An Audit Report Form is a vital tool used by auditors to record findings and conclusions from an audit process. This comprehensive guide provides detailed examples and explanations on how to effectively fill out and utilize these forms, incorporating key terminology such as Technical Audit Report and Report Form. By using these forms, auditors can ensure a systematic approach to recording audit evidence, evaluating internal controls, and compliance with regulations, making them indispensable in the auditing profession. Whether for financial, operational, or compliance audits, this guide helps auditors maintain accuracy and integrity in their reporting.

Download Audit Report Form Bundle

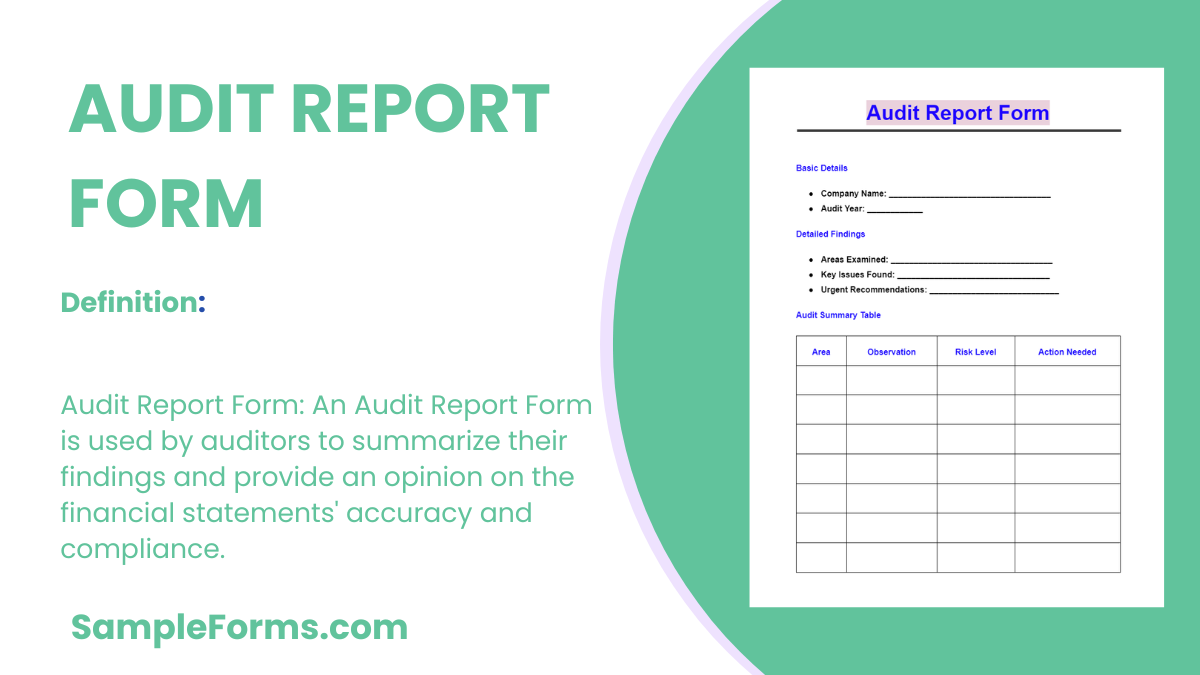

What is Audit Report Form?

An Audit Report Form is a structured document used by auditors to summarize the results of their examination of an organization’s financial records, compliance, and operational processes. It provides a clear, concise, and formal means of communicating the outcome of an audit, highlighting any discrepancies, issues, and recommendations for improvements. This form is essential for management to understand the areas needing attention and for taking corrective actions to enhance the efficiency and security of processes.

Audit Report Format

Organization Information

- Organization Name:

- Fiscal Year:

- Audit Period:

Audit Scope

- Areas Reviewed:

- Methodology:

Findings

- Compliance Issues:

- Financial Discrepancies:

- Recommendations:

Audit Conclusion

- Summary of Audit:

- Actions Required:

- Auditor’s Assurance:

Auditor Information

- Auditor Name:

- Signature:

- Date:

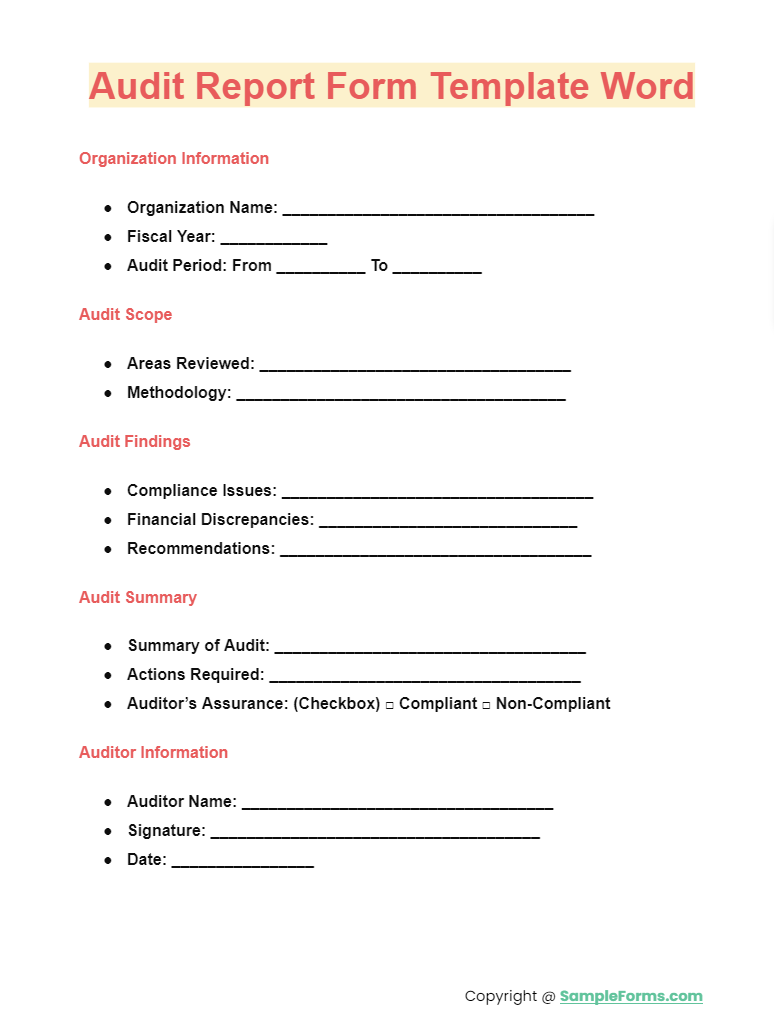

Audit Report Form Template Word

Utilize our Audit Report Form Template in Word to streamline your audit processes. This template integrates the Internal Audit Form structure, ensuring all necessary internal compliance checks are thoroughly documented. You also browse our Service Report Form

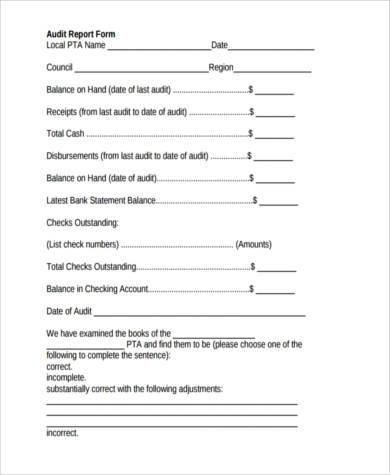

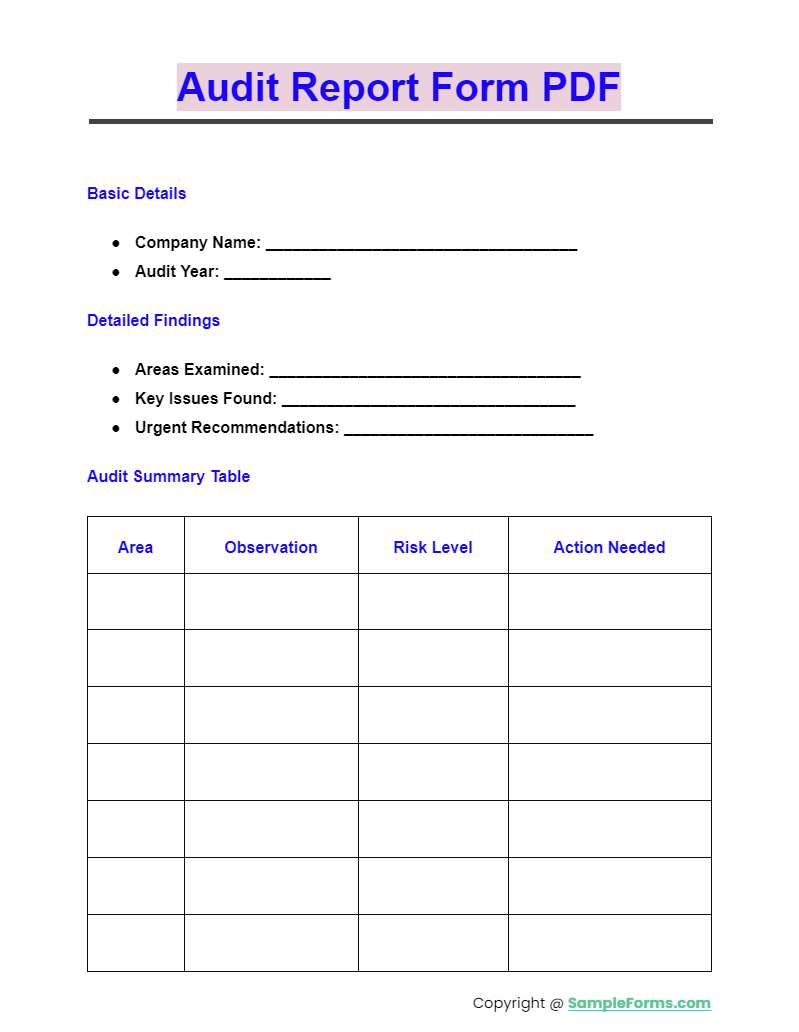

Audit Report Form PDF

Download our comprehensive Audit Report Form PDF for a standardized approach to recording audit findings. This form is designed to complement a Safety Audit Form, ensuring all safety compliance issues are captured and addressed. You also browse our Accident Report Form

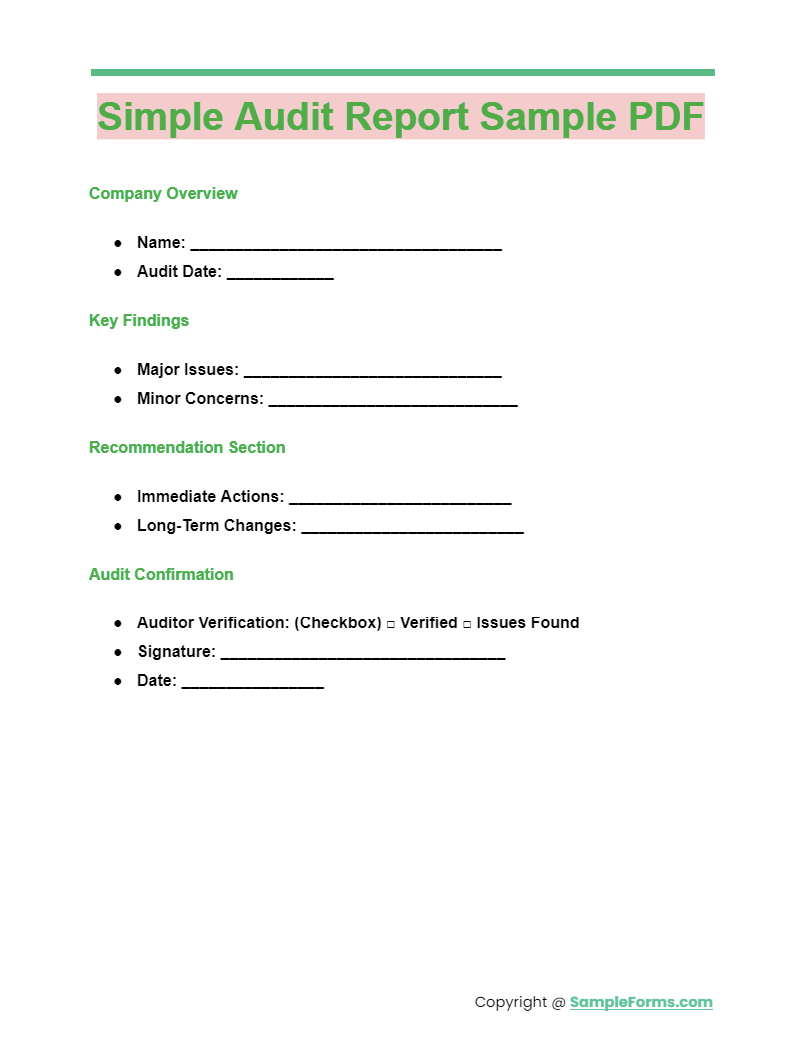

Simple Audit Report Sample PDF

Access a Simple Audit Report Sample PDF to see how effective auditing is conducted with minimal complexity. This sample incorporates elements of the Nursing Audit Form, tailored for healthcare settings to ensure nursing practices meet regulatory standards. You also browse our Activity Report Form

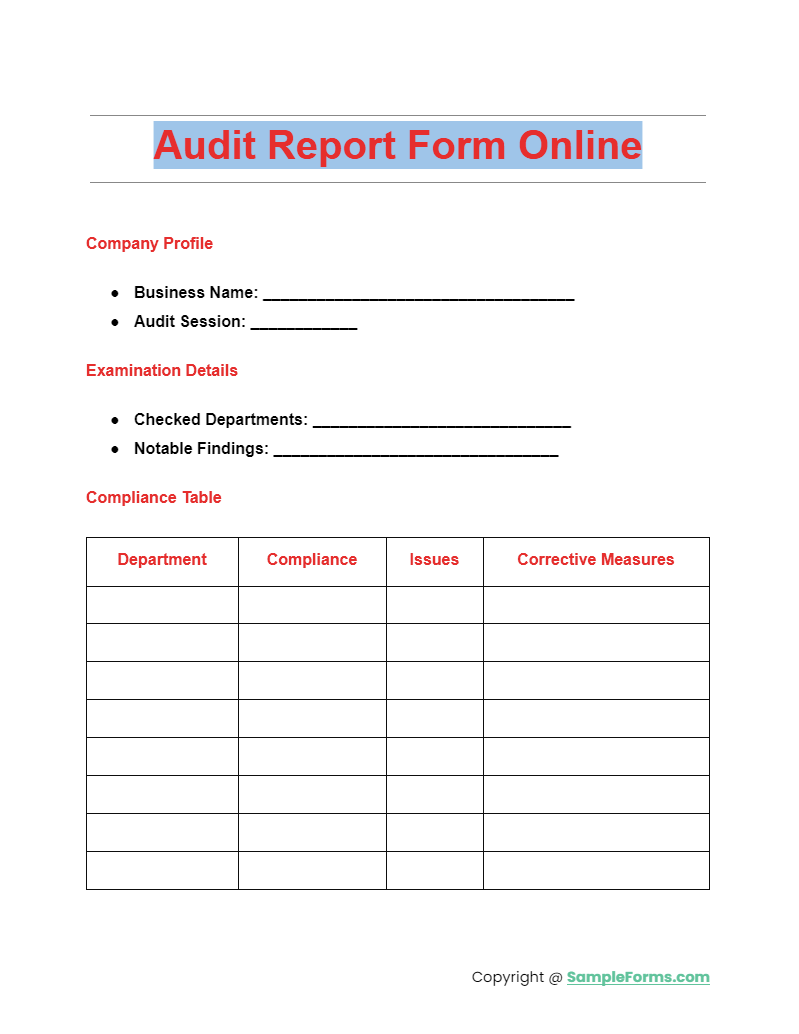

Audit Report Form Online

More Audit Report Form Samples

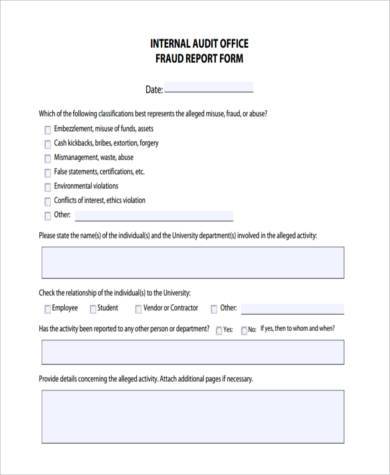

Internal Audit Report Form

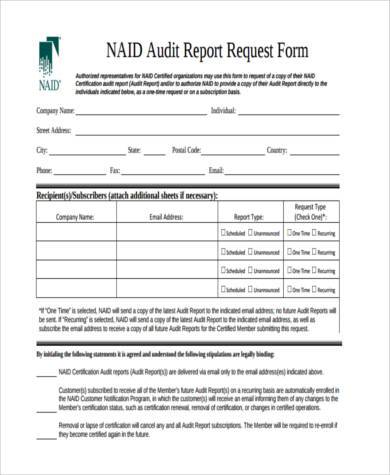

Audit Report Request Form

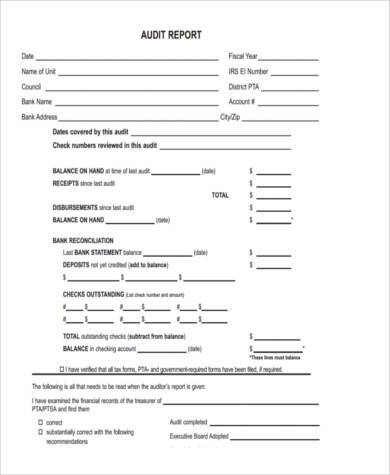

Audit Report Long Form

Security Audit Report Form

Audit Report Form in PDF

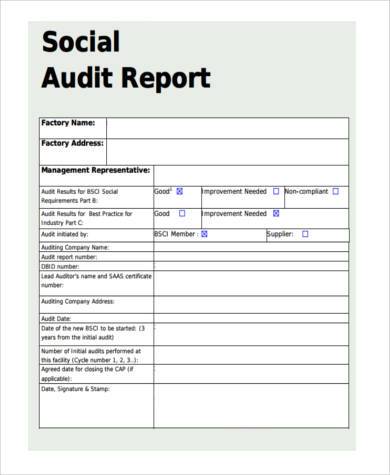

Social Audit Report Form

Audit Report Form Example

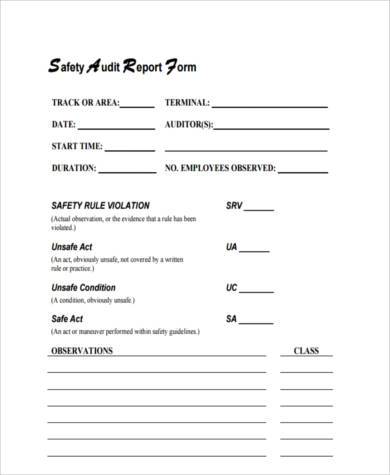

Safety Audit Report Form

Audit Report Form in Word Format

What are the Forms for Audit Report?

Audit reports utilize different forms to document and organize findings based on the audit’s focus and scope:

- The Safety Report Form is used to record safety compliance checks. You also browse our Disability Report Form

- A Behavior Report Form is crucial for assessing ethical conduct and workplace culture.

- In medical audits, the Case Report Form documents individual case details.

- The Breakage Report Form captures information on damages during audits.

- For regular checks, the Inspection Report Form ensures thorough documentation. You also browse our Management Report Form

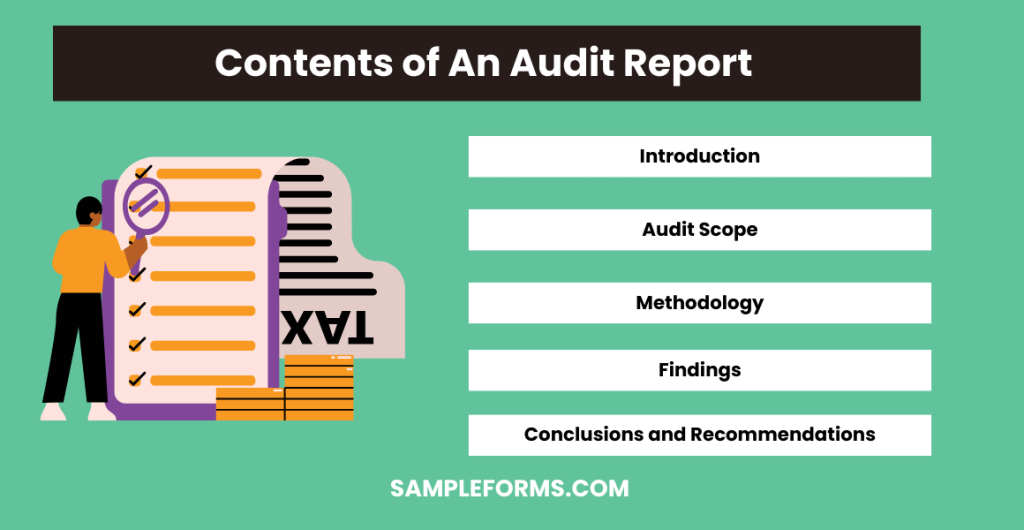

What are the 5 Contents of an Audit Report?

An effective audit report comprises five key components to provide a complete overview of the audit’s results:

- Introduction: Establishes the audit’s scope and objectives, providing context for the report.

- Audit Scope: Outlines the boundaries and areas covered during the audit. You also browse our Sponsorship Report Form

- Methodology: Describes the processes and techniques used in the audit.

- Findings: Summarizes the significant outcomes and issues identified.

- Conclusions and Recommendations: Offers solutions and recommendations based on the findings. You also browse our Daily Cash Report

What are the 5 Types of Audit Reports?

Audit reports can fall into five distinct categories, each indicating a different outcome:

- An Unqualified (Clean) Report confirms the financial statements are accurate without any reservations.

- A Qualified Report indicates minor discrepancies that do not significantly impact the financial statements.

- An Adverse Report suggests major issues that affect the integrity of the financial data. You also browse our Referee Report Form

- A Disclaimer of Opinion occurs when auditors cannot form an opinion due to insufficient information.

- The Combined Report features elements of more than one type of audit report, addressing multiple focus areas. You also browse our Marketing Report Form

What are the 4 C’s of Audit Report Writing?

The 4 C’s define effective audit report writing, ensuring clarity and usefulness:

- Clarity: Ensures the report is easily understandable and free of ambiguity. You also browse our Construction Report Form

- Conciseness: Keeps the report direct and to the point, avoiding excessive detail.

- Completeness: Includes all necessary information for a thorough analysis.

- Credibility: The report is based on accurate and reliable data, reinforcing its validity. You also browse our Evaluation Report Form

What are the Main Items on Which the Auditors Report?

Auditors typically report on several key aspects of an organisation’s operations and finances:

- Financial Statements Accuracy: Ensures that all financial statements fairly reflect the company’s financial position. You also browse our Patient Report Form

- Compliance with Laws and Regulations: Verifies that the organisation adheres to all applicable legal and regulatory requirements.

- Internal Control Effectiveness: Assesses the effectiveness of the organisation’s internal controls over financial reporting.

- Risk Management: Evaluates the effectiveness of the organisations risk management procedures.

- Operational Efficiency: Reviews the efficiency and effectiveness of the organisations operations, identifying areas for improvement. You also browse our Car Accident Report Form

This comprehensive evaluation helps stakeholders understand the health and sustainability of the organisation. You also browse our Missing Report Form

What Documents Do Auditors Usually Look At?

During an audit, several key documents are scrutinized to ensure accuracy and compliance:

- Financial Statements: Comprehensive review of balance sheets, income statements, and cash flow statements.

- Bank Reconciliation Statements: Helps verify the accuracy of the accounting records relating to bank transactions. You also browse our Confidential Report Form

- Contracts and Legal Agreements: Assessed to ensure that all terms are being followed and liabilities are accounted for.

- Previous Audit Reports: Provides a baseline for current findings and showcases areas of improvement or ongoing issues.

- Transaction Documentation: Invoices, purchase orders, and receipts are examined to verify the transactions recorded in the financial statements. You also browse our School Report Form

Each document plays a crucial role in painting an accurate picture of the organisation’s financial and operational status, providing the audit team with the necessary tools to deliver a reliable report. You also browse our Financial Report Form

Uses of Audit Reports

- Appraisal

Covering a business’s assets and liabilities, an audit report is an educated assessment which presents the company’s future as it determines its financial position and value in the market. You also browse our Visit Report Form

- Adherence

An audit report is usually mandated by governments and companies that trade publicly, or industries that are regulated by particular bodies are required to adhere to these standards. You also browse our Internship Report Form

- Funding

Investors would want to spend their money on financially stable businesses, so reports like Book Report Forms are necessary. This will also let them feel secure and confident, especially when they see that large profits are gained. You also browse our Student Progress Report Form

- Improvement

Companies usually have a number of stockholders, and a good financial record enables operators to gain more internal control of company operations. It ensures more success since decisions are made within the workforce. You also browse our Medical Report Form

To validate the reliability of the financial statements of any organization, an audit report should be completed by an external accountant or auditor. Its ultimate reason is to provide an assurance that material errors are not present in the company’s financial documents, and adherence to rules is in order. You also browse our Joining Report Form

What is the Most Common Audit Report?

The most common audit report is the unqualified Audit Report, indicating that financial statements are fairly and appropriately presented without any identified exceptions. You also browse our Quality Audit Report Form

What Proof Do You Need for IRS Audit?

For an IRS audit, you need:

- Receipts and invoices.

- Bank statements.

- Legal papers (e.g., divorce agreements, inheritances).

- Employment documents if applicable, aligning with a Daily Report Form for consistency in reporting daily activities or transactions.

What is a Good Internal Audit Report?

A good internal audit report provides:

- Clear findings and evidence.

- Recommendations for improvements.

- An executive summary.

- Sections for response and action plans, utilizing an Expense Report Form format for financial accuracy.

Who Prepares an Audit Report?

An audit report is typically prepared by the external or internal auditors of the organization. The content is often finalized after collaboration with the audit committee. You also browse our Desk Audit Form

What is an Unqualified Audit Report?

An unqualified audit report, also known as a clean report, states that financial statements give a true and fair view without any misrepresentations, essentially mirroring the clarity expected in a Book Report Form.

How Do You Read an Audit Report?

To read an audit report effectively:

- Start with the auditor’s opinion. You also browse our Financial Audit Form

- Review the financial statements included.

- Pay attention to any notes or qualifications.

- Consider management’s response to the audit findings, similar to reviewing a Project Report Form for project-specific insights.

What Should Auditors Report to?

Auditors should report their findings to:

- The board of directors or audit committee. You also browse our Chart Audit Form

- Senior management.

- Regulatory bodies if required by law, ensuring compliance as you would update a Hazard Report Form in safety audits.

Related Posts

-

Report Form

-

FREE 15+ Case Report Forms in PDF | MS Word

-

Referee Report Form

-

FREE 4+ Campaign Finance Forms in PDF

-

Joining Report Form

-

Laboratory Report Form

-

FREE 5+ Sponsorship Report Forms in PDF | MS Word

-

FREE 9+ Final Report Forms in PDF | MS Word | Excel

-

11+ Confidential Report Form

-

FREE 6+ Rent Report Forms in PDF

-

FREE 5+ Mileage Report Forms in MS Word | PDF | Excel

-

FREE 4+ Management Report Forms in PDF | MS Word

-

FREE 17 + Disciplinary Report Forms in MS Word | PDF | Google Docs | Apple Pages

-

Damage Report Form

-

FREE 14+ Disability Report Forms in PDF