Dive deep into the world of Invoice Forms with our all-encompassing guide. This tutorial not only elucidates the steps to create compelling invoices but also integrates the nuances of the Invoice Request Form and the utility of Fillable Form documents. Whether you’re invoicing for services or products, our guide is packed with examples, best practices, and essential tips to ensure your invoicing process is both efficient and effective. Ideal for businesses looking to streamline their financial documentation, our guide makes managing invoices a breeze.

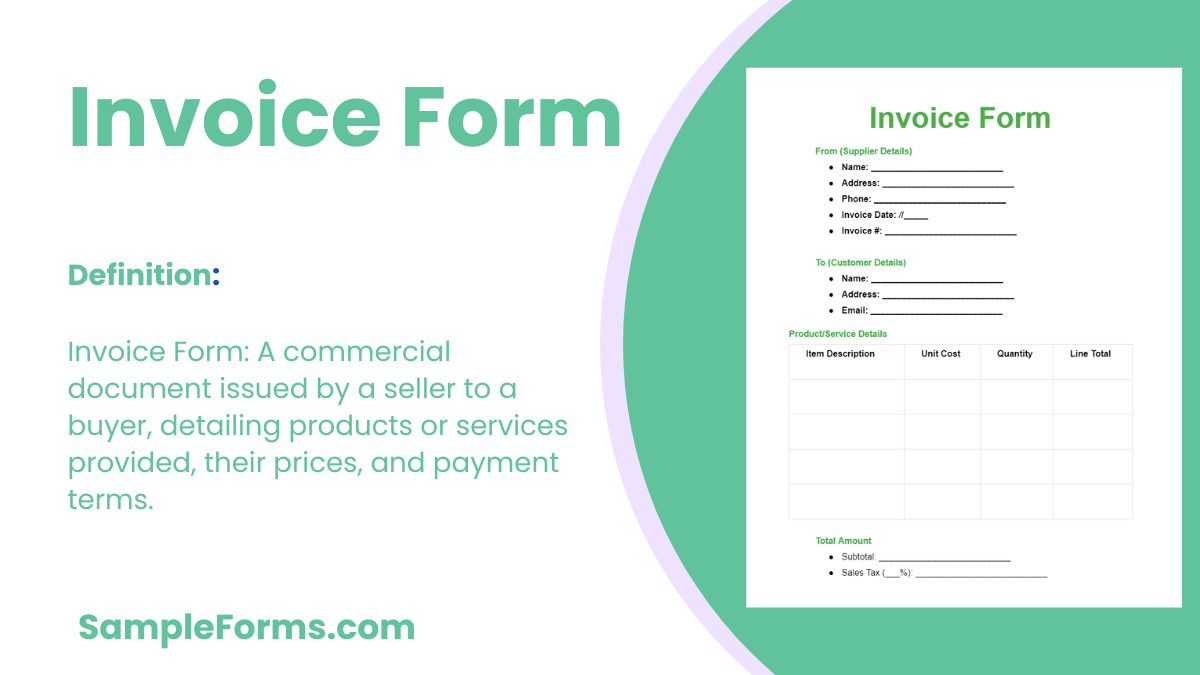

What is an Invoice Form?

An Invoice Form is a formal document sent by a seller to a buyer, detailing the goods or services sold, their prices, and payment terms. It serves as a request for payment, recording the transaction details crucial for both accounting and legal purposes. Invoice forms can vary in format and design but essentially provide a clear breakdown of charges to facilitate timely and accurate payment from the client.

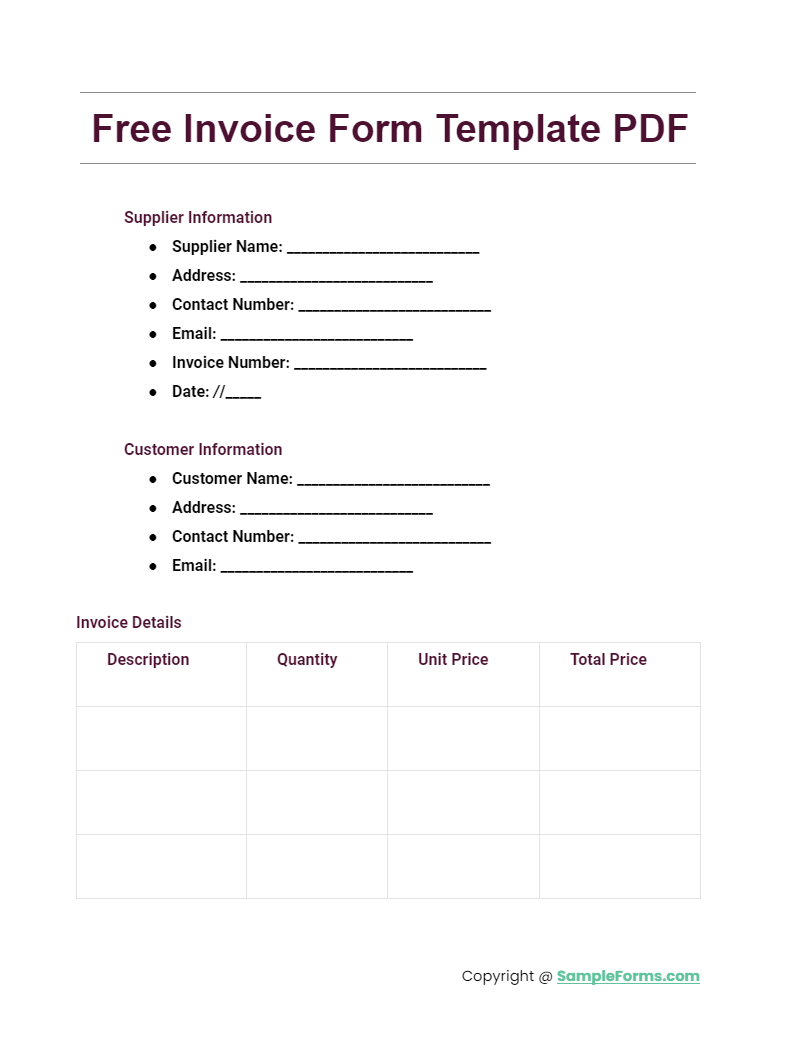

Invoice Format

Supplier Information

- Supplier Name: [Enter Supplier Name]

- Address: [Enter Address]

- Contact Number: [Enter Contact Number]

- Invoice Number: [Enter Invoice Number]

- Date: [DD/MM/YYYY]

Customer Information

- Customer Name: [Enter Customer Name]

- Address: [Enter Address]

- Contact Number: [Enter Contact Number]

Invoice Details

- Description of Goods/Services: [Enter Description]

- Quantity: [Enter Quantity]

- Unit Price: [Enter Unit Price]

- Total Price: [Calculate Total Price]

Payment Information

- Payment Method: [Enter Payment Method]

- Due Date: [Enter Due Date]

Free Invoice Form Template PDF

Download Free Invoice Form Template PDFs to streamline your billing process. Ideal for a Landscaping Business Invoice, these templates are customizable and ready to be filled with transaction details, enhancing your professional image. You also browse our Voluntary Statement Form

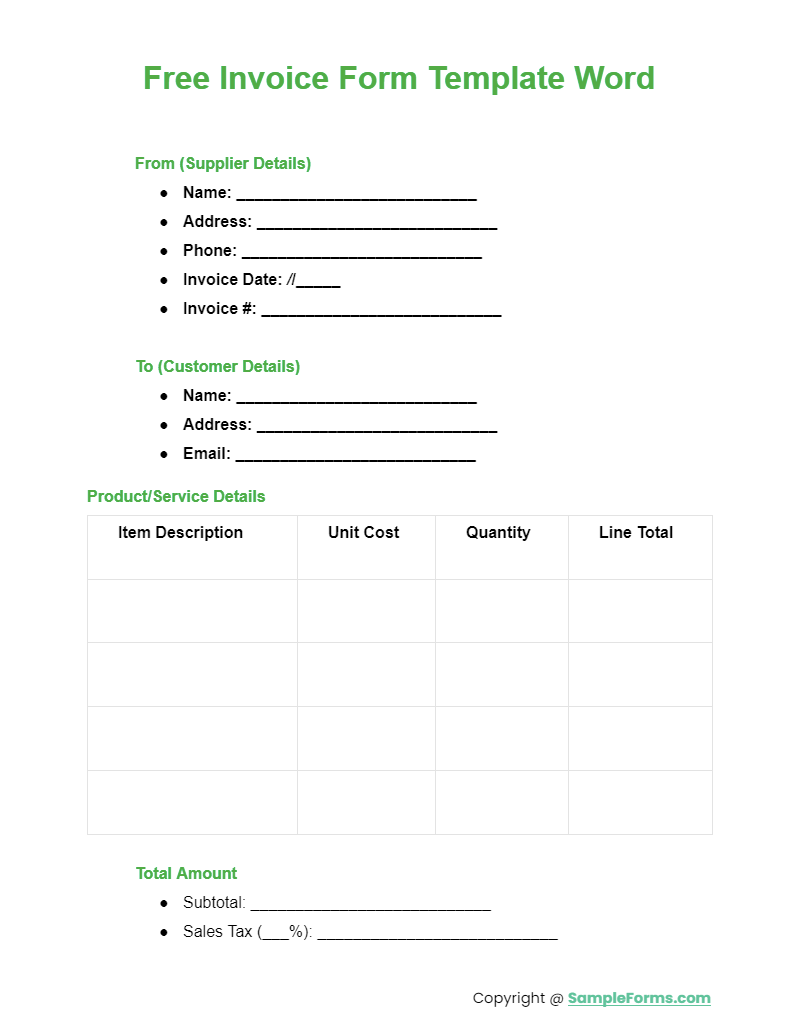

Free Invoice Form Template Word

Free Invoice Form Template Word documents offer flexibility for any Internet Marketing Business Invoice. Easily adjust the template to match your branding, ensuring your invoices look professional and are in line with your marketing strategy. You also browse our Confirmation Statement Form

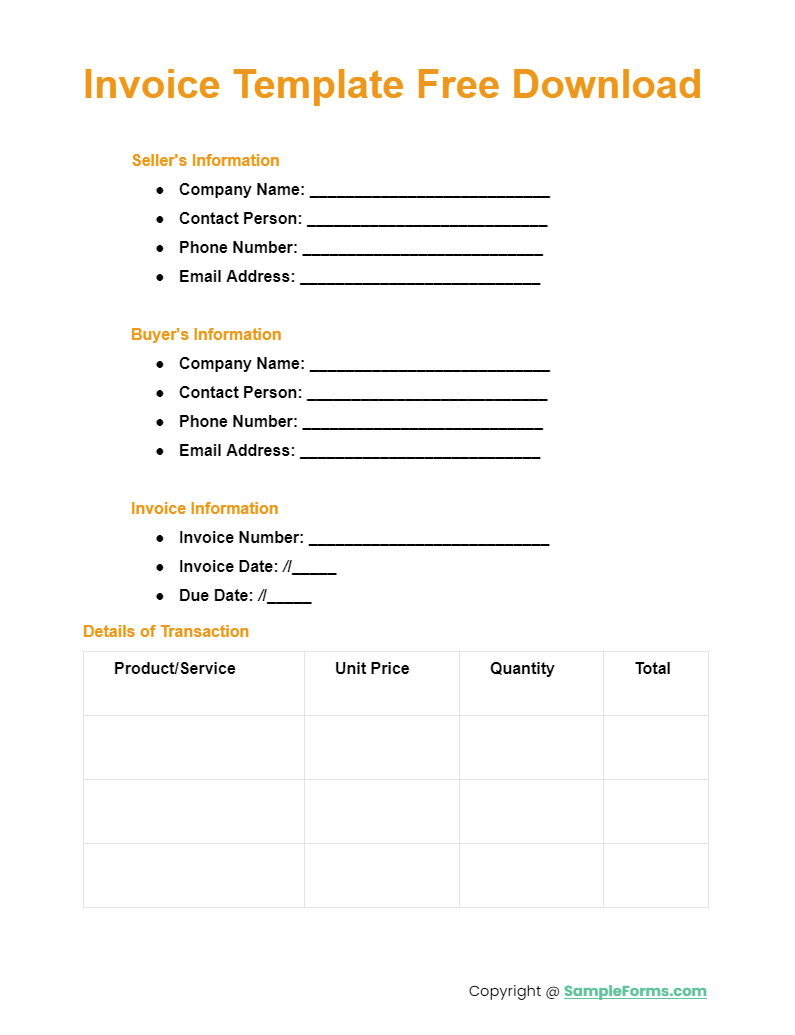

Invoice Template Free Download

Access a variety of Invoice Template Free Downloads for immediate billing solutions. Whether for a Vehicle Invoice Form or general billing, these templates provide a structured format to detail charges and services accurately. You also browse our Reference Check Form

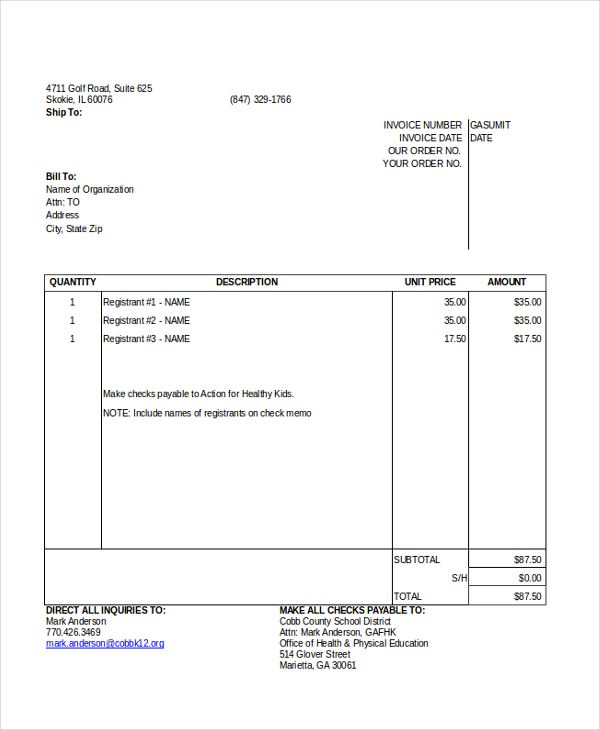

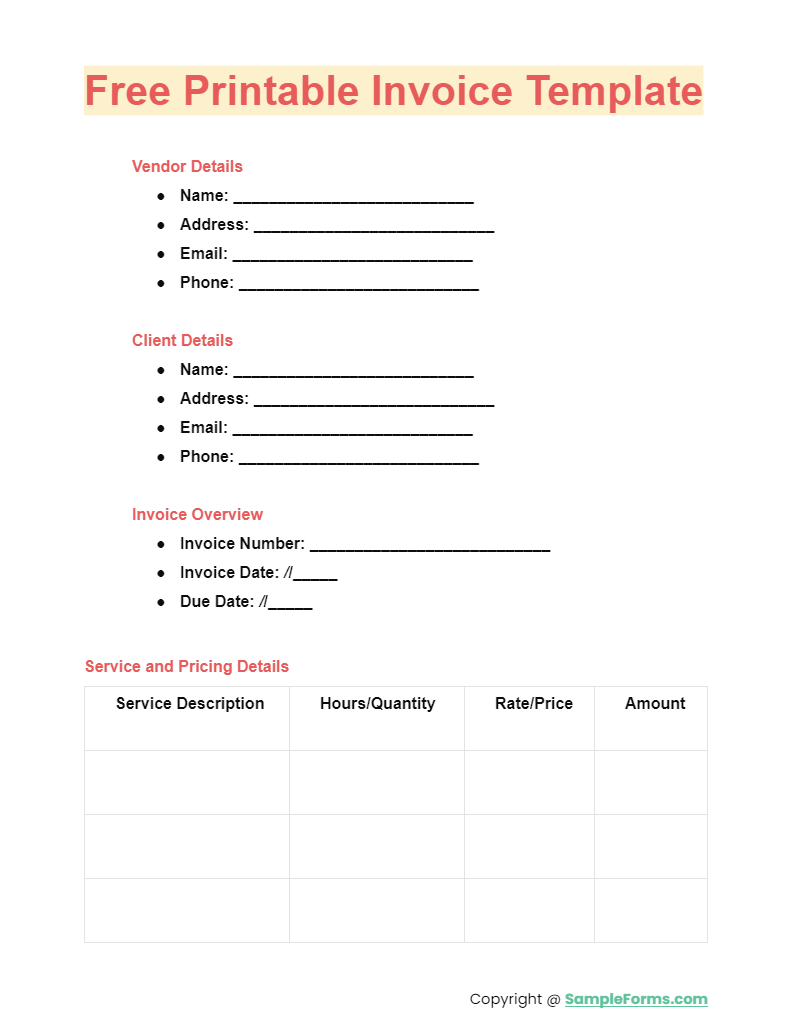

Free Printable Invoice Template

More Invoice Form Samples

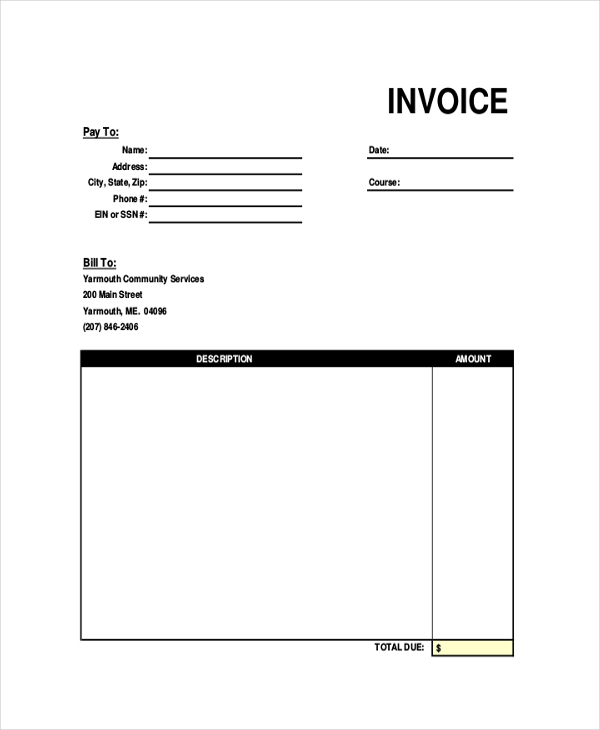

Blank Invoice Sample

Here is the perfect blank invoice sample available online in PDF format that helps you create a detailed invoice for requesting payment from your client. Get downloaded online now today. You also browse our Health Statement Form

Printable Blank Invoice

Get this printable blank invoice downloaded online and get customized to frame your personalized invoice to request payment from the client. This sample will help you create a detailed invoice in a few minutes. You also browse our Statement Form

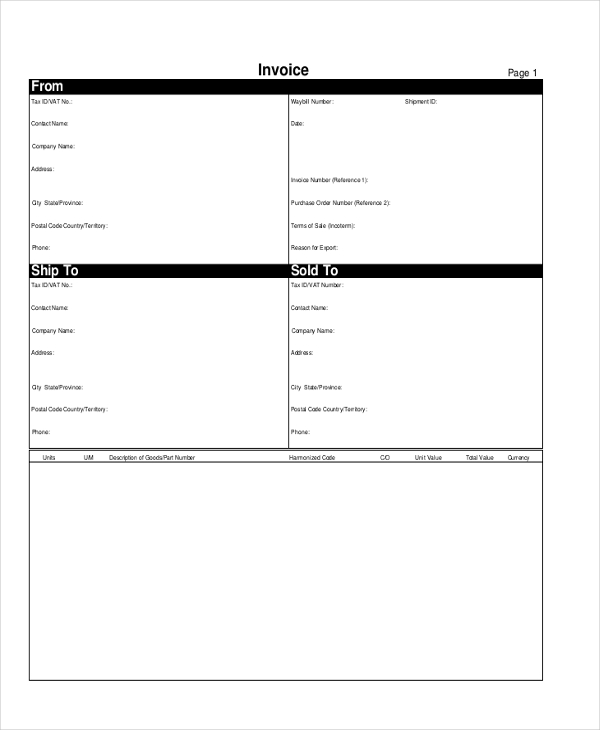

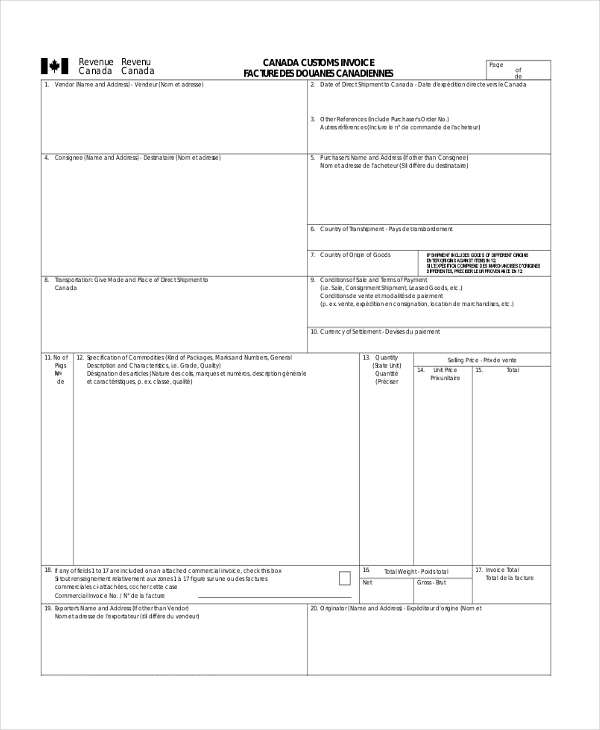

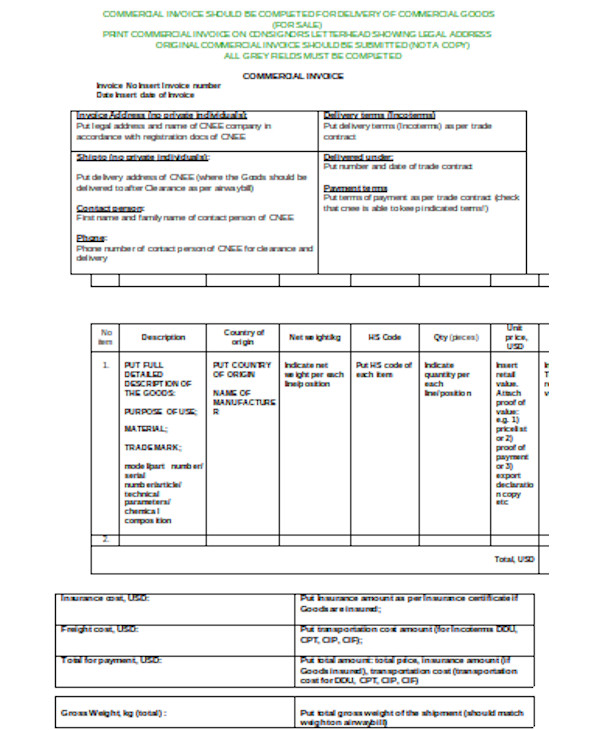

Blank Customs Invoice

Invoice your customers in the most continent way by using this blank customs invoice template available in PDF format. This sample comes with perfectly organized columns which you can fill with your customized details. You can also make changes to the format to add or remove columns. You also browse our Legal Statement Form

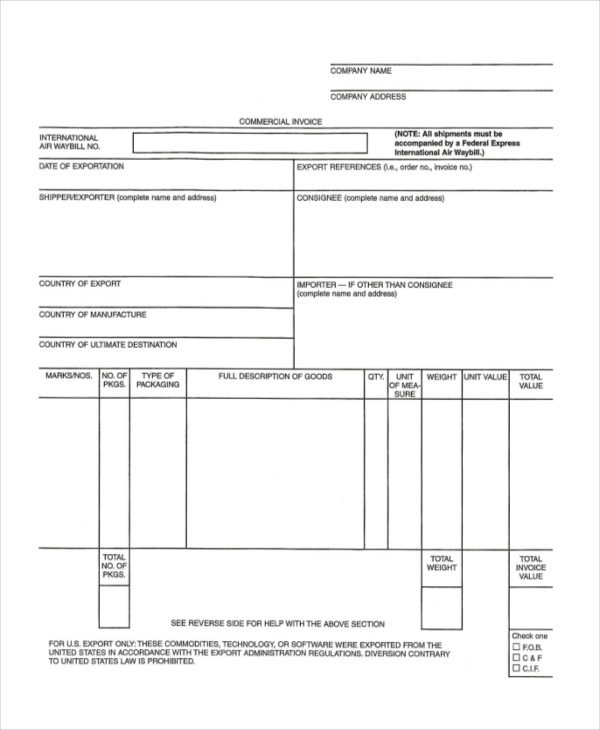

Blank Commercial Invoice

Looking to create a detailed commercial invoice? Get this blank commercial invoice form downloaded online and create a thorough and professional commercial invoice created to request payments from the client. You also browse our Medical Statement Form

Blank Invoice Excel

Here is another perfect blank invoice option for you if you are looking for an ideal invoicing format. This template is available in excel format and is highly easy to get customized. You also browse our Personal Statement Form

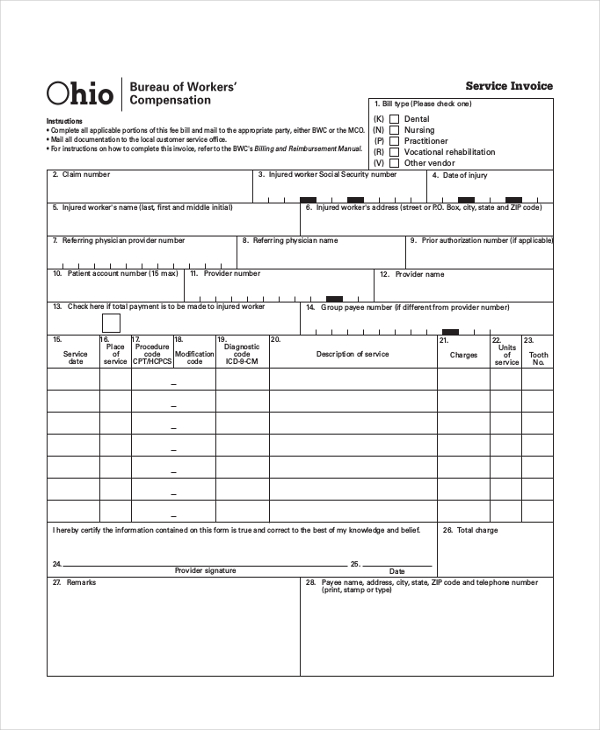

Blank Service Invoice

Give the detailed elaboration of your delivered products or services to your clients while also requesting payments with this effective blank service invoice template available online for instant download in PDF format. You also browse our Financial Statement Form

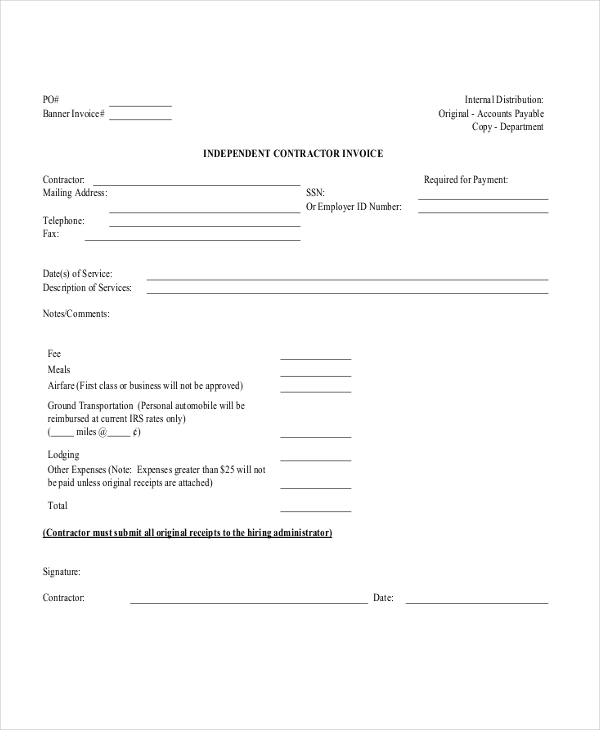

Blank Independent Contractor Invoice

Are you an independent contractor looking to send invoices to your client? Check out this blank invoice form and get downloaded to create detailed invoices fast. Fully customizable PDF file with editable fields. You also browse our Auto Bill of Sale Form

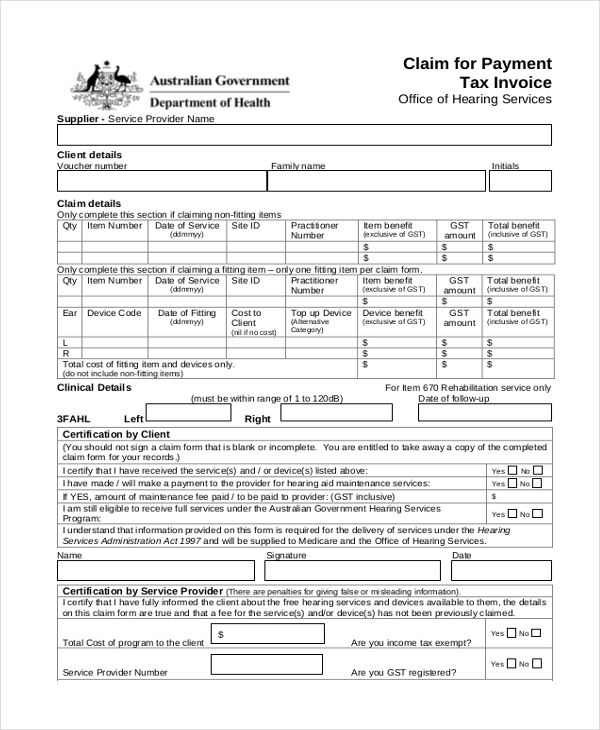

Blank Tax Invoice Form

Try this blank tax invoice form if you are looking to create a tax invoice to send to your client. With this sample, you just need to fill the columns with your personalized details. You can also edit the form to create required field names. You also browse our Equipment Bill of Sale Form.

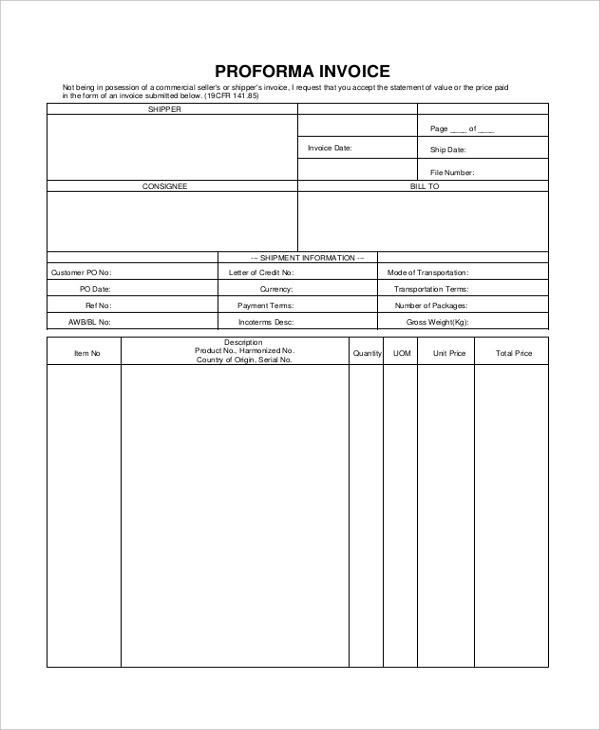

Blank Proforma Invoice

Do you need help in creating a proforma invoice? Utilize this Proforma Invoice Form and create detailed invoices to request payments from your customers. Available for instant download in PDF format. Download now. You also browse our Notarized Bill of Sale Form

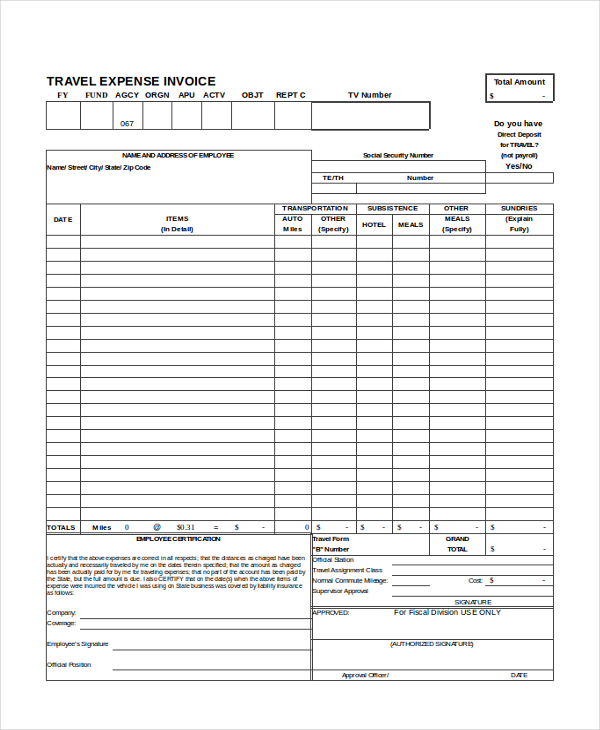

Blank Travel Expense Invoice

Need to request payment for your business travel expenses? Here is the required type of your blank travel expense invoice template with which you can create a perfect blank travel expense invoice in seconds. You also browse our Mobile Home Bill of Sale

Simple Blank Invoice Form

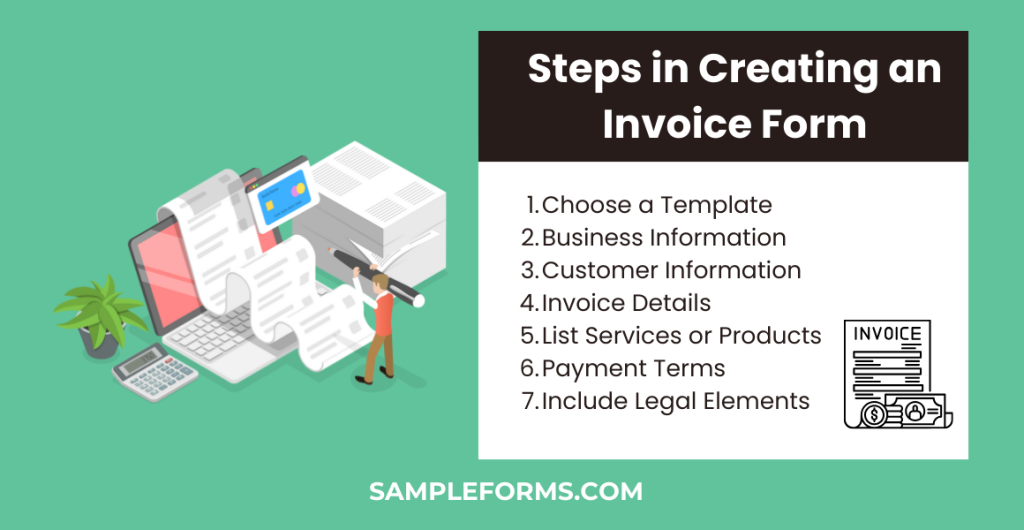

How do I create an invoice form?

Creating an invoice form involves several crucial steps to ensure accuracy and completeness:

- Choose a Template: Start with a template that suits your business needs. Many software programs offer customizable templates.

- Business Information: Include your business name, contact details, and logo at the top.

- Customer Information: Add the customer’s name, address, and contact information.

- Invoice Details: Assign an invoice number, date of issue, and payment due date.

- List Services or Products: Clearly itemize the services or products provided, including descriptions and prices.

- Payment Terms: Specify the payment terms, including preferred payment methods and any late payment penalties.

- Include Legal Elements: For specific industries, integrating a Bill of Lading Form can be crucial for documenting the receipt and shipment of goods. You also browse our Accounts Receivable Ledger Form

How do I write an invoice?

Writing an invoice correctly ensures clarity and prompt payment:

- Header: Label the document as an “Invoice” prominently.

- Your Details: Include your business name, address, and contact information.

- Customer’s Details: Input the customer’s name and address.

- Invoice Number and Date: Every invoice should have a unique number and the date of issuance.

- Description of Goods/Services: Provide a detailed list of goods or services with prices.

- Total Amount: Calculate the total amount due, including taxes.

- Payment Instructions: Outline how the customer can make the payment, possibly referencing the Salary Statement Form for clarity in payment expectations. You also browse our Asset Receipt Form

What does an invoice need?

An invoice needs specific elements to be effective and compliant:

- Header: Clearly state that the document is an invoice.

- Sender and Receiver Information: Business and customer contact details.

- Invoice Number: A unique identifier for tracking.

- Date: The date the invoice is issued and the due date for payment.

- Itemized List of Services or Products: Including quantities, rates, and total price.

- Total Amount Due: Including any taxes or discounts.

- Payment Terms: Such as the due date and penalties for late payment, akin to information in a Billing Statement Form.

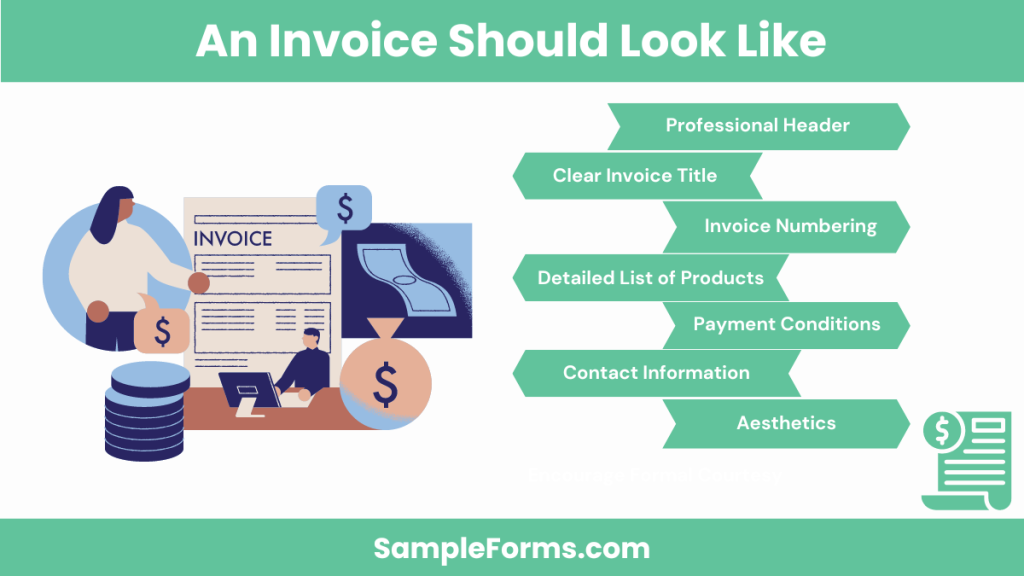

How should an invoice look?

An invoice should be clear, professional, and easy to read:

- Professional Header: With your logo and company name.

- Clear Invoice Title: The word “Invoice” should be prominent.

- Sequential Invoice Numbering: For easy tracking.

- Detailed List of Products/Services: With prices and totals.

- Payment Terms and Conditions: Highlighted clearly.

- Contact Information: For any queries.

- Aesthetics: Use a clean layout with readable fonts, considering formats like the Boat Bill of Sale Form for specific transactions. You also browse our Petty Cash Receipt Form

What is acceptable as an invoice?

An acceptable invoice must meet legal and professional standards:

- Legibility: It must be easy to read and understand.

- Completeness: Including all necessary details such as company information, invoice number, and itemized charges.

- Compliance: Adhering to local tax laws and regulations.

- Professional Presentation: Following a structured format similar to industry standards like a Salary Review Form.

- Proof of Transaction: It should serve as a legitimate record of the transaction between the buyer and seller. You also browse our Deposit Receipt Form

What is an invoice and its purpose?

An invoice is a document issued by a seller to a buyer detailing a transaction and requesting payment. Its purposes include:

- Record Keeping: It provides a record of sales transactions for both parties.

- Legal Documentation: It serves as a legal document that can be used in disputes.

- Accounting: It aids in tracking income and expenses.

- Tax Compliance: Necessary for tax assessments and audits.

- Payment Request: Clearly communicates the amount owed, supporting documents like a Salary Survey Form may also play a role in determining payment standards and practices. You also browse our Cash Payment Receipt Form

Can I just write an invoice?

Yes, you can write an invoice yourself, especially for small businesses or freelance work. Ensure it includes all essential details for clarity and legal compliance, akin to a Wealth Statement Form.

Is an invoice a bill or receipt?

An invoice is a bill issued prior to payment, requesting payment for goods or services, unlike a receipt, which is provided after payment as proof, similar to a DMV Bill of Sale Form.

Can I use invoice as proof of payment?

No, an invoice itself is not proof of payment; it’s a request for payment. Proof of payment is typically a receipt or a bank statement, not unlike a Medical Bill Form confirming services paid.

Should I put my EIN on invoices?

Yes, including your EIN on invoices is good practice, especially for B2B transactions, enhancing transparency and tax-related processes, similar to information on a Motorcycle Bill of Sale.

Can anyone make an invoice?

Yes, anyone who provides a service or sells goods can create an invoice. It’s a universal document, just as a Horse Bill of Sale Form is used in private sales.

Who issues an invoice?

The seller or service provider issues an invoice to the buyer or client, requesting payment for goods or services provided, paralleling a Vehicle Bill of Sale Form for transferring ownership.

Related Posts

-

FREE 9+ Invoice Request Forms in MS Word | PDF | Excel

-

FREE 4+ Photography Invoice Forms in PDF

-

FREE 9+ Sample Service Invoice Forms in MS Word | PDF

-

FREE 6+ Vehicle Invoice Forms in MS Word | PDF

-

FREE 6+ Sample Tax invoice Forms in Excel | PDF

-

FREE 6+ Sample Rent Invoice Forms in PDF

-

Medical Invoice Form

-

Catering Invoice Form

-

FREE 24+ Invoice Forms in Excel

-

FREE 7+ Sample Plumbing Invoice Forms in PDF | MS Word

-

FREE 6+ Sample Payment Invoice Forms in MS Word | PDF

-

FREE 6+ Sample Work Invoice Forms in PDF | MS Word

-

FREE 6+ Sample Job Invoice Forms in PDF | MS Word

-

FREE 9+ Sample Business Invoice Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Invoice Forms in PDF | MS Word | Excel