A Medical Form is an essential tool for managing healthcare expenses. It serves as a record of services rendered, treatments provided, and associated costs, ensuring transparency between patients, healthcare providers, and insurers. Whether for personal use or insurance claims, a well-drafted Medical Bill Form includes all necessary details such as patient information, service dates, descriptions, and total amounts. This guide offers detailed examples to help individuals and organizations create effective forms tailored to their needs. By ensuring accuracy and completeness, a Medical Form reduces the chances of billing errors and facilitates faster reimbursements.

Download Medical Bill Form Bundle

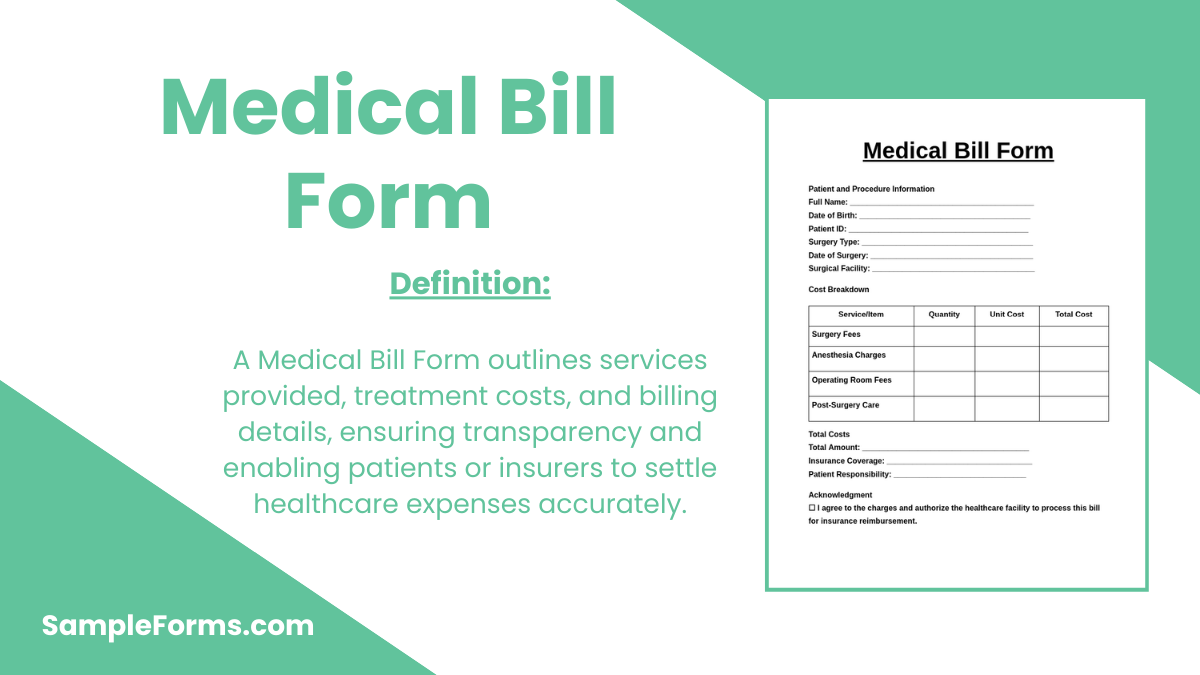

What is Medical Bill Form?

A Medical Bill Form is a document used to detail the healthcare services a patient has received along with associated costs. It typically includes information like patient details, treatment descriptions, service dates, and total charges. Healthcare providers use it for accurate billing, while patients and insurers rely on it for claims processing. Its primary purpose is to maintain transparency, ensure accountability, and streamline financial transactions in healthcare. With a properly filled Medical Bill Form, misunderstandings are minimized, and reimbursements or payments can be processed efficiently.

Medical Bill Format

Patient Information

Full Name: ___________________________________________

Patient ID: ___________________________________________

Date of Birth: ________________________________________

Contact Number: _____________________________________

Email Address: ______________________________________

Service Information

Date of Service: _____________________________________

Service Provided: ____________________________________

Name of Healthcare Provider: __________________________

Provider Contact: ____________________________________

Billing Details

Total Amount Charged: ________________________________

Amount Paid by Insurance: ____________________________

Outstanding Balance: _________________________________

Payment Information

Payment Method: _____________________________________

Payment Date: _______________________________________

Signature: __________________________________________

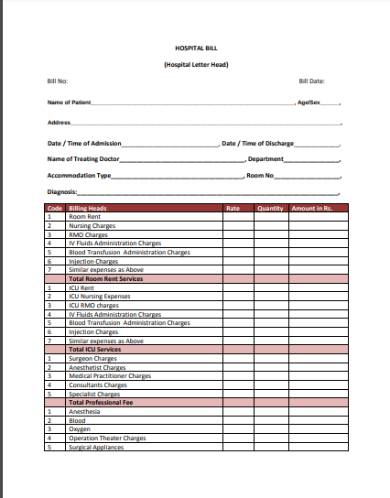

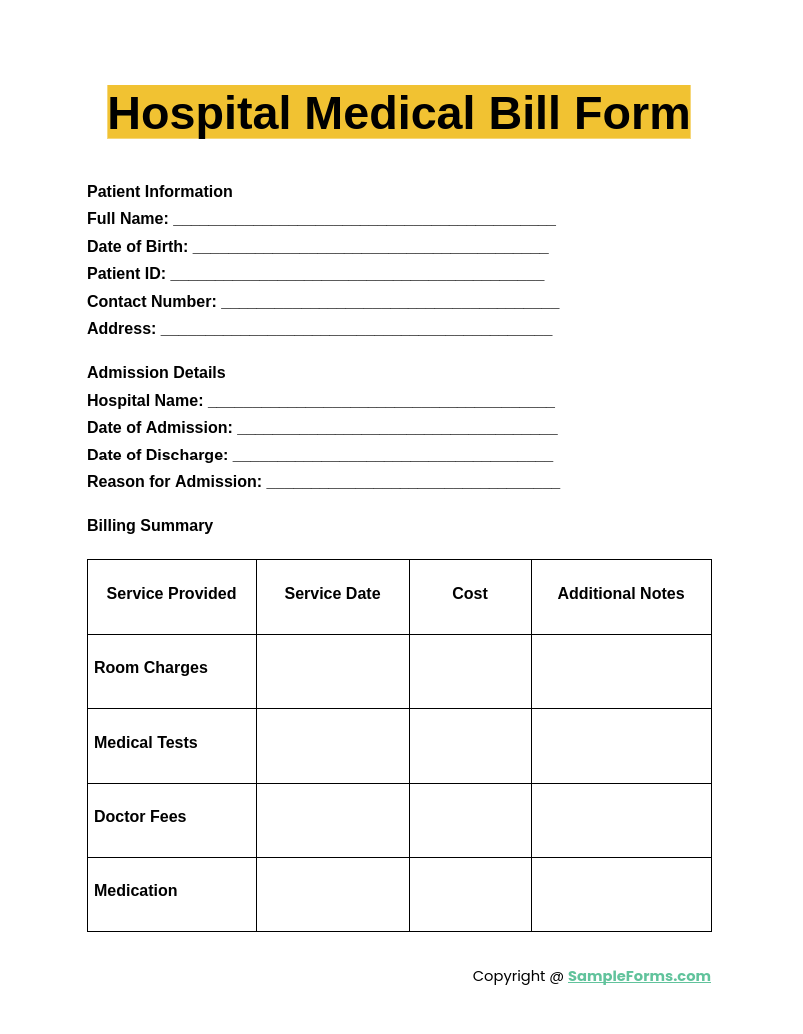

Hospital Medical Bill Form

A Hospital Medical Bill Form provides a detailed summary of a patient’s health history and treatment. Similar to a Medical Report Form, it ensures accurate documentation for healthcare providers and patients, promoting transparency in medical evaluations and follow-ups.

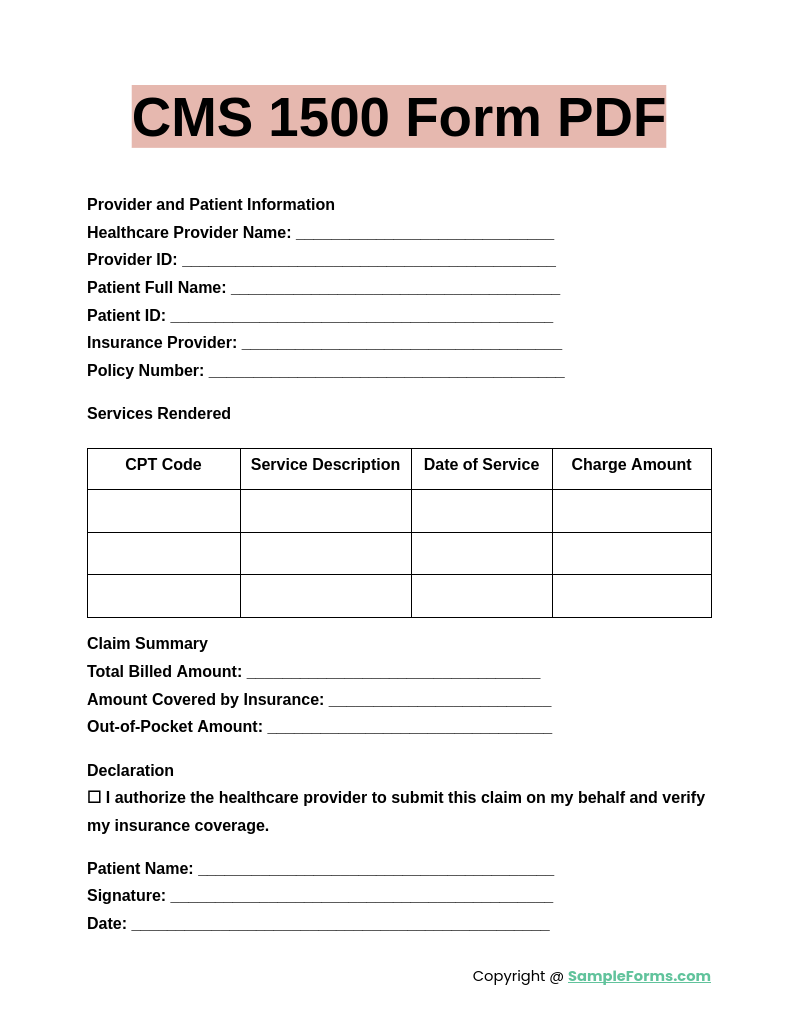

CMS 1500 Form PDF

A CMS 1500 Form PDF is used to release liability in specific medical situations. Similar to a Medical Waiver Form, it requires detailed completion to outline conditions and ensure all parties are informed and protected.

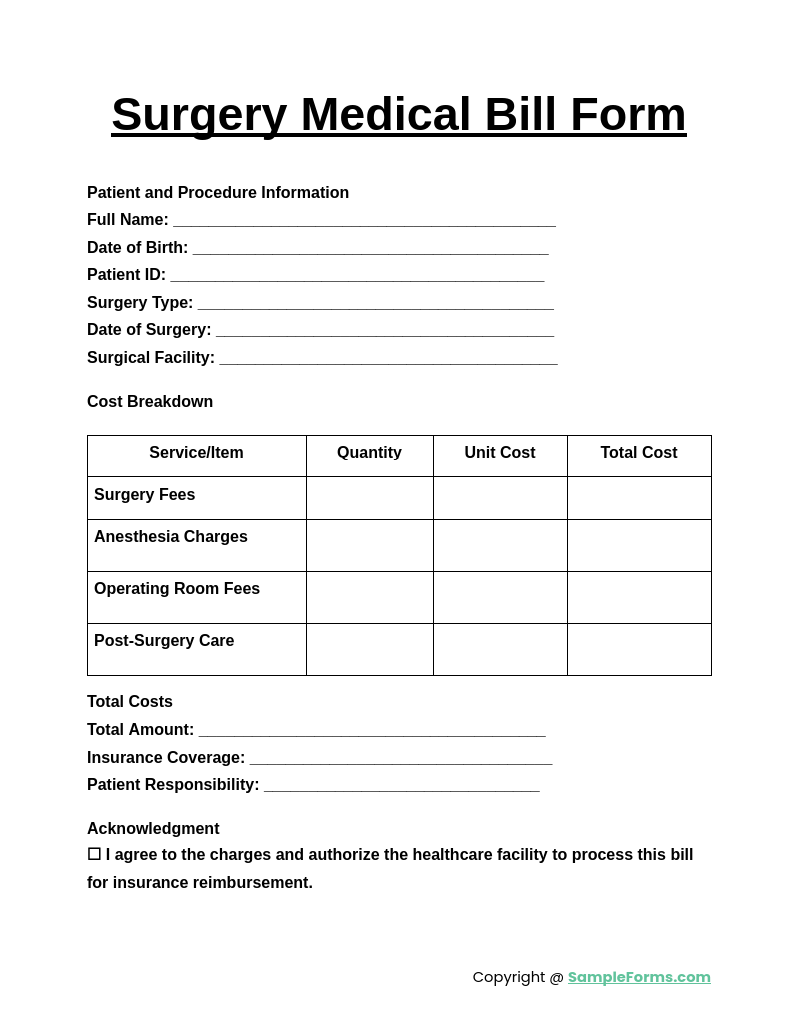

Surgery Medical Bill Form

A Surgery Medical Bill Form records findings from a physical check-up. Similar to a Medical Examination Form, it ensures thorough reporting, capturing necessary data for employment, school admission, or health evaluations with accuracy.

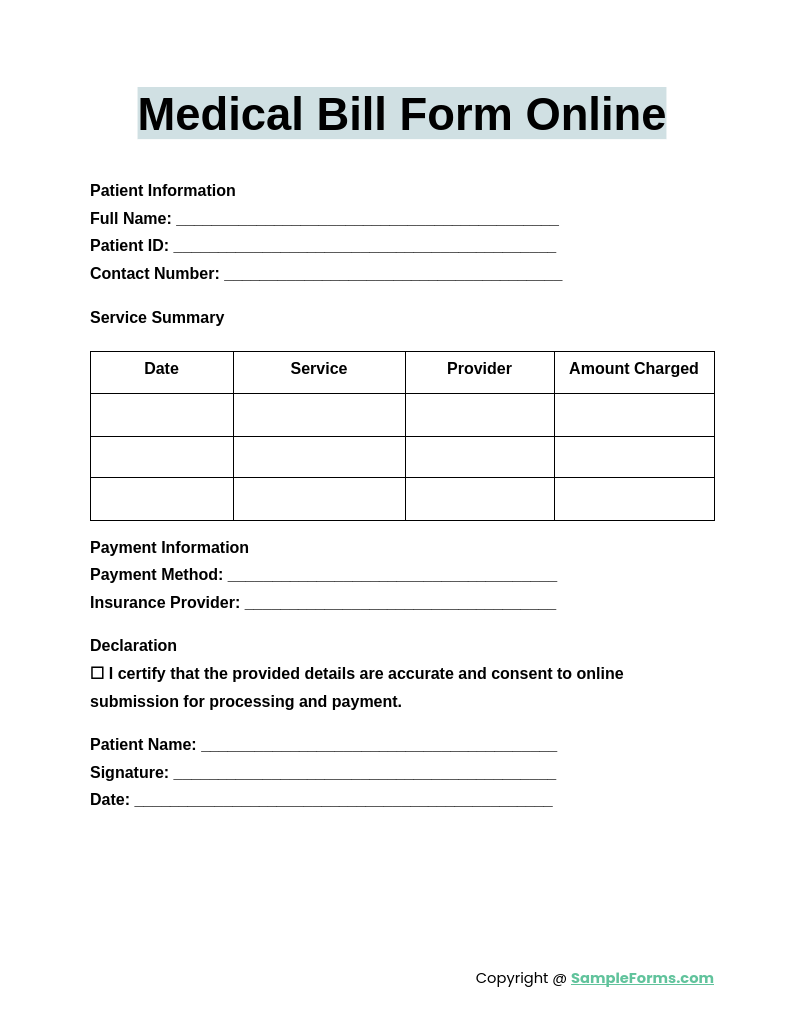

Medical Bill Form Online

A Medical Bill Form Online verifies an individual’s health status for official purposes. Similar to a Medical Certification Form, it is a structured document providing proof of fitness, illness, or recovery for employment, insurance, or legal requirements.

Sample Medical Bill Forms

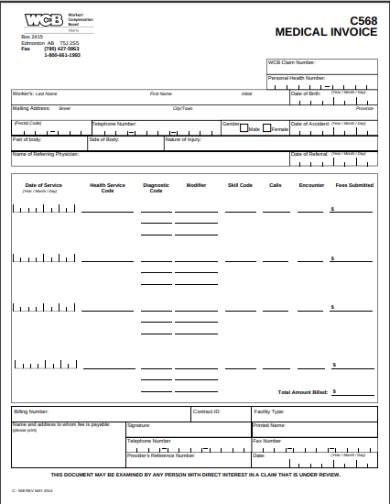

Workers Compensation Board Sample Medical Invoice

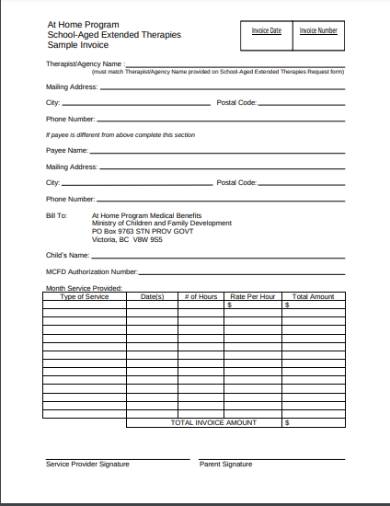

Home Program Therapy Sample Invoice

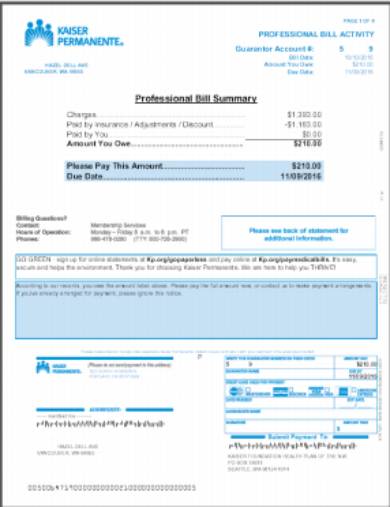

Kaiser-Permanente Sample Medical Bill

Sample Hospital Bill

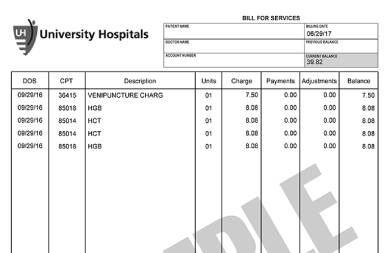

University Hospital Sample Bill

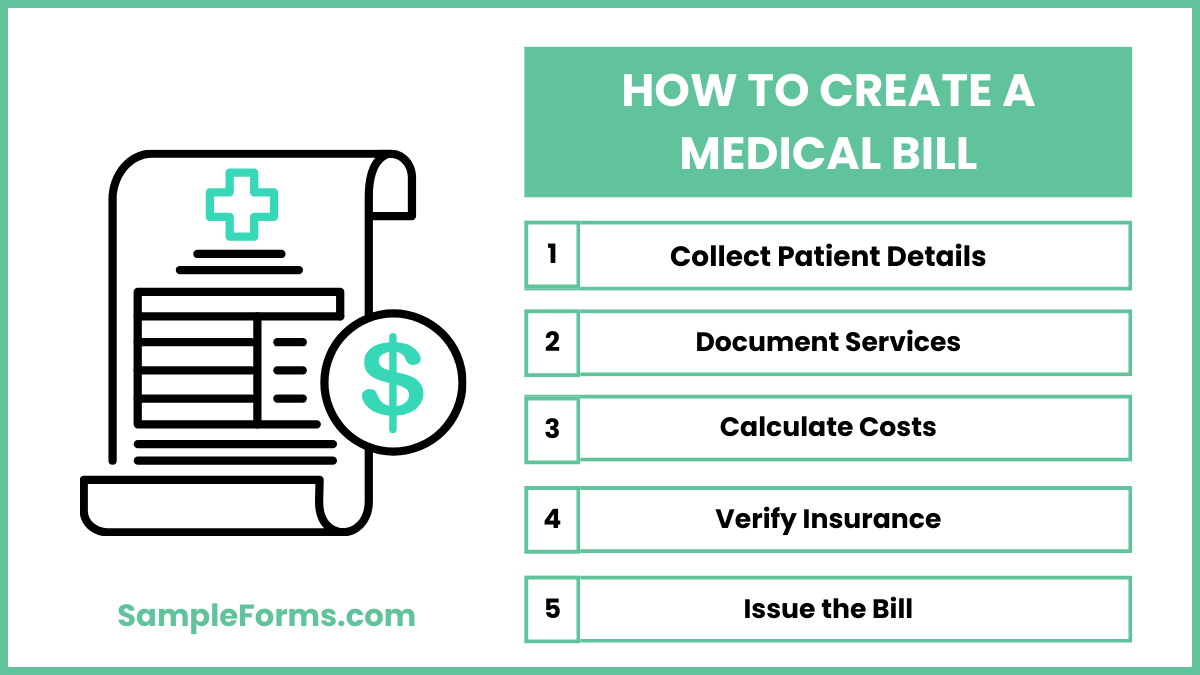

How to create a medical bill?

Creating a medical bill involves detailing patient information, services provided, and associated costs in a structured format for accurate financial documentation.

- Collect Patient Details: Include name, address, and insurance information, similar to a Medical Release Form.

- Document Services: Record all treatments and procedures with corresponding codes.

- Calculate Costs: Add charges for services, medications, and tests.

- Verify Insurance: Confirm coverage for listed services to avoid claim rejections.

- Issue the Bill: Provide the finalized bill to the patient or insurer.

How to do medical billing?

Medical billing processes claims between healthcare providers and insurers, ensuring accurate reimbursements for rendered services.

- Gather Patient Information: Collect personal and insurance details.

- Verify Coverage: Confirm the insurer covers treatments, as with a Dental Medical Clearance Form.

- Submit Claims: Use standardized forms to file claims electronically or manually.

- Follow Up: Monitor claim status and resolve issues promptly.

- Process Payments: Record payments and manage outstanding balances.

What forms are used for medical billing?

Medical billing relies on specific forms to document and process financial transactions for healthcare services.

- CMS-1500 Form: Standardized for outpatient billing.

- UB-04 Form: Used for hospital billing.

- Explanation of Benefits (EOB): Details services and coverage.

- Against Medical Advice Form: Captures patient decisions that may impact billing.

- Payment Receipt Forms: Verify received payments for accuracy.

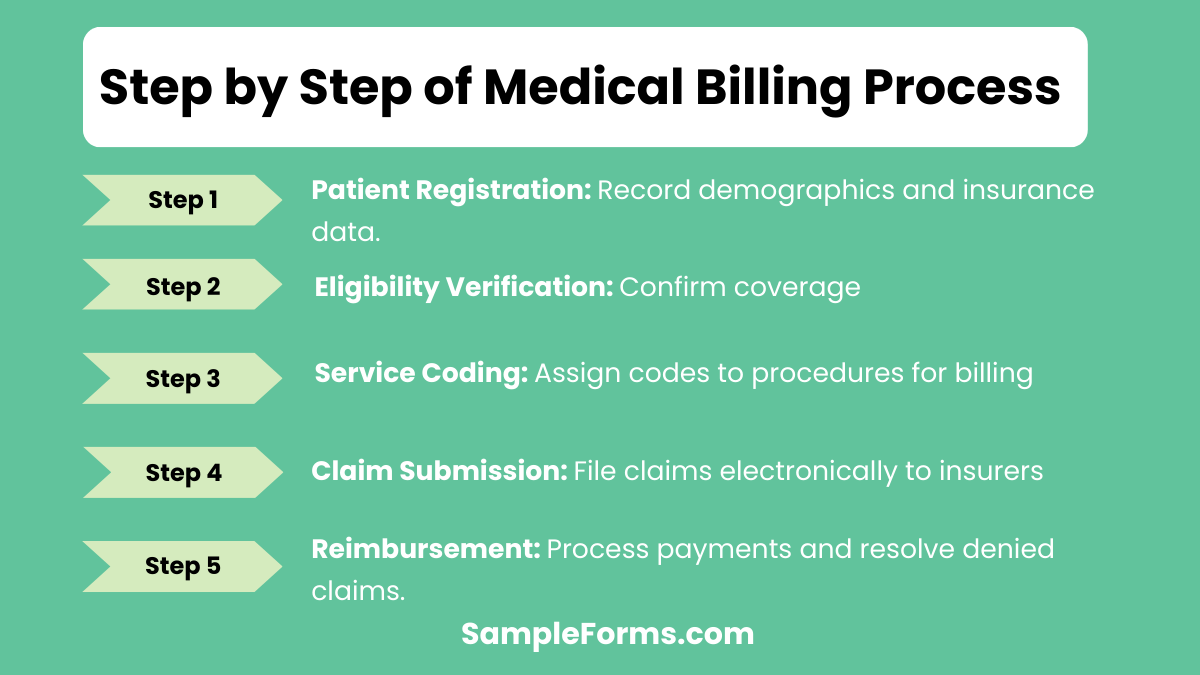

What is the medical billing process step by step?

Medical billing involves systematic steps to ensure accurate claim submission and reimbursement.

- Patient Registration: Record demographics and insurance data.

- Eligibility Verification: Confirm coverage, similar to a Medical Records Request Form.

- Service Coding: Assign codes to procedures for billing.

- Claim Submission: File claims electronically to insurers.

- Reimbursement: Process payments and resolve denied claims.

Why is medical billing so hard?

Medical billing is challenging due to its complexity, strict regulations, and frequent coding changes.

- Regulatory Compliance: Adhering to legal requirements is demanding.

- Frequent Updates: Code systems and insurer policies change often.

- Insurance Rejections: Claims are frequently denied or delayed.

- Data Accuracy: Errors in a Medical Reimbursement Form can delay payments.

- High Workload: Handling multiple claims simultaneously requires expertise and efficiency.

What is a medical billing form called?

A medical billing form, such as the CMS-1500, is commonly used for submitting healthcare claims. Similar to a Medical Invoice Form, it ensures accuracy and completeness for reimbursement.

What form is used for medical billing?

The CMS-1500 form is the standard for outpatient billing, while hospitals use the UB-04. Similar to a Medical Assessment Form, these forms streamline healthcare documentation.

How much do medical bills cost?

Medical bills vary widely based on procedures and services. Similar to a Medical Application Form, precise documentation helps clarify and manage costs effectively.

Can medical billing be done from home?

Yes, medical billing can be performed remotely, provided you have proper training and software. Similar to a Child Medical Consent Form, it requires accuracy and attention to detail.

Does Medicare accept handwritten claims?

No, Medicare requires electronically submitted claims. Handwritten claims, unlike a Medical Questionnaire Form, lack standardization and may delay processing.

Can I teach myself medical billing?

Yes, self-learning is possible through online courses and certifications. Similar to a Medical Information Form, structured learning resources enhance understanding and skills.

How much do medical billers charge?

Medical billers charge a percentage (5-10%) of collections or a flat fee per claim. Similar to a Family Medical History Form, accurate records impact billing efficiency.

Is medical billing easy?

Medical billing can be challenging due to regulations and coding requirements. Similar to a Medical Appraisal Form, it demands attention to detail and specialized knowledge.

What is denial in medical billing?

A denial occurs when a claim is rejected due to errors or lack of coverage. Similar to a Medical Consent Form, resolving issues requires accurate documentation.

Can I do medical billing online?

Yes, online platforms enable medical billing with electronic submissions and real-time tracking. Similar to a Medical History Form, digital tools streamline efficiency.

A Medical Permission Form complements the billing process by ensuring transparency and trust in healthcare transactions. A well-structured Medical Bill Form simplifies financial documentation, bridging the gap between healthcare providers, patients, and insurers. From detailing services rendered to verifying costs, it ensures that all parties are aligned, avoiding disputes and delays. By following examples and using standard formats, you can create clear, concise, and effective Medical Bill Forms tailored to various healthcare scenarios. This tool not only improves operational efficiency but also supports timely reimbursements and financial clarity.

Related Posts

-

FREE 50+ Medicaid Forms Download – How to Create Guide, Tips

-

FREE 50+ Dental Forms Download – How to Create Guide, Tips

-

FREE 50+ Hospital Forms in PDF | MS Word | MS Excel

-

FREE 5+ Health Care Surrogate Forms in PDF

-

FREE 11+ Do-Not-Resuscitate Forms in PDF | MS Word

-

Proof of Pregnancy Form

-

FREE 5+ Clinical Observation Forms in PDF | MS Word

-

Medical Release Form

-

FREE 7+ Sample Family Medical History Forms in MS Word | PDF

-

FREE 8+ Sample Medical Renewal Forms in MS Word | PDF

-

FREE 9+ Sample Medical Permission Forms in PDF | MS Word

-

FREE 9+ Sample Medical Records Release Forms in PDF | MS Word | Excel

-

FREE 3+ Patient Sign In Sheets in PDF | MS Word

-

Medical Waiver Form

-

FREE 6+ Sample Army Dental Forms in PDF | MS Word