An Employee Declaration Form ensures accurate employee details, including job responsibilities, tax declarations, and compliance acknowledgment. This guide simplifies the process, providing examples and tips to create effective, error-free forms. The inclusion of the terms Employee Form and Declaration Form emphasizes the document’s relevance to HR operations and record-keeping.

Download Employee Declaration Form Bundle

What is Employee Declaration Form?

An Employee Declaration Form is a document used to record an employee’s personal, professional, and financial details. It confirms acknowledgment of workplace policies, tax responsibilities, or employment conditions. This form ensures compliance and transparency.

Employee Declaration Format

Employee Details

- Name: ____________________________

- Employee ID: ____________________________

- Department: ____________________________

- Position: ____________________________

Declaration Details

- Nature of Declaration: ____________________________

- Relevant Dates: ____________________________

- Supporting Information: ____________________________

Acknowledgment

- I confirm the above details are accurate to the best of my knowledge.

- Employee Signature: ____________________________

- Date: ____________________________

Employer’s Section

- Verified By: ____________________________

- Designation: ____________________________

- Signature: ____________________________

- Date: ____________________________

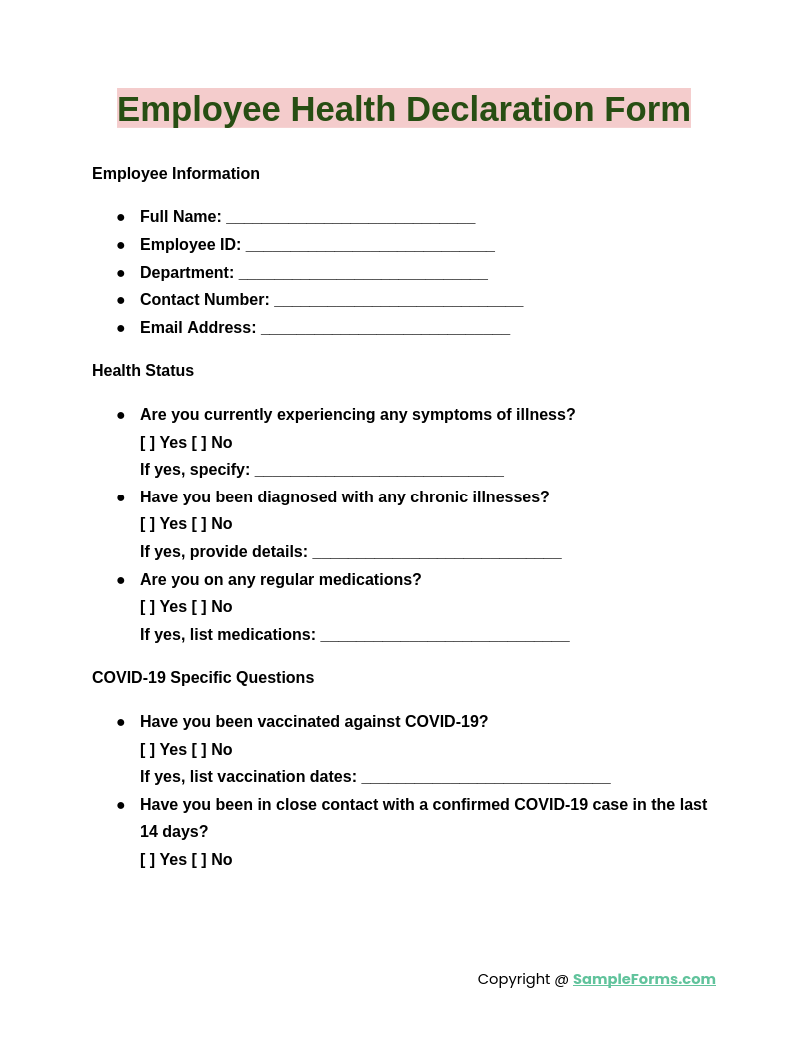

Employee Health Declaration Form

An Employee Health Declaration Form ensures transparency regarding an employee’s health status. It aligns with workplace safety protocols by disclosing relevant medical conditions, enabling employers to manage risks effectively while ensuring compliance with Health Declaration Form standards.

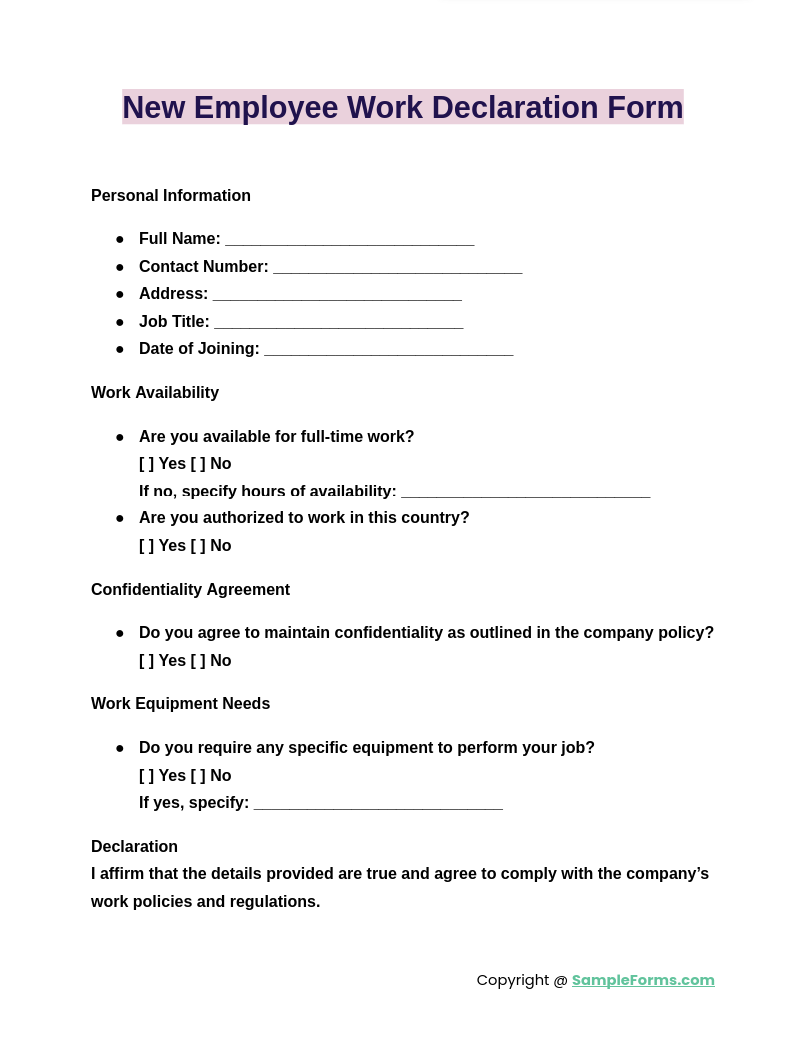

New Employee Work Declaration Form

A New Employee Work Declaration Form captures essential job-related details of new hires. It supports seamless onboarding, confirming roles and responsibilities while fulfilling the requirements of an Employment Declaration Form for organizational compliance and record-keeping.

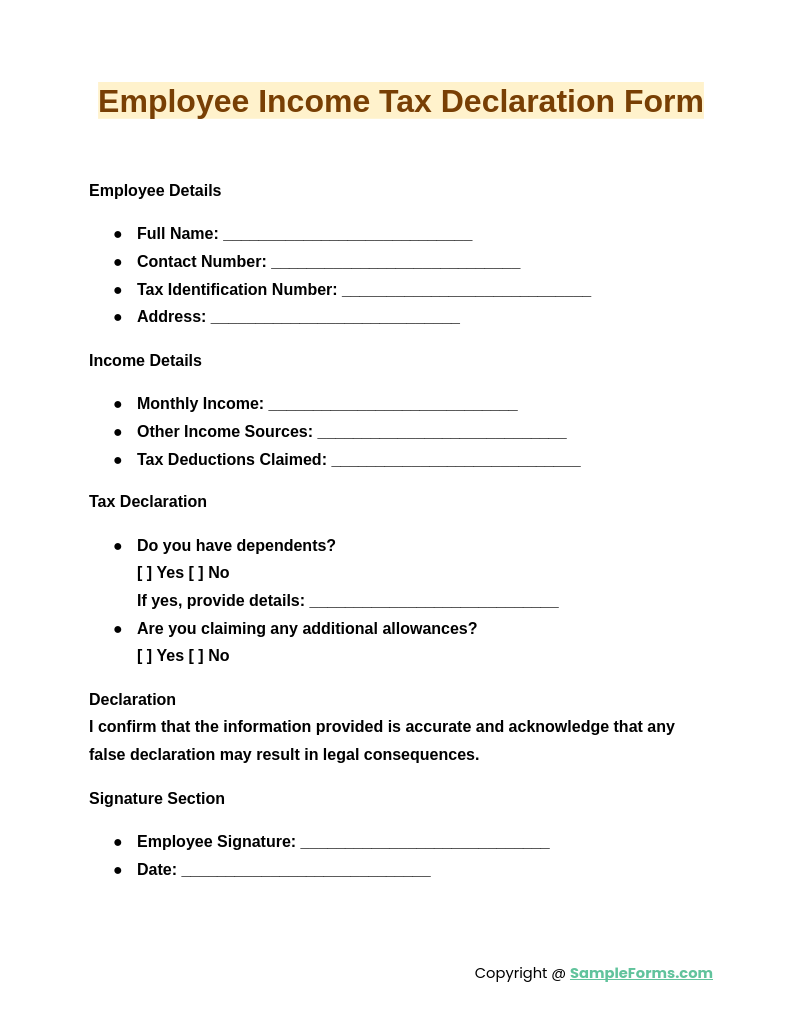

Employee Income Tax Declaration Form

An Employee Income Tax Declaration Form documents tax-related information, including exemptions and liabilities. This ensures accurate payroll processing and adherence to fiscal regulations, aligning with the principles of a Business Declaration Form for smooth tax management.

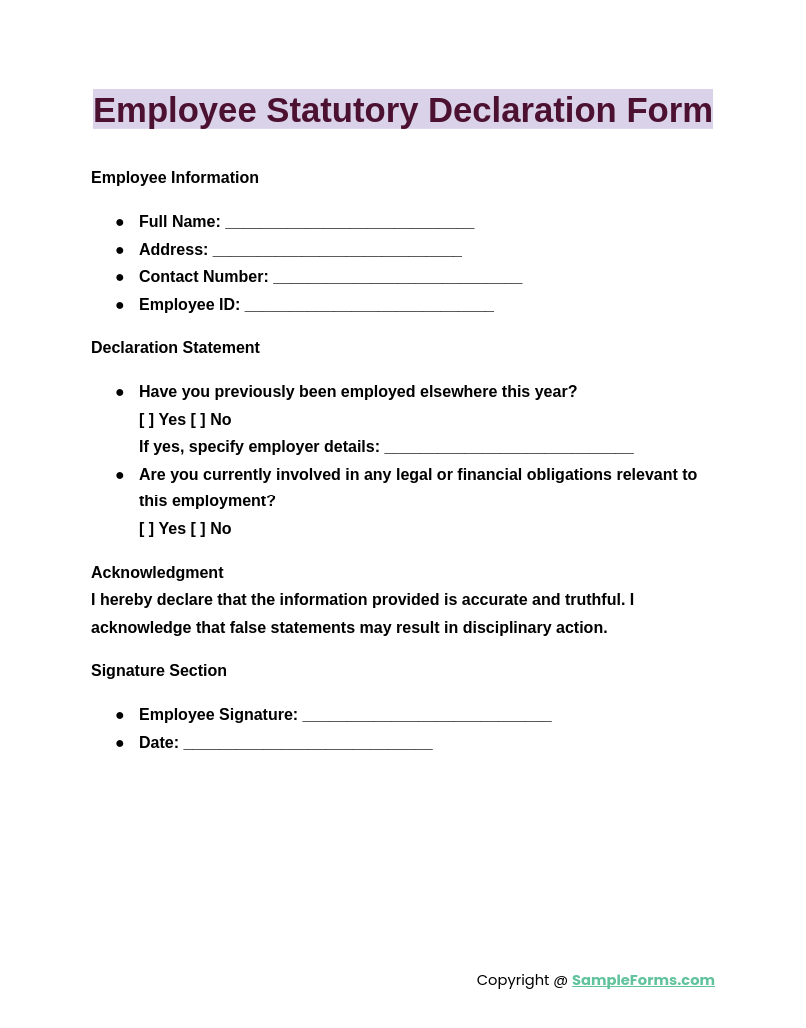

Employee Statutory Declaration Form

An Employee Statutory Declaration Form serves as a formal acknowledgment of specific legal conditions related to employment. It reinforces compliance and fosters transparency, following the protocols of a Legal Declaration Form for workplace ethics and governance.

Browse More Employee Declaration Forms

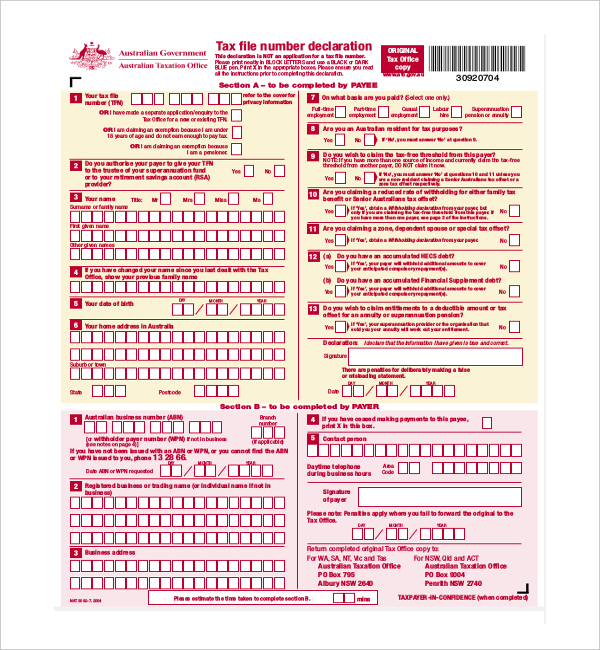

Employee Tax Declaration Form Template

eait.uq.edu.au

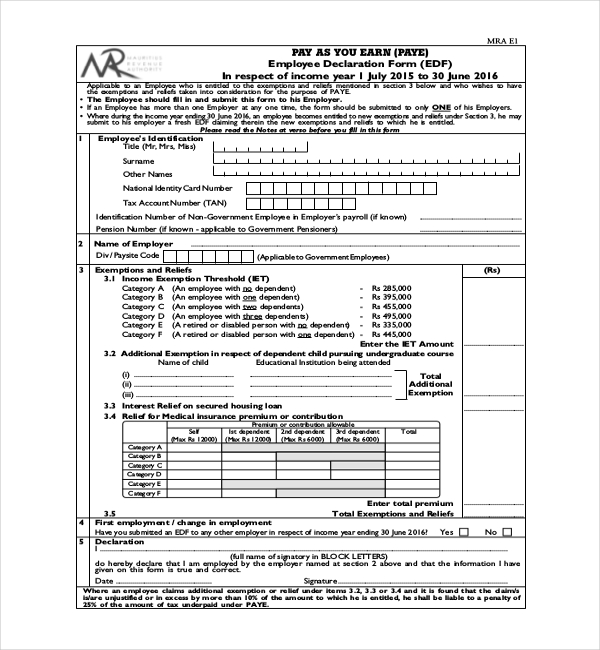

PAYE Employee Declaration Form

mra.mu

Sample Employee Declaration Form Download

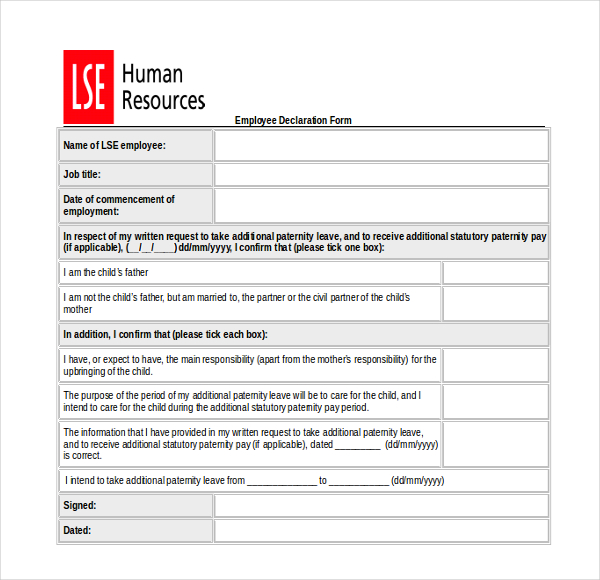

lse.ac.uk

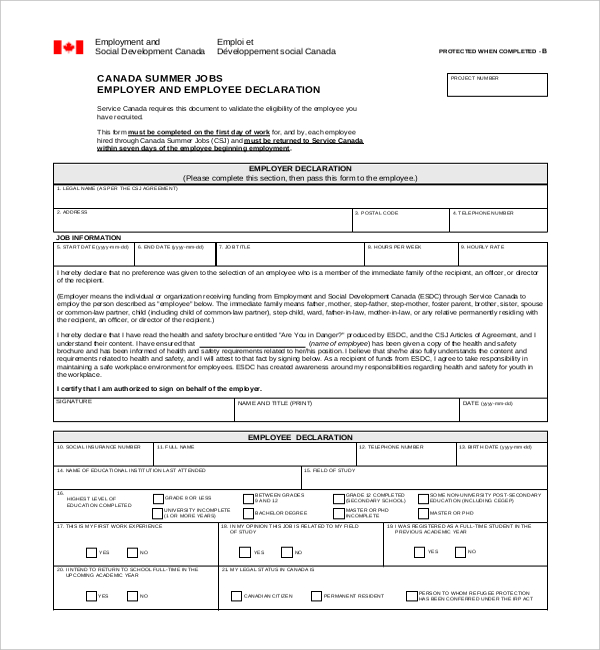

Canada Summer Jobs Employer and Employee Declaration

servicecanada.gc.ca

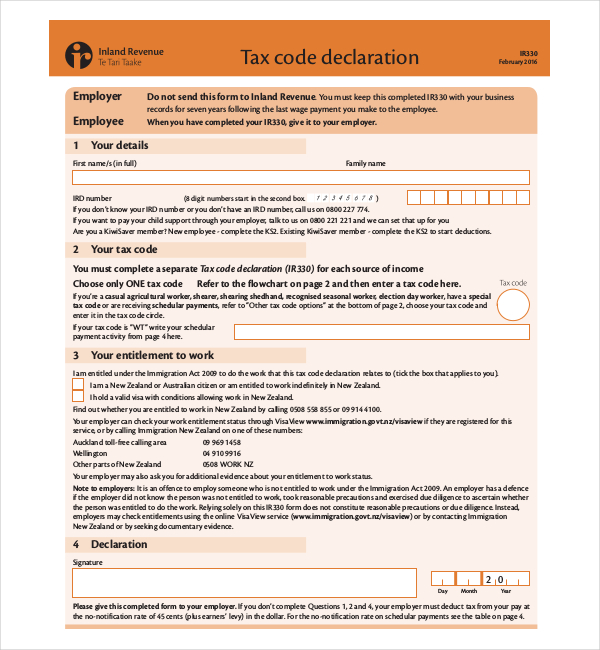

Employee Tax Code Declaration Form

ird.govt.nz

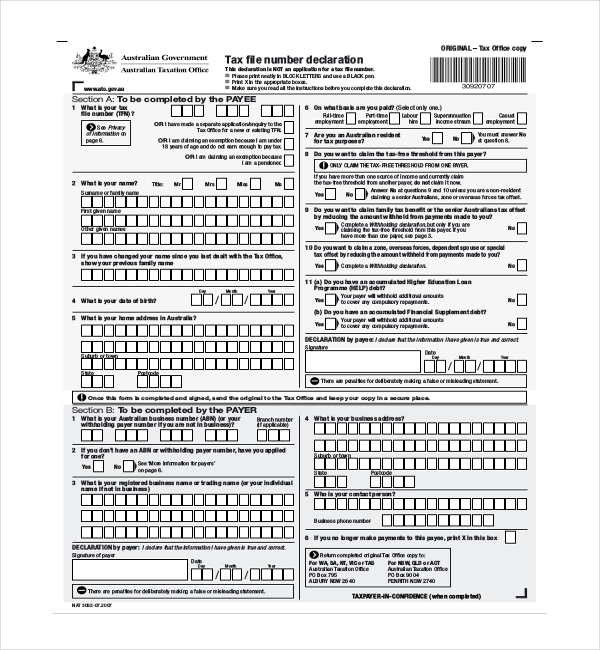

Employee Tax File Number Declaration

ird.govt.nz

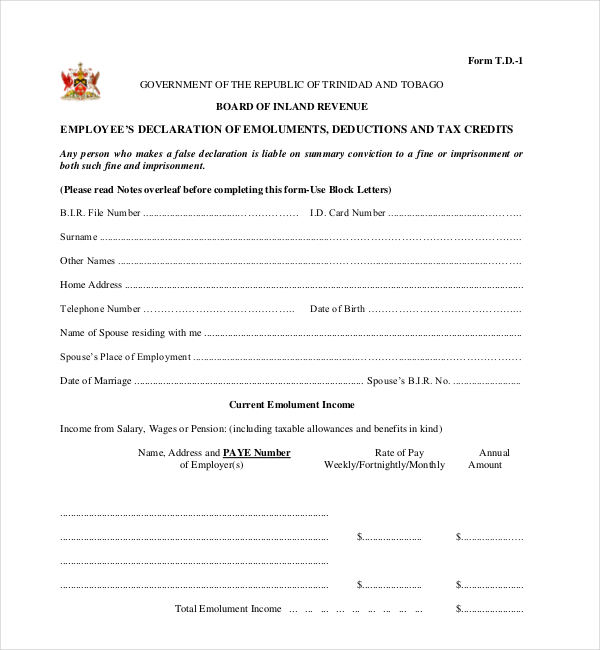

Employee Declaration Form of Emoluments

ird.gov.tt

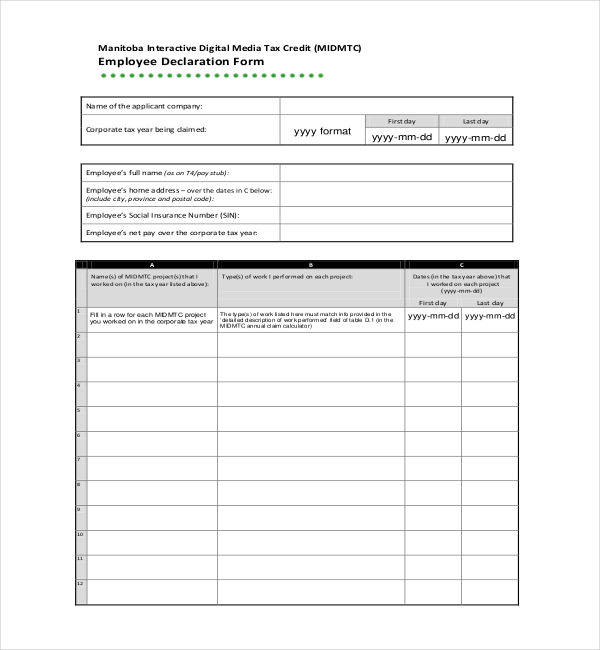

MIDMTC Employee Declaration Form

gov.mb.ca

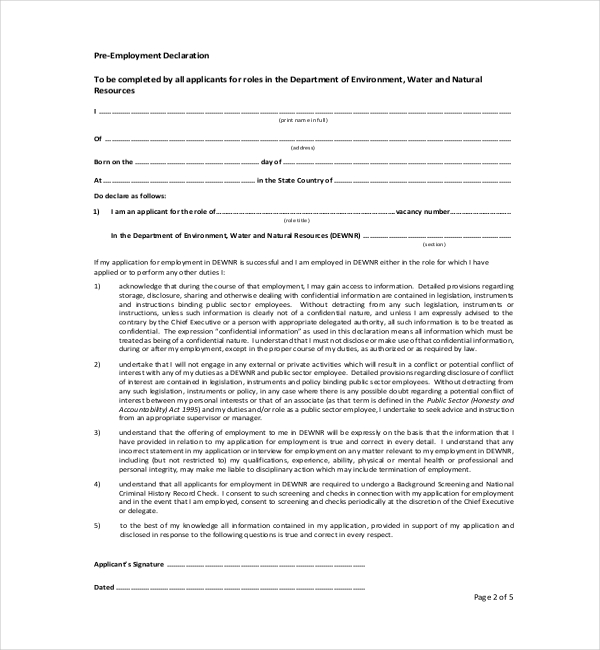

Pre- Employment Declaration

environment.sa.gov.au

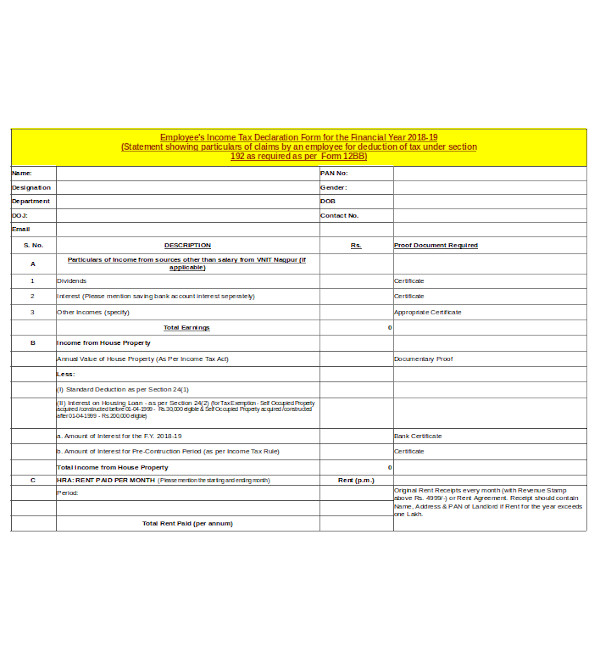

Employee Income Tax Declaration Form

vnit.ac

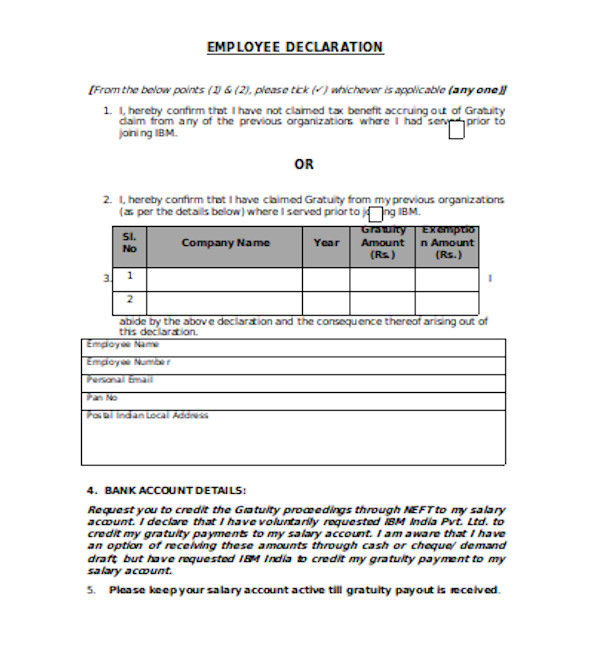

Standard Employee Declaration Form

ibmindiaseparations.zendesk.com

How to make a declaration form?

Creating a declaration form involves structuring clear and concise sections to ensure legal compliance and usability. The Custom Declaration Form serves as a vital example.

- Define Purpose: Clearly state the objective of the form, such as legal, employment, or personal declarations.

- Include Basic Details: Add sections for the declarant’s name, contact information, and declaration type.

- Declaration Statement: Write a precise declaration statement covering the necessary details.

- Signature Section: Include spaces for the declarant’s signature and date to validate authenticity.

- Review Compliance: Ensure the form meets legal standards for its intended use.

What is the purpose of a declaration?

A declaration establishes a formal acknowledgment of facts or commitments, ensuring transparency and accountability in processes, like an Employee Bio Data Form.

- Record-Keeping: Maintains accurate records for organizational or legal purposes.

- Transparency: Ensures all parties have a clear understanding of the stated facts.

- Accountability: Holds the declarant responsible for the information provided.

- Legal Compliance: Ensures adherence to regulatory requirements.

- Conflict Resolution: Acts as a reference in disputes or verifications.

Why is the declaration so important?

Declarations ensure clarity and legal accountability in various contexts, such as employment or customs, similar to an Employee Information Form.

- Fosters Trust: Builds confidence between parties by formalizing commitments.

- Compliance Assurance: Adheres to statutory and organizational requirements.

- Prevents Miscommunication: Clearly outlines facts to avoid misunderstandings.

- Protects Rights: Safeguards both declarants and recipients legally.

- Supports Decision-Making: Informs organizational or individual actions effectively.

What are the three main points of the declaration?

The declaration focuses on purpose, accountability, and legal compliance, as reflected in documents like the Employee Evaluation Form.

- Purpose Statement: Clearly defines the intention behind the declaration.

- Factual Accuracy: Ensures all information is true and verifiable.

- Acknowledgment Clause: Confirms the declarant’s understanding and acceptance of responsibilities.

What are the 5 parts of the declaration?

A well-structured declaration includes essential sections for clarity and legal validity, as seen in an Employee Write-Up Form.

- Title: Clearly states the form’s purpose (e.g., Employee Declaration).

- Declarant Information: Details about the individual making the declaration.

- Declaration Statement: Comprehensive explanation of the facts or commitments.

- Signature Section: Space for signatures to validate the declaration.

- Witness or Notary Section: Optional but recommended for added credibility.

What is an example of a declaration in form?

A declaration form, like an Employee of the Month Nomination Form, records truthful statements, such as achievements or acknowledgments, under formal acknowledgment for organizational purposes.

Can I write a declaration myself?

Yes, individuals can draft declarations, such as an Employee Feedback Form, ensuring clarity, factual accuracy, and adherence to legal requirements where applicable.

What is a good declaration form?

A good declaration form, like an Employee Warning Notice Form, is concise, legally compliant, and includes essential details for transparency, accountability, and validation.

How do I make my own declaration?

To create a declaration, follow a clear format, such as an Employee Availability Form, including personal details, declaration statements, and signature sections for authenticity.

How do you prove an employee?

Prove employee status through documents like an Employee Sign in Sheet, contracts, or official ID reflecting roles, responsibilities, and organization affiliation.

What qualifies you as an employee?

An employee is someone hired under an agreement, supported by documentation like an Employee Grievance Form, outlining roles, rights, and duties within the organization.

Are declarations legally binding?

Yes, declarations, including forms like an Employee Complaint Form, are legally binding when signed and validated, ensuring accountability and legal compliance.

How do I make my own declaration?

Draft a self-declaration by clearly stating facts, intentions, and commitments, similar to an Employee Shift Change Form, and include a signature for authenticity.

What is a simple sentence for declaration?

“I hereby declare the information provided is true,” is a simple statement, often used in documents like an Employee Resignation Form.

How do I get a self-declaration form?

Obtain a self-declaration form from relevant authorities, such as an Employee Absence Form, or draft one using standardized templates for accuracy.

An Employee Declaration Form is a vital HR tool for ensuring accurate employee records, legal compliance, and workplace transparency. Incorporating documents like the Employee Pay Increase Form, it streamlines HR functions, fosters accountability, and enhances workforce management.

Related Posts

-

Employment Declaration Form

-

FREE 51+ Termination Forms in PDF | MS Word | XLS

-

FREE 5+ Recruiter Performance Review Forms in PDF | MS Word

-

FREE 4+ Payroll Reallocation Forms in PDF | Excel

-

FREE 4+ Employment Eligibility Verification Forms in PDF

-

FREE 4+ Skills Analysis Forms in PDF | MS Word

-

Employment Reference Form

-

FREE 4+ Incorporation Forms in PDF | MS Word

-

New Hire Form

-

FREE 6+ Employee Manual Acknowledgment Forms in MS Word | Pages | PDF

-

Employee Nomination Form

-

FREE 4+ Employee Time Sheet Forms in MS Word | Excel | PDF

-

Employee End of Day Report Form

-

Employment Rejection Letter

-

FREE 4+ Employee Termination Checklist Forms in MS Word | Excel | PDF