Account forms are used by accountants of any agency or company to indicate their regular and annual financing statements. These documents are great instruments for tracking down the expenses and loss of the company. One specific form under this category is an Account Report Form.

The uses of accounting forms will range from attaining a complete record for every financial statement, having an accurate image of the company’s transactions, to knowing what particular steps to take that will help in improving the company’s profit management. Inventories are also a part of tracking down the company’s expenditures. These inventories may include the company’s assets and shares.

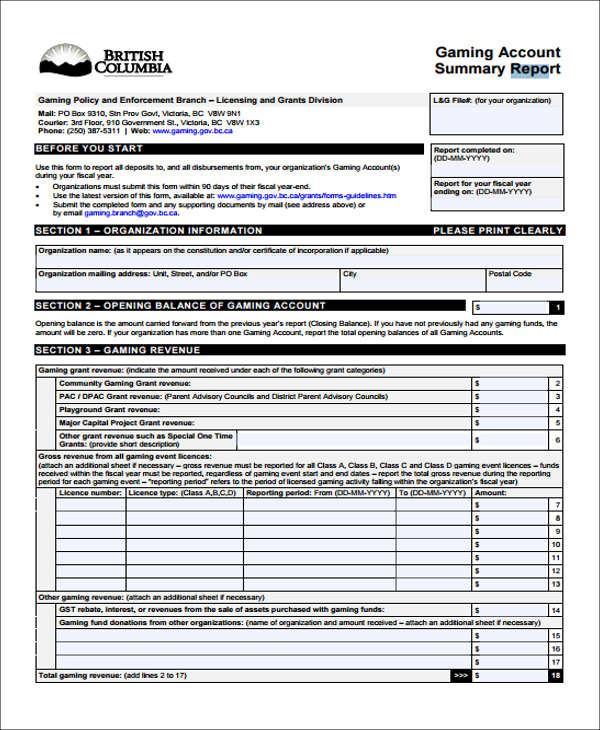

Gaming Account Report

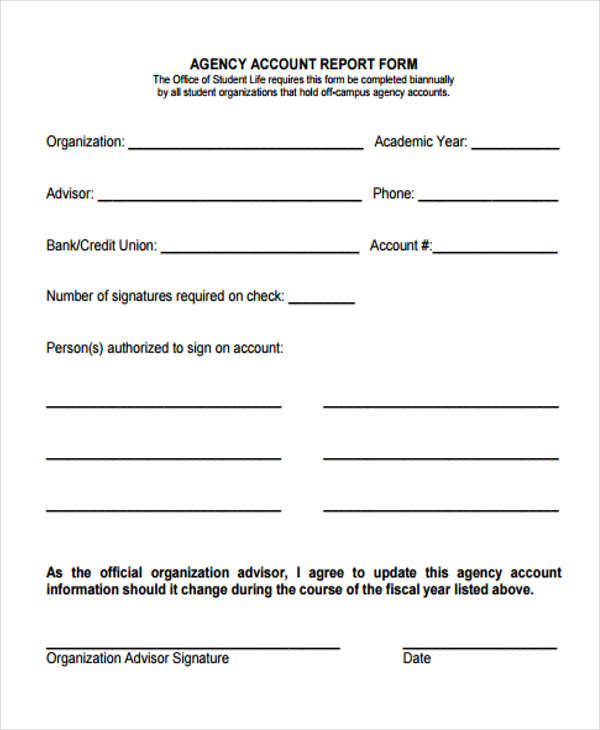

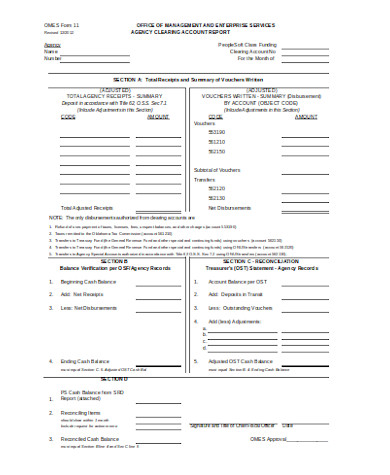

Agency Account Report

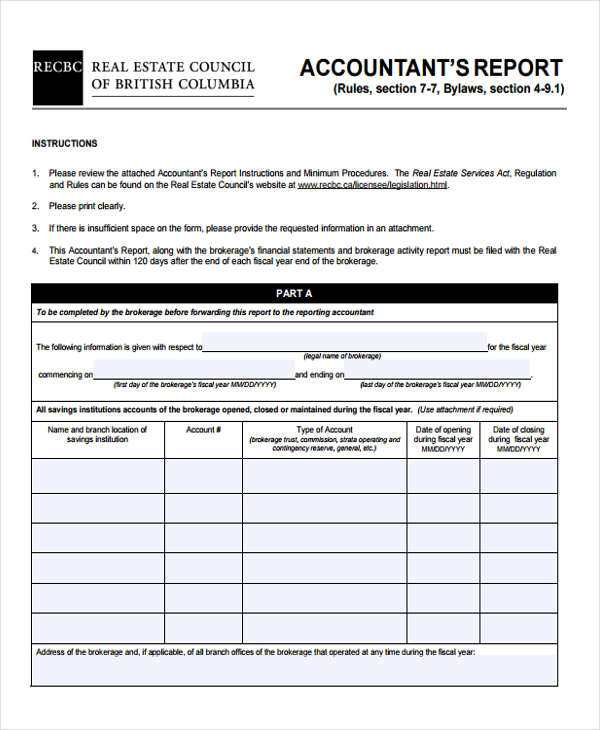

Accountant’s Report Form

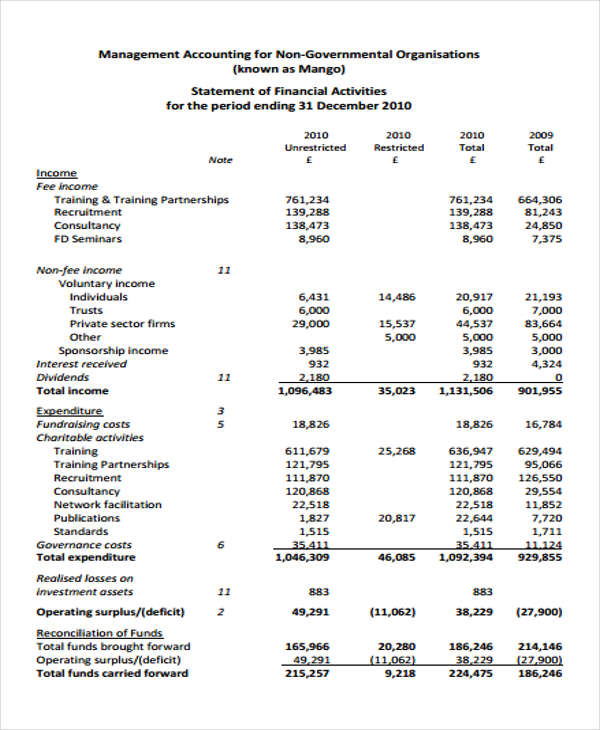

Annual Management Account Report

What Is Management Accounting Report?

In the industry of accountancy and business, an accountant creates an accounting report from the data which he gathered within a specified period of time. However, not every piece of data is subjected to a financial accounting report, since there are also employees and other members of the company to be considered.

This is why a Management Accounting Report will be made and used by the accountant and head officers of the company. The departments, teams, and jobs of the employees are one of the aspects which will affect the management accounting report.

The data on a Management Accounting Report and a Financial Accounting Report is computed from the information found on a company’s General Ledger Account Form. This is the building block or the backbone of the financing department of any company.

How to Prepare an Account Report?

Regardless of the type of accounting form report you used, either a Complex or a Basic Accounting Form, stating accurate information is the important thing in the document.

Step 1: Write an overview of the company’s business operations and the changes in the field of industry.

Step 2: Indicate the objective and the range or time period of the financial report.

Step 3: State the financial percentages.

Step 4: Conclude the findings of the report.

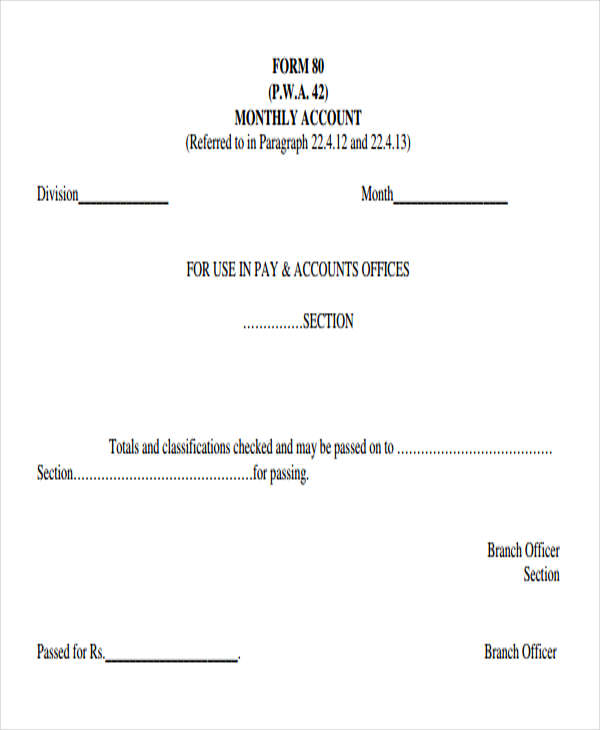

Monthly Account Report

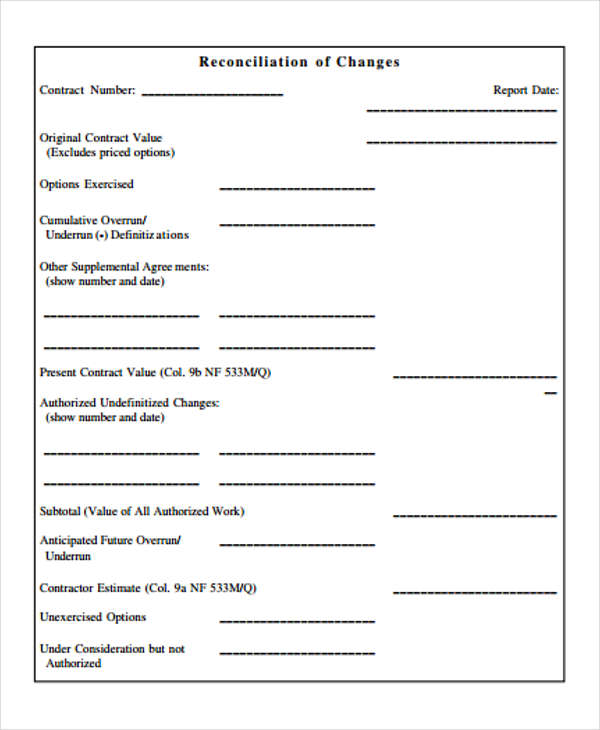

Monthly Contractor Financial Management Report

Witness Account Report Form

Agency Clearing Account Report Form

What Is a Closed Account on a Credit Report?

A closed account refers to a status given to accounts which were active but the account-holder is no longer paying the credit amount stated on the agreement. This status will be on an account holder’s credit report for a minimum of seven years upon closing. The debt is still owed by the account-holder, which means that he will still be able to pay at anytime to clear his name and account.

Some mortgage loan providers require a credit report from their applicants to guarantee that an individual is a responsible person when it comes to paying credit amounts. Therefore, an account-holder should have a clear and accurate credit report to qualify for financing and loan benefits.

If you are an account-holder, you should avoid having your account closed, and maintain a clean credit report. To help you attain this, setting your personal goal will be the first move that you should make. Keeping track of your expenses is the most effective way to veer you away from having debts.

You can use various tracking strategies, such as regularly filling out an Accounting Expense Form. This document will let you have categories of your spending priorities and your current credit balances.

Related Posts

-

Accounts Receivable Ledger Form

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF

-

FREE 7+ Claim Accounting Forms in PDF

-

FREE 11+ Accounting Request Forms in PDF | Excel | MS Word

-

FREE 6+ Credit Accounting Forms in PDF

-

FREE 7+ Accounting Registration Forms in PDF

-

FREE 8+ Change Accounting Forms in PDF

-

What are Accounting Forms? [ Purpose, How to Create, Includes, Importance ]

-

What are Financial Accounting Forms? [ Objective, How to, Benefits, Guidelines ]

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 8+ Budget Transfer Forms in PDF | Excel