It is one of the vital points of being a business owner to have a good business credit in the industry, And sometimes, you would want to do business with the vendors, suppliers and business-to-business customers who have good credit. Therefore, it is an important operational ability to run a business credit check on your business and companies that you partner with. Monitoring your business credit score periodically must be an important concern while handling business and to make it possible, you will have to maintain a business credit report regularly.

What is a Business Credit Check Form?

To check the business credit score is one of the most important things that a business owner must do if he wants his business to run well among the many other competitors. Business credit can be considered as a track record that will include the financial responsibilities of a business that companies, investors, or financial organizations make use of to determine whether or not that business is a good candidate to lend money to or with whom the business will be done. To check and evaluate the credit history of a business or an individual, a business credit check form must be produced to layout certain important data.

What is Business Credit Score?

The moment a business is created, a credit score begins to form since credit bureaus are public records and financial data to create a preliminary report. A credit score is generally a number in the case of business credit scores, it is usually a number from 1 to 100 that will represent how trustworthy your business is and whether the lending institution should lend to the business and how much they can lend. Business credit scores are mainly based on public information and are available to anyone willing to pay for it.

4+ Business Credit Check Forms & Samples in PDF | DOC

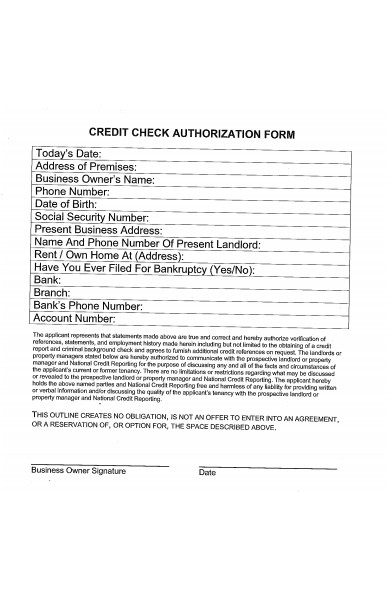

1. Business Credit Check Authorization Form

Having a strong business credit can help you grow your business and to make that possible, you will have to conduct a business check with the help of this business check form. There are many banks, investors and companies that will rely on your business credit’s worthiness when they are setting loan terms, determining insurance premiums, increasing lines of credit along or considering your business as a practical partner.

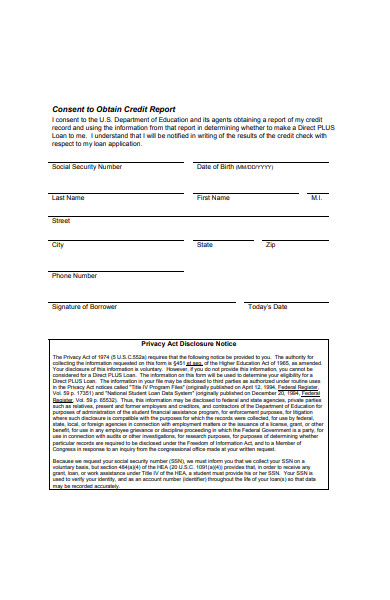

2. Sample Business Credit Report Form

A document that is used to give permission to an individual or organization, to perform a credit report of your business or company or an individual is known as credit report consent form or authorization form. This form will provide a broad language that will allow a credit report to be generated checking the business credit score of a particular business or to check the credits of an individual. The given template consists of a similar business credit check form consisting of consent from the individual to obtain a credit report and includes the social security number, date of birth, name of the individual along with a detailed privacy act disclosure notice.

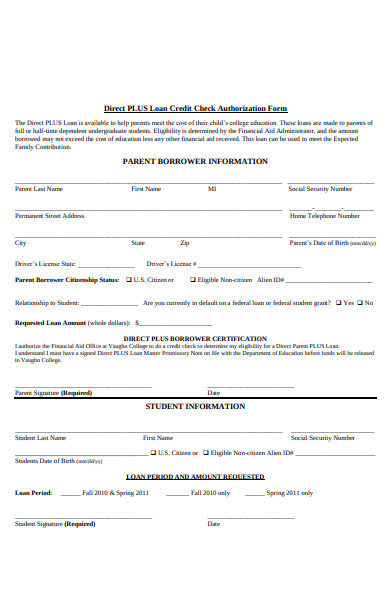

3. Business Loan Credit Check Form

In this document, you will find a basic business credit check form that can be used by the parents of a student for whom, they are applying for a student loan. Before providing the student loan, the loan lenders would want to investigate the credit report of the parents and this is where a credit check form is required. This template lays out a credit check authorization form that will state the information of the borrower i.e is the parents of the student and explains the details of the loan along with the basic details of the student. It will also mention the loan period and the amount requested.

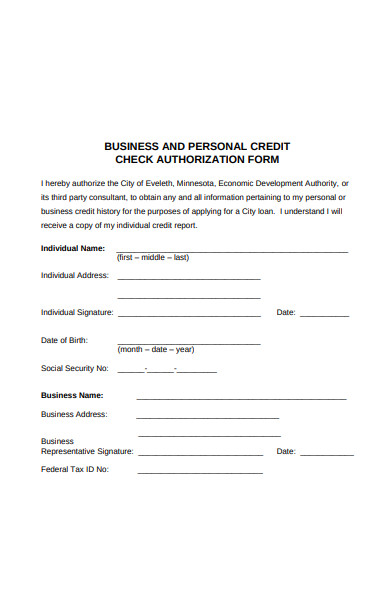

4. Business and Personal Credit Check Authorization Form

This form consists of the business and personal credit report authorization form that will outline an authorization form that can be used as an example. Here an individual filling up the form authorizes a third-party authority or its third-party consultant, to obtain any or all information about any kind of personal or business credit history to apply for a loan. It will carry out the personal information of the individual and the name and other important information of the business altogether.

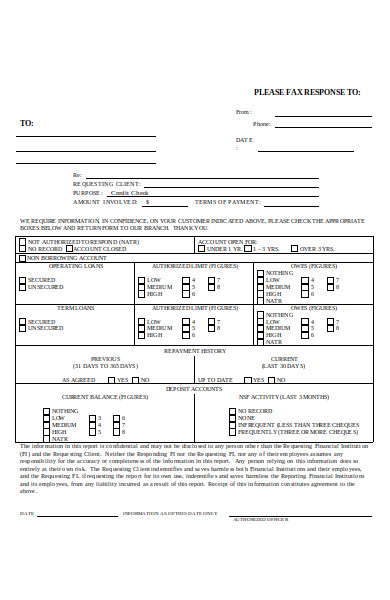

5. Simple Business Credit Check Form

Not everyone is capable of preparing a business credit check and that too in a short period. It must lay down several important sections that will provide information about the credit score of a client who is thinking about applying for a loan. It states the repayment history along with the data regarding the deposit accounts and also mentions that the information in this report is confidential and may not be disclosed to any person other than the requesting financial institution and the requesting client.

Related Posts

-

Move-in / Move-out Inspection Checklist

-

FREE 4+ Garage (Parking) Rental Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Receipt of Agreement Forms in PDF

-

FREE 2+ Verbal Agreement Forms in PDF

-

FREE 2+ Bedbug Disclosure Forms in PDF

-

FREE 4+ Swimming Pool Lease Addendum Forms in PDF | MS Word

-

FREE 4+ Pool & Spa Lease Addendum Forms in PDF | MS Word

-

FREE 5+ Residential Lease Addendum Forms in PDF | MS Word

-

FREE 5+ Condo Lease Forms in PDF

-

FREE 7+ Parking Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Condominium Rental Sample or Forms in PDF | MS Word

-

FREE 7+ Property Enquiry Forms in PDF | MS Word

-

FREE 7+ Release of Earnest Money Forms in PDF

-

FREE 5+ Employment (Income) Verification Letters in PDF | MS Word

-

FREE 8+ Personal Guarantee Forms in PDF | MS Word