A Personal Loan Contract is an agreement between a lender and a borrower for repayment of a loaned amount with interest. A Personal Loan is a loan that you can use for personal uses, which can either be secured or unsecured, depending on whether or not you will provide a collateral. There are various types of Personal Loan Contract Forms with varied terms. See our samples below to get a better idea of how you should draft yours. You may also download our samples and customize them as needed.

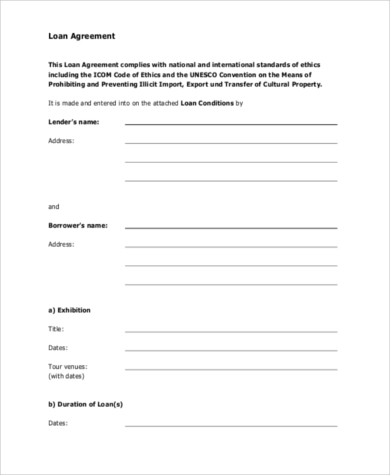

Free Personal Loan Agreement Contract

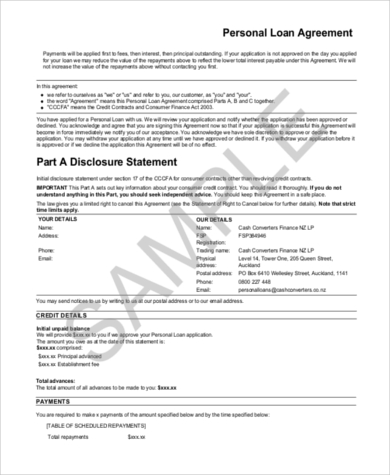

Personal Loan Agreement Contract

Personal Loan Contract Between Friends

Personal Loan Contract PDF

Types of Personal Loan Contracts

- Home Equity Personal Loan: This is for short-term loans that use your home as collateral.

- Pay-day Loan: These are loans that have to be paid back within a week. This usually has high interest rates and possible hidden charges.

- No Credit or Bad Credit Personal Loan: This is for people with limited or bad credit history.

- A Personal Loan can also be secured or unsecured. A secured loan is when the borrower provides a collateral, and an unsecured one is when he doesn’t.

Benefits of Having a Secured Loan

If you own a valuable property that can act as collateral, it would be best to take a secured loan for the following reasons:

- Qualification is easier and faster because you have a collateral.

- You can avail of a lower interest rate. Because you have a collateral, you do not have a high credit risk. Therefore, your interest rate would be lower.

- You can borrow more money, depending on the value of the collateral you will present.

- You may not need a job. Although lending companies would require employment for you to qualify for a loan, you may not need it if you have a good collateral to secure the loan. This is applicable in cases where you lost your job and you need a loan to apply for a new job. You may also see our other Loan Agreement Forms for samples of other types of loans.

Personal Loan Contract Example

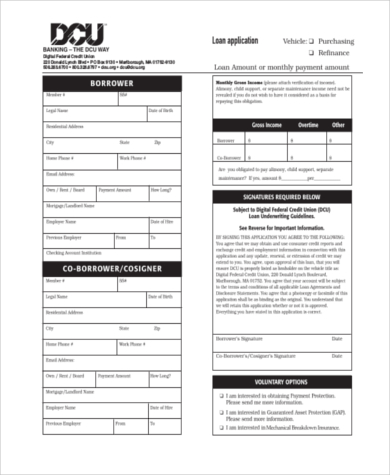

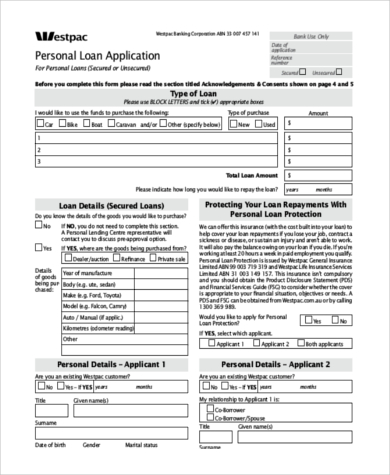

Personal Car Loan Contract

Personal Auto Loan Contract

Personal Loans for Contract Workers

Personal Credit Agreement

Things to Consider before Applying for a Personal Loan

- Your credit score: Before you apply for a loan, check your credit score first. This will help you determine what types of loans you are eligible for. A good credit score is anything above 700. A fair credit score is anything between 650 to 699. A bad credit score is anything below 649. If you have a bad credit score, you may need a collateral for you to acquire the loan.

- Your budget: Calculate your monthly budget by deducting your total expenses from your total income. This will help you determine if you have enough money to pay off the loan.

- The balance of your credit cards: Paying down the outstanding balances on your credit cards can help you improve your credit score and your debt-to-income ratio. These two are factors that lending companies consider if you apply for a loan.

No matter what type of loan you plan to apply for, it is important to make sure that you really need the money and that you have enough room in your budget to pay it off, because having late payments can have a negative impact on your credit score. You may also see our Loan Contract Forms for samples of other types of loans contracts.

Related Posts

-

FREE 31+ Contract Agreement Sample Forms in PDF | MS Word

-

FREE 7+ Sample Deposit Contract Forms in PDF | MS Word

-

FREE 7+ Sample Contract Registration Forms in PDF | MS Word

-

FREE 8+ Sample Agency Contract Forms in PDF | MS Word

-

FREE 7+ Sample Financial Contract Forms in PDF | MS Word

-

FREE 7+ Sample Subcontractor Contract Forms in PDF | MS Word

-

FREE 8+ Sample Sublease Contract Forms in PDF | MS Word

-

FREE 9+ Sample Business Contract Forms in PDF | MS Word

-

FREE 7+ Sample Sponsor Contract Forms in PDF | MS Word

-

FREE 6+ Sample Behavior Contract Forms in PDF | MS Word

-

FREE 8+ Sample Sale Contract Forms in PDF | MS Word

-

FREE 9+ Sample Equipment Contract Forms in PDF | MS Word | Excel

-

FREE 7+ Loan Contract Forms in PDF | MS Word

-

FREE 8+ Sample Loan Contract Forms in PDF | MS Word

-

Contract Termination Letter