Dive into the world of auditing with our detailed Internal Audit Form guide, designed to simplify your audit processes. This essential resource is packed with unique, Fillable Form and practical examples that cater to every auditor’s needs. Whether you’re conducting a comprehensive financial audit or just starting, our guide ensures you have all the tools at your disposal for an efficient and effective evaluation. Incorporate Financial Audit Form seamlessly into your audit routine and transform the way you audit today.

Download Internal Audit Form bundle

What is an Internal Audit Form?

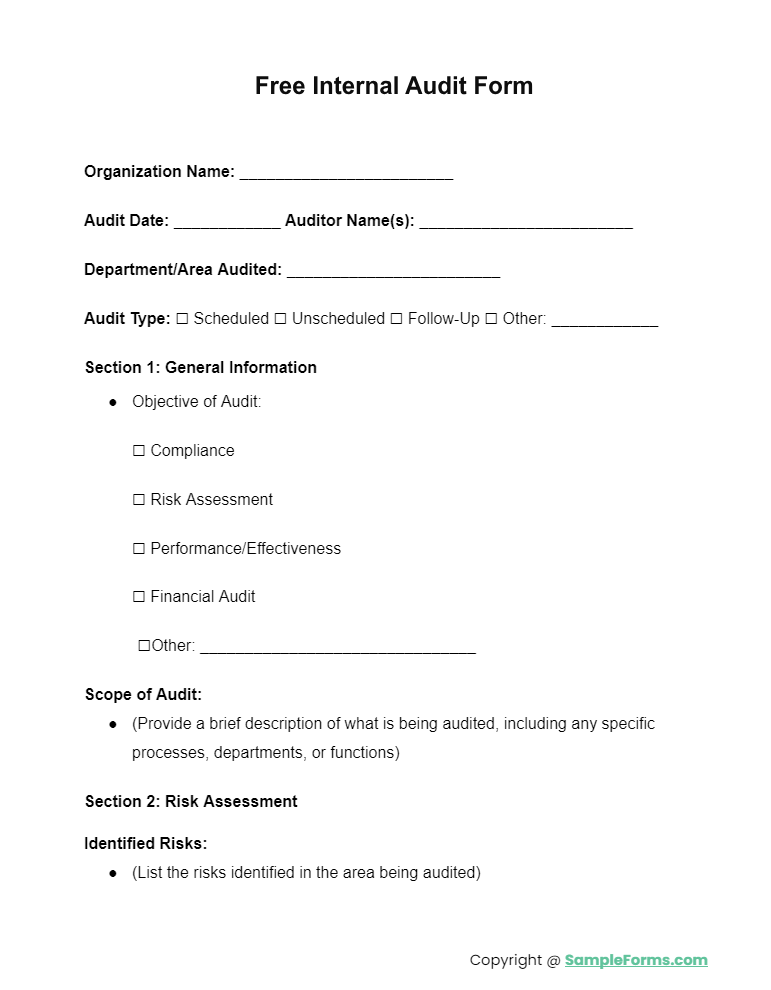

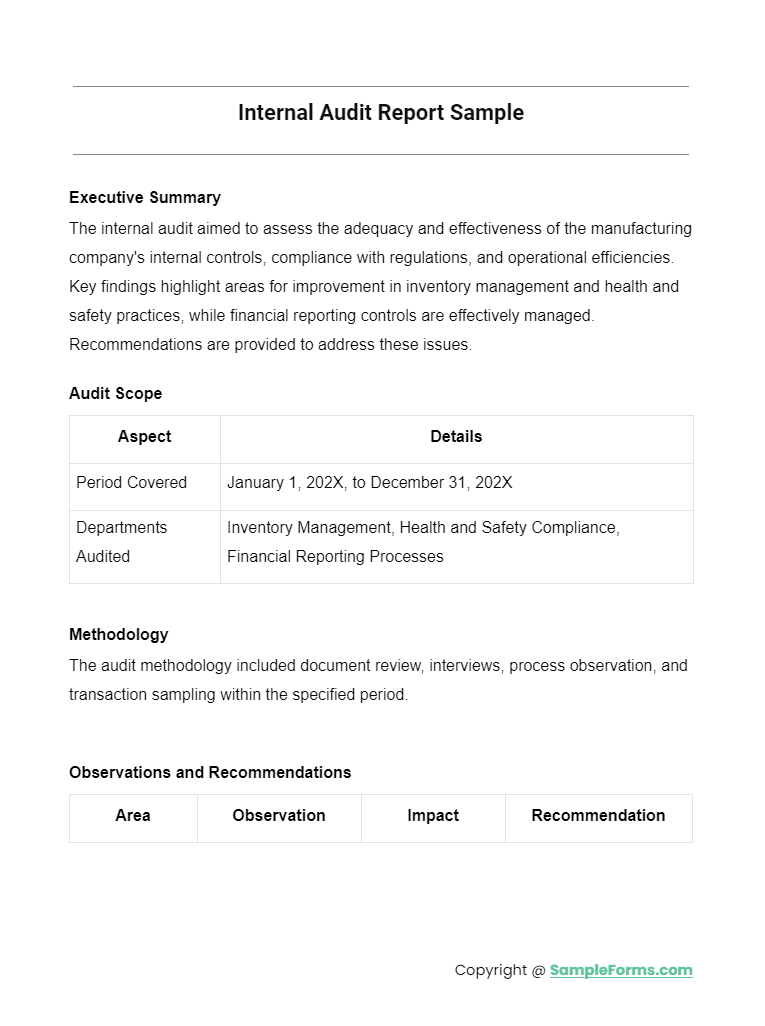

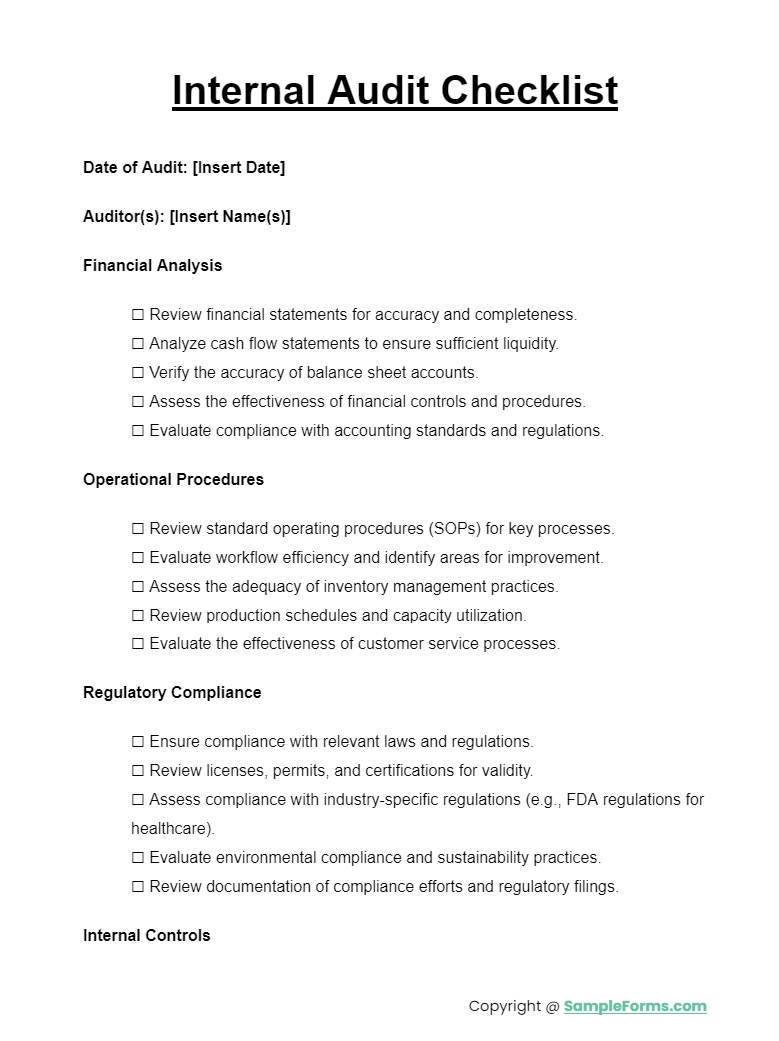

An Internal Audit Form is a structured document used by auditors to systematically review and evaluate an organization’s financial and operational activities. It serves as a critical tool in assessing compliance with laws, regulations, and internal policies. These forms are meticulously designed to capture essential data in a coherent manner, making them fillable and user-friendly. Their purpose extends beyond mere compliance; they are instrumental in identifying inefficiencies and areas for improvement, thereby enhancing the overall effectiveness of the organization’s internal controls and procedures

What is the best Sample Internal Audit Form?

More Internal Audit Forms Samples

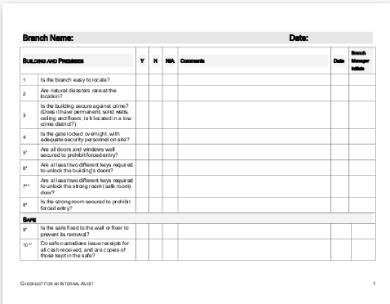

Simple Internal Audit Checklist Form

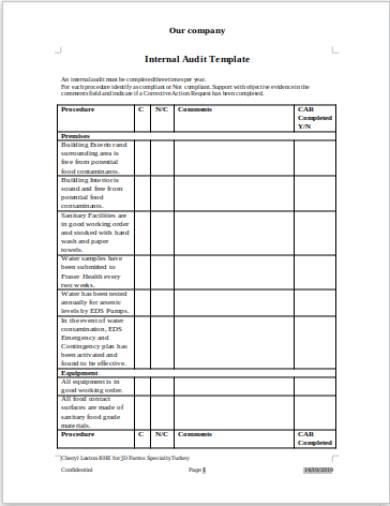

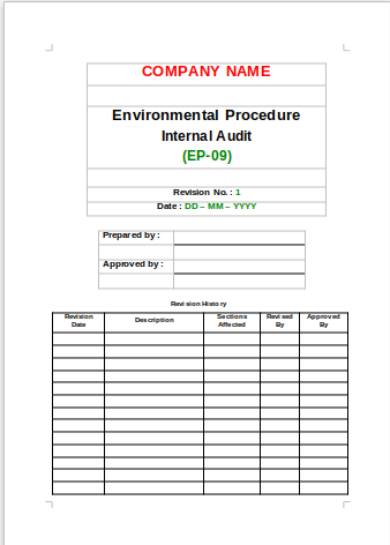

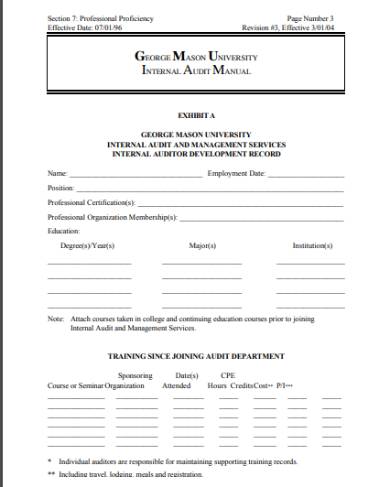

General Internal Audit Template

Internal Audit Template Word

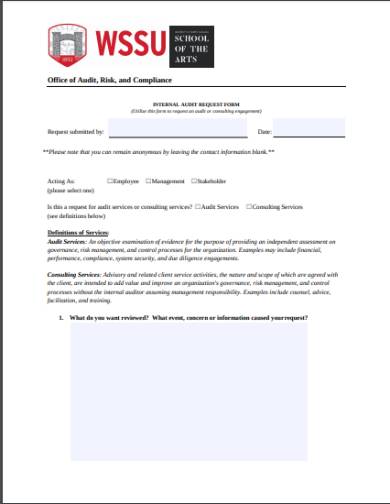

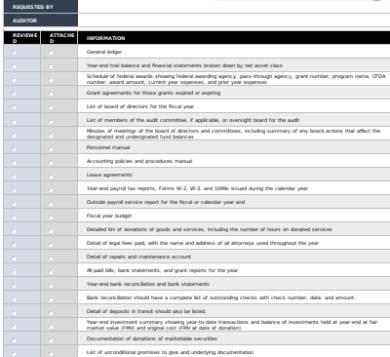

Internal Audit Compliance Request Form

Internal Audit Report Standard Form

Checklist for Internal Audit Form

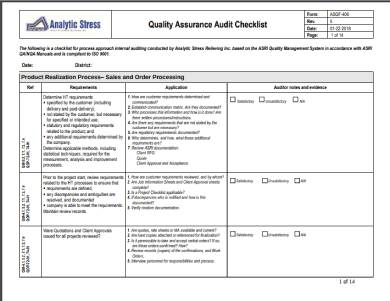

Internal Audit Checklist Sample

Internal Audit Checklist Form Template

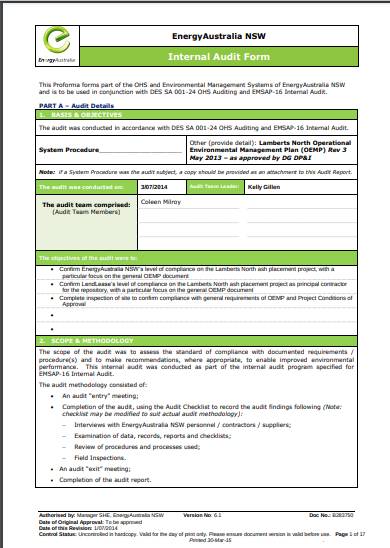

Internal Audit Form Sample

How to Complete an Internal Audit Form

Internal Auditing equates to personal assessment but on a larger scale. Its primary purpose is to improve an organization’s performance by solving problems and preventing them from happening, and, identifying discrepancies in control and processes and act upon them. An Internal Audit Form allows organizations to improve themselves by providing them an insight on how the organization performed during a specified period. Below are the steps on how to complete an Internal Audit Form.

Step 1. Compile all the Data and Information

Compile all the data and information gathered from different departments within the organization. You can find those data and information in various reports, such as a risk assessment review form, production reports, and employee surveys. These data and information details how the organization performed as a whole in a certain period. Having a compiled list enables you to summarize each information into relevant facts and statistics, which in turn allows you to make brief and concise your Internal Audit Report.

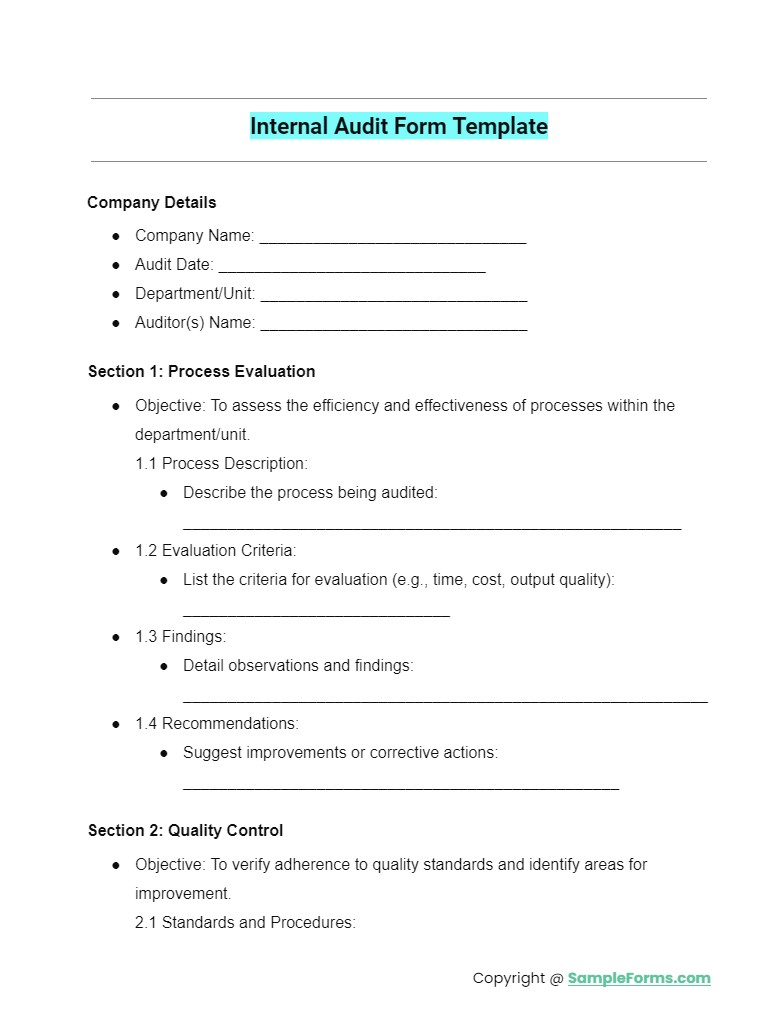

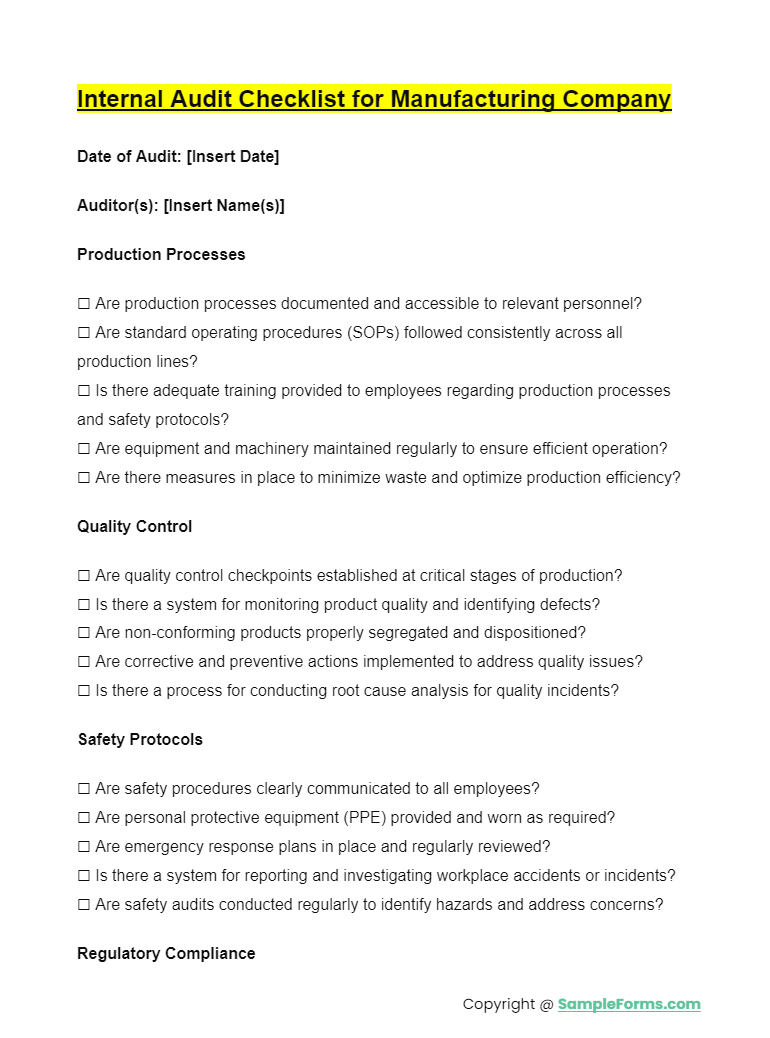

Step 2. Download an Internal Audit Form Template

After compiling all the data and information you’ve gathered from reports from different departments, now it’s time for you to write your Internal Audit Report. To do start, download an Internal Audit Form Template by choosing from the samples provided in this article. Downloading a template enables your organization to follow a standard format in their Internal Audit Reports, plus, it also saves you time as well.

Step 3. Complete the Internal Audit Form Template

Edit the Internal Audit Form Template right after downloading it. Replace the prewritten information in the template with the information prescribed by your organization. Then, write down all the data and information that you’ve compiled. Lastly, write the auditors’ names and have it signed by them as well. Also, remember to use the editing software related to the template’s file format when editing the template.

Step 4. Print or Save the Completed the Internal Audit Form

After completing the Internal Audit Form, you can opt to store it on your computer or print it using your office printer. Storing a soft copy of the Internal Audit Form in your laptop enables you to access it quickly anytime, whenever you need it. Likewise, a printed copy of the Internal Audit Form allows you to have something to use when doing an on-site inspection.

Step 5. Submit the Internal Audit Report to the Senior Management

Submit the Internal Audit Report to the Senior Management right after completing and printing the form. An Internal Audit Report allows the Senior Management to have a glimpse of the organization’s performance at the same time, enables them to plan for its further improvement.

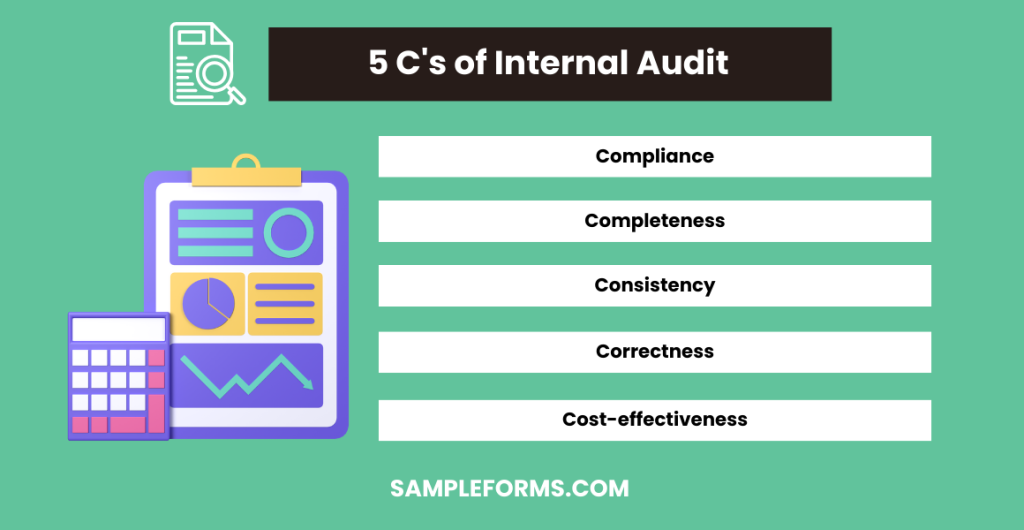

What are the types of Internal Audits?

What Documents are Needed for an Internal Audit?

Who can Conduct the Internal Audit?

Related Posts Here

-

Report Form

-

FREE 49+ Budget Forms in PDF | MS Word | Excel

-

Profile Form

-

Menu Form

-

Event Planner Form

-

FREE 16+ Ticket Order Forms in PDF | MS Word | Excel

-

Employee Dress Code Policy Form

-

Rental History Form

-

Advertising Contract Form

-

Service Agreement Form

-

Income Statement Form

-

Accident Statement Form

-

Performance Review Form

-

Event Contract Form

-

Contest Registration Form