Tax Forms also known as Tax Return, are the forms used to report income and file income taxes with tax authorities like the Internal Revenue Service. These tax forms present many types of forms which are appropriate for filing and registering income tax, income tax extension, tax returns, tax exemption, sales tax form, and many more.

As an employer, the organization must withhold and deduct certain taxes from an employee’s paycheck. Employee Tax Forms are forms used for an employee’s tax paid by the employer based on the employee’s wages.

We have different samples of Employee Tax forms provided below in which you can download and fill out for free for your personal and future intents.

New Employee Tax Form

Employee Income Tax Form

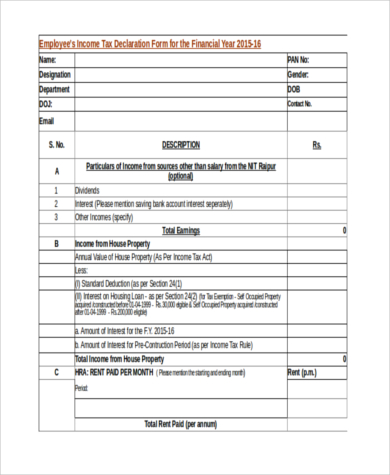

Employee Tax Declaration Form

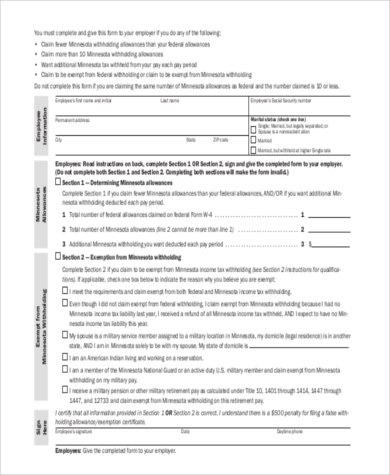

Employee Tax Deduction Form

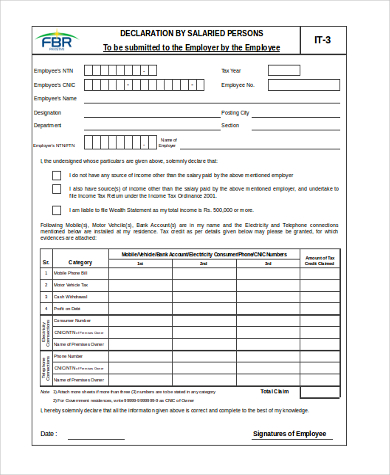

Income Tax Form for Salaried Employee

Payroll Tax Forms, also known as payroll reports, are forms used as a way of accumulating and organizing accounting information on the employees of a business or an organization. Payroll transactions, where employment tax reports in varying time periods are seen, may be generated based on the information needed to be known by the company, legal counsels and/or outside auditors.

What Are Employment Taxes?

If an organization has employees, they are mostly responsible for several federal, state, and local taxes for their employees. An employees’ certain taxes in their paychecks in an organization must be withheld by the employer. Employment taxes include the following:

- Federal Income Tax Withholding – An organization generally must withhold federal income tax from its employees’ wages. It is one of the duties of an employer to ensure that a part of the taxes of an employee is withheld and deposited; by which the company should be able to pay the matching amount to its workforce.

- Social Security and Medicare Taxes – These are the taxes that pay for benefits that workers and families receive. Social Security Tax is withheld from the employee’s gross wages until the employee’s cumulative wages for the year reach the wage base limit.

- Federal Unemployment Taxes – These are the taxes that pay unemployment compensation to workers who lose their jobs.

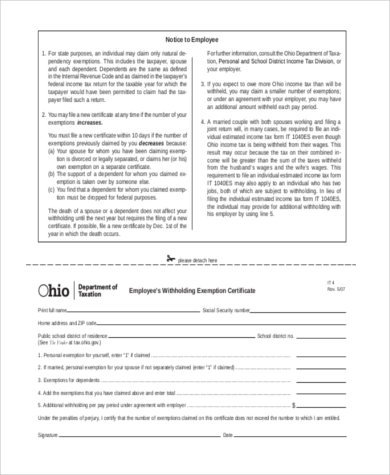

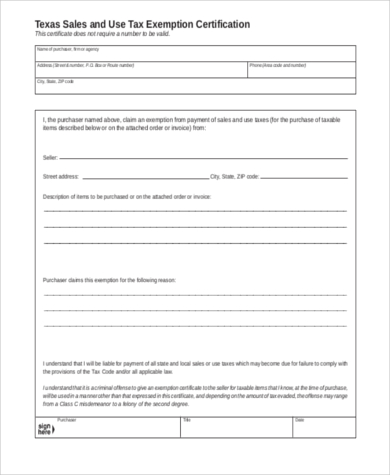

Employee Tax Exempt Form

Contract Employee Tax Form

Target Employee Tax Form

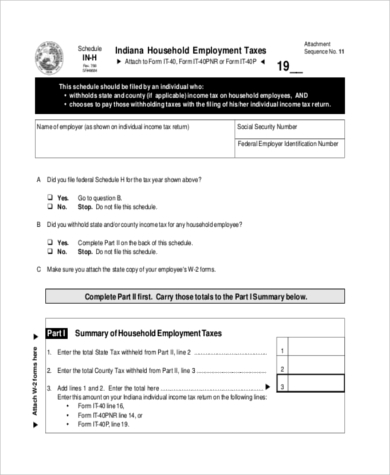

Household Employee Tax Form

Employee Declaration Forms are forms in which written advice is given to you by an employee containing information relating to the fringe benefits they have received. Employee declarations can be sent through e-mail or any other electronic platforms as long as the employee has electronically signed the document.

Why Are Employee Tax Forms Important?

Employee Tax Forms are important because these are the forms that you can use to keep track of certain deducted taxes in your paycheck; that is, if you are the employee. Generally, meals, lodging, clothing, services, and other payments in kind are under authority of the Social Security and Medicare taxes, as are wages paid in cash. Nevertheless, if furnished for the employee’s convenience and on the employer’s premises, meals are not taxable wages. Lodging is not taxable if furnished for the employee’s convenience, on the employer’s premises, and as a condition of employment. As for the Federal Unemployment Program, it was executed to inspire and embolden states for workers who have lost their jobs to provide payment. This tax should be paid and reported separately from FICA and FITW. Employees do not have it withheld from their pay or pay this tax because it is only paid form an organization’s own capital.

Related Posts

7+ Sample Short Term Disability Forms

Sample Health Care Tax Forms - 8+ Free Documents in Word, PDF

Sample Self Employment Forms - 10+ Free Documents in Word, PDF

Sample Payroll Reporting Forms - 7+ Free Documents in Word, PDF

Sample Employment Expenses Forms - 7+ Free Documents in Word ...

Sample Payroll Register Form - 9+ Free Documents in PDF

8+ Sample Schedule C Forms

8+ Sample Custom Declaration Forms

Sample Employee Payroll Forms - 10+ Free Documents in PDF

8+ Sample Employee Status Change Forms Sample Forms

6+ Sample Payroll Tax Forms

9+ Sample Employee Declaration Forms Sample Forms

8+ Sample Federal Tax Forms

20+ Payroll Forms in Excel

Sample Certified Payroll Form - 7+ Free Documents in PDF