forms for various reasons. An Employment Expenses Form is used to list all expenses incurred by an employee for business purposes, which are going to be reimbursed by their employer. This can also be filled out by employees for tax write-offs for certain allowable expenses.

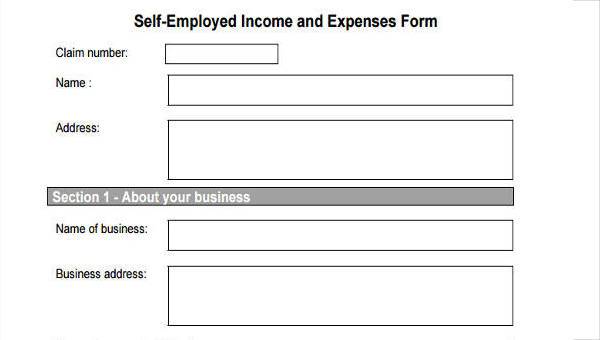

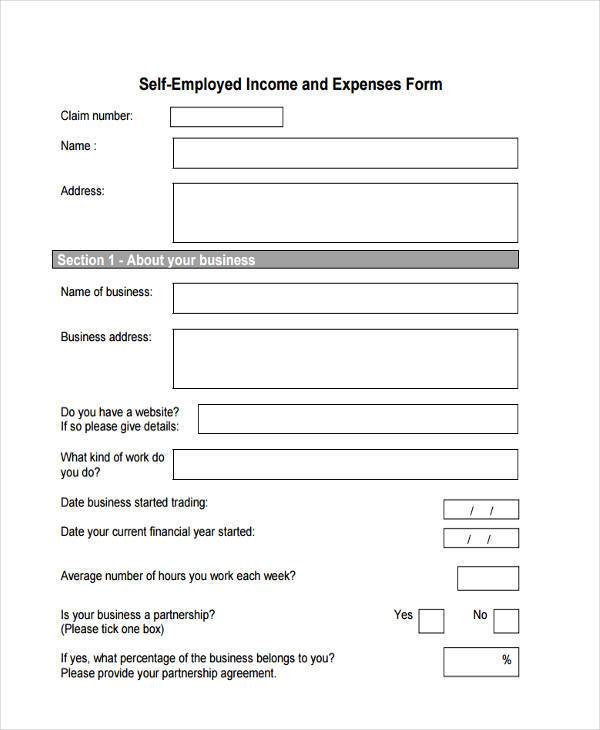

Self-Employment Expenses Form

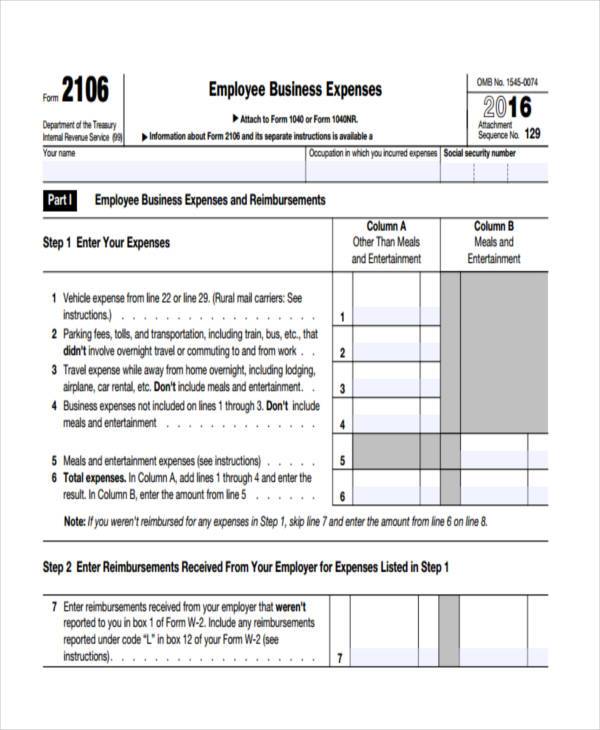

Employment Related Expenses Form

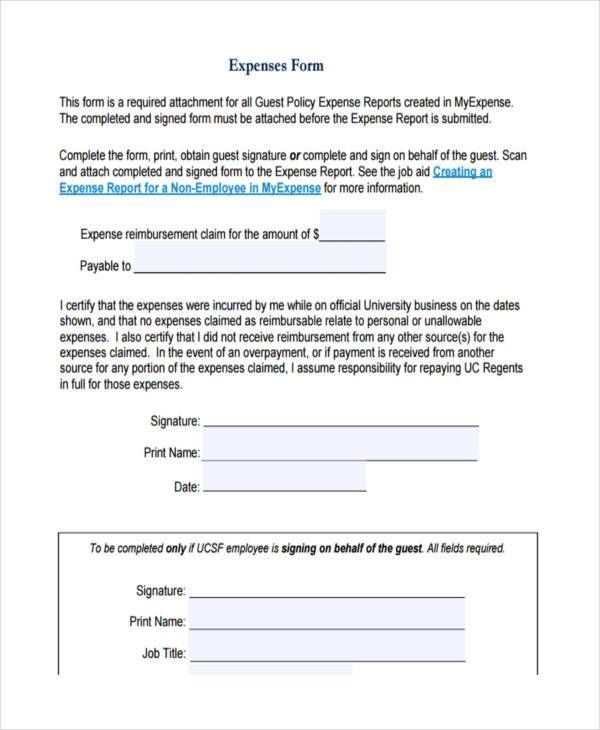

Employment Expenses Form in PDF

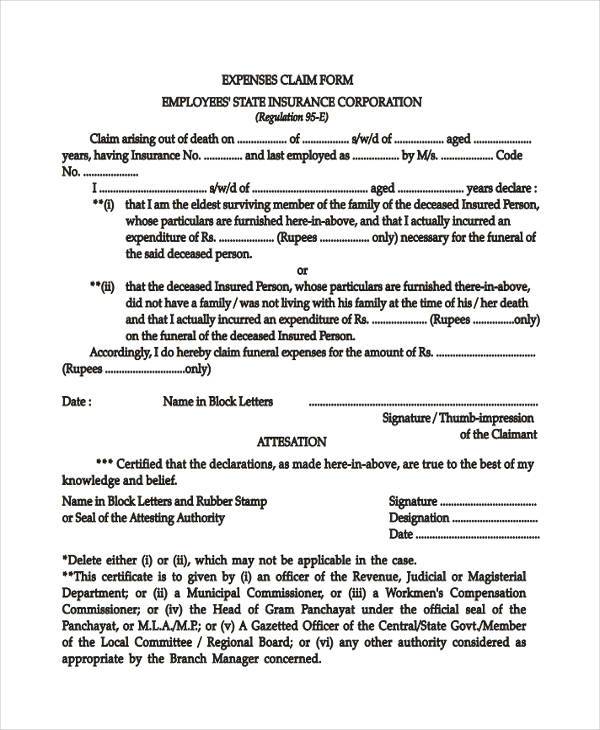

Employment Expenses Claim Form

Types of Employment Expenses Forms

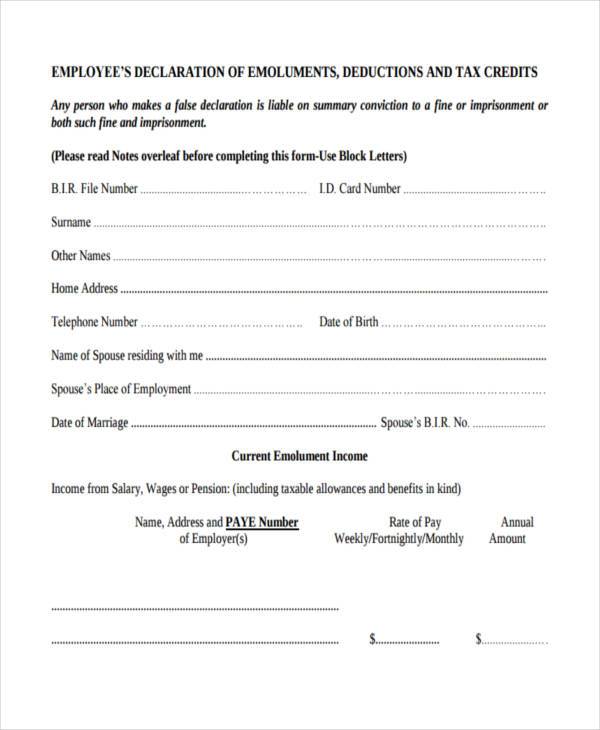

- Self-Employment Expenses Form: This is used to declare the expenses of a self-employed person for the purposes of tax deductions. Deductible business expenses are those that are considered ordinary and necessary to the operation of your business. An ordinary expense is one that is common and natural in your field or business. A necessary expense is one that is helpful and appropriate for your field or business. You may also check out our Self Employment Forms for other forms for self-employment.

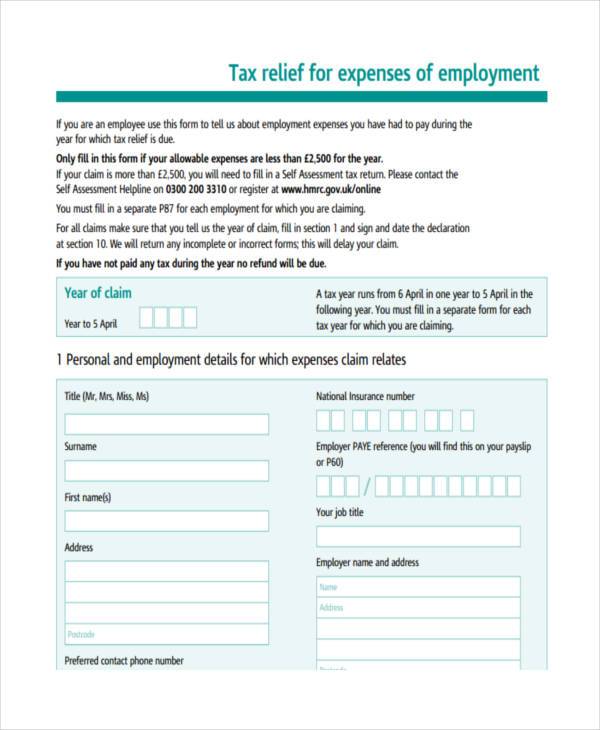

- Employment Related Expenses Form: This is used for tax reliefs for expenses incurred for employment. There are certain terms that have to be met for the expense to be claimed for tax relief, because there are expenses that are reimbursed by the employer which are treated as compensation and are taxed as such.

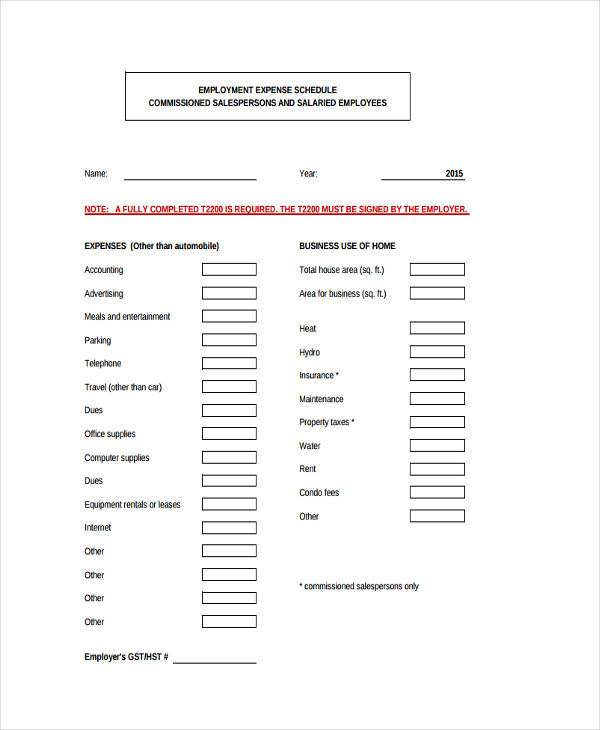

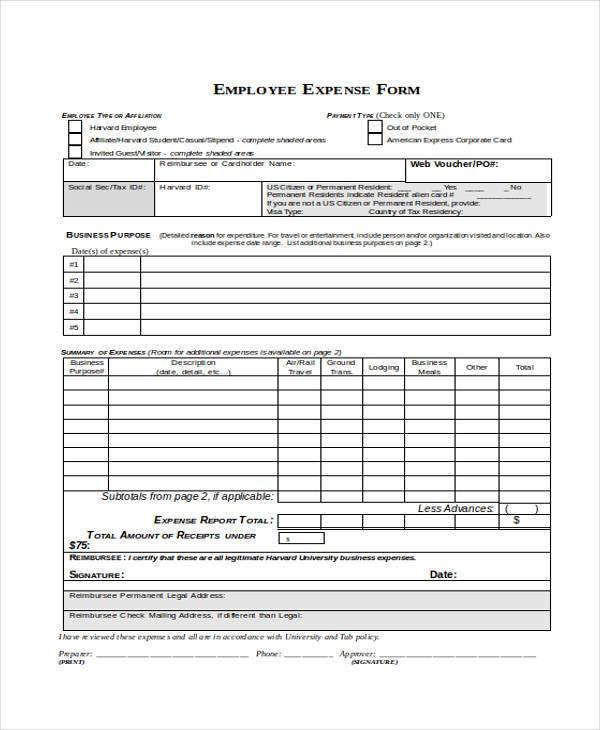

- Employment Expenses Form: This is used to list expenses incurred by the employee for business purposes and are to be reimbursed by the employer.

Each of these forms should be accurately and completely filled out for them to be valid. In addition, certain receipts or proof of the expenses may also be required to validate the forms.

Employment Expenses Tax Form

Employment Expenses Form Example

Employment Expenses Deduction Form

Employment Expenses Form in Word

Employee Expenses Forms are important for tax deduction. A tax deduction is a deduction from your taxable income, thereby reducing the taxes that you pay to the government. This is usually the result of expenses an employee has incurred that results to the generation of more income.

Ways to Manage Employee Expenses

- Enforce policies that your employees have to abide by. Set limits on how much they can spend on certain business activities.

- Properly assign approval for the reimbursement of expenses to the appropriate departments based on the amount of expenses claimed. This way, you can make sure that every approval and reimbursement was well thought of.

- Make sure that the Employee Expenses Forms are filled out accurately and completely. Make sure that all data necessary for the validity of the forms is captured, and that proof for the expenses is provided accordingly.

- Keep the forms simple and clear to avoid confusion and errors when filling out the forms. This results to a seamless process of reimbursement.

It is important for the employer to make sure that every employee is disciplined and would not be too lax in spending the company’s money. This is why Employee Expenses Forms are helpful. They help you keep track of the expenses your employees have incurred. You may also check out our Employee Application Forms for those who are seeking employment.

Related Posts

-

FREE 8+ Employment Statement Form Samples in PDF | MS Word

-

FREE 7+ Sample Employee Name Change Forms in PDF | MS Word

-

FREE 9+ Sample Employment Renewal Forms in PDF | MS Word

-

FREE 7+ Sample Employee Vacation Request Forms in PDF | MS Word

-

FREE 7+ Sample Employee Medical History Forms in PDF | MS Word

-

FREE 10+ Sample Employment Release Forms in PDF | MS Word

-

FREE 7+ Sample Employee Expense Reimbursement Forms in PDF | MS Word

-

FREE 9+ Sample Employee Warning Forms in PDF | MS Word

-

FREE 8+ Sample Employee Misconduct Forms in PDF | MS Word

-

FREE 8+ Sample Employment Questionnaire Forms in PDF | MS Word

-

FREE 8+ Sample Employment Verification Request Forms in PDF | MS Word

-

FREE 7+ Sample Employee Time Sheets in MS Excel | PDF | MS Word

-

Employment Rejection Letter

-

Employment Reference Form

-

FREE 9+ Employment Eligibility Forms in PDF | MS Word