Companies are always obliged to send a letter or a document to the government to register their business operations legally. Those documents are known as confirmation statements. This document works like business certificates. It certifies that you have legal operations, and you have a registration in the companies house. Confirmation statements are formerly known as the annual returns. These documents should be submitted annually to ensure that you are giving out to date information to the public registration offices. If you want to learn more about confirmation statement forms, then you might want to read further for tips and steps on how to write one.

What is a Confirmation Statement Form?

A confirmation statement confirms that a company has given the required information the Companies House needed. This document has replaced the company’s annual return that provides details about a company’s management, company shares, and ownership. A confirmation statement works like the annual report. Confirmation statements prove that the details you have provided are up to date and accurate. You still need to file the document within the 12 months since you filed the last statement form.

FREE 5+ Confirmation Statement Forms in PDF

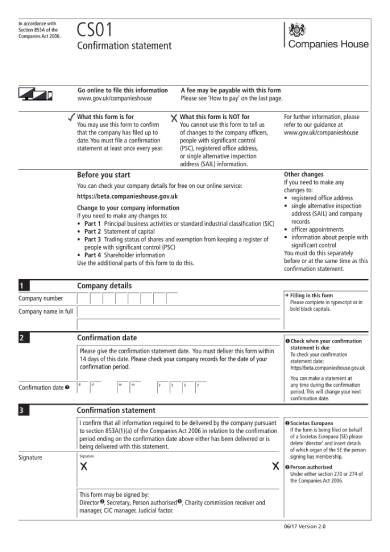

1. Sample Confirmation Statement Form

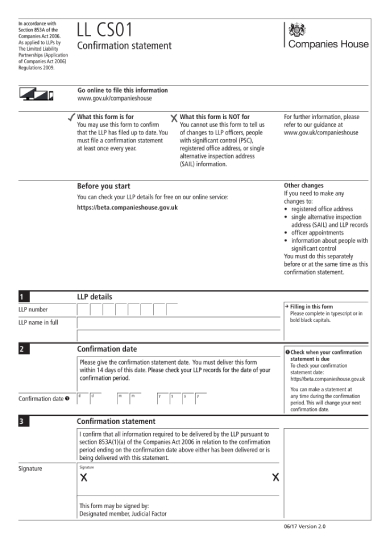

2. LLP Confirmation Statement Sample

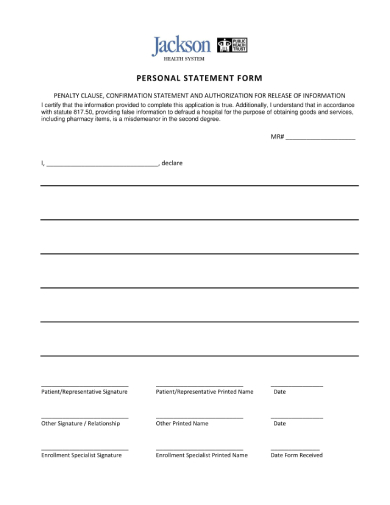

3. Personal Confirmation Statement Form

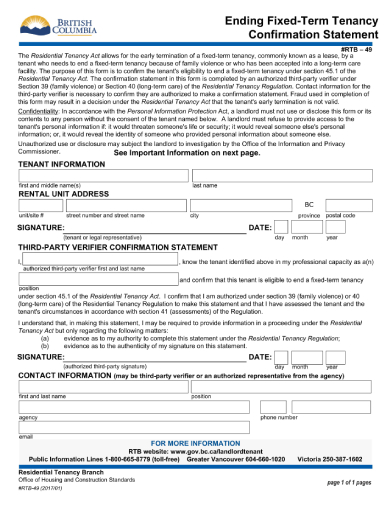

4. Fixed-Term Confirmation Statement Form

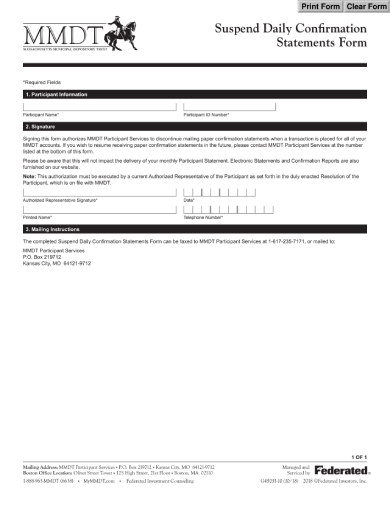

5. Daily Confirmation Statements Forms

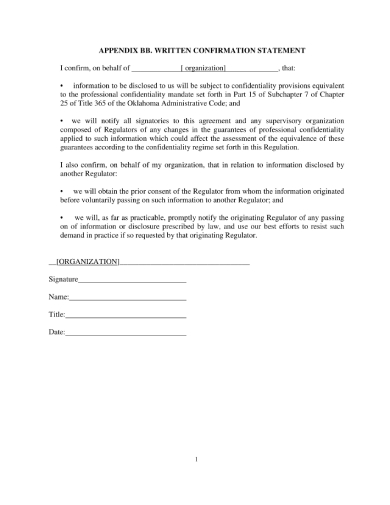

6. Written Confirmation Statement Form

Things to Remember When Filing Confirmation Statements

Confirmation statements are essential documents in keeping your business validated in the public registrations or the Companies House. These business registration forms may be replacements of the annual returns, but confirmation statements are more direct than the latter. For you to create confirmation documents accurately, you must keep in mind some vital things when you file one. Here are a few tips we can give you.

Responsible for filing the statement forms: You should know who is responsible for filing confirmation statements. Company directors, secretaries, and selected limited liability partnership (LLP) members are mostly the legal issuers of a confirmation document. They are the ones who should secure that the confirmation statements have successfully submitted to the Companies House.

Specify changes: When updating your registered company profile, you must specify in the form the areas of your changes. For instance, you must make sure to state the specific changes in your directors, secretaries, company address, and people with significant control (PSC) in your company. This information is an essential part of your confirmation statements. Even if you don’t have any changes, you still need to submit statement forms to verify that the information you last presented is up to date.

Avoid missing due dates: Always meet the deadlines before you face filing overdue consequences. You have to present a confirmation statement to the public register to prevent the government from ceasing your business operations. The companies house will assume that your business is off the market and would invalidate all your services. Make sure you send your confirmation statements a year after your previous submission.

Sign-up for reminders: To avoid missing deadlines, you can always register or sign-up online for your designated public registrations. The administration will send you email reminders for your upcoming annual confirmation due and prevent you from skipping to file. Having an account for the companies house will benefit you in more ways, especially if you are new in the industry.

How to File a Confirmation Statement Form

Companies need to file confirmation statements to keep their businesses in the market legally. This professional document will ensure the heads that you have given them up to date information about your business. Filing confirmation statements might sound challenging, especially if you are not familiar with it. For your convenience, we have a few steps below to guide you in filing your very own statement forms.

Step 1: Check Your Company Profile

You must check your company details first before filing a confirmation statement. Check if there are changes in your systems or management to keep the companies house updated. This document also gives you the chance to correct mistakes when you last filed a confirmation statement. Make sure you have noted all the details you need to update for an easy filing of the document.

Step 2: Provide Details about the Changes

Confirmation statements are verification of the details you provided the public registrations. Most companies often have significant changes in their directors and secretaries, registered company address, shareholders, trading status, and statement of capital. You must either confirm or update these details to your previous filed annual return or confirmation statement.

Step 3: File Your Confirmation Statement

Filing your confirmation statements can either be online or via mail. There statement forms available online provided by the companies house that you can fill out with the information you have prepared for you to mail. You may also file though online registration, but you will need your Companies House password and authentication code to proceed.

Step 4: Settle All Payments

Just like any other registration forms, you must settle all the payments you need to register. Confirmation statements’ fees depend on your payment period, which is 12 months from the day you last paid for your filed confirmation statement. There is also a difference in annual fees if you filed your statement forms online or mailed a paper form. You should settle these payment forms first before you submit your confirmation statements.

Step 5: Update Annually

For you to keep your registration valid, you should file your confirmation statements annually. This document would let the Companies House know that your business is still in operations, and trading of shares is still going on. You have a 14-day extension for you to file your statement forms if ever you missed the exact date of the day you last submitted. But, it is better to present this business document on time. Keep on track of the changes in your business, as well as the filing of your confirmation statements.

Related Posts

-

Billing Statement Form

-

Closing Statement Form

-

FREE 13+ Operating Statement Forms in PDF | MS Word

-

Instructions for Other Uses Statement Of Claimant [ What Is, Uses, Instructions ]

-

Creating a Sources and Uses of Funds Statement [ What Is, Steps, Sources and Uses ]

-

10 Tips for Writing a Personal Statement

-

Writing a Small Business Vision Statement [ What Is, How To, Steps ]

-

FREE 10+ Sample Disclosure Statement Forms in MS Word | PDF

-

FREE 7+ Business Statement Forms in MS Word | PDF

-

What is a Contingent Statement? [ Importance, Components ]

-

FREE 12+ Sample Medical Statement Forms in PDF | MS Word

-

What is a Categorical Statement? [ How to, Importance, Components, Guidelines ]

-

FREE 7+ Profit and Loss Statement Forms in PDF

-

FREE 8+ Voluntary Statement Forms in MS Word | PDF

-

What are Financial Statement Forms? [ How to, Include, Functions, Importance ]