Tax forms enable individuals or companies to file various types of tax returns easily. These tax forms present many types of forms which are suitable for filing income tax, income tax extension, tax returns, tax exemption, sales tax form and many more. They also provide instructions on filing tax returns and provide detailed requirements for applying tax refunds. One can search Google using income tax form download or income tax return form PDF and get more information.

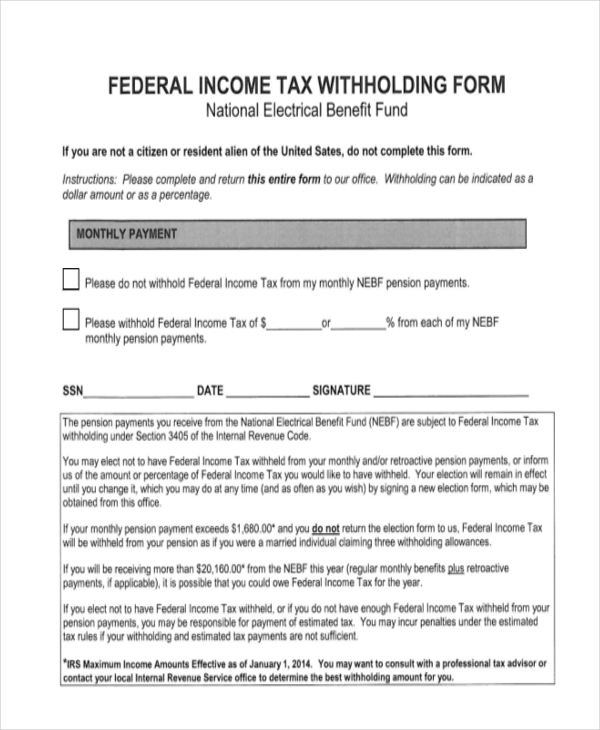

Sample Federal Income Tax Form

This federal income tax form presents the SSN number, date and signature of the pensioner. It provides the option either not to withhold federal income tax from pension payments or withhold income tax from monthly pension payment.

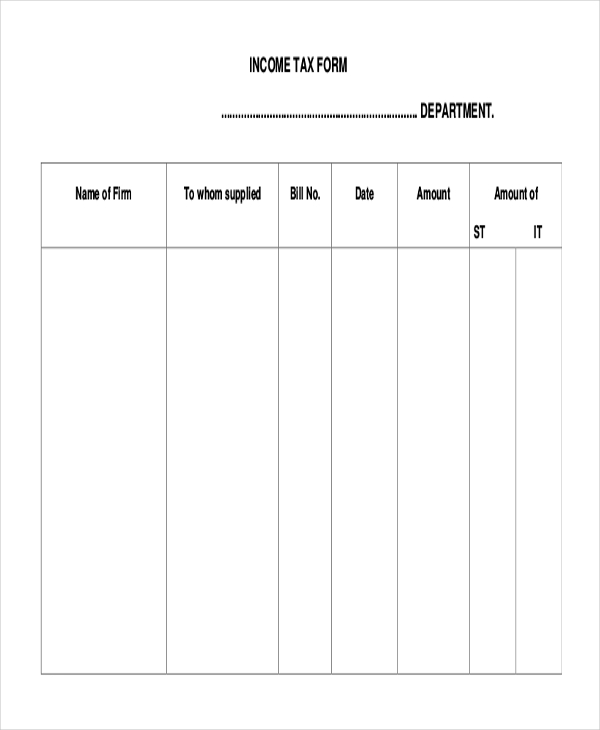

Income Tax Form

This income tax form presents the statement containing deduction of sales and income tax. It mentions the name of firm, supplier name, bill number, date, amount as well as sales tax details.

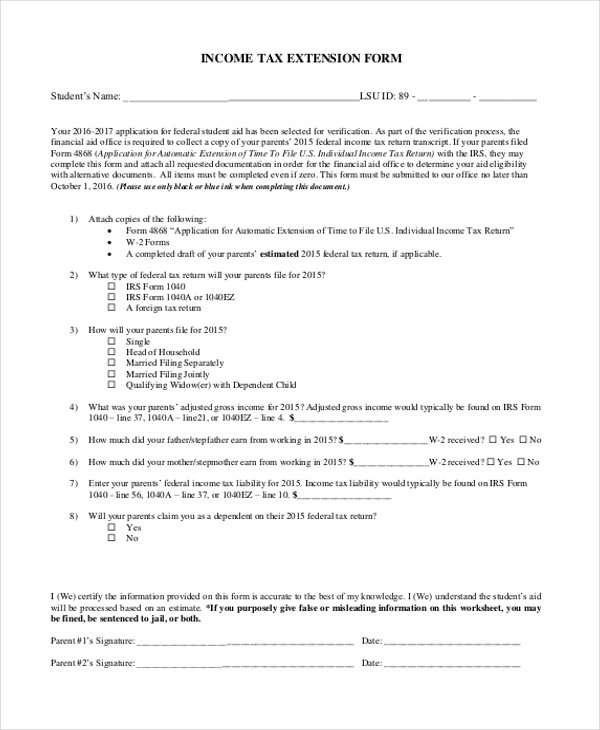

Income Tax Extension Form

This income tax extension form presents the student’s name and id as well as details of federal tax forms. It provides various income proof details and obtains the signature of the parents.

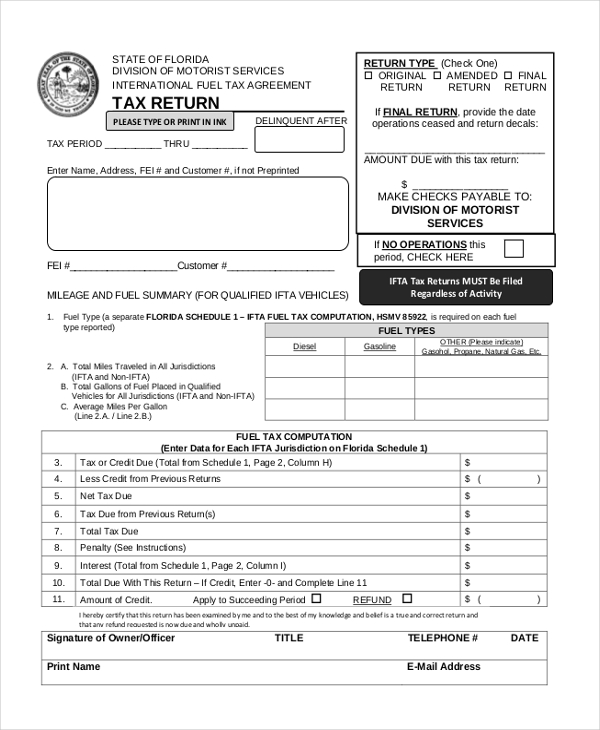

Sample Tax Return Form

This tax return form presents the name, address, FEI and customer number, fuel tax computation details, total miles travelled and obtains the signature of the officer. It mentions the title, telephone number and date.

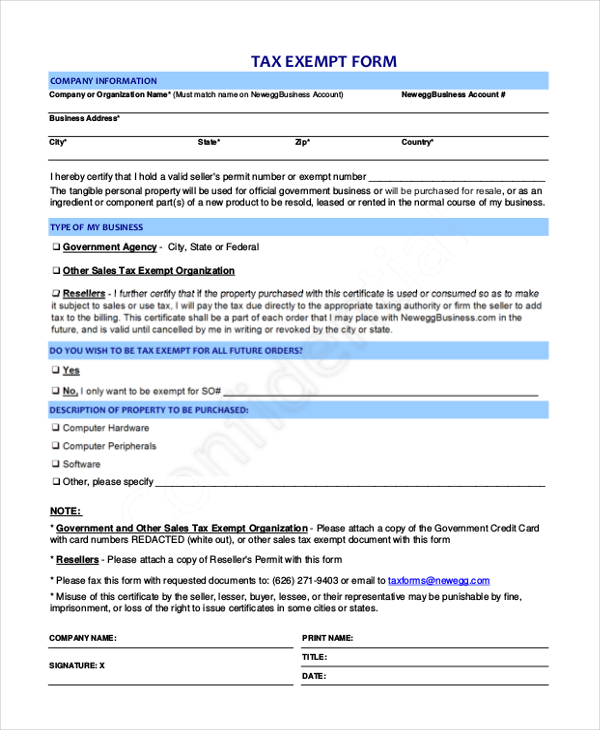

Tax Exempt Form

This sales tax exempt form presents the organization name, address and tax exempt number. It mentions the nature of business, tax exemption details and property purchase details. It obtains the signature from authorized person of the company.

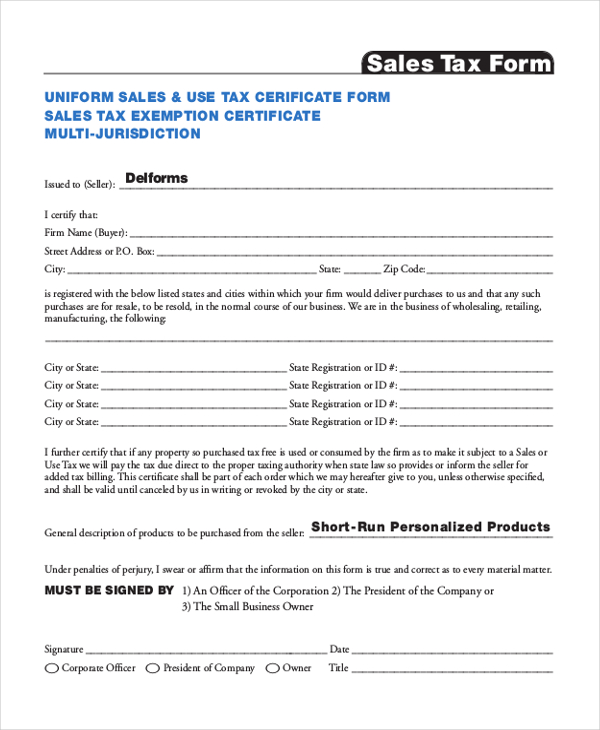

Sales Tax Form

This sales tax form presents the seller name, buyer name, address and purchase details. It also mentions the description of the products and obtains the signature of the company authorized person.

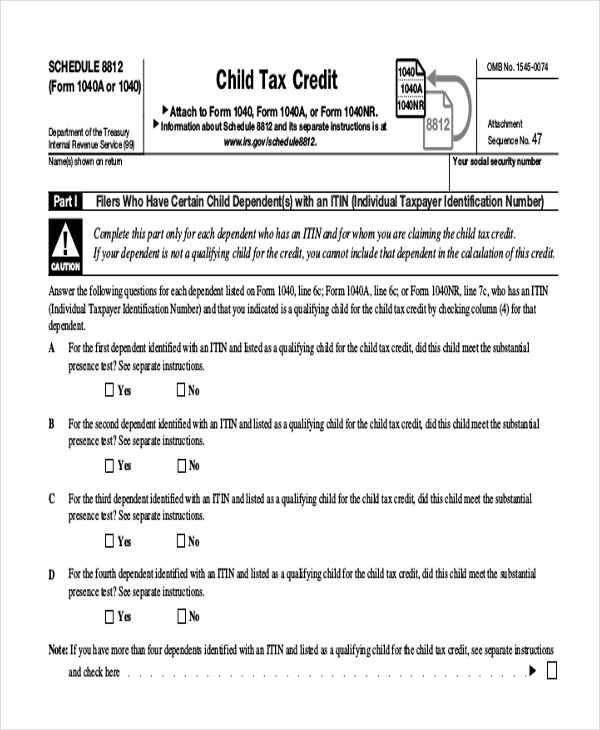

Child Tax Credit Form

This child tax credit form presents the various questionnaires for filers who have individual taxpayer identification number. It also mentions questionnaires for filers who want to claim additional child tax credit and separate questionnaires for filers who have three or more qualifying children.

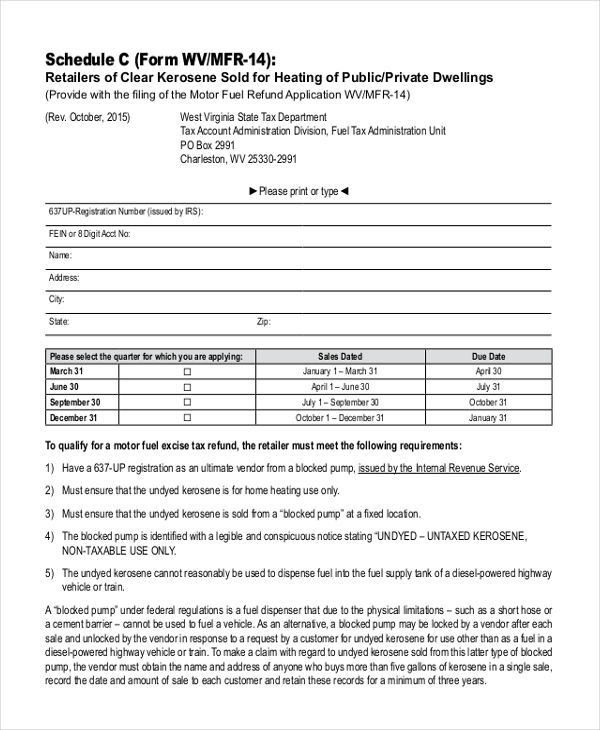

Sample Schedule C Tax Form

This schedule C tax form is used for claiming motor tax refund. It presents the account number, name and address and applying quarter. It also mentions the requirements that one should meet to apply for tax refund.

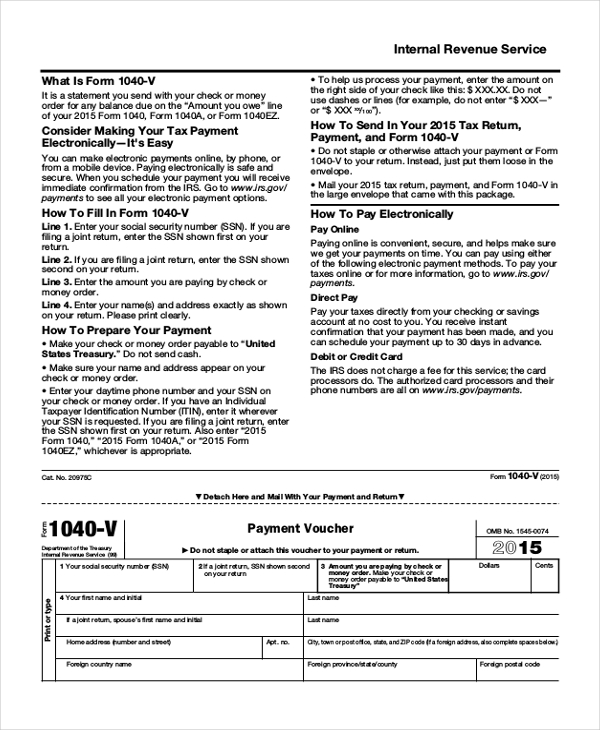

Internal Revenue Service Tax Form

This internal revenue service tax form presents the instructions on how to fill in form 1040-V and methods of preparing payment as well as instructions for sending tax return. It also mentions different modes of payment.

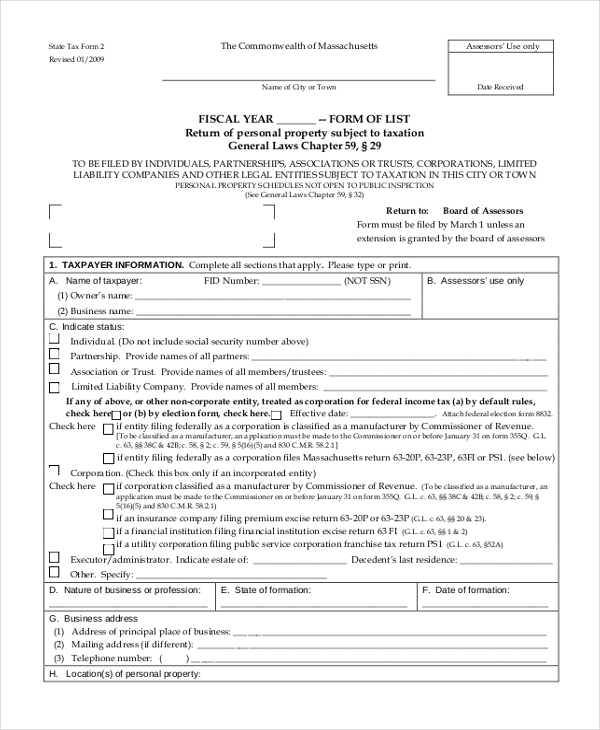

Printable Tax Form

This tax form presents the tax payer information like name, FID number, owner and business name, status and information of the tax payer as well as business address. It provides information regarding filing tax returns.

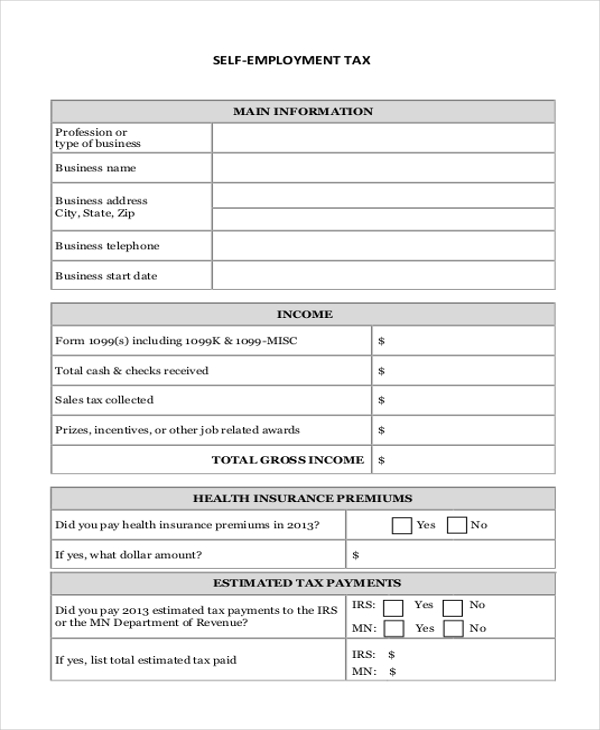

Self Employment Tax Form

This self employment tax form presents information like type of business, business name, business address and start date. It also mentions income details like Form 1099, cash and checks, sales tax and incentives. It provides business expenses, products sold and vehicle information.

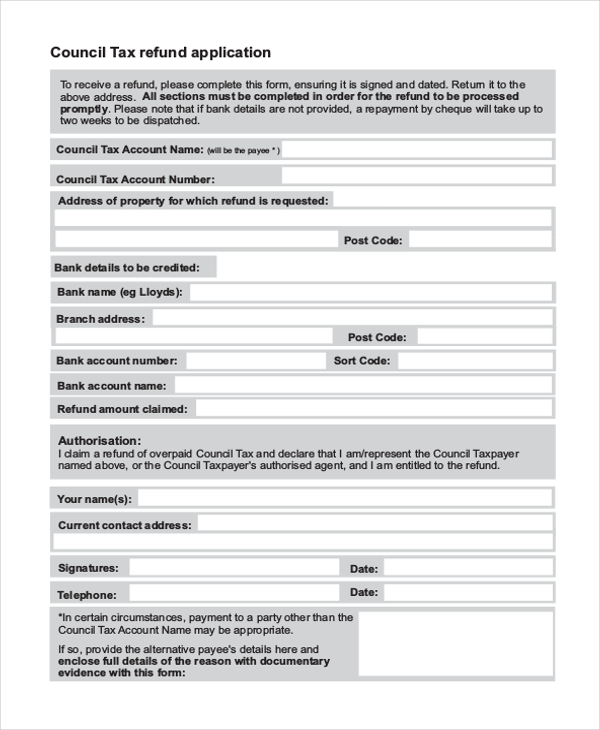

Sample Tax Refund Form

This tax refund form presents council tax account name, account number, property address, bank details like bank account number, branch and refund amount claimed as well as obtains the signature of the tax payer.

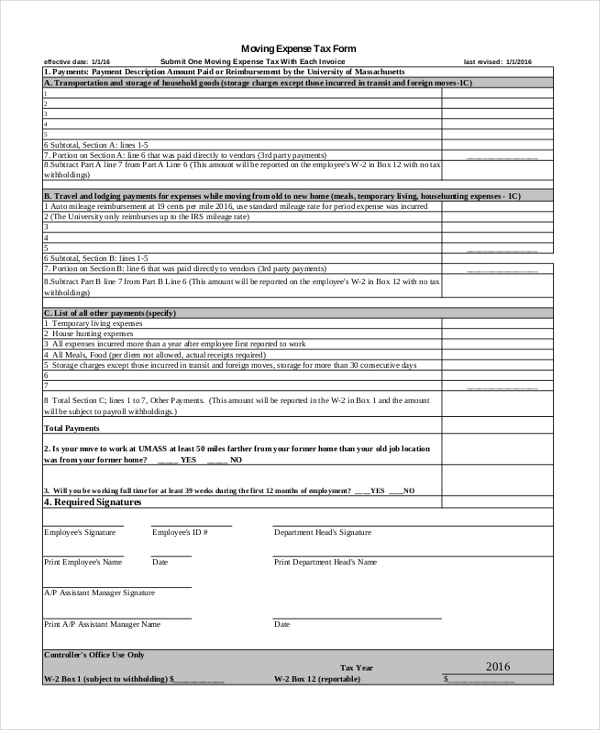

Moving Expense Tax Form

This moving expense tax form presents the payments details like payment description amount paid, transportation as well as storage of household articles, travel and lodging payments for expenses and list all other payments. It obtains the signatures of employer, department head and assistant manager.

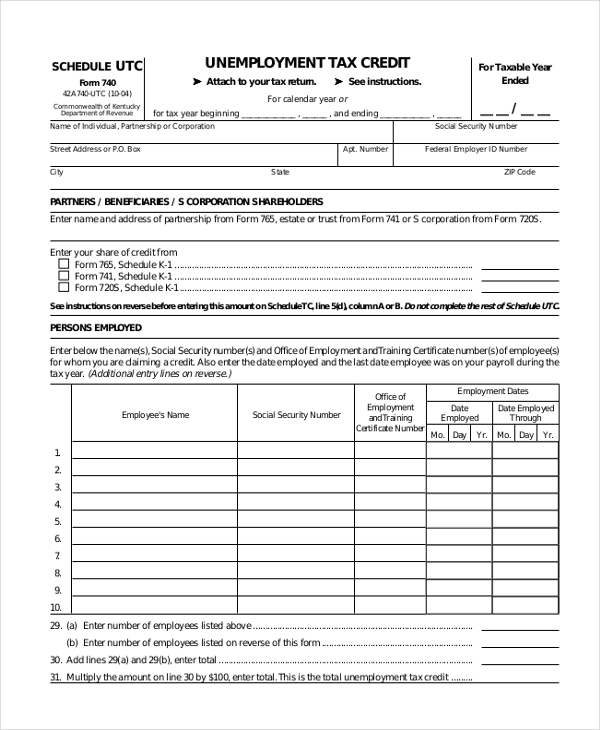

Sample Unemployment Tax Form

This unemployment tax form presents the name of the individual or corporation, social security number, address, partner’s details, employee details of the organization like employee name, social security number, training certificate number as well as employment dates.

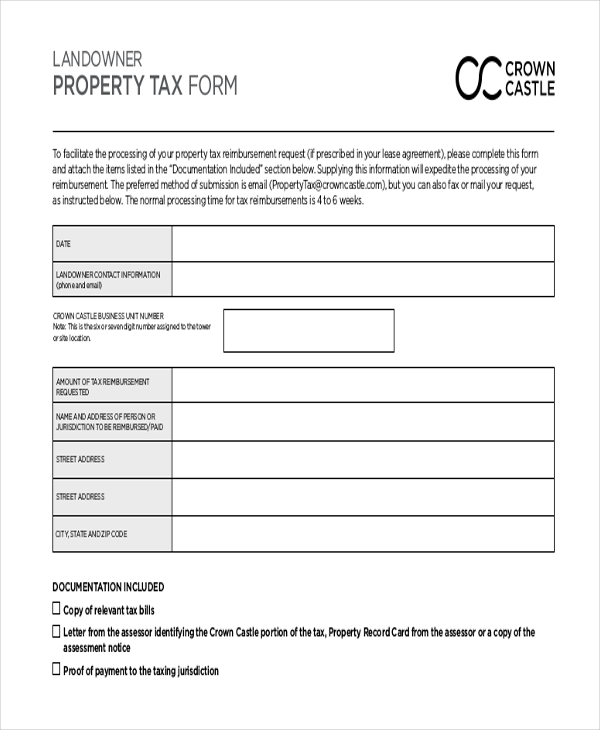

Property Tax Form

This property tax form presents the date, landowner contact information, amount of tax reimbursement requested, address as well as provides copies of relevant tax bills, assessment notice, proof of payment.

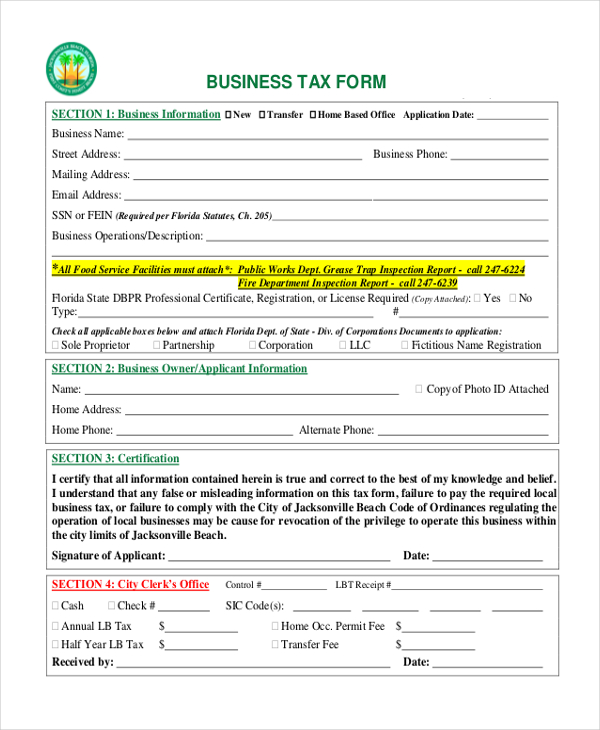

Business Tax Form

This business tax form presents the business name, address, contact number, SSN number, business description, business owner information like name, home address and contact number. It also obtains the signature from the applicant.

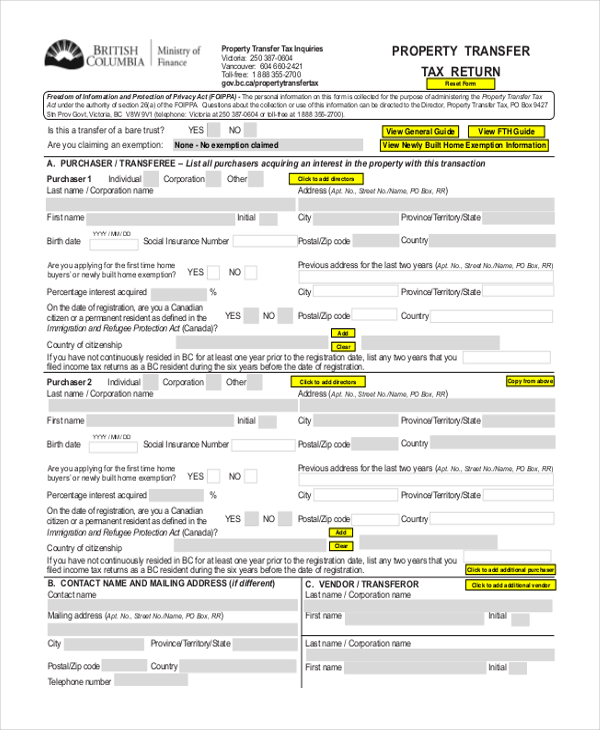

Sample Property Transfer Tax Return Form

This property transfer tax return form presents the purchaser details like corporation or individual name, address, date of birth, social insurance number, contact name and mailing address, vendor name as well as description of property and transfer.

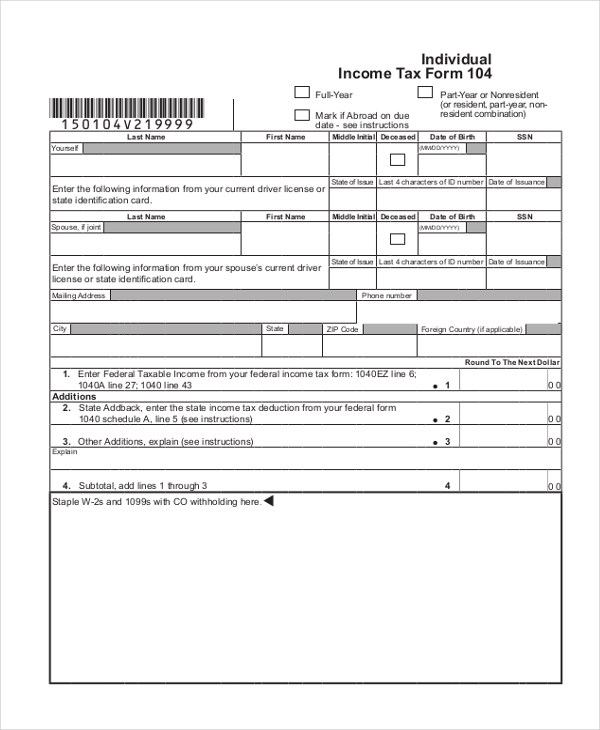

Individual Tax Form

This individual tax form presents the name, date of birth, SSN, address, taxable income details including deductions, voluntary contribution details and direct deposit details. It obtains the signature of the individual.

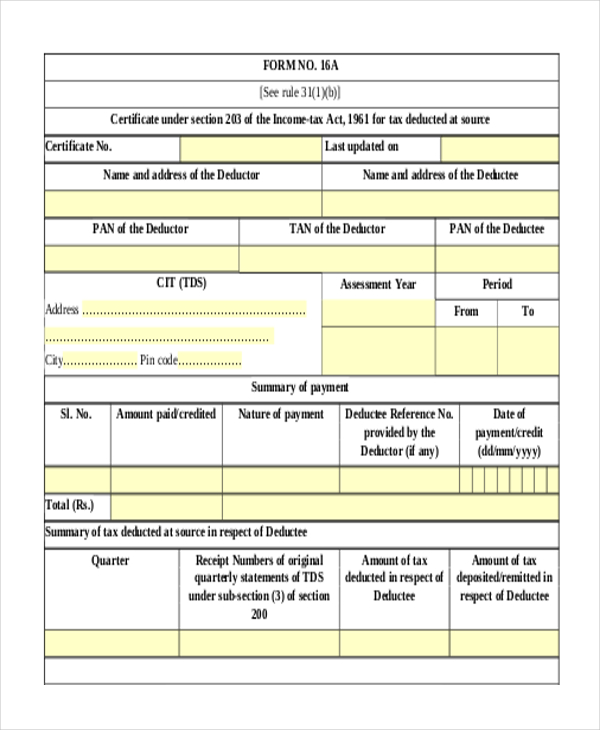

Sample Income Tax Department Form

This income tax department form presents the name and address of the deductor, name and address of the deductee, PAN and TAN details of deductor and deductee, assessment year, period and details of tax deducted.

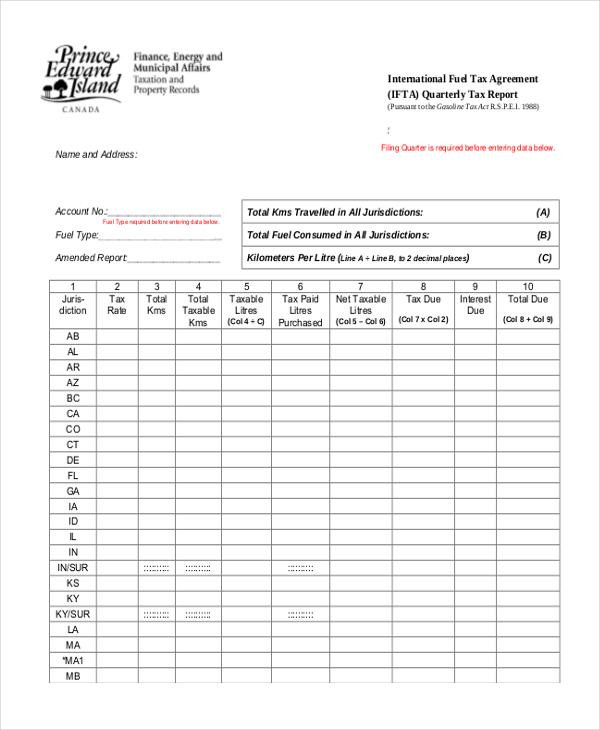

Quarterly Tax Form

This quarterly tax form presents name and address, account number, fuel type, travelling details and fuel consumption details. It also obtains the signature, title and phone number of the individual.

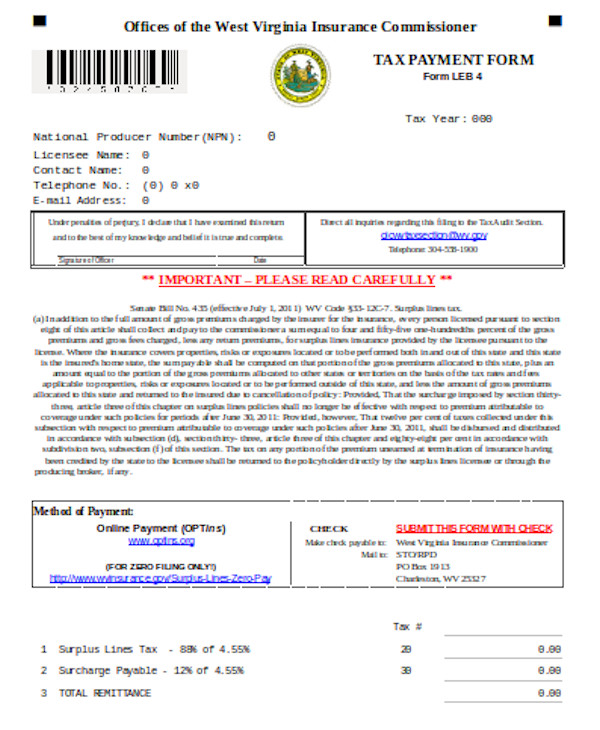

Standard Tax Payment Form

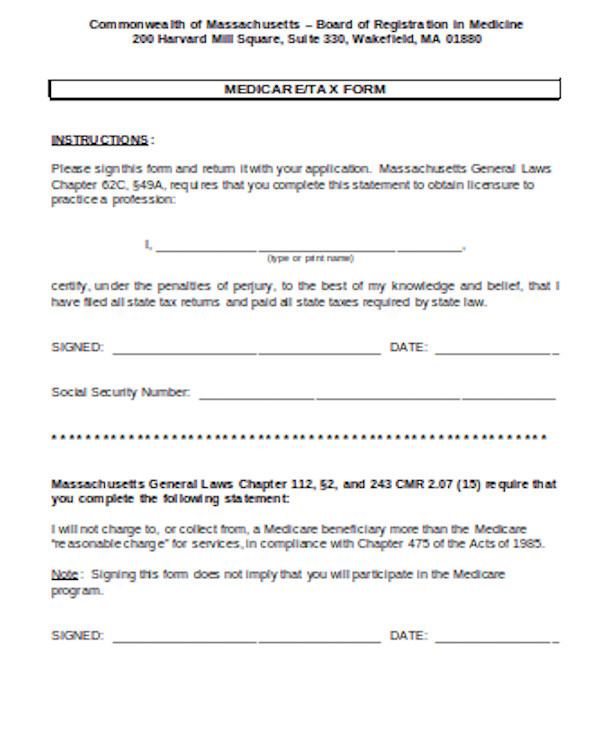

Simple Medicare Tax Form

What to Include in Tax Forms?

Tax forms should contain all the relevant details and information pertaining to the tax payer. They should contain all the details required for filing tax returns including payment methods and modes. They should comply with government norms and should be relevant with type of tax credit one is applying or claiming refund. For companies that are claiming sales tax returns, the details of all sales and purchases should be disclosed. There are various clauses available when one is applying for child tax credits. When one is applying for tax returns for motor vehicles, they should contain fuel consumption details along with other relevant information.

What are The Benefits of Tax Forms?

Some of the important benefits of tax forms are

- They enable one to file tax returns and claim income tax deductions

- They provide details of income proof and avail income tax benefits

- They enable organizations to provide sales transactions and sales tax payment details to the tax department

- They help the parents to show proof towards expenses made for children education and claim tax deductions

- They enable to claim tax details and obtain tax credits smoothly

- They enable the employees to provide exact income information and help the tax authorities to deduct income tax from employees as well as pensioners

Tax forms are available in plenty of varieties and they come with various clauses based on the type of tax returns one is filing. They come in PDF format and one can easily download them and take printout. They comply with the tax rules and regulations laid by the government which enable the individuals and organizations to file tax returns smoothly.

Related Posts

6+ Sample Offer to Purchase Real Estate Forms

Sample Payroll Deduction Forms - 10+ Free Documents in PDF, Word

7+ Sample Short Term Disability Forms

8+ Sample Donation Receipt Forms

Sample Business Registration Forms - 7+ Free Documents in Word ...

Sample Employee Expense Forms - 8+ Free Documents in Word, PDF

Payroll Deduction Form Samples - 9+ Free Documents in Word, PDF

Sample Schedule Form - 16+ Free Documents in PDF, Doc

Sample Employment Expenses Forms - 7+ Free Documents in Word ...

9+ Sample Injured Spouse Forms

7+ Income Assessment Form Samples - Free Sample, Example ...

Sample Real Estate Deed Forms - 9+ Free Documents in Word, PDF

Sample Employee Tax Forms - 9+ Free Documents in Word, PDF

8+ Sample Federal Tax Forms

Sample Business Tax Forms - 9+ Free Documents in Word, PDF