Writing a Financial Hardship Letter is crucial when seeking financial assistance or relief. This comprehensive guide offers practical tips and detailed examples to help you create a compelling Financial Hardship Form. Whether you’re facing unexpected medical bills, job loss, or other financial difficulties, understanding how to articulate your situation in a Sample Letter can significantly improve your chances of receiving the help you need. Learn the essential components of an effective hardship letter, including how to present your case clearly and professionally, and what supporting documents to include for maximum impact.

Download Financial Hardship Letter Bundle

What is Financial Hardship Letter?

A Financial Hardship Letter is a formal document used to request financial assistance or relief due to economic difficulties. This Financial Form outlines the reasons for your financial struggles, providing a detailed account of your situation and the relief you are seeking. By clearly presenting your case, a Sample Letter helps creditors, lenders, or financial institutions understand your circumstances and consider your request for assistance. It is an essential tool for communicating your need for support in a structured and effective manner.

Financial Hardship Letter Format

Financial Hardship Letter

1. Personal Information:

- Full Name: [Full Name]

- Address: [Address]

- Contact Number: [Phone Number]

- Email: [Email]

2. Date:

- Date: [Date]

3. Recipient Information:

- Recipient Name: [Name]

- Company/Institution: [Company]

- Address: [Address]

4. Subject:

- Subject: Request for Financial Hardship Assistance

5. Introduction:

- [Brief introduction stating the purpose of the letter]

6. Explanation of Hardship:

- Description: [Detailed description of financial hardship]

- Cause of Hardship: [Explanation of the causes]

7. Impact on Financial Situation:

- Details: [Details on how the hardship has impacted your finances]

8. Requested Assistance:

- Request: [Specific assistance or relief being requested]

9. Supporting Documentation:

- Documents: [List of any documents attached]

10. Conclusion:

- [Thank the recipient and provide any additional information]

Sincerely,

[Full Name]

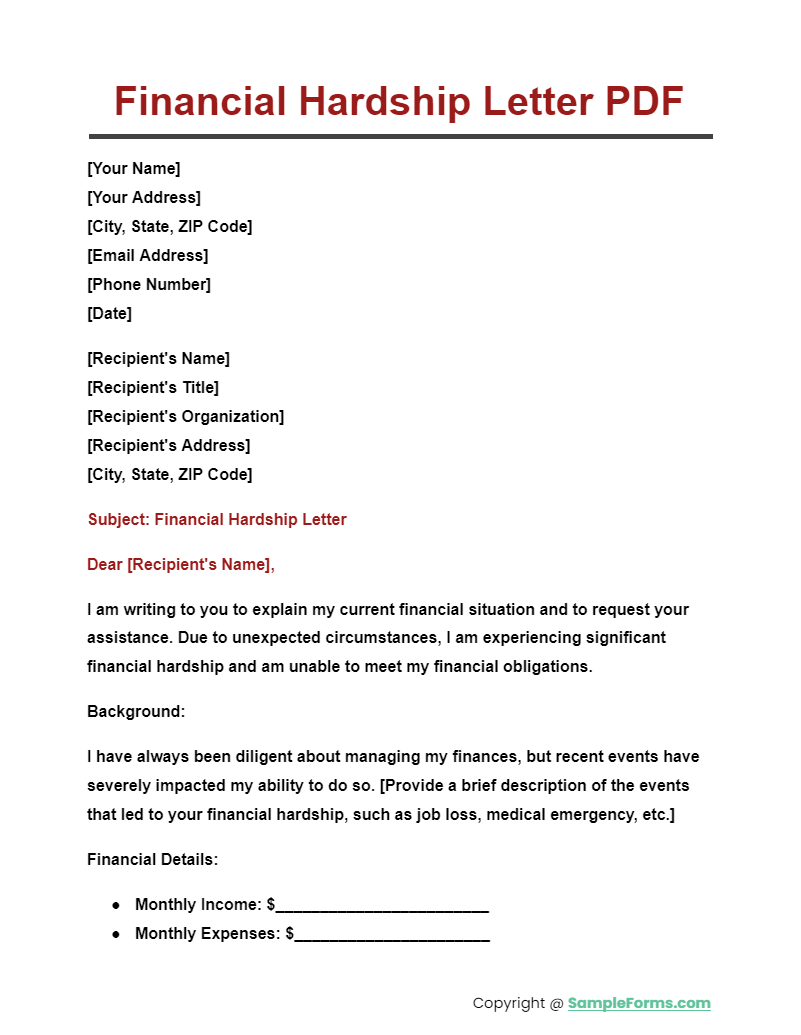

Financial Hardship Letter PDF

A Financial Hardship Letter PDF provides a professional and easily shareable format for requesting financial assistance. This format ensures your Letter of Application Form is clearly presented and accessible, enhancing your chances of receiving the needed support.

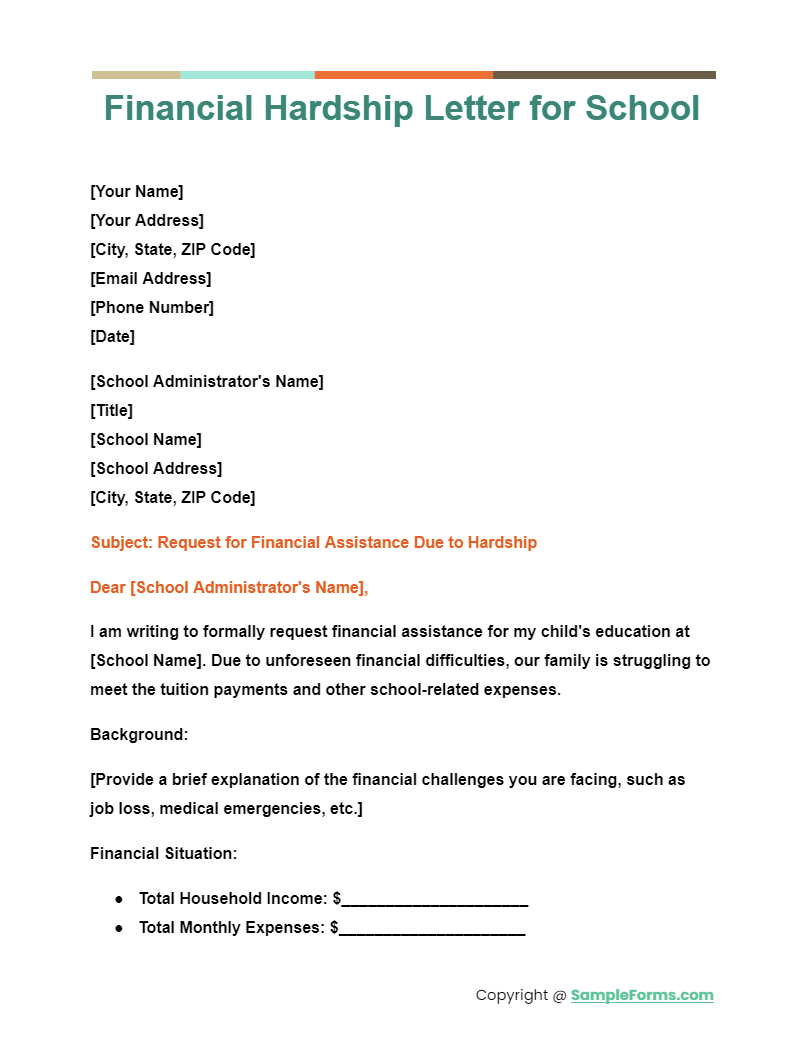

Financial Hardship Letter for School

A Financial Hardship Letter for School helps parents and students request financial aid due to economic challenges. This letter, similar to an Authorization Letter, should clearly outline the financial difficulties and specify the assistance required for educational expenses.

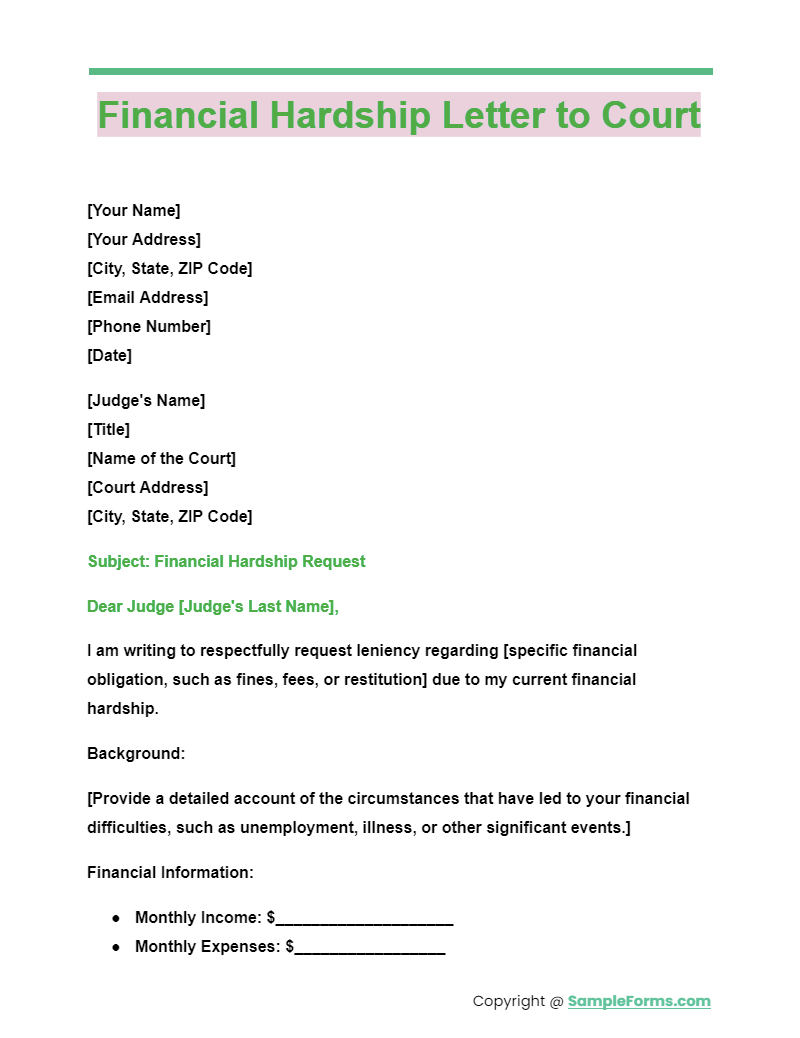

Financial Hardship Letter to Court

Writing a Financial Hardship Letter to Court involves detailing your financial struggles and requesting leniency or adjustments in legal financial obligations. This letter is crucial, akin to submitting a Letter of Resignation, in presenting your case for financial relief effectively.

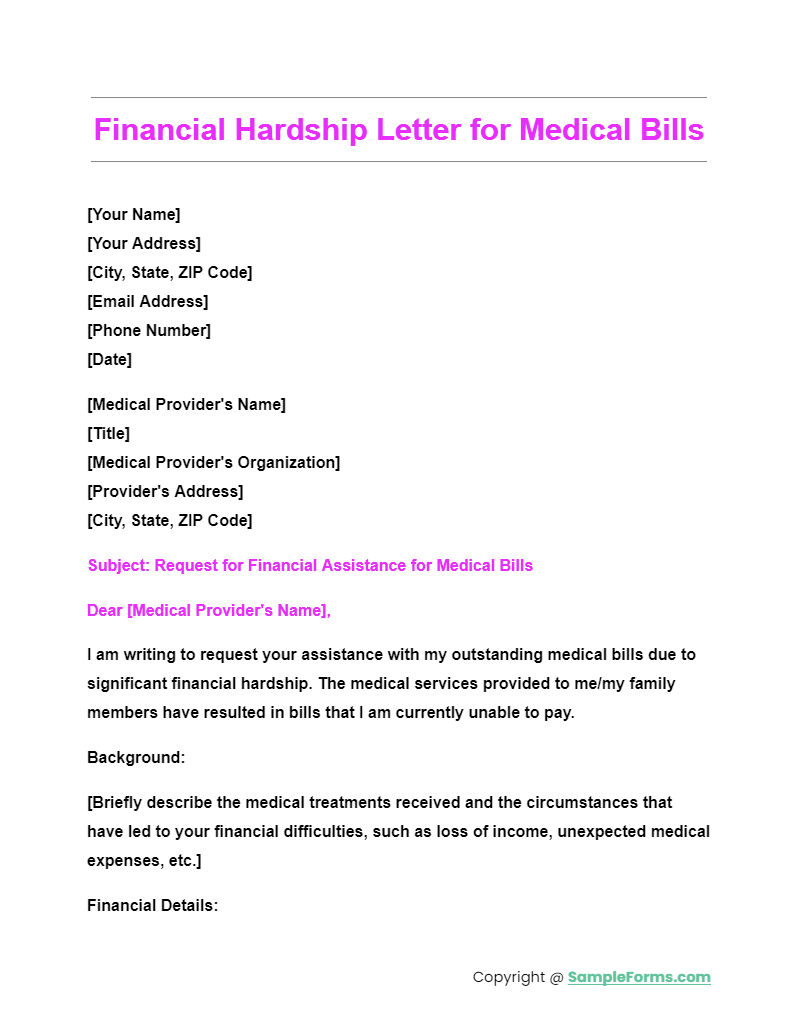

Financial Hardship Letter for Medical Bills

A Financial Hardship Letter for Medical Bills is essential for requesting assistance or payment plans due to overwhelming medical expenses. This letter, much like a Letter of Consent, should clearly explain your financial situation and include supporting documents to substantiate your claims.

More Financial Hardship Letter Samples

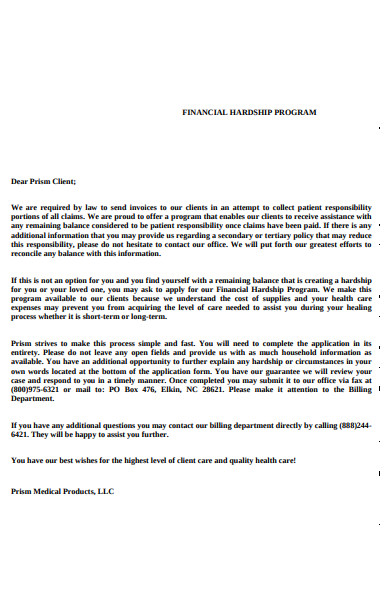

Financial Hardship Program Letter

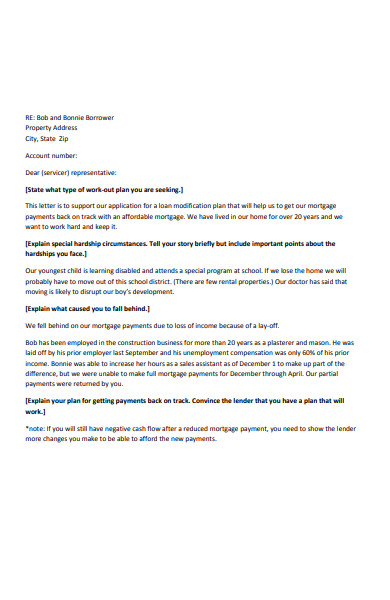

Sample Financial Hardship Letter

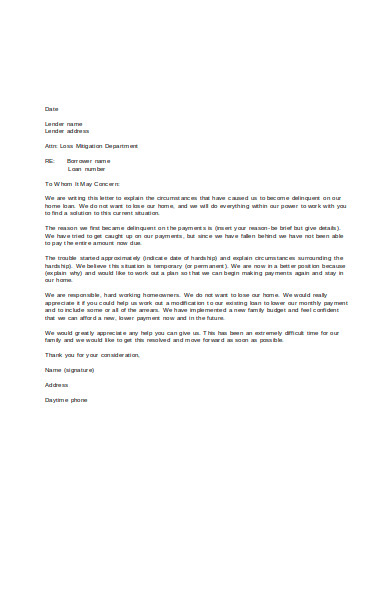

Simple Financial Hardship Letter

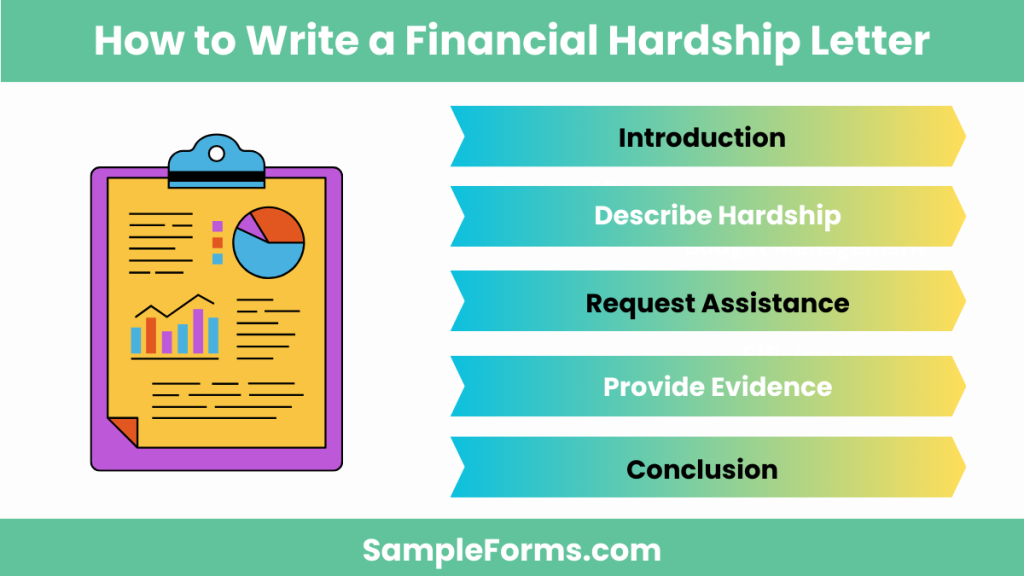

How do I write a financial hardship letter?

Writing a Financial Hardship Letter involves detailing your financial struggles and requesting assistance. Key steps include:

- Introduction: Start with a formal Letter of Introduction and explain the purpose of your letter.

- Describe Hardship: Clearly describe your financial situation and the events leading to it.

- Request Assistance: Specify the type of assistance you need.

- Provide Evidence: Include supporting documents to substantiate your claims.

- Conclusion: End with a polite request for consideration, similar to closing a Donation Letter.

What qualifies as financial hardship?

Financial hardship includes situations where an individual cannot meet financial obligations due to unforeseen circumstances. Key examples include:

- Job Loss: Sudden unemployment affecting income stability.

- Medical Expenses: Unexpected medical bills straining finances.

- Divorce: Financial strain from legal and personal separation, akin to writing an Appeal Letter.

- Natural Disasters: Property damage leading to financial distress.

- Reduced Income: Significant reduction in income due to economic changes. You may also see Financial Report Form

What should not be included in a hardship letter?

Avoid including irrelevant or unprofessional information in a Financial Hardship Letter. Key points to exclude are:

- Blame: Avoid blaming others or external entities.

- Irrelevant Details: Stick to pertinent financial information.

- Inaccuracies: Do not include false or misleading information.

- Emotional Language: Maintain a professional tone, unlike an emotional Job Offer Acceptance Letter.

- Exaggerations: Ensure all claims are factual and substantiated. You may also see Financial Affidavit Form

What are the evidence for financial hardship?

Providing evidence strengthens your Financial Hardship Letter. Key evidence includes:

- Income Statements: Proof of reduced income or unemployment.

- Medical Bills: Documentation of medical expenses, similar to a detailed Letter of Application.

- Bank Statements: Showing financial transactions and current balances.

- Tax Returns: Evidence of income and financial status.

- Foreclosure Notices: Proof of housing-related financial issues. You may also see Business Financial Statement Form

What are hardship circumstances?

Hardship circumstances are situations causing significant financial strain. Key circumstances include:

- Illness or Injury: Medical conditions affecting earning ability.

- Job Loss: Sudden unemployment leading to loss of income.

- Natural Disasters: Events causing property damage and financial stress, like detailing conditions in an Offer Letter.

- Divorce or Separation: Legal separation affecting financial stability.

- Death of a Breadwinner: Loss of a primary income source leading to financial difficulties. You may also see Financial Aid Form

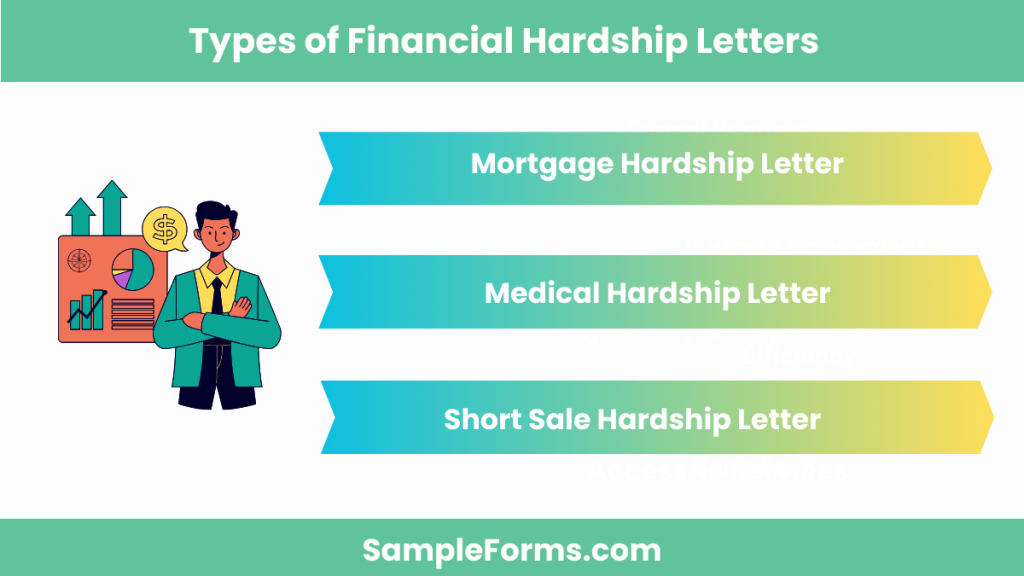

Types of Financial Hardship Letters

There are various types of hardship letters we offer on our website that you can choose from. It depends on a certain purpose. Let’s examine some of them:

-

Mortgage Hardship Letter

In this type of letter, you have to provide statements and proof that you are qualified to be in financial hardship. As a homeowner, for instance, you have to describe and substantiate your financial setbacks that resulted in your inability to comply with the payment of the mortgage. You may also see Financial Form

-

Medical Hardship Letter

In a medical hardship letter sample, the applicant must provide details about the financial hardship which resulted in the inability to pay the medical bills. In connection to this, the letter must clearly state a settlement offer and you should also provide the exact amount and the date along with the method of payment. You may also see Financial Audit Form

-

Short Sale Hardship Letter

In this kind of letter, you have to politely and genuinely express the reasons why you can no longer sustain the payment of the monthly mortgage payment. You have to provide proof and clear reasons for the inability to pay. You may also see Financial Assessment Form

7 Steps to Write an Appealing Financial Hardship Letter

Step 1:

Write your name, address and phone number at the top of your letter and write the date underneath. You may also see Financial Review Form

Step 2:

Mention the contact information of the creditor underneath the date and include the name of the employee, specific department, company name and address along with it.

Step 3:

Make sure you address the letter to the creditor’s employee and if you do not have a specific creditor employee name, you can address the letter as you do in other formal standard letters like “Dear Sir/Madam” or “To Whom It May Concern”. You may also see Financial Statement Form

Step 4:

Start stating your intent in the first paragraph of your letter. Try to ask the creditor if they can postpone the payments, review your financial situation for the assistance program or determine your eligibility for other payment options.

Step 5:

Mention the change in your financial situation in the next paragraph. Explain what kind of hardships you are suffering in case you lost your job, suffered a serious injury, could not sell your home or have endured other types of events that affected your finances. Describe your current financial status and give details about your income and mention the financial details that add to your problem. You may also see Financial Assistance Form

Step 6:

Withhold from making any kind of accusation like placing blame or complaining or insulting the creditor’s company or any other entity in your letter. Make sure to keep your tone respectful and remember that you are asking for help and highlight the fact that you are suffering and that financial hardship is seriously affecting your life.

Step 7:

In the end, finish your letter by providing instructions on how and when to contact you to discuss the matter in the future and print your name at the bottom of the letter along with a signature. You may also see Financial Contract Form

How do you ask for financial hardship?

Request financial hardship assistance by clearly explaining your situation, providing necessary details, and politely asking for help, similar to writing a Letter of Reference.

How do you prove you are in financial hardship?

Prove financial hardship with documentation such as income statements, medical bills, and bank statements, akin to supporting a Fundraising Letter.

What is another way to say financial hardship?

Another term for financial hardship is “economic distress,” commonly used in formal contexts like an Email Resignation Letter.

What is significant financial hardship?

Significant financial hardship refers to severe financial strain due to events like job loss or medical emergencies, comparable to issues addressed in a Debt Validation Letter.

How do you say I am struggling financially?

Say “I am experiencing financial difficulties” to convey your situation professionally, similar to the tone used in a Business Letter.

What is personal financial hardship?

Personal financial hardship is an individual’s struggle to meet financial obligations due to unforeseen events, akin to scenarios addressed in a Job Offer Letter.

What is considered a personal hardship?

Personal hardship includes severe financial strain due to life events such as illness, job loss, or family emergencies, much like situations detailed in a Debt Collection Letter.

What is an example of an unexpected financial hardship?

An example of unexpected financial hardship is sudden medical expenses from an unforeseen illness or accident, similar to providing context in an Audit Response Letter.

The Financial Hardship Letter is a vital resource for individuals seeking financial relief. Our guide, complete with Sample, Forms, and Letters, provides all the tools you need to craft a persuasive and effective hardship letter. By following the outlined steps, you can clearly convey your financial situation and the assistance you require. Properly presenting your case can make a significant difference in the response you receive. Use this guide to navigate the process smoothly, ensuring your Tenant Rejection Letter approach is thorough and professional, ultimately increasing your chances of obtaining the financial support you need.