Assets refer to property owned by a person or a company which has specific value and a selling point that is acceptable for paying loans and debts. A Transfer of Property is a legislative act in India that states the specific conditions for transferring a property or an asset.

Most countries use a Deed of Transfer to legalize the transaction of transferring a property from one person to another. If a property is under a mortgage loan, the owner will have to inform the lender that he is selling the property, but this will still require the owner to continue paying the debts of the mortgage.

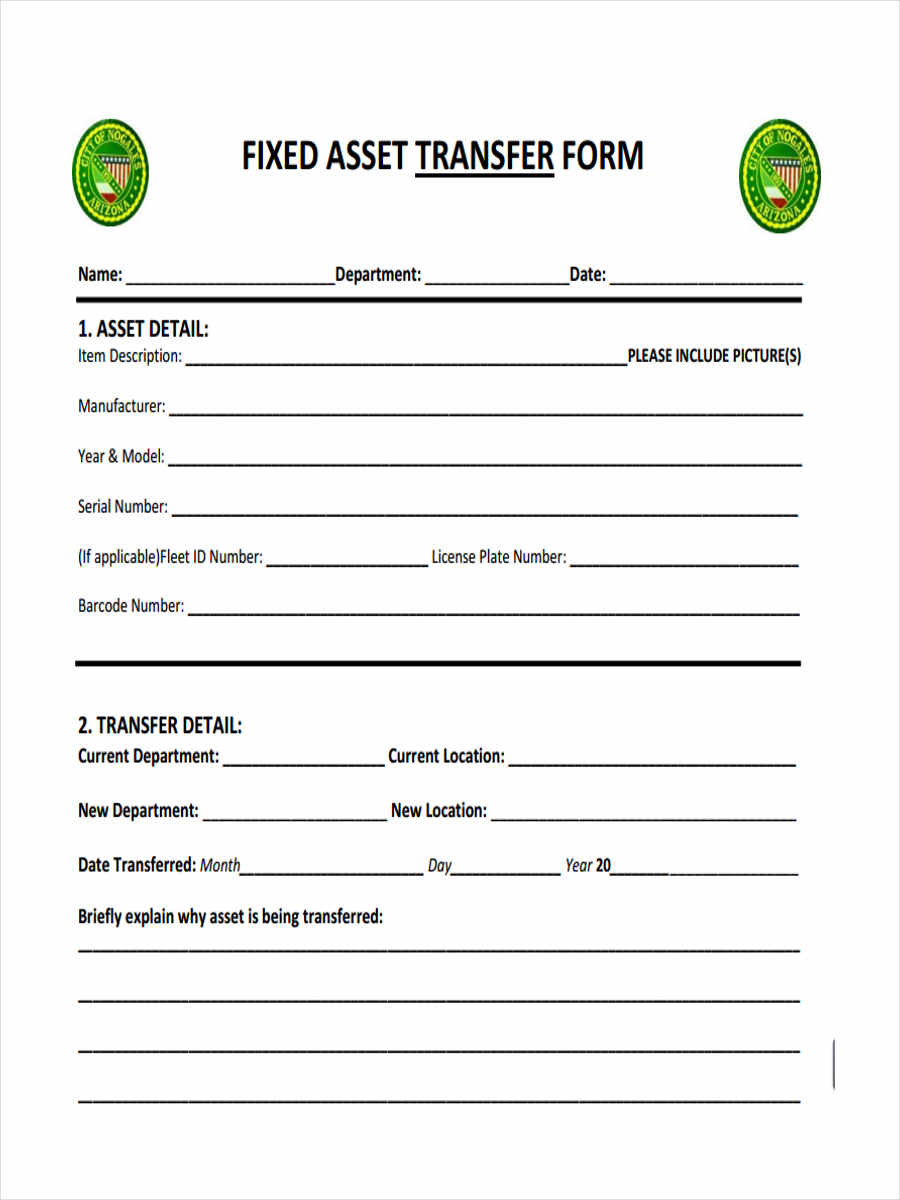

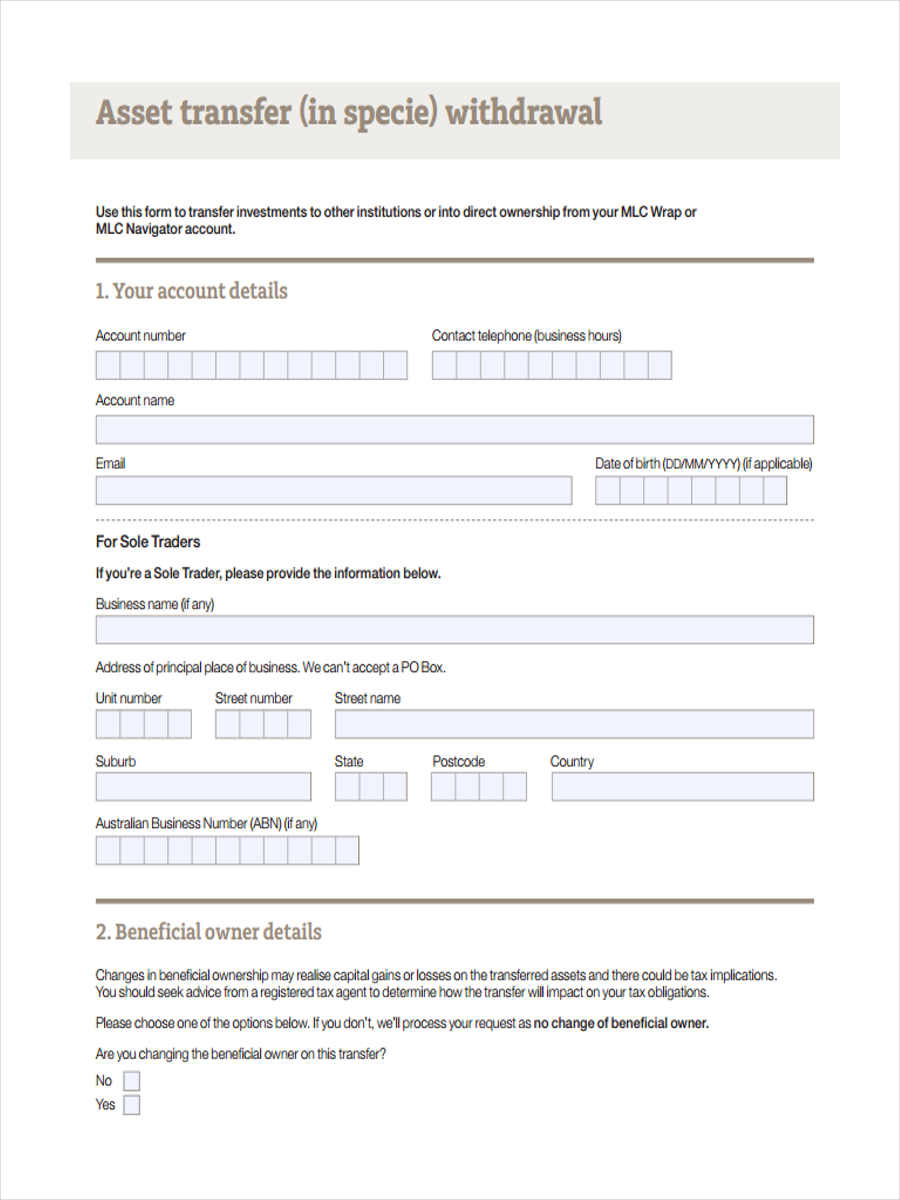

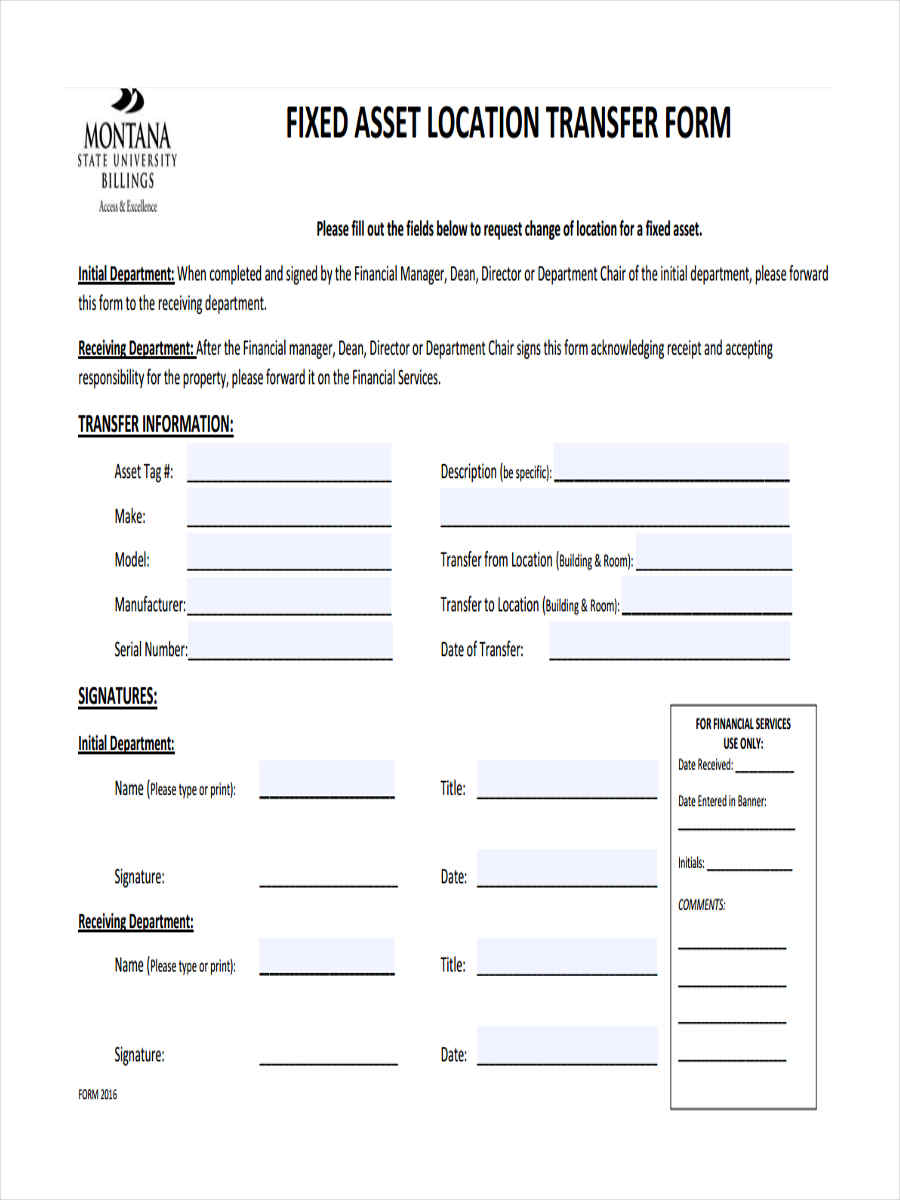

Fixed Asset Transfer

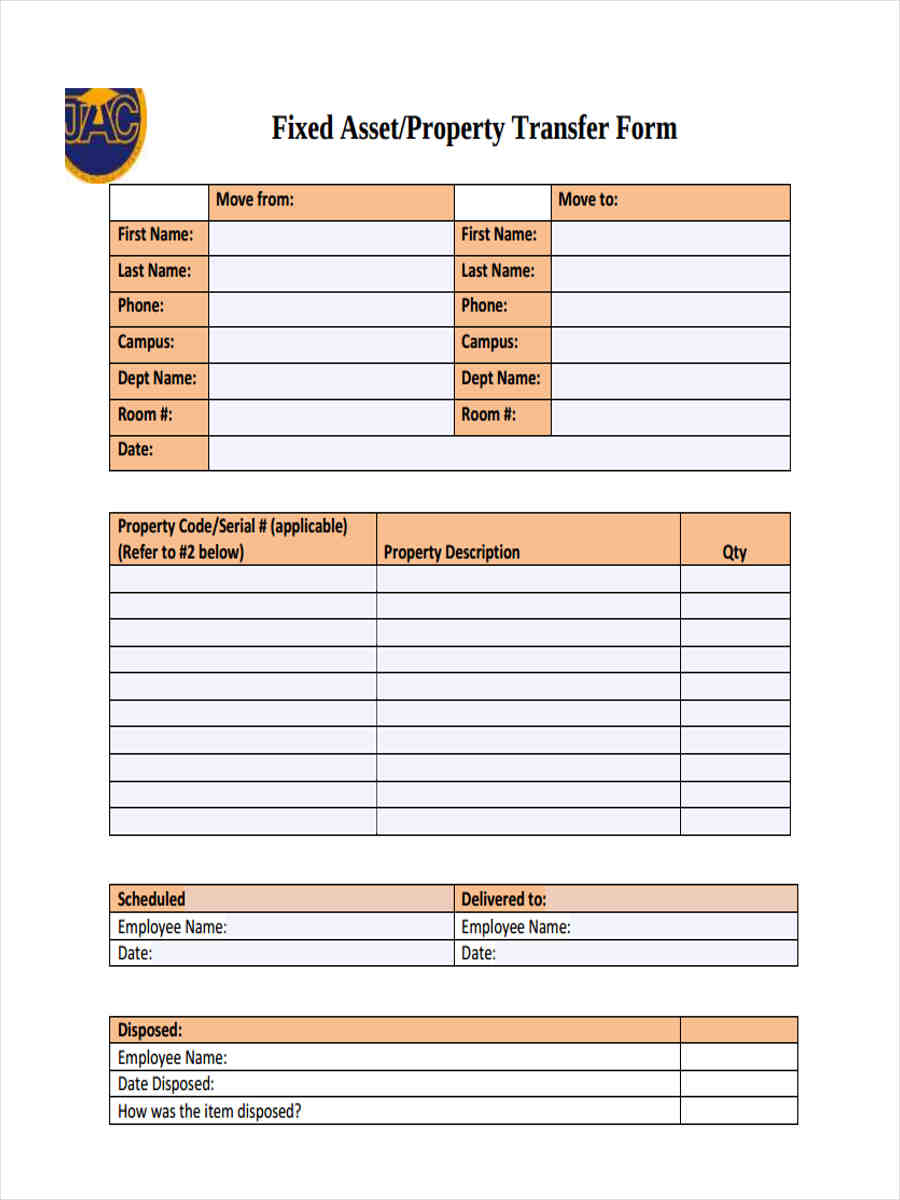

Property Asset Form

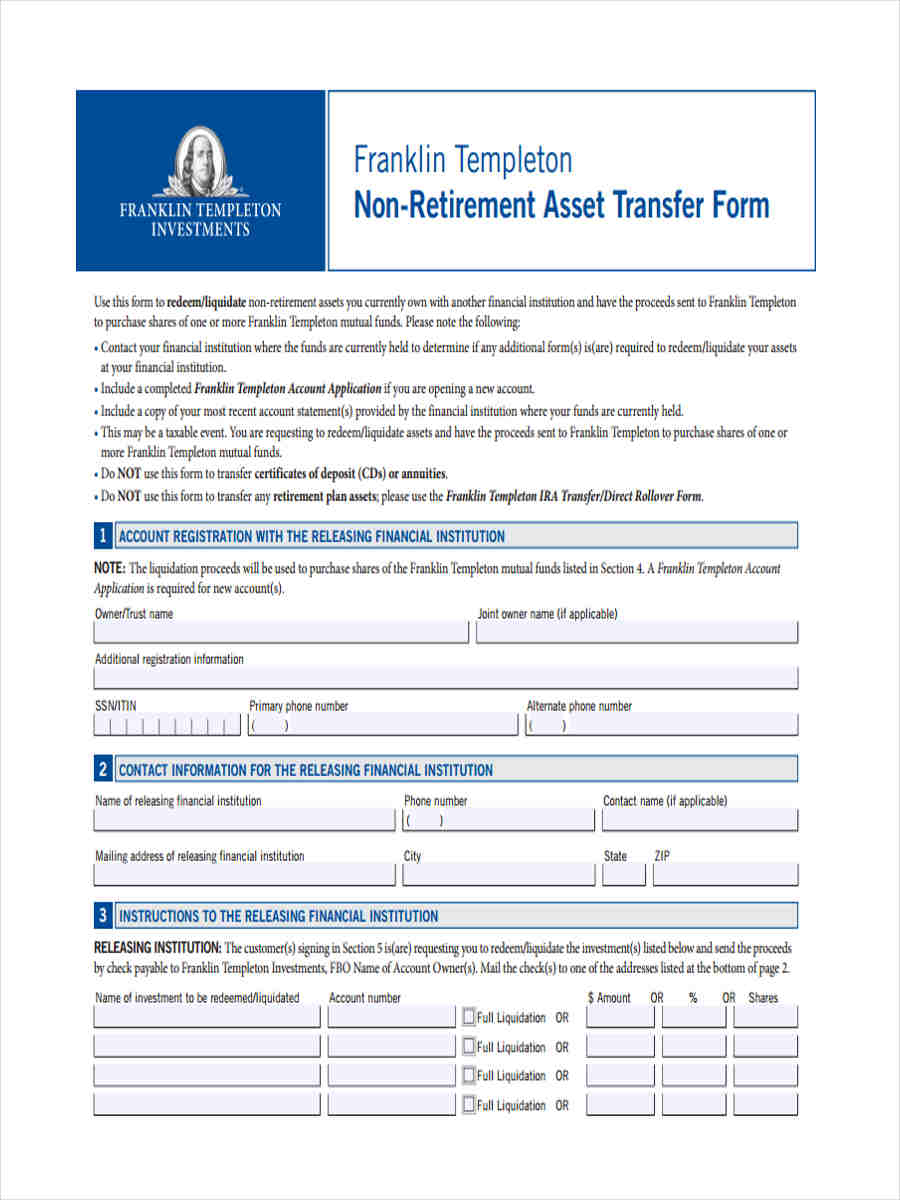

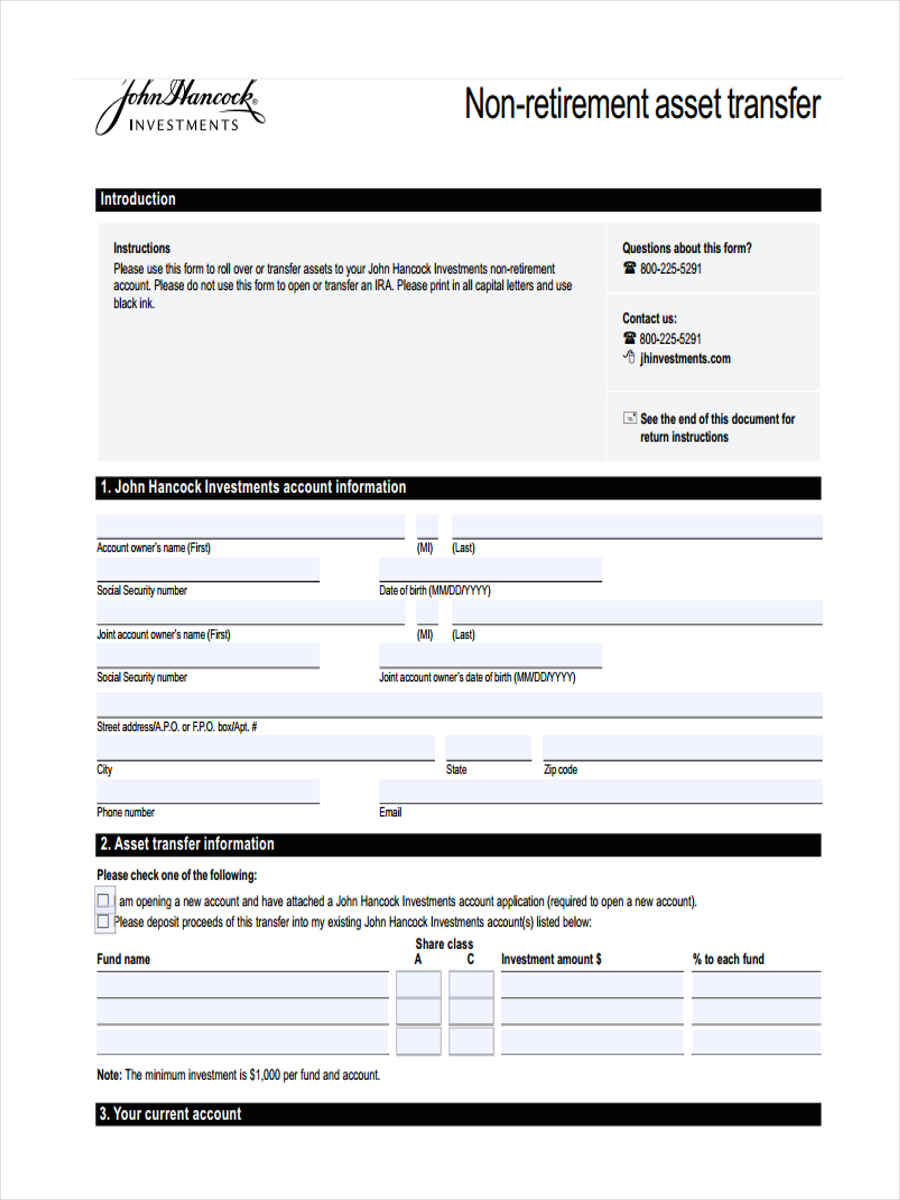

Non-Retirement Asset

Capital Asset Transfer

Asset Transfer Withdrawal

What is an Asset Transfer?

Asset Transfer refers to the transaction of transferring the rights, ownership, and obligations of a particular property from one person to another. Government-owned properties, such as parks and libraries, may undergo a Community Asset Transfer.

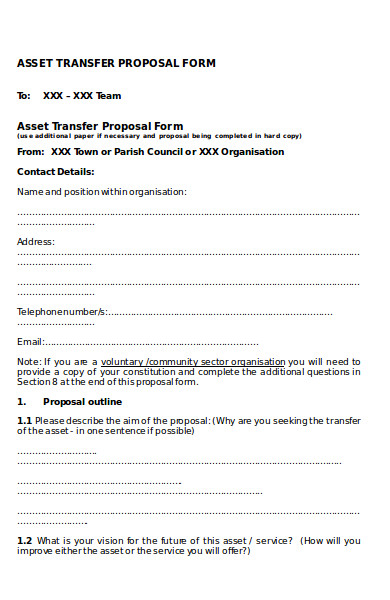

However, if a privately owned property is being confiscated by the government due to foreclosure and death of the owner, an Involuntary Asset Transfer is to be conducted by the government officials. An Asset Transfer Form will be used by the owner or the seller to transfer all the rights and responsibilities accompanying the ownership of the property bought by the buyer.

How to Record a Fixed Asset Transfer?

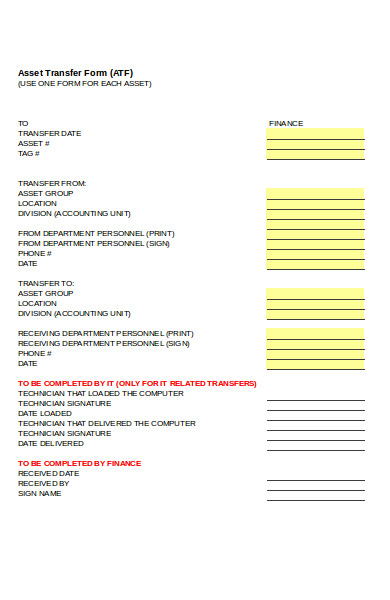

After using a Property Transfer Form to transfer your asset to the buyer, it is important to record the transaction. Here are the steps on recording a fixed asset transfer:

- Assign a unique sequence number per asset that is to be recorded.

- State a description for the asset in a sentence.

- Indicate the serial and tag numbers of the assets.

- Write the area of where the asset is located.

- Assign a person to look out for the asset.

- Input the total cost of the asset.

- Approve and store the fixed asset record.

Non-Retirement Asset

Fixed Asset Location

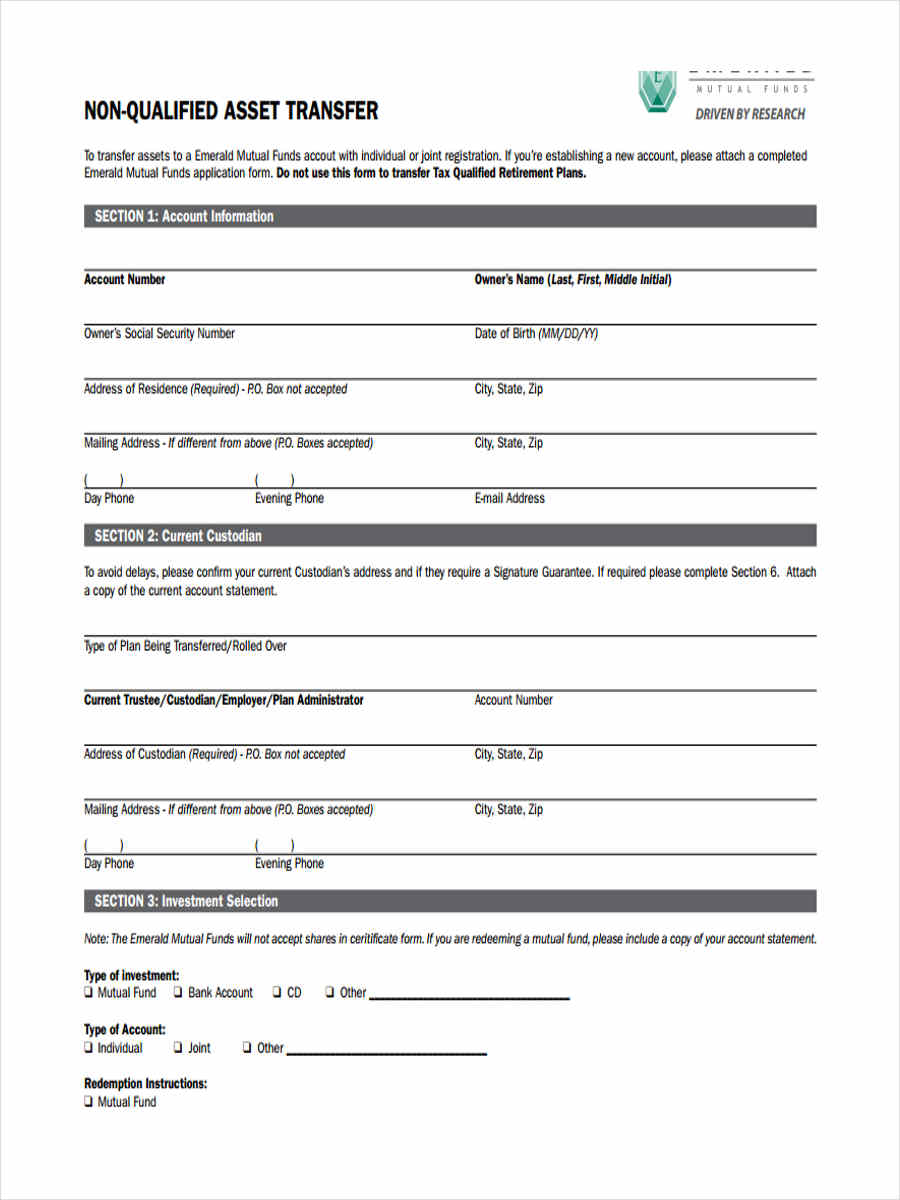

Non-Qualified Asset

Basic Asset Transfer Form

Formal Asset Transfer Form

Top Tips for Communities Taking Care of their Assets

- Give a value to your assets. Most communities and cities do not value the buildings, the land, and the people in their location. No matter what the assets of a community is, whether a tangible or an intangible property, these should be taken care off.

- Keep track of laws and legislation in your community. As a citizen or a residence living in the community, you have the right to bid for the properties which are considered for selling and for transferring ownership titles.

- Research your assets. Know the restrictions and conditions of the owner of a property. Ask the authorities for the information about the buildings, the streets, and other potential properties that may be an asset with a huge value in the market.

- Think ahead. Selling an asset should be done with caution, especially if it is a property under a mortgage or is a collateral for a loan. Decide what would be the best option that an asset can offer for your community in the future. Weigh your decisions with the people in your community and with the law of your country.

Stocks are also considered as assets, but for a company and not for a community. To transfer stock ownership, a businessman should use Stock Transfer Form as a legal document. Click on the links to view our Sample Transfer Forms.

Related Posts

-

FREE 7+ Sample Assets Transfer Forms in MS Excel | PDF

-

Wire Transfer Instructions Form

-

Registration Transfer Form

-

Land Transfer Form

-

Material Transfer Form

-

Vehicle Transfer Form

-

Employee Transfer Form

-

Fund Transfer Form

-

FREE 8+ Deed Transfer Form Samples in PDF | MS Word

-

Transfer of Ownership Form

-

FREE 9+ Sample Firearm Transfer Forms in PDF | MS Word

-

Gun Ownership Transfer Form

-

FREE 9+ Sample Title Transfer Forms in PDF | Word

-

School Transfer Form

-

Deed Transfer Form