You were once a bookkeeper and then soon became an accountant, all in one year. You are a master of keeping track of the flow of the finances of a company, where it goes, and how many are left. Not one error or mistake in terms of calculating the balance can escape your eagle eyes. You have been handing in so many expense reports already that you can spot an error in an instant once your eyes land on it. Along the way, expense reports have become your friend at helping you solve the financial agreement issues that the company had trouble solving before.

What Is an Expense Report?

An expense report is a business document that tracks expenses and is part of a financial report. A financial report is a written accounting document that helps businesses and company owners see how the flow of the company funds is going. A financial statement has significant scope and covers a lot of areas from investments, funds, income, and so much more. Anything under the finance department of a company is within the range of a financial report.

According to Forbes.com, there are five different kinds of financial reports that can help business owners. The five examples of financial reports include profit and loss statement, balance sheet, statement of cash flows, net profit margin over time, and AR days vs. AP days. Some of the mentioned documents fall under the domain of an expense report. These five different financial reports cater to various aspects of finance that needs the business owner to assess the cash flow.

An expense report is smaller in scope than that of a financial statement. An expense report only deals with tallying the expenses the company or business had incurred within a specific duration. Within the scope of an expense report are debts, payables, loans, product transactions, etc. Expense reports help an accountant for these documents include lists of the expenses incurred, which an accountant can browse through easily. Expense reports track every cent and penny that the company has spent, so this makes part of an accountant’s job easier.

FREE 6+ Expense Report Forms in PDF | Excel | MS Word

Here are six examples of expense report forms that we have carefully researched and acquired from the Internet, specifically credible websites. Most of the expense report sample forms are curated and displayed by official organizations and companies that may have used the documents before already. You can examine each of the expense report sample forms.

Look at the details of the written content in the expense report sample forms we have presented below. Compare and contrast an expense report sample to another sample and see if there are any similarities and differences from you thoroughly examining each of them.

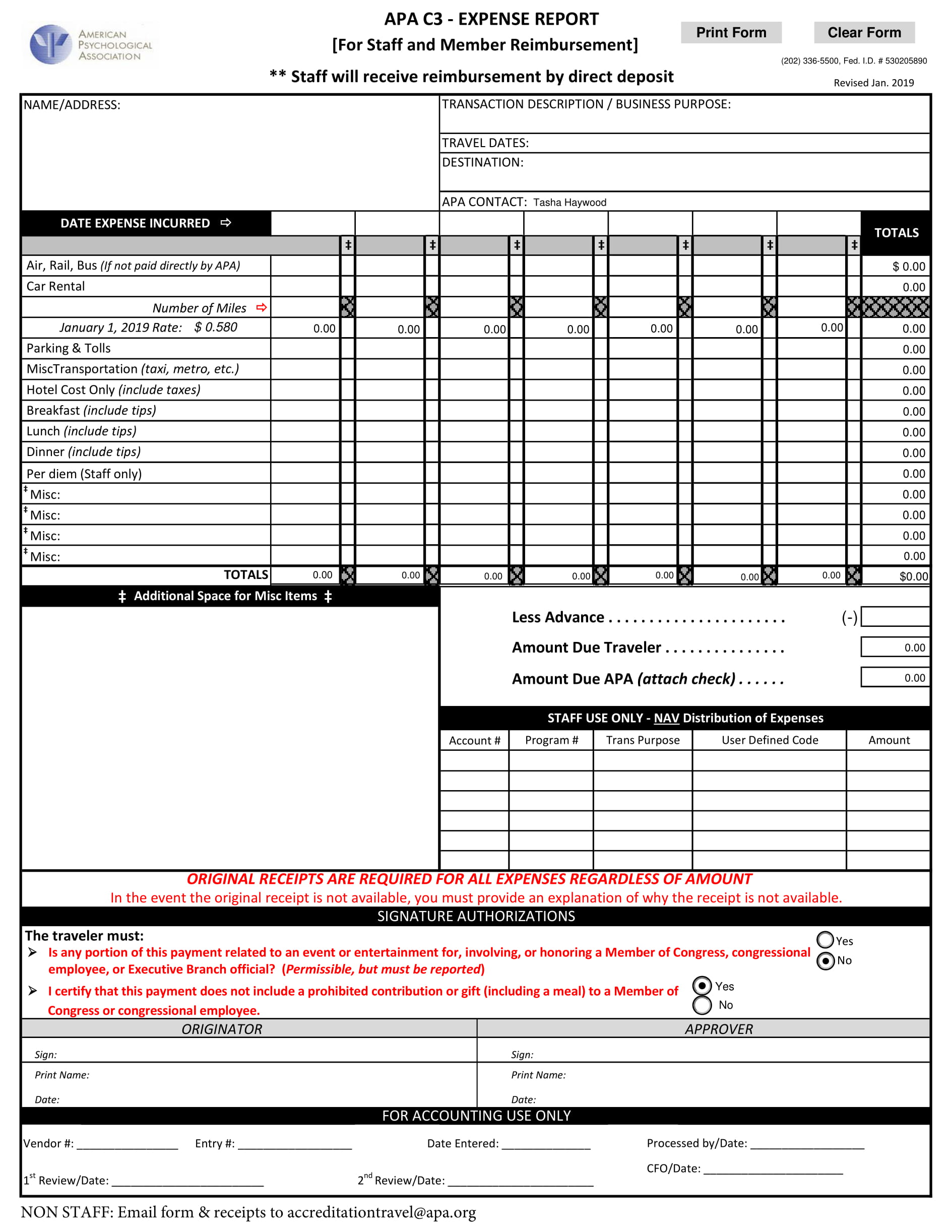

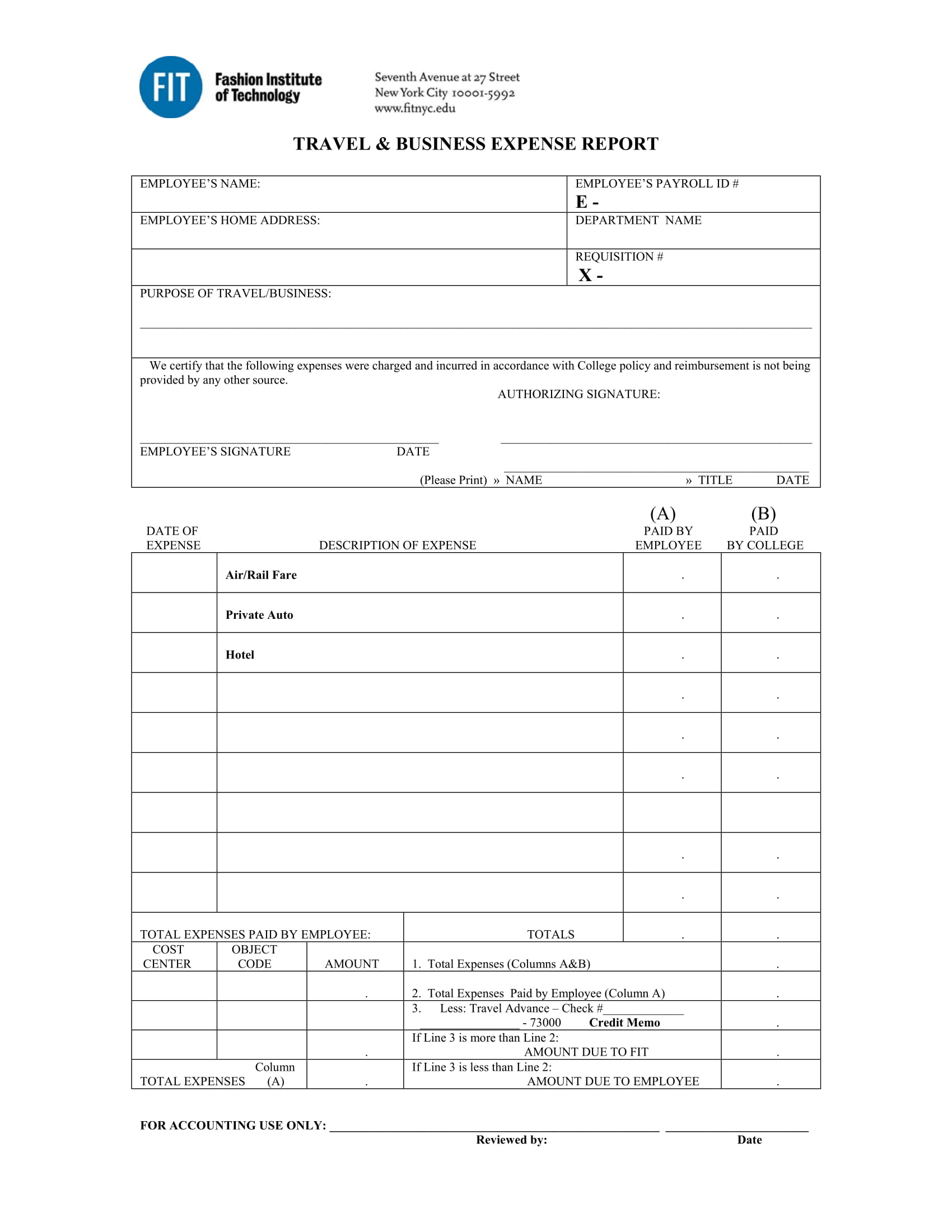

1. Sample Expense Report Form

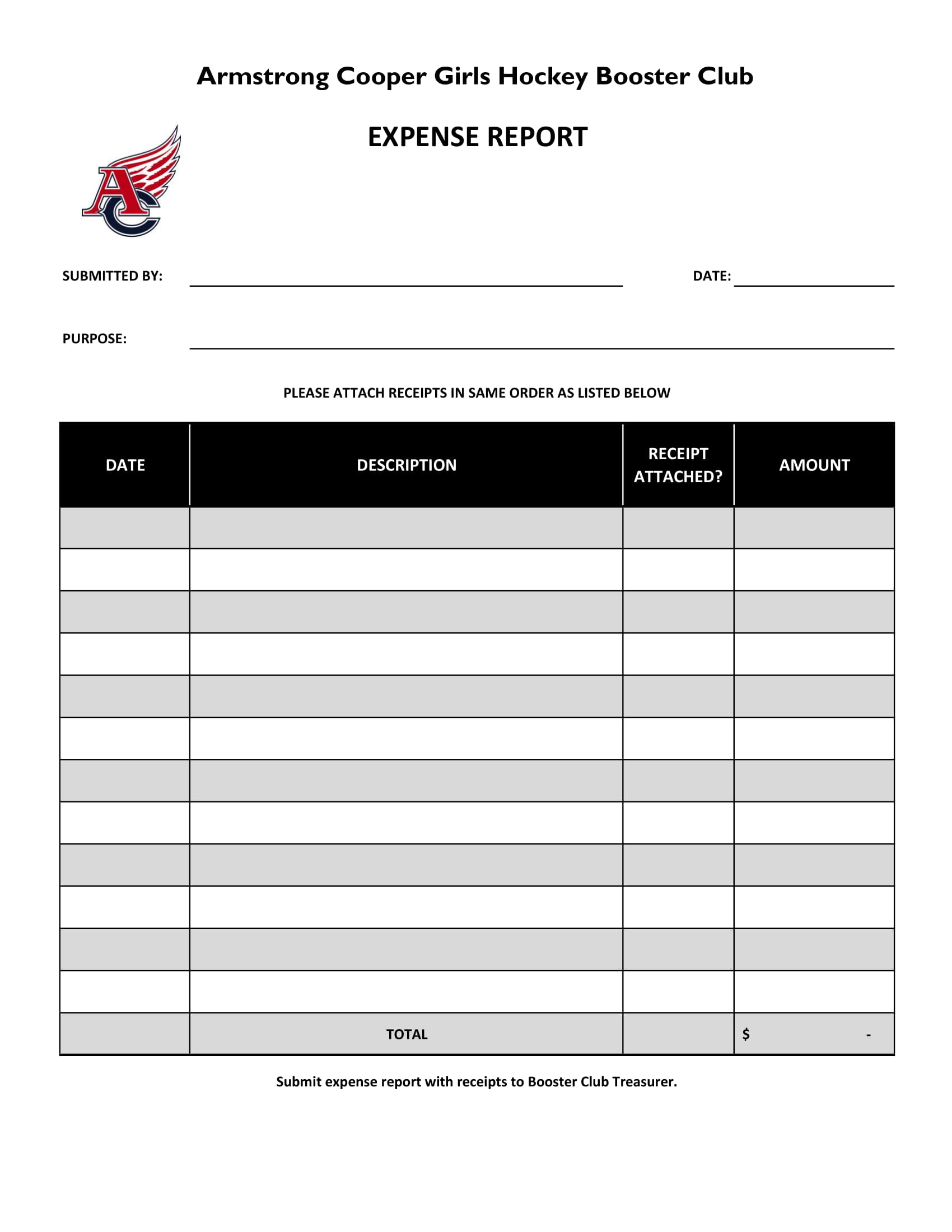

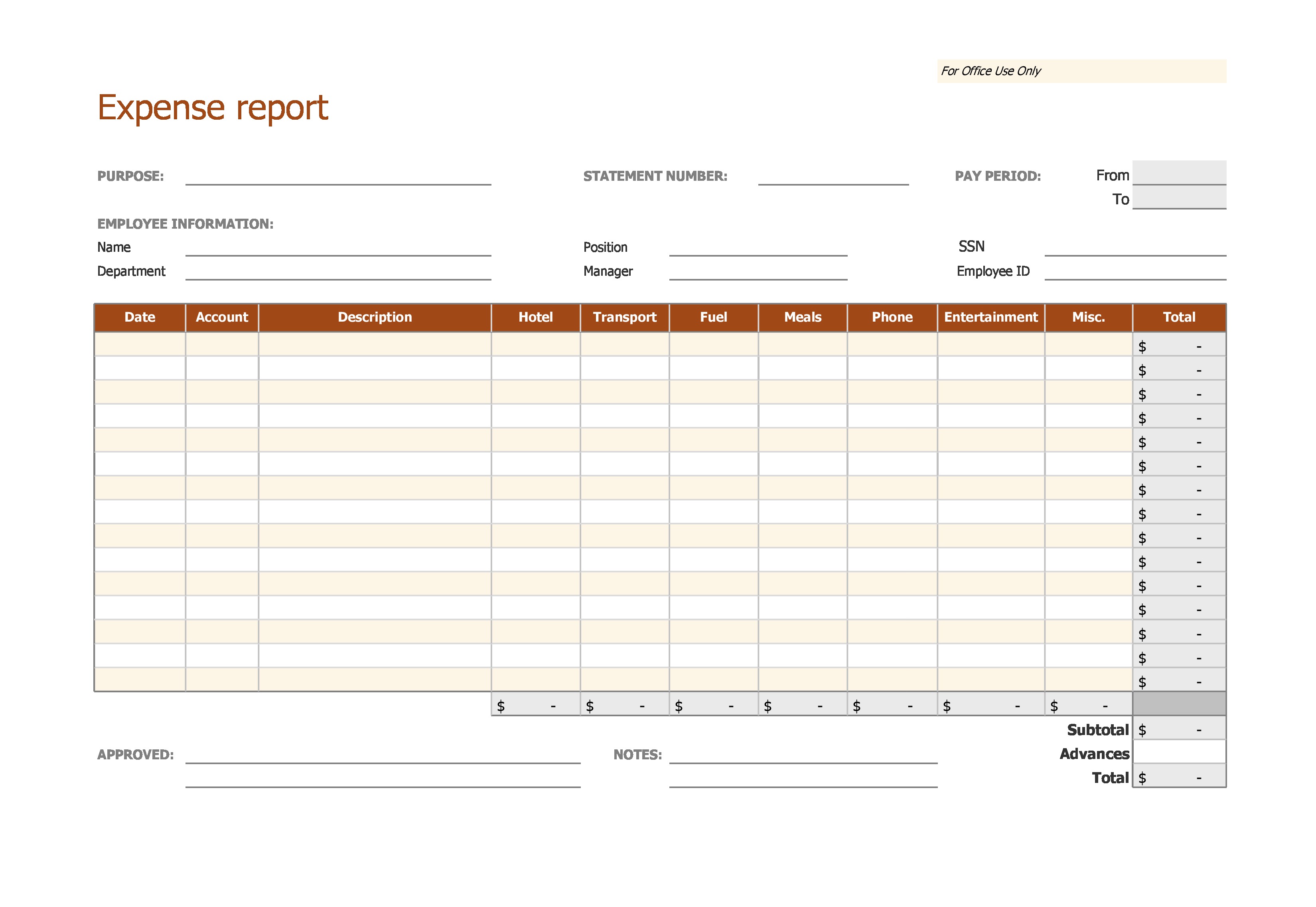

2. Sample Expense Report Sheet

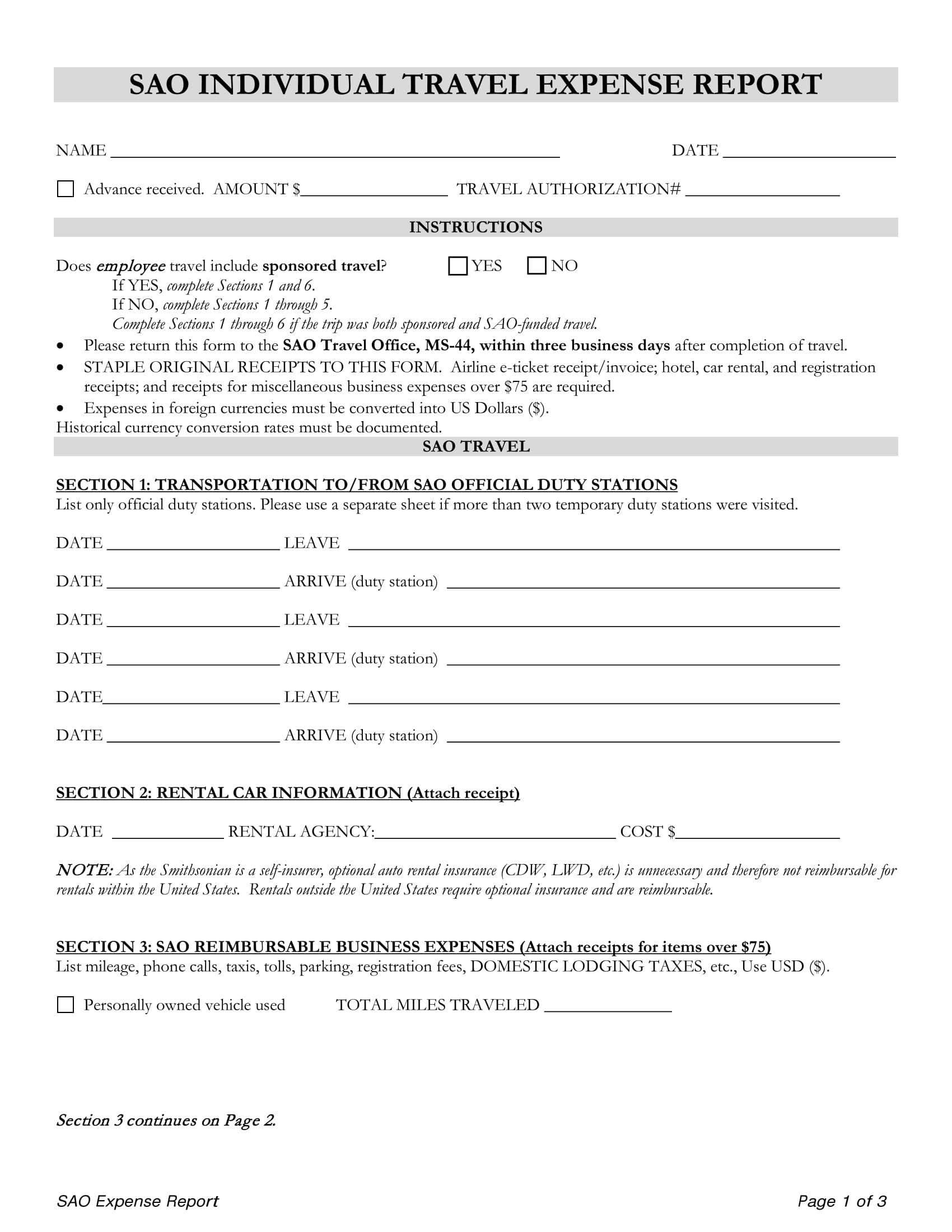

3. Expense Report Sample Form

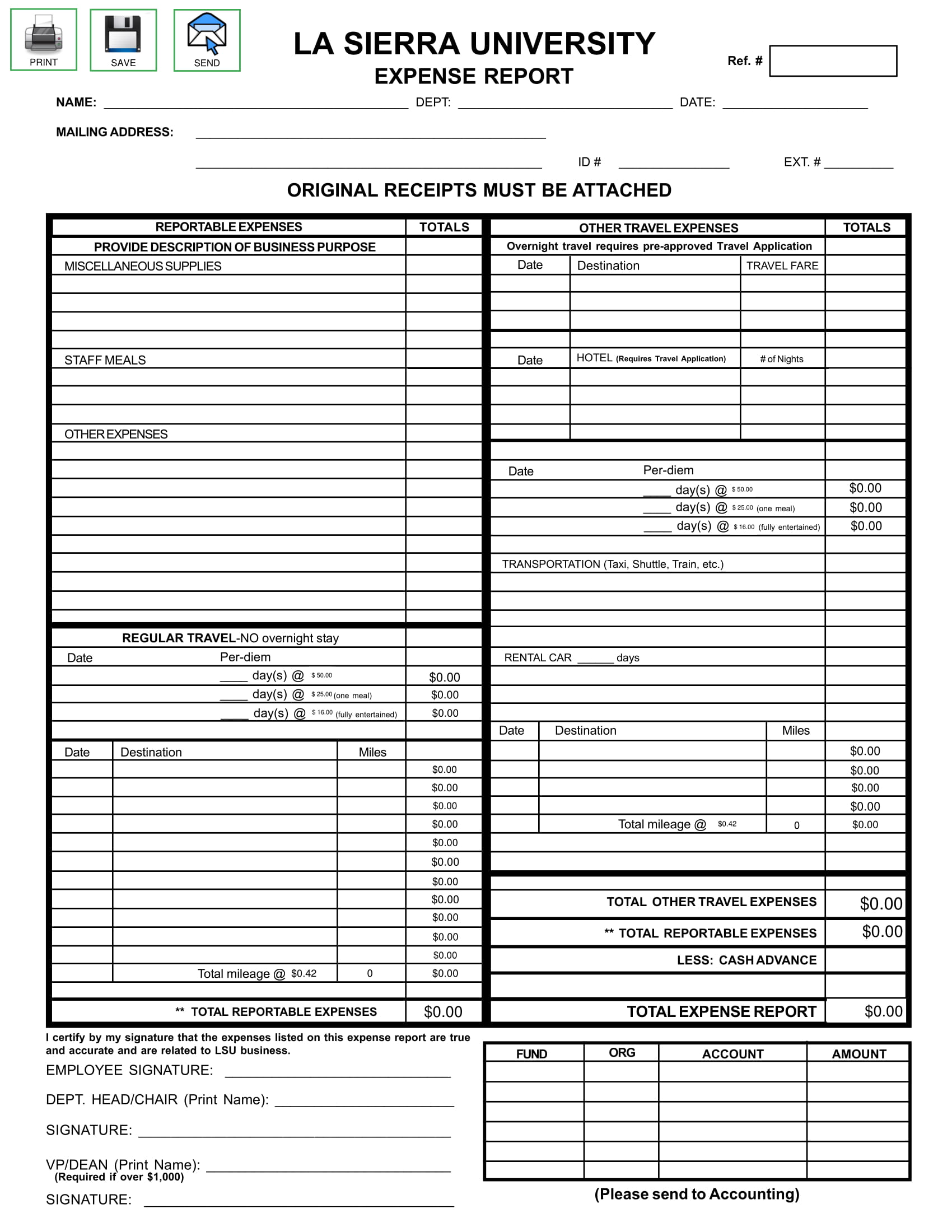

4. Expense Report Sample Sheet

5. Report Sample Sheet

6. Generic Expense Report Form

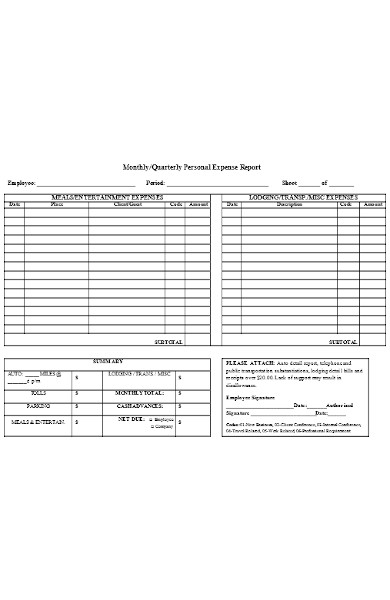

7. Monthly Personal Expense Report Form

Four Common Types of Expense Report Frauds

Whenever expense reports make mistakes such as miscalculations, companies will have to pay huge amount of money since the act is considered illegal. No one can fully know if the report is fake or not, only those involved when the report was being conducted?—the owner and the one who conducted the expense report. Here are the four common types of expense report frauds that you can read to avoid having to commit such things even unconsciously.

1. Fake Expenses

This type of fraud cannot be compared to a human error. Unless you are very skilled at making a fraudulent act that seems like a human error. This type of fraud affects the whole total of the company’s expense list form. This type involves made up purchases of items and services with a fictitious price from a fictitious store for the need to have something be reimbursed.

2. Personal Expenses

This type of expense report fraud attempts to include personal expenses and list them as business-related transactions such as shopping for clothes from Uniqlo or having your nails done to have something to reimburse.

3. Multiple Reimbursements

This is one type of expense report fraud that is difficult to determine whether it is done on purpose or not. This type of expense report fraud is defined as when a similar expense is reported multiple times. On a longer expense report, this type can be seen as an error, but on a shorter one, a reader can say that this is done deliberately. However, it still depends on the situation. Maybe the person who conducted the report really did commit a human error or not.

4. Overstated Expenses

This is similar to the multiple reimbursement type. This type can be an expense report fraud or a sincere human error. This type is defined as when a specific expense is reported higher than what is the exact and original amount of a certain item or service.

How to Create an Expense Report

Here are a few tips and steps on how to create a professionally effective expense status report form that you can use when you tally or list down the company’s expenses in an organized manner. You may not follow the whole process chronologically, for we have not made the guide with that kind of order in mind. Carefully take note of the steps that we have provided.

Step 1: Browse the Web to Find the Right Template

Go to template.net, a website known for containing various professionally designed high-quality templates. Browse through the site’s rich gallery of sample templates and forms. Grab the opportunity and download that template. And then, make it your own.

Step 2: Customize the Template

Customize the template to how you want to present it. You can look at the samples we have shown above. Look carefully at their structures and forms.

Step 3: Utilize Serif Font Styles

Most business files utilize serif typefaces due to their formal appearance when used in printed materials. You can use Times New Roman, Garamond, Georgia, and some other default font style that belongs to the serif typeface group.

Step 4: Evaluate the Whole Template

After you have created the final output, you must assess the document for any errors that you have missed checking since you might have been preoccupied with the creation process of the file.

Step 5: Print the Document When You Are Done

You must then print the expense report and show it to your client who wanted you to do it. Print more than one copy, and remember to save a file on your desktop. Just in case.

Related Posts

-

Student Progress Report Form

-

Testimonial Report

-

Daily Cash Report

-

Inspection Report Form

-

Medical Report Form

-

Car Accident Report Form

-

Report Form

-

Referee Report Form

-

Joining Report Form

-

Laboratory Report Form

-

11+ Confidential Report Form

-

Damage Report Form

-

FREE 14+ Disability Report Forms in PDF

-

FREE 15+ Weekly Report Forms in PDF | MS Word | Excel

-

FREE 14+ Teacher Report Forms in PDF