Navigating through the complexities of Legal Confirmation Letters can be daunting, but our complete guide is here to simplify the process. With detailed examples and insights from experienced paralegals, you’ll learn how to craft effective and professional letters with ease. Whether you’re drafting a Paralegal Recommendation Letter or looking for a Sample Letter, our guide covers all the essentials. Start your journey to mastering legal documentation with confidence.

Download Legal Confirmation Letter Bundle

What is a Legal Confirmation Letter?

A Legal Confirmation Letter is a document that verifies specific details or agreements in writing, serving as a formal acknowledgment between two or more parties. It plays a crucial role in the legal field by providing written proof of conversations, decisions, or agreements made. This type of letter can be used in various scenarios, including employment verification, loan approvals, or legal proceedings. Understanding how to compose a Legal Confirmation Letter is essential for ensuring clarity, legality, and professionalism in communications.

Legal Confirmation Letter Format

Heading

- Your Name

- Your Position/Title

- Your Organization’s Name

- Your Address

- Date

Salutation

- Dear [Recipient’s Name],

Introduction

- State the purpose of the letter.

- Mention the relevant legal matter or agreement.

Body

- Confirm the details discussed or agreed upon.

- Outline any legal terms, conditions, or obligations.

Conclusion

- Summarize the key points.

- Indicate the next steps or any action required.

Closing

- Yours sincerely,

- [Your Name]

- [Your Signature (if sending a hard copy)]

- [Your Contact Information]

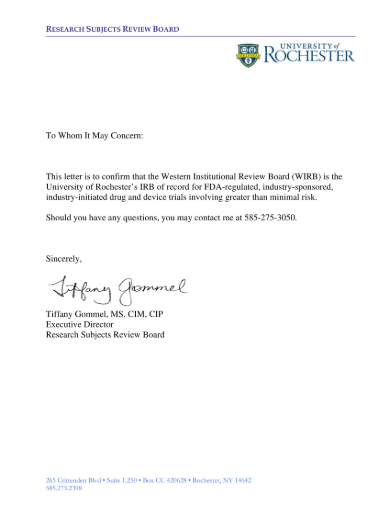

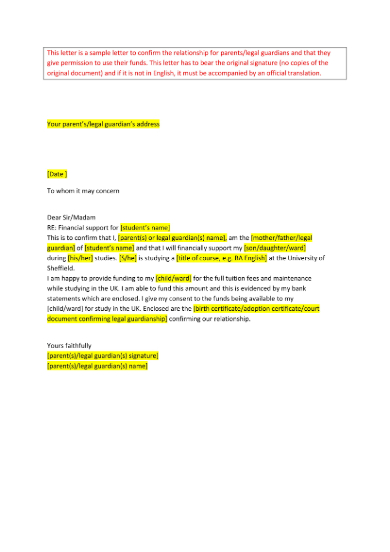

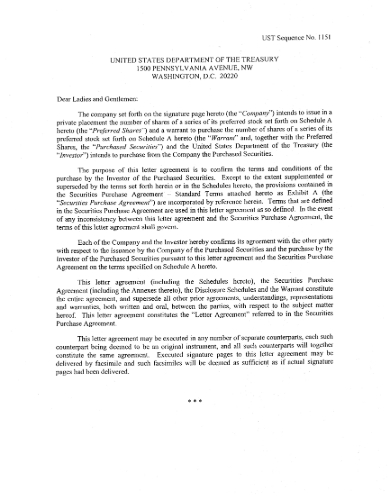

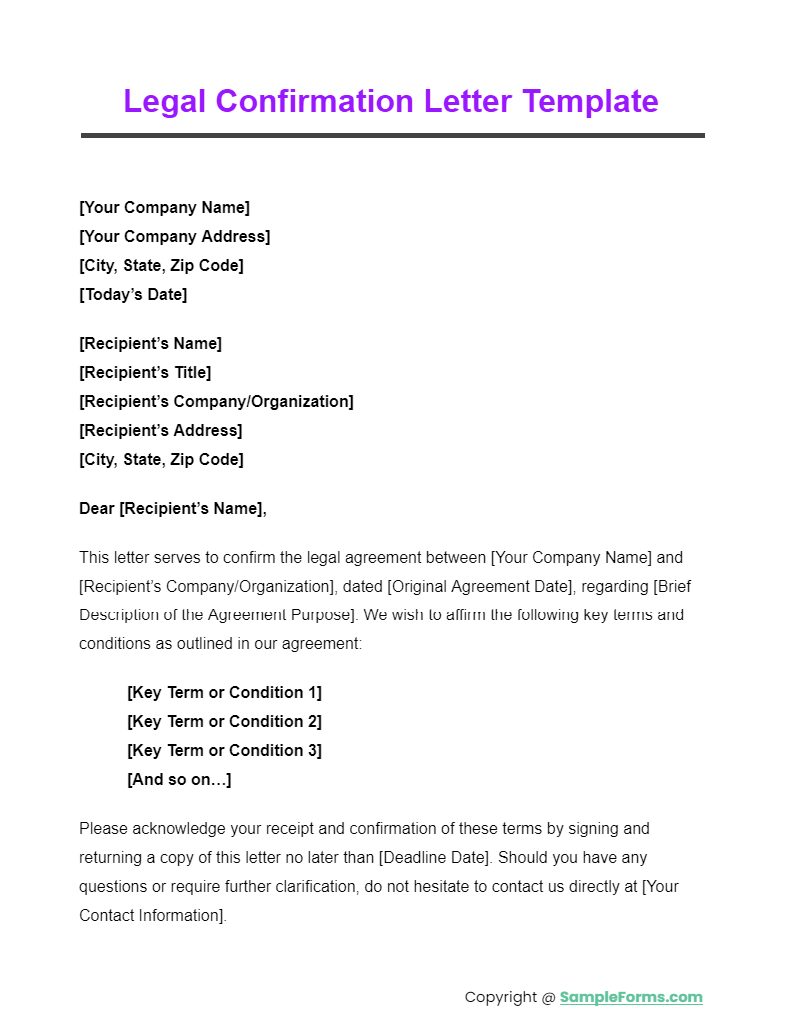

Legal Confirmation Letter Template

Discover the perfect template for drafting your Legal Confirmation Letter, integrating crucial elements like the Application Letter structure. This template streamlines the documentation process, ensuring clarity and legal compliance in professional communications.

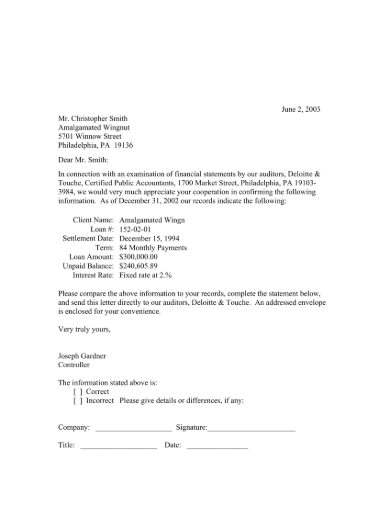

Legal Confirmation Audit Procedure

Explore the step-by-step audit procedure for Legal Confirmation, emphasizing the role of the Authorization Letter. This guide ensures thorough verification and compliance, essential for legal and financial accuracy in audits.

Legal Confirmation Letter PDF

Our guide provides a downloadable Legal Confirmation Letter PDF format, incorporating the Letter of Interest nuances. This resource is designed for easy customization and use in various legal contexts, enhancing document preparation efficiency.

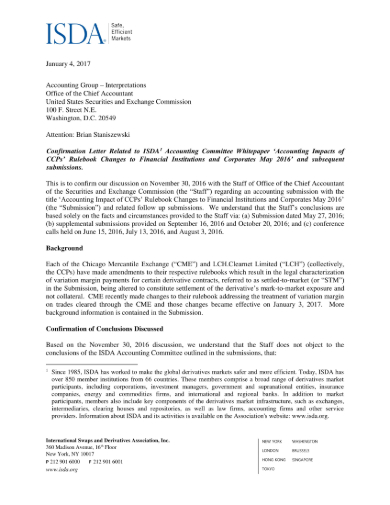

Audit Inquiry Letter to Legal Counsel Example

More Legal Confirmation Letter Samples

Here a few samples of professional high-quality confirmation forms that will ensure your opinions and doubts of the audit will be relayed to the one who conducted the review. Professionally-crafted and formally-structured, these business legal confirmation letters are carefully selected from credible online sources that have displayed these samples on their website. Carefully examine each of the content of the sample legal confirmation letters. Compare and contrast each of the sample confirmation letters to one another and see if there are any similarities and differences that you can find in each of the samples’ content.

Sample Legal Confirmation Letter

Legal Confirmation Sample Form

Sample Legal Confirmation Form

Legal Confirmation Sample Letter

Letter of Confirmation Sample Form

Letter of Confirmation Form

Sample Confirmation Form

Sample Letter of Confirmation

Simple Letter of Confirmation Form

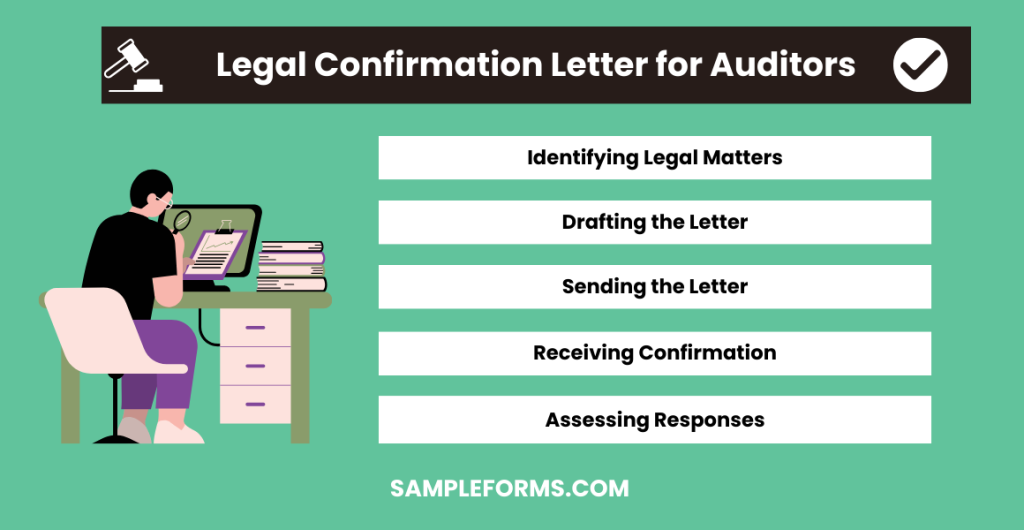

What is the Legal Confirmation Letter for Auditors?

A Legal Confirmation Letter for Auditors is a Formal Letter sent by auditors to verify the accuracy of financial statements and legal matters related to a company. The process involves several steps:

- Identifying Legal Matters: Auditors review the company’s financial records to identify transactions and matters requiring legal confirmation.

- Drafting the Letter: Based on the identified matters, auditors draft a Legal Confirmation Letter, typically including a Reference Letter from legal counsel attesting to the accuracy of the information.

- Sending the Letter: The letter is sent to the relevant legal counsel or parties involved in the legal matters under review.

- Receiving Confirmation: The auditors await a response, confirming the details as stated or providing the correct information.

- Assessing Responses: The received confirmations are assessed to ensure they align with the financial statements and disclosures.

What is a Legal Response Letter?

A Legal Response Letter is a document written in response to a legal inquiry, such as an auditor’s request for information. The steps to create this letter include:

- Review Inquiry: Begin by thoroughly reviewing the inquiry, understanding the specifics of what is being asked.

- Gather Information: Collect all necessary documents and information related to the inquiry, such as contracts or agreements.

- Drafting the Response: Write the response, ensuring it addresses all points raised in the inquiry. Incorporate a Letter of Intent if the response commits to specific actions or agreements.

- Legal Review: Have the response reviewed by legal counsel to ensure accuracy and completeness.

- Sending the Response: Send the completed response back to the inquirer, ensuring it is received within the specified timeframe.

How Do You Write a Legal Response Letter?

Writing a Legal Response Letter involves a detailed process to ensure accuracy and compliance:

- Understanding the Request: Fully understand the request to ensure your response is relevant and comprehensive.

- Collecting Relevant Information: Compile all documents and information that pertain to the request, such as a Security Deposit Return Letter or a Tenant Rejection Letter, depending on the context.

- Drafting the Letter: Begin with a clear statement of purpose, followed by a detailed discussion addressing each point or question raised in the initial request.

- Review for Compliance: Ensure the draft complies with legal standards and addresses the inquiry’s requirements. Incorporate a Letter of Authorization if acting on behalf of another party.

- Finalizing and Sending: Review the letter for accuracy, then send it to the requester, ensuring to meet any deadlines.

Are Confirmations Required for an Audit?

Confirmations are a key part of the audit process, providing third-party verification of financial information:

- Determining the Need for Confirmation: Identify areas within the financial statements where external confirmation is needed.

- Preparing Requests: Draft confirmation requests for each area identified, such as confirming the balance of a Complaint Letter regarding disputed transactions.

- Sending Requests: Send out the confirmation requests to the appropriate third parties, such as banks or legal counsel.

- Receiving and Analyzing Confirmations: Analyze the responses received for consistency with the company’s records.

- Documenting Findings: Document the confirmation process and findings, noting any discrepancies or issues uncovered. You should also take a look at our Legal Statement Form

Why Do Auditors Use Confirmations?

Auditors use confirmations as a means to obtain external verification of financial information:

- Verification of Balances: Confirmations are used to verify account balances and transactions with external entities.

- Evidence of Assertions: They provide evidence supporting the assertions made in financial statements.

- Identifying Misstatements: Through confirmations, auditors can identify misstatements or discrepancies.

- Assessing Fraud Risks: Confirmations can help assess the risk of fraud or error in reported information.

- Compliance and Legal Verification: They are crucial for verifying compliance with legal requirements and the existence of legal agreements, supported by an Example Reference Letter from legal counsel or other parties.

How to Create a Legal Confirmation Letter?

Legal confirmation letters are not easy, but these documents are not also tricky. You need to wait for the audit report and state your opinion about the report. Here are a few tips and steps on how to correctly write a legal confirmation that you can use whenever an audit was conducted. You should also take a look at our Legal Application Form.

Step 1: Select a Template

The process starts with the selection of a professional and formal high-quality template that you can look up on Go to and browse the vast media library for a single high-quality legal confirmation letter template. Download it and start customizing the template. You should also take a look at our Legal Guardianship Form.

Step 2: Be Direct When Addressing Uncertainties

When you address some uncertainties and misunderstandings in the report that the auditor sent to you, you must be direct in asking for an explanation. Ask them to expound further on the ambiguous topic. You should also take a look at our Legal Ownership Form.

Step 3: Use a Serious But Also a Polite Tone

Even when you want to address something serious in the letter, you must harbor a polite tone. You do not know that the auditor might have sincerely overlooked in that section and forgot to expound it further. You do not know the circumstances of how the report was created, so be polite in your writing. You should also take a look at our Legal Declaration Form.

Step 4: Review the Legal Confirmation Letter

After you have successfully crafted your legal confirmation letter form, you must have it reviewed to correct any mistakes and errors that can be found in your message, may it be grammatical or contextual errors. You should also take a look at our Legal Guardian Form.

Step 5: Print the Legal Confirmation Letter and Submit It

Print at least five copies of the legal confirmation letter, in case one of the copies get ripped by your dog or blown into the wind and lands on a puddle. You should also take a look at our Legal Petition Form.

How Do You Send a Legal Letter?

To send a legal letter, draft it with precision, incorporating key details like a Letter of Reference for credibility. Use certified mail for delivery to ensure receipt confirmation and legal validity.

What Happens if You Ignore an Audit Letter?

Ignoring an Audit Response Letter can lead to severe consequences, including legal actions, penalties, or further audits. It’s crucial to respond promptly to avoid escalating the situation.

What Is the Purpose of the Confirmation?

The purpose of confirmation, such as in a Debt Validation Letter, is to verify accuracy and authenticity of information between parties, ensuring transactions and balances are correctly recorded and acknowledged.

Why Do You Need to Be Confirmed?

Being confirmed, through processes like credit checks or Credit Report Dispute Letter submissions, is essential for validating personal information, financial integrity, and eligibility for loans, contracts, or legal standings.

Are Audits Legally Required?

Yes, audits are legally required for certain entities to ensure transparency and compliance with financial reporting standards, often necessitating a Financial Hardship Letter for exceptions under specific circumstances.

Is Confirmation a Proof?

Yes, confirmation serves as proof of agreement, accuracy, or compliance, similar to an Insurance Termination Letter confirming the end of an insurance policy, providing legal and formal acknowledgment of facts.

How Do I Get My Confirmation?

To get your confirmation, submit a formal request, such as a Legal Form, to the relevant authority or institution. Provide necessary documentation and follow their procedure for receiving confirmation.

Related Posts

-

Security Deposit Return Letter

-

FREE 5+ Fraternity Recommendation Letters in PDF

-

Audit Response Letter

-

Medical School Recommendation Letter

-

Law School Recommendation Letter

-

FREE 9+ Professional Recommendation Letters in PDF | MS Word

-

FREE 5+ Employment Resignation Letters in PDF

-

Official Resignation Letter

-

Character Reference Letter for Immigration

-

Job Recommendation Letter

-

Tenant Recommendation Letter

-

Rent Increase Letter

-

FREE 5+ Thank You Letters for Recommendation in PDF | MS Word