Checking your credit history from credit reports allows you to keep track of your spending habits and outstanding debts. It also gives you an idea of your creditworthiness before planning to secure another loan or apply for another credit card. It also allows you to be two steps ahead in planning your next expenditures and effectively managing your finances. Plus, it also informs you and will enable you to immediately address errors, discrepancies, and other red-flags in your account, such as possible identity theft.

What Is A Credit Report

A Credit Report is a record of a person’s credit history. The information inside a credit report are sourced from different financial institutions like banks, credit card companies, collection agencies, and government agencies. When someone decides to borrow money from a specific financial institution, these records are then used to view that person’s credit history. A person’s credit history provides lenders an idea of how much trust should be given to them based on how responsible they are in paying their debts. The purest expression of credit history are Credit Scores.

Credit Report Request Sample Forms

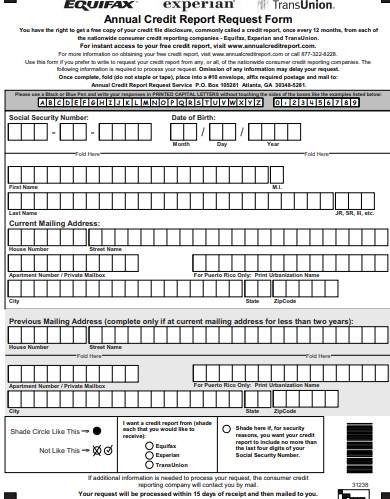

Government Issued Annual Credit Report Request Form

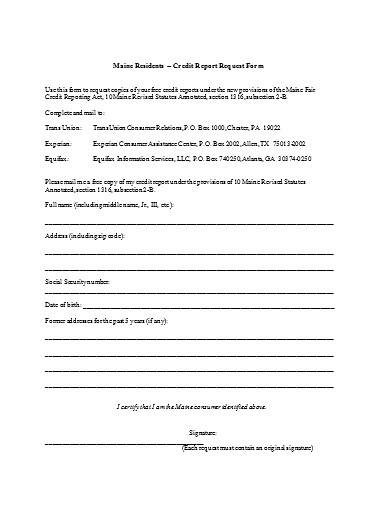

Equifax Credit Report Request Form

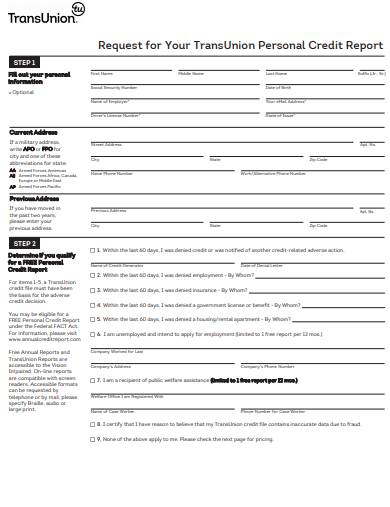

TransUnion Credit History Report Request FormTransUnion Personal Credit Report Request Form

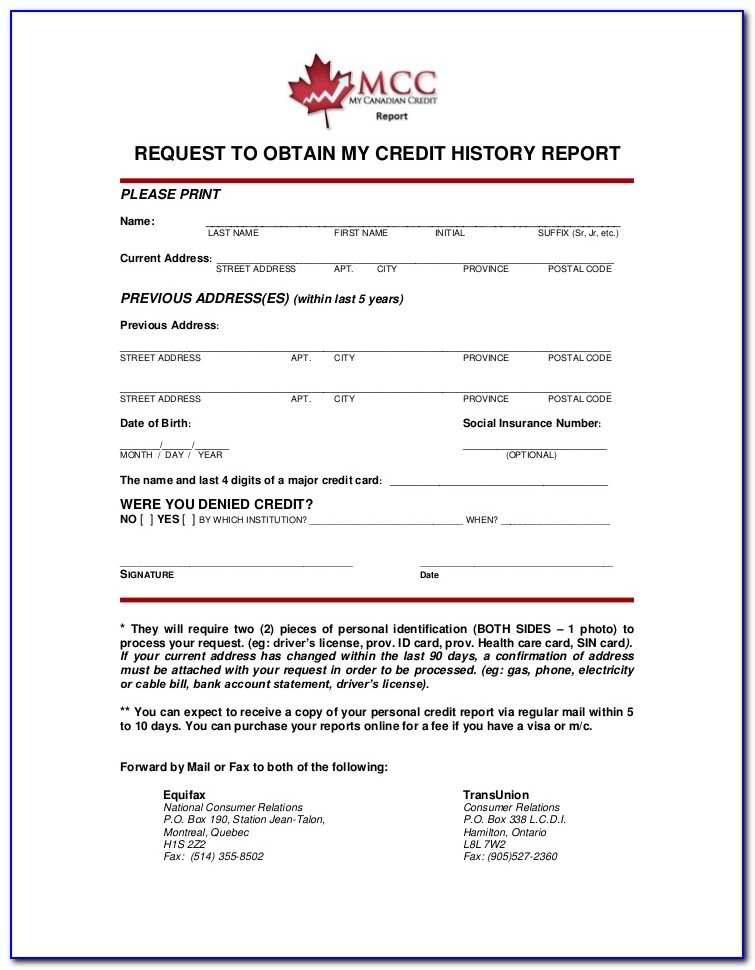

My Canadian Credit History Report Request Form

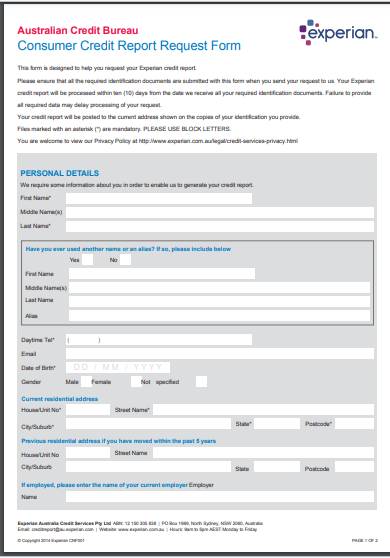

Experian Australia Credit Report Request Form

Credit Report Information Request Form

How To Request A Free Annual Credit Report

Being updated with your credit history prevents you from having unpaid and outstanding debts. Federal law states that annual credit reports be provided to you at your request. Below are the steps on how to request a copy of your annual credit report for free.

Step 1. Secure A Credit Report Request Form

Secure a Credit Report Request Form. The easiest way of securing a Credit Report Request Form is by downloading one online. Obtaining a request form online allows you to instantly fill out forms immediately anytime and anywhere using your computer. Plus, after filling out those request forms, you can easily submit your request online through email.

Step 2. Fill In Personal Information

Once you’ve downloaded a request form, type in your personal information on it. The request form will ask for your name, address, contact details, birth date, and social security number. You might also be asked if your credit application has been denied and which financial institution did you apply. The information above will match your files for identification and verification.

Step 3. Print And Submit Credit Report Request Form

After you’ve filled the request form, you can immediately print it and mail them for submission, or you can submit them through e-mail. You can submit your request to Annual Credit Report Request Service through this address.

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

You can also submit your credit report request to individual Credit Bureaus such as Equifax, Experian, and TransUnion using their Credit Report Request Forms.

Step 4. Review Your Credit Report

Once you’ve received your credit report, review them immediately. Take note of changes in your credit history by using your previous credit reports as reference. Also, be on a constant lookout for any discrepancies, and errors in your credit report. Watch out for other red flags such as possible identity them. In the event of spotting such, report them immediately.

Step 5. File A Credit Dispute In Case Of Errors In The Report.

In case you’ve spotted errors in your credit report, you need to file a credit dispute to your individual Credit Bureaus to address those right away. Submitting a credit dispute doesn’t only correct errors in your credit history, but it also detects potential identity theft.

Regularly requesting a credit report ensures that there are no loose ends in your credit history. Sometimes, people wouldn’t won’t even bother to submit a request for a credit report due to the length and wordiness of its content. The most simple representation of your credit-worthiness are reflected in credit scores. A credit score informs you right away of your solvency and financial stability. Credit scores are not included in your credit report and will have to be requested separately from your individual credit bureaus.

What Are Credit Scores

Credit Scores is the most straightforward representation of your creditworthiness and credit history. Usually written in three-digit numbers ranging from 301 to 850. These scores are based on credit reports from information sourced from Credit Bureaus. Financial institutions use your credit scores to evaluate the risk of lending you money and make up for losses from bad debt. Your Credit Score affects the chance of securing a loan, getting that dream car, and even having your credit card application approved when applying for a new one.

Tips On How To Maintain A Good Credit Score

Purchasing everything on credit is the most convenient way of getting hold of what we want and need. But sometimes, such convenience also has its drawbacks like maxing out our credit limit due to overspending. Such often result in unpaid debts which meant bad credit scores. To prevent this, down below are tips on how to maintain a good credit score.

- Never Spend More Than You Can Afford. Overspending leads to a lot of problems. Yes, we know it’s hard to resist the temptation that Black Friday and Cyber Monday brings. By putting a sturdy leash on your spending habits, you not only prevent yourself from maxing out your card’s credit limit but you also saved yourself from potential insolvency.

- Prioritize Needs More Than Wants. Knowing the difference between your wants and needs allows you to refine your spending habits by shedding off excess weight from your lifestyle. Put more emphasis on the essentials in your next shopping list. Doing so not only saves you a lot of money, but it also saves you from the clutter and mess in your home.

- Regularly Check Your Credit History. Knowing how much you’ve spent and where you spent it on enables you to plan your future spendings wisely. Always make checking your credit history a habit. Report any errors if you find one in it.

Related Posts

-

Credit Report Dispute Letter

-

Accommodation Request Form

-

Transportation Request Form

-

FREE 8+ Handling Request Forms in PDF | MS Word

-

FREE 6+ Expedite Service Request Forms in PDF | MS Word

-

FREE 10+ Copy Request Forms in PDF | MS Word

-

FREE 9+ Certification Request Forms in PDF | MS Word

-

FREE 6+ IT Service Request Forms in PDF | MS Word

-

Testimonial Request Form

-

FREE 13+ Customer Request Forms in PDF | MS Word | Excel

-

FREE 11+ Holiday Request Forms in PDF | MS Word | Excel

-

FREE 10+ Expense Request Forms in PDF | MS Word | Excel

-

FREE 8+ Support Request Forms in PDF | MS Word

-

FREE 8+ Budget Transfer Forms in PDF | Excel

-

FREE 14+ Schedule Adjustment Forms in PDF | MS Word