A Debt Collection Letter is a crucial tool for recovering owed money. This complete guide provides detailed examples and practical tips for writing effective Debt Letter. Understanding how to structure and word a collection letter can significantly improve your chances of successful debt recovery. Our guide includes various Sample Letter to help you tailor your approach to different situations, whether you’re a business seeking payment from a client or an individual trying to recover a personal loan. Learn the best practices for drafting persuasive and legally compliant debt collection letters to maximize your recovery efforts.

Download Debt Collection Letter Bundle

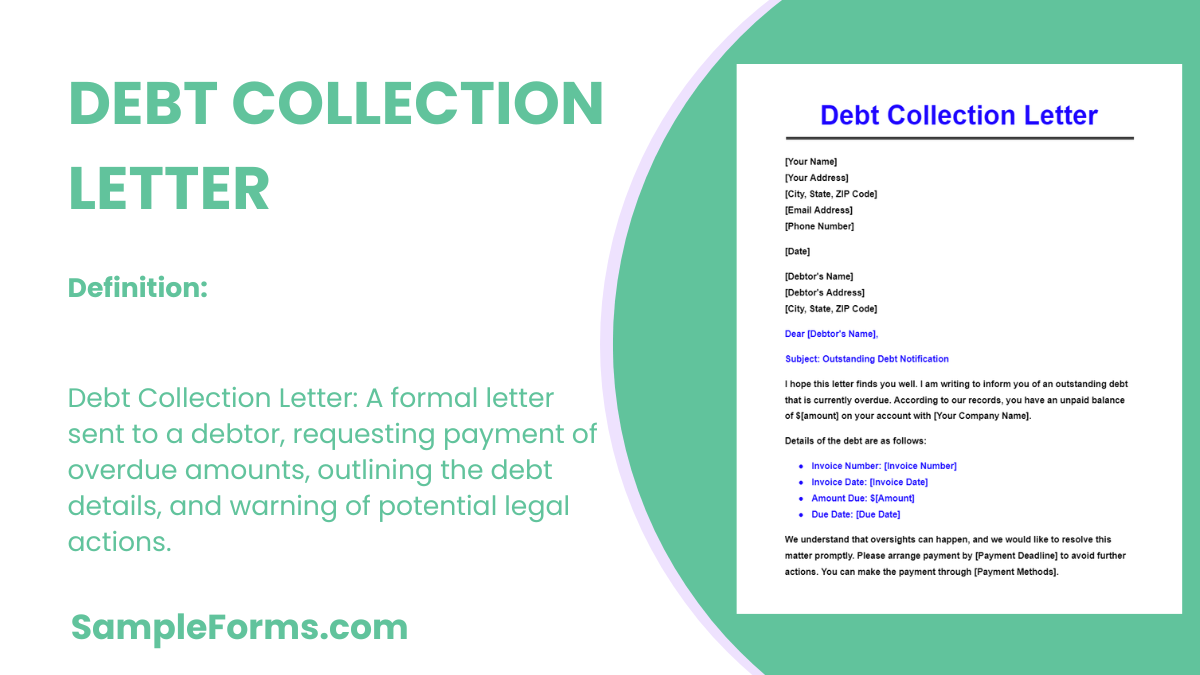

What is Debt Collection Letter?

A Debt Collection Letter is a formal document sent by a creditor to a debtor, requesting payment of an overdue debt. This Debt Letter outlines the amount owed, due date, and consequences of non-payment. It serves as a formal reminder and often a final notice before legal action. By clearly stating the debt details and payment instructions, it aims to prompt the debtor to settle the outstanding balance. Effective debt collection letters are polite yet firm, ensuring clear communication and adherence to legal standards.

Debt Collection Letter Format

- Sender’s Information:

- Name:

- Address:

- Contact Number:

- Email Address:

- Date:

- Recipient’s Information:

- Name:

- Address:

- Subject:

- Outstanding Debt Collection

- Body:

- Introduction (mention the debt and due date)

- Amount Due:

- Payment Instructions:

- Consequences of Non-Payment:

- Contact Information for Queries:

- Closing:

- Signature

- Name

- Designation

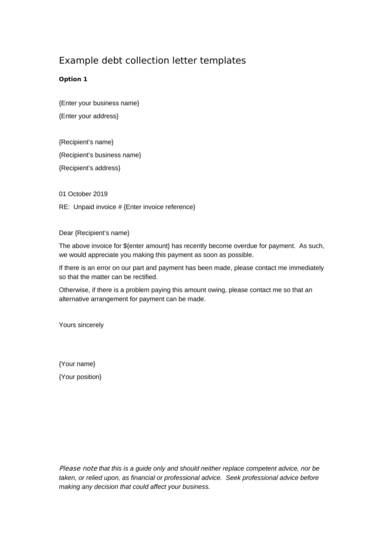

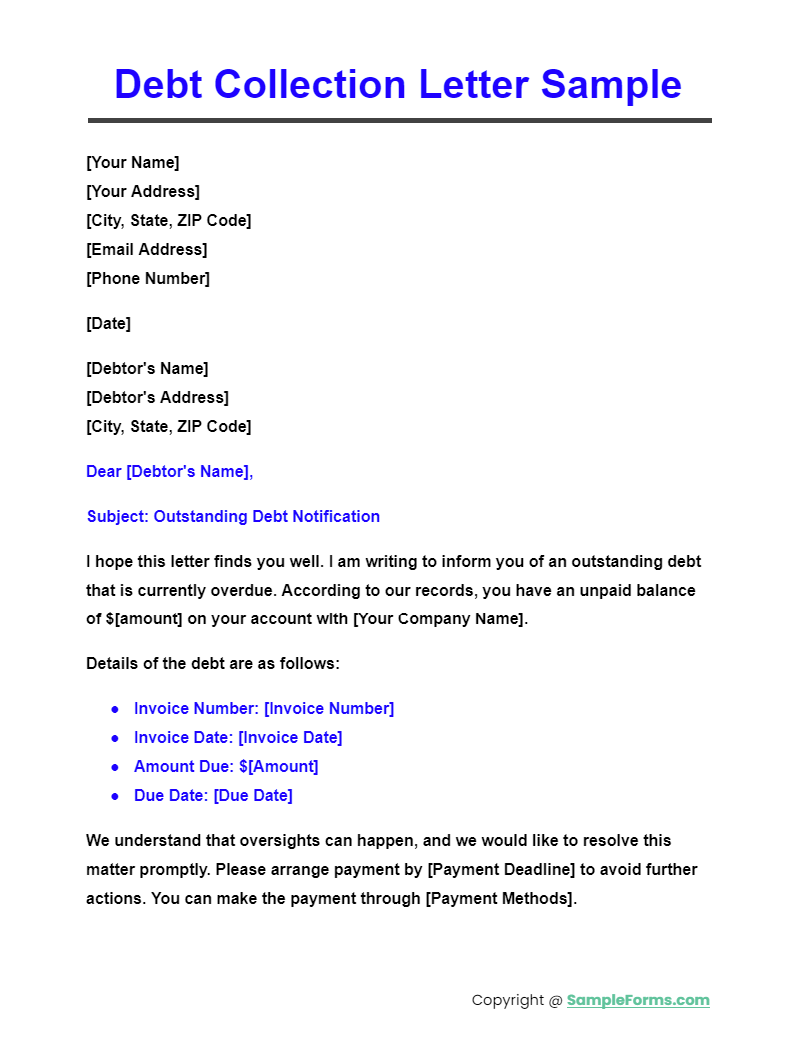

Debt Collection Letter Sample

A Debt Collection Letter Sample provides a practical example of how to request payment of an overdue debt. This sample includes key elements such as the debt amount, due date, and consequences of non-payment, similar to a Debt Acknowledgment Form.

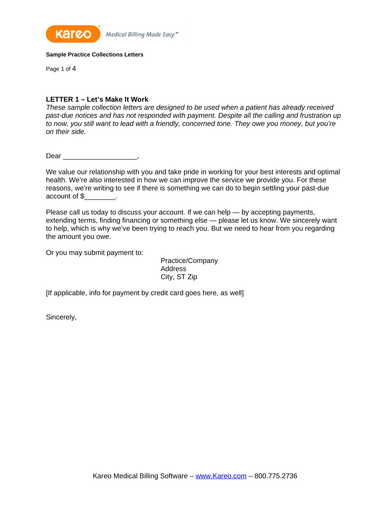

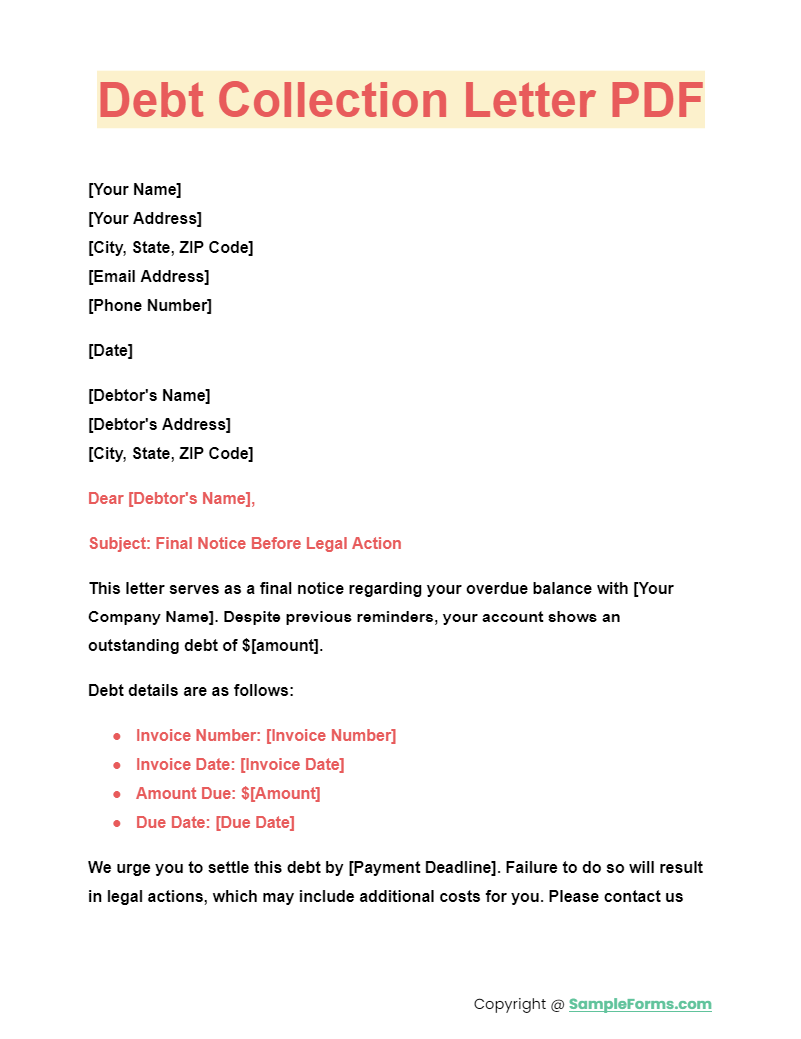

Debt Collection Letter PDF

A Debt Collection Letter PDF offers a downloadable and printable format for easy use. This PDF ensures that all necessary information is included and formatted correctly, much like a Debt Validation Letter for verifying debts.

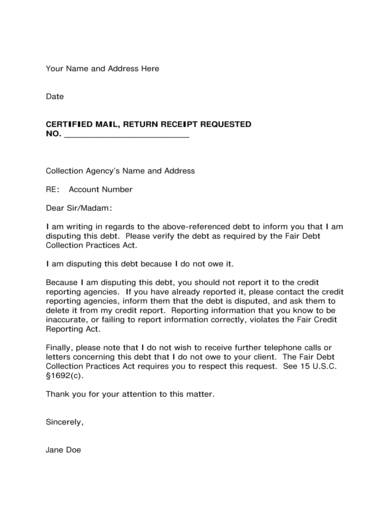

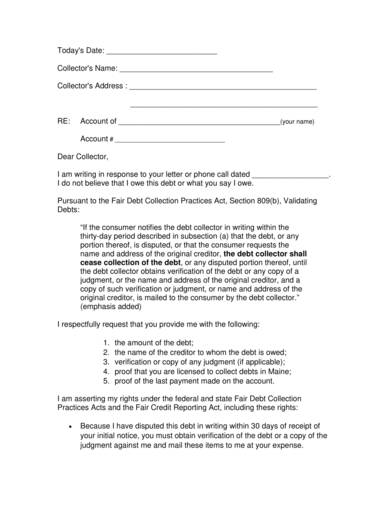

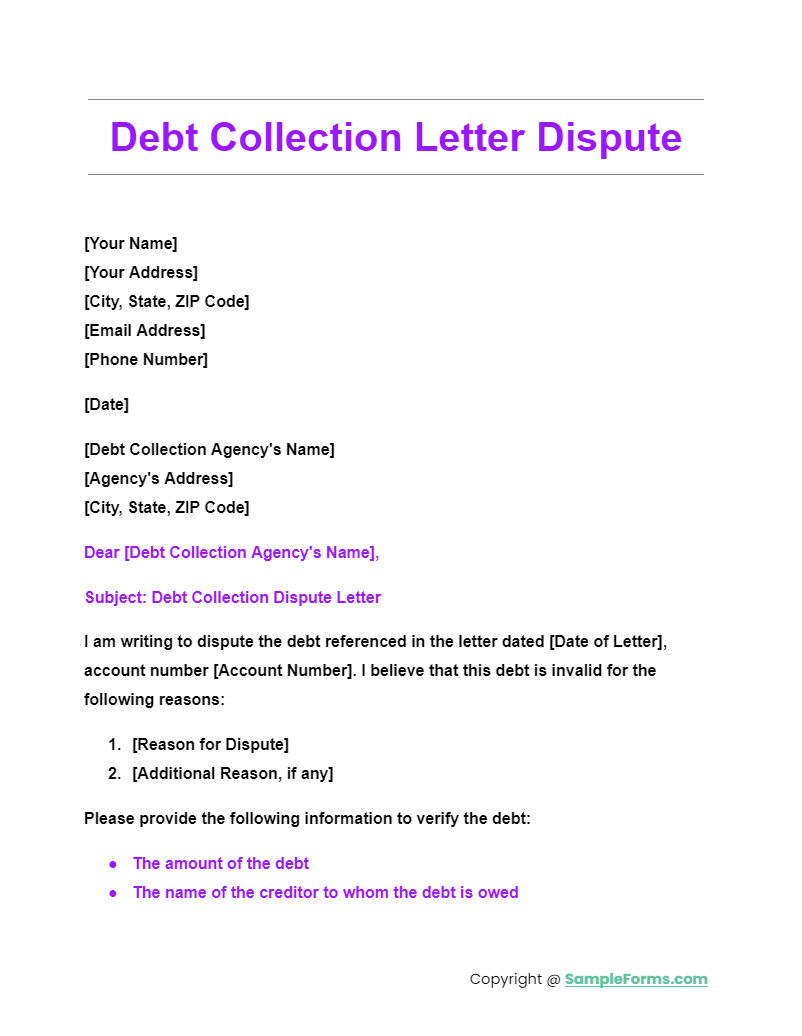

Debt Collection Letter Dispute

A Debt Collection Letter Dispute is used when a debtor contests the validity or accuracy of a debt. This letter outlines the debtor’s reasons for disputing the debt and requests verification, similar to a Letter of Application Form.

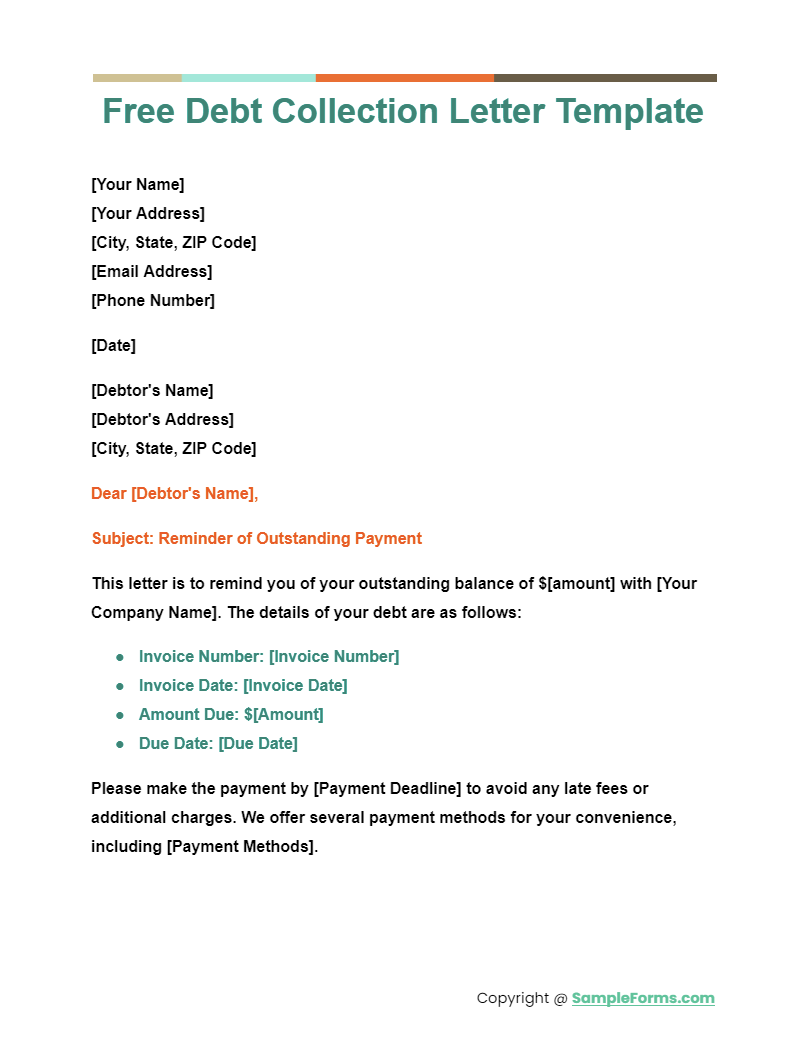

Free Debt Collection Letter Template

A Free Debt Collection Letter Template provides a ready-to-use format for creating effective debt collection letters. This template includes all essential sections and ensures compliance, offering a straightforward solution, akin to an Authorization Letter.

More Debt Collection Letter Samples

Blank Debt Collection Letter

Debt Collection Agency Dispute Letter

Debt Collection Cease and Desist Letter Template

Debt Collection Letter Example

Debt Collection Letter Sample

Initial Debt Collection Request Letter

Types of Debt Collection Letters

1. Debt Collection Agency Dispute Letter

Debtors who want to verify the details of their debts must use this document. The purpose of a debt collection agency dispute letter is to inform an agency about the dispute. The debt collector will need to adhere to the statements of the debtor in the letter. This includes sending the requested debt verification information immediately or within five days. During the waiting period, the debt collector should not call and collect the debt. This rule is pursuant to the FDCPA or Fair Debt Collection Practices Act of the State. In specific, the debtor has the right to verify, contest, and dispute his debt to a debt collector. You also browse our Letter of Resignation

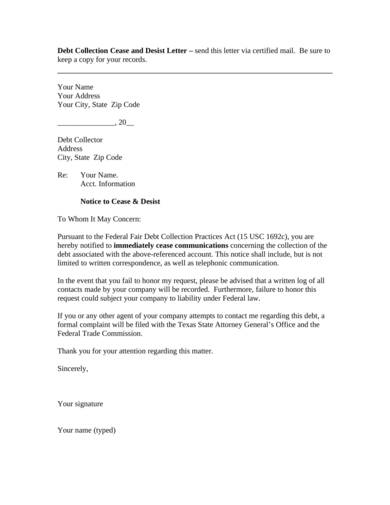

2. Debt Collection Cease and Desist Letter Template

Thirty-days is the maximal length of time when a debtor can send a dispute letter. After the thirty-day period, the debtor can no longer send and file a dispute. Rather, he must send a cease and desist letter to the debt collector. It will notify the debt collector about the request and in pausing debt collection calls. Once created and signed, the debtor must keep a copy of the letter for personal reference. Also, he must send a copy to the Consumer Financial Protection Bureau to get legal support. You also browse our Letter of Consent

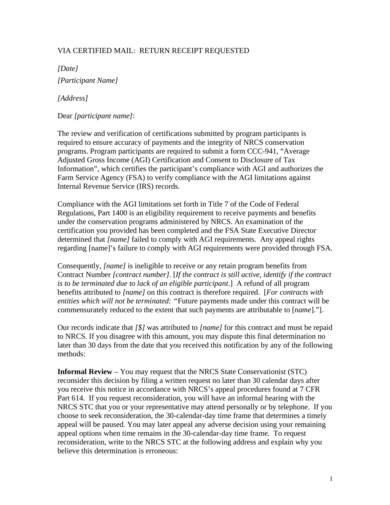

3. Initial Debt Collection Request Letter

This is the type of letter that debtors will use for their first debt verification request. The date of the request and the details of both parties will be the first information to disclose in the letter. This is then followed by the date when the debt collector called the debtor. Also, the letter will need to have a detailed list of the debtor’s rights and his assertions of the debt. You also browse our Reference Letter

How to Make a Debt Collection Letter for a Nonresponsive Debtor

A debt collector must notify the debtors of the details of their debts. But, there should be limitations in the frequency of sending notice forms and letters. Most often, debt collectors will send no more than three letters to notify debtors. And if there is still a failure to pay the debts, then a final notice will be necessary. You also browse our Letter of Intent

Follow the steps below to create a final debt collection letter with ease:

Step 1: Create a Letterhead

The letterhead must have the debt collector’s company name, logo, address, and motto. You also browse our Proof of Employment Letter

Step 2: State and Emphasize the Title of the Letter

Emphasizing the title requires the use of bold or italic font designs. The title should also have a larger font size as compared to the other contents of the letter. You also browse our Donation Letter

Step 3: Place a Greeting and a Salutation

This will serve as the beginning of the letter, which should have the name of the recipient and his title.

Step 4: Add the Body of the Letter

The body should state the debt collector’s reason for sending the letter. Some of the details in the letter should explain the amount of due and the date of the last letter. Moreover, the letter must also state the legal actions the collector is taking.

Step 5: Create a Signature Line

This will be where the debt collector can affix his signature, name, and the date when he signed the letter.

After checking and reviewing the contents of the letter, printing it out will be the last step. Once printed, the assigned debt collector must sign the letter and send it to the debtor. You also browse our Job Offer Acceptance Letter

How to Use Our Debt Collection Letter Templates

Each of our debt collection letter templates is downloadable and editable for free. Using the templates will allow debt collector companies to create letters faster. The first step to use our templates is to choose and download. In our site, the download button is below the details section beside each of the letter templates. Clicking the download button will start the download immediately.

After downloading the template, extracting it from its file folder is necessary. The reason why the templates are in ZIP file folders is for keeping minimal file size. Getting the template will depend on the device’s software and operating system. For Windows, all that needs to do is to right-click on the file folder and choosing the extract option. For Mac, double-clicking the file and selecting the “Open with Archive Utility” will start the extraction process. You also browse our Resignation Letter

And the last step is to edit or customize the contents of the letter. This includes the statements in the body and the names stated in the letter. Moreover, some companies have document preferences. It is also important edit fonts, sizes, and layout of the letter as per the preferences of the company. You also browse our Contract Termination Letter

How to respond to debt collection letter?

Responding to a debt collection letter requires careful steps to ensure proper handling and protection of your rights. Key steps include:

- Review the Letter: Thoroughly read the debt collection letter to understand the claims.

- Verify the Debt: Request a Debt Validation Letter to confirm the debt’s legitimacy.

- Gather Documentation: Collect all relevant documents, similar to preparing a Job Acceptance Letter.

- Write a Response: Draft a clear, concise response disputing or acknowledging the debt.

- Send Certified Mail: Send your response via certified mail to ensure proof of delivery. You also browse our

How do I write a debt collection letter?

Writing a debt collection letter involves clearly stating the debt details and requesting payment. Follow these steps:

- Header Information: Include your contact information and the debtor’s details, like a Tenant Recommendation Letter.

- Debt Details: Clearly state the amount owed, due date, and reference number.

- Payment Instructions: Provide clear instructions on how to pay the debt.

- Consequences: Outline the consequences of non-payment, professionally.

- Closing: End with a polite but firm closing, and your signature. You also browse our HR Letter

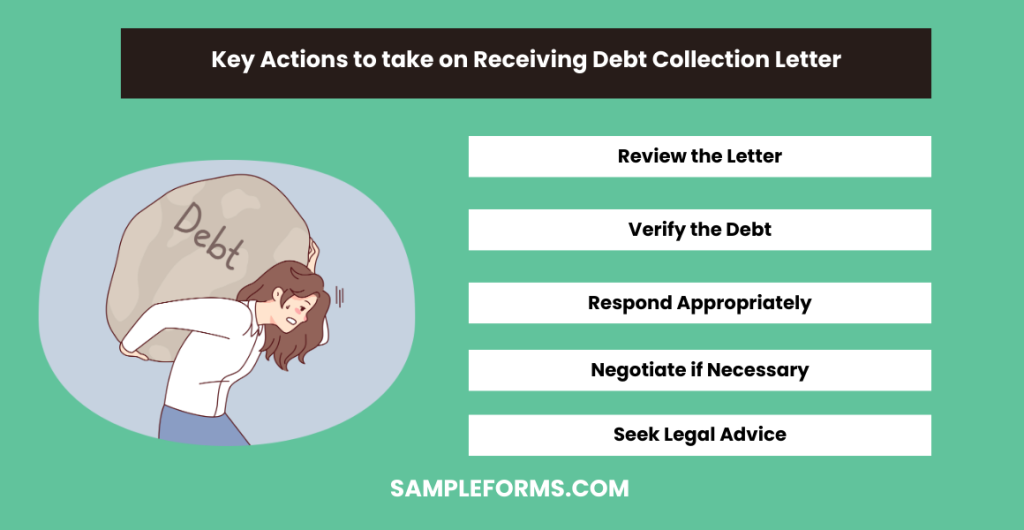

What happens when you get a debt collection letter?

Receiving a debt collection letter can have several implications. Key actions to take include:

- Review the Letter: Understand the claims and the amount owed.

- Verify the Debt: Ensure the debt is valid by requesting a Debt Validation Letter.

- Respond Appropriately: Send a formal response acknowledging or disputing the debt.

- Negotiate if Necessary: Consider negotiating repayment terms if you acknowledge the debt.

- Seek Legal Advice: If unsure, seek legal counsel similar to consulting for a Job Recommendation Letter.

What not to say to a debt collector?

When speaking to a debt collector, avoid statements that can negatively impact your situation. Key points to avoid include:

- Admission of Debt: Don’t admit the debt until it’s verified.

- Personal Information: Never share unnecessary personal details.

- Promises to Pay: Avoid making promises you can’t keep.

- Hostile Language: Keep the conversation professional and calm.

- Unauthorized Settlements: Don’t agree to settlements without proper verification, like needing a Letter of Authorization.

What is the word phrase to stop debt collectors?

The 11-word phrase to stop debt collectors is a powerful tool. It includes:

- Phrase Content: “Please cease and desist all calls and contact with me immediately.”

- Usage: Use this phrase to legally demand the debt collector stop contacting you.

- Legal Basis: It’s based on your rights under the Fair Debt Collection Practices Act.

- Written Request: Send it in writing for official record.

- Follow-Up: If ignored, seek legal help, similar to drafting an Immediate Resignation Letter for urgent matters.

Should I respond to a debt collector letter?

Yes, you should respond to a debt collector letter to verify the debt and protect your rights, similar to responding to a Business Letter.

Should I pay a collection letter?

Before paying, verify the debt’s legitimacy. Paying can settle the debt but won’t remove it from your credit report immediately, unlike a Teacher Resignation Letter which ends employment promptly.

What makes a collection letter effective?

An effective collection letter is clear, concise, polite yet firm, and includes all necessary details about the debt, akin to a well-crafted Teacher Recommendation Letter.

Does a collection letter hurt your credit?

A collection letter itself doesn’t hurt your credit, but the reported debt can negatively impact your credit score, similar to a negative Employee Verification Letter.

What happens after 7 years of not paying debt?

After 7 years, most unpaid debts fall off your credit report, although the debt may still be collectible, unlike a College Recommendation Letter which remains valid indefinitely.

What happens if you never answer a debt collector?

Ignoring a debt collector can lead to persistent collection efforts, potential legal action, and negative credit impact, much like ignoring a Recommendation Letter from Employer can affect job prospects.

What happens if I ignore debt collection letters?

Ignoring debt collection letters can lead to legal actions, garnished wages, and further credit damage, similar to ignoring a Letter of Introduction which can miss networking opportunities.

In conclusion, a Debt Collection Letter is a vital tool for recovering owed money effectively. Our guide provides detailed Sample Letters, forms, and templates to assist you. Utilizing a well-structured Complaint Letter can also be beneficial for addressing unresolved issues. By implementing the strategies and examples in this guide, you can enhance your debt collection efforts, ensuring timely payments and maintaining professional relationships. Whether you are a business or an individual, mastering the art of debt collection letters will significantly improve your financial recovery process.

Related Posts

-

Nursing RN Resignation Letter

-

MBA Recommendation Letter

-

Security Deposit Return Letter

-

FREE 5+ Fraternity Recommendation Letters in PDF

-

Audit Response Letter

-

Medical School Recommendation Letter

-

Law School Recommendation Letter

-

FREE 9+ Paralegal Recommendation Letters in PDF | MS Word

-

FREE 9+ Professional Recommendation Letters in PDF | MS Word

-

FREE 5+ Employment Resignation Letters in PDF

-

Official Resignation Letter

-

Character Reference Letter for Immigration

-

Job Recommendation Letter

-

Tenant Recommendation Letter