Embark on a journey to financial clarity with our comprehensive guide to the Promissory Note Agreement Form. This essential tool, pivotal in formalizing loans, comes in a user-friendly, Fillable Form format, simplifying the loan process for both lender and borrower. Our guide, enriched with examples, demystifies the Agreement Form, ensuring you understand every aspect of this crucial financial document. Whether you’re lending money to a friend or financing a major purchase, our guide provides the insights you need to navigate the process with ease and confidence>

Download Promissory Note Agreement Form Bundle

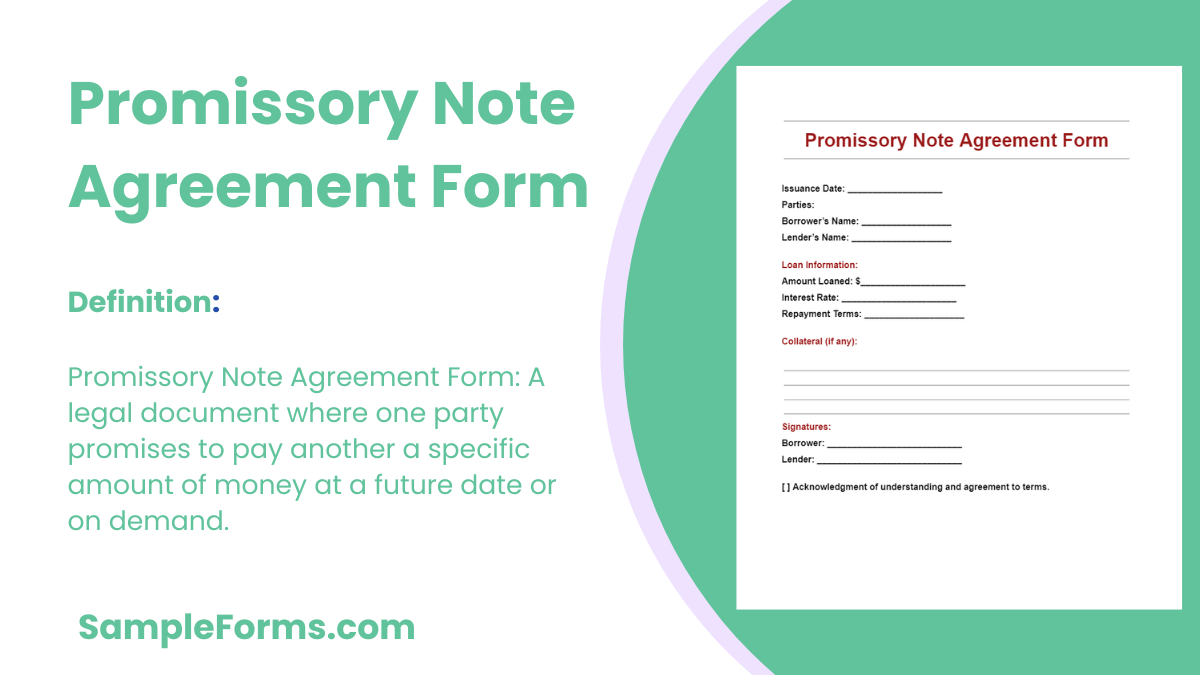

What is Promissory Note Agreement Form?

A Promissory Note Agreement Form is a binding legal document in which one party promises to pay another party a specific sum of money by a certain date or upon demand. Acting as a detailed payment agreement form, it specifies the loan’s terms, including repayment schedule, interest rate, and consequences of non-payment. This form serves as a clear, mutual understanding between lender and borrower, ensuring both parties are aligned on the financial commitment and terms of the loan.

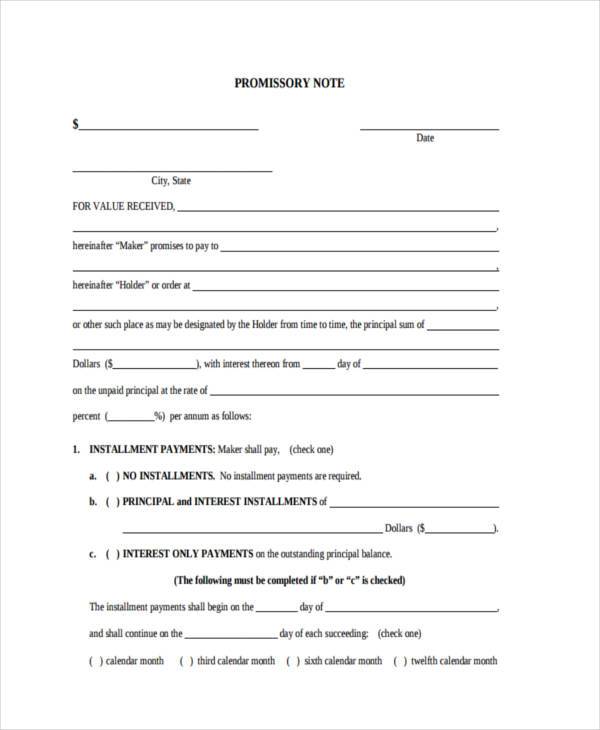

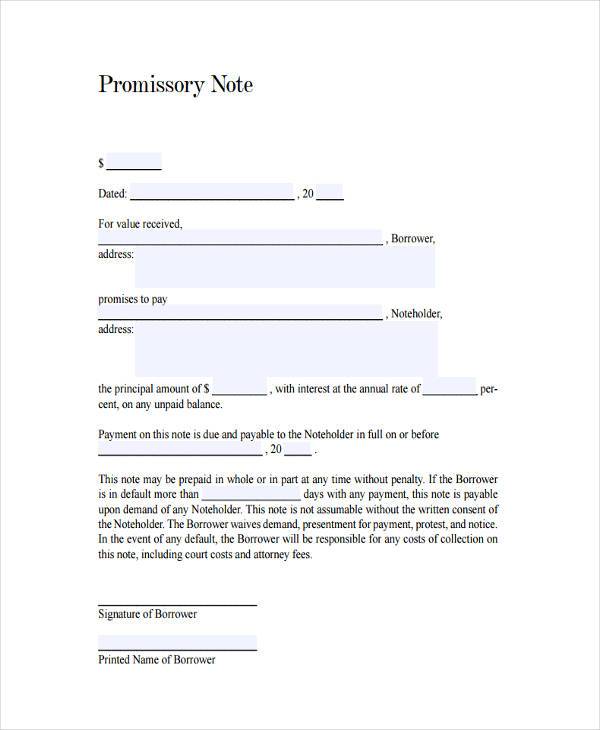

Promissory Note Agreement Format

Promissory Note Date: ___________________________

Due Date: ___________________________

Borrower Information:

- Name: ___________________________

- Address: ___________________________

Lender Information:

- Name: ___________________________

- Address: ___________________________

Loan Details:

- Principal Amount: ___________________________

- Annual Interest Rate: ___________________________%

- Repayment Terms: ___________________________

Signatures:

- Borrower: ___________________________

- Lender: ___________________________

- Witness (if any): ___________________________

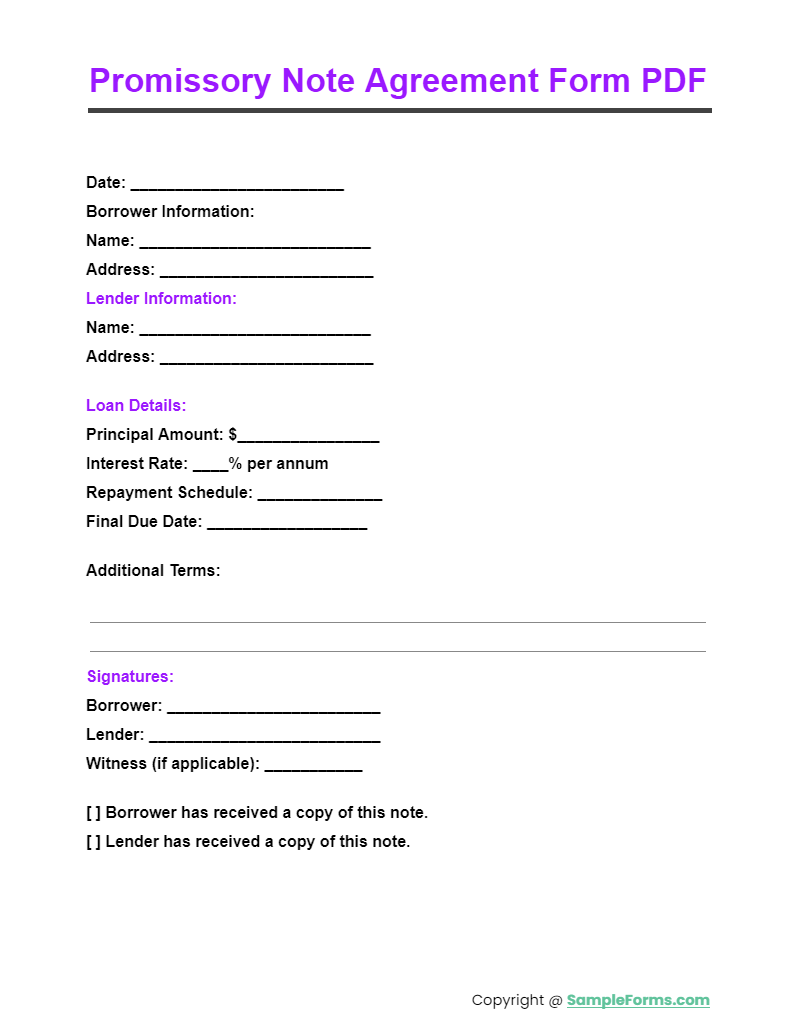

Promissory Note Agreement Form PDF

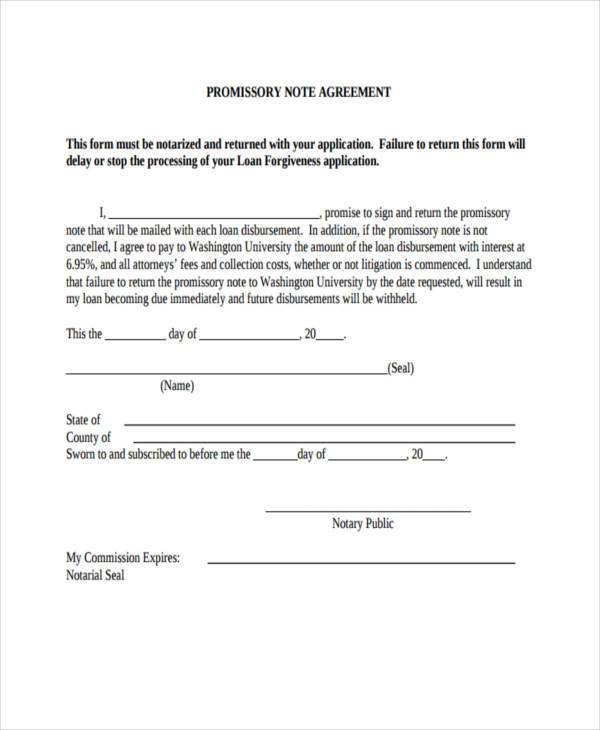

A Promissory Note Agreement Form PDF provides a secure, printable format for financial commitments, ensuring clarity and legality in transactions akin to a Business Agreement Form, fostering professional and clear financial dealings. You may also see Trailer Rental Agreement Form

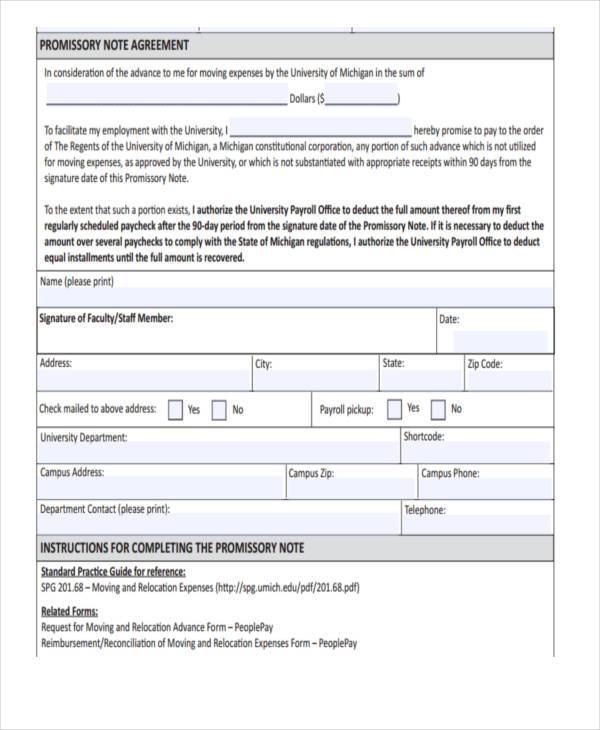

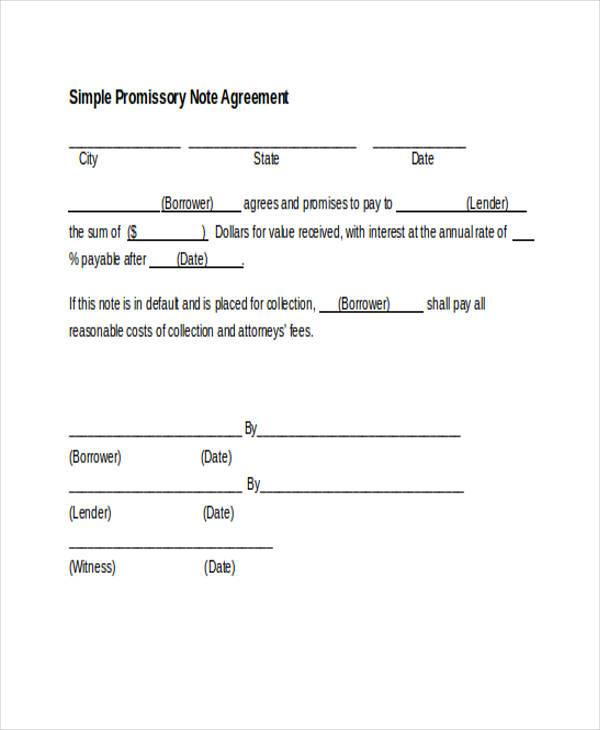

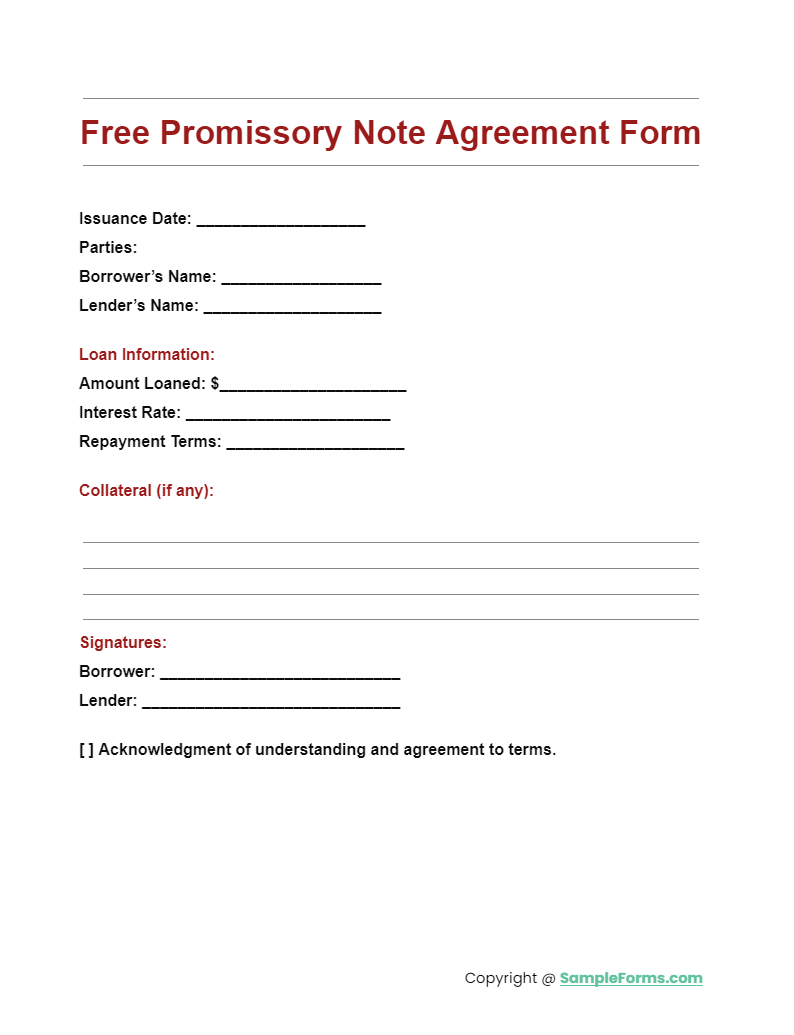

Free Promissory Note Agreement Form

Accessing a Free Promissory Note Agreement Form enables individuals to document loan terms without cost, offering a solution as straightforward as a Lease Agreement Form for securing personal or business loans efficiently. You may also see Rental Lease Agreement Form

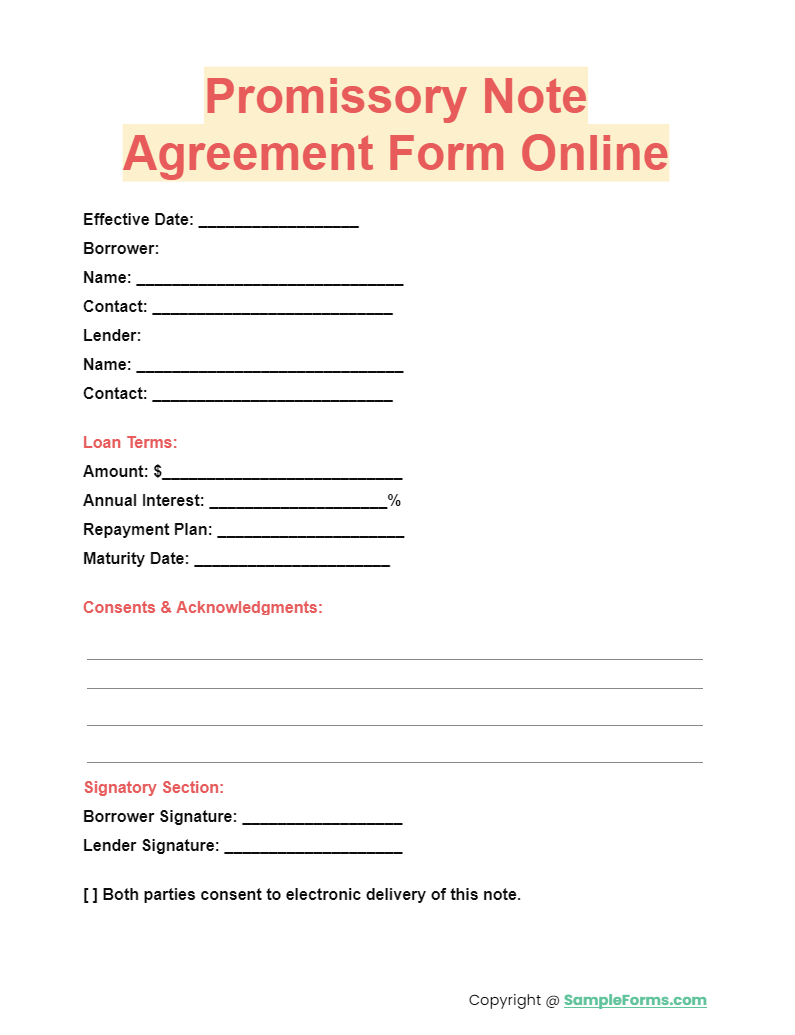

Promissory Note Agreement Form Online

Utilizing an Online Promissory Note Agreement Form streamlines the process of securing loans, offering digital convenience and security on par with the simplicity of a Hold Harmless Agreement Form, ensuring agreements are made swiftly and securely. You may also see Contract Agreement Form.

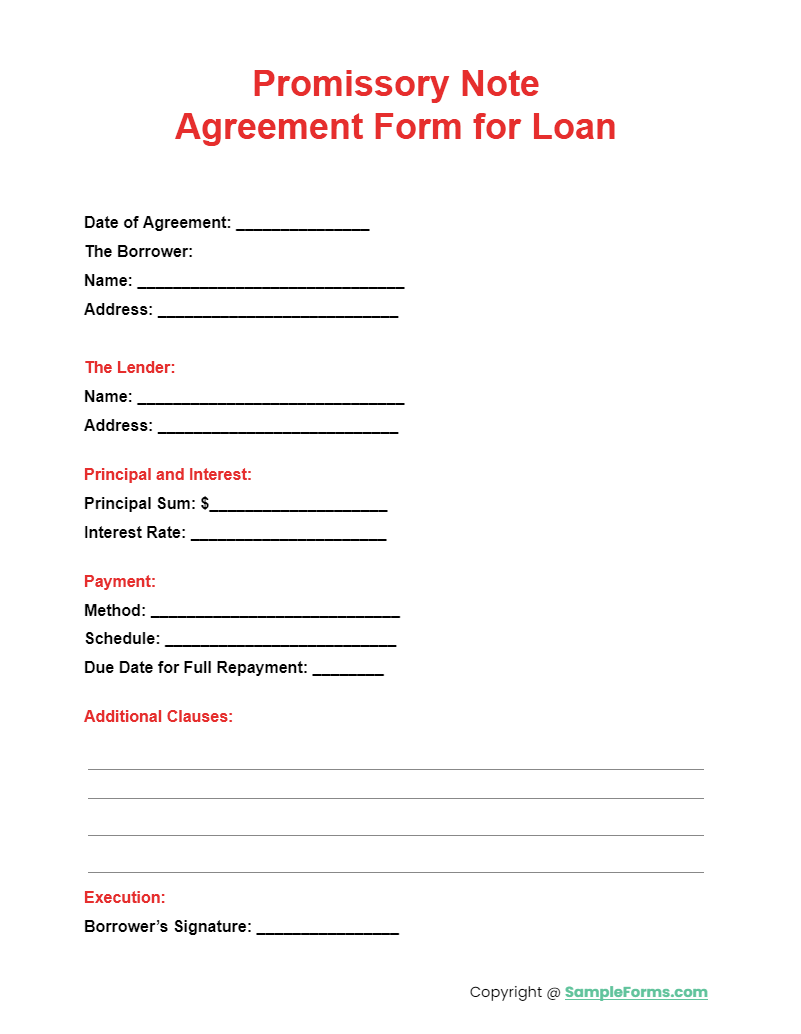

Promissory Note Agreement Form for Loan

More Promissory Note Agreement Form

Free Promissory Note Agreement Form

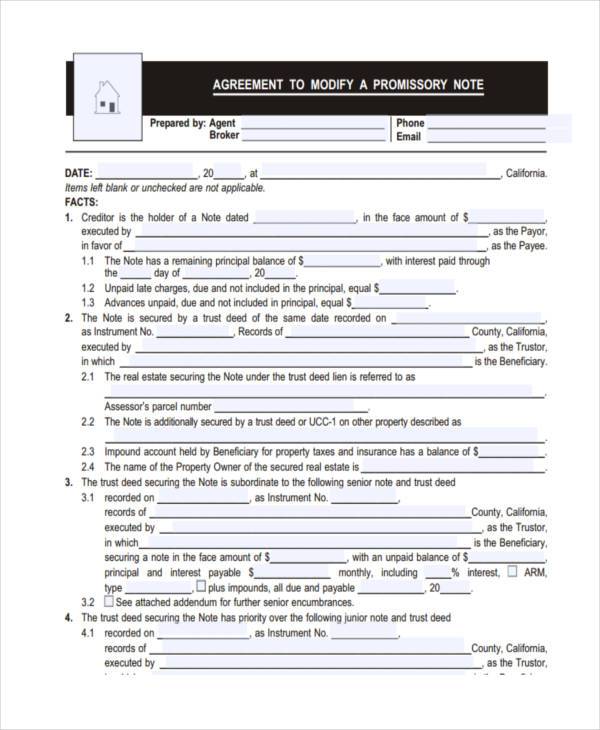

Promissory Note Modification Agreement Form

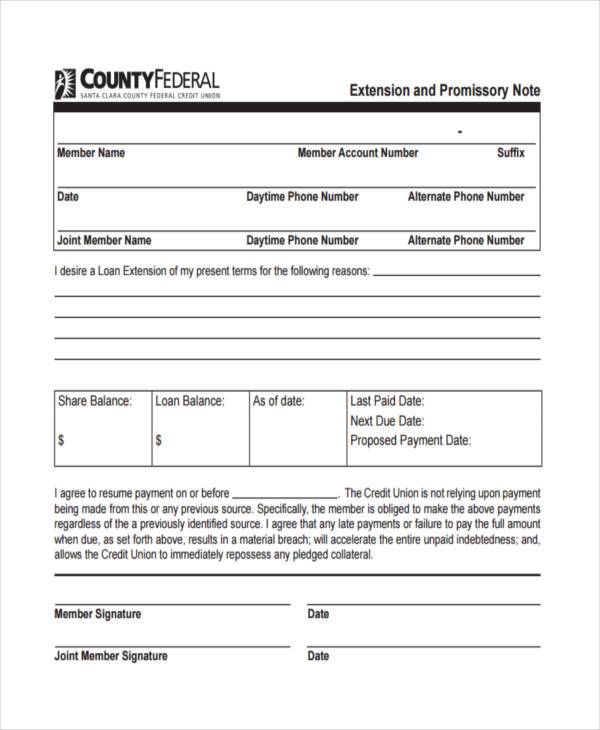

Promissory Note Extension Agreement Form

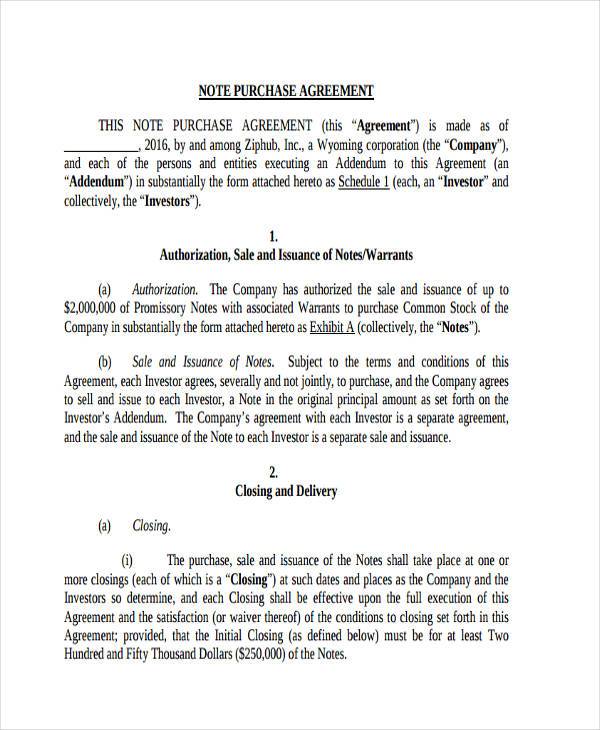

Promissory Note Purchase Agreement Form

Promissory Note Agreement Form PDF

Promissory Note Agreement Form Example

Promissory Note Agreement Form in Word Format

Generic Promissory Note Agreement Form

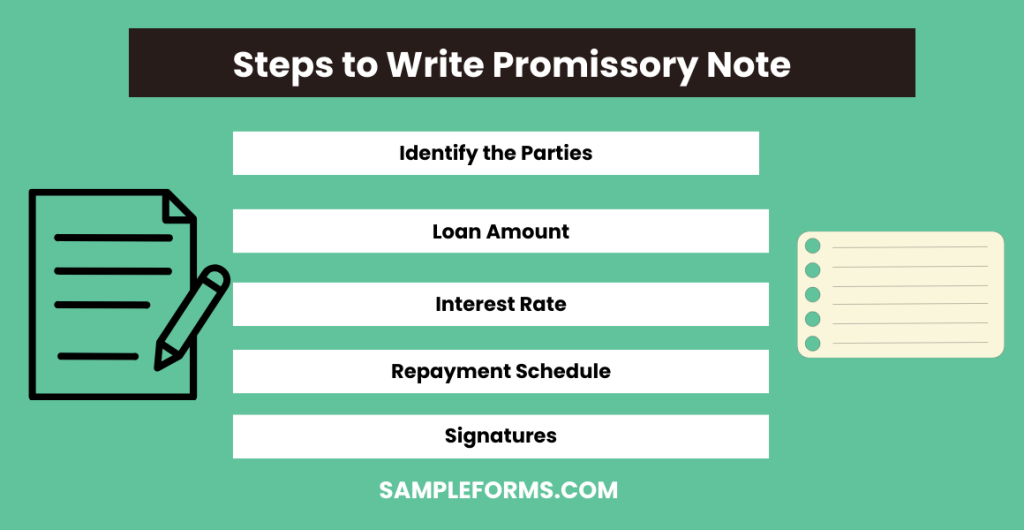

How Do I Write a Simple Promissory Note?

- Identify the Parties: Clearly state the names of the borrower and lender, similar to an Apprenticeship Agreement Form.

- Loan Amount: Specify the principal amount, like setting a price in a Sales Agreement Form.

- Interest Rate: Define the interest rate, if applicable, akin to terms in an Investment Agreement Form.

- Repayment Schedule: Detail the repayment plan, mirroring the structure of a Deposit Agreement Form.

- Signatures: Both parties must sign, ensuring the note’s enforceability, similar to a Employment Agreement Form. You may also see Operating Agreement Form.

What Are Promissory Note Requirements?

- Legal Names: Include full legal names, as you would in a Vendor Agreement Form.

- Amount Borrowed: Clearly state the borrowed amount, akin to a Purchase Agreement Form.

- Payment Terms: Outline repayment terms, similar to conditions in a Sublease Agreement Form.

- Interest Information: Specify interest rates, if any, as detailed in a Joint Venture Agreement Form.

- Signatures: Ensure both parties sign, making it legally binding like a Guarantor Agreement Form.

How Do You Make a Simple Promissory Note?

- Date and Parties: Start with the date and names of both the borrower and lender, akin to a Custody Agreement Form.

- Principal Amount: State the loan’s principal amount clearly, as in a Land Purchase Agreement Form.

- Interest Rate: Detail the interest rate, reflecting terms found in a Confidentiality Agreement Form.

- Repayment Terms: Describe the repayment schedule, similar to a Training Agreement Form.

- Signatures: Finalize with signatures from both parties, legitimizing it like a Prenuptial Agreement Form.

What Must a Promissory Note Contain?

- Principal Amount: Just like a Sales Agreement Form, state the exact amount being borrowed.

- Interest Rate: Similar to a Service Level Agreement Form, include any interest rate applied.

- Maturity Date: Specify when the loan must be repaid in full, akin to a Rental Agreement Form.

- Security Agreement: If applicable, akin to a Financial Agreement Form, detail any collateral securing the loan.

- Signatures: Required for validity, much like a Child Support Agreement Form.

What Happens if a Promissory Note is Not Signed?

- Lack of Enforceability: Without signatures, the note lacks legal enforceability, similar to an unsigned Holding Deposit Agreement Form.

- Proof of Agreement Issue: Proving the existence of the loan agreement becomes challenging, akin to a Assignment Agreement Form without signatures.

- Legal Recourse Limitation: The lender may have limited legal recourse, similar to disputes in an unsigned House Agreement Form.

Do You Record a Promissory Note?

- Document Creation: Create the note, incorporating essential elements like in a Pet Agreement Form.

- Sign and Witness: Ensure both parties sign, possibly in the presence of a witness, as with a Postnuptial Agreement Form.

- Official Recording: Though not always required, consider recording the note with a government body, similar to the registration of a Roommate Agreement Form.

What Happens if a Promissory Note is Not Paid?

- Notice of Default: Issue a formal notice, akin to a breach notification in a Service Level Agreement Form.

- Collection Efforts: Engage in collection efforts, similar to the actions outlined in a Rental Agreement Form for overdue rent.

- Legal Action: Pursue legal action to recover the owed amount, as stipulated in a Construction Agreement Form for breaches.

- Repossession or Foreclosure: If collateral is involved, proceed with repossession, mirroring steps in a Consignment Agreement Form.

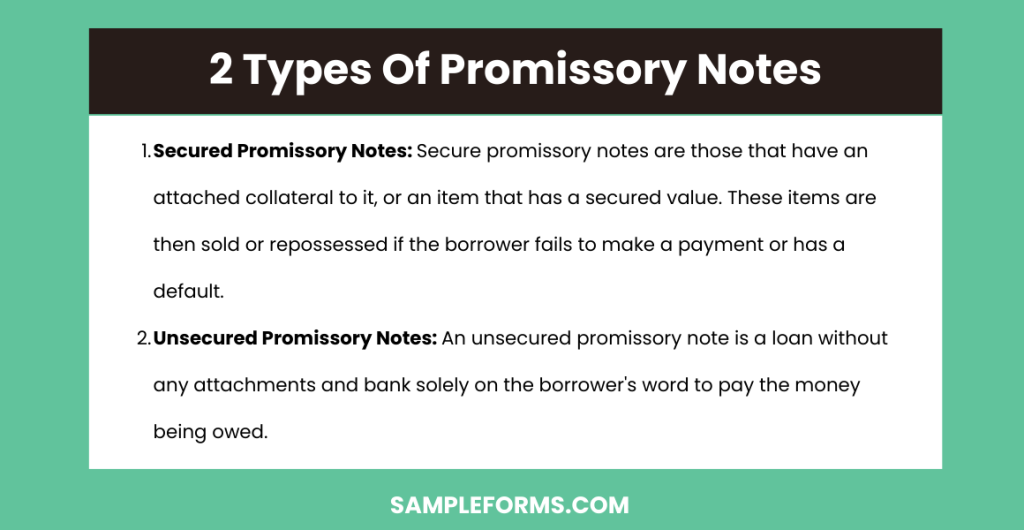

What Are The Types Of Promissory Notes?

Because promissory notes are considered to be a form of a loan agreement contract, their varieties are also synonymous or co-related. Below are the different types of promissory notes:

- Secured Promissory Notes: Secure promissory notes are those that have an attached collateral to it, or an item that has a secured value. These items are then sold or repossessed if the borrower fails to make a payment or has a default. Examples of such loans are mortgages and auto loans wherein the house or the vehicle is taken by the bank if a borrower defaults from payment. You may also see Room Agreement Form

- Unsecured Promissory Notes: An unsecured promissory note is a loan without any attachments and bank solely on the borrower’s word to pay the money being owed. You may also see Non-Compete Agreement Form

What Are The Essential Elements of a Promissory Note?

In most states, a promissory note usually contain the following key information:

- The complete name of the payor or the person who is obligated and promises to pay off the loan.

- The complete name of the payee or the lender. This is the person or the name of the organization who lent the money. You may also see Electrical Subcontractor Agreement Form

- The date of the promissory note that is deemed effective. This is important especially if the loan is to be paid in terms or has an expiration date.

- The amount being owed or the total amount of money that is owed by the borrower. You may also see Parking Agreement Form

- The terms of interest. Although interest rates are regulated by federal and state laws, be sure to check with your state mandated laws. Interest rates can be simple interest or compounded interest among other ways to calculate interest. You may also see Sponsorship Agreement Form

- The installment plan. If the payment of the debt is chunked into installments, the dates or schedules of subsequent payments should be indicated in the form.

- The date wherein the note ends. This date could be amortized and paid off in a series of even and equal payments on a certain date.

- Penalties or fees. Some lenders usually charge late payments while others provide zero interest rates for a period of time, usually for the first 6 months. You may also see Business Purchase Agreement Form

Where Can I Get a Free Promissory Note?

Free promissory notes are available online through financial and legal service websites, similar to finding a Month-to-Month Rental Agreement Form, offering templates tailored to various borrowing needs.

Does a Promissory Note Need to Be Notarized?

Notarization isn’t mandatory for a promissory note to be valid, akin to a Doctor Note. However, notarizing can add legal robustness, making the document more credible in disputes.

Can I Write My Own Promissory Note?

Yes, you can write your own promissory note, much like drafting a Party Wall Agreement Form. Ensure it includes all legal elements: amount, repayment terms, and both parties’ signatures.

How Legally Binding Is a Promissory Note?

A promissory note is legally binding if it contains clear terms of the loan and is signed by both parties, similar to the enforceability of a Commercial Rental Agreement Form.

Can Promissory Note Be on a Plain Paper?

A promissory note can be written on plain paper and still be valid, similar to a Buy-Sell Agreement Form. It’s the content and signatures that confer its legal standing, not the paper type.

Can a Promissory Note Hold Up in Court?

Yes, a properly executed promissory note can hold up in court, akin to a Land Agreement Form. It must clearly outline the loan terms and have signatures from both involved parties.

What Makes a Promissory Note Illegal?

A promissory note becomes illegal if it involves deceit, fraud, or violates state lending laws, similar to the invalidity of a Lottery Syndicate Agreement Form under certain jurisdictions.

Related Posts

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word

-

FREE 5+ Lottery Agreement Forms in PDF | MS Word