An Expense Reimbursement Form is crucial for accurately tracking and reimbursing employee expenses. This complete guide provides detailed instructions, templates, and practical examples for creating an effective Expense Form. Learn how to design a Request Reimbursement Form that includes all necessary details, such as expense categories, dates, and receipts. Our guide ensures you streamline the reimbursement process, reducing errors and saving time. With our comprehensive guide, managing expenses becomes straightforward and efficient, improving overall financial management within your organization.

Download Expense Reimbursement Form Bundle

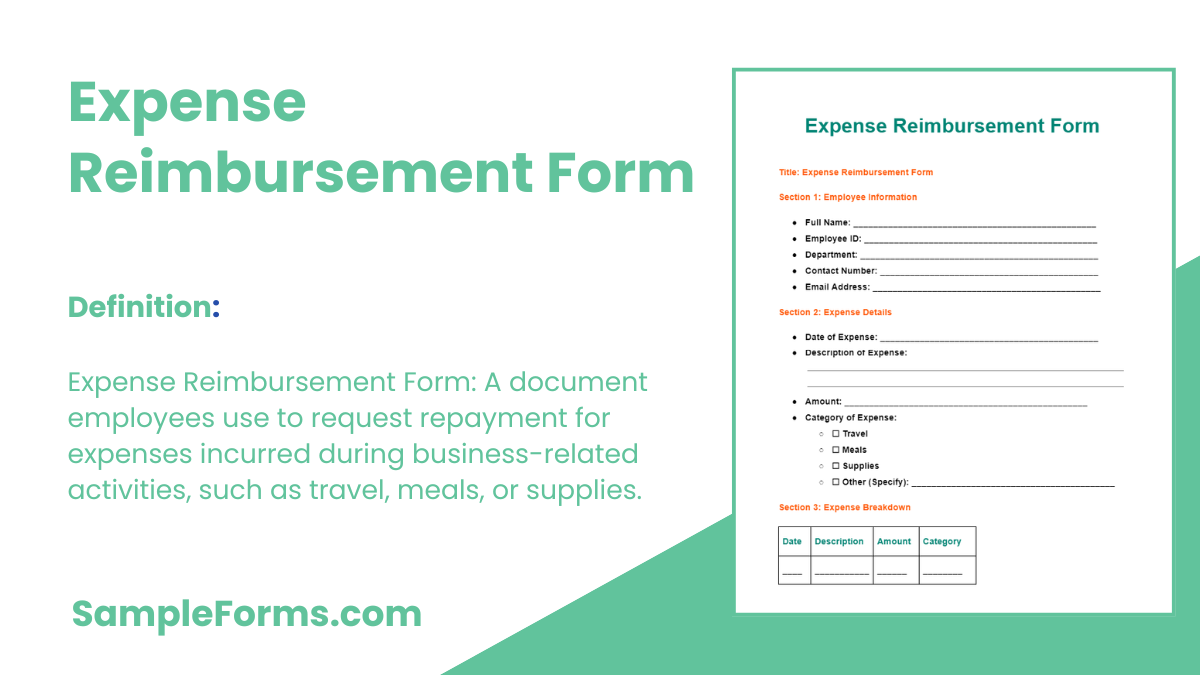

What is Expense Reimbursement Form?

An Expense Reimbursement Form is a document used by employees to request repayment for business-related expenses they have incurred. This Expense Form includes sections for itemizing expenses, attaching receipts, and obtaining necessary approvals. It ensures transparency and accountability in financial transactions, facilitating accurate and timely reimbursements.

Expense Reimbursement Format

Title: Expense Reimbursement Form

Section 1: Employee Information

- Full Name:

- Employee ID:

- Department:

- Contact Number:

Section 2: Expense Details

- Date of Expense:

- Description of Expense:

- Amount:

- Receipts Attached (Yes/No):

Section 3: Authorization

- Supervisor’s Name:

- Supervisor’s Signature:

- Date:

Section 4: Employee Declaration

- I declare that the above expenses were incurred for business purposes.

- Employee’s Signature:

- Date:

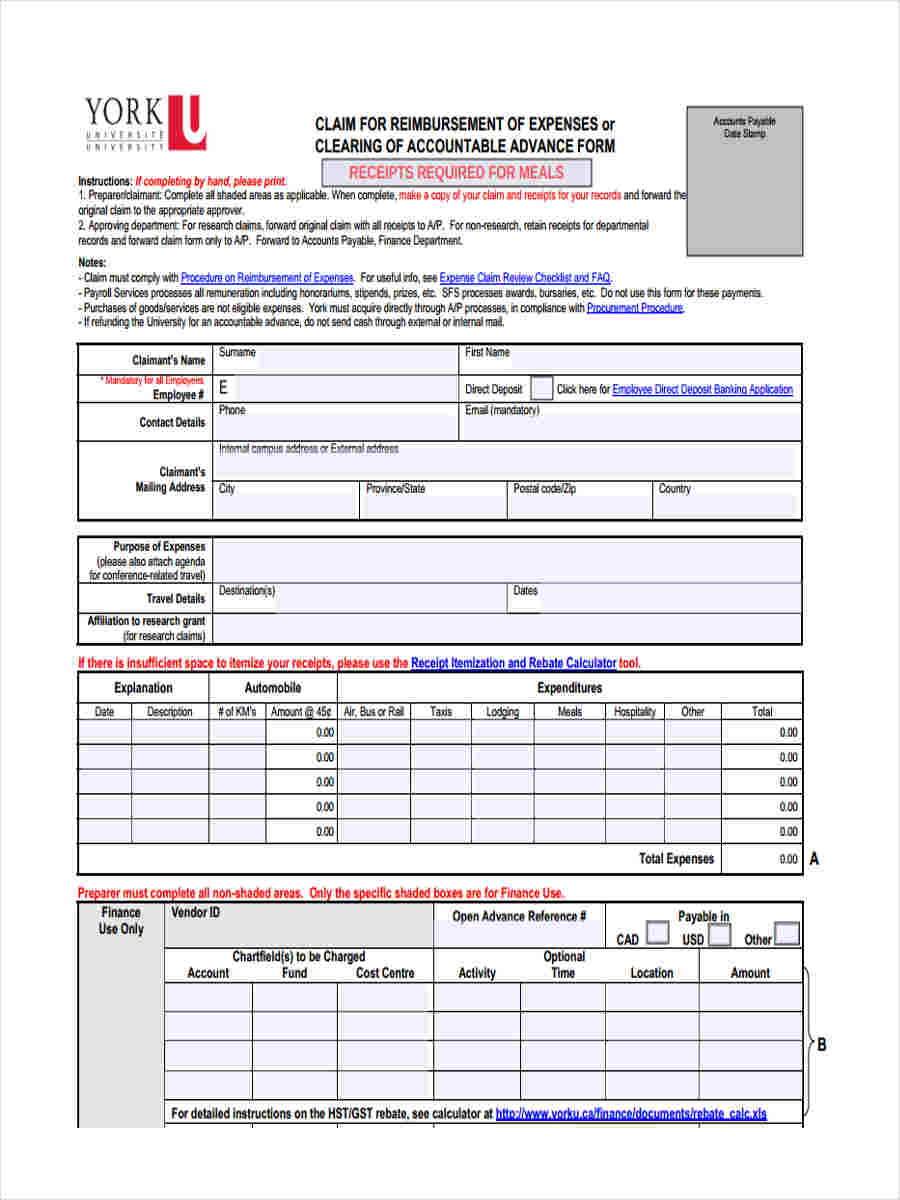

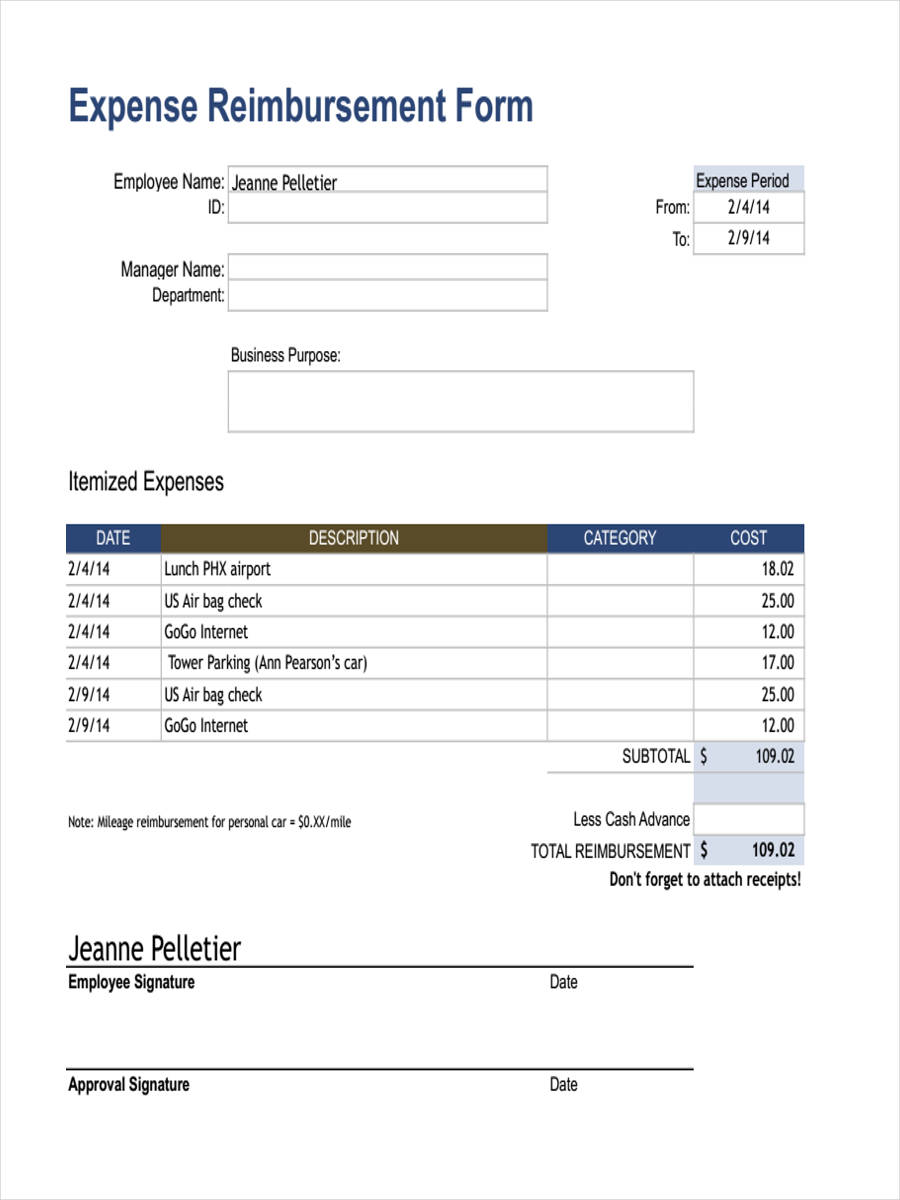

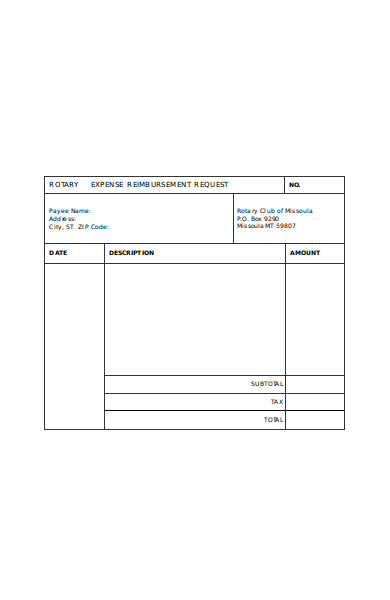

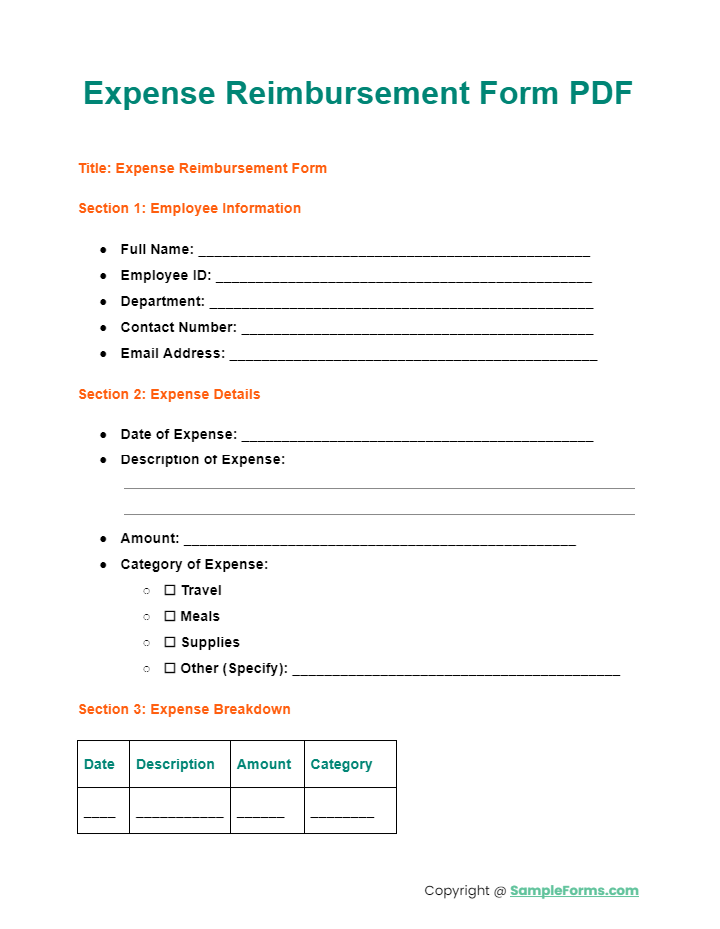

Expense Reimbursement Form PDF

An Expense Reimbursement Form PDF offers a standardized, fillable format for employees to request expense repayments. This digital form ensures consistency and ease of use, similar to a Petty Cash Reimbursement Form, simplifying the reimbursement process for both employees and employers.

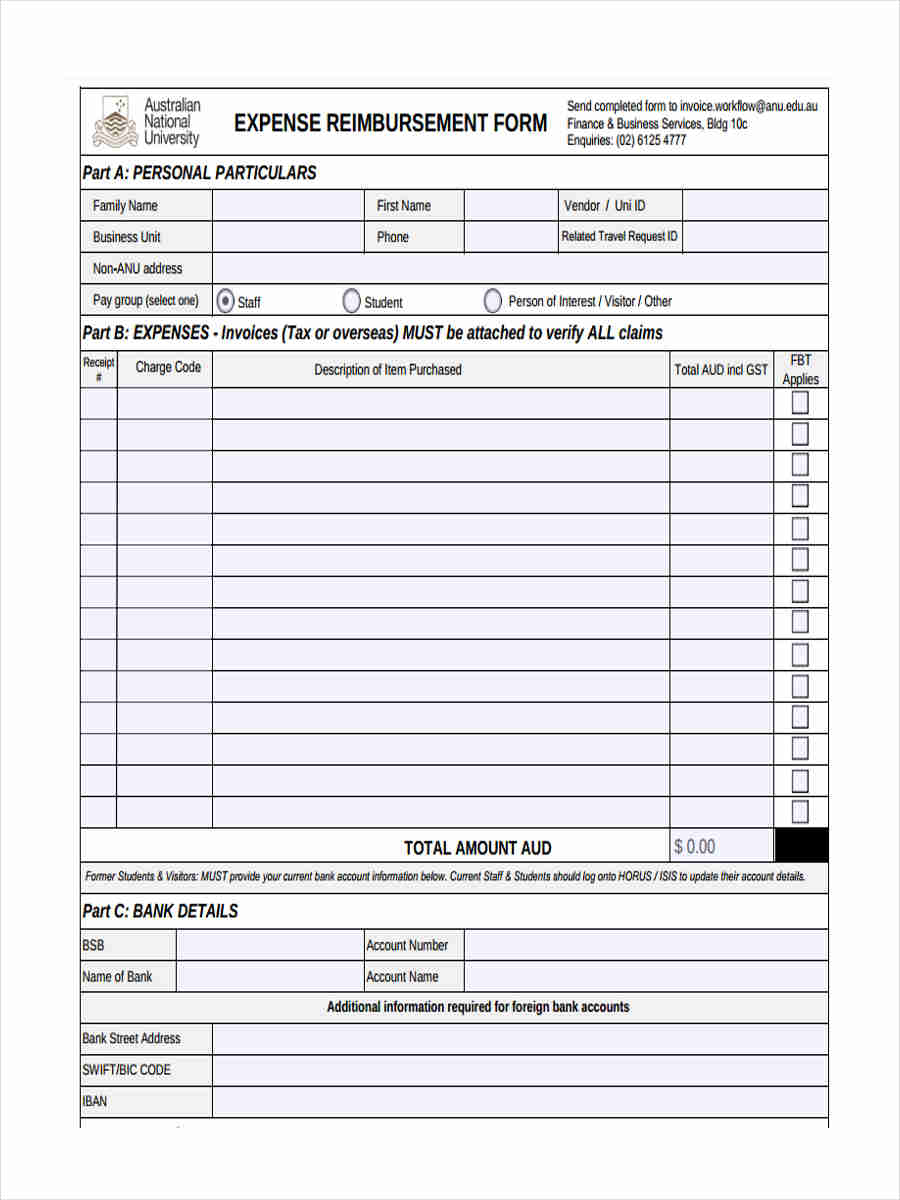

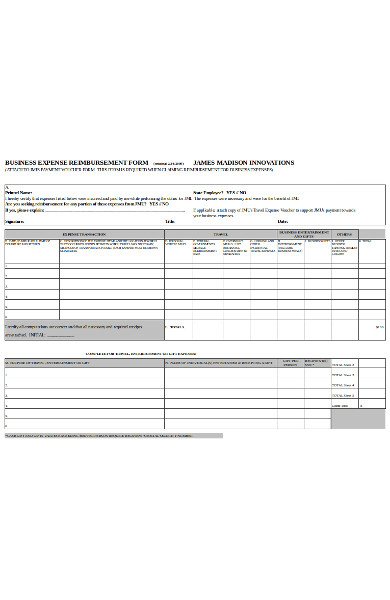

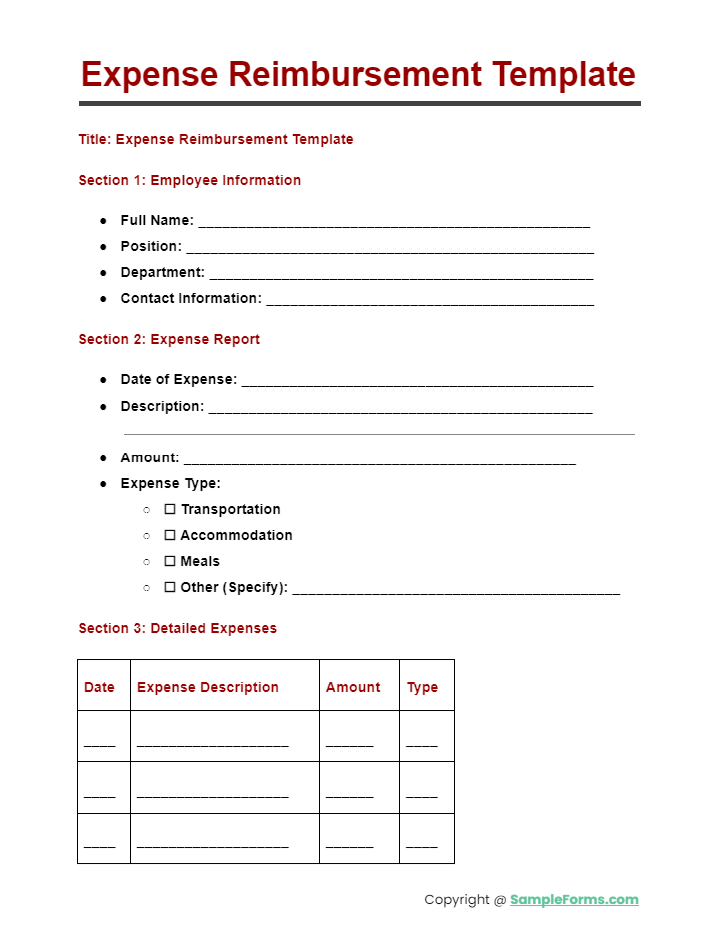

Expense Reimbursement Template

An Expense Reimbursement Template provides a pre-designed layout for documenting expenses, making it easy to track and manage business-related costs. This template is akin to a Medical Reimbursement Form, ensuring all necessary details are captured for accurate reimbursement.

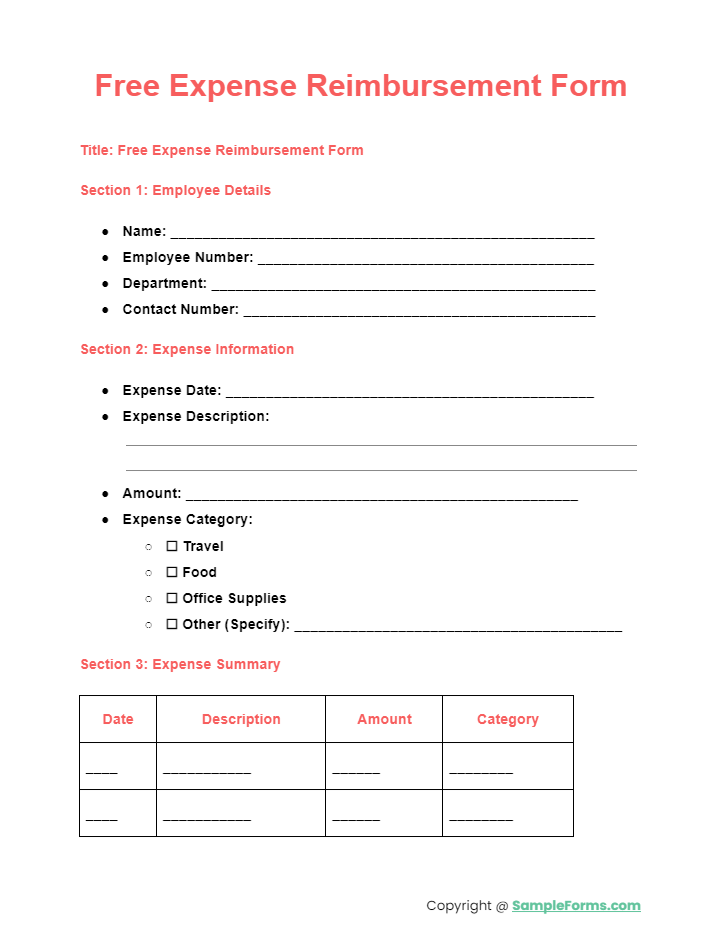

Free Expense Reimbursement Form

A Free Expense Reimbursement Form is a cost-effective tool for employees to itemize and submit their expenses. Available at no cost, this form is as accessible as a Tuition Reimbursement Form, helping organizations streamline their reimbursement process without additional expenses.

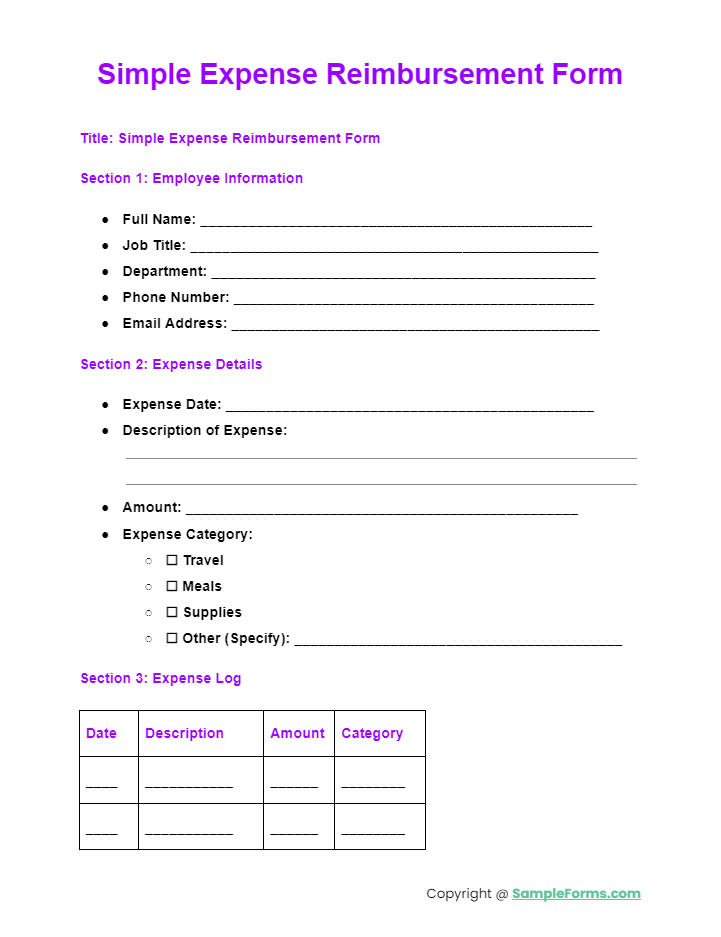

Simple Expense Reimbursement Form

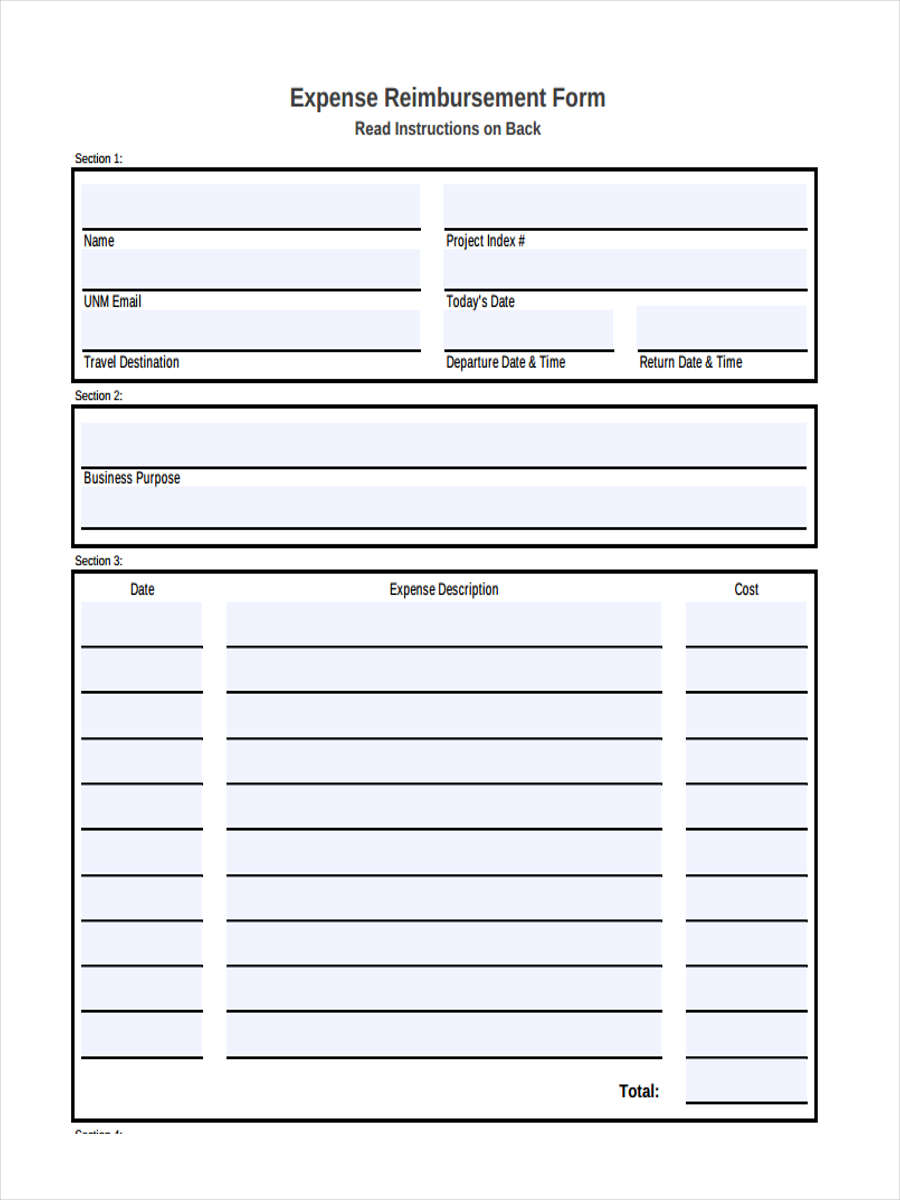

A Simple Expense Reimbursement Form focuses on ease of use and efficiency, allowing employees to quickly document their expenses. This straightforward form is as user-friendly as a Travel Reimbursement Form, ensuring a hassle-free experience for both employees and approvers.

More Expense Reimbursement Form Samples

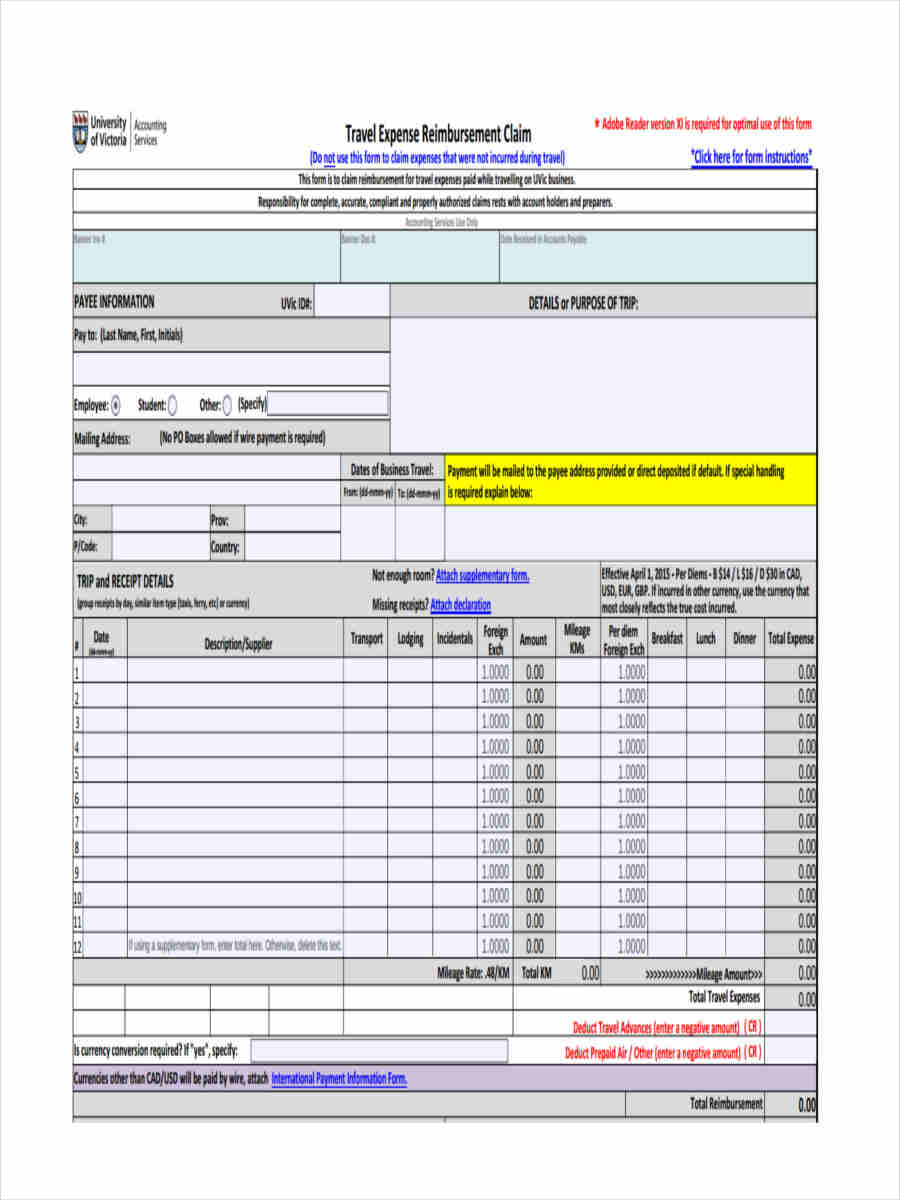

Travel Expense Reimbursement

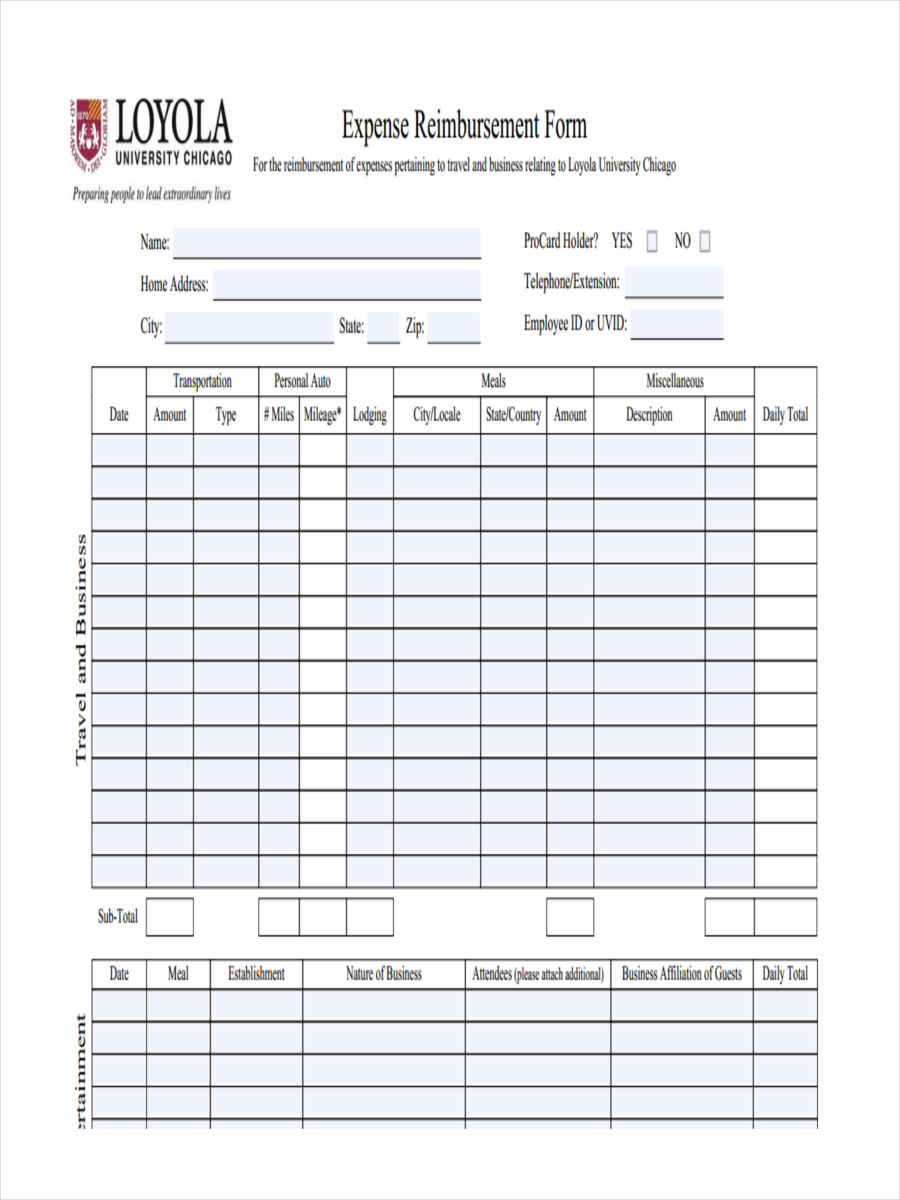

Sample Expense Reimbursement

Simple Expense Reimbursement

Expense Claim Reimbursement in PDF

Expense Reimbursement for Business

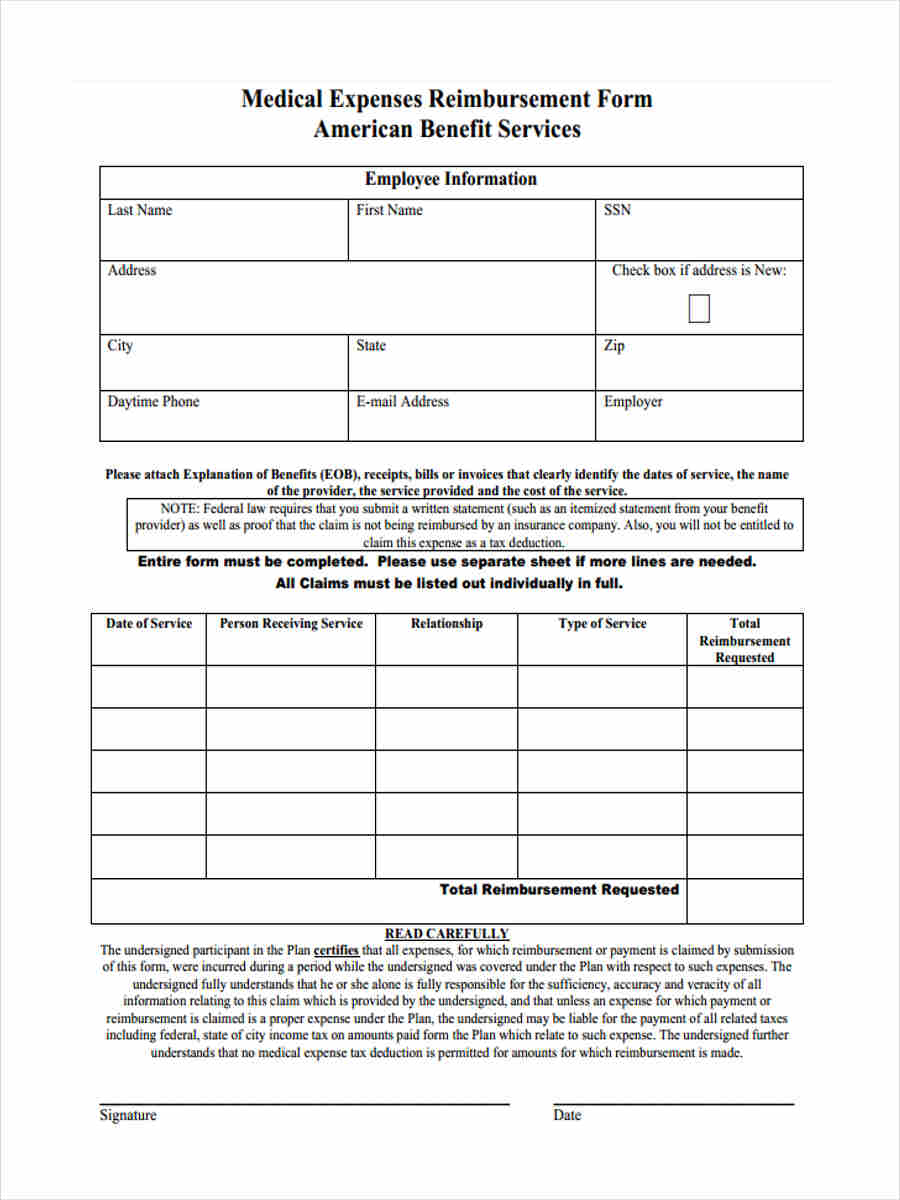

Medical Expense Reimbursement in PDF

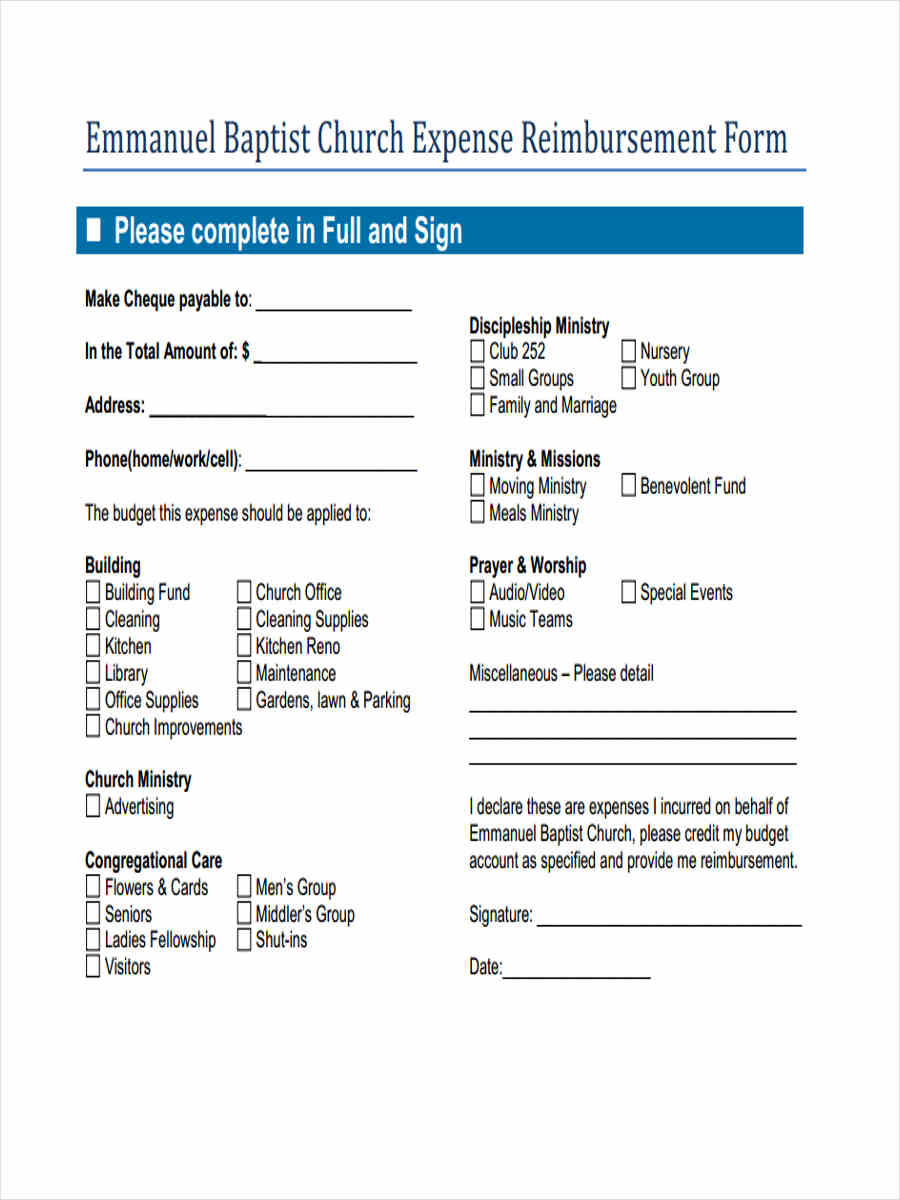

Church Expense Reimbursement

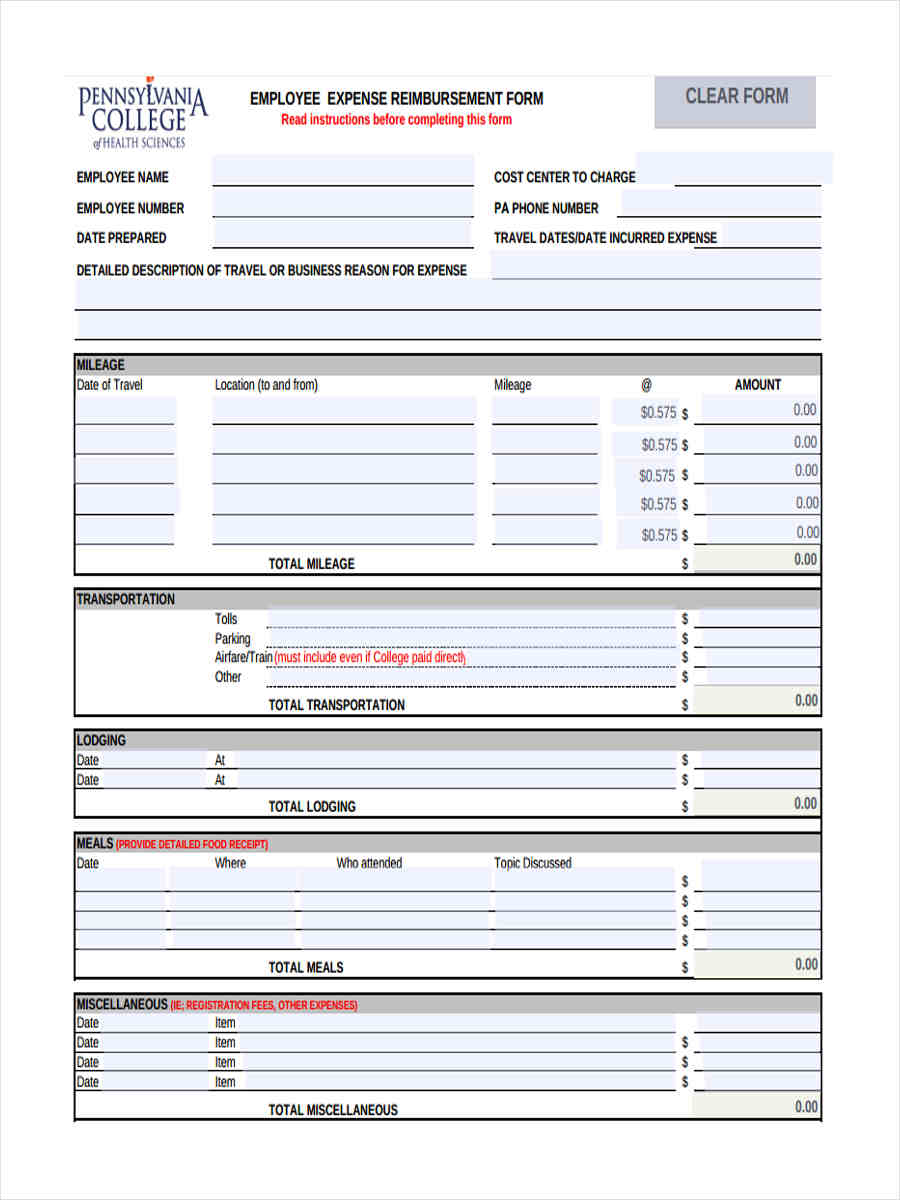

Employee Expense Reimbursement

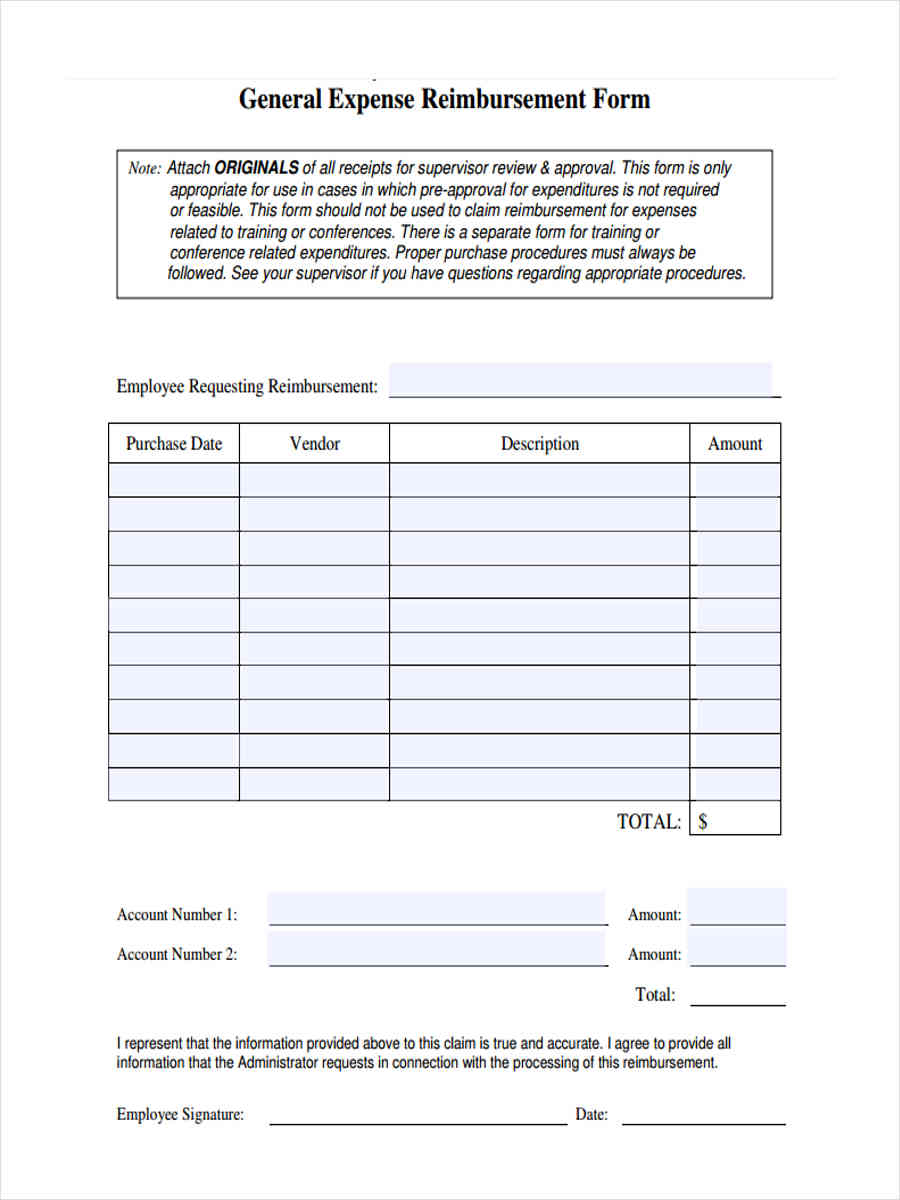

General Expense Reimbursement

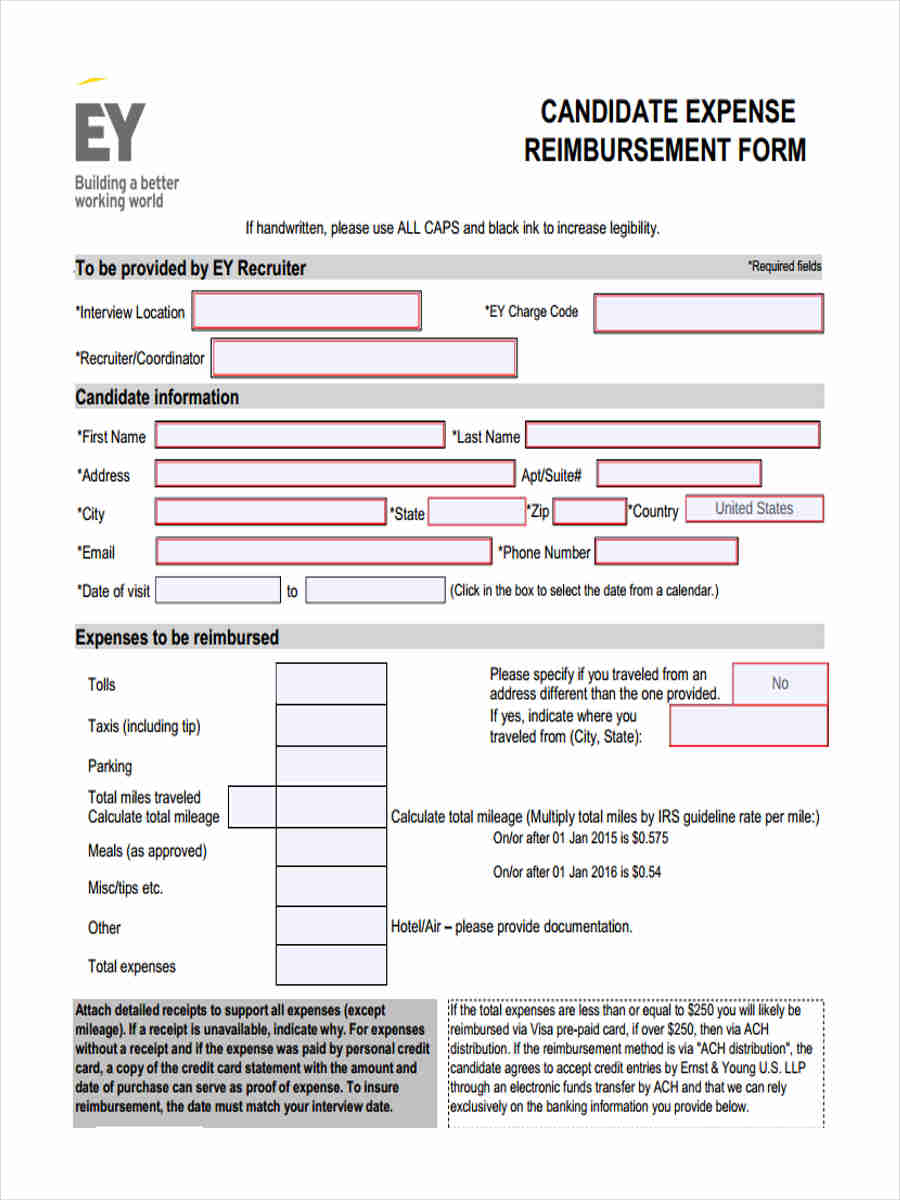

Candidate Expense Reimbursement

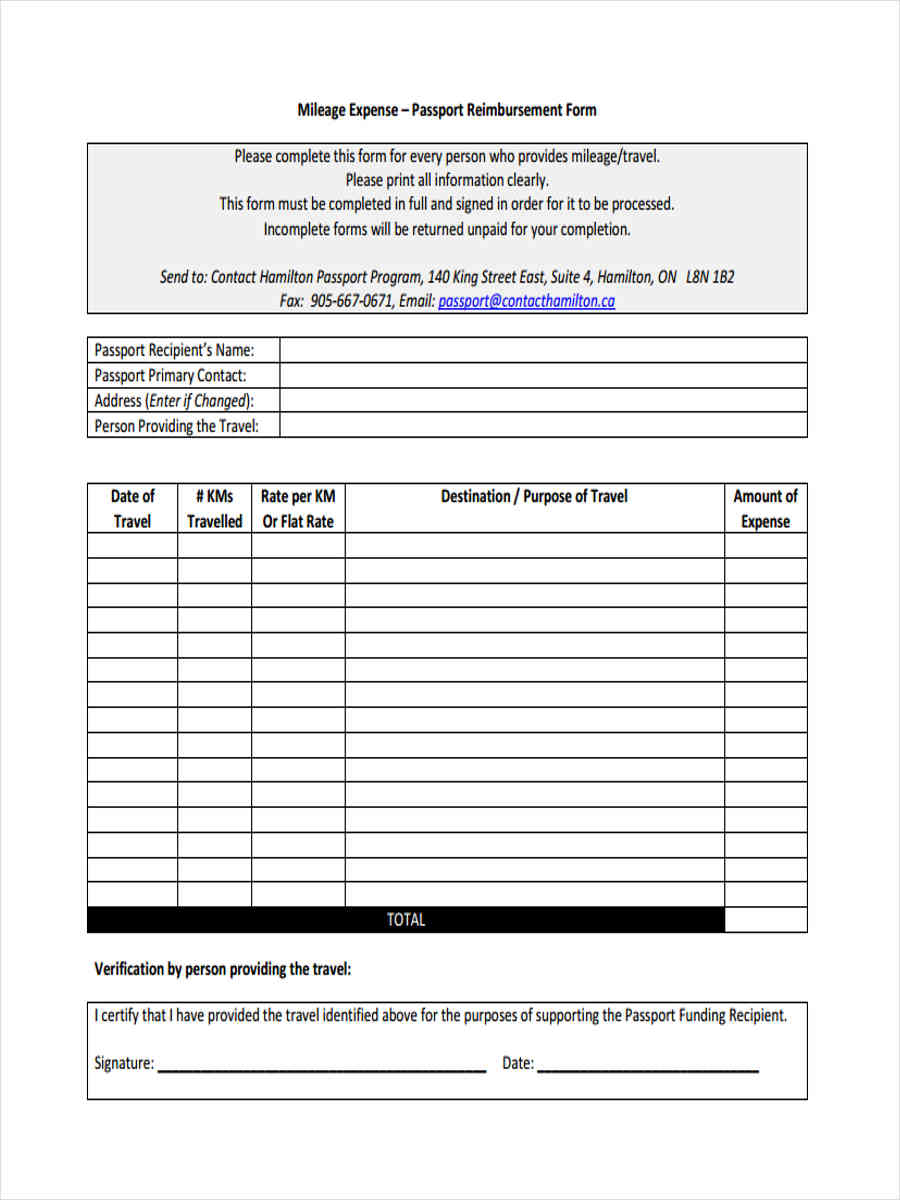

Mileage Expense Reimbursement

Expense Reimbursement Form Template

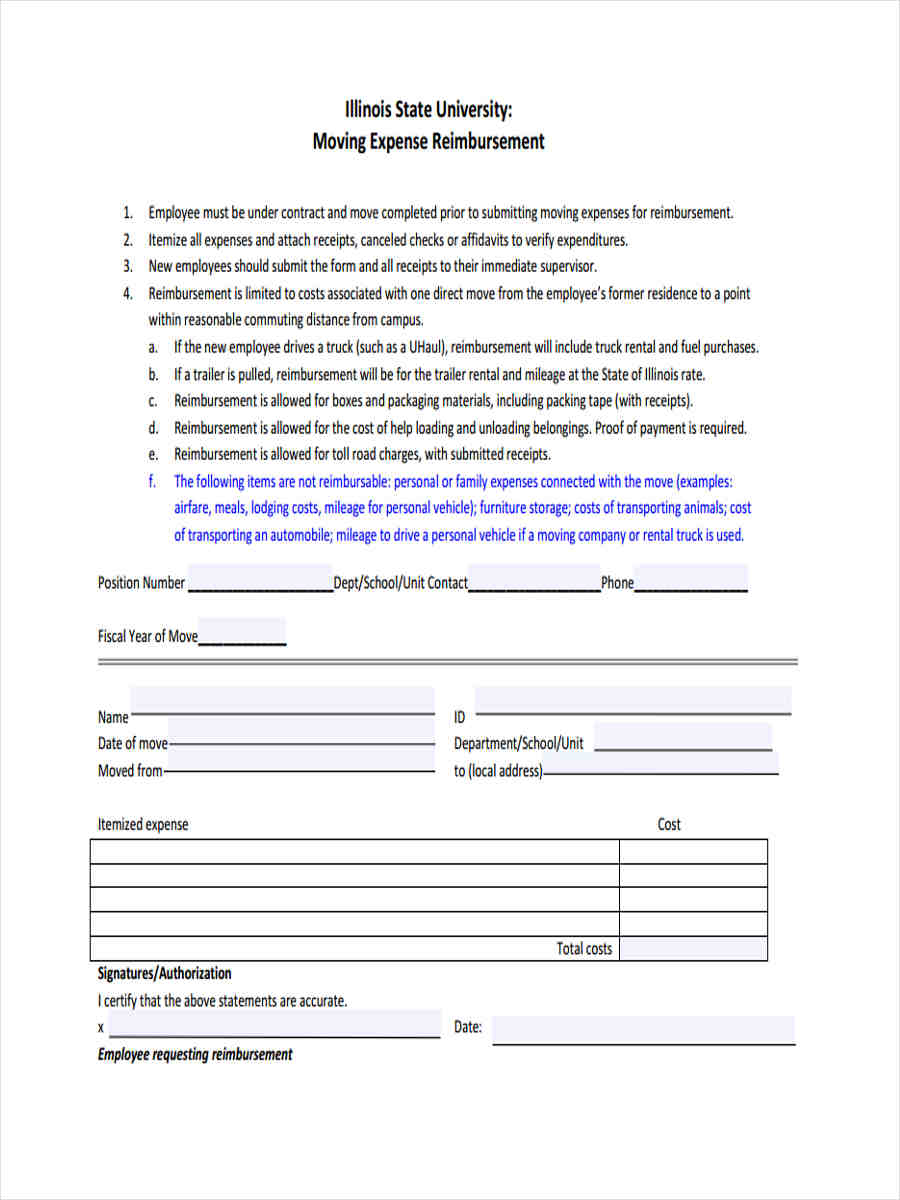

Moving Expense Reimbursement

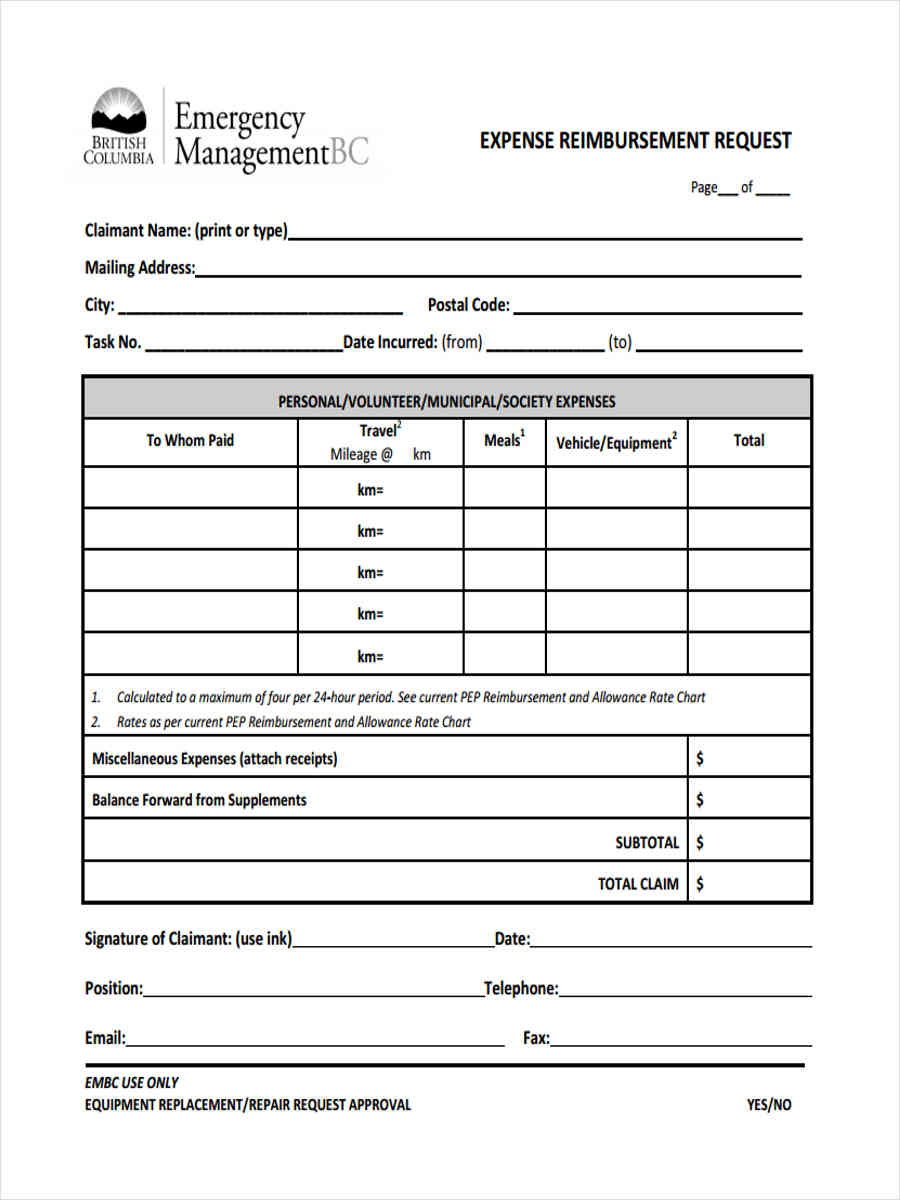

Expense Reimbursement Request

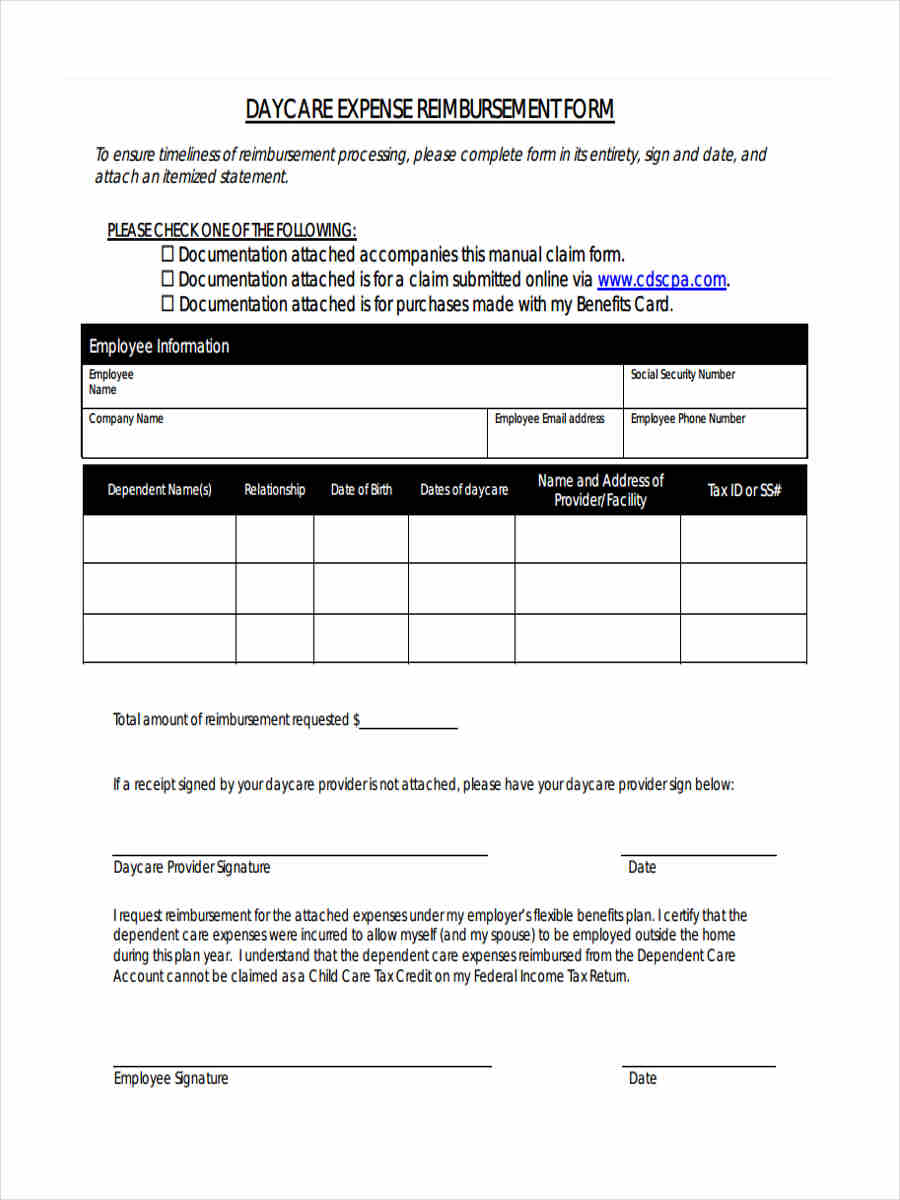

Daycare Expense Reimbursement

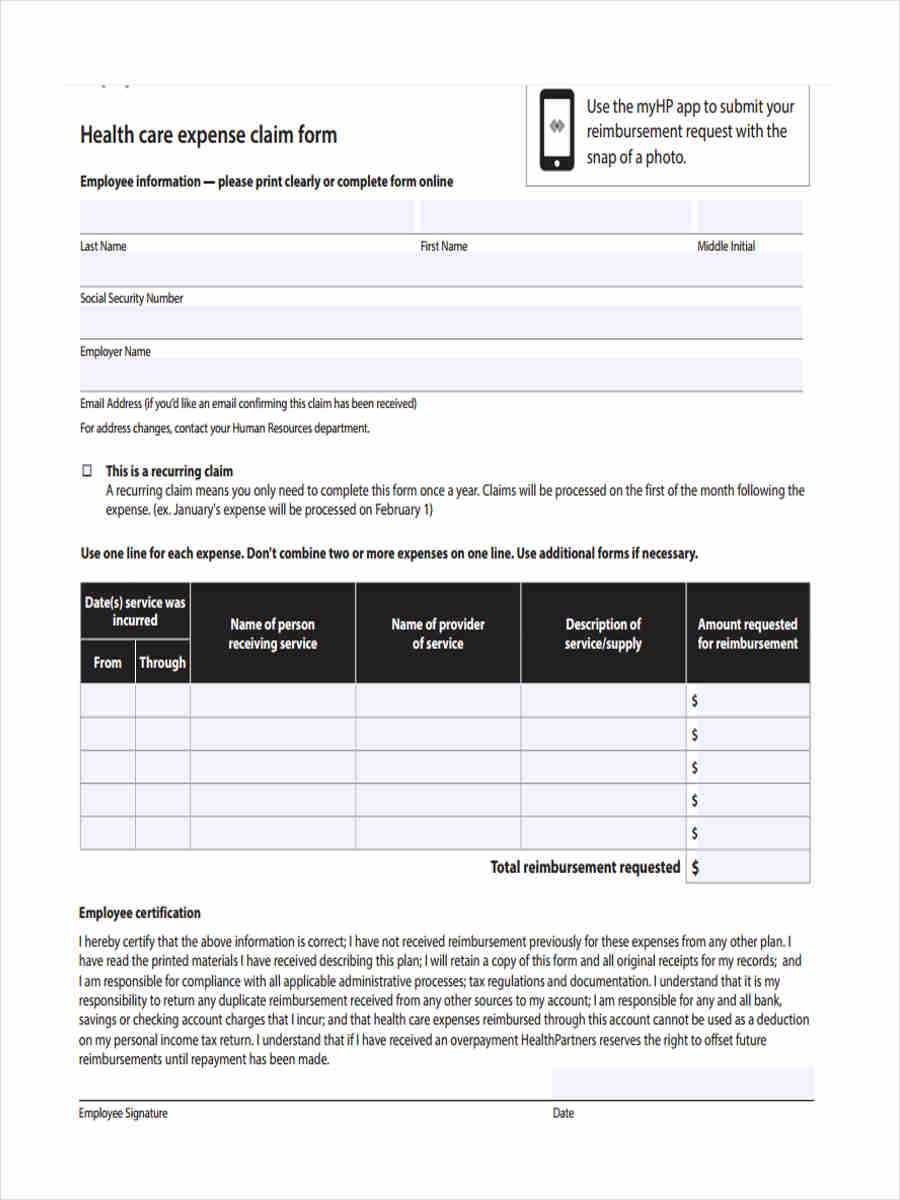

Healthcare Expense Claim

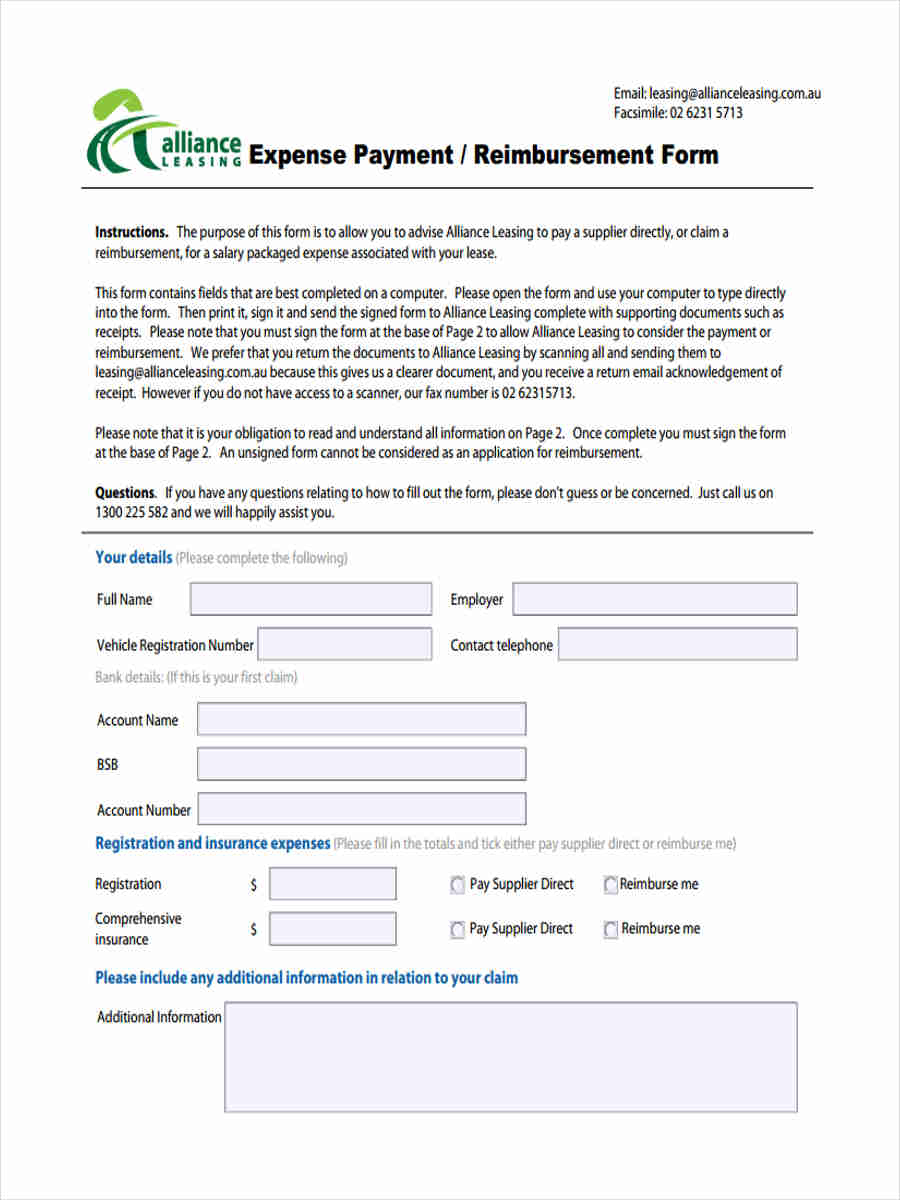

Expense Payment Reimbursement

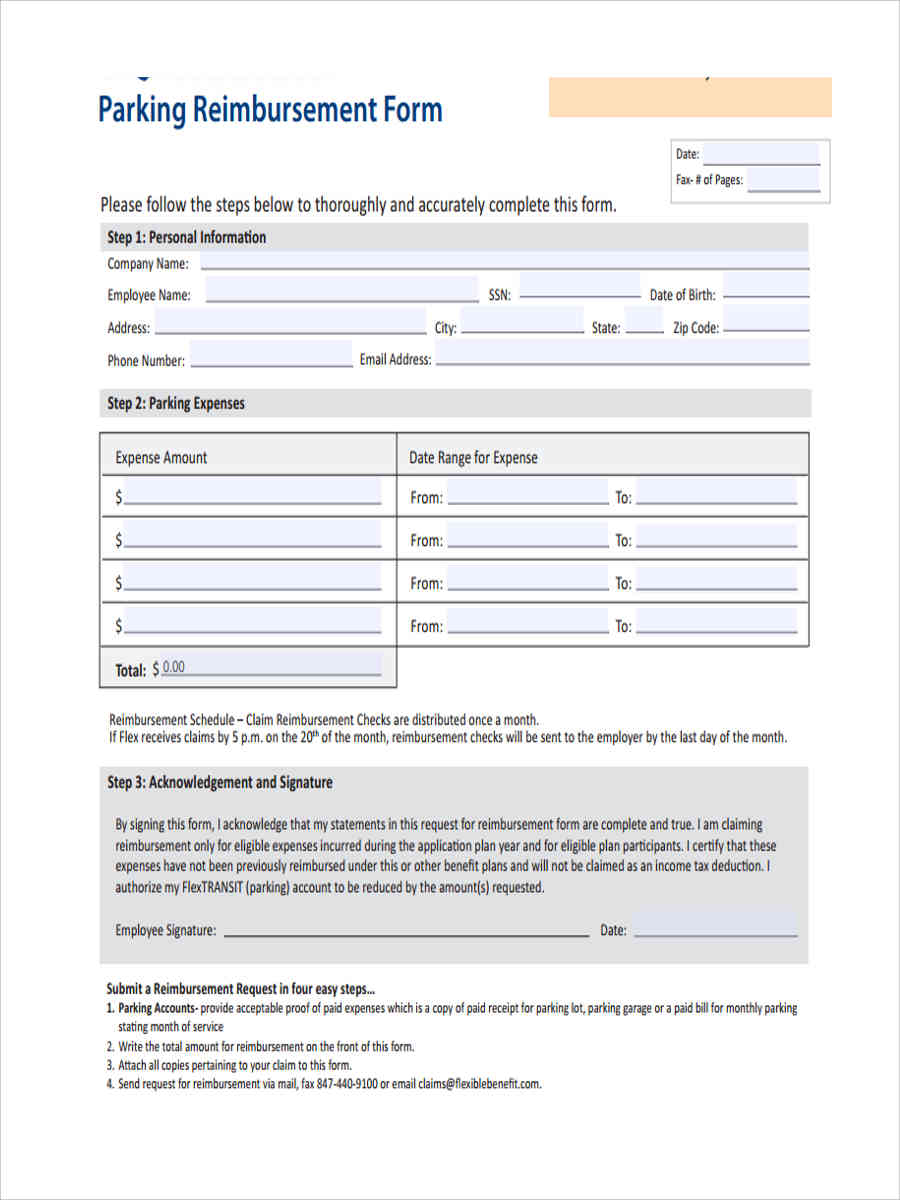

Parking Expense Reimbursement

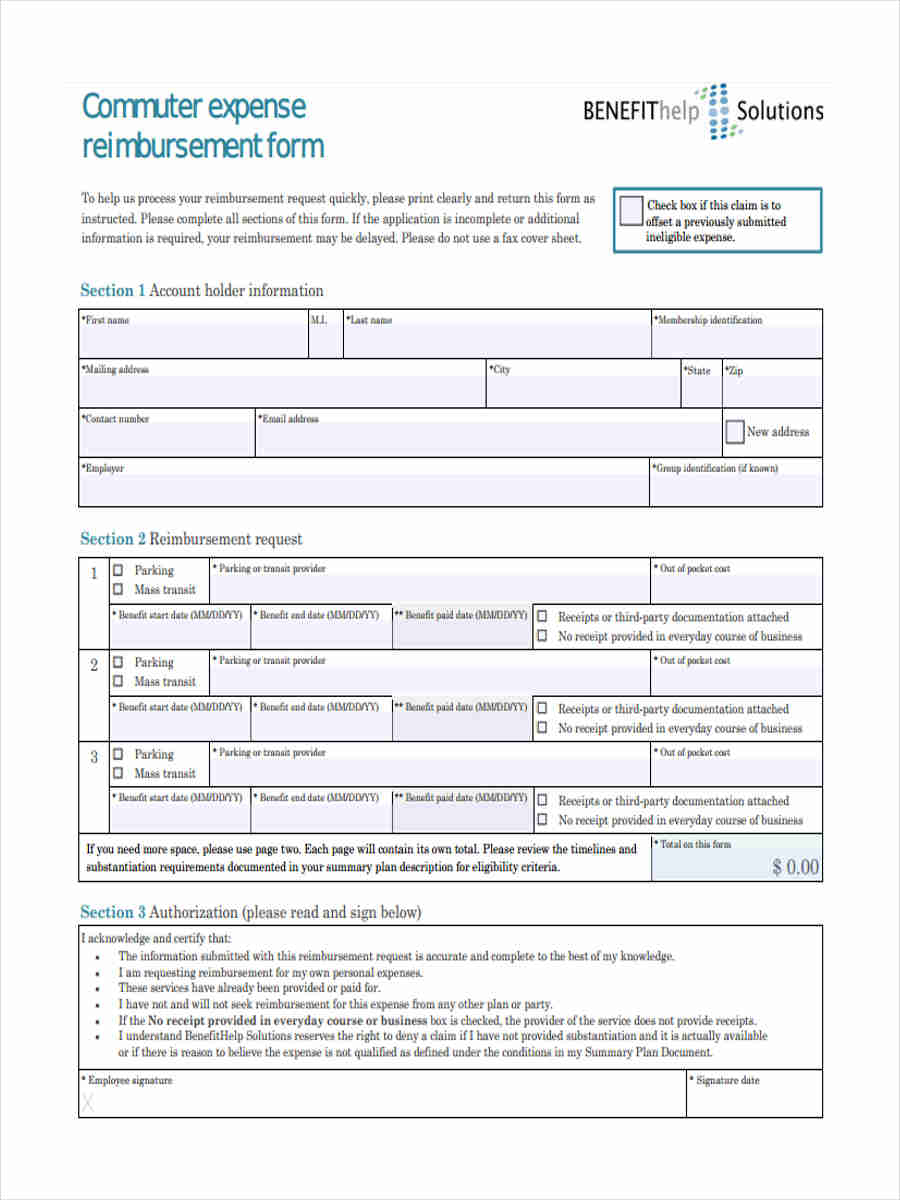

Commuter Expense Reimbursement

Printable Expense Reimbursement Form

General Expense Reimbursement Form

Guidelines for Expense Reimbursements

Any kind of reimbursement form such as a Nextcare Reimbursement Form, Cash Reimbursement Form , and Travel Reimbursement Form is considered to be a useful, informational, and important document. It takes care of the reimbursement of expenses from a company’s account of funds. There may be instances of financial discrepancies or inconsistencies which may be hard for the company to handle.

To lessen or fully eliminates situations like that, a company would develop and implement financial guidelines for employees to abide by. Violation of such guidelines puts the employee in question in an unfavorable situation involving penalties are punishments.

Reimbursement of expenses can come from different kinds of expenses. Accepted or reimbursable expenses can come from air travel, car rental, hotel and lodging, personal meals, business meals, telecommunication expenses, business mileage, baggage fees, license fees, and passport fees.

Guidelines for expenses depend on the nature of the expense. Guidelines may require the provision of financial documents as proof of payment or purchase, approval from an authoritative figure through a signature, information of the people involved, details on the location of where the funds have been spent, the exact amount paid by the employee, and the date of when the expenses occurred. You also browse our Payment Receipt Form

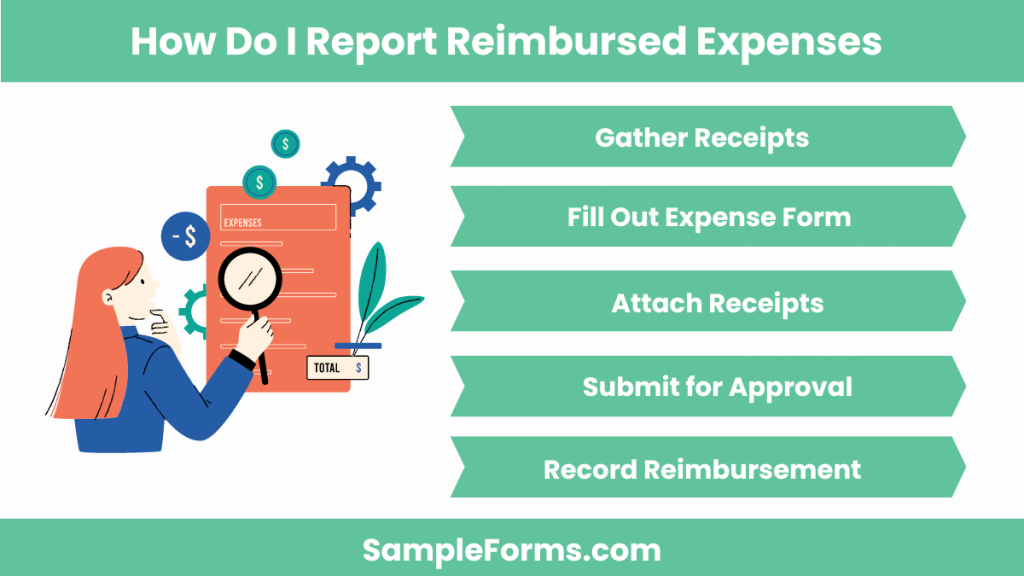

How Do I Report Reimbursed Expenses?

Reporting reimbursed expenses involves documenting all costs incurred and providing necessary receipts. This process is similar to completing a Business Expense Claim Form.

- Gather Receipts: Collect all receipts related to your expenses.

- Fill Out Expense Form: Complete an Expense Authorization Form with detailed information.

- Attach Receipts: Attach all relevant receipts to the form.

- Submit for Approval: Submit the form to your supervisor or finance department for approval.

- Record Reimbursement: Ensure the reimbursement is recorded in your financial records.

How Do I Claim Reimbursement Form?

Claiming a reimbursement form requires submitting a completed form along with all necessary documentation. This process is similar to using a Nextcare Reimbursement Form.

- Complete the Form: Fill out the Request Reimbursement Form with detailed information.

- Attach Supporting Documents: Include receipts, invoices, and any other required documents.

- Submit the Form: Send the completed form and attachments to the relevant department.

- Follow Up: Check on the status of your claim if needed.

- Receive Reimbursement: Once approved, you will receive the reimbursement. You also browse our Payment Agreement

What’s an Accountable Plan for Reimbursing Employees?

In the educational aspect, expenses from classes, projects, and other academic activities can pile up and cause some financial difficulty to the student. There are cases where these expenses are take cared of with the student’s own money. Any academic business that the student has spent for may be repaid to them through the completion of a Student Reimbursement Form. You also browse our Payment Request Form

In the industrial setting, employee reimbursement is done in order to maintain balance in the company’s expenses. An accountable plan is a method used for this situation. It is an reimbursement allowance arrangement for employees when the funds from business related expenses come from their personal funds.You also browse our Payment Contract Form

How to Ask for Expense Reimbursement?

Requesting expense reimbursement involves clear communication and providing all necessary documentation. This process is similar to filling out a Claim Reimbursement Form.

- Prepare Your Request: Gather all relevant information and receipts.

- Fill Out the Form: Complete the Employee Expense Reimbursement Form.

- Attach Documentation: Include all receipts and relevant documents.

- Submit to Supervisor: Send the form to your supervisor or finance department.

- Follow Up: Ensure your request is processed and approved.

How to Account for Expense Reimbursements?

Accounting for expense reimbursements involves recording the transaction accurately in your financial records, similar to managing a Student Reimbursement Form.

- Record the Expense: Log the initial expense in your accounting system.

- Track Reimbursement: Note the reimbursement request and approval.

- Update Financial Records: Adjust your records once the reimbursement is received.

- Reconcile Accounts: Ensure your expense and reimbursement records match.

- Maintain Documentation: Keep all forms and receipts for future reference. You also browse our Receipt of Payment Form

What Are the Types of Reimbursement?

Understanding the different types of reimbursement helps in managing various expenses effectively. These categories are akin to filling out various reimbursement forms like the Mileage Reimbursement Form.

- Travel Reimbursement: Covers expenses related to business travel.

- Medical Reimbursement: Includes healthcare-related expenses.

- Tuition Reimbursement: Provides for educational expenses.

- General Expense Reimbursement: Covers miscellaneous business expenses.

- Employee Reimbursement: Specific to costs incurred by employees on behalf of the company. You also browse our Payment Authorization Form

How Do You Create an Expense Reimbursement Form?

Expense reimbursement forms are created in order to systematically track down and record all the expenses that occurred during a business related event relating to company, school, or another setting. This form requires the individual to list down all the kinds of expenses that happened as well as their corresponding amount. A standard format may be provided or one can search for a Reimbursement Form in PDF format as the basis for the form. You also browse our Expense Report Form

The first section contains the general information of the person requesting reimbursement. What follows is tabular form of a liquidation report which all the expenses and amount of funds are indicated. The form is then signed to validate its content and claim. You also browse our Payment Requisition Form

Ways to Improve Your Employee Expense Management

The supervision of the expenses of employees is important to uphold in any company. There may be instances wherein unaccountable employee expenses an affect the annual financial reports of a company as well as their overall financial performance. Financial discrepancies can cause conflict within a company. Having an effective employee expense management can decrease the likelihood of conflicts and financial problems. You also browse our Payment Confirmation Form

There ways to practice a good employee expense management in the company. One way is to limit expense accounts in order to gain more control over of costs. Another way is creating well-written financial documents through the use of references such as a Reimbursement Form Sample. The clarification of acceptable and unacceptable expenses can improve the tracking of finances. You also browse our Payment Application Form

How to Use Expense Reimbursement Form

An aspiring business owner has the opportunity to invest their time, effort, and money into any business venture they want to pursue. Business ventures and concepts have their own share of unique characteristics that make one stand out. These same characteristics can present factors that may be challenging on the business owner or on the employees of the company. You also browse our Payment Agreement Form

Some businesses may require travelling to other place for business related activities. Funds for the travelling and the business related events can cost a company or the employee a lot if the funds and expenses were not taken into account or recorded into the company’s financial statements.

The finance department creates reimbursement form with the use of online or the company’s standard reimbursement form template as a reference. The use of a expense reimbursement form is for the circumstance wherein an employee utilizes their own personal funds in order to take care of expenses that a business related events encompass and is repaid by the company.

This kind of reimbursement form is usually in correspondence with a Travel Expense Form. Business related events and activities may require employees of a company to travel to various locations. Travelling can incur a lot of expenses which in turn, the employee spends a lot of money. You also browse our Contractor Payment Form

Since the employee’s personal money was spent on business related expenses, it would be unfair towards the employee if all the funds spent were not reimbursed by the company. That particular situation is unfair because any business related event is supposed to be taken cared of by the company itself in all aspects of the event or activity.

The utilization of a expense reimbursement form in line with the company’s finances is a way of practicing financial responsibility and enforcing an ethical procedure between employees and the authority figures of the company. You also browse our Payment Form

Do I Need to Issue a 1099 for Expense Reimbursement?

No, you do not need to issue a 1099 for reimbursed expenses if they are substantiated and follow an Expense Approval Form policy.

Can a Company Refuse to Reimburse Expenses?

Yes, a company can refuse to reimburse expenses if they do not meet the criteria outlined in the Travel Expense Form or other relevant policies.

Do Expense Reimbursements Count as Income?

No, properly documented expense reimbursements do not count as income and should not be included in a Travel Expense Claim Form.

What is the Time Limit for Expense Reimbursement?

The time limit for submitting expense reimbursements varies by company but is often outlined in the Child Care Expense Form or similar policy documents.

Should Reimbursements Be Paid Through Payroll?

No, reimbursements should typically be processed separately from payroll to avoid confusion with Personal Expense Form entries.

What is Eligible for Reimbursement?

Eligible expenses typically include travel, meals, and supplies as outlined in an Income and Expense Form, subject to company policy.

Do Expense Reimbursements Get Reported on 1099?

No, if expenses are properly documented and reimbursed, they should not be reported on a 1099, unlike a Medical Expense Form.

Do Expense Reimbursements Show Up on W2?

No, legitimate expense reimbursements do not show up on a W2, distinguishing them from taxable income reported on an Expense Request Form.

The Expense Reimbursement Form is a vital tool for managing employee expenses. This article provided samples, forms, and practical advice to help you implement an efficient reimbursement process. By following our guide, you can create a reliable system for tracking and reimbursing expenses. Just as with a Cash Payment Receipt Form, ensuring all necessary details are included is crucial for accuracy and accountability. Implement these best practices to enhance financial management and streamline your expense reimbursement process.