A petty cash log is essential for tracking small business expenses. This Daily Cash Log ensures accuracy and accountability in managing operational costs. Designed to streamline cash flow, the log records transactions, balances, and approvals systematically. With our comprehensive guide, learn how to create an efficient log that supports your organization’s needs. From setting up the petty cash fund to monitoring expenses and reconciling balances, our examples and tips make the process simple. Enhance your financial tracking and ensure smooth business operations with this step-by-step guide tailored for small businesses and organizations.

Download Petty Cash Log Bundle

What is Petty Cash Log?

A petty cash log is a record used to track and manage small cash expenses in an organization. It documents transactions, balances, and approvals to maintain accuracy and prevent misuse of funds. This tool ensures transparency in cash flow and supports accountability in financial operations. A well-maintained petty cash log helps businesses avoid discrepancies and monitor their daily cash usage efficiently. It serves as a vital component of financial management, particularly for small or immediate transactions.

Petty Cash Log Form

[Company Name]

[Company Address]

Petty Cash Information

- Starting Balance: __________________________________________

- Authorized User: _________________________________________

- Date of Last Reconciliation: _______________________________

Transaction Records

- Date: _______________________________________________

Description of Expense: ________________________________

Amount: _____________________________________________

Payee Name: ________________________________________

Authorized By: ________________________________________ - Date: _______________________________________________

Description of Expense: ________________________________

Amount: _____________________________________________

Payee Name: ________________________________________

Authorized By: ________________________________________

Reconciled Balance

- Remaining Balance: _______________________________________

Signature of Custodian: ___________________________________

Date: _________________________________________________

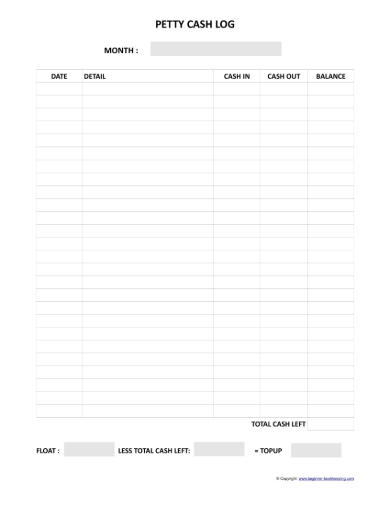

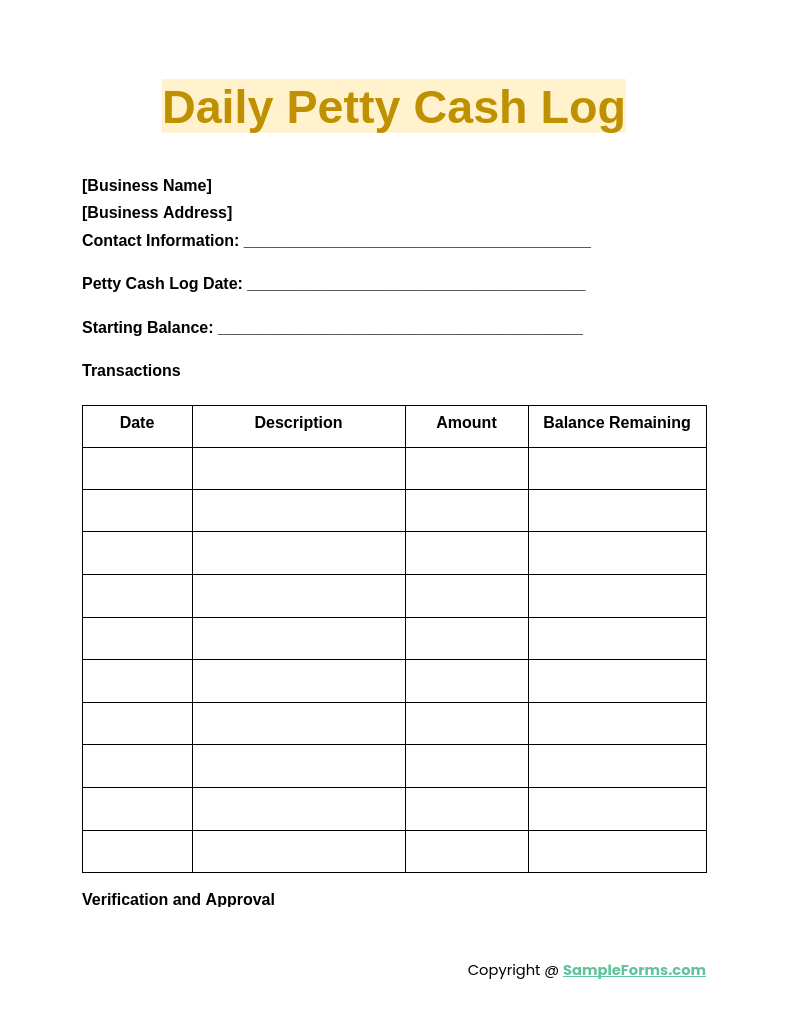

Daily Petty Cash Log

A daily petty cash log records small transactions made daily, ensuring accountability and accurate reconciliation. It’s essential for managing frequent cash expenses, similar to maintaining a Cash Receipt Form for financial clarity.

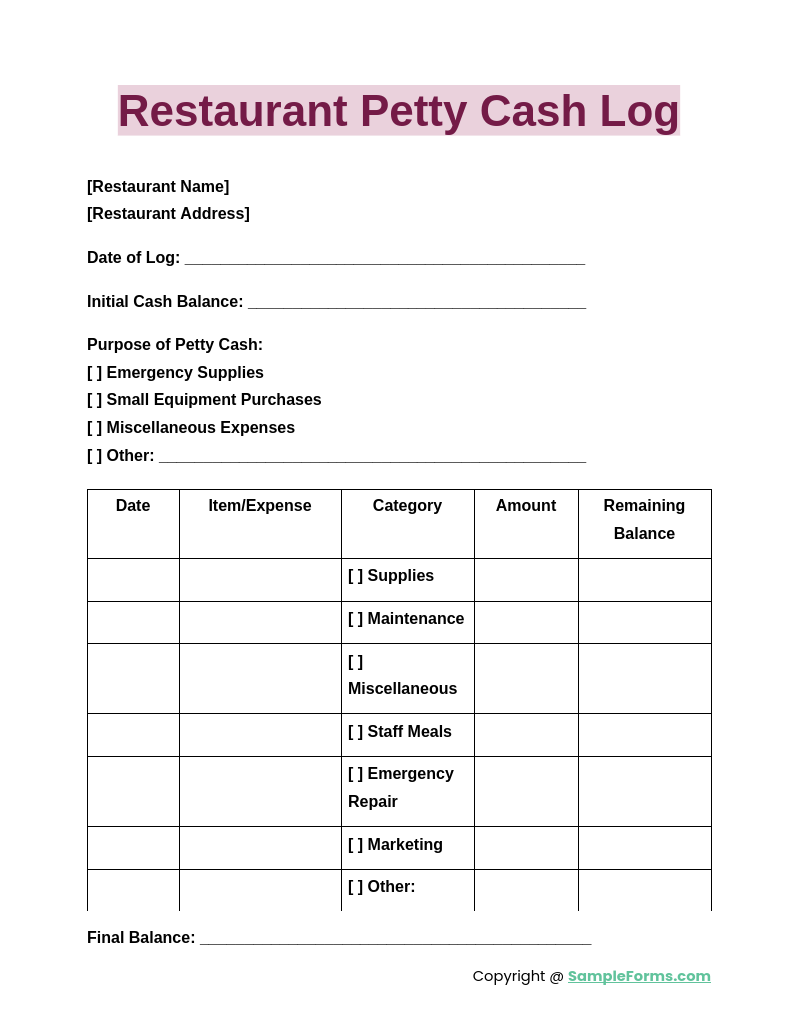

Restaurant Petty Cash Log

A restaurant petty cash log tracks daily operational expenses like food supplies or staff tips. It simplifies cash flow management, much like using a Cash Receipt Journal Form to ensure seamless financial recording.

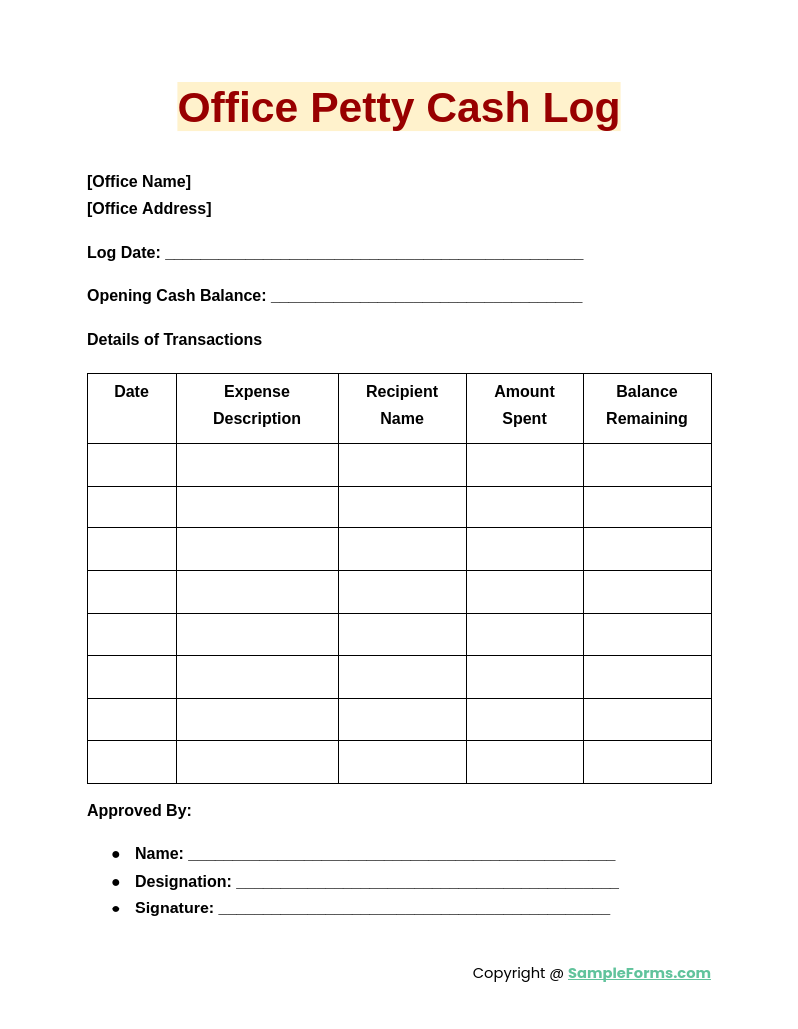

Office Petty Cash Log

An office petty cash log manages cash disbursements for supplies or minor expenses. It supports efficient office management, akin to preparing a Daily Cash Report for accurate reconciliation and accountability.

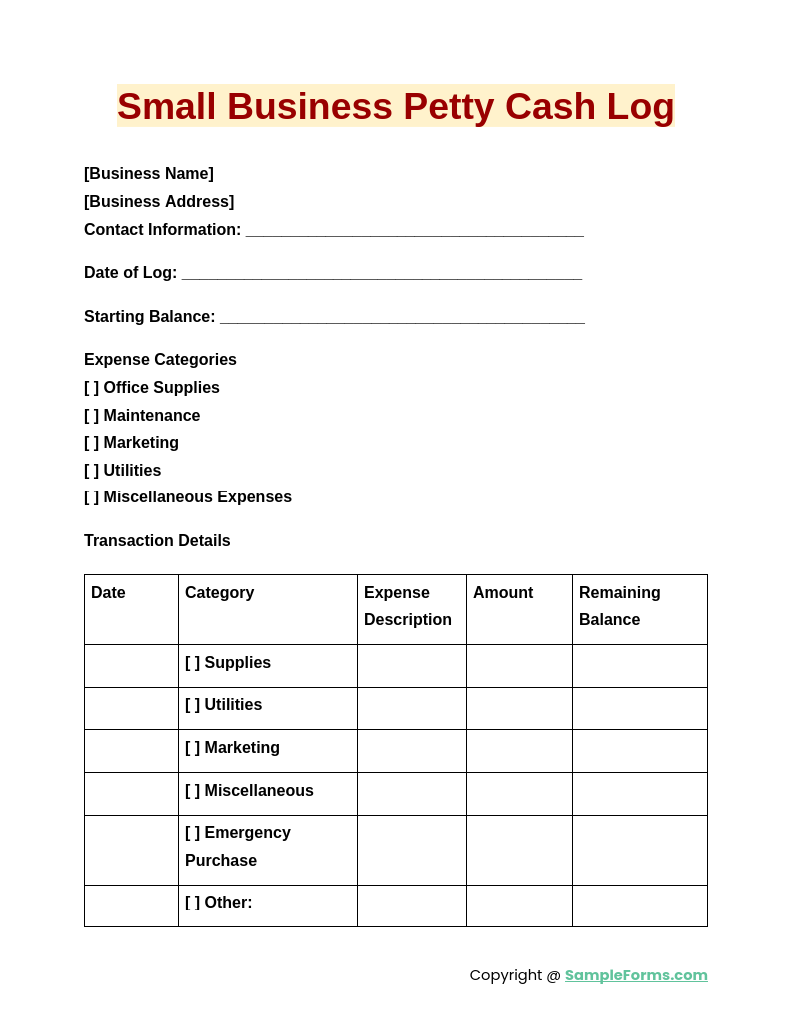

Small Business Petty Cash Log

A small business petty cash log records everyday transactions like utilities or quick repairs. It provides financial oversight, similar to a Petty Cash Receipt Form, ensuring transparency in cash usage.

Browse More Petty Cash Logs

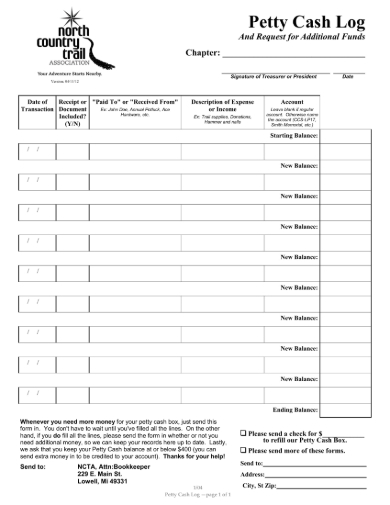

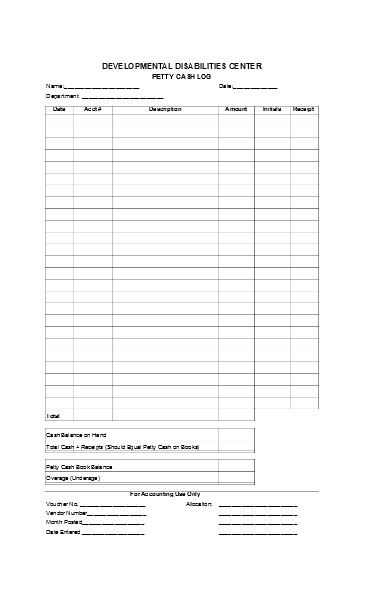

1. Sample Petty Cash Log

2. Petty Cash Log Sample Form

3. Petty Cash Log Sample

4. Specific Petty Cash Log

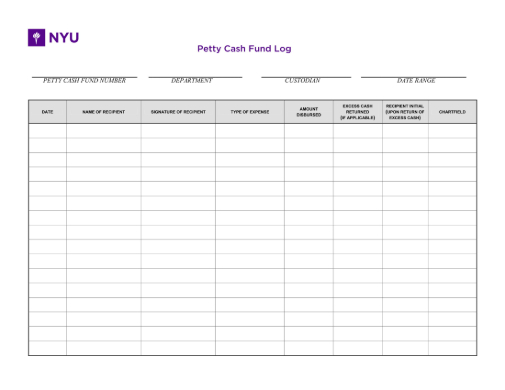

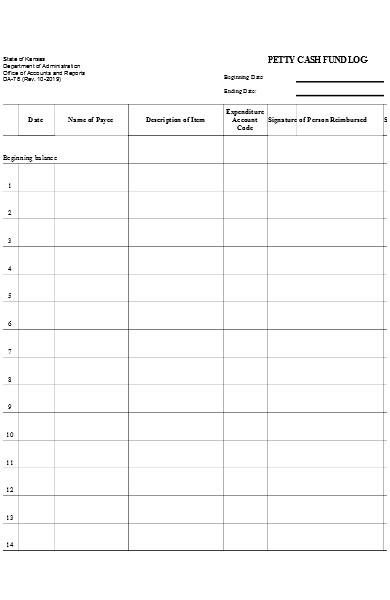

5. Sample Petty Cash Fund Log

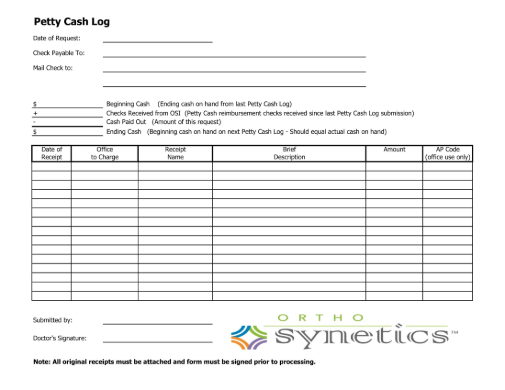

6. Petty Cash Sample Log

7. Simple Petty Cash Log Form

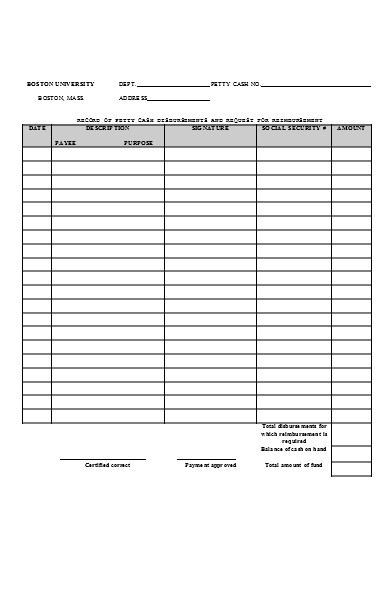

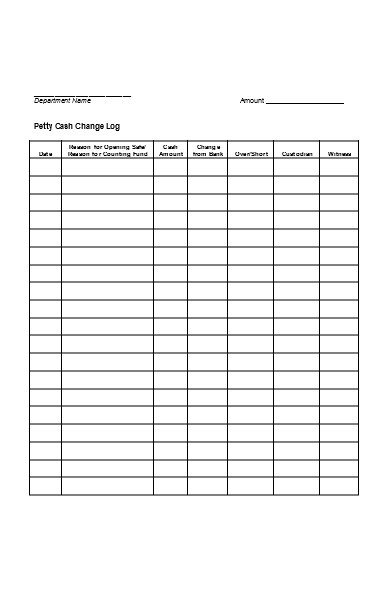

8. Petty Cash Change Log Form

9. Daily Petty Cash Log Form

10. Petty Cash Fund Log Form

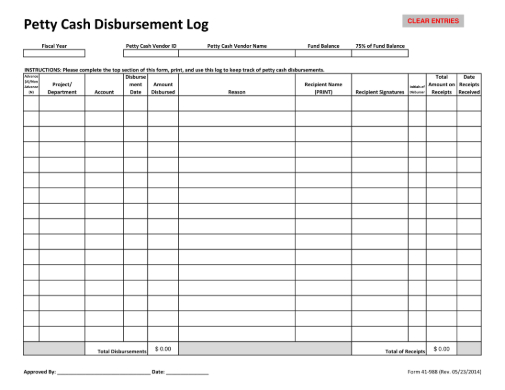

How to create a petty cash log?

Creating a petty cash log ensures efficient tracking and accurate management of small transactions. Follow these steps for an effective log:

- Set Up a Format: Designate columns for date, purpose, and amount.

- Record All Entries: Log each transaction as it occurs.

- Attach Supporting Documents: Use receipts or a Petty Cash Reimbursement Form for verification.

- Assign Custodianship: Appoint a responsible person to manage the log.

- Review Regularly: Check the log periodically to ensure all entries are accurate.

What are the risks of petty cash?

Petty cash carries inherent risks, such as mismanagement and fraud, which can disrupt financial accuracy. Mitigate these risks by:

- Lack of Documentation: Ensure every expense has a Petty Cash Register for accountability.

- Unauthorized Access: Restrict access to the petty cash fund.

- Misuse of Funds: Monitor spending habits for irregularities.

- Theft or Loss: Store cash securely to avoid theft.

- Reconciliation Errors: Perform regular reconciliations to catch discrepancies early.

How to prepare a petty cash book?

Preparing a petty cash book ensures streamlined tracking and proper financial management of small cash transactions. Steps to prepare include:

- Design the Layout: Include sections for date, purpose, and balance.

- Allocate Initial Fund: Set a starting amount for the petty cash fund.

- Record Transactions: Log each payment with its purpose and a Financial Form.

- Perform Reconciliation: Match recorded transactions with actual cash periodically.

- Review Regularly: Use a Financial Statement Form to validate petty cash transactions.

What are the five petty cash controls?

Implementing petty cash controls ensures security and accountability for small business transactions. The five essential controls include:

- Authorization Policy: Require a Petty Cash Requisition for every disbursement.

- Limited Access: Restrict fund handling to authorized personnel only.

- Proper Documentation: Attach supporting receipts for all expenses.

- Regular Reconciliation: Balance the petty cash fund periodically to avoid discrepancies.

- Audit Trail: Maintain a clear record for review, ensuring all expenses align with organizational policies.

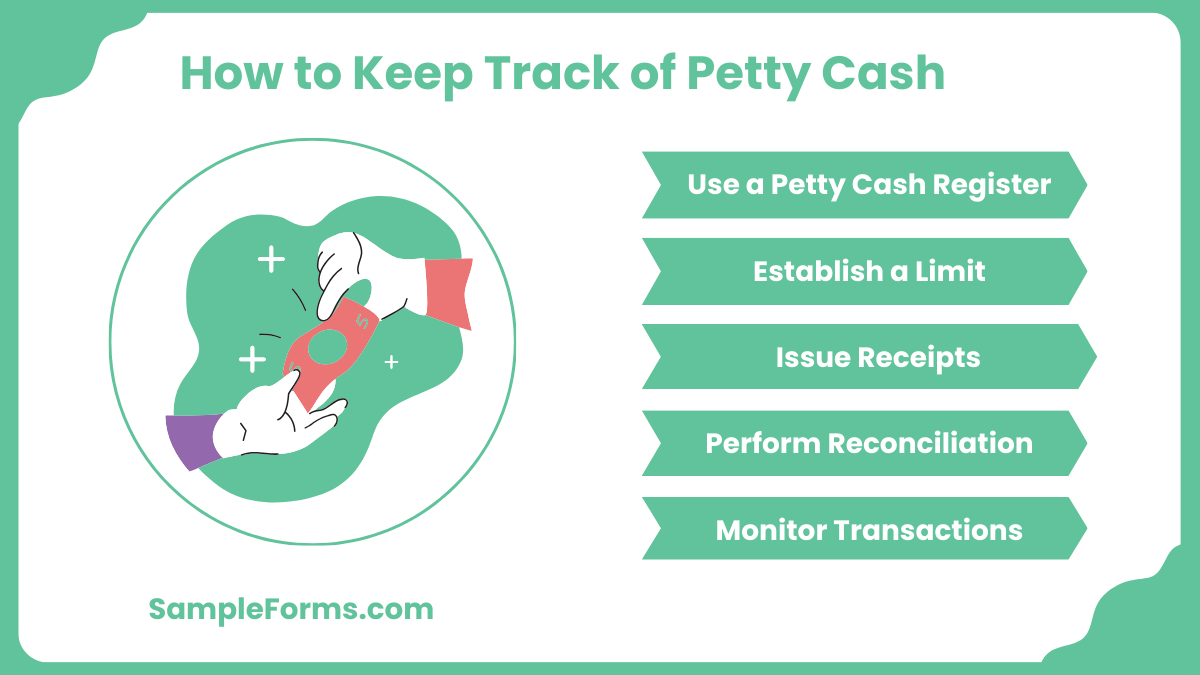

How to keep track of petty cash?

Tracking petty cash ensures accountability and prevents misuse by maintaining detailed records and monitoring expenses consistently. Key steps include:

- Use a Petty Cash Register: Record all cash inflows and outflows systematically.

- Establish a Limit: Set a cash limit to control the fund’s usage.

- Issue Receipts: Provide a Cash Payment Receipt Form for every disbursement.

- Perform Reconciliation: Regularly reconcile the petty cash to ensure accuracy.

- Monitor Transactions: Periodically review usage to identify irregularities or trends.

What is the rule for petty cash?

Petty cash rules require proper documentation, approval, and reconciliation, similar to maintaining a Financial Report Form for tracking small transactions efficiently.

What is an example of petty cash?

Petty cash can cover office supplies, postage, or minor repairs, much like funds allocated in an Affidavit of Financial Support Form for specific needs.

How much money should be in petty cash?

The amount depends on business size but typically ranges between $50–$500, as documented in a Financial Questionnaire Form for budget planning.

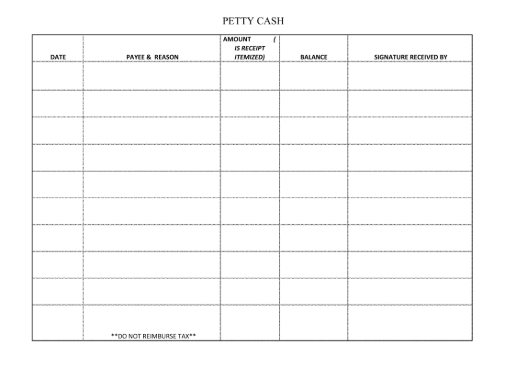

How to write a petty cash slip?

A petty cash slip includes the date, purpose, amount, and approval signature, similar to a Financial Affidavit Form for transparency.

What should petty cash not be used for?

Petty cash should avoid personal expenses or large purchases, aligning with rules similar to a Financial Evaluation Form for accountability.

Can you write off petty cash?

Yes, petty cash expenses can be written off as business expenses if documented correctly, similar to a Business Financial Statement Form.

What are the basic petty cash procedures?

Basic procedures include establishing a fund, recording expenses, reconciling balances, and maintaining receipts, akin to a Financial Statement Form for clarity.

How much petty cash is allowed?

The allowed petty cash amount varies by company policy, typically ranging from $100 to $1,000, as managed in a Financial Assistance Form.

How do I report petty cash?

Report petty cash by summarizing transactions, attaching receipts, and reconciling balances, much like preparing a Financial Contract Form for review.

What is the limit of petty cash per day?

The daily limit is usually set by company policy, ranging from $20 to $200, resembling terms in a Financial Agreement Form.

The Petty Cash Log is tool for managing small-scale expenses in organizations. It promotes transparency, tracks transactions, and ensures accountability in cash handling. By using structured logs, businesses can streamline expense tracking and simplify reconciliations. A log is particularly useful for recording frequent cash transactions, preventing misuse, and supporting financial planning. With proper maintenance, petty cash logs contribute to smooth business operations and efficient financial management. Use these insights to optimize your cash handling practices.