Budgeting is a smart and useful tool to help you control the amount of money that you spend. Proper budgeting actually helps people plan for their future, pay off debts, and allows one to have savings. However, budgeting is not as easy as it seems. Controlling yourself not to spend money impulsively on things you do not necessarily need can actually be a difficult feat.

Our Budget Forms can help tackle the challenges of budget planning a tad easier. Our Sample Budget Forms come in a variety of templates to tailor to your needs, such as our Monthly Budget Forms and our Household Monthly Budget Forms.

Personal Monthly Budget Form

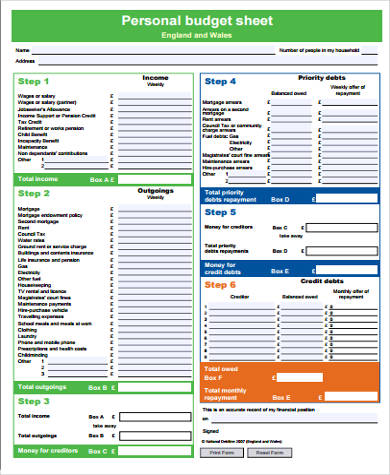

Household Monthly Budget Form

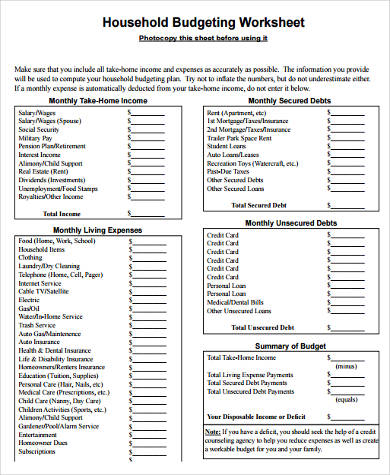

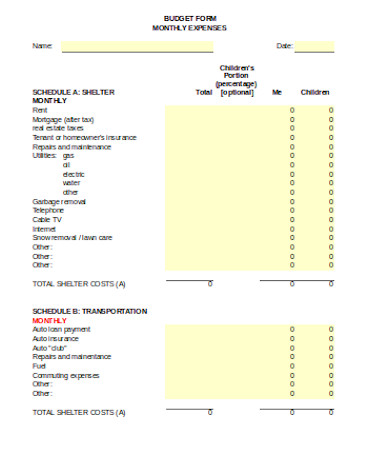

Monthly Budget Components Form

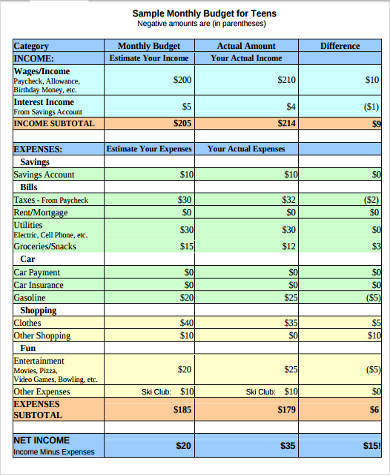

Printable Monthly Budget Form

Blank Monthly Budget Form

Creating a Budget Plan might sound like a simple and insignificant process; however, when done properly, budgeting might just make you the next Bill Gates. Below are tips and tricks on how you can work your way to structuring a Budget Plan.

Keep Track of Your Income; Deduct the Expenses

By using our Sample Budget Forms, keep track of your income and your expenses. Pulling up receipts from previous purchases is a great way to get an average of the cost you spend on every month for particular items such as gas and groceries.

Categorize Your Expenses

After you have determined your expenses, set them apart into 2 different categories. The first category should list down the expenses that you essentially need and have to be paid immediately, such as your mortgage and you utilities. The second category should list down your extra expenses – items that do not necessarily have to be paid or bought, such as Chinese take-outs or that new Givenchy tote.

Basic Monthly Budget Form Example

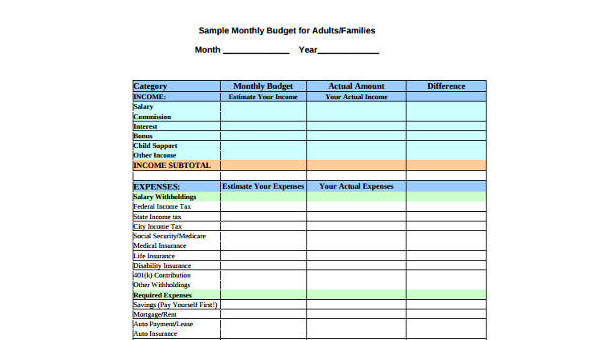

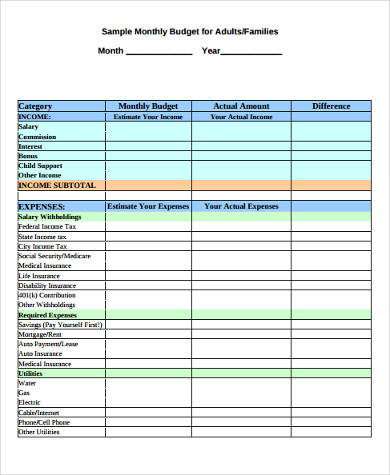

Sample Monthly Budget Form for Families

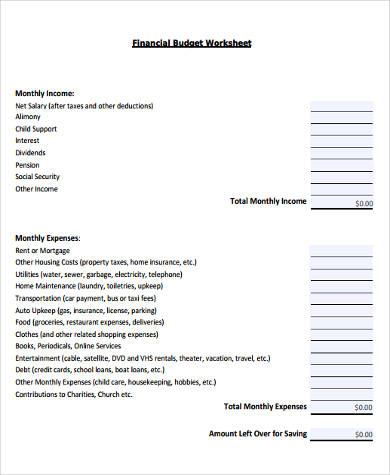

Monthly Financial Budget Form

Monthly Budget Planner Form

General Monthly Budget Form

Be Flexible with Extra Expenses

Look through your list of extra expenses and mark those that you do not immediately need to purchase or pay ASAP.

Add Up Both Categories

Add up both categories of extra and essential expenses. Get the separate total for your extras and a separate total for your essentials.

Deduct the Essentials from Your Income

Deduct the total amount of essential expenses from your total income and if you still have extra, see if it is able to cover for the expenses listed in your extra expenses.

Learn to Cut Back

If you still have extra money left after covering both essential and extra expenses, then good for you! You can use that extra money to add into your savings. However, if covering your essential costs alone already gives you a negative amount, then look into your list again and see where you can cut back.

One important thing to remember when budgeting is to live within your means. Rule of thumb is that your income should be at least twice as much as your total monthly expenses. If your current salary does not give you enough leeway to buy a new car, then don’t. When people live beyond their means, they usually end up in a web of debt.

Related Posts

-

FREE 9+ Project Budget Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Proposal Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Budget Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Wedding Budget Forms in PDF | MS Word

-

FREE 7+ Sample Child Care Budget Forms in PDF | MS Word

-

FREE 8+ Sample College Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Annual Budget Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Marketing Budget Forms in MS Word | PDF

-

FREE 7+ Sample Travel Budget Forms in PDF | MS Word

-

FREE 9+ Sample School Budget Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Personal Budget Forms in MS Word | PDF | MS Excel

-

FREE 6+ Sample Family Budget Forms in MS Word | PDF

-

FREE 8+ Sample Monthly Budgets in PDF | MS Word | MS Excel

-

Restaurant Budget Form

-

Church Budget Form