Banks and other businesses that deals with finances have varying instructions for deposit transactions. Some financing agencies allow deposits to be transferred directly to the account of their organization while some require their clients to use a specified form manually.

Deposit Forms are not only for depositing an amount of cash but also for opening a bank account, changing an account’s information, and for helping the State’s Library in keeping records which involve monetary transactions between parties. The financing agencies and banks require a critical step in the verification of deposit forms to assure that the applicant or the account-holder is using the exact and correct information which he wrote and stated on the document.

Term Deposit Forms

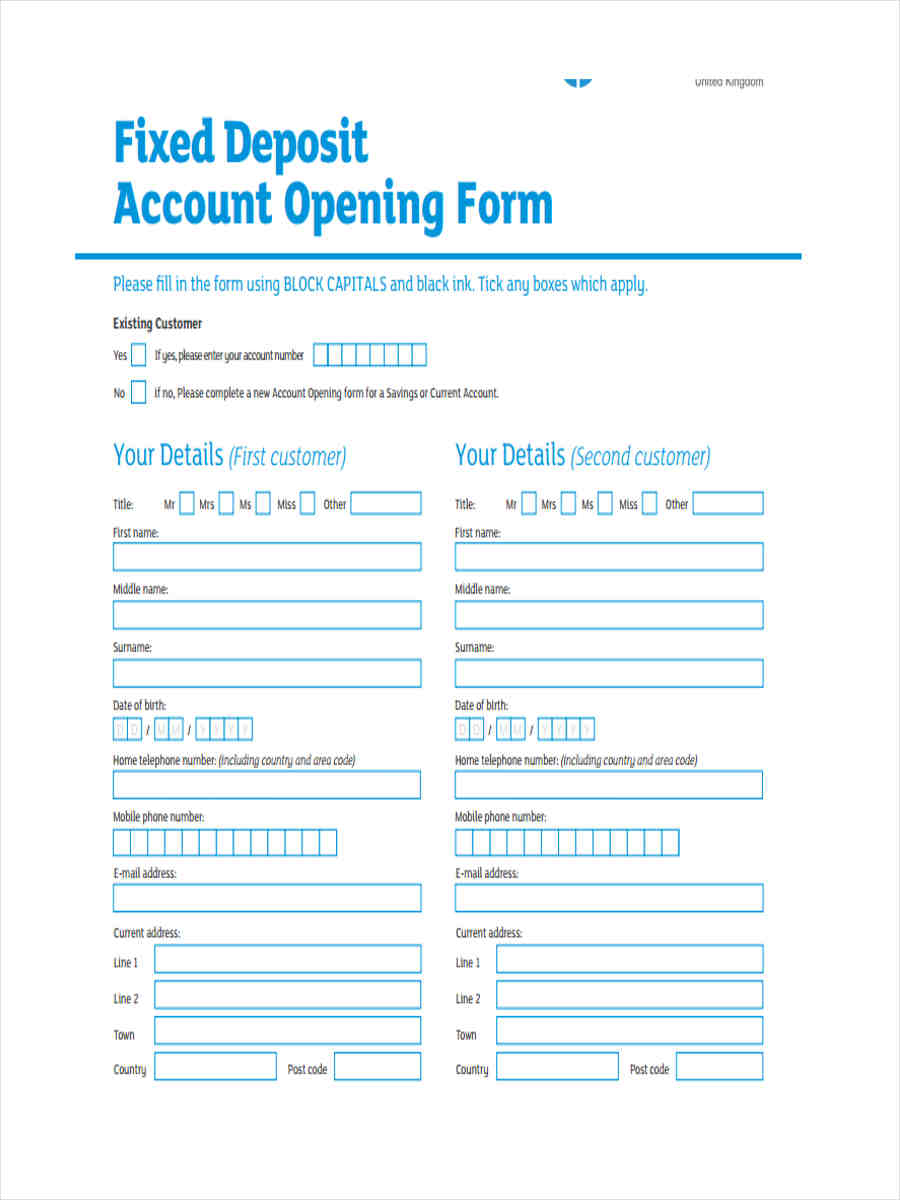

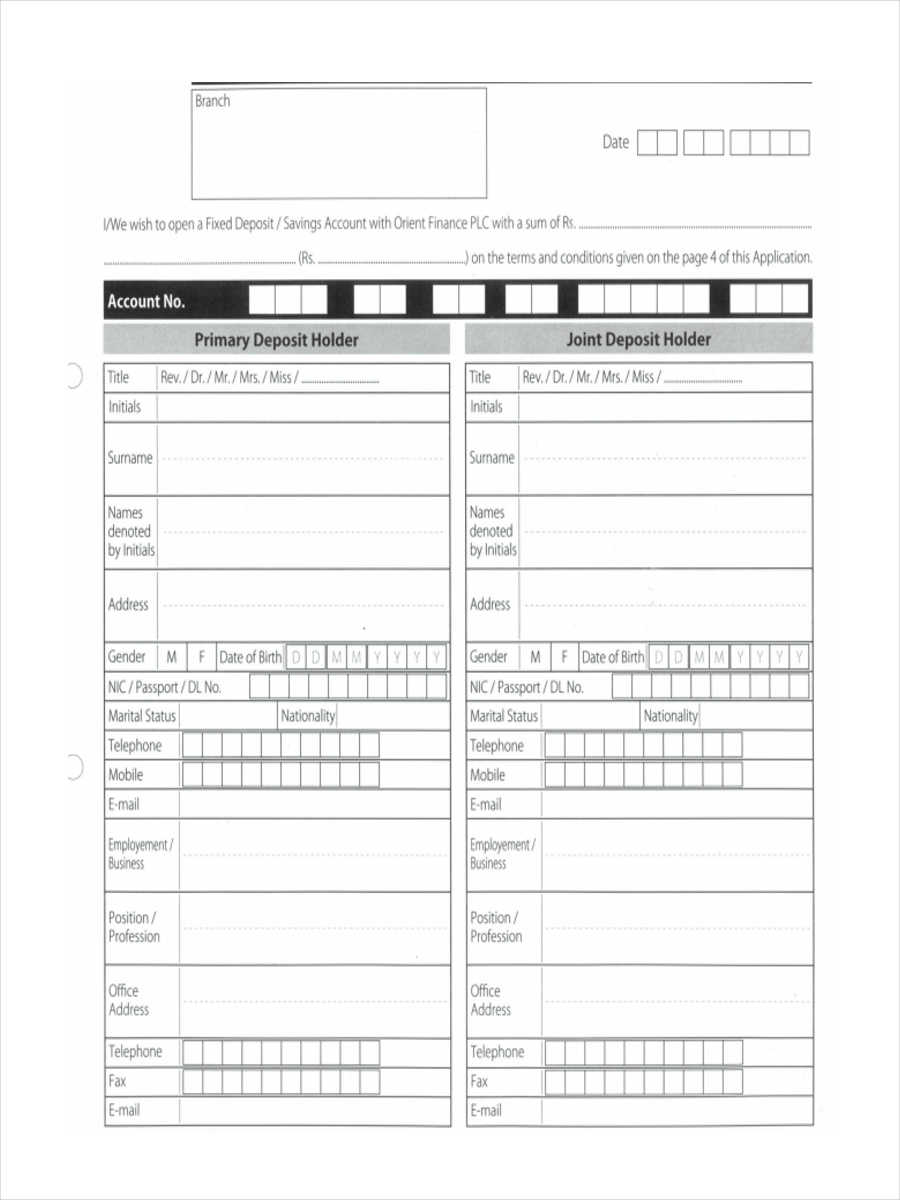

Term Deposit Account Opening

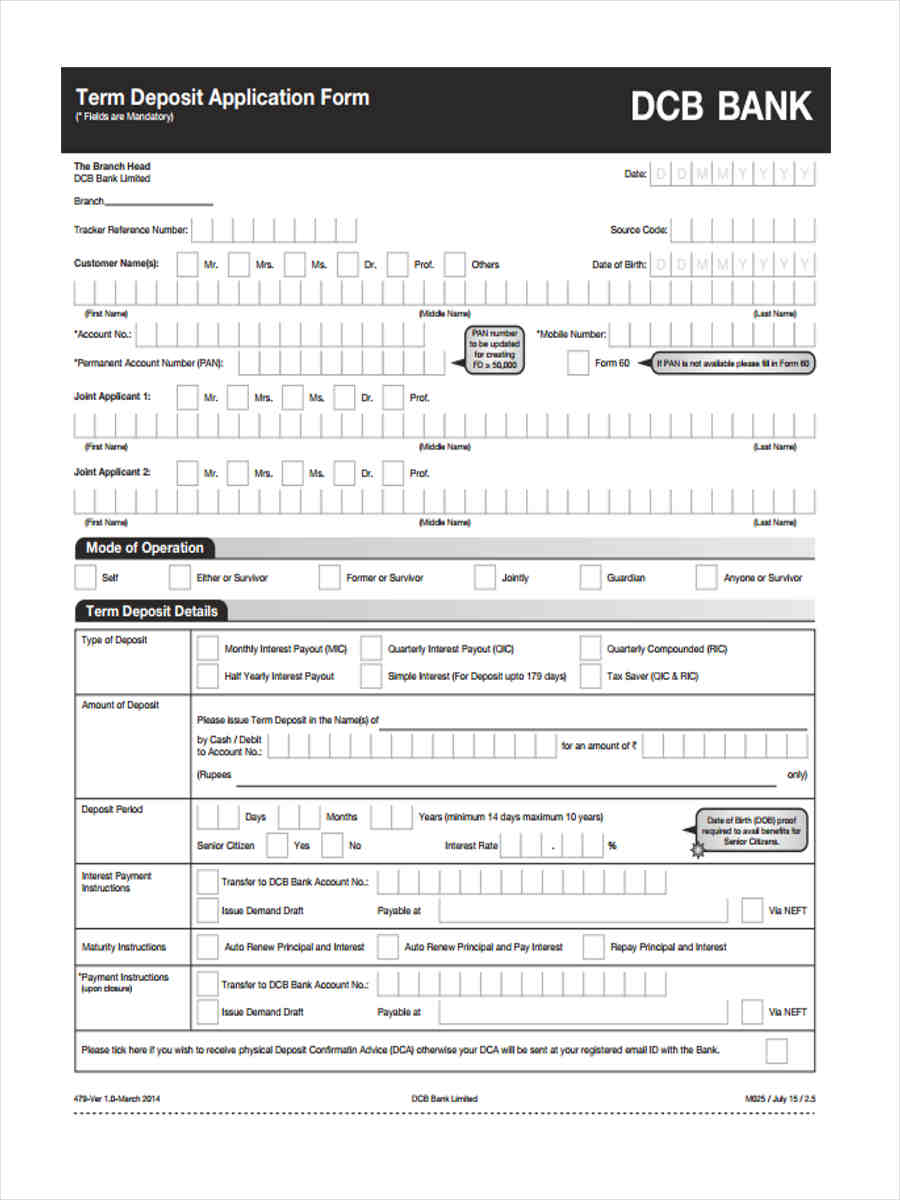

Term Deposit Application

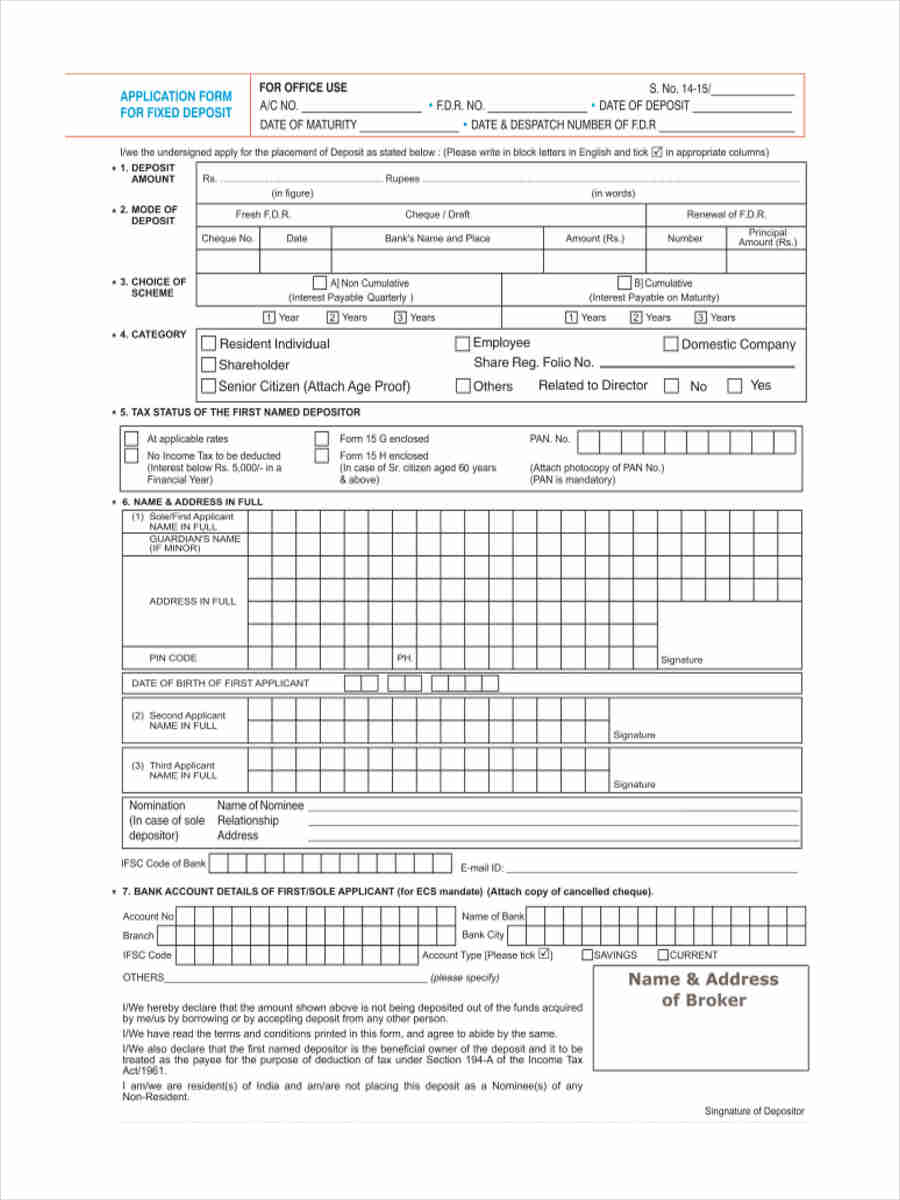

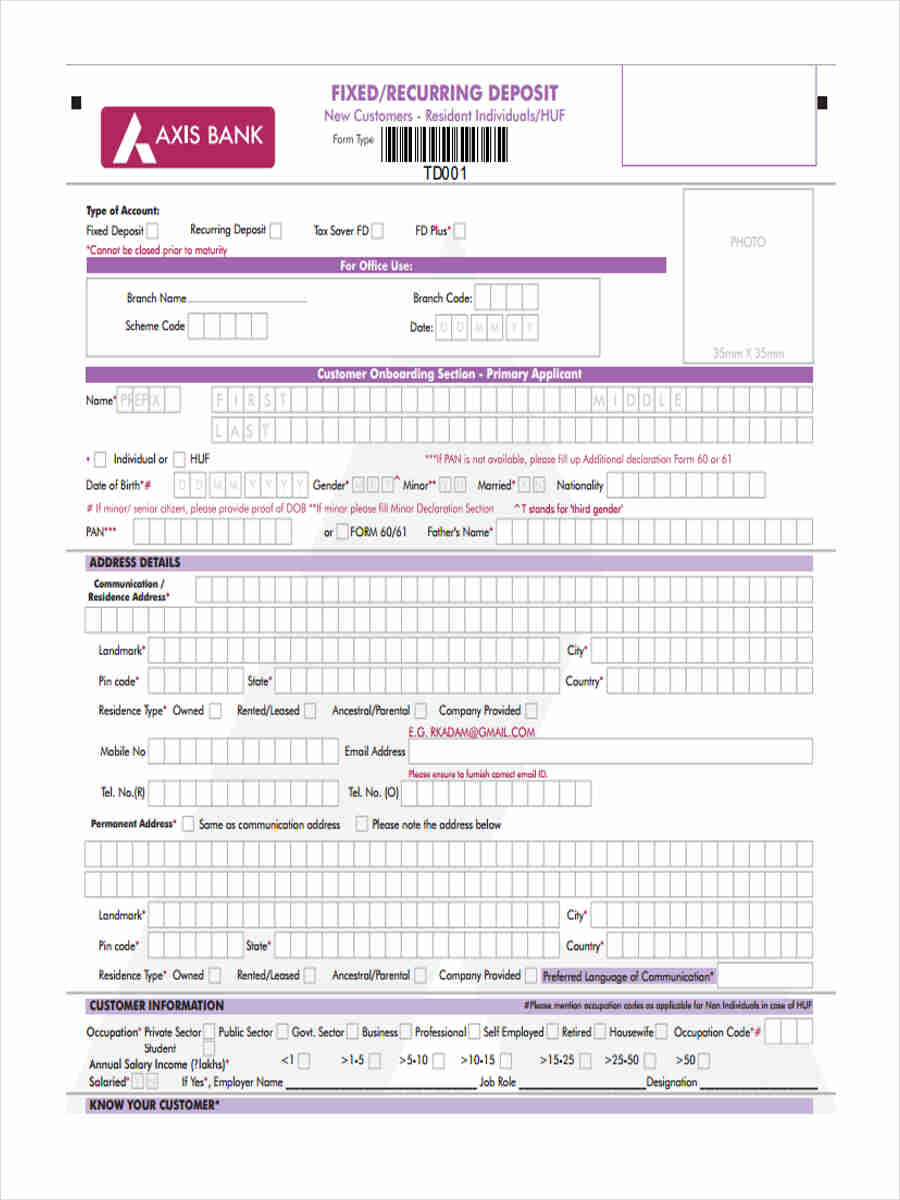

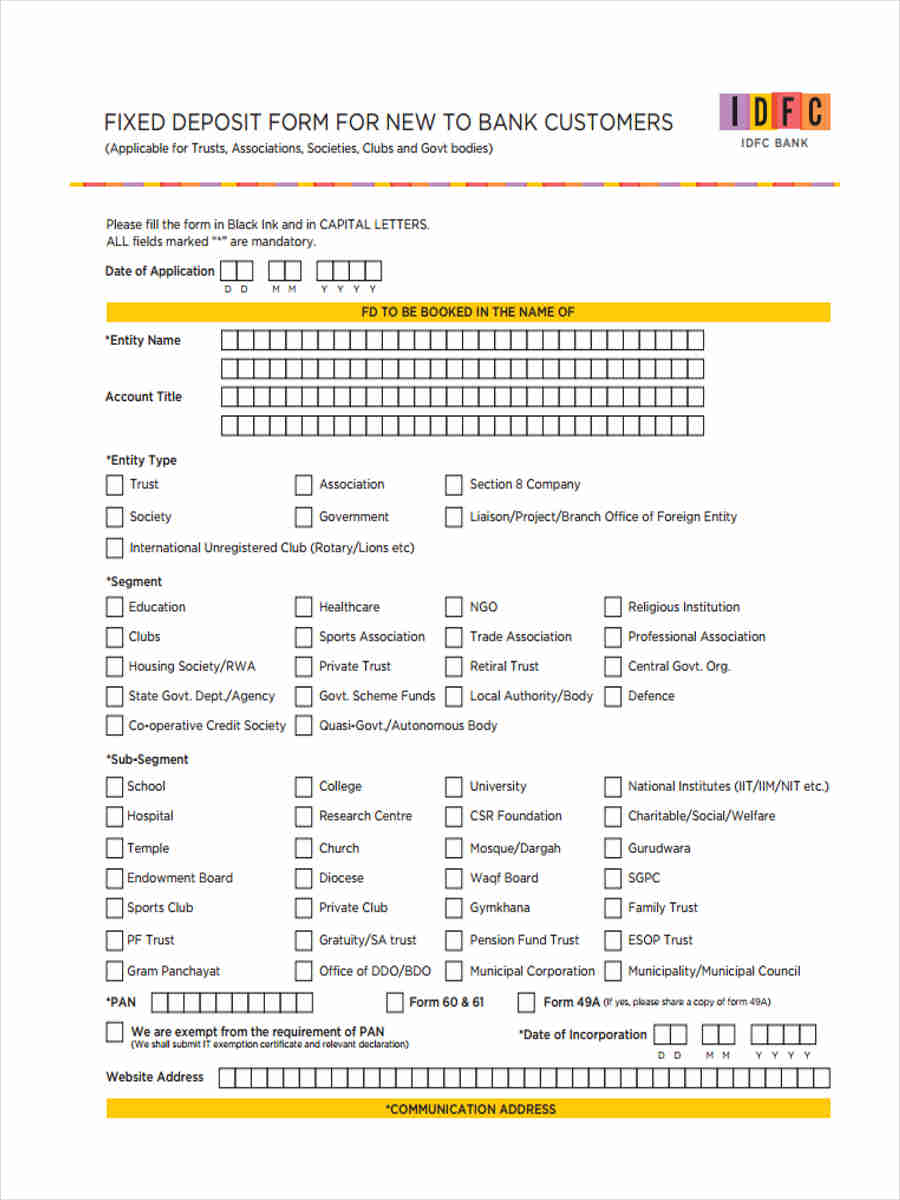

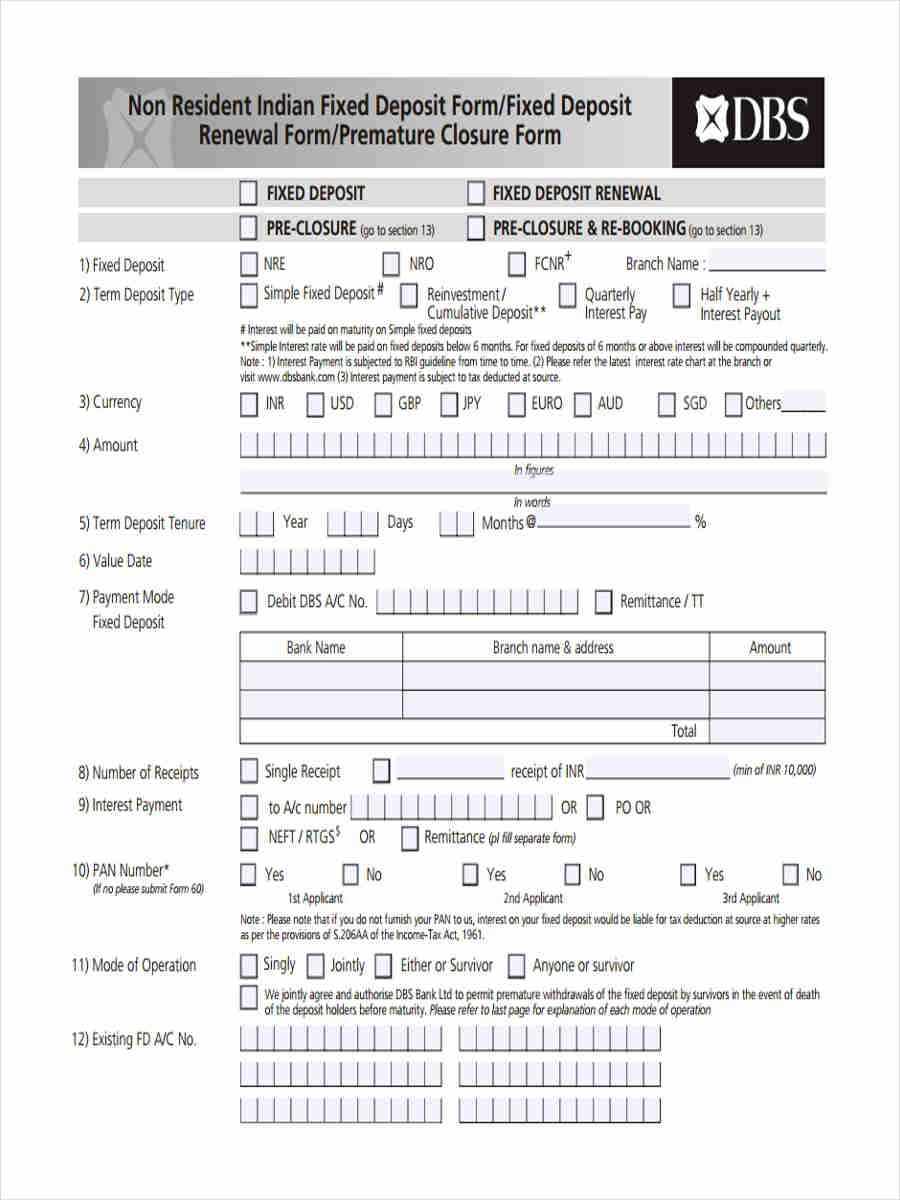

Fixed Deposit Forms

Fixed Deposit Scheme

Fixed Deposit Application

Fixed Deposit Account Opening

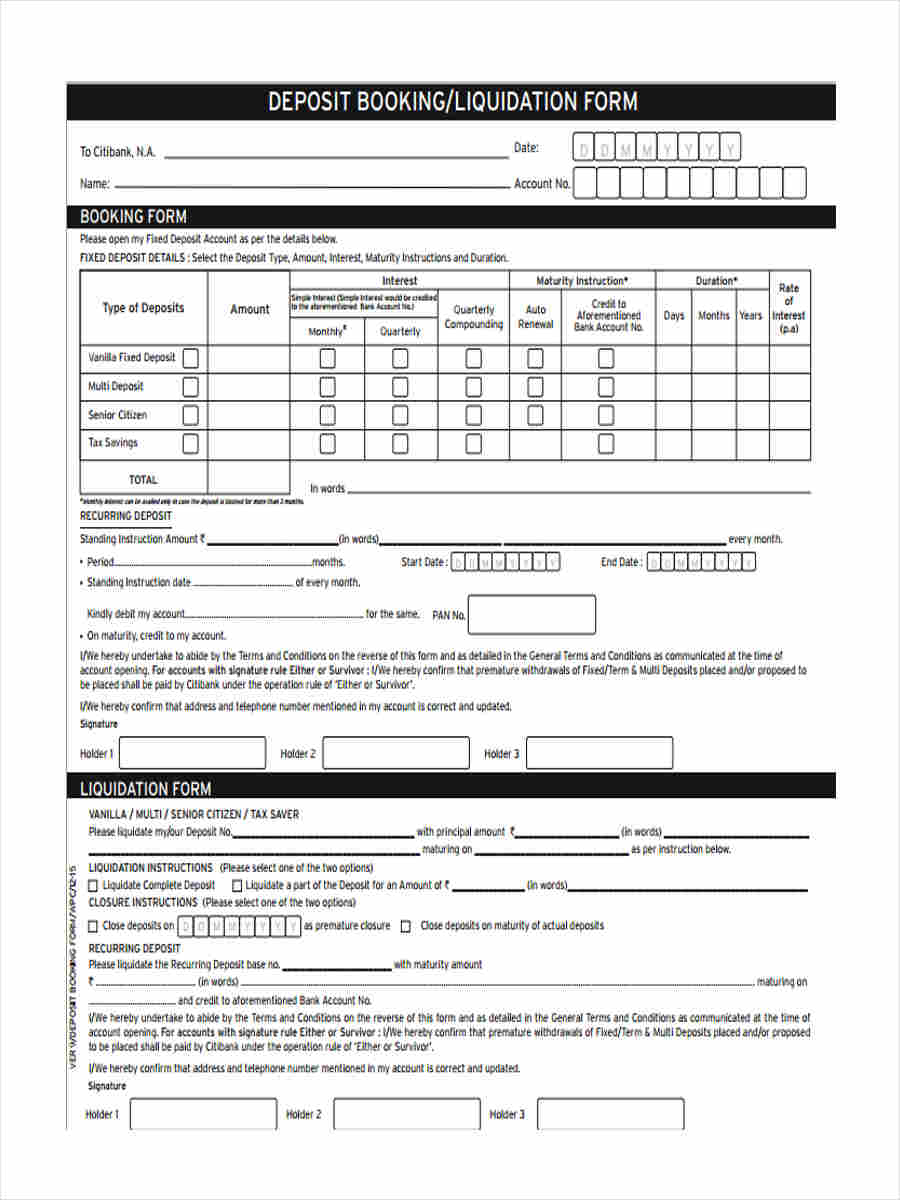

Fixed Deposit Booking

Deposit Booking Liquidation

What Is a Recurring Deposit?

A Recurring Deposit is a type of time deposit evidently used in India that allows any individual with an income to have a fixed amount to be deposited on a monthly basis. This form of depositing scheme gives privileges to those who are earning a minimum income yet aims to attain an increase in their savings using the interest associated with the recurring deposit within specific periods of time. Compared to a fixed deposit, the recurring deposit can be withdrawn before its maturity date.

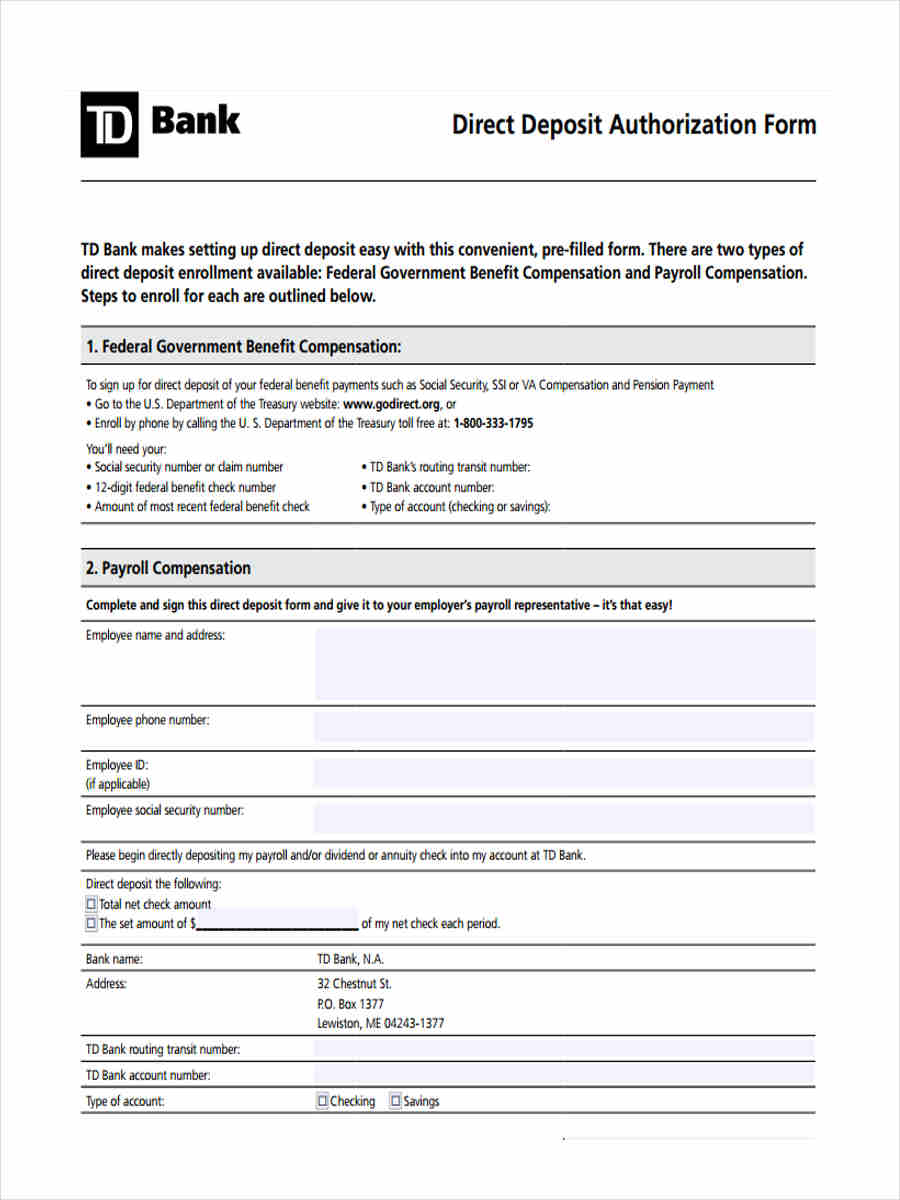

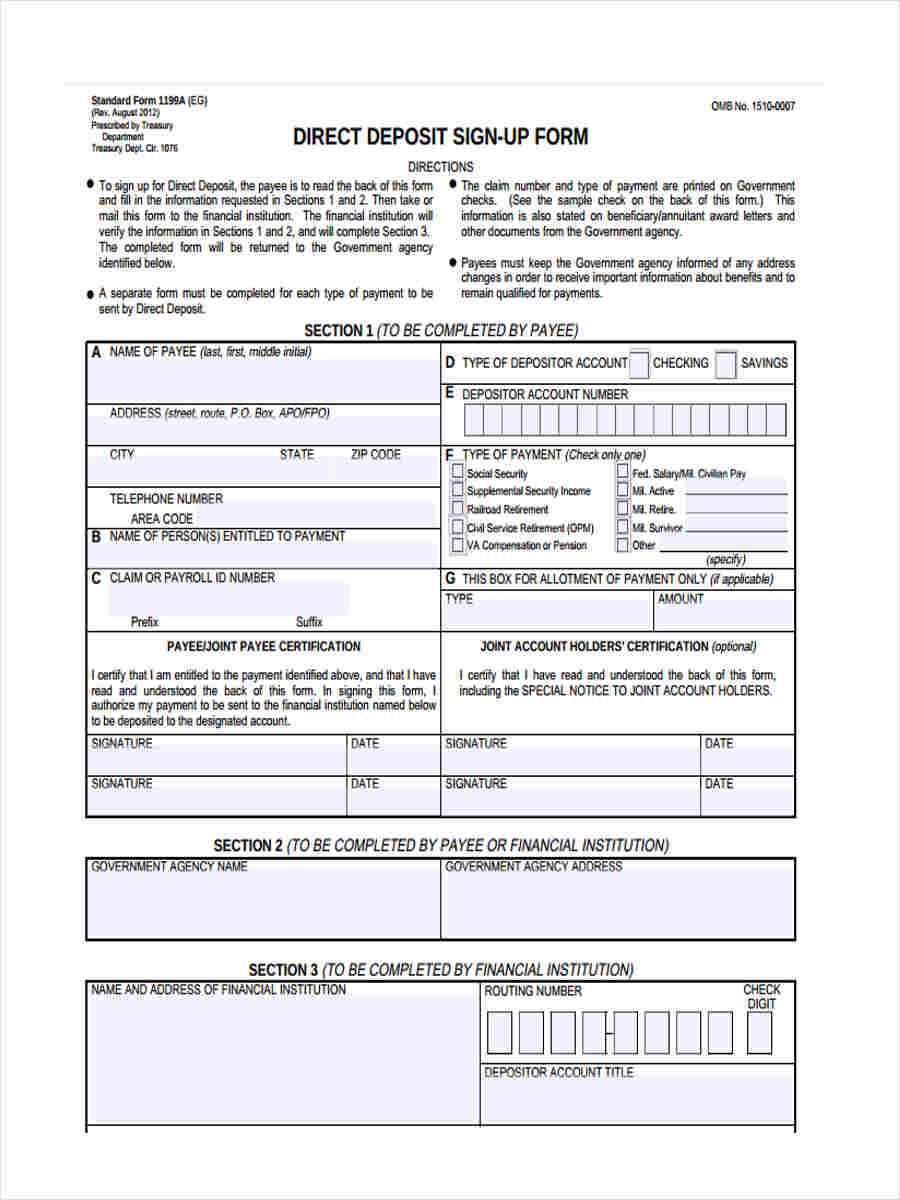

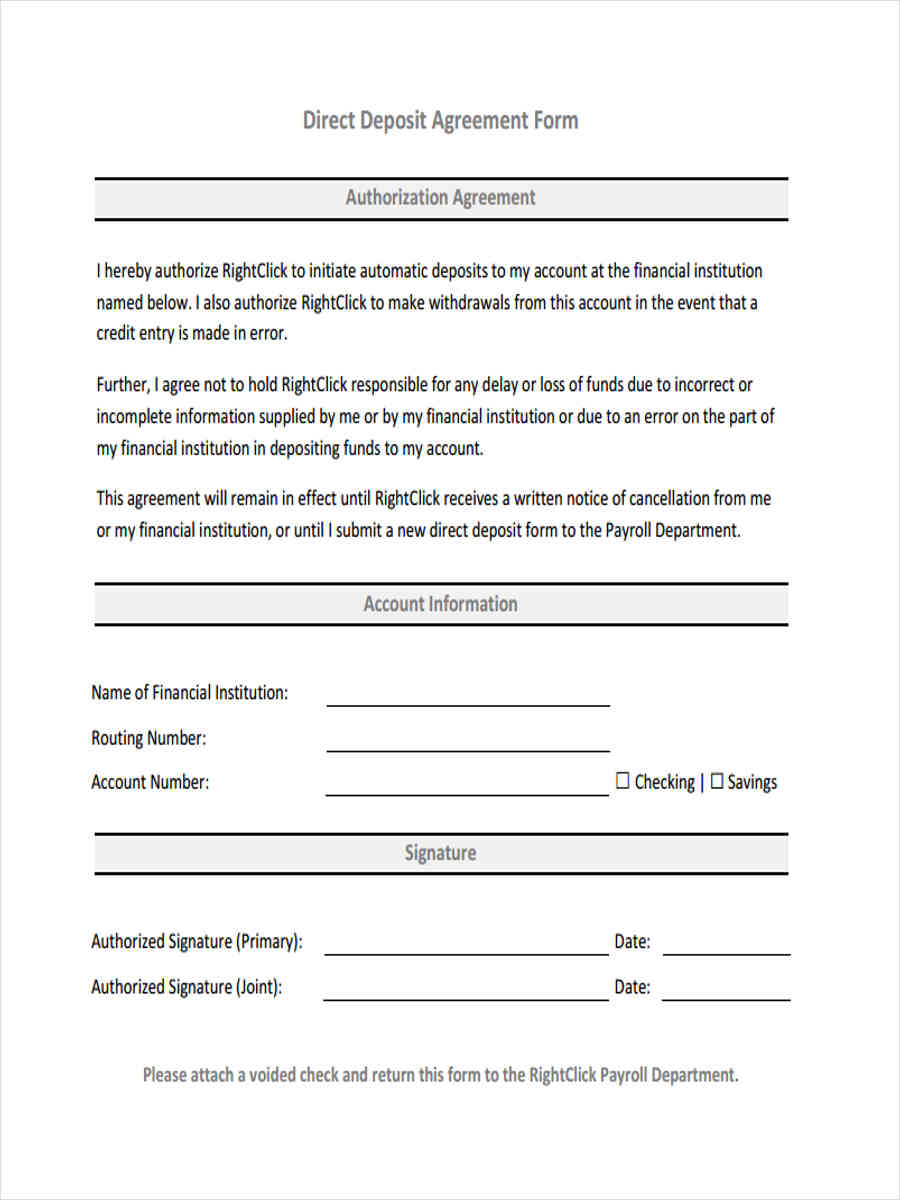

Another type of deposit scheme is a Direct Deposit wherein an individual can directly send an amount of money electronically through banks to the recipient’s account. This requires the use of a Direct Deposit Form which has the information regarding the transaction and account details of both parties.

How to Fill Out a Direct Deposit Form

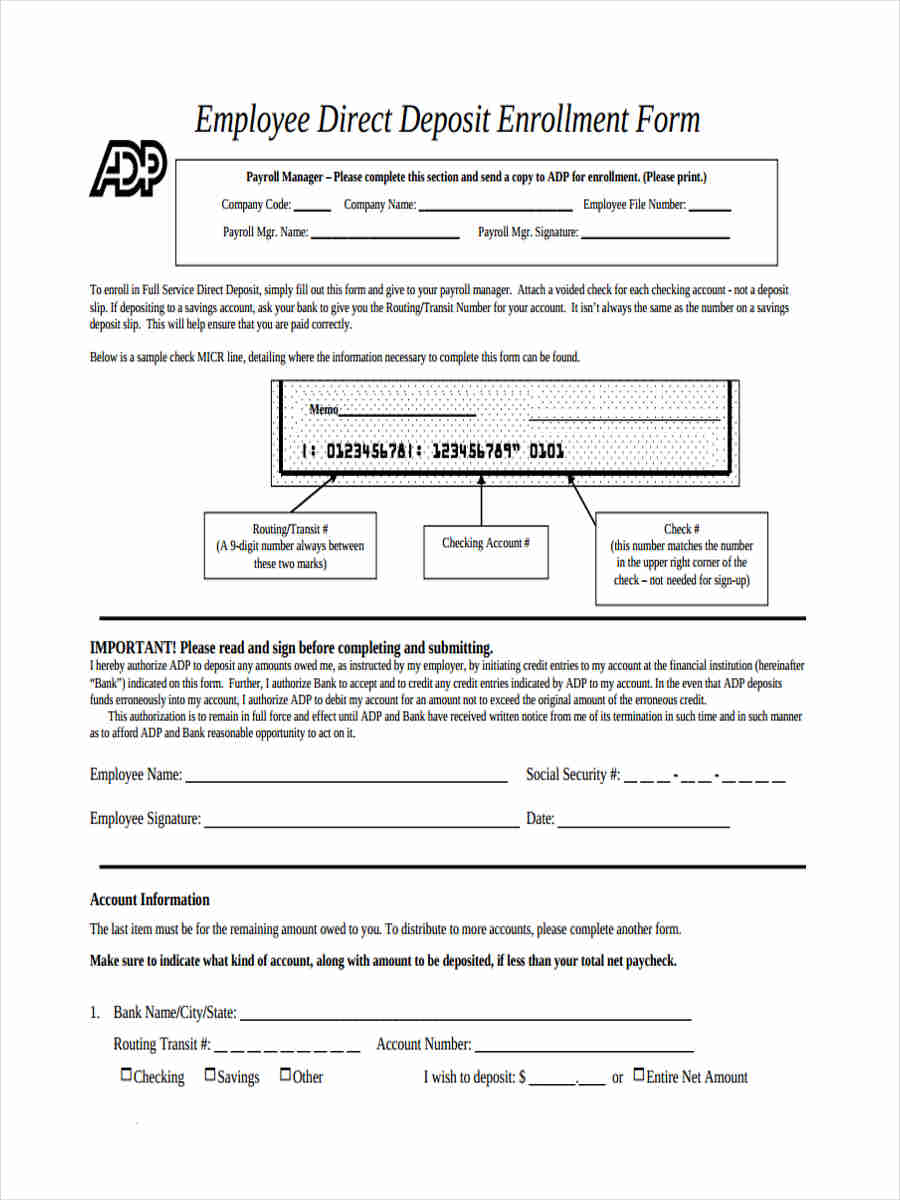

A Direct Deposit Form is usually used by employees to grant a permission for their employers to directly deposit the salary amount to the employees’ bank accounts. This specifically uses a Payroll Direct Deposit Form. Here’s how to fill out the document:

- First, indicate your details. Including your name and your address.

- Next, write your account number.

- Lastly, agree to an authorization by stating the name of the company as the organization you are granting permission for your account and by affixing your signature on the form.

Direct Deposit Form

Direct Deposit Authorization

Direct Deposit Signup Form

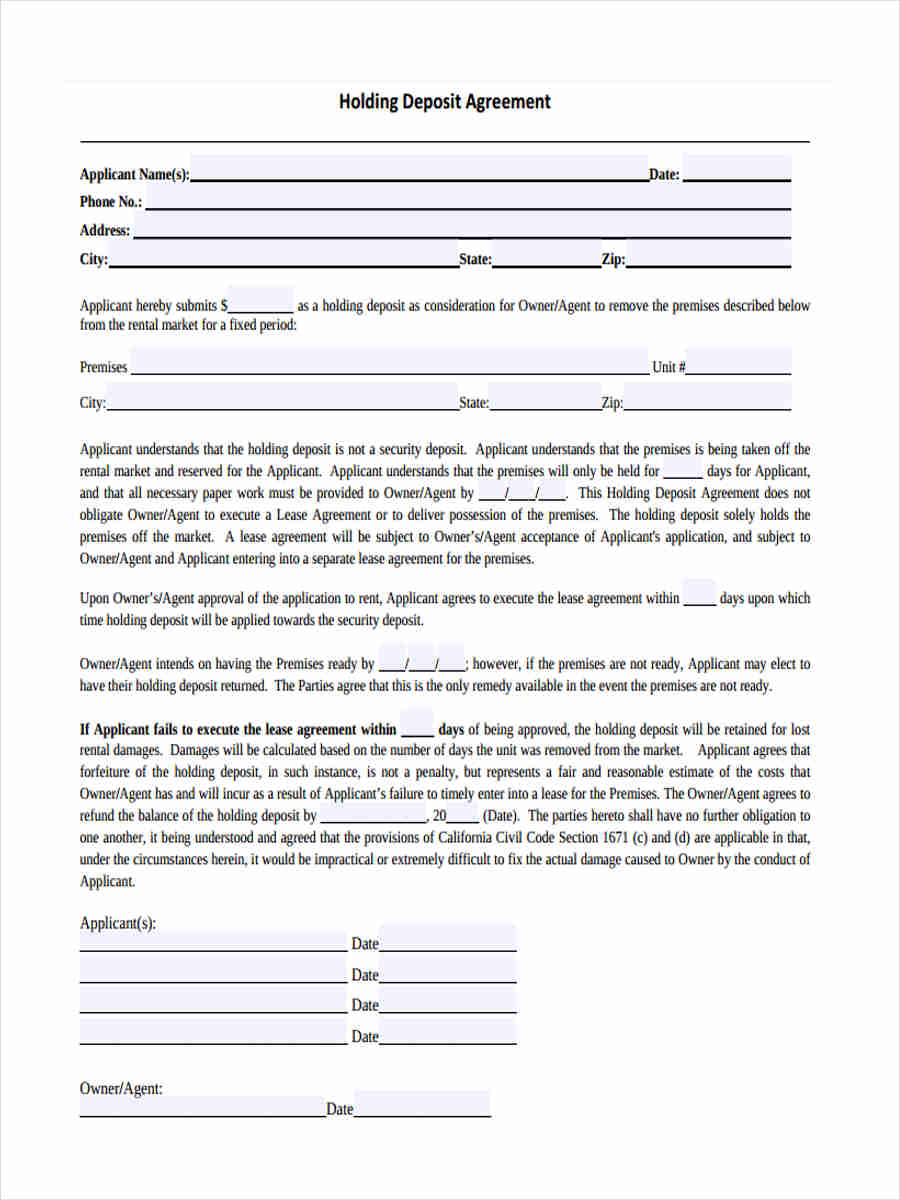

Deposit Agreement Forms

Holding Deposit Agreement

Direct Deposit Agreement

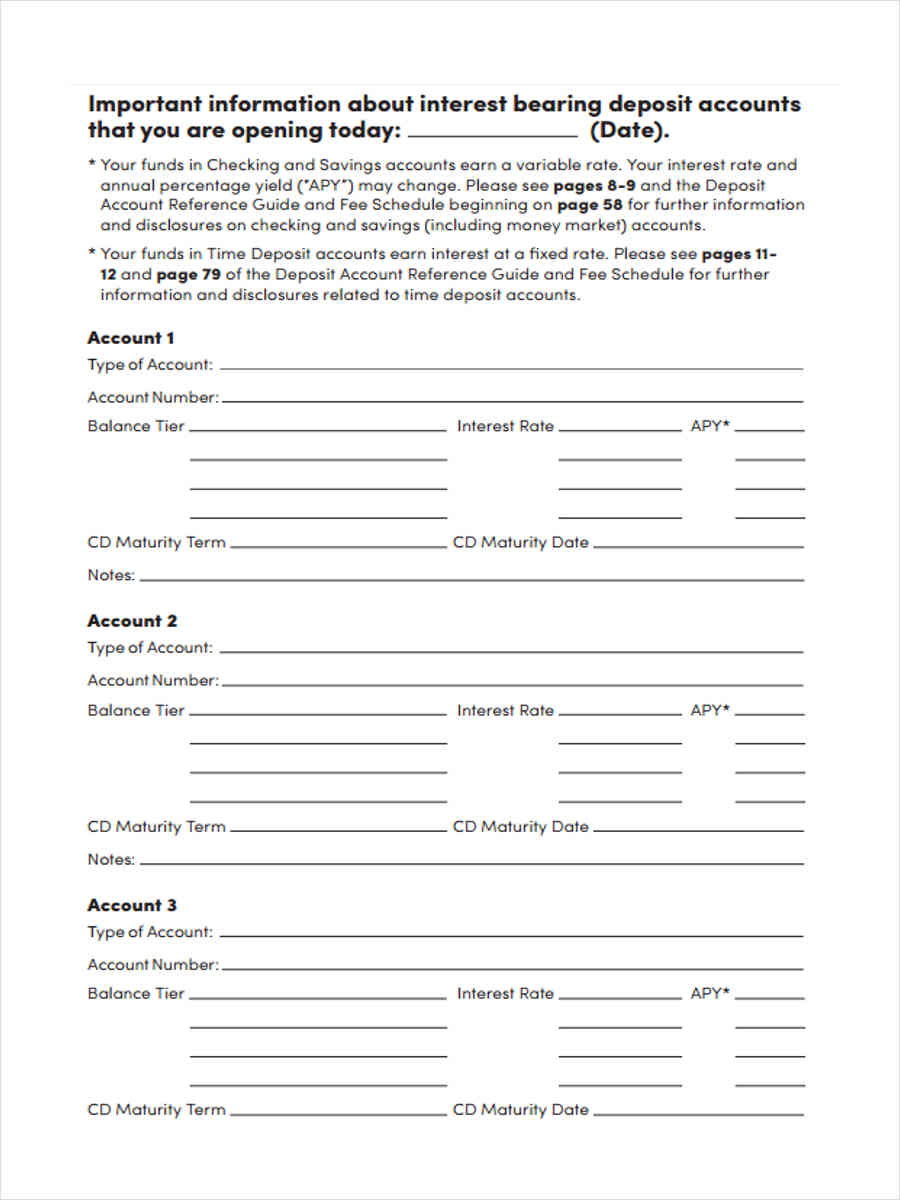

Deposit Account Agreement Disclosures

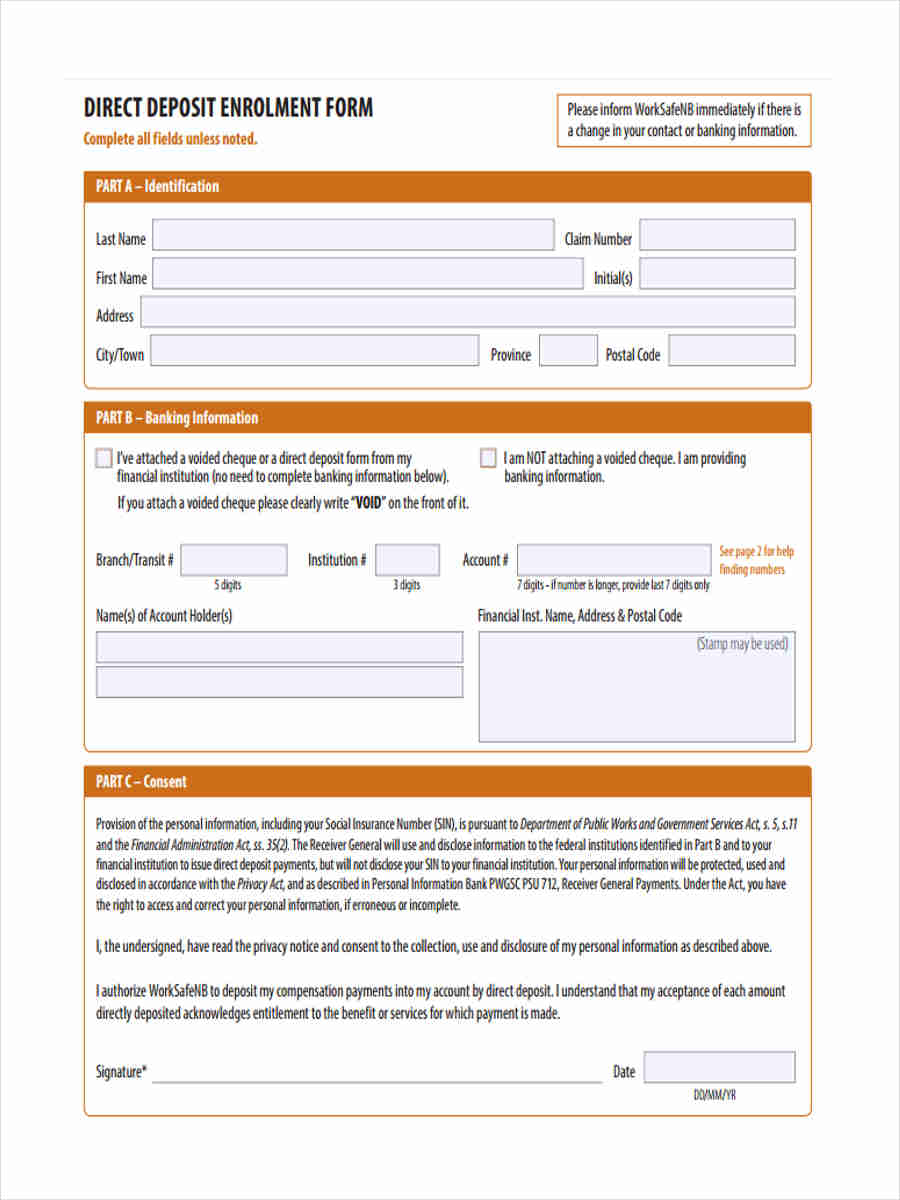

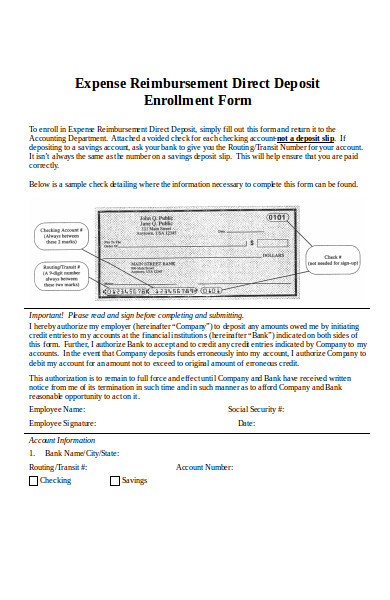

Deposit Enrolment Forms

Direct Deposit Enrolment

Employee Direct Deposit Enrollment

Where Can You Find a Direct Deposit Form?

Direct Deposit Forms can be found:

In bank offices and departments. You can simply go to the bank and inquire about direct deposit to the bank teller. This allows a more secure and easy direct deposit transaction.

In various websites. This refers to the e-banking system of banks and those websites that offer ready-made documents to clients. By using an online transaction, the user should be vigilant enough in providing his personal data with the use of a public internet connection since this can be the bridge for hackers to attack and cause identity theft.

What Is the Purpose of a Direct Deposit Form?

The purpose of using a direct deposit form is mainly to have a record of an individual’s transaction with the other account holder. The form also states and grants permission to an organization wherein it acts as a legal Authorization Letter with the approval and verification of the bank.

Another purpose for having a direct deposit form is to conveniently and efficiently track an individual’s expenses. This document contains all the numbers needed by the individual as his own tally of expenditures.

Direct deposits are not only for payroll and employers but also for sellers and landlords. A seller may use a Vendor Direct Deposit that will state his provided goods and services to his client, while a landlord may have a Security Deposit Form as an agreement for the required down payment or initial payment of his prospective tenant.

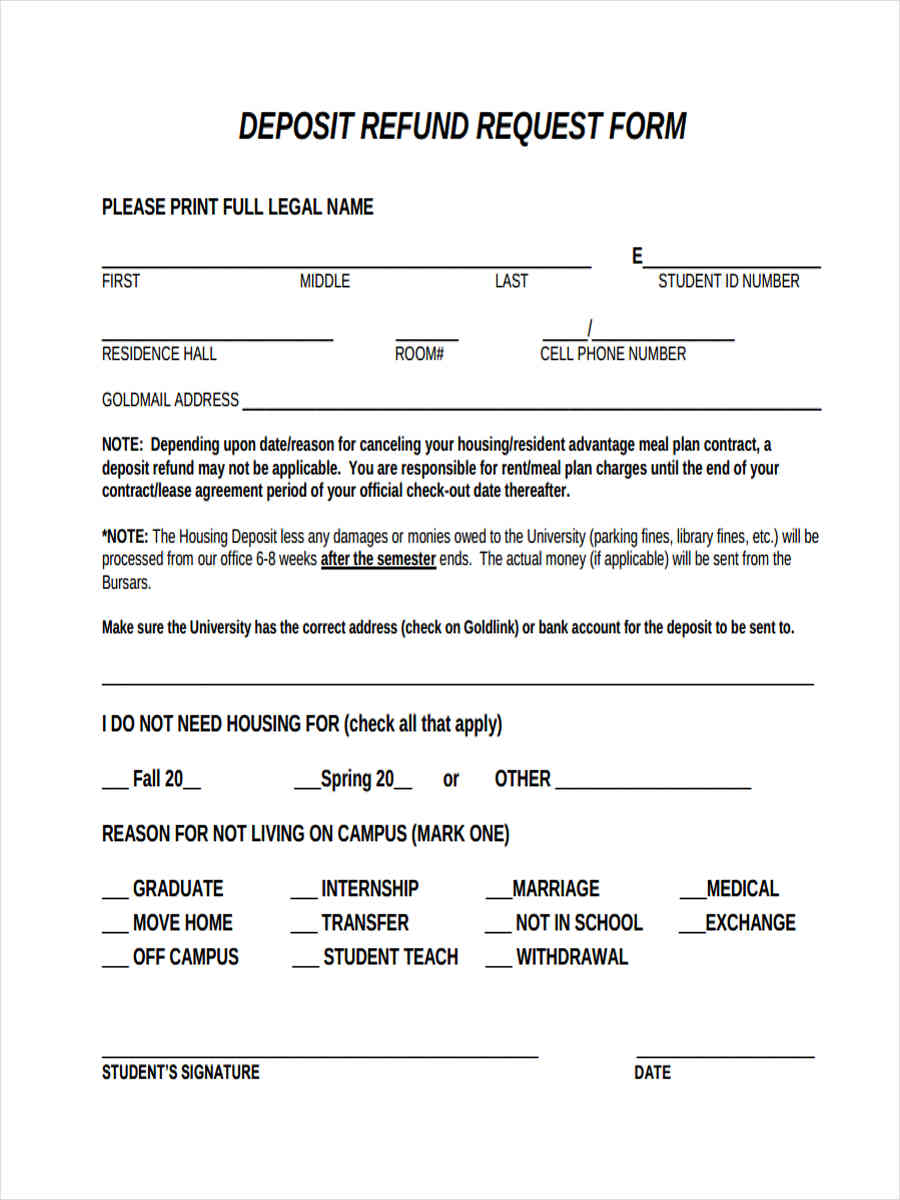

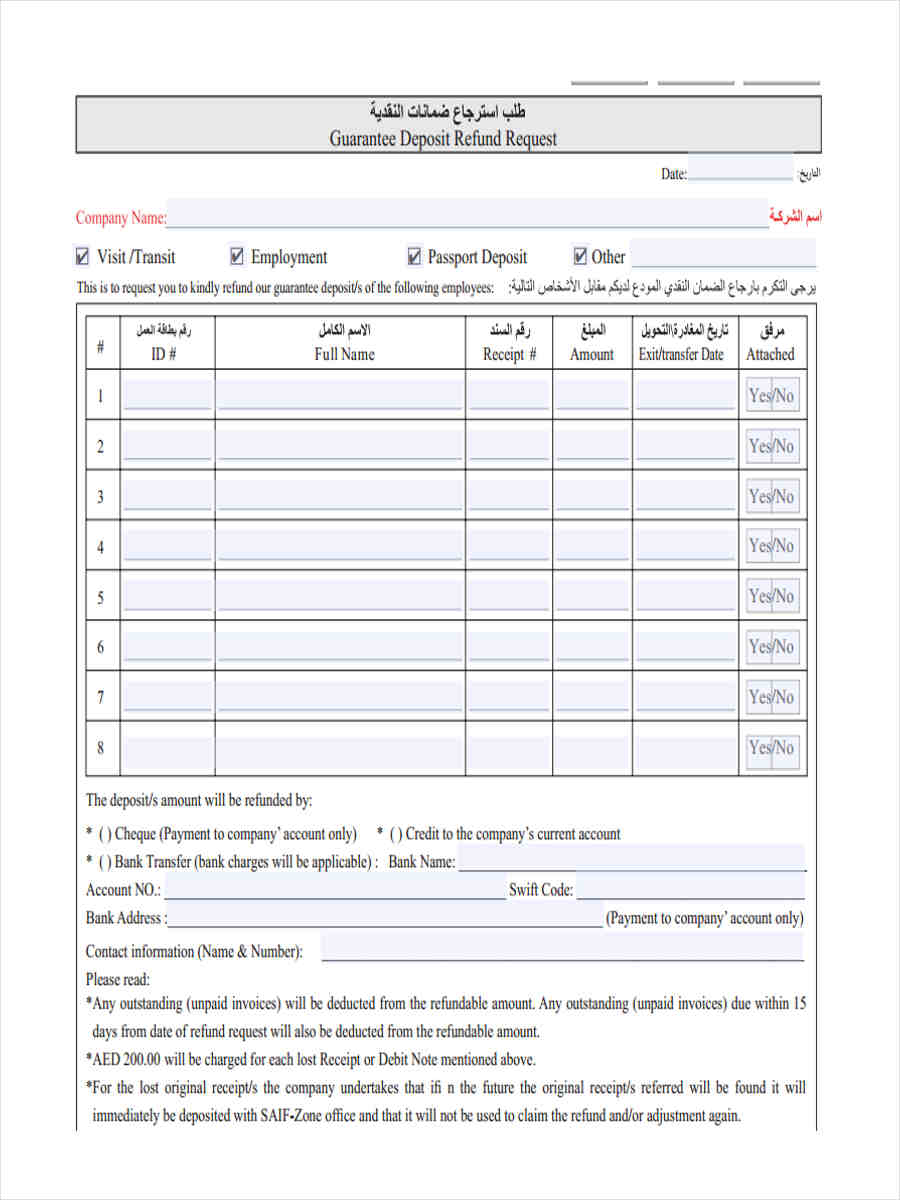

Deposit Refund Forms

Deposit Refund Request

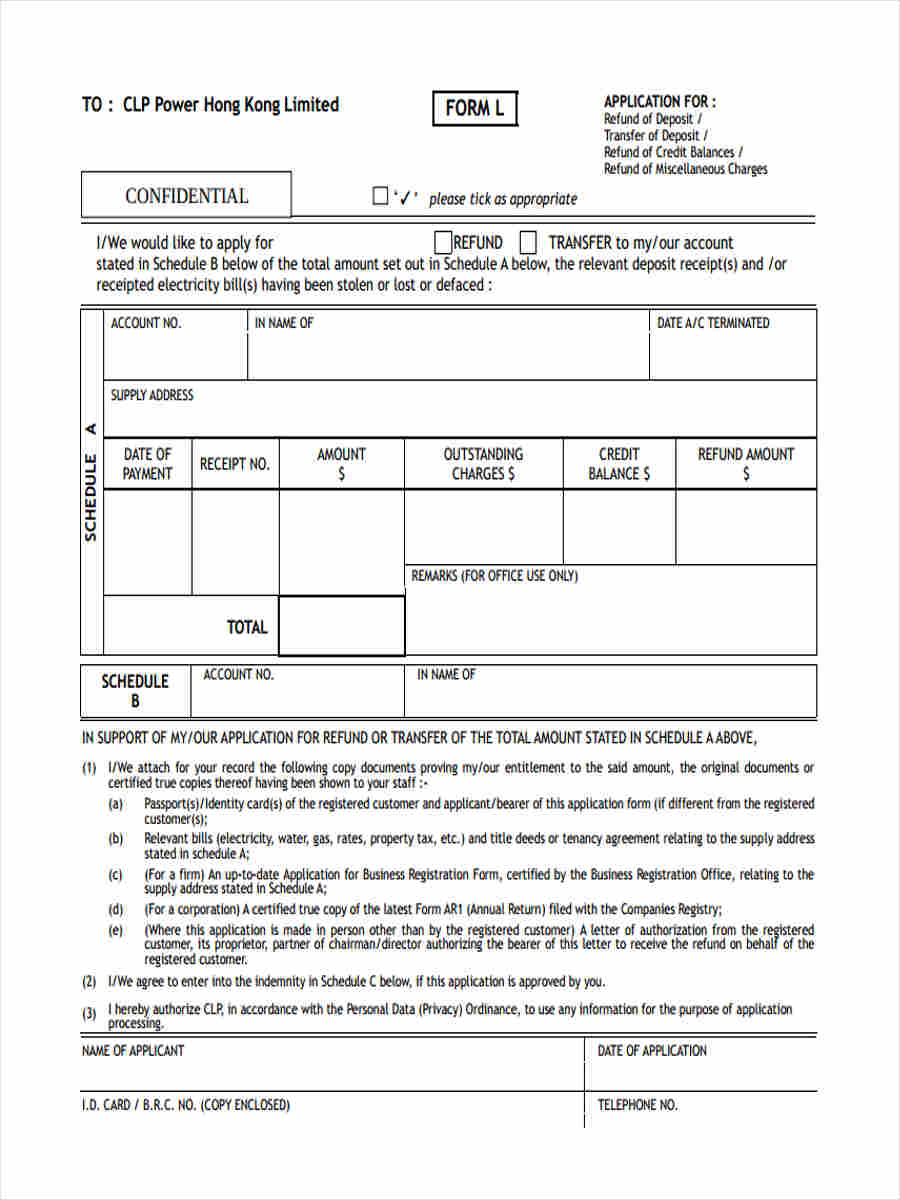

Deposit Refund Application

Guarantee Deposit Refund

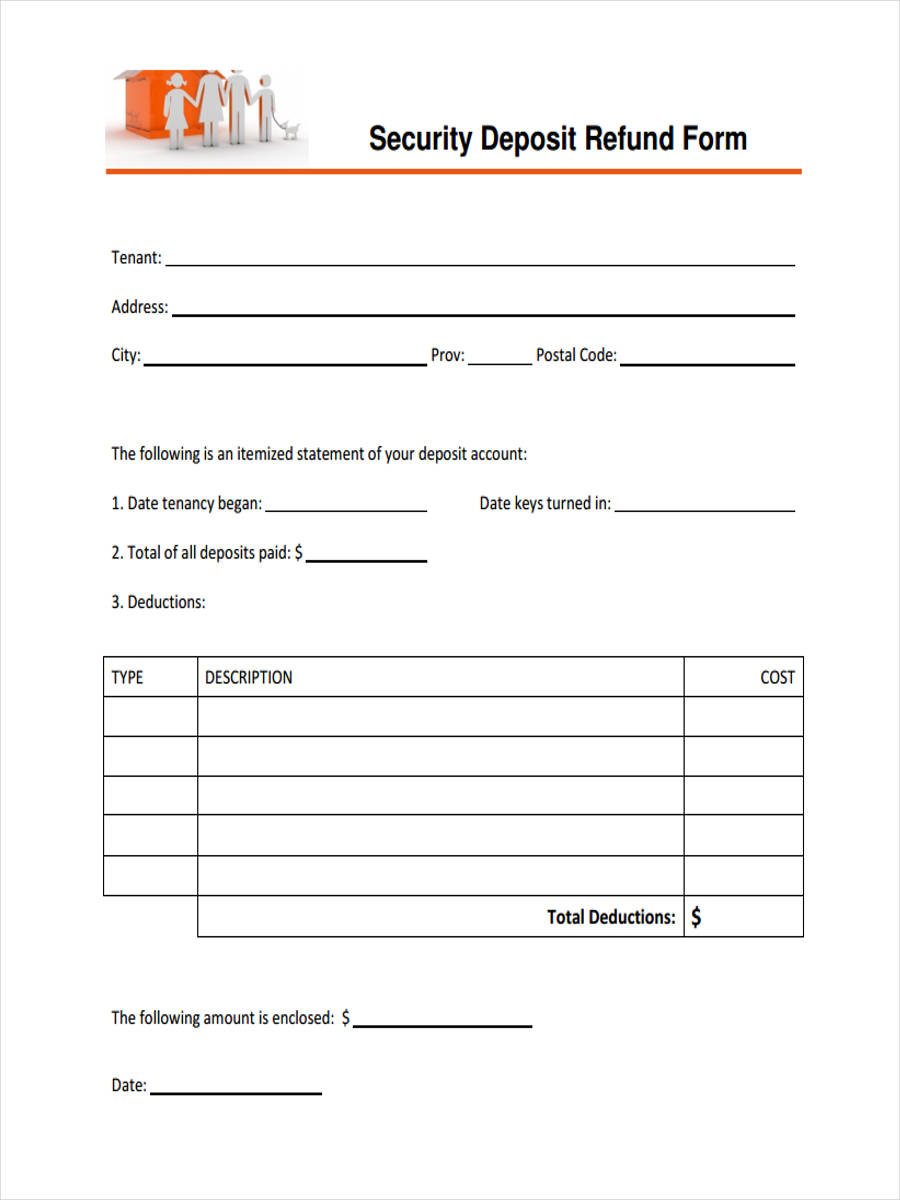

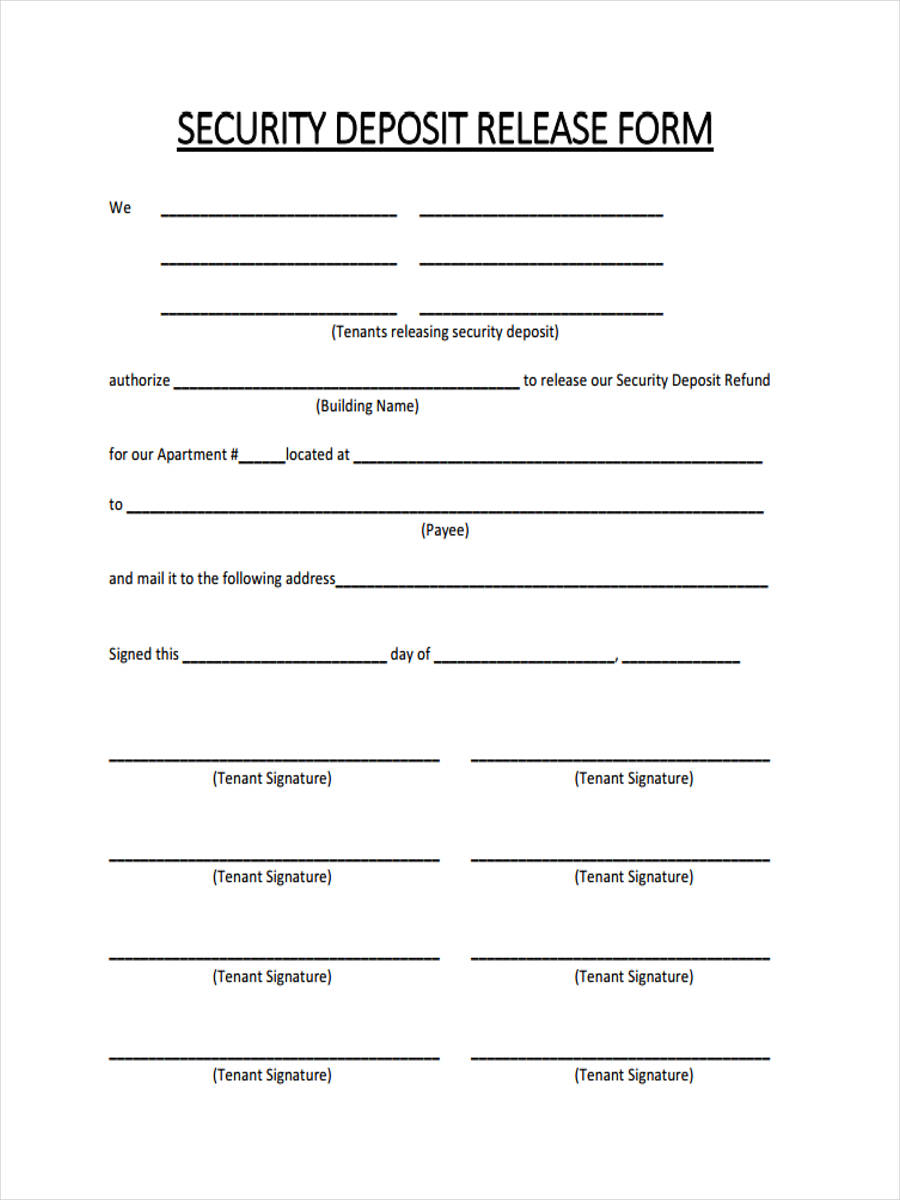

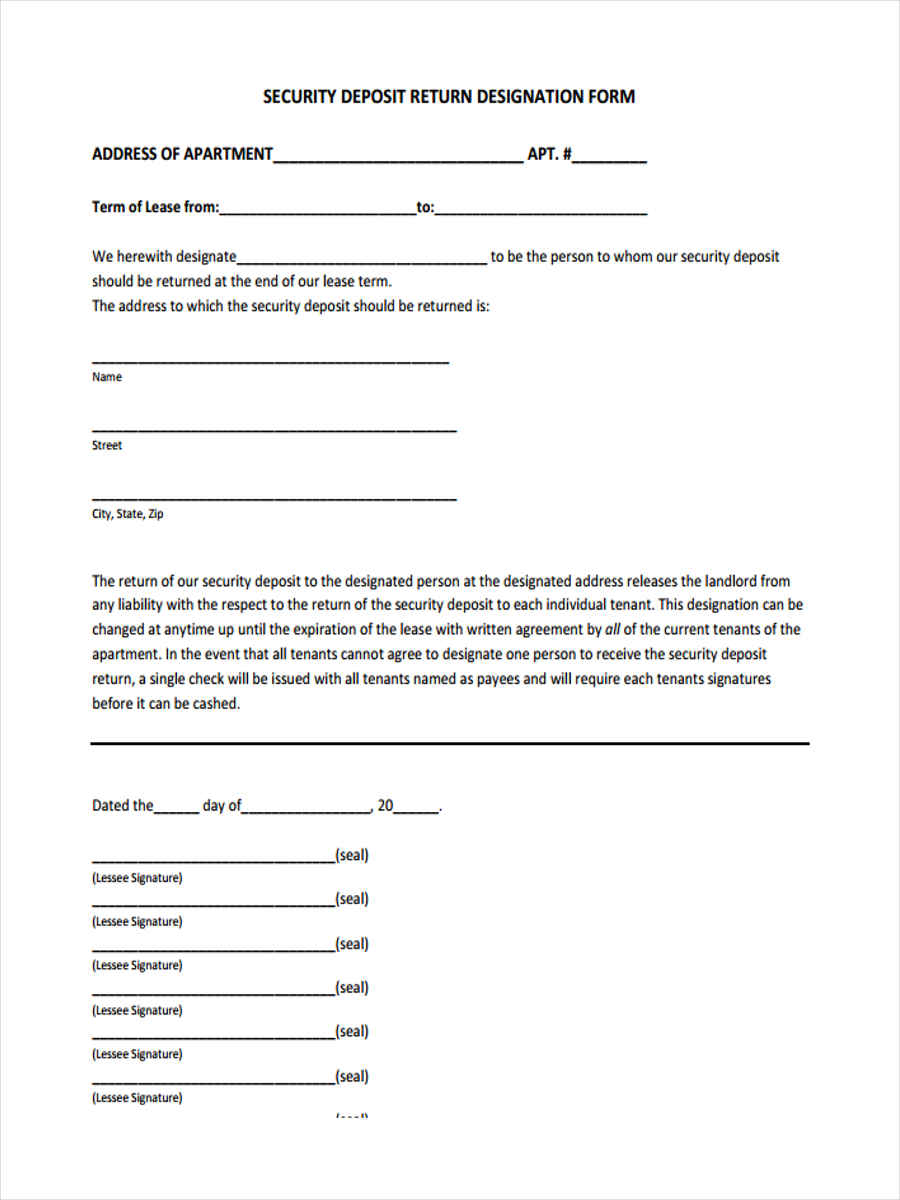

Security Deposits

Security Deposit Refund

Security Deposit Release

Deposit Return Designation

Security Deposit Receipt

What Is Fixed Deposit?

Similar to a Recurring Deposit, a Fixed Deposit (FD) is a type of scheme wherein an individual will have an increased amount with regards to his saved money. However, compared to the recurring scheme, the FD allows a higher interest rate to be attained by the depositor and the deposited money can’t be withdrawn before the date of maturity.

Fixed deposits are usually available for periods of one to twelve months, depending on the client holding the account. The invested amount of money will gain ample interest at the end of the selected time-period of the depositor. With the aid of a Fixed Deposit scheme, the depositor is guaranteed to have a return of his investments.

Authorizations and receipts are also handy for depositing. Usually, a Direct Deposit Authorization is presented to have an access to another person’s account with the sole purpose of depositing an amount for that person as a payment for his job, or his sold products.

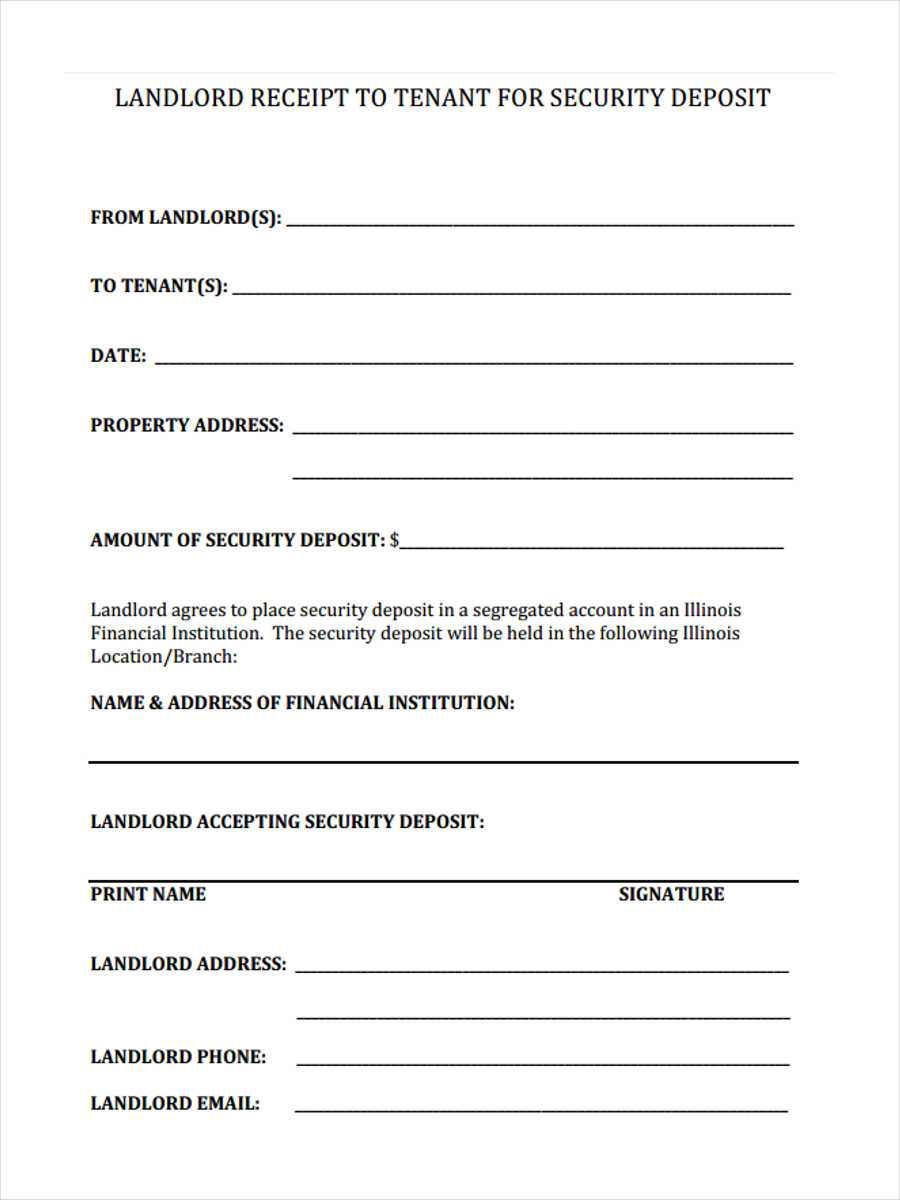

Then, a receipt will be granted to the depositor, such as a Security Deposit Receipt wherein the landlord will state that the tenant or a client have successfully deposited the amount required for the tenancy period.

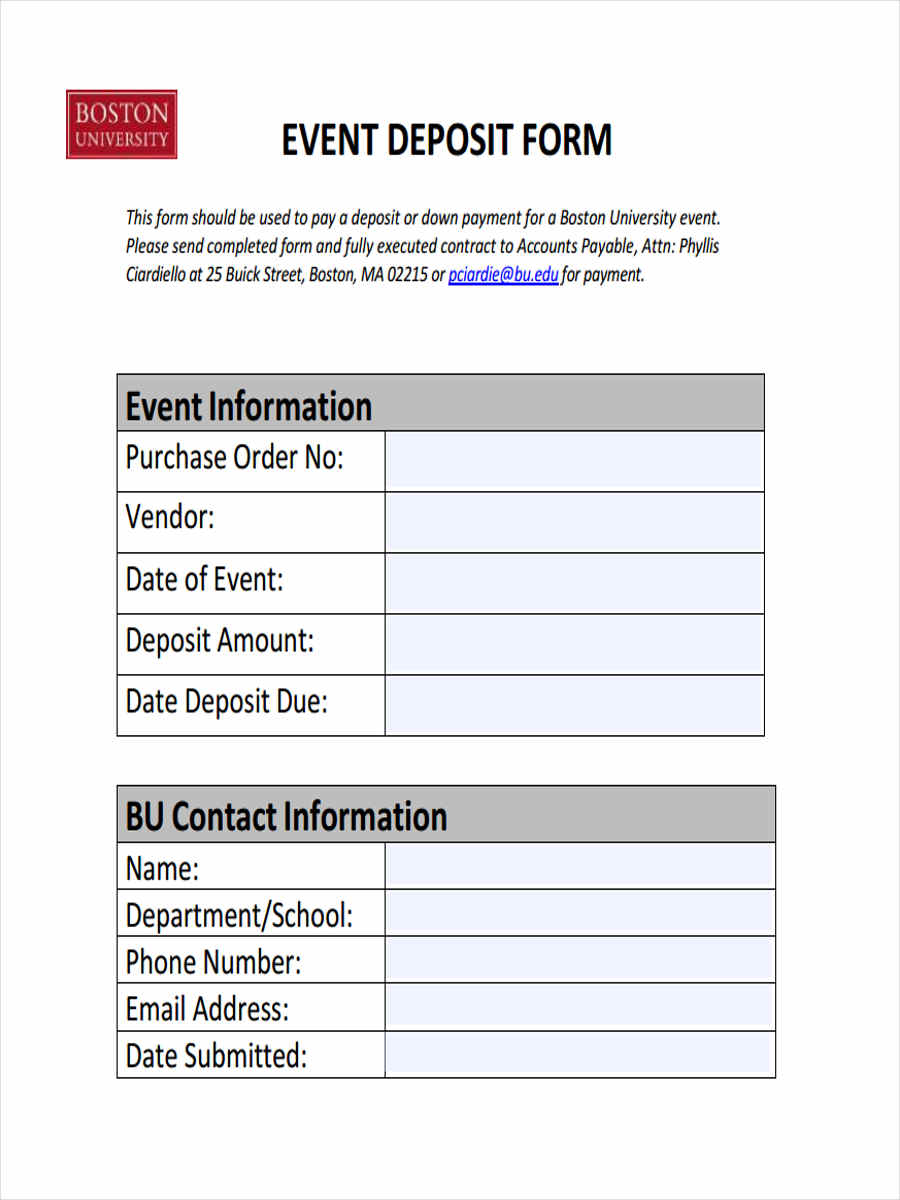

Event Deposit Form

Cash Receipt Deposit

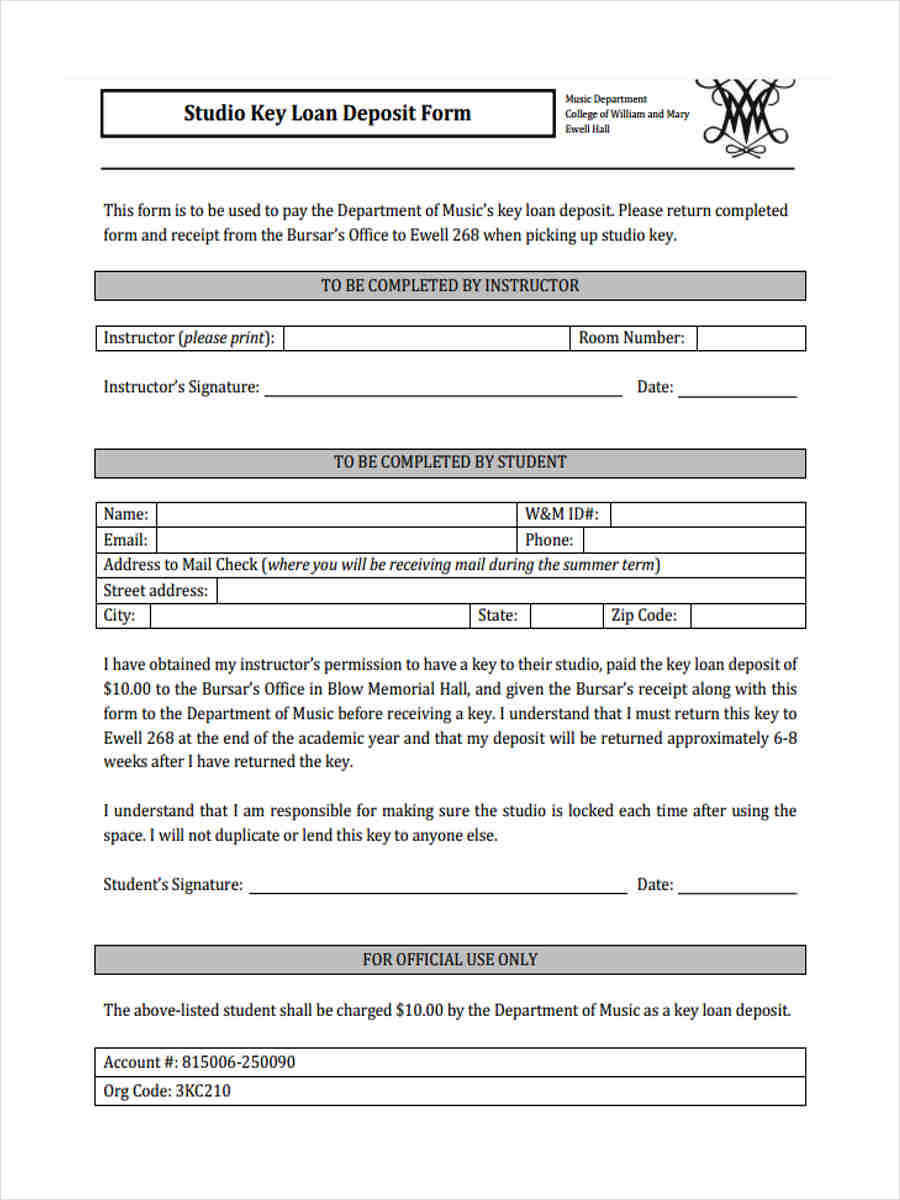

Deposit Loan Form

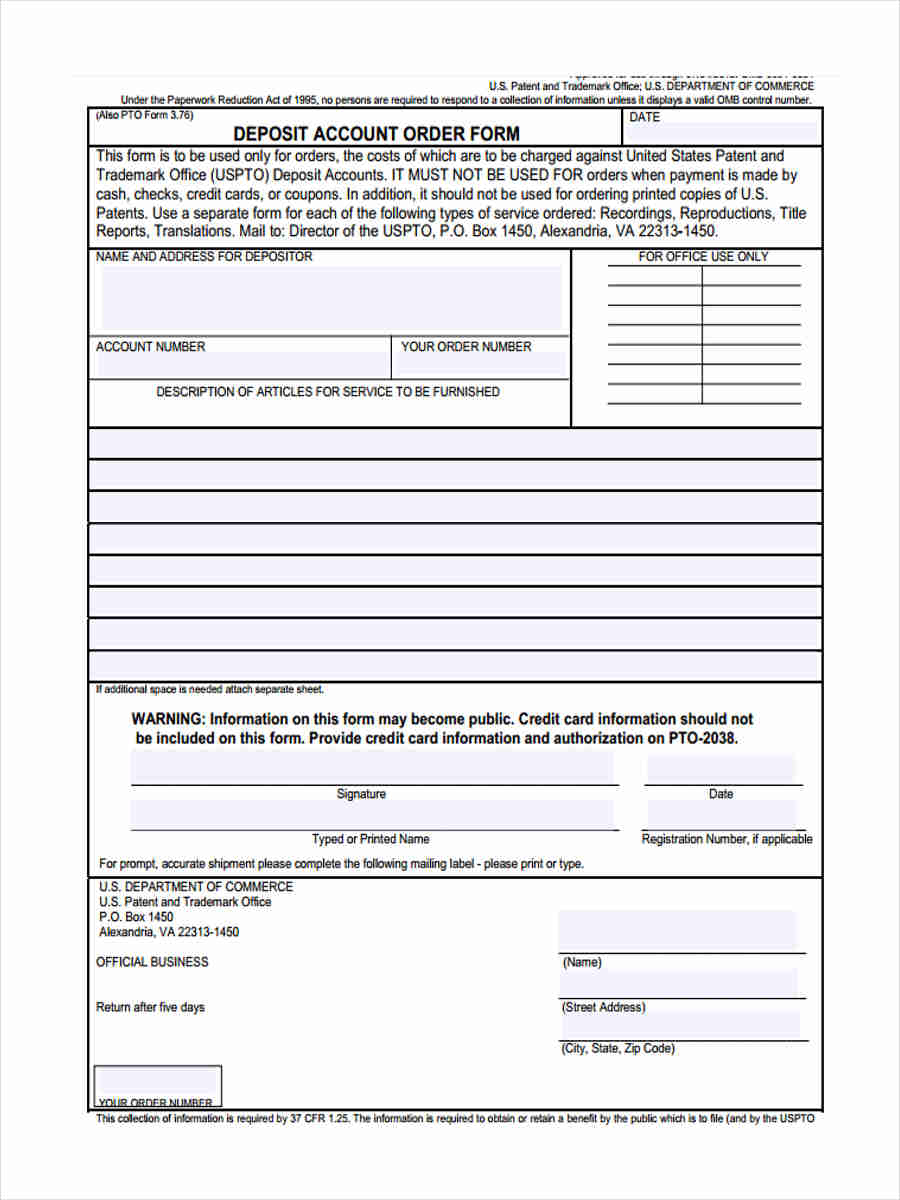

Deposit Account Order

Non-Resident Fixed Deposit

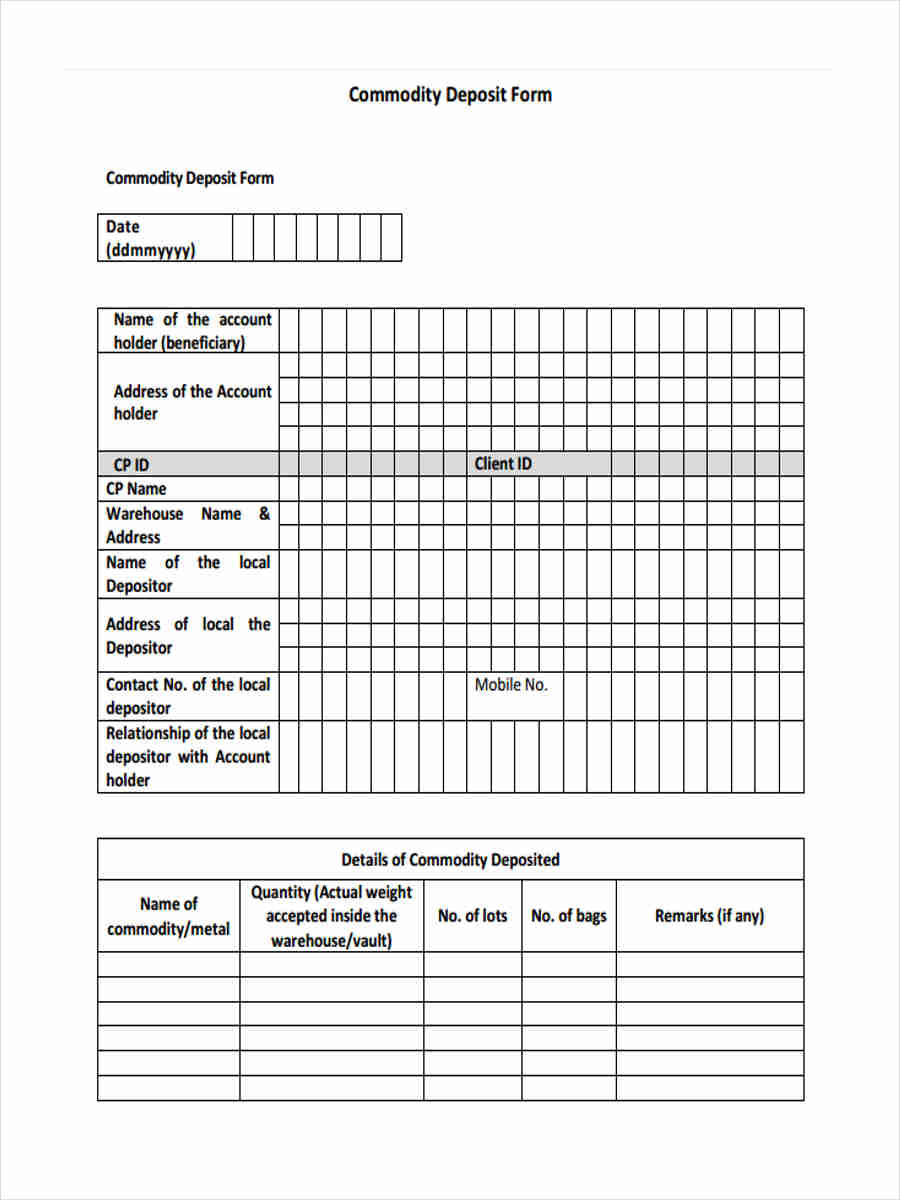

Commodity Deposit

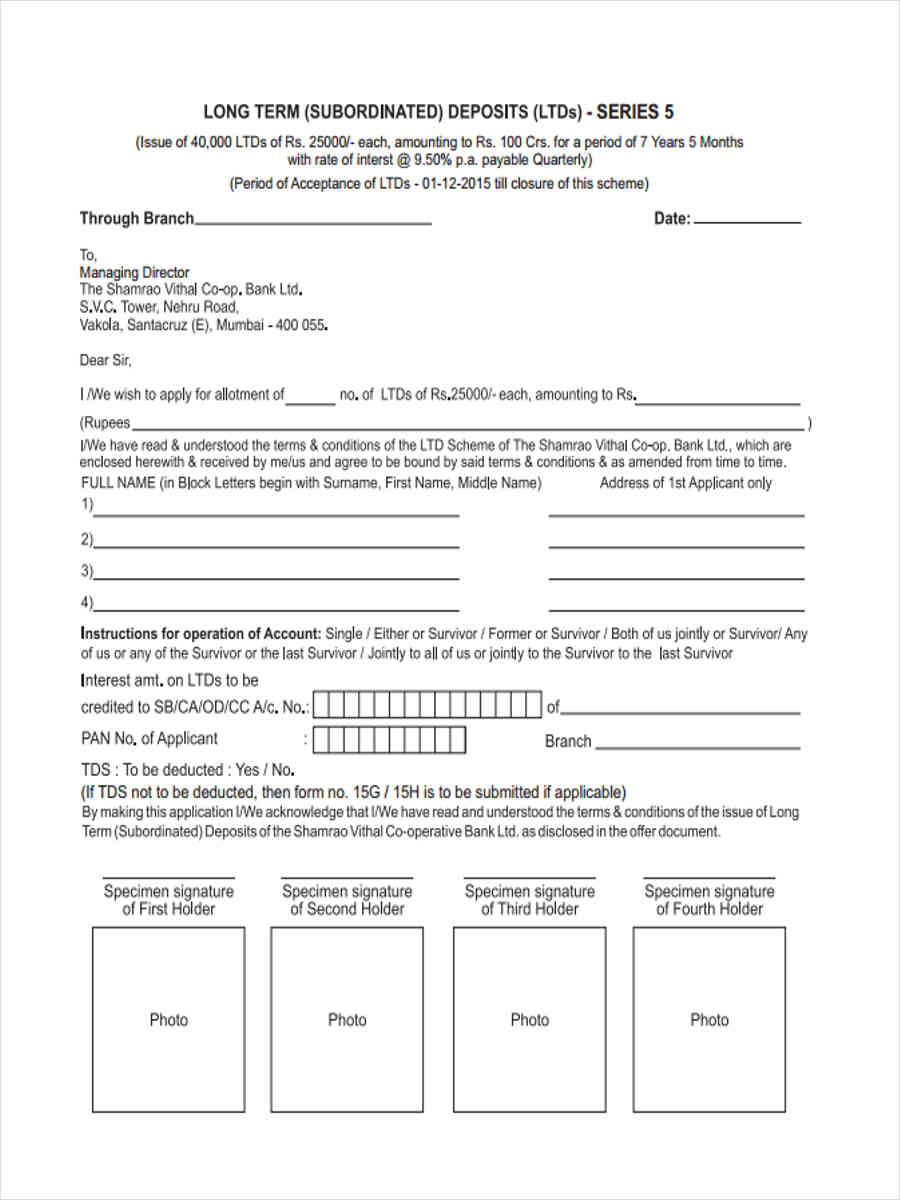

Long Term Deposit

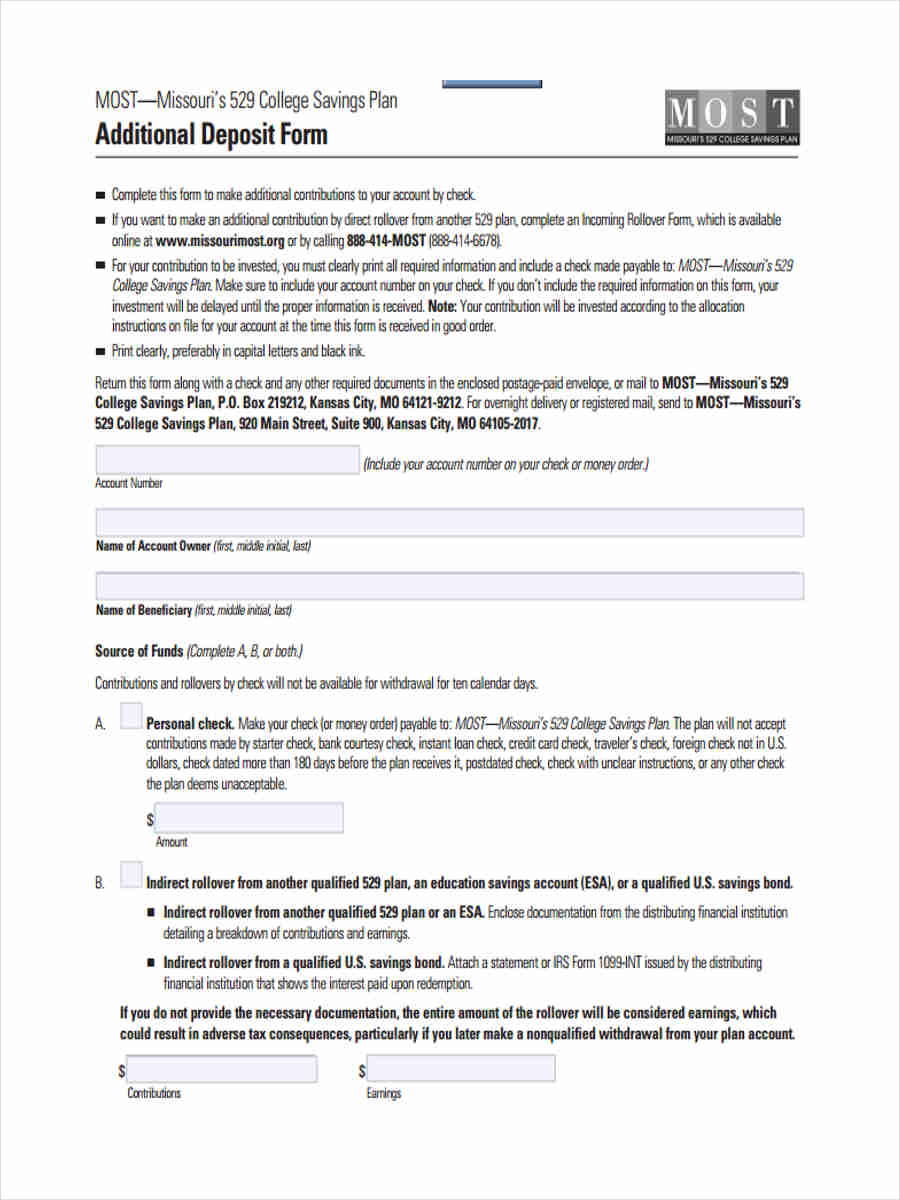

Additional Deposit

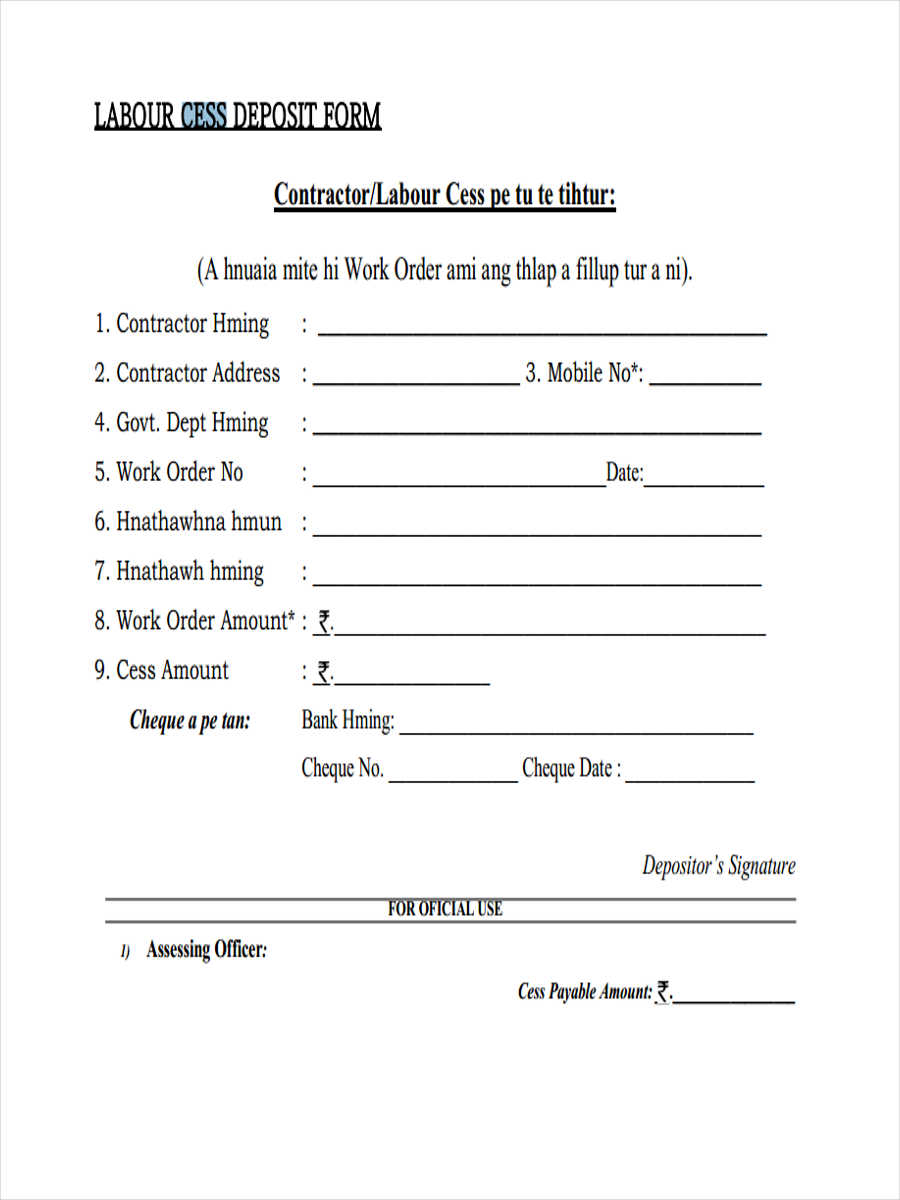

Labour Cess Deposit Form

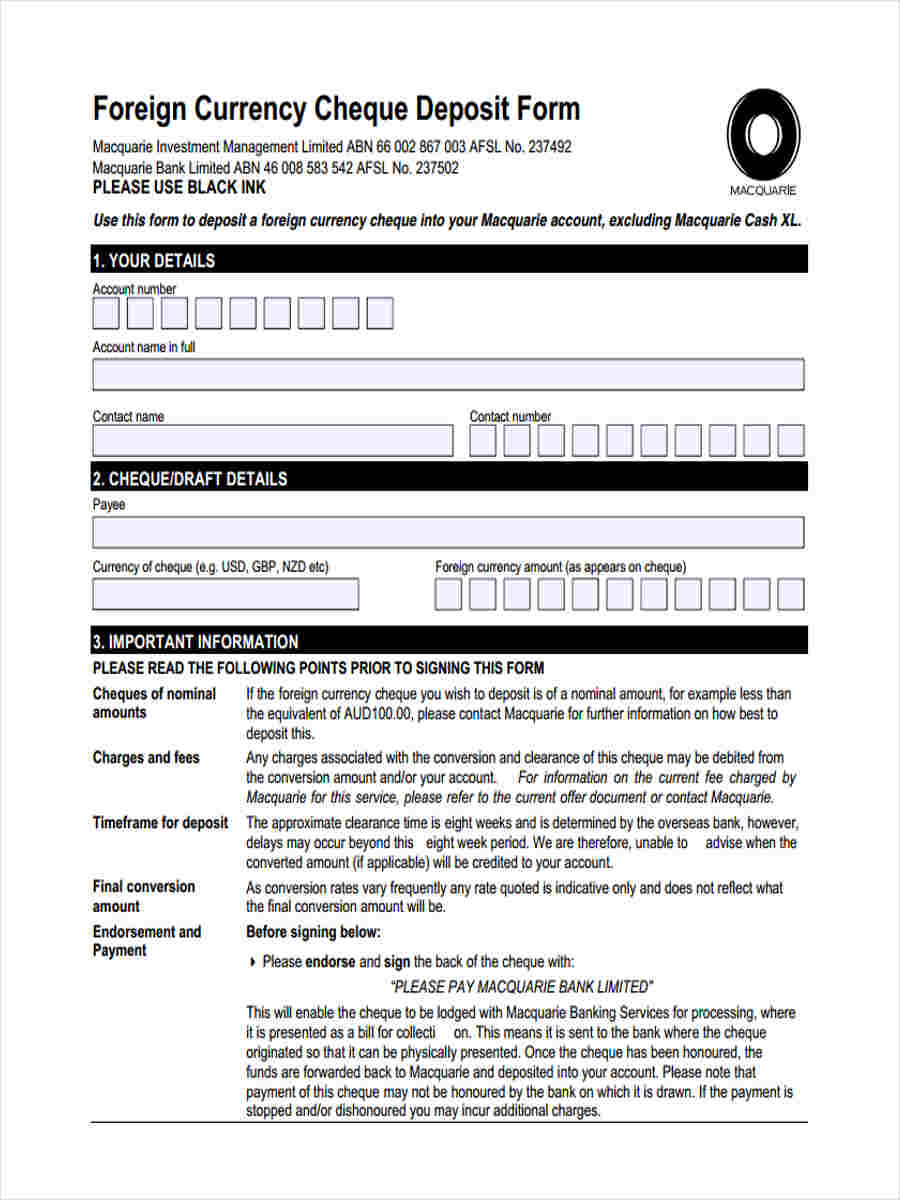

Cheque Deposits

Foreign Currency Cheque

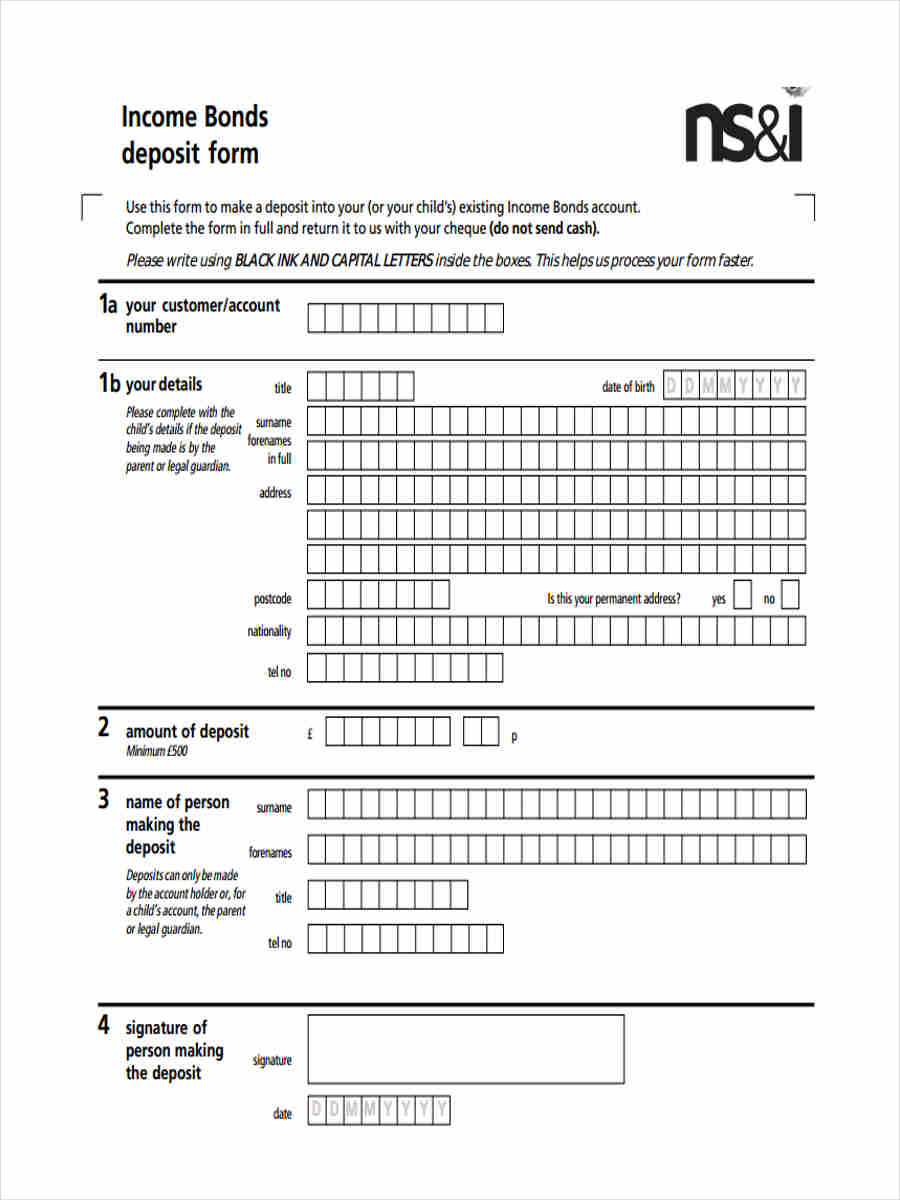

Income Bonds Deposit

Direct Deposit Enrollment Form

How to Complete a Security Deposit Itemization Form?

A Security Deposit Itemization Form will contain the breakdown of the prospective tenant’s initial payments. Follow the steps below to start filling out the form:

Step 1: List all the damaged areas and materials in your property, from the broken tiles on the floor to the creaking ceiling fans.

Step 2: Indicate the directions wherein the damaged properties are specifically located.

Step 3: State the descriptions of the damaged property, such as minor scratches on the walls, or dysfunctional stoves.

Step 4: Write the possible repairs needed.

Step 5: Calculate and indicate the amount needed to have the repair.

Step 6: Sign the form and present it to the tenant.

As soon as the tenant agreed to the itemized breakdown, you will have to completely fill out a Security Deposit Receipt Form to serve as an acknowledgment for your tenant’s payment.

Deposit forms can range with its variety of uses, from applications to authorizations. When banks agree with an investor for a deposit or savings plan, they will then present a document which indicates an agreement that the bank will take good care of the amount and that the investor will be guaranteed to have a return on his invested money, this is known as a Deposit Agreement Form. It can also have a disclosure statement at the end of the agreement as a documented protection for the investor’s information.