The idea that money can easily be lost or taken away makes one want to practice safety measures in order to keep their money intact. The concept of being financially responsibility is instilled in every individual. There are methods to keep this skill consistent in a person such as utilizing financial forms and creating a personal budget.

Being more aware of one’s financial situation can shift the individual’s perspective on the value of money and the importance of being financially responsible. It is not an easy road to take so if one encounters difficulties, there are differences agencies that offer financial aid by filling out financial aid forms.

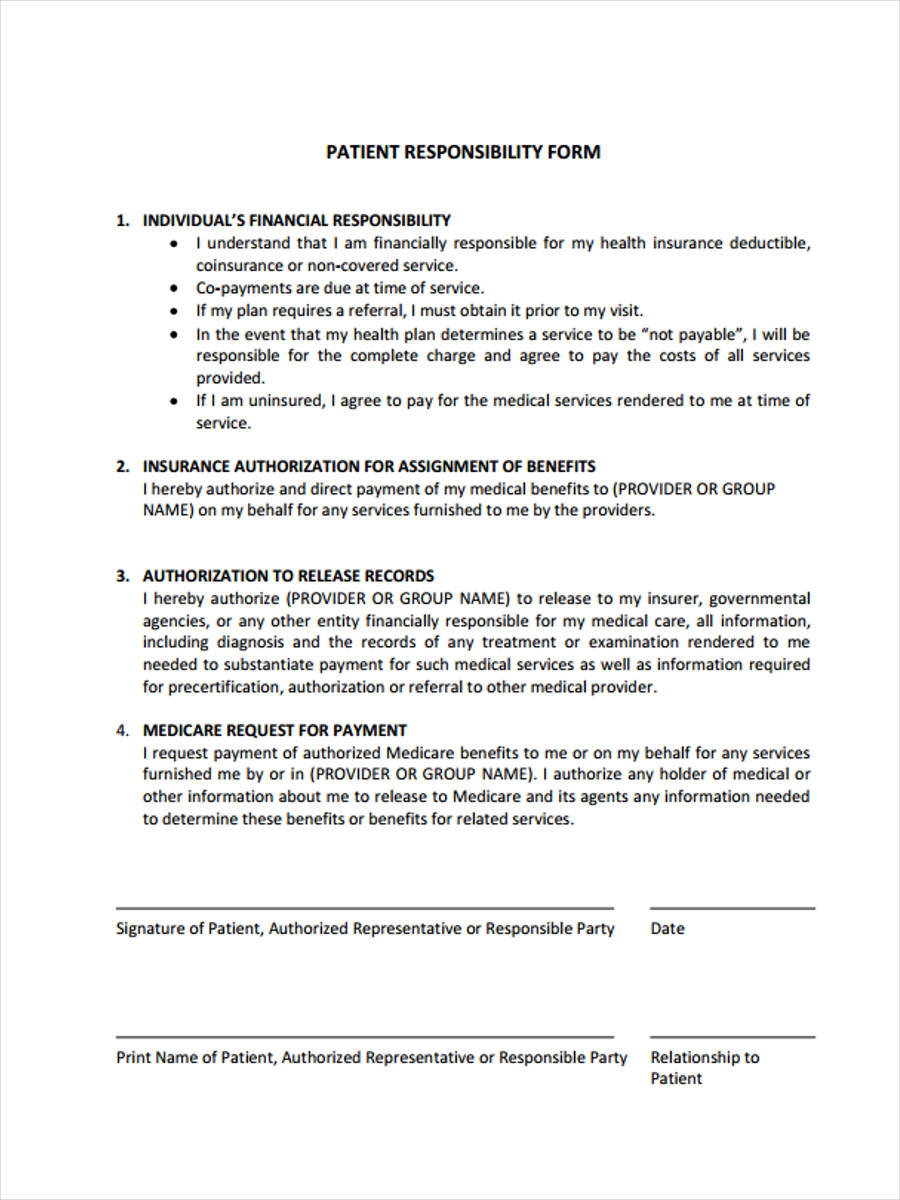

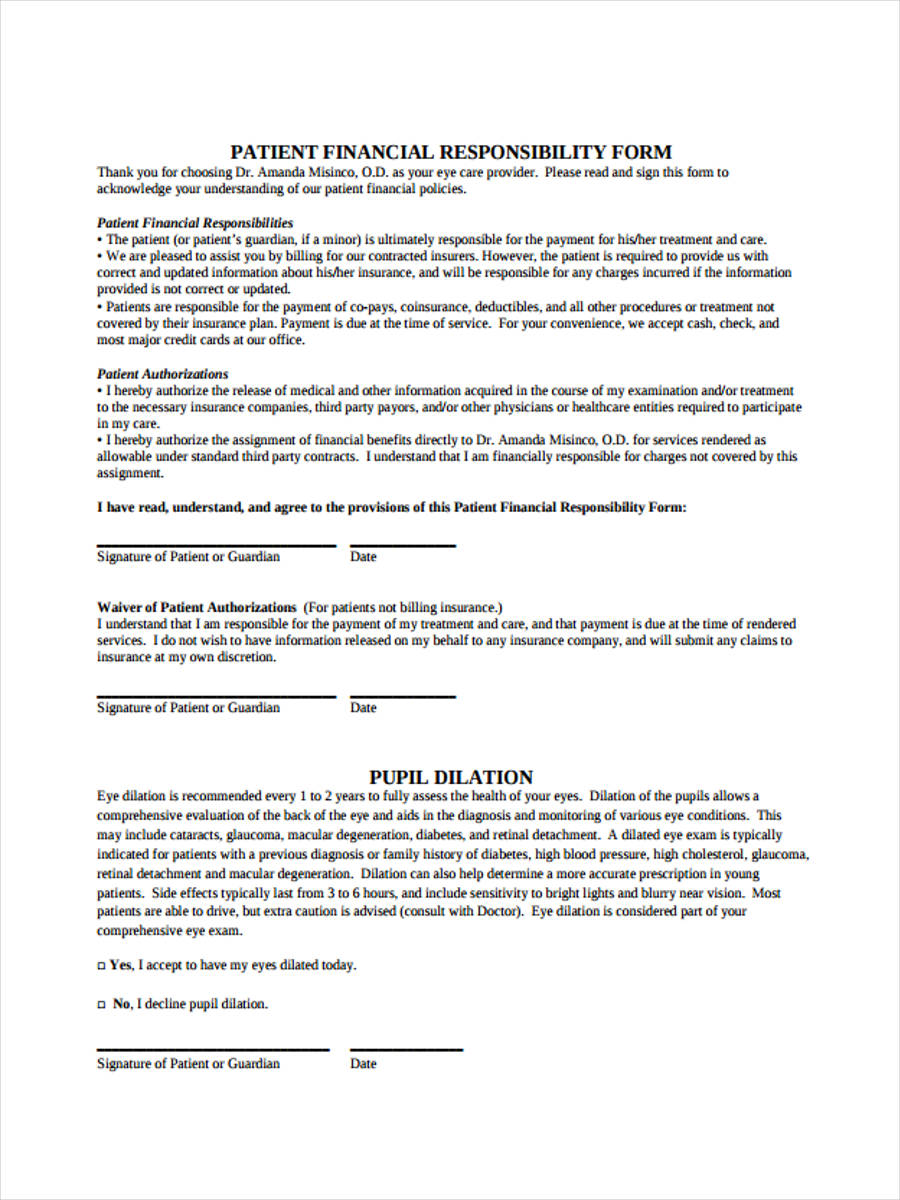

Patient Financial Responsibility

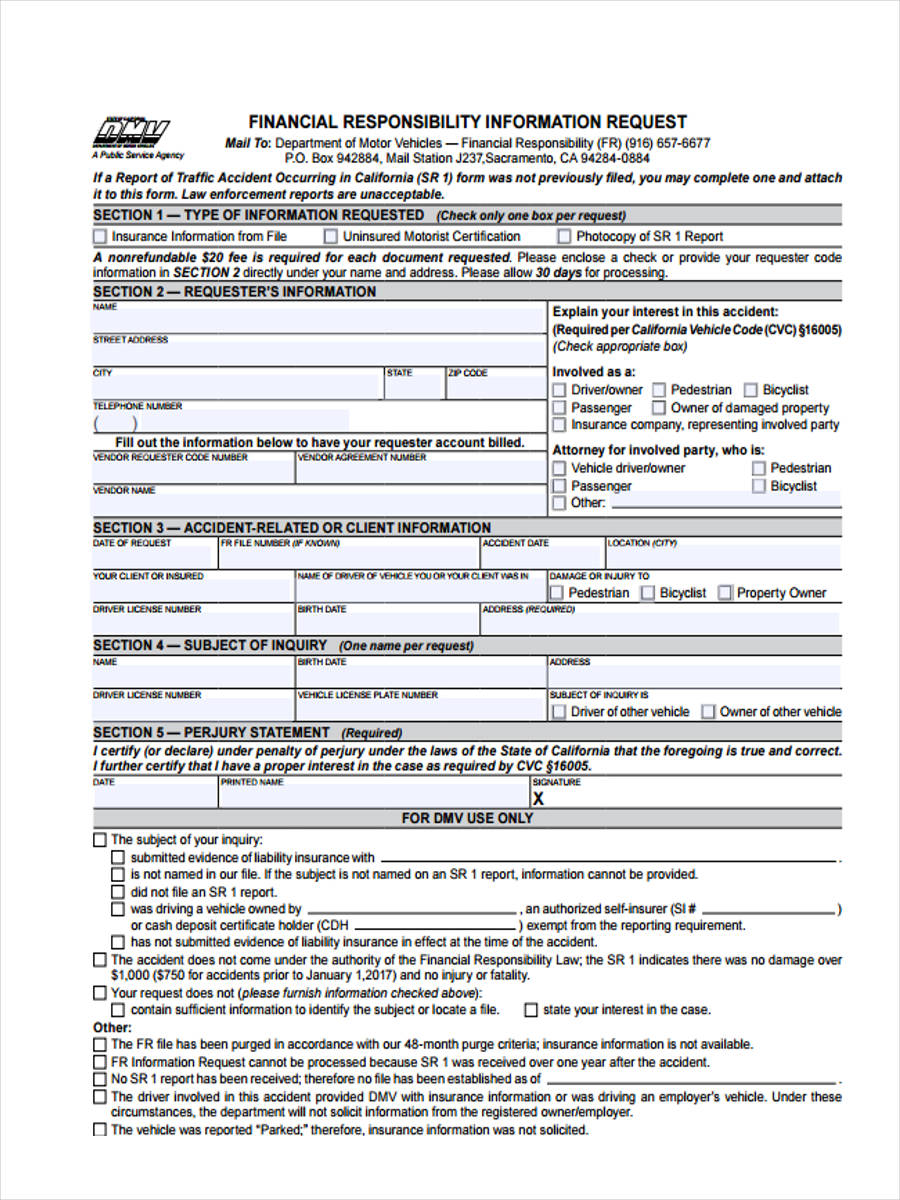

DMV Financial Responsibility

Release of Financial Responsibility

What is a Financial Responsibility Form?

Each finance form has its own unique characteristics that makes it different from the rest. When Financial Assistance Forms are being used, an individual is signing up for financial aid that can help their current financial situation. This form helps agencies track down eligible candidates as they acquire the benefits of the financial aid.

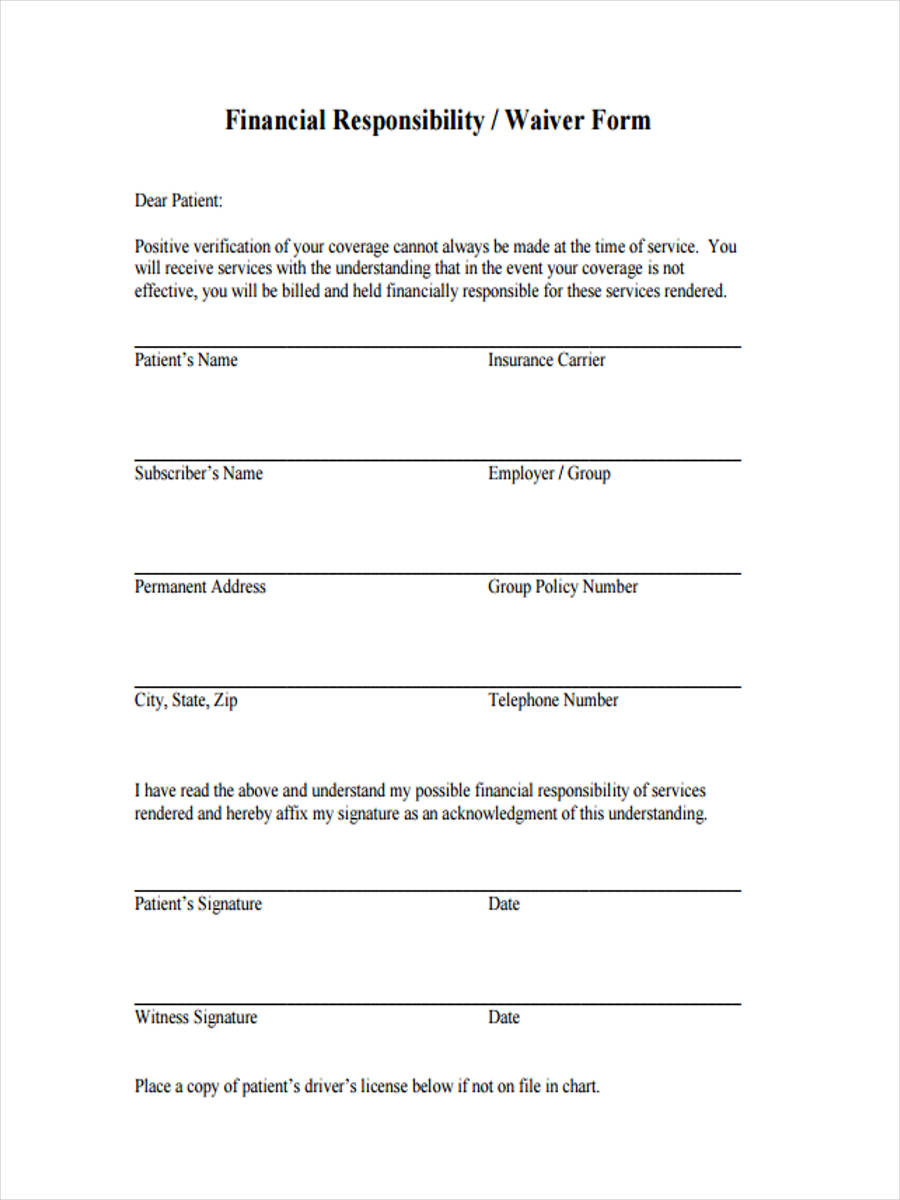

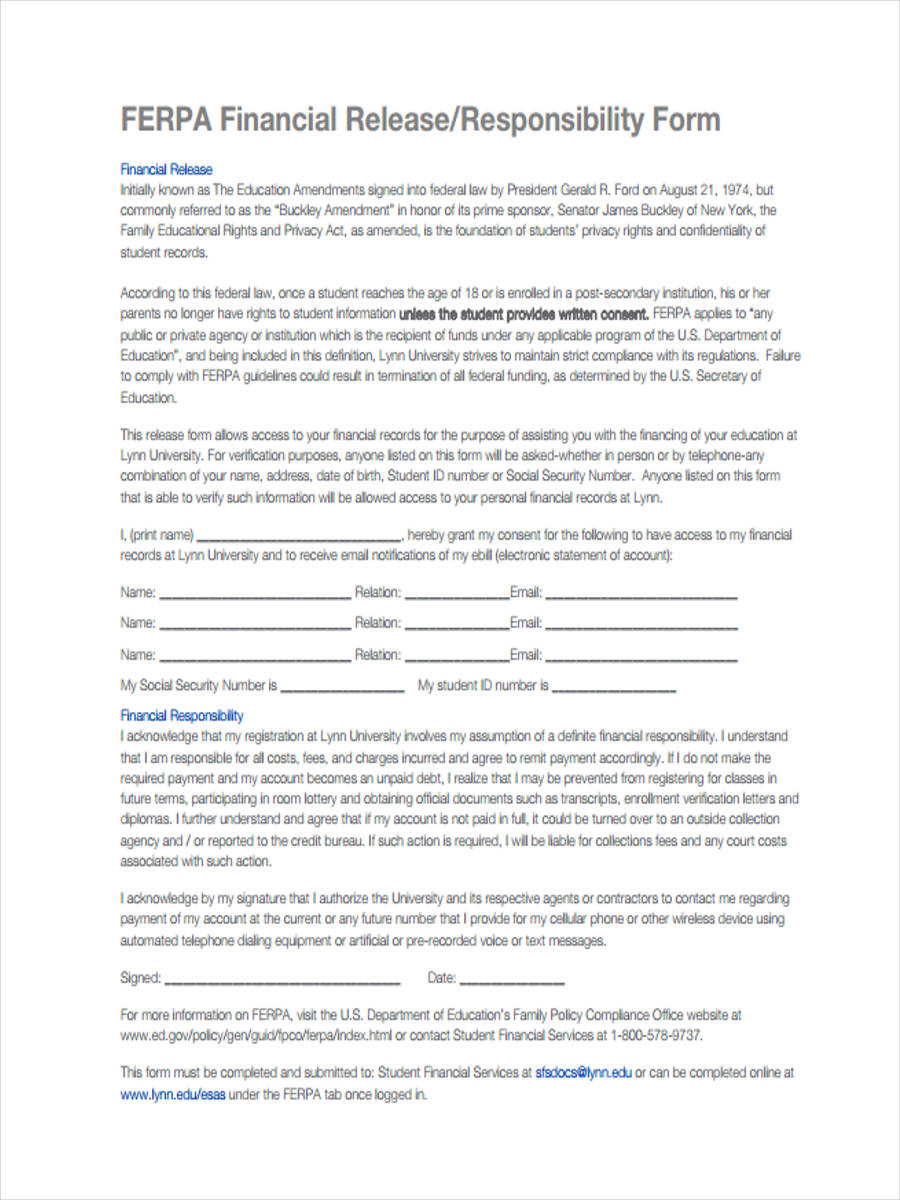

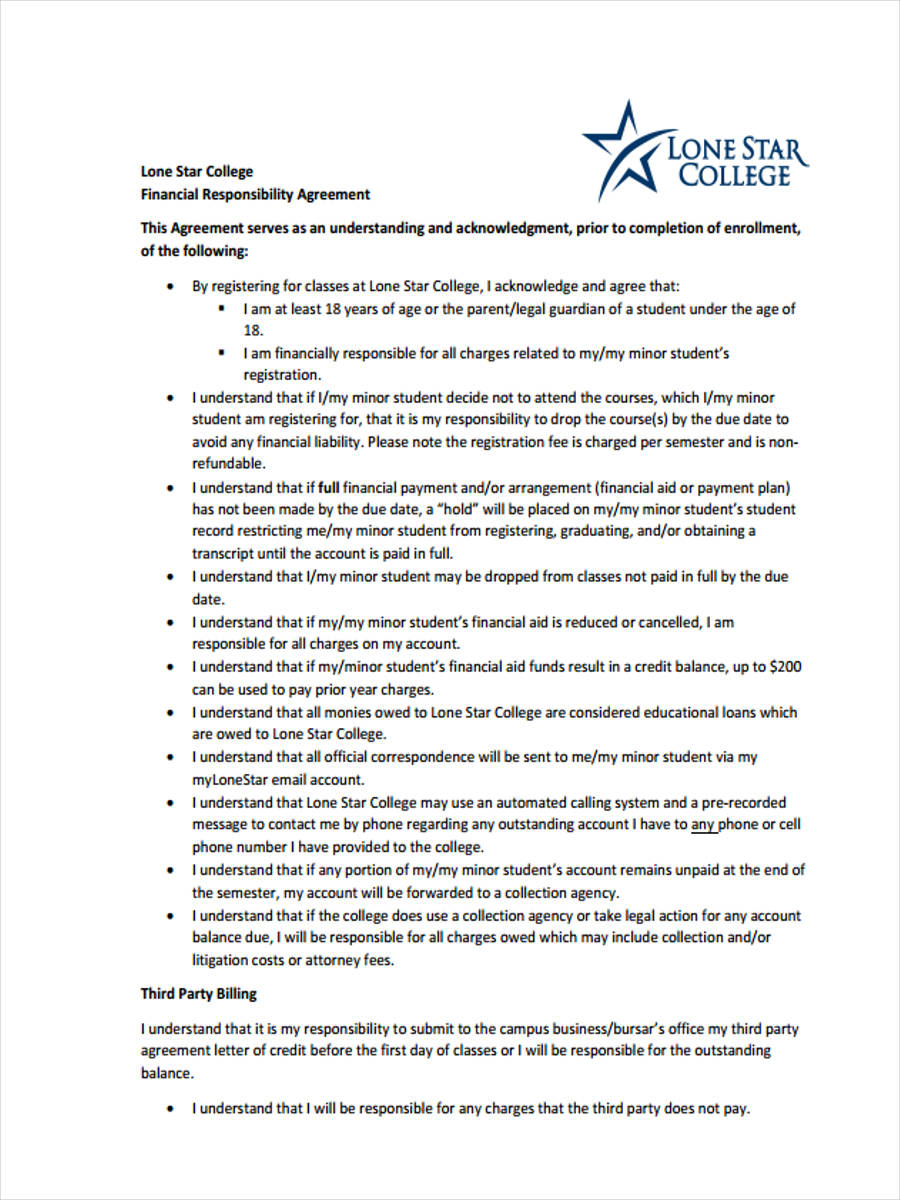

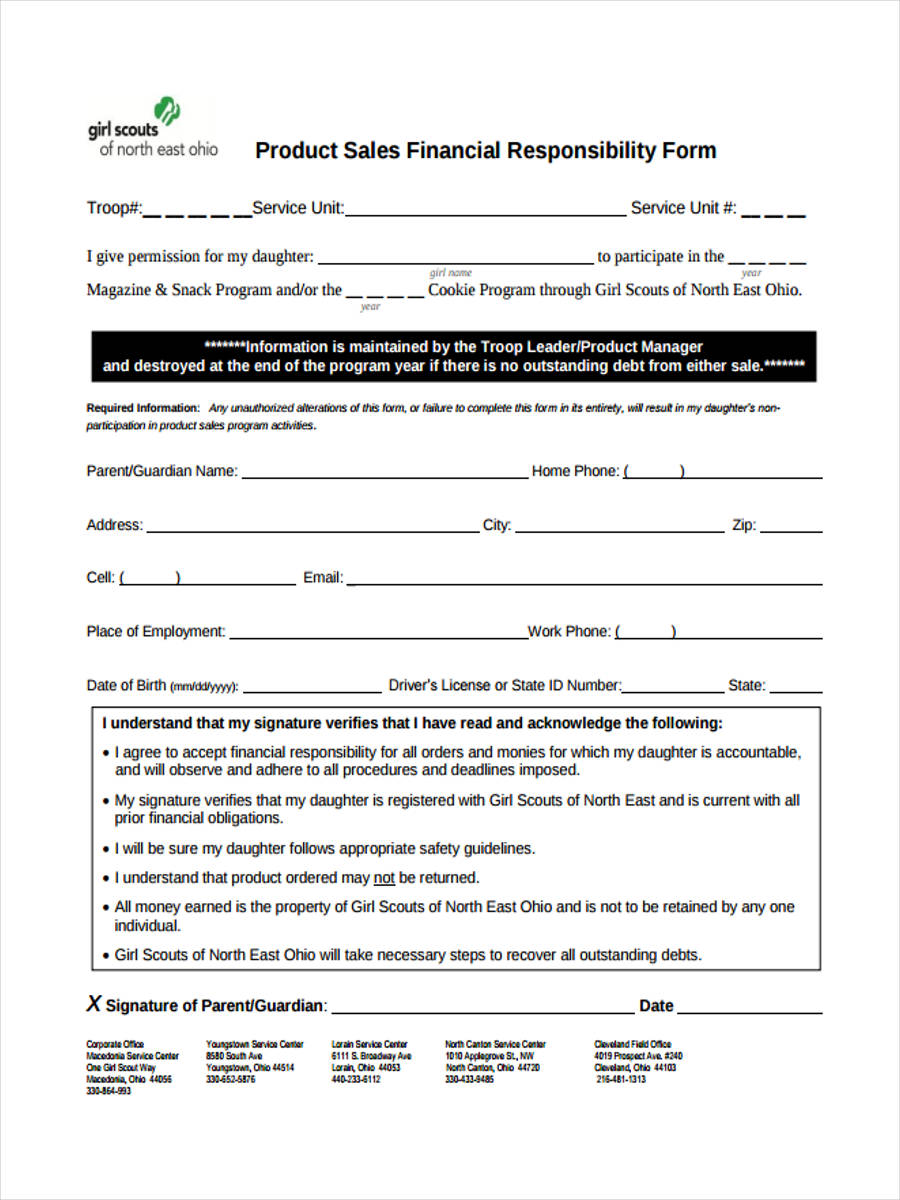

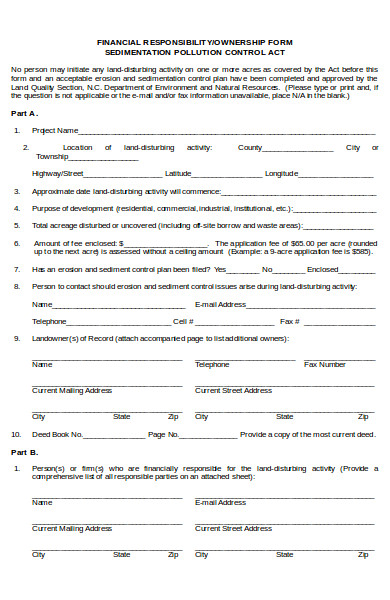

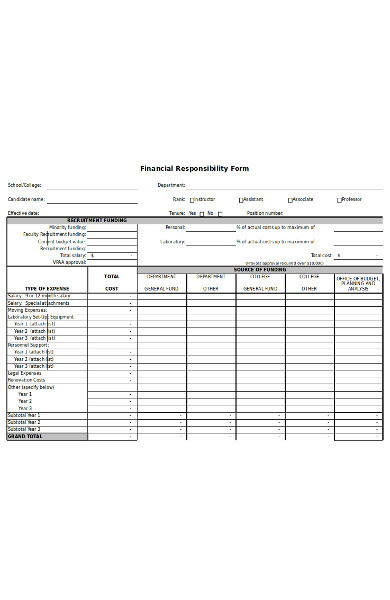

With a financial responsibility form, it formally records the details of an individual who is deemed financial responsible or held accountable for the payments to be paid in a particular circumstance. These type of financial forms are typically given in the business, medical, and the academic setting.

How to Write a Letter of Financial Responsibility

Different institutions incorporate the financial form for financial responsibility in order to know if the individual is capable of proving payment for the service or requires another source for the payment. When writing a letter of financial responsibility, the individual starts off with who the letter is addressed to. The content of the letter talks about informing the concerned party of who is financial responsibility for the payments that come with the service.

There are documents to be attached along the letter such as Financial Planning Forms, Social Security Numbers, and Passport Number. Other requirements may be asked depending on the preference and protocol of the concerned party.

Financial Responsibility Waiver

Financial Responsibility Release

Financial Responsibility Agreement

Product Sales Financial Responsibility

Sample Financial Responsibility Form

Basic Financial Responsibility Form

What Is Division of Financial Responsibility?

Financial Contract Forms may be used in different setting throughout society such as the business setting, the medical setting, and the academic setting. The same an be said for the use of division of financial responsibility. The division of financial responsibility is the concept of delegating a part of the payment to different parties and keep track of such information.

When applied to the medical field, the division of financial responsibility is utilized in the contracting process. In this process, the patient’s health plans may come into play and the contract includes which individuals are assigned to pay which medical treatment or procedure.

Tips in Financial Responsibility

In order to not experience any financial problems in the long run, one must equip themselves with tips in becoming financial responsible. The first thing to consider is to raise self-awareness when it comes to how much money is earned and how much money is spent.

A way to get to know one’s financial situation is to use various such as Personal Financial Statement Forms, Liquidation Reports, and Income Statements. Once all the forms have been completed, one can start creating a budget plan that appropriately allocates all the expenses the individual has. Another thing to remember is to save money when the opportunity presents itself.

Related Posts

-

FREE 5+ Financial Waiver Forms in MS Word | PDF

-

FREE 6+ Financial Consent Forms in MS Word | PDF

-

What are The Different Forms of Financial Aid? [ Types, Benefits, Purposes ]

-

How to Fill Out Financial Aid Forms? [ Include, Importance, How to, Steps ]

-

What are Financial Forms? [ Types, Purposes, Guidelines, Components, Importance ]

-

FREE 8+ Sample Financial Aid Forms in PDF | MS Word

-

FREE 10+ Sample Financial Disclosure Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Financial Information Release Forms in PDF | MS Word

-

FREE 9+ Sample Financial Assistance Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Financial Planning Forms in PDF | MS Word

-

FREE 9+ Personal Financial Statement Form Samples in PDF | MS Word | Excel

-

Business Financial Statement Form

-

FREE 9+ Sample Financial Hardship Forms in PDF | MS Word

-

FREE 8+ Sample Income Based Repayment Forms in PDF | MS Word

-

FREE 9+ Sample Financial Statement Forms in PDF | MS Word | Excel