Alongside Payroll Forms, a payroll is an organization’s full record of the employees’ salaries, bonuses, net pay, deductions, and other related details. The payroll is the sum of the documents of employee salaries, bonuses, and deductions. It specifies the amount given to workers for the work they have done over a period of time, and it is vitally beneficial to them.

Employees can be and are generally wary of inaccuracies and inconsistencies, so the company should dole out payroll correctly and on time with the necessary deductions. They must also ensure that any withholdings and deductions are calculated and submiitted appropriately.

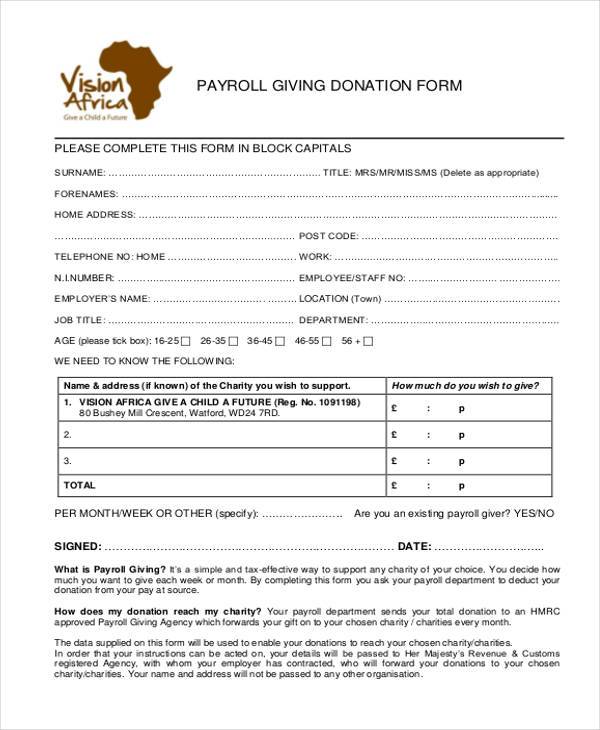

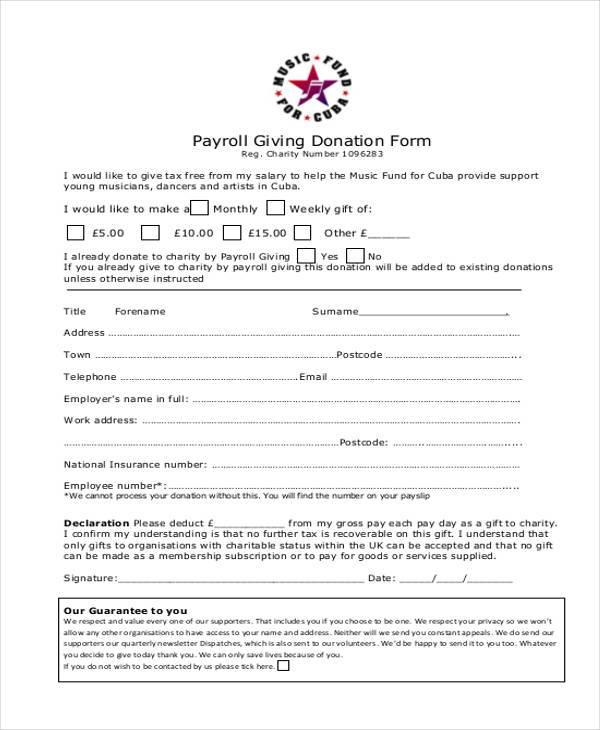

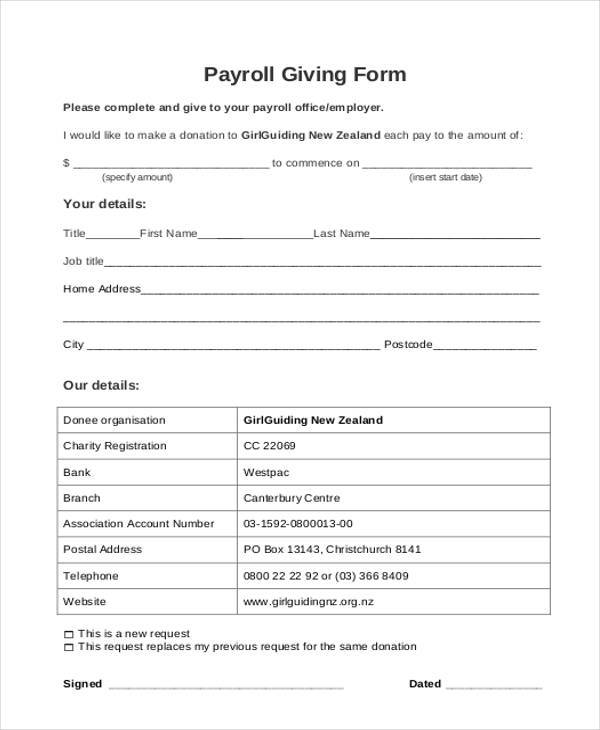

Payroll Giving Donation Form

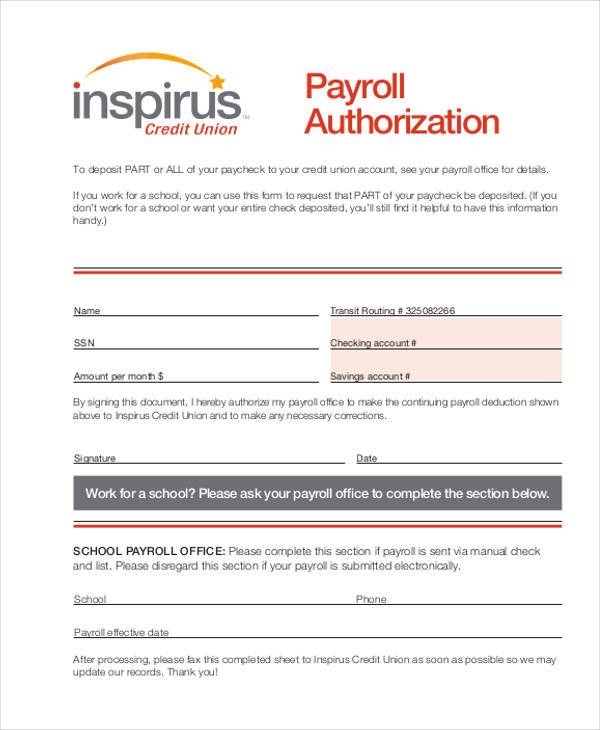

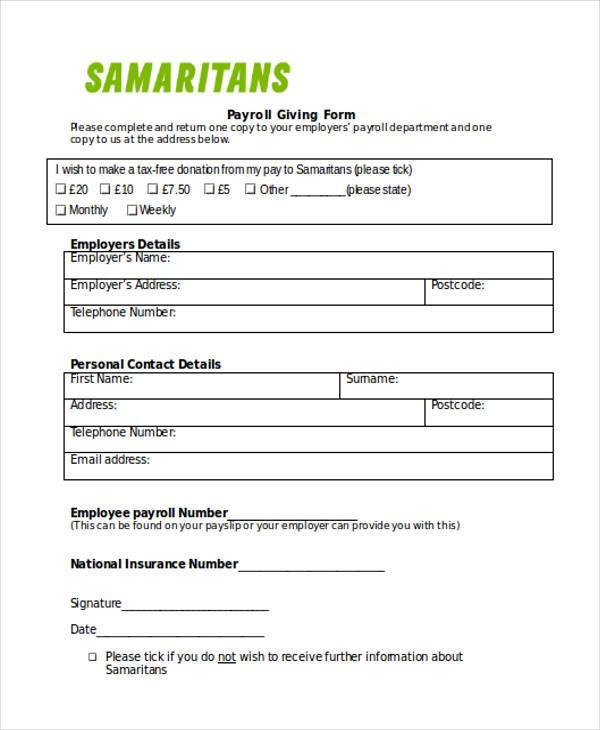

Payroll Giving Authorization Form

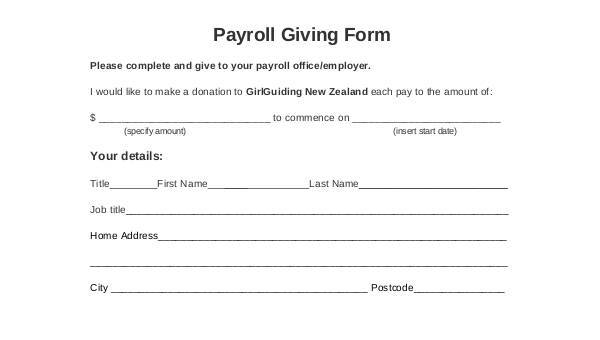

Payroll Giving Form in PDF

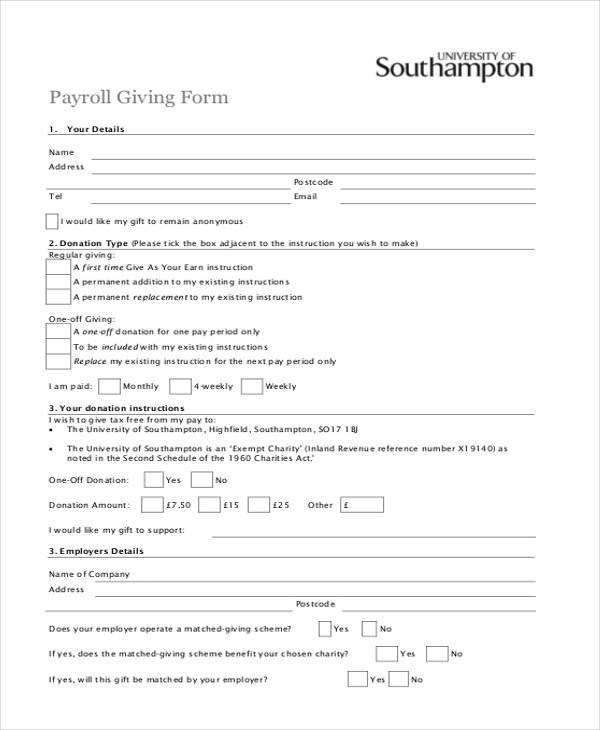

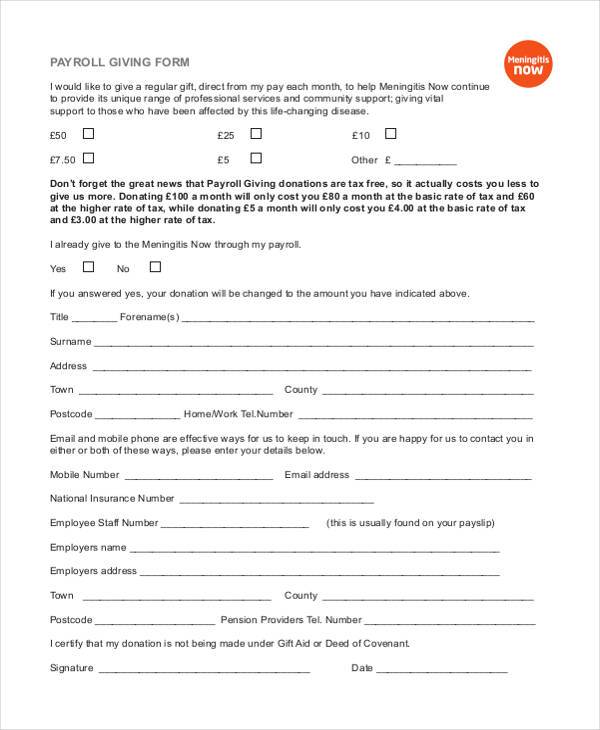

Free Payroll Giving Donation Form

Payroll Giving Application Form

Payroll Register Forms comes in two forms: electronic and physical. A payroll register is a document that lists the total information from each payroll (the total gross pay, each deduction type, and net pay), and should be on that register. The calculation for each individual employee for total gross pay, each deduction type, and net pay is recorded in an employee earnings record and the totals from employee earnings for the pay period are the references of the totals in the register. A payroll register is usually part of an online accounting software package or online payroll application.

The payroll register may be used as a supplemental paper work or as a special journal. When the company places money into the payroll account, a deposit appears in the register. Each paycheck printed and given to an employee appears as a separate item in the register. Each line item includes the current balance of the payroll checking account. The register records any tax deductions that are made from the gross pay. In the event that other deductions are made, such as for a national health system or some other type of government-sponsored retirement program, those figures are also listed.

Payroll Giving Form in Doc

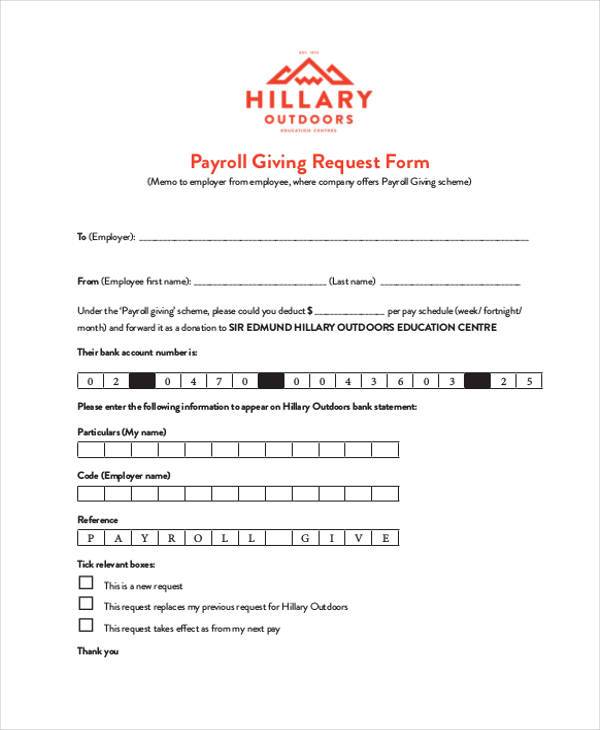

Payroll Giving Request Form

New Payroll Giving Form

Payroll Giving Form Example

The Payroll Deduction Form usually comes with payroll deduction (the mount withheld by an employer from an employee’s earnings) and is expected to include Social Security contributions, income tax, pension fund contributions, group insurance, association dues, child support payments, wage assignments, uniform dues, etc. Despite that, all other subtracted amounts are non-compulsory. Regardless of how many hours an employee has worked, payroll deductions must be retained from checks. In the event that no subtractions are retained, the employer becomes liable for any mandated amounts that were supposed to be withheld, which means the payment of deductions or the cancellation of the insurance policy altogether.

We assure you that we have a collection of payroll forms and all other forms related to it. Moreover, our website is so easy to use that even the least of tech-savvy individuals will have little trouble making sense of it. We do not sell these forms, nor will we ever. If I were you, I would grab this chance.

All the forms here are at your disposal. Do not worry about anything as long as you know what you’re looking for and your printer is in good shape. Go ahead and download as many as you want, but of course, make sure you will use them for the right purposes.

Related Posts

-

FREE 10+ Sample Payroll Register Forms in PDF | Excel

-

FREE 8+ Sample HR Payroll Forms in PDF | Word | Excel

-

FREE 8+ Sample Payroll Tax Forms in PDF | Excel | MS Word

-

FREE 9+ Sample Certified Payroll Forms in PDF | Excel | Word

-

FREE 9+ Sample Payroll Remittance Forms in PDF | Excel

-

Payroll Advance Form

-

Payroll Deduction Form