An income-based repayment is a type of loan wherein the applicant is obligated to pay the amount through installment basis within 20 or more years. The process in paying is through getting a percentage from the individual’s monthly income until it will be fully paid or until the end of a contract. This loan is common among students who are in great need to borrow money for their college tuition in the US. A form is to be used when applying for this loan, which is called an Income-Based Repayment Form. To view samples of the form, scan through this article and click on the desired format.

We also have Income Statement Forms available for download here on our site.

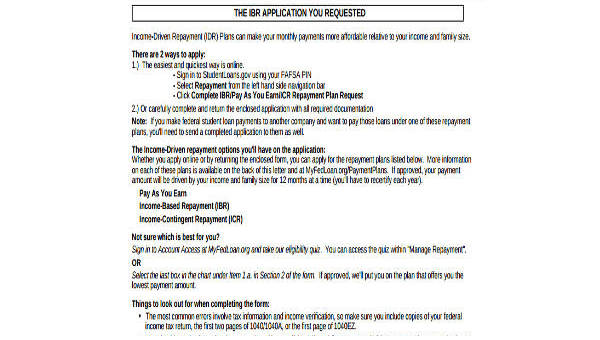

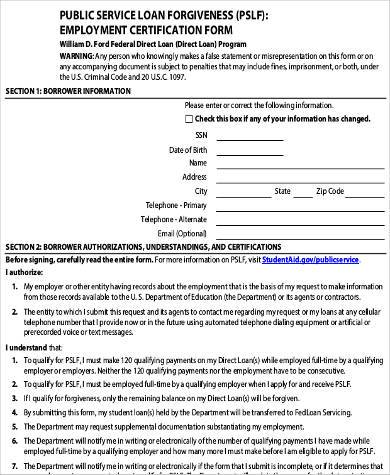

Student Loan Income Based Repayment Form

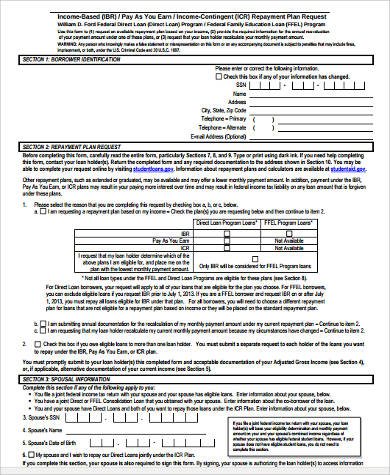

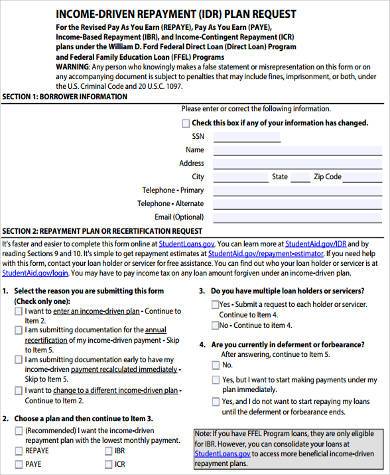

Income Based Repayment Plan Request Form

Income Based Repayment Plan Form Sample

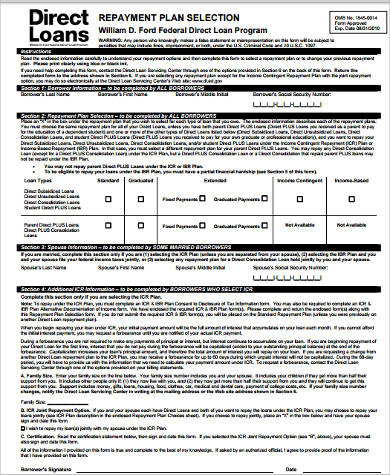

Servicing Income Based Repayment Form

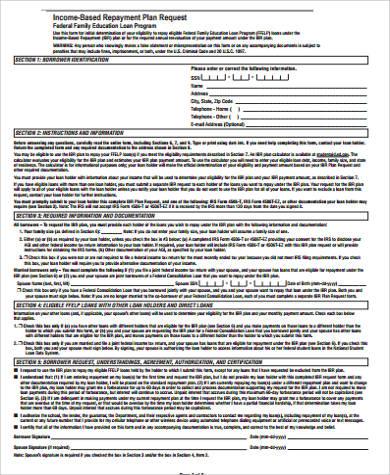

Income Based Repayment Plan Request Form

Vital Parts of an Income-Based Repayment (IBR) Form

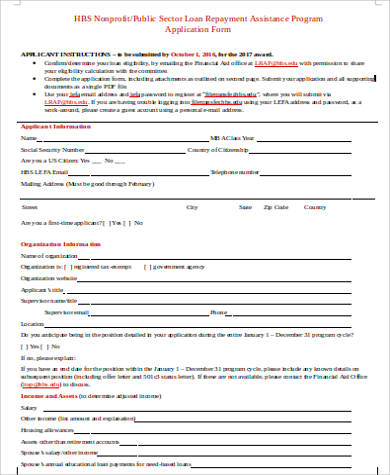

- Borrower Identification. This area is for the legal name, address, state, zip code, and the contact details of the applicant.

- Employment History. It is efficient if an applicant will be able to fill this out since it can be a basis for his capability in paying the loan.

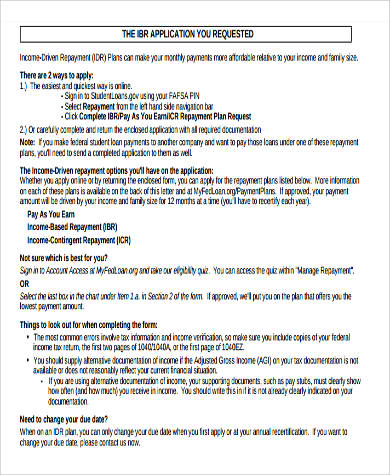

- Repayment Plan Request. This is where the applicant will state his reasons for why he needed the loan. He will also choose a plan depending on his monthly income. This area also shows if the applicant has other loans from more than one loan holder. Our Sample Income Verification Forms may be used to verify the applicant’s capability in paying the loan before the due date comes.

- Spousal Information. This is to be completed by those who aim to apply for a joint account with their spouse.

- Family Size. This section illustrates how family size matters in being able to pay the loan, since there are other aspects that may affect the ability of the applicant to fully pay due to familial circumstances. The applicant should honestly state the number of the members of his family.

- Borrower’s Agreement. This area is the most important part as it is where the borrower will need to agree to the terms and conditions applied in the form.

Income-Driven Based Repayment Plan Form Example

Income Based Repayment Public Sector Form

Income Based Repayment Self-Certification Form

Income Based Repayment Application Form in PDF

Quick Tips in Filling Out Income-Based Repayment Forms

- Read the instructions. Always mind the instructions before proceeding with filling up the form. Some instructions include the color of the ink to be used, which is commonly black.

- Reason out honestly. There are a number of repayment forms that need a sentence or two for providing a reason why you needed the amount you specified. Never veer away from your main purpose just to improve your chances of having the loan granted.

- Support your information with documents. Birth certificates, clearances, and employment certificates are few of the documents that the loan holder may need from you. An Income Tax Extension Form will also be a proof that you are a responsible person who complies with the state’s laws.

- Fill up only what you know. Mistakes are not welcome in filling out an important form. Some physical documents will not be accepted if there are visible erasures in your answers. Write the information that you know and avoid adding things that are faulty.

- Read the agreement. At the bottom part of the form, there is an agreement and a space to put your signature. Read first the content of the agreement and ask an authorized personnel if you have any inquiries or if you found the content questionable. Remember that it is better to be cautious and vigilant than to be passive when signing agreements.

Related Posts

-

FREE 8+ Sample Financial Aid Forms in PDF | MS Word

-

FREE 10+ Sample Financial Disclosure Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Financial Information Release Forms in PDF | MS Word

-

FREE 9+ Sample Financial Assistance Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Financial Planning Forms in PDF | MS Word

-

FREE 9+ Personal Financial Statement Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Financial Hardship Forms in PDF | MS Word

-

FREE 9+ Sample Financial Statement Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Profit and Loss Forms in PDF | Excel

-

FREE 18+ Sample Financial Forms in PDF | MS Word | Excel

-

FREE 5+ Financial Waiver Forms in MS Word | PDF

-

FREE 6+ Financial Consent Forms in MS Word | PDF

-

What are The Different Forms of Financial Aid? [ Types, Benefits, Purposes ]

-

How to Fill Out Financial Aid Forms? [ Include, Importance, How to, Steps ]

-

FREE 8+ Financial Responsibility Forms in PDF | Ms Word | Excel