Business tax and income tax return forms are not the only documents which need to be filed by an individual or a company who are deemed as taxpayers in a country. Although these documents are also significant, they are required to file a wealth statement form along with the essential paperwork to prove their wealth claims.

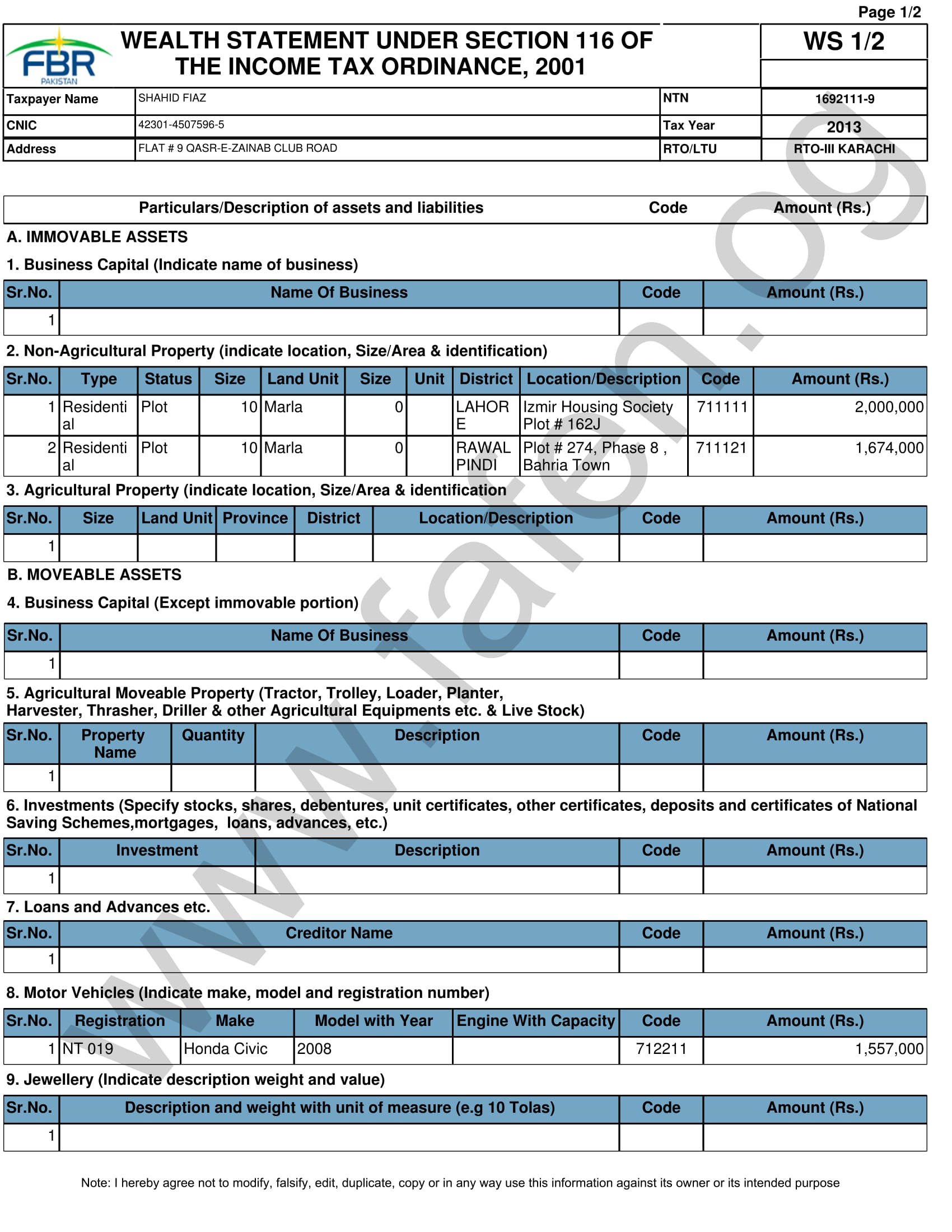

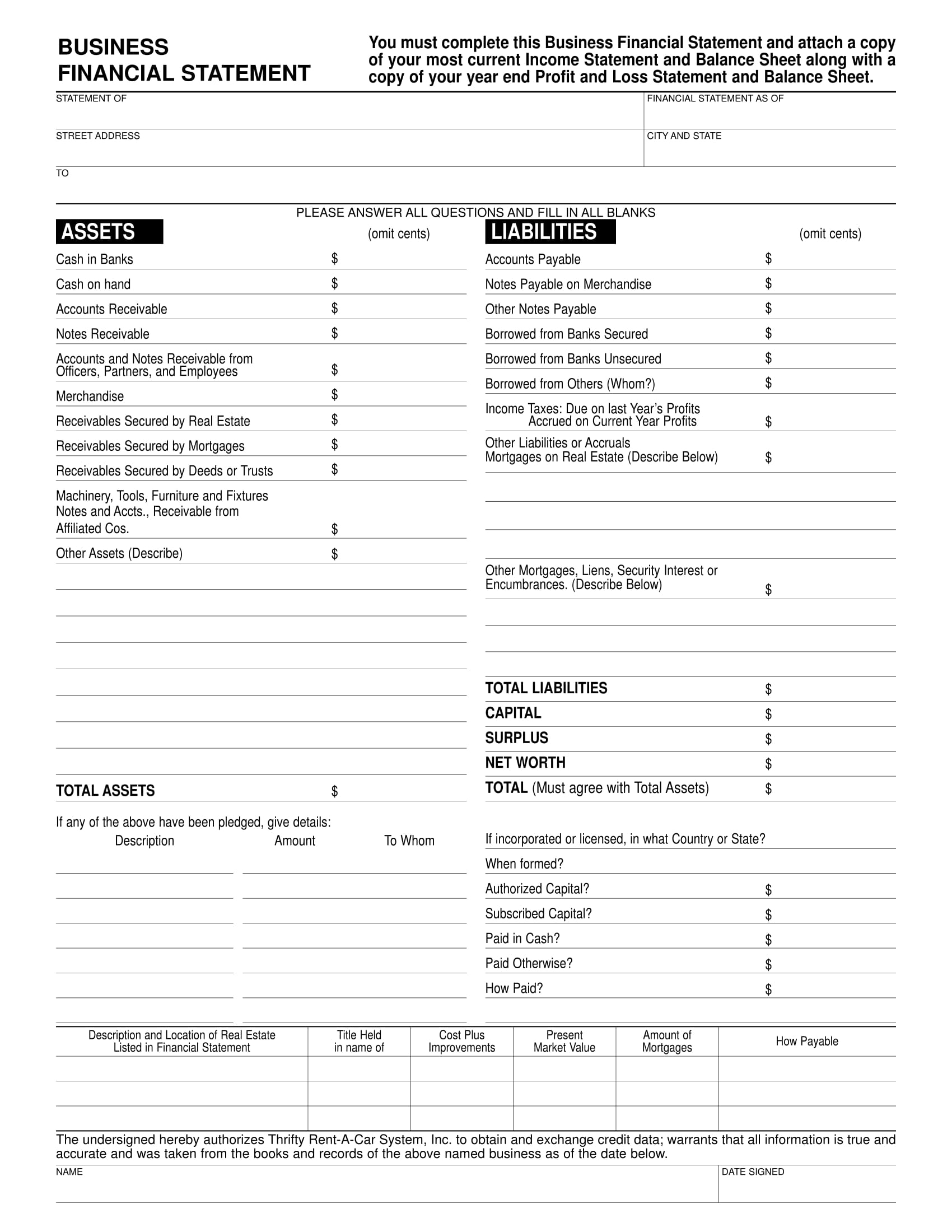

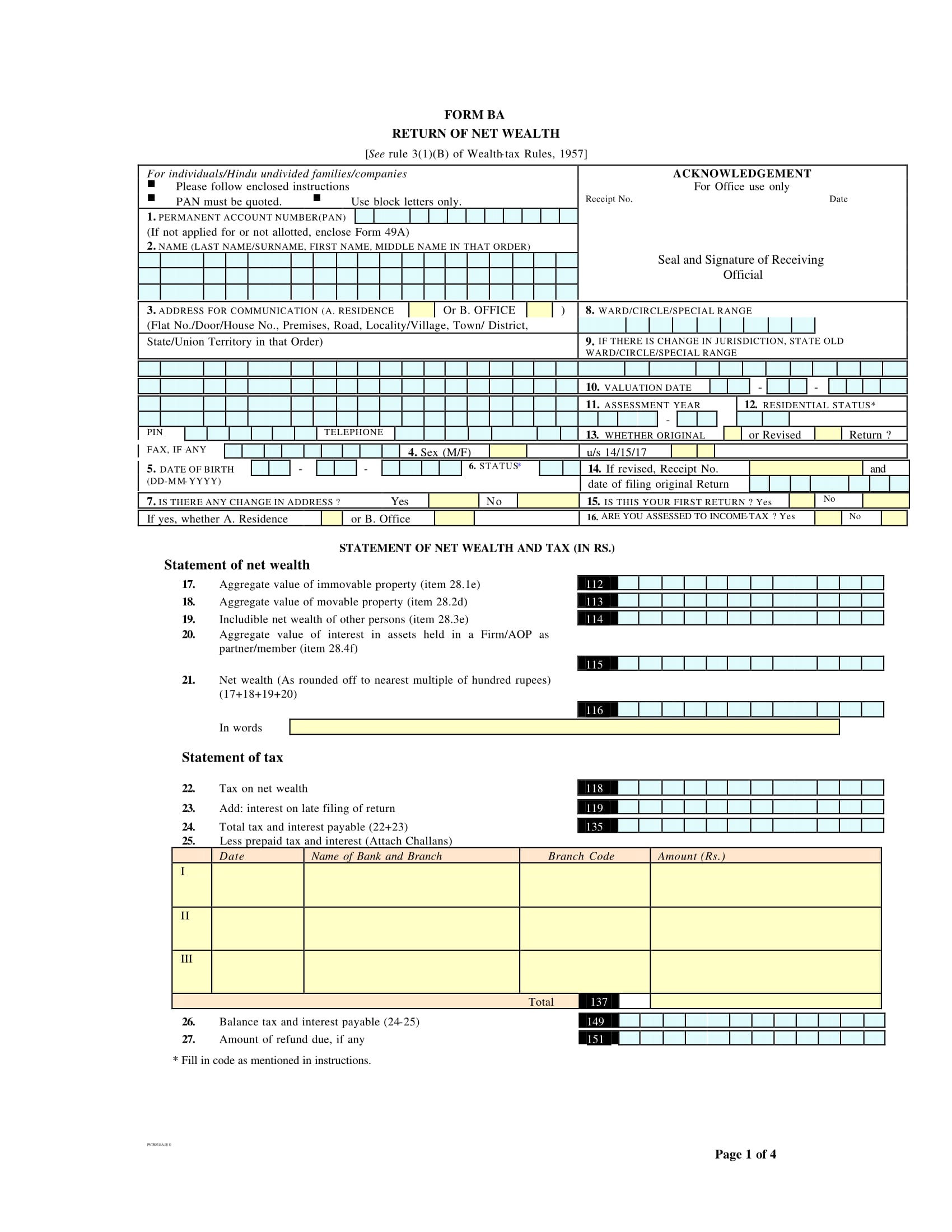

Blank Wealth Statement Form

What Is a Wealth Statement?

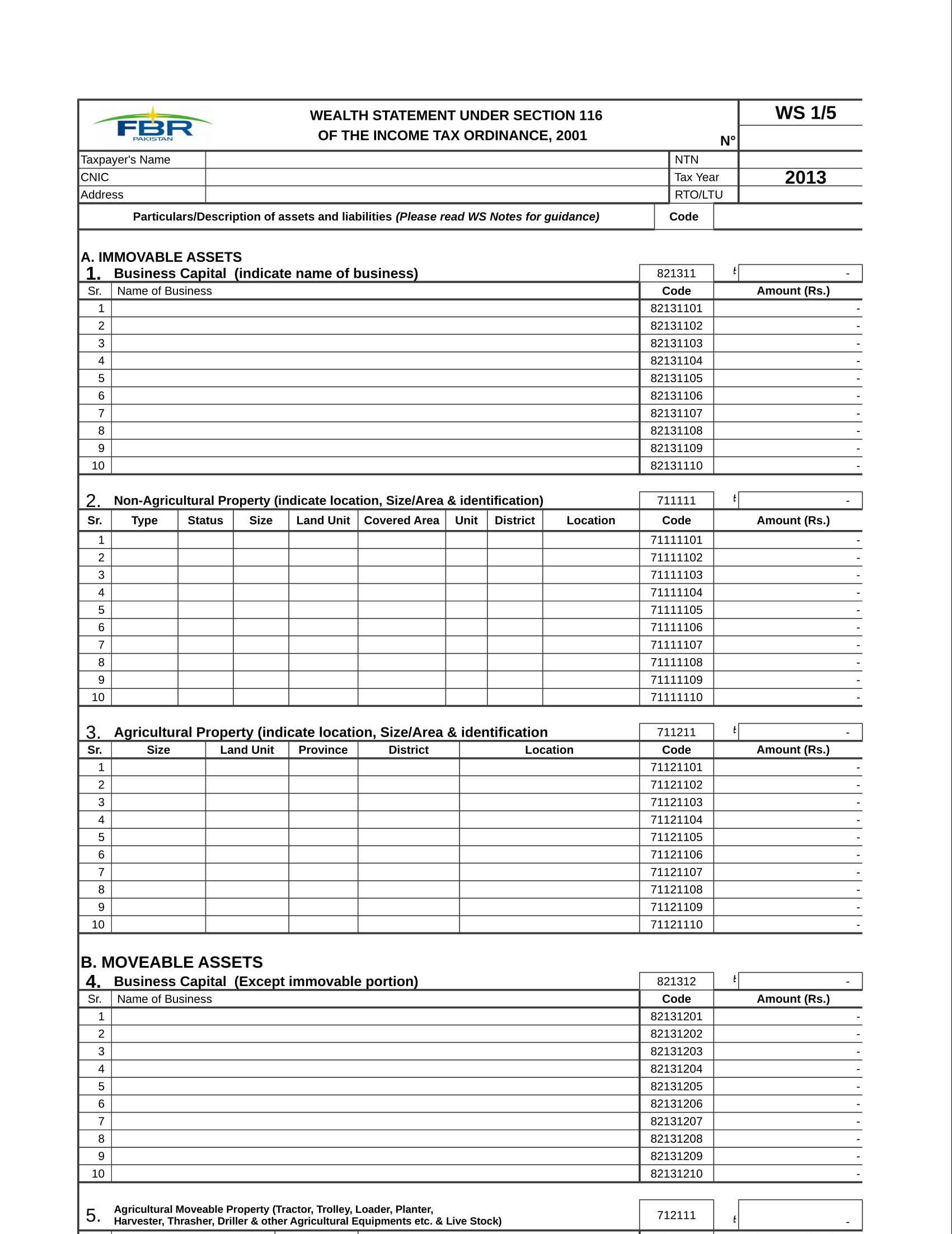

A wealth statement is a type of legal paperwork which needs to be submitted by a taxpayer. This centers on gathering the general information of a taxpayer’s property, assets, and own liabilities. Two types of documents compose this paperwork which is known as a statement and a reconciliation of net assets. A statement of net assets include the estate properties, business capital amount, investments and all the personally owned properties of the taxpayer.

The liabilities of the taxpayer should indicate the credit amount and all the loans that he or she had acquired within the particular tax period. On the other hand, a reconciliation statement of net assets focuses on determining the asset verification of the taxpayer which has changed by means of decreasing or increasing in value from the year that it has been owned. It is vital that the taxpayer has to state and specify his or her properties, mortgage values and all the assets that he or she personally owned or which are under his or her partnership application in the family as he or she can be subject for a penalty if he or she fails to do his or her tax and wealth declaration obligations on time.

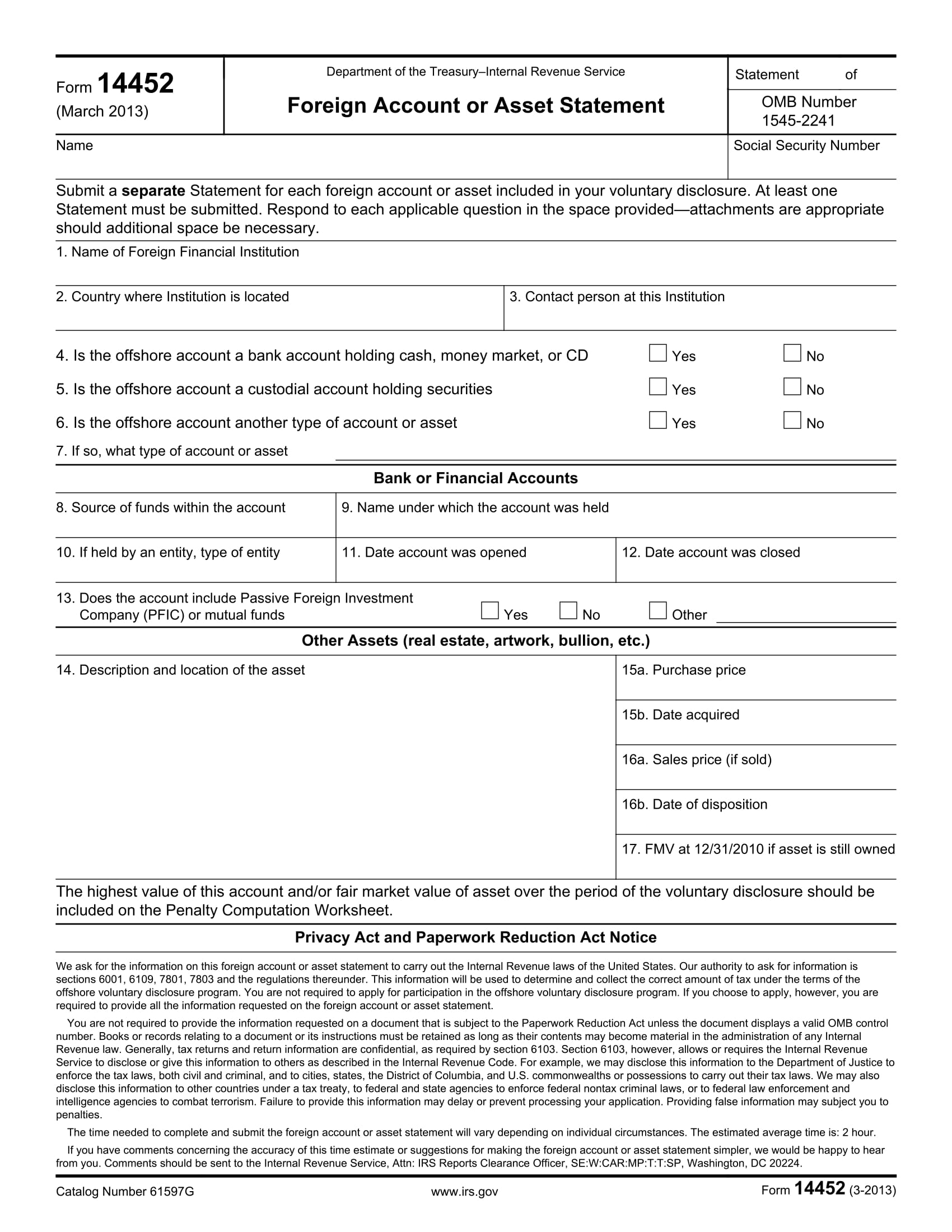

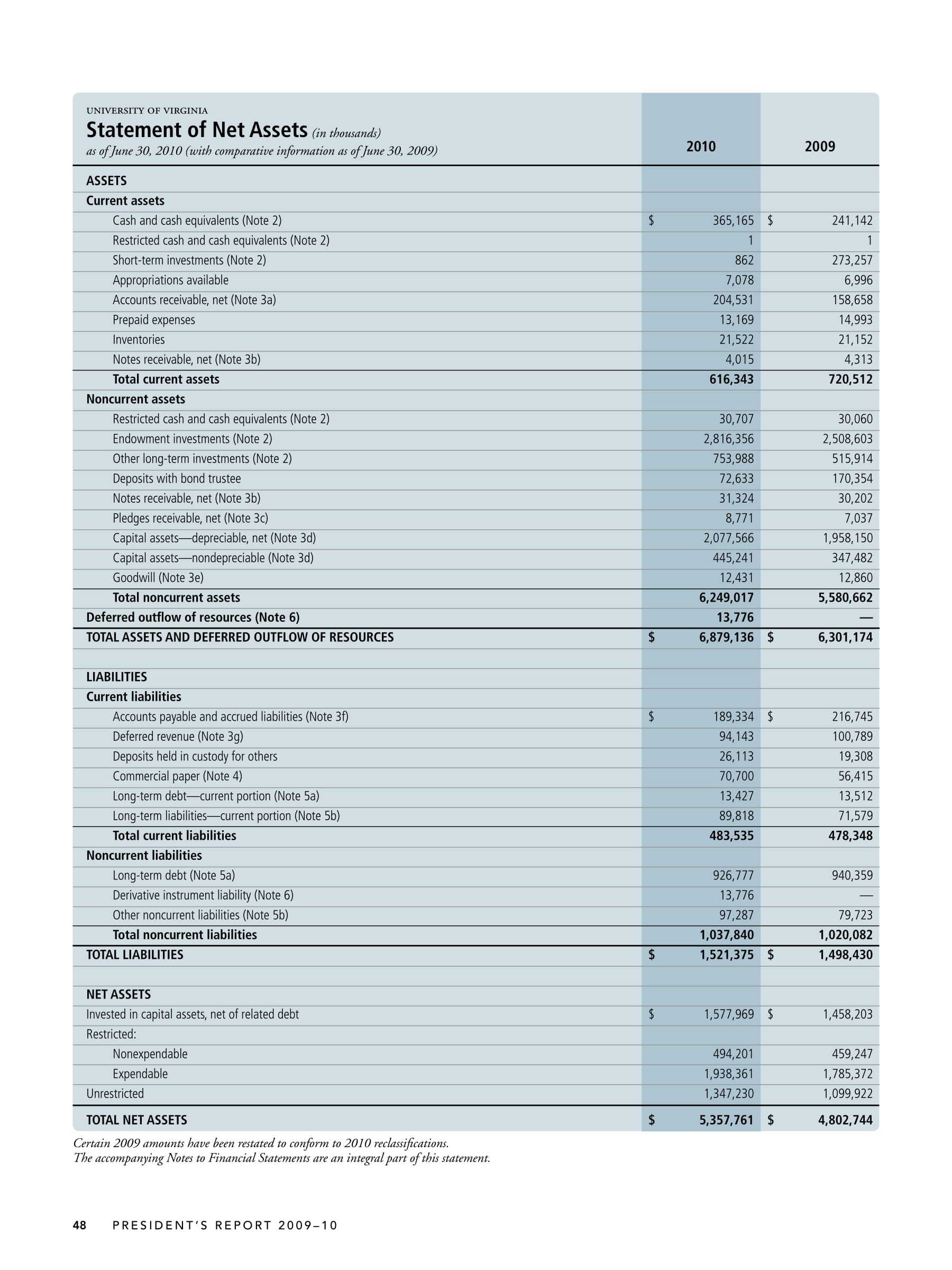

Asset Statement Form Sample

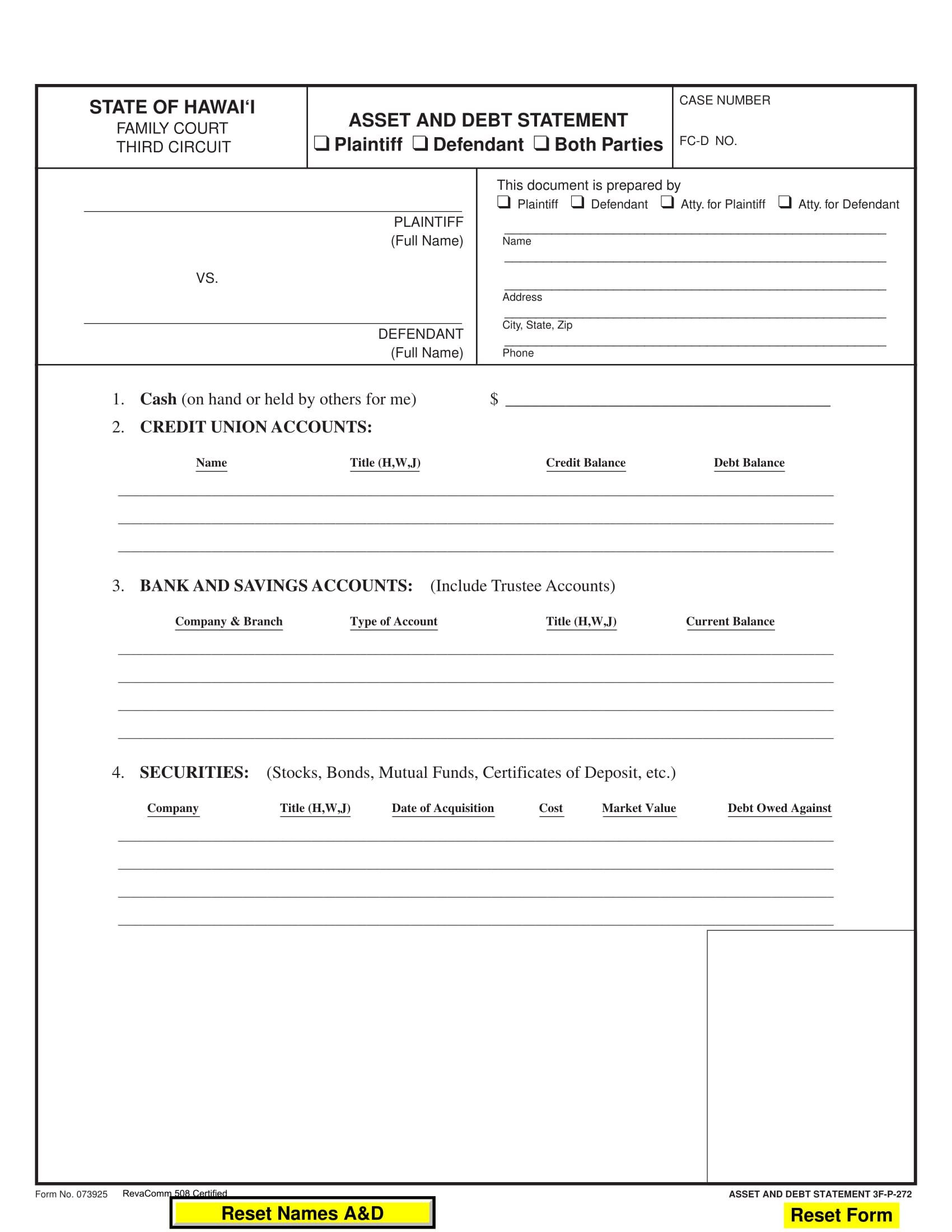

Asset and Debt Statement Form

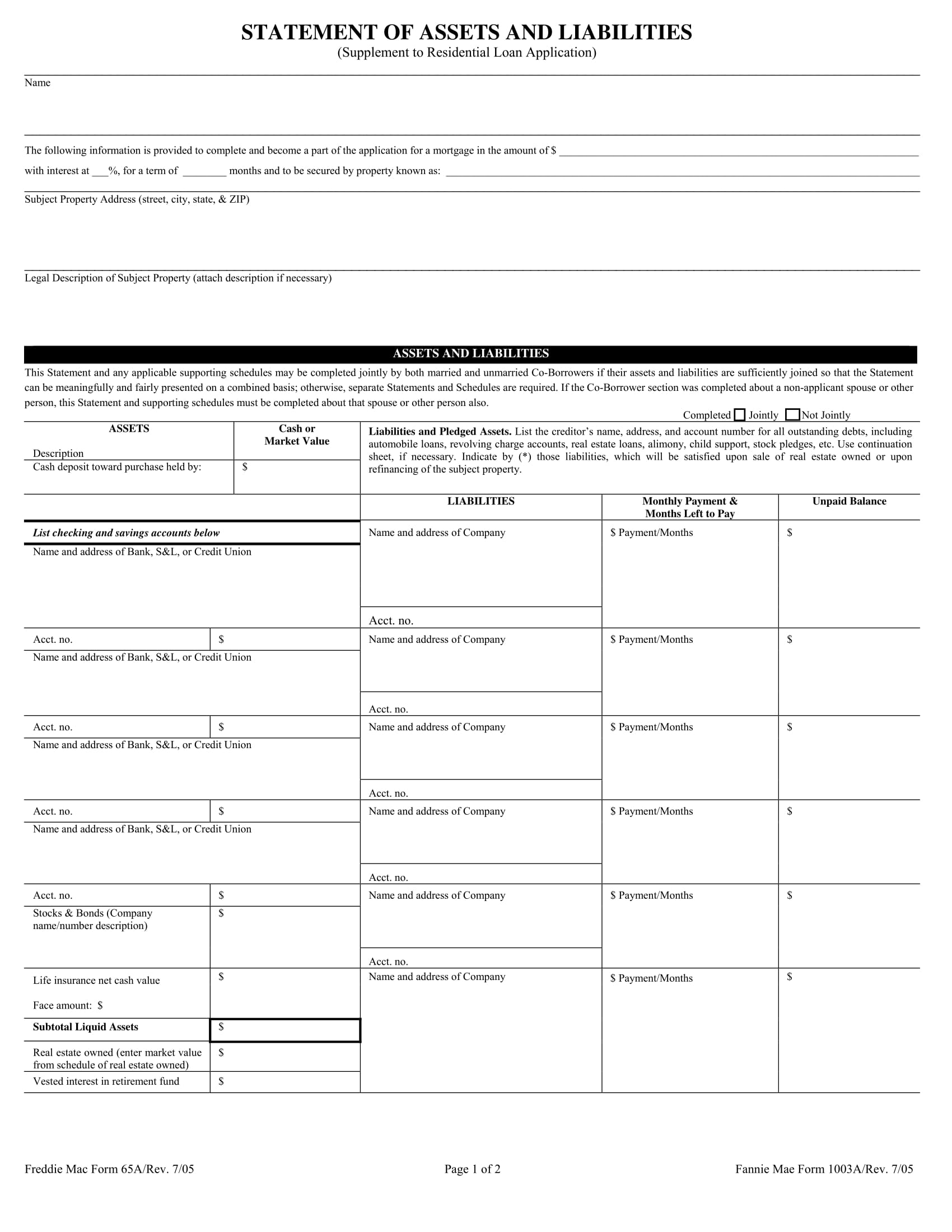

Assets and Liability Statement Form

What’s In a Statement of Net Assets Form?

A statement of net assets form is used together with the reconciliation form for the wealth statement submission. This specific document is dealing with the following property statement and contains necessary information needed for meeting the requirements of a country with regards to regulating a taxpayer’s assets:

Bank Account

The taxpayer’s owned bank account report or any financial account where he or she is involved into is the main subject of this area in the statement form. His or her complete account number, the type of account that he or she has such as whether it is a credit or savings account, the name of the bank where he or she is registered, the kind of currency in his or her account, as well as the date when the account was opened is included. The taxpayer should also state whether his or her account has been closed within the tax period or if his or her account is currently in use.

Property Information

The properties of a taxpayer whether it is a commercial agreement or a residential property must be listed and reported in this statement document. The type and form of the property with its complete address, land area, country where it can be found as there are some taxpayers who own properties in foreign continents, as well as the property’s measurement and the date when it was owned or acquisition date are also on the form.

Details of Business

The amount of tax that the taxpayer has to provide to his or her country depends on what he or she owns and what sorts of activities he’s or she’s involved such as being in a business partnership agreement or mainly managing his or her own small business enterprise. With this, the taxpayer has to state the location of his or her business, the type of goods and services that his or her business is providing, as well as the business capital that the taxpayer allocated for starting his or her career as a business owner.

Taxpayer’s Investment

If the taxpayer was able to sign an investment agreement, he or she needs to state the details of his or her investment on the statement form. This should contain the type of investment, the company where the taxpayer provided an investment as well as the actual amount of the invested money.

Amount of Assets

The balance of the general account that the taxpayer has along with all the other amounts that associate the claims in this statement form should be calculated in order to complete the amount section. If the statement form is an interactive document such as a portable document file (PDF) file format personal statement form, then the taxpayer has to click the calculate button allocated on the amount section to allow him or her in achieving an exact calculation for the amount and the overall total of his or her assets.

Business Liability Statement Form

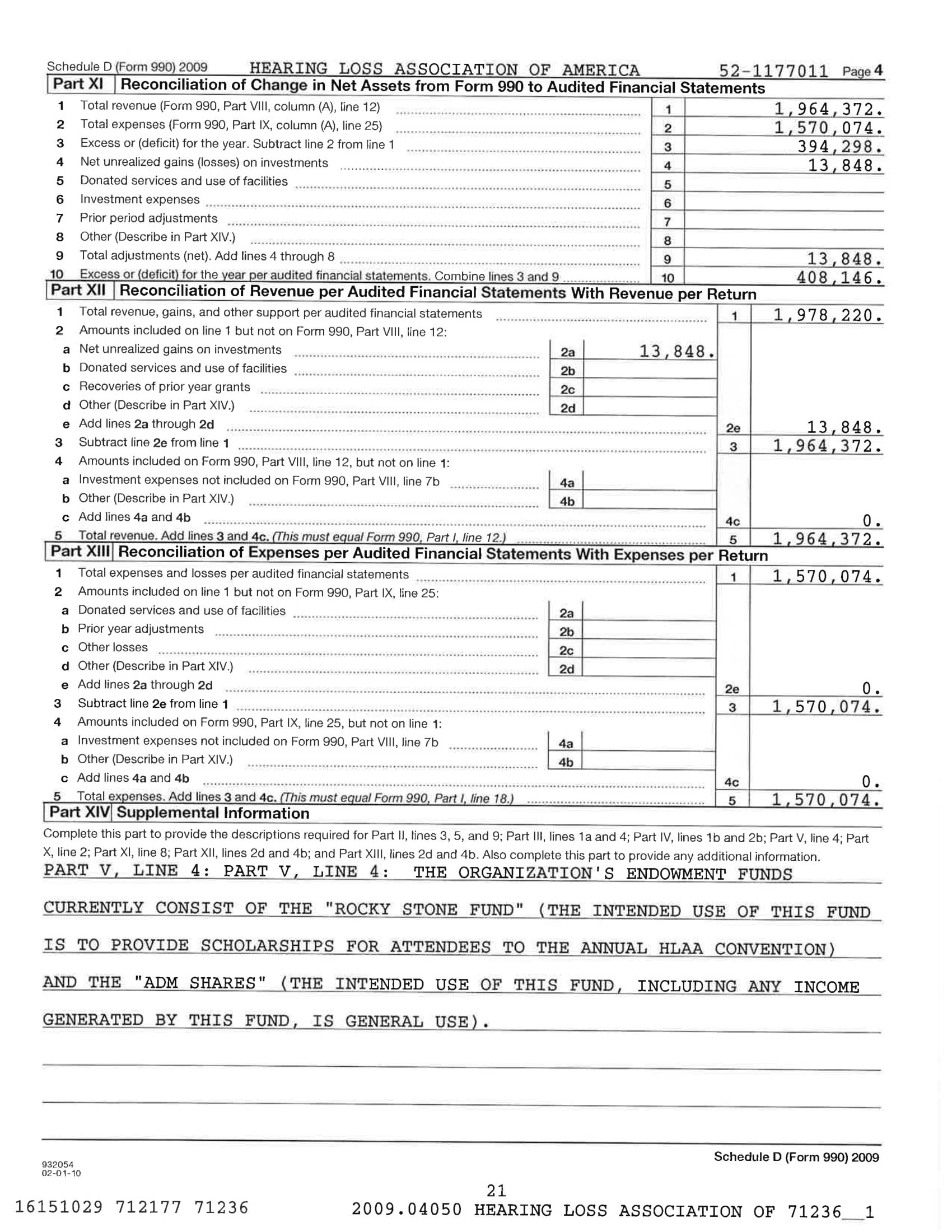

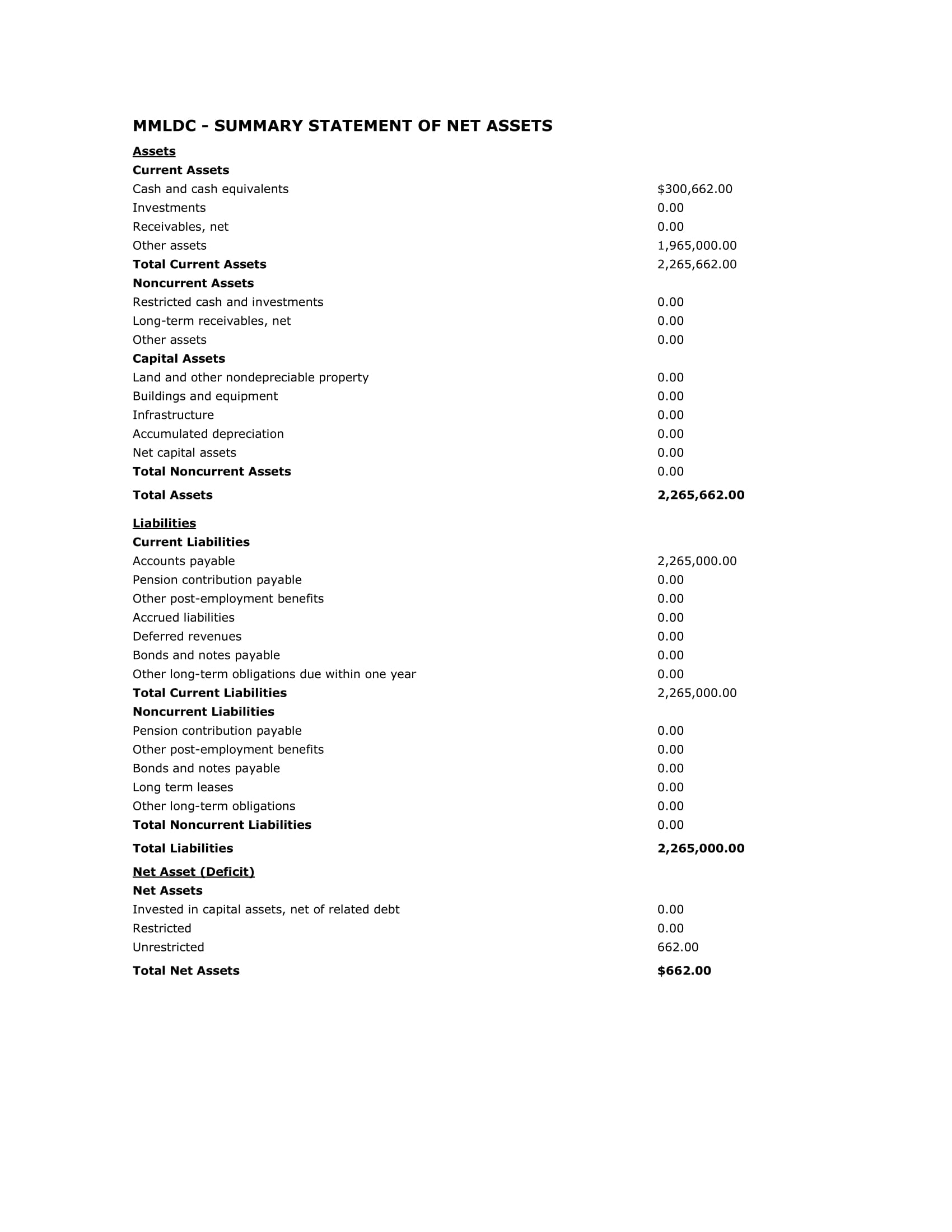

Assets Reconciliation Statement Form

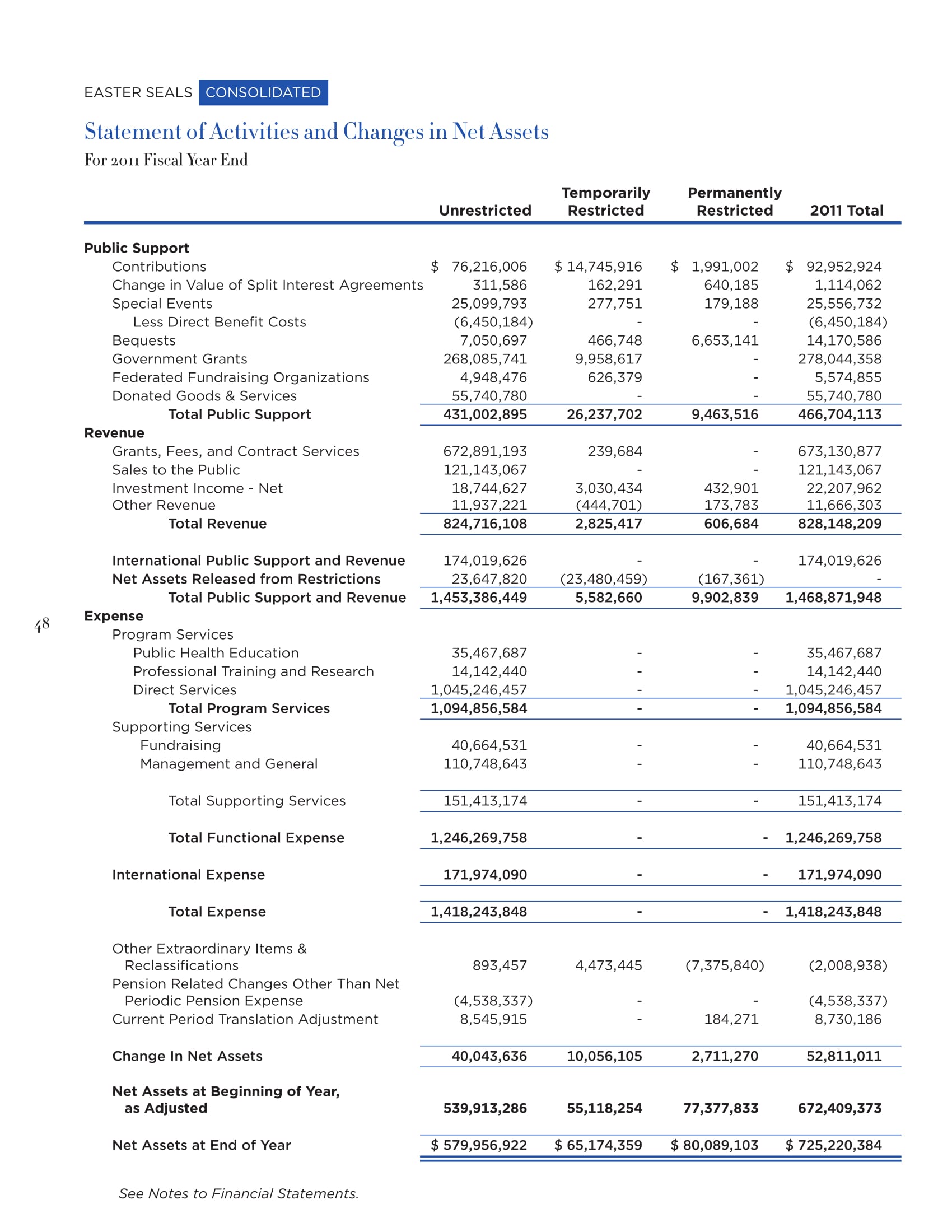

Changes in Net Assets Statement

What Is a Reconciliation of Net Assets?

Before a taxpayer can reconcile his or her net assets, he or she needs to compile his or her balance sheets and financial statement forms from two previous tax periods or years. The documents aid the taxpayer in determining whether his or her assets have increased or decreased over the specific period. Additionally, a reconciliation of net assets indicates if the taxpayer had an asset which was not reconciled for the report.

The importance of creating and conducting a reconciliation is due to the need of a taxpayer or a company to distinguish possible strategies on how to acquire more assets over time and how to maintain the assets without losing any during the process of asset transfers. However, analyzing the statements in this reconciliation document must only be done by gathering the financial forms and the transaction documents of the tax forms for taxpayer to assure that all the amounts and claims on the form acquires an in-depth explanation as well as avoid dealing with invisible or doubtful figures.

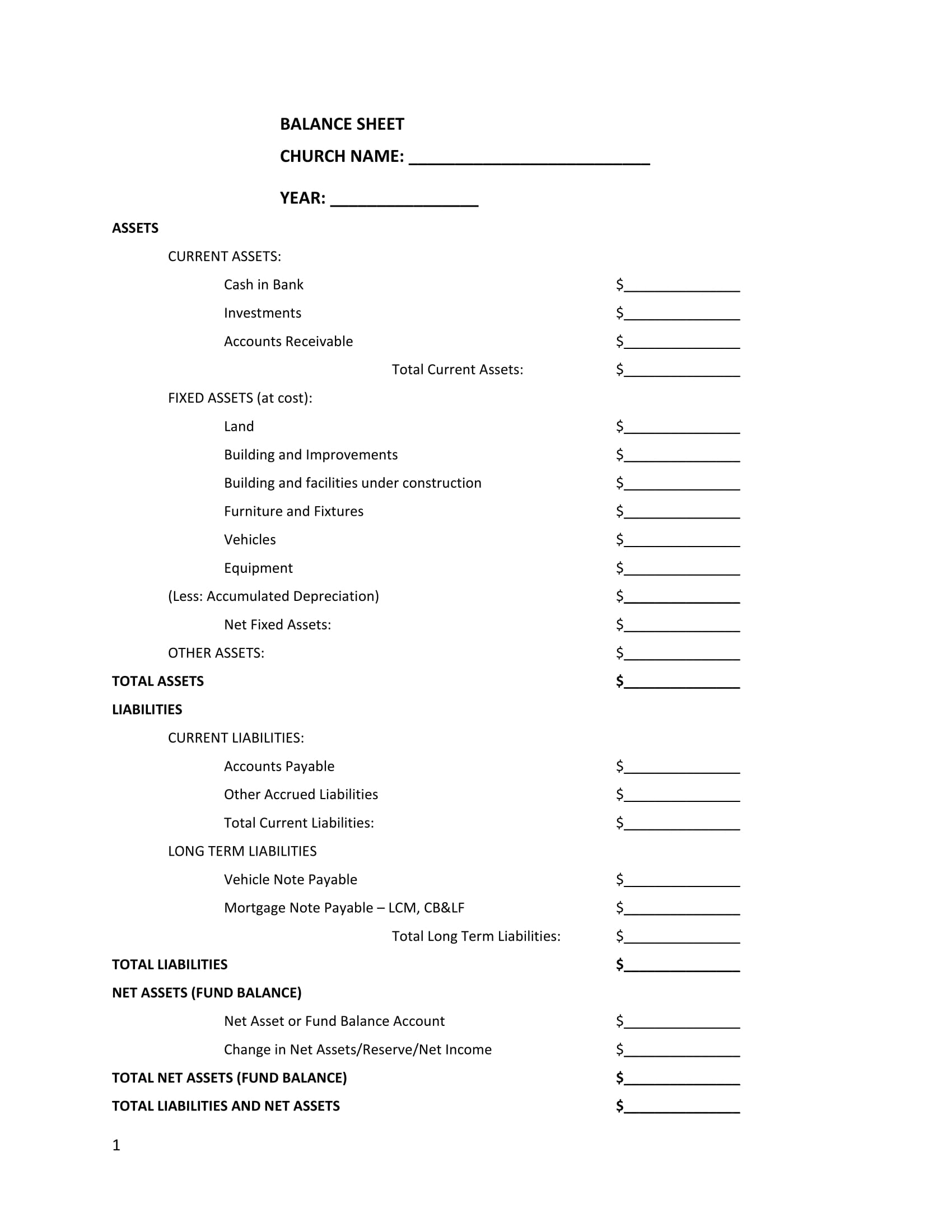

Net Assets Balance Sheet Form

Net Wealth Return Statement Form

10 Steps in Filing a Wealth Statement

Wealth statements are also known as personal expense or expenditure statement forms in some countries as it deals with the details of what and where the taxpayer spent his or her owned money. However, regardless of what term is used for naming this paperwork, a taxpayer must be able to file it on time and must be knowledgeable of how he or she must complete and file the document. Below are the steps that a taxpayer must take in order for him or her to acquire a completion:

Step 1: Go to the website or the office of the government agency who will be dealing with tax inquiries.

Step 2: Know the required legal forms which are needed to accompany the submission.

Step 3: Request for acquiring the appropriate tax form or the statement form.

Step 4: Read the documents and the instructions on each page to secure that you will not be making errors and mistakes as you begin answering the fields.

Step 5: Start by indicating the tax period or the year which you will be filing the statement and business declaration.

Statement of Net Assets Form

Summary Statement of Net Assets

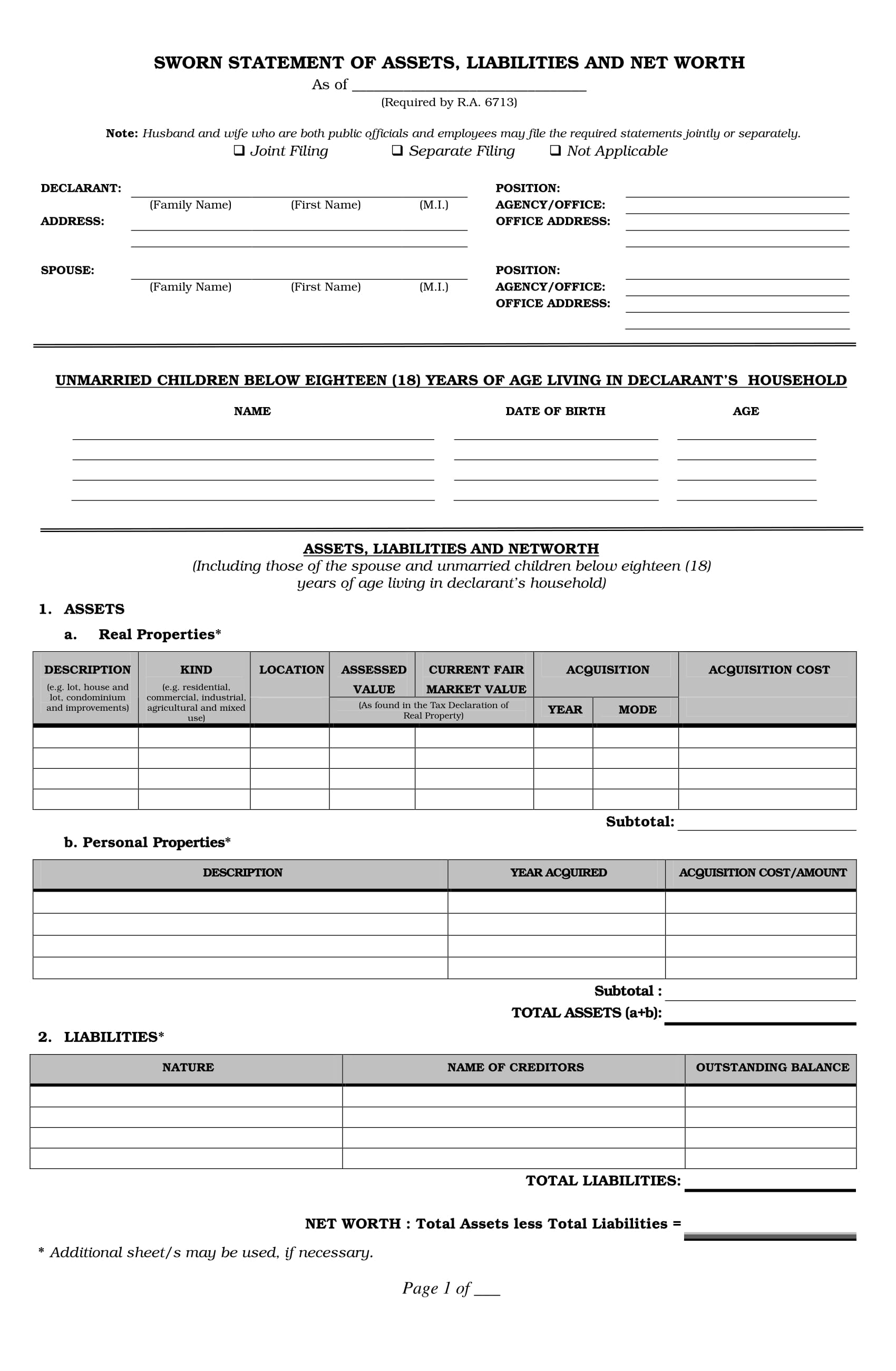

Sworn Statement of Assets and Liabilities

Step 6: Write down your personal information on the allocated areas.

Step 7: Complete the personal expenses section of the form with the description of your expenditures and their associated amount for you to be able to do a calculation. Your personal expenses must include your rental lease payments, electricity and telephone bill amounts, organization fees, as well as the actual amount of contribution you are required to provide to your family.

Step 8: Fill out the personal assets and liabilities section. As this section will state your properties and non-business related ownership, you need to include their descriptions such as its form of whether it is a house or an apartment, measurement, addresses and an indication of whether you have been involved in a property transfer transaction within the tax period or if any of your properties are to be sold.

Step 9: Complete the reconciliation of net assets section. This section must be associated with you asset statements which should determine your total net assets from a number of assets that you have indicated on the previous sections. You will also need to state the previous year’s amount of net assets that you have reported and acquired. Your income and expense declarations are also needed for the completion of this section which will be separated into categories of income declared, tax exemptions, and income attributable.

Step 10: Proceed to the tax verification area and submit the form. You must complete this area with your verification code if done online or your signature if written in a physical document. After the submission, you must receive a notice form or an indication that your document was successfully submitted to the agency of your state.

Wealth Reconciliation Statement Form

Wealth Statement Event Registration Form

General Wealth Statement Form

Why Is a Wealth Statement Important?

Wealth statements are important to any individual, group, organization, company, and taxpayer to meet the regulations of a state with regards to reporting taxes and owned properties. The importance of this statement is similar to the significance of an income statement as it will aid in specifying and clarifying the financial issues of the user.

The statement document not only helps the users in dealing, managing, and be aware of their properties as it also helps the government in determining whether the owner or the user of the wealth statement have been paying the right amount for his or her taxes or if there are updates needed about a property assessment which was sold recently to a third party. Additionally, this will also avoid conflicts when it comes to the tax amount that the taxpayer needs to comply every tax period as it depends on how much his or her properties and businesses costs in the market.

Related Posts

-

Billing Statement Form

-

Closing Statement Form

-

FREE 13+ Operating Statement Forms in PDF | MS Word

-

Instructions for Other Uses Statement Of Claimant [ What Is, Uses, Instructions ]

-

Creating a Sources and Uses of Funds Statement [ What Is, Steps, Sources and Uses ]

-

10 Tips for Writing a Personal Statement

-

Writing a Small Business Vision Statement [ What Is, How To, Steps ]

-

FREE 10+ Sample Disclosure Statement Forms in MS Word | PDF

-

FREE 7+ Business Statement Forms in MS Word | PDF

-

What is a Contingent Statement? [ Importance, Components ]

-

FREE 12+ Sample Medical Statement Forms in PDF | MS Word

-

What is a Categorical Statement? [ How to, Importance, Components, Guidelines ]

-

FREE 7+ Profit and Loss Statement Forms in PDF

-

FREE 8+ Voluntary Statement Forms in MS Word | PDF

-

What are Financial Statement Forms? [ How to, Include, Functions, Importance ]