Real Estate Forms are also known as a Contract for Deed, or as a Rent-to-Own Agreement. This is a type of proprietor-financed lodging contract. This is not at all like general leases for investment property; the occupant’s lease is connected toward a home deal.

Real Estate Tax Forms or Property Tax Forms, meanwhile, are forms charged on undaunted property like a house, building, or land. In the event that you claim a home, you pay property tax directly to your local tax assessor or by implication with your month-to-month contract installment. You can download our provided Real Estate Tax forms below.

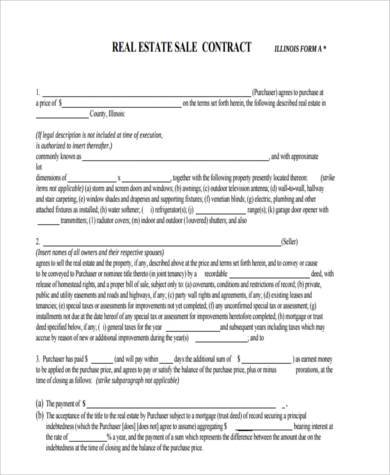

Real Estate Sale Tax Form

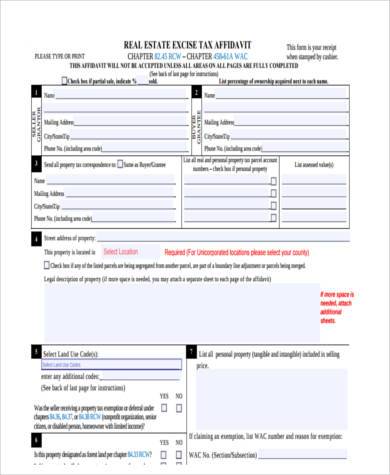

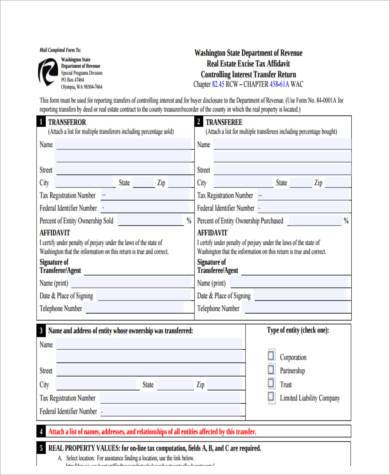

Real Estate Excise Tax Form

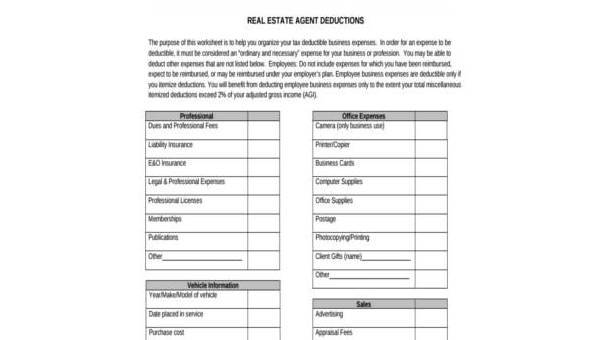

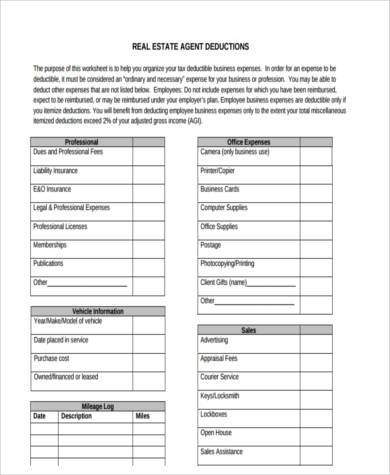

Real Estate Agent Tax Form

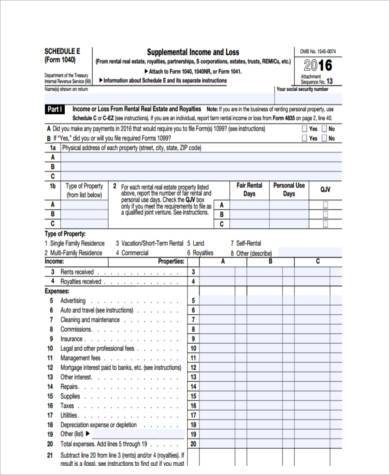

Real Estate Rental Tax Form

Real Estate Interest Tax Form

Real Estate Agreement Forms are the documents used in a Consent or Agreement to offer property at a future date under specific terms and conditions. You can utilize this Agreement to decide the commitments of both sides for the deal to happen on the end date.

Property Tax or Real Estate Tax Rates Vary

Various factors determine property tax rates; for instance, the measure of property expense due on comparable properties will differ all an area. The three principle figures that decide the tax rate include:

- Various combinations of taxing districts in various zones of the county

- Budget amounts for each taxing district

- Voter-approved special levies and bonds

Advantages of Property Tax

Listed below are a few advantages of Property or Real Estate Tax. These include:

- It is technically and administratively possible to introduce and / or maintain in almost any circumstances.

- It is cheap to administer, and it is possible to aim for a cost-yield ratio of 2 percent or less.

- It is very difficult to avoid or evade, and collection success rates of 95 percent are readily achievable.

- It is transparent.

- In general, there is a good correlation between assessed value and the ability to pay.

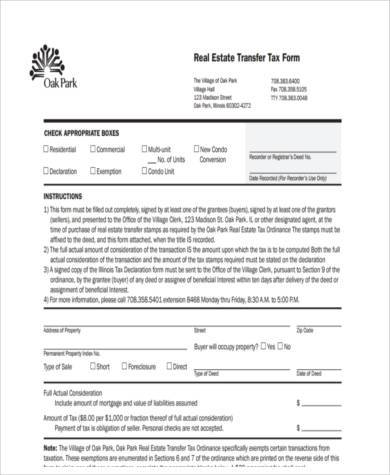

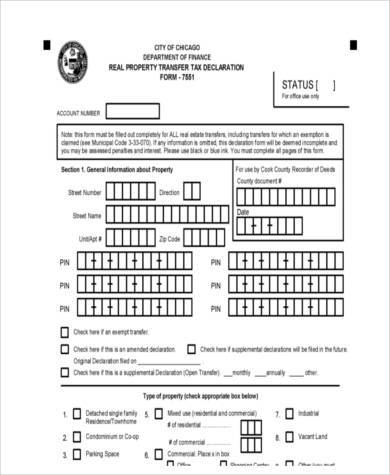

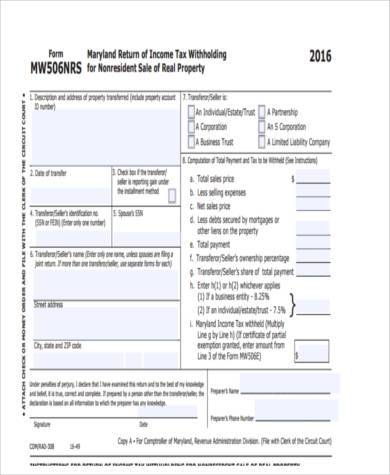

Real Estate Transfer Tax Form

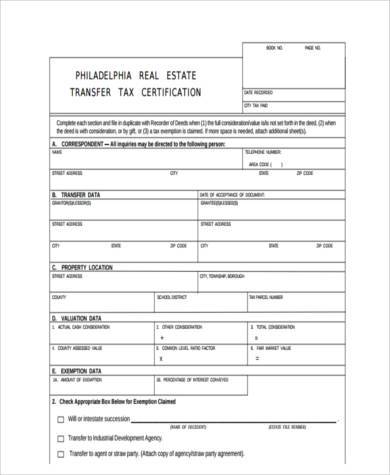

Real Estate Tax Certification Form

Real Estate Tax Declaration Form

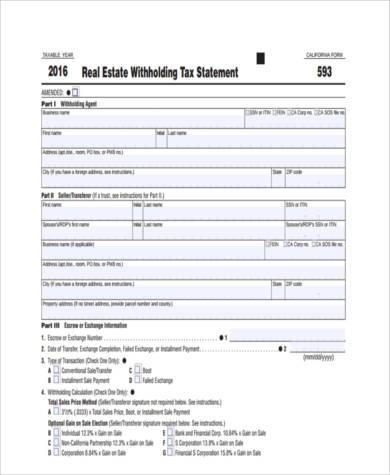

Real Estate Tax Form in PDF

Real Estate Tax Form Example

With the use of Real Estate Disclosure Forms, you have a commitment to disclose potential issues to a forthcoming purchaser that could influence the esteem of the property you’re trying to sell. In addition, it is viewed as illicit in many states to purposely disguise major defects on your property.

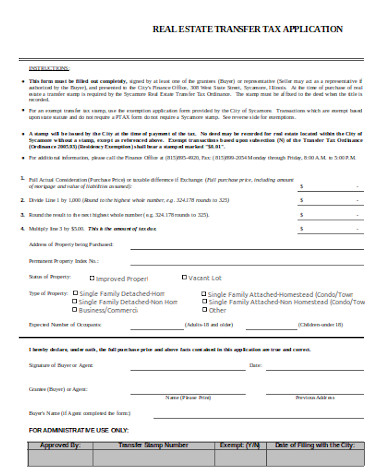

Real Estate Tax Transfer Application

Use of Property Taxes

Listed below are some of the uses of property taxes:

- A source of local revenues – As an essential source of income, property tax assumes an essential part in decentralization and the self-sufficiency of local government. Full decentralization of government joins the ability to raise income autonomously in addition to powers allowing local governments to utilize the assets as they see fit as per the cutoff points of their legal powers. In practice, local government independence is constantly constrained. Expanding independent powers of raising incomes through property charges through property taxes ends up plainly essential.

- Support for other functions – Valuation records might be utilized as a part of transitional economies for different purposes such as to build up rent rates on lands owned by the government. Where land markets are not yet created and developed, mass valuation results can likewise be utilized as a reason for building up market values for properties. Contingent upon the assessment rates and cost of accumulation, valuation lists may give a reasonable and financially effective reason for doing such.