A Medical Reimbursement Form is essential for claiming repayment of healthcare expenses. This guide provides a comprehensive overview of how a Medical Form and Expense Reimbursement Form simplify the claim process. Designed to help employees or individuals recover costs for treatments, prescriptions, and medical services, it ensures accuracy and efficiency. Learn to document expenses, attach required proofs, and submit correctly. With step-by-step instructions and practical examples, this guide ensures your reimbursements are processed without delays or errors. Whether for workplace benefits or personal healthcare claims, a well-prepared form saves time and provides peace of mind.

Download Medical Reimbursement Form Bundle

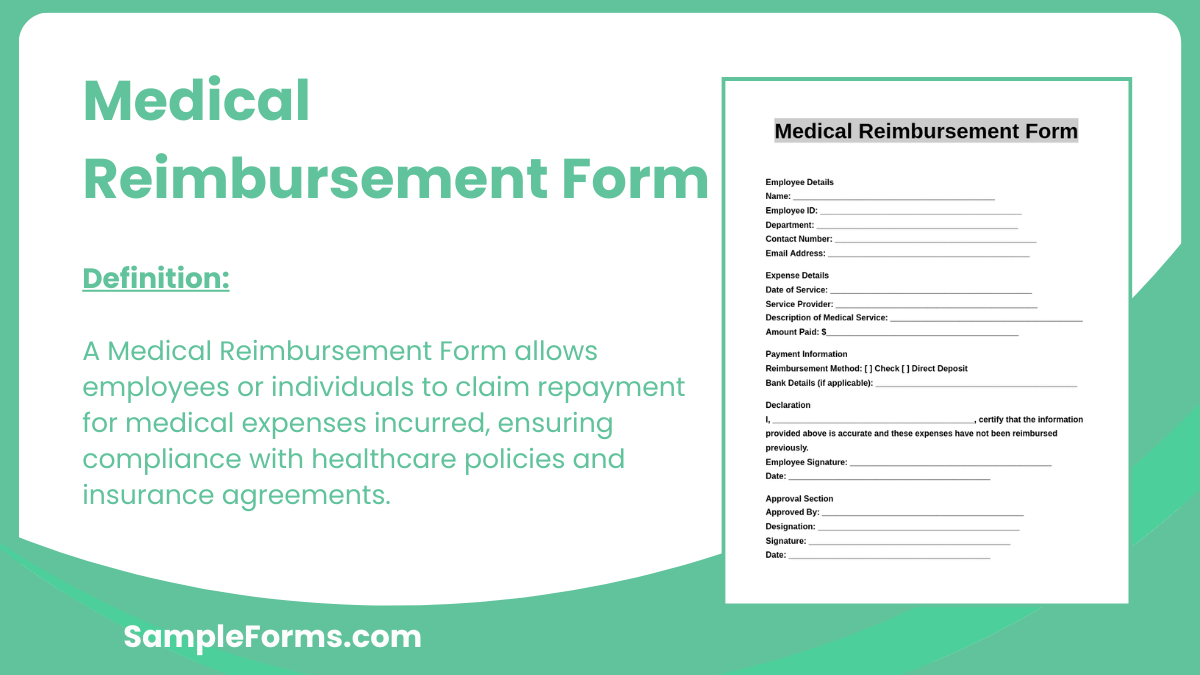

What is Medical Reimbursement Form?

A Medical Reimbursement Form is a document used to claim repayment for medical expenses incurred by an individual. It typically includes details such as the nature of the expense, treatment date, and healthcare provider information. Supporting documents like receipts and prescriptions are often required. The form streamlines the process of reimbursement by ensuring all necessary information is documented for approval. It is widely used in workplaces, insurance claims, and other reimbursement setups to ensure financial accountability and transparency.

Medical Reimbursement Format

Employee Name: ____________________________________________

Employee ID: ____________________________________________

Department: ____________________________________________

Contact Number: ____________________________________________

Medical Expense Details:

Date of Expense: ____________________________________________

Service Provider: ____________________________________________

Description of Service: ____________________________________________

Amount Paid: $________________________________________

Supporting Documents Provided:

[ ] Receipts

[ ] Prescriptions

[ ] Other: ____________________________________________

Payment Information:

Reimbursement Method: [ ] Check [ ] Direct Deposit

Bank Details (if applicable): ____________________________________________

Employee Declaration:

I confirm that the above expenses are valid and not previously reimbursed.

Employee Signature: ____________________________________________

Date: ____________________________________________

Approval Section:

Approved By: ____________________________________________

Designation: ____________________________________________

Signature: ____________________________________________

Date: ____________________________________________

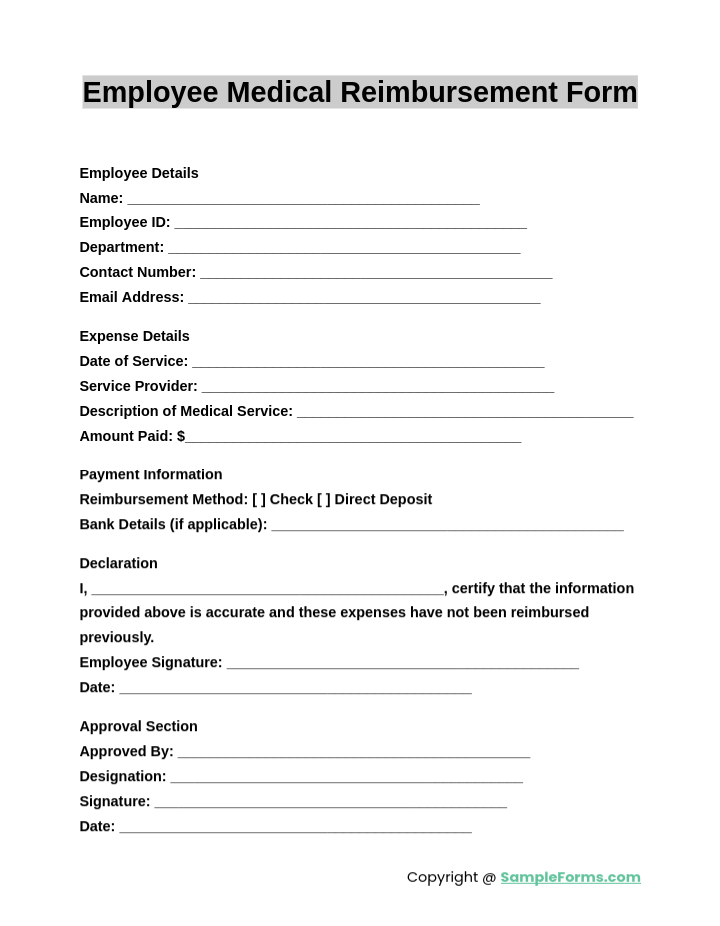

Employee Medical Reimbursement Form

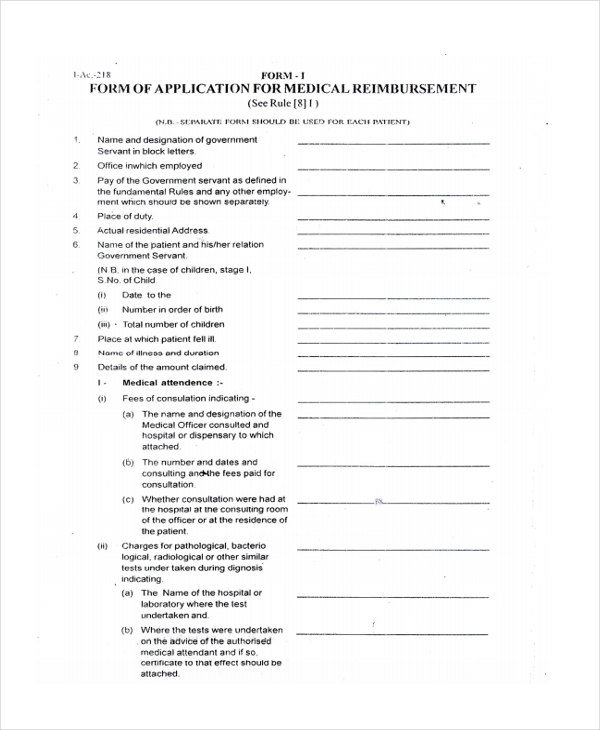

An Employee Medical Reimbursement Form facilitates employees in claiming medical expenses incurred during treatment. Similar to a Tuition Reimbursement Form, it requires details of expenses, receipts, and employer approval to process payments efficiently.

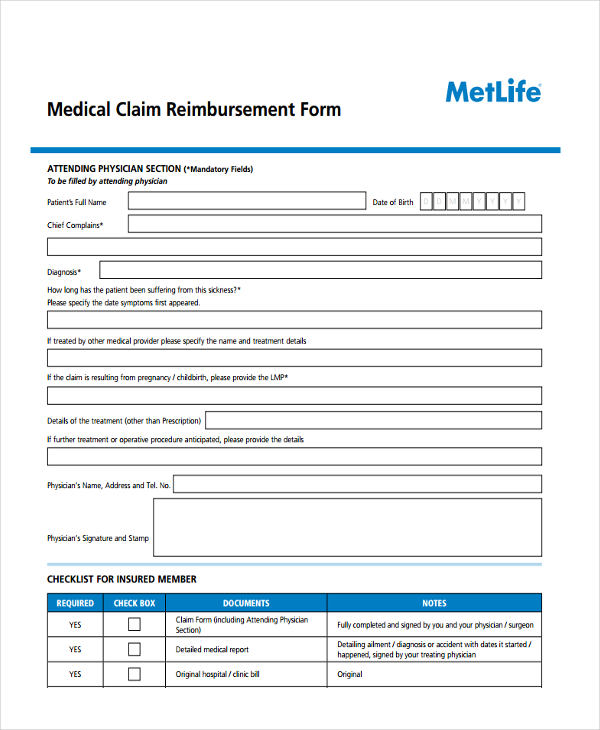

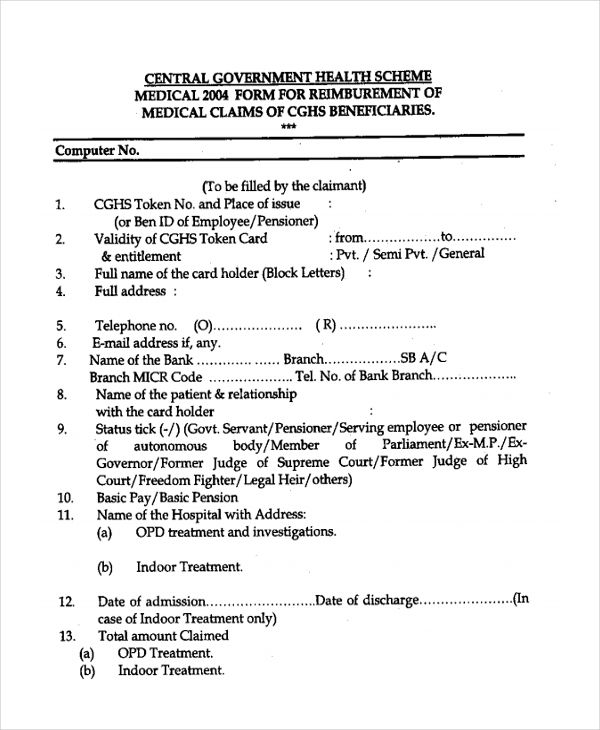

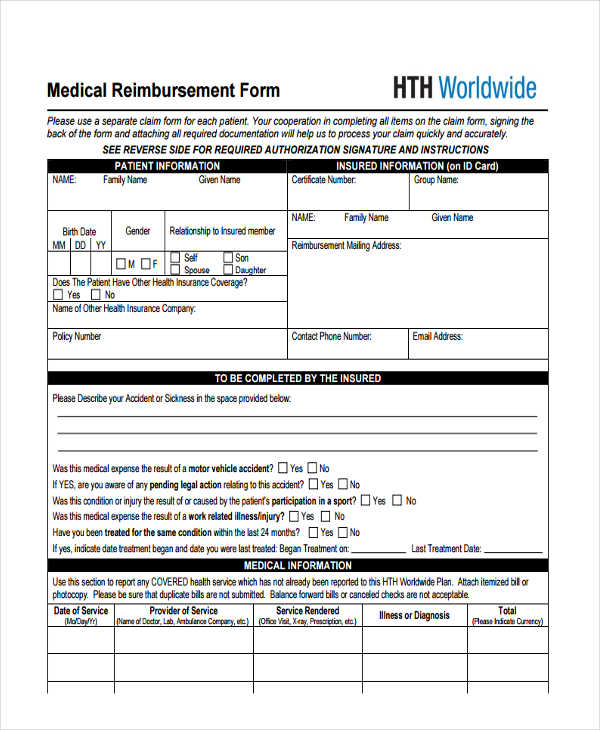

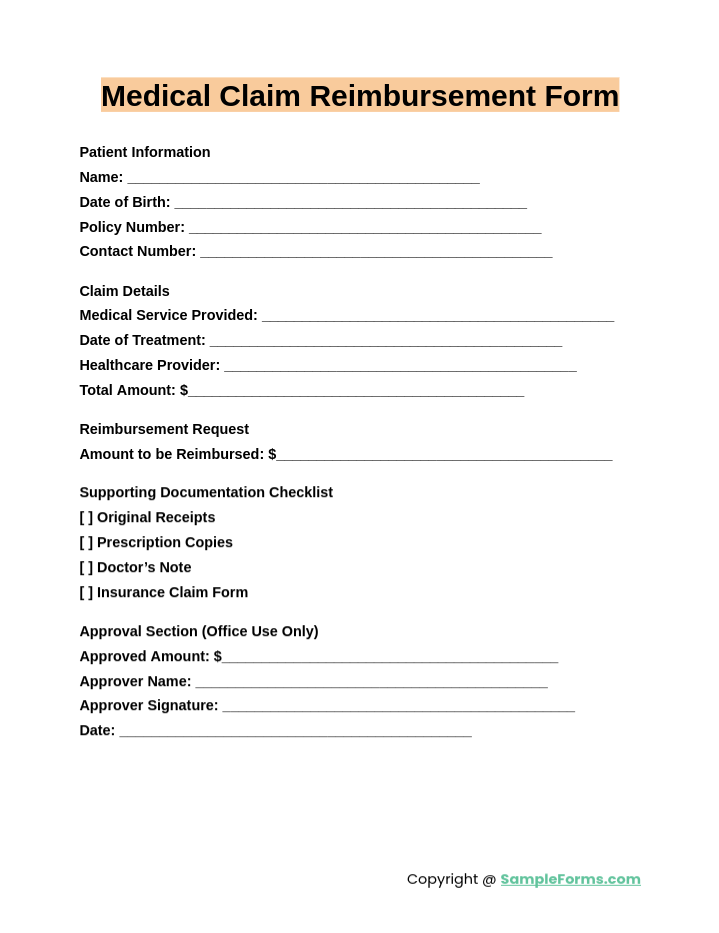

Medical Claim Reimbursement Form

A Medical Claim Reimbursement Form is vital for insurance-related claims, ensuring accurate documentation of healthcare expenses. Much like a Travel Reimbursement Form, it captures expense details and supporting documents for swift processing and approval.

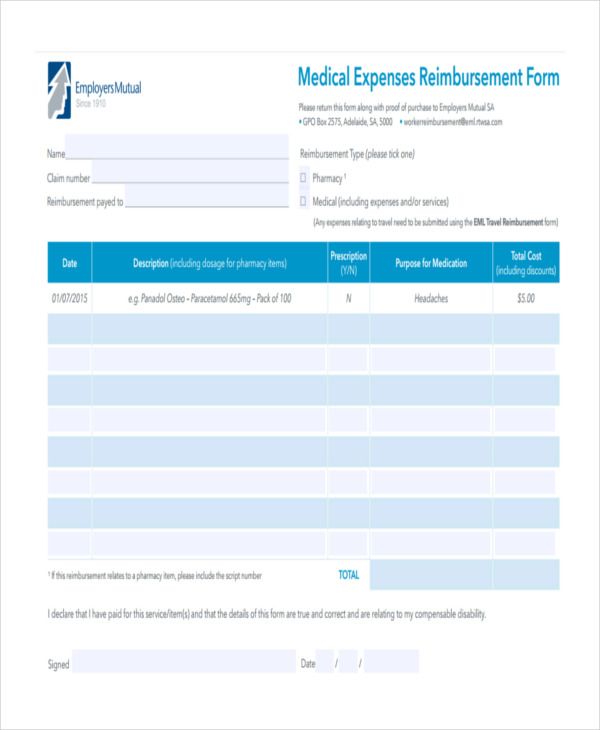

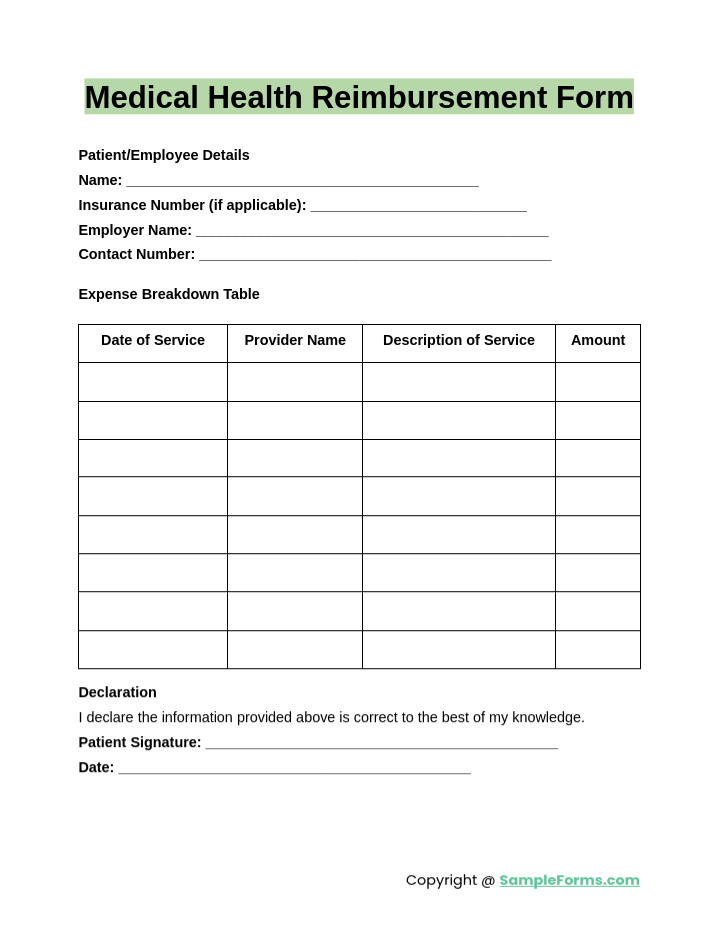

Medical Health Reimbursement Form

A Medical Health Reimbursement Form helps individuals recover costs for routine check-ups or treatments. Comparable to a Mileage Reimbursement Form, it ensures accurate tracking of expenses with necessary proof for effective claim submission.

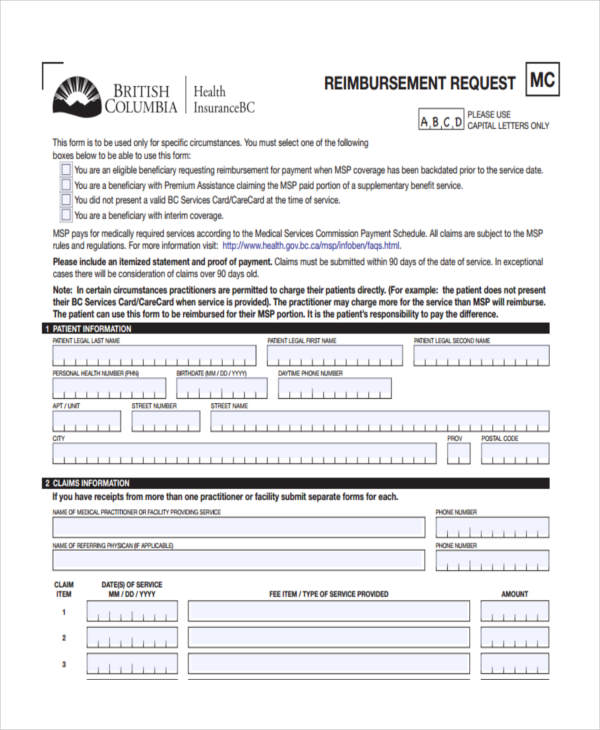

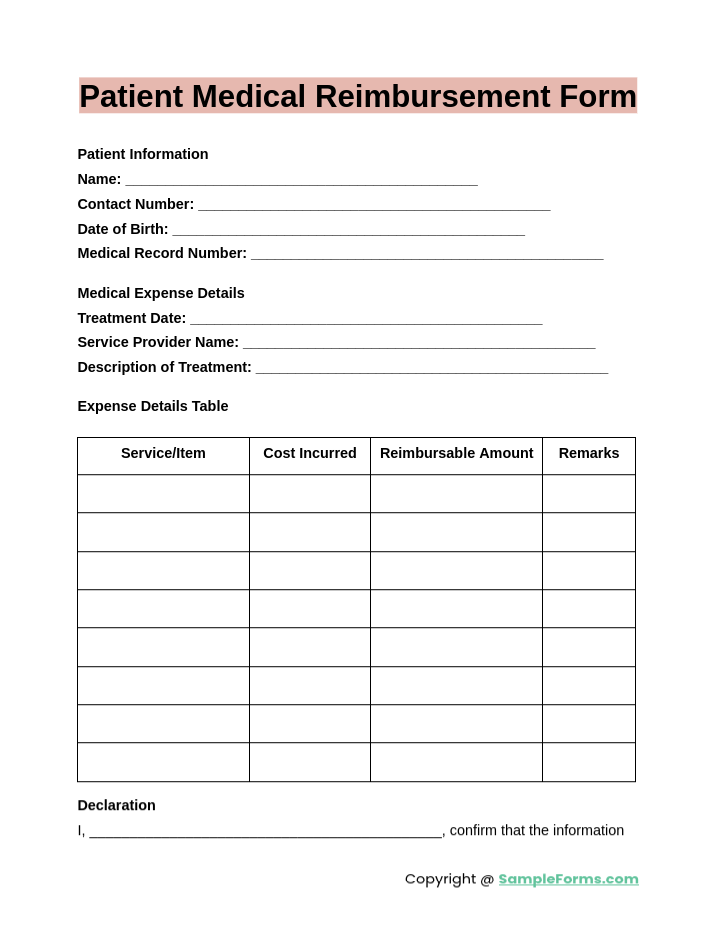

Patient Medical Reimbursement Form

A Patient Medical Reimbursement Form allows patients to request reimbursements for medical services received. Like a Nextcare Reimbursement Form, it requires itemized bills, provider information, and a clear explanation of incurred costs for validation.

Browse More Medical Reimbursement Forms

Medical Claim Reimbursement Form

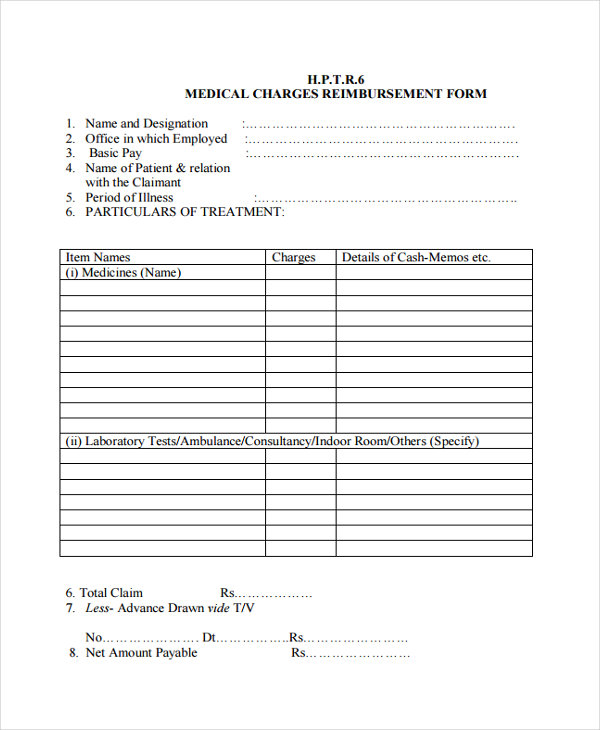

Medical Charges Reimbursement Form

Medical Bill Reimbursement

Medical Reimbursement Application

Insurance Reimbursement Form

Medical Expenses Reimbursement

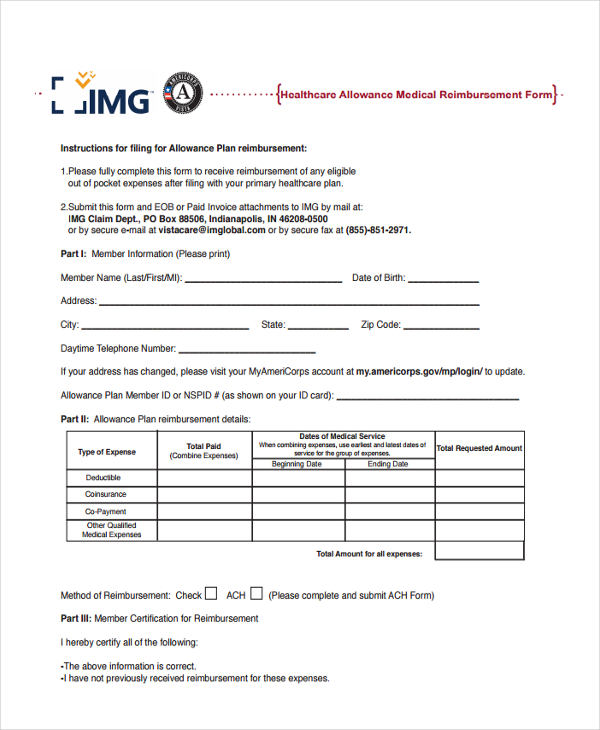

Healthcare Allowance Medical Reimbursement Form

Medical Reimbursement form Sample

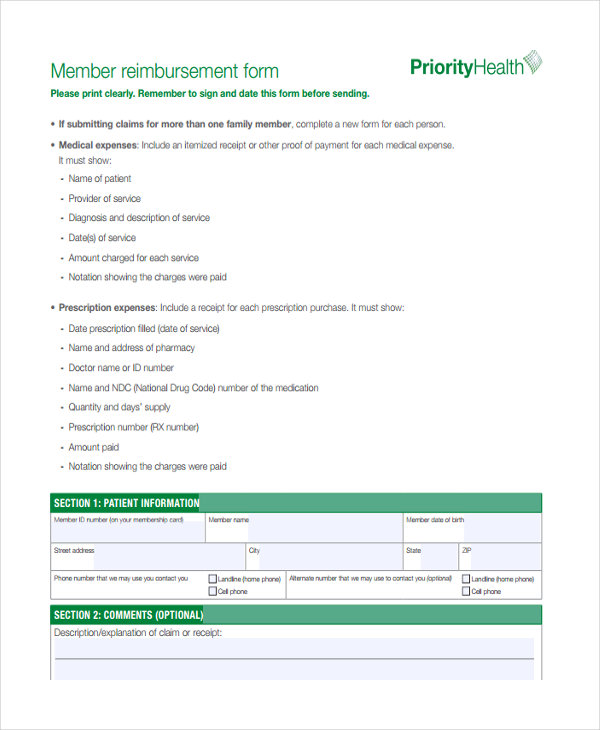

Medical Member Reimbursement

How to reimburse a medical claim?

Reimbursing a medical claim involves submitting proper documentation and proofs to the relevant authority. Similar to a Request Reimbursement Form, the process ensures accountability and accurate claim processing.

- Prepare Necessary Documents: Gather all medical bills, receipts, and prescriptions.

- Complete the Form: Accurately fill out the reimbursement form.

- Attach Supporting Evidence: Include necessary proofs like reports or invoices.

- Submit to Authority: Send the form to the relevant department or insurer.

- Follow Up: Track the claim status to ensure timely reimbursement.

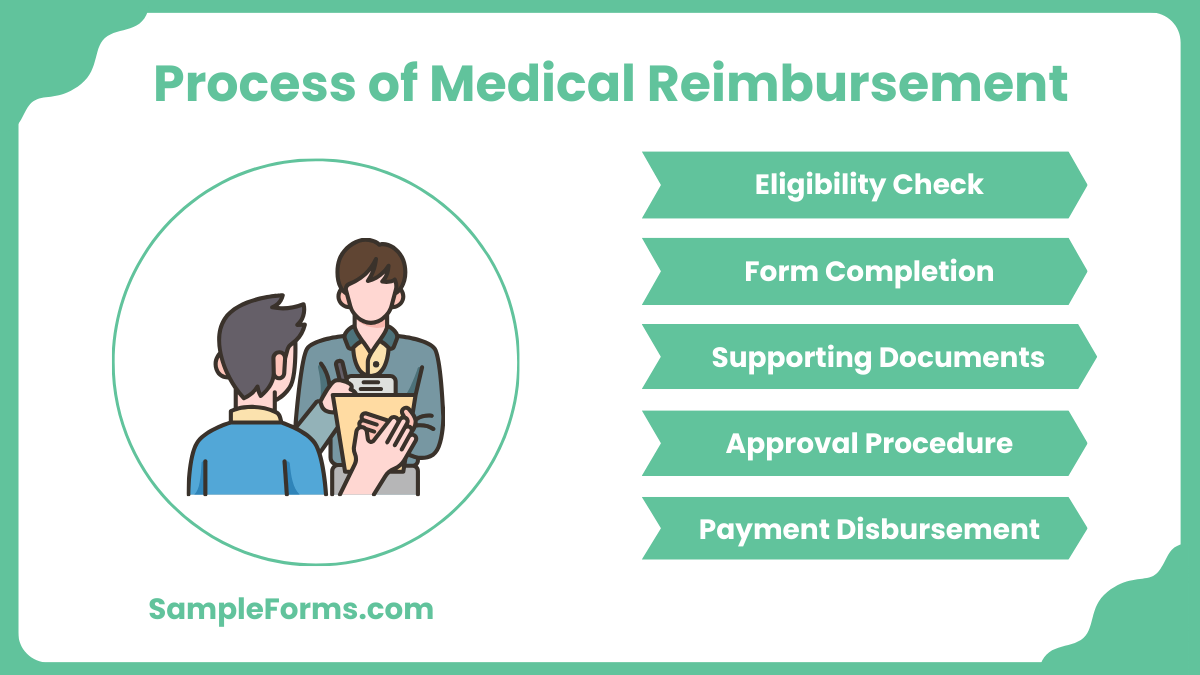

What is the process of medical reimbursement?

The medical reimbursement process ensures recovery of healthcare expenses. Similar to a Petty Cash Reimbursement Form, it requires accurate record-keeping and systematic documentation.

- Eligibility Check: Verify if the expense qualifies for reimbursement.

- Form Completion: Fill out the necessary reimbursement form correctly.

- Supporting Documents: Attach prescriptions, receipts, and other required details.

- Approval Procedure: Submit the form for review and approval.

- Payment Disbursement: Receive the reimbursed amount post-verification.

How to ask for medical reimbursement?

Requesting medical reimbursement requires formal communication and proper submission of documents. Like a Claim Reimbursement Form, clarity and accuracy in documentation are key.

- Draft a Formal Request: Write a professional email or letter.

- Attach Documents: Include all necessary proofs like bills and prescriptions.

- Specify Details: Clearly mention the treatment and related costs.

- Submit to HR/Insurer: Send the documents to the concerned authority.

- Follow Up on the Request: Ensure timely processing of your claim.

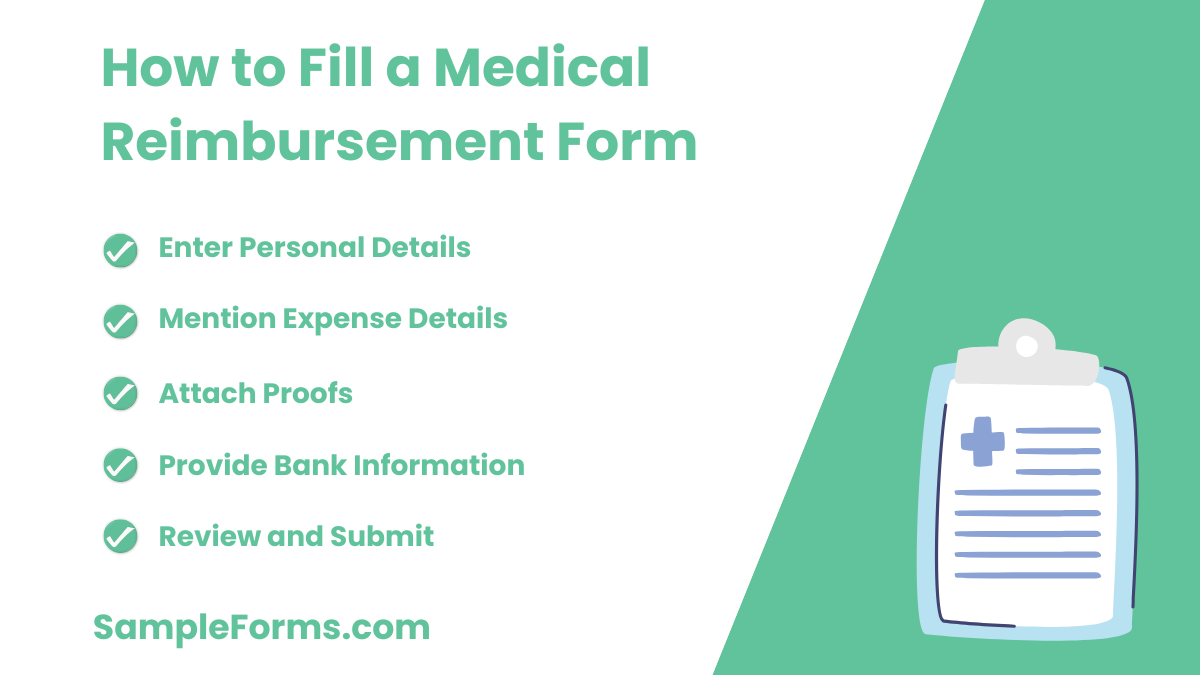

How to fill a medical reimbursement form?

Filling a medical reimbursement form ensures clear documentation of expenses. Similar to a Student Reimbursement Form, it requires accurate details and supporting proofs.

- Enter Personal Details: Include your name, ID, and contact information.

- Mention Expense Details: List treatments, dates, and amounts incurred.

- Attach Proofs: Add receipts, prescriptions, and invoices.

- Provide Bank Information: Specify account details for reimbursement.

- Review and Submit: Ensure all information is correct before submission.

How do I check my medical reimbursement?

Checking your medical reimbursement status involves regular follow-ups and tracking. Like verifying an Employee Expense Reimbursement Form, staying updated ensures timely claim processing.

- Contact Authority: Reach out to the insurer or HR department.

- Provide Reference Number: Share the claim ID or form number.

- Check Online Portals: Log in to insurer or company platforms.

- Review Updates: Monitor notifications or emails regarding status.

- Seek Clarification if Needed: Address any discrepancies promptly.

What is the time limit for a medical reimbursement bill?

The time limit for medical reimbursement typically ranges from 30 to 90 days, as outlined in an Employee Reimbursement Form policy.

How many days required for reimbursement?

Reimbursement processing usually takes 7–14 working days, depending on the organization’s procedure, as documented in a Medical Report Form.

What is reimbursement amount?

The reimbursement amount is the total eligible medical expenses submitted for repayment, detailed in a Medical Invoice Form.

Is reimbursement part of salary?

Reimbursement is not a direct part of the salary but an additional benefit, similar to claims mentioned in a Medical Certification Form.

What is Form C for medical reimbursement?

Form C is a specific format required for claim submission, similar to a Medical Examination Form, ensuring accurate expense reporting.

What is medical reimbursement in payslip?

Medical reimbursement in a payslip represents tax-free medical expense claims, detailed like a Medical Waiver Form benefit.

What is the medical reimbursement payment?

Medical reimbursement payment refers to the refunded amount for approved medical expenses, as clarified in a Medical Release Form.

What is the maximum medical reimbursement?

The maximum reimbursement amount is determined by company policy, often capped annually, similar to Dental Medical Clearance Form limits.

What is form B for medical reimbursement?

Form B outlines additional details for claim validation, often required for specific approvals, like an Against Medical Advice Form.

Is medical reimbursement tax free?

Yes, medical reimbursements are tax-free up to a specified limit, documented in Medical Records Request Form policies.

The Medical Reimbursement Form is a key tool for efficiently managing healthcare expense claims. By providing a structured way to document costs and attach supporting proofs, it reduces delays and errors in processing. Similar to a Medical Referral Form, it simplifies interactions between individuals and organizations, ensuring clarity and accuracy. This guide equips you with the knowledge to prepare, submit, and follow up on your reimbursement claims, optimizing your experience and ensuring timely financial recovery.