Every company would always prepare a small amount of cash to start your daily operations. This little cash is what the business industry call petty cash. Employees utilize petty cash for office necessities, such as lunches, supplies, and other small expenses. Cashiers in-charge for the day will need a written document to record all the transactions with the office’s petty cash—a petty cash register form. This cash register form will keep all your financial activities within the coverage of your petty cash.

What is a Petty Cash?

Petty cash is a small amount of money the cashiers have on hand for minor expenses such as office necessities, and other reimbursements. This cash is in a cash drawer, where cashiers store their coins and bills. Just like other financial transactions, you must keep track of the petty cash activities for the whole operation. This tracking form is in a log format covering daily, weekly, or monthly. Petty cash register allows you to track and write down entries about the financial activities relevant to your petty cash.

FREE 5+ Petty Cash Register Samples in Excel | PDF

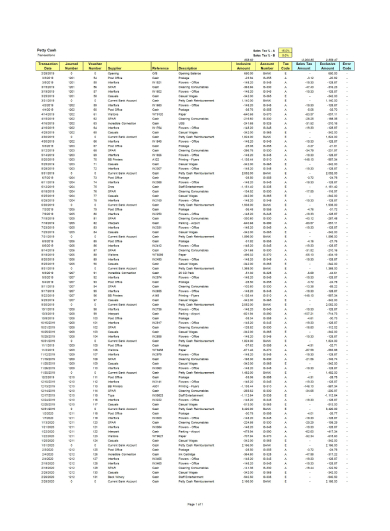

1. Sample Petty Cash Form

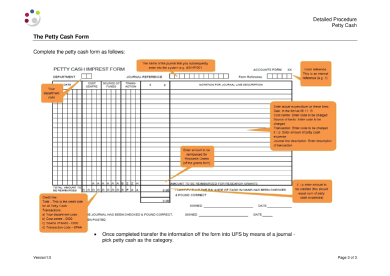

2. Petty Cash Register Form

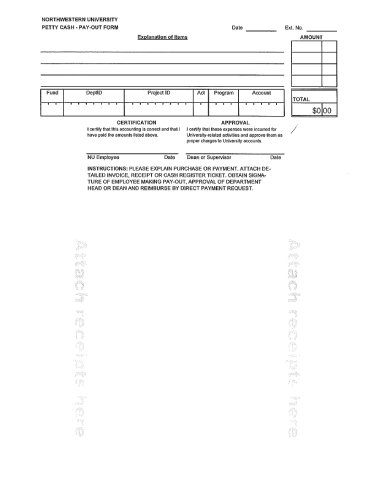

3. Petty Cash Pay-out Form

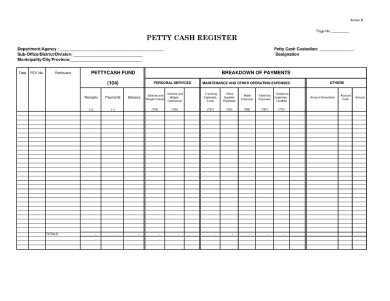

4. Petty Cash Register Sample

5. Petty Cash Log

6. Example Petty Cash Form

Benefits of Using Petty Cash Register Forms

Using petty cash registers is already part of any company’s financial operations. This document will help you trace and record your expenses that cater to your office’s needs for the day’s activities. There are more benefits you can get from using petty cash registers. Here are a few significant advantages you will have.

Trackers of your financial activities: With the help of petty cash registers, you will have an efficient way of tracking your business activities. This document helps you record all the transactions relevant to your petty cash. If ever you have to review somethings on your operations, it will be easier to use your petty cash register forms.

Control significant cash transactions: Since tracking your sales become more comfortable with an accounting sheet, you will be able to monitor and control your petty cash transactions efficiently. Your petty cash register forms will serve as your basis on how much you have already used for the day. Without recording your operations, you won’t notice that you have overspent your stored cash.

Transparency of transactions: One purpose of having cash register forms is to maintain transparency. That is why petty cash registers with backup documents are preferable. Petty cash registers would reflect all your transactions within the day—leading you to have an accurate and honest entry on your sheets.

Petty cash registers are like cash reports. There are times that the accounting department will require backup documents of your petty cash register forms. These documents could be receipts, order forms, and other proof of purchase. You must keep all these papers to include in your financial reports.

How to Create Petty Cash Registers

In business, transparency is always important. That is why you need to have a written document to record all your activities within your petty cash. Tracking forms like cash register forms would make your tracing easier. It is also an excellent tool in a company’s cash management and supports the data on your balance sheet. For you to have accurate results for your cash reports, you must create your petty cash registers appropriately. Here are a few tips and steps you can follow in making cash registers effectively.

Step 1: Decide on a Register Format

You need to choose a format for your cash register form. For you to have an efficient way of recording, you must have an organized format to write entries quickly. Most petty cash registers have tables to categorize data for secure computation easily. There are also sample cash register forms available online. You can download these documents and use them as references.

Step 2: Learn the Essential Elements

First thing you should know about creating petty cash registers are the elements you need to include. Usually, petty cash registers contain the date of transaction, purpose, cash amount, receipt numbers, and the final balance. This data is needed to have accurate calculations at the end of the cash period. Placing the name of the cashier in-charge in the form will also help in keeping track of who is responsible for the day’s operation.

Step 3: Fill in the Details You Need

Once you have settled with your tables, you should start filling in other vital details. Register sheets’ content depends on the period it is covering. For instance, you are going to have a monthly petty cash register forms. You should have the respective month reflected on the sheet to avoid mixing up data. Make sure you have filled in the correct information for you to prevent miscalculations and conflicts of balancing your petty cash.

Step 4: Keep the Sheet Updated

You need to keep the register forms updated from time to time, especially if it is a monthly petty cash register form. Keeping receipts and other proof of purchase will backup your registers. It proves your data accurate and maintains transparency. You should attach these backup documents as you submit the monthly or daily petty cash register to your head cash manager.

Step 5: Calculate and Evaluate

At the end of the coverage period of your petty cash registers, you must calculate the data carefully and assess if the amount would cater to your daily expenses. Petty cash registers are also part of your business financial statements. The results of your petty cash register form will reflect in the business statement. People in your accounting department would analyze your report and see if the calculations are accurate and balanced. Through your petty cash registers, your company can come up with ways to improve your procedures and adjust things to fix lapses.

Related Posts

-

Cash Receipt Journal Form

-

Daily Cash Log

-

Check Register Form

-

FREE 6+ Checkbook Register Forms in PDF | Excel

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 5+ Travel Expense Reimbursement Forms in PDF | MS Word | Excel

-

FREE 3+ Loan Application Review Forms in PDF | MS Word | Excel

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 11+ Accounting Request Forms in PDF | Excel | MS Word

-

FREE 8+ Account Report Forms in PDF | MS Word | Excel

-

FREE 17+ Sample Printable Accounting Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Accounting Expense Forms in PDF | MS Word | MS Excel

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 5+ Debenture Short Forms in PDF

-

FREE 5+ Credit Card Billing Authorization Forms in PDF | MS Word