Sometimes some homebuyers have insufficient credit or down payment funds who are not capable of qualifying for conventional financing. It is at this time of crisis that these people may seek Federal Housing Administration loans for which they will need a document laying out some seller financing addendum. It is a government administration or agency that works within the Department of Housing and Urban Development that insures home loans that are funded by approved banks and mortgage institutions.

What is the Federal Housing Administration (FHA)?

It is the United States government agency that is founded by President Franklin Delano Roosevelt and is created in part by the National Housing Act of 1934. This agency sets standards for the construction and insures loans that are made by banks and other private lenders for home building. The sole aim of this organization is to improve housing standards and conditions to provide a sufficient home financing system through insurance of mortgage loans, and also to stabilize the mortgage market.

What is FHA/VA Financing Addendum?

Since the FHA insures mortgages to give borrowers who have lower credit scores or larger amounts of debt, a chance to purchase a home. It is usually easier to qualify for an FHA mortgage than it is to qualify for a normal conventional loan, the FHA still imposes many requirements on the borrowers and the lenders throughout the approval process. One of these requirements is signing an FHA/VA financing addendum. It is a document that lays out lease addendum or clauses that essentially ensures that the home is worth enough to secure the loan and that must be filled out before the extension of an FHA-insured mortgage is known as an FHA/VA Financing Addendum. This addendum is used in an agreement that is made between the buyer and the seller of the property in question.

2+ FHA/VA Financing Addendum Sample Forms in PDF

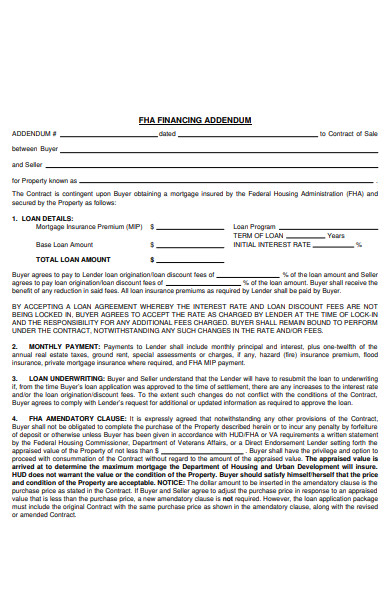

1. FHA Financing Addendum Sample

The FHA financing addendum form is prepared to specifically state that the buyer is not legally required to go through with a home sale in case the appraised value comes back lower than the price that is listed on the sales contract. If such a situation arises, the buyer will get back his or her earnest money and will not have to pay any kind of penalty, even if it was spelled out in the initial contract. The given template lays out a professional FHA financing addendum including every term that is required in such an addendum like the name of the buyer and seller, date, name of the property followed by several terms like loan details, mortgage insurance, monthly payment, etc. It will be a wise choice to take this template as a reference to understand this kind of addendum.

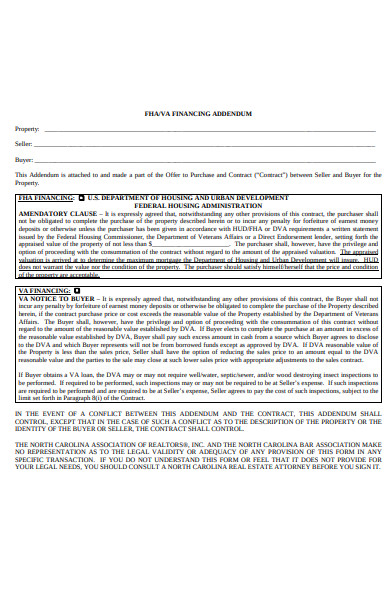

2. Simple FHA/VA Financing Addendum

This type of financing addendum can be attached to a purchase agreement that will help you in laying down some important clauses along with a notice to the buyer. This document consists of an FHA/VA addendum that starts with the basic details of the seller and the buyer along with the property’s information and then states a detailed FHA Financing amendatory clause and it also consists of a VA notice to the buyer shall not incur any kind penalty by forfeiture of earnest money deposits or will otherwise be obligated to complete the purchase of the property described herein case the contract purchase price or cost is more than the reasonable value of the property established by the particular organization. Besides, it also contains a real estate certification that can add a plus point to your document in case you are preparing one for your purpose.

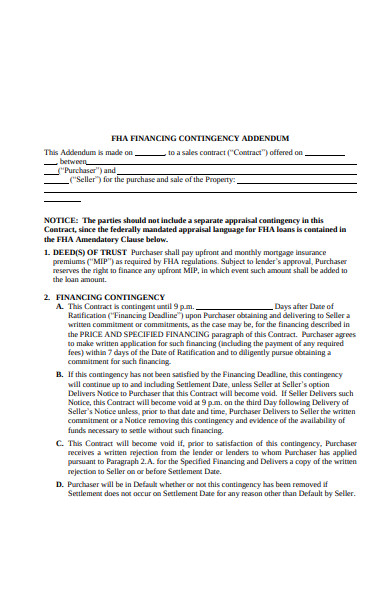

3. FHA Financing Contingency Addendum

The real estate agents may present the FHA/VA addendum along with the buyer’s offer to purchase, therefore notifying the seller that the home must pass an appraisal evaluation. This purchase contract addendum may contain a separate contingency which also serves as a protection to the buyer’s right to back out within a specified amount of time and without the hassle of paying any penalties. The given document lays out such an FHA financing contingency addendum where it states the deeds of trust, the description of the financial contingency followed by an explanation of the appraisal provisions and various other terms and conditions. It must be noted that the FHA/VA appraisal must be finished within the given time-frame that specified under the appraisal contingency, unless and until if the seller agrees to give more time to the buyer.

Related Posts

-

FREE 4+ Swimming Pool Lease Addendum Forms in PDF | MS Word

-

FREE 4+ Pool & Spa Lease Addendum Forms in PDF | MS Word

-

FREE 5+ Residential Lease Addendum Forms in PDF | MS Word

-

FREE 4+ Condominium Rental Sample or Forms in PDF | MS Word

-

FREE 10+ Sample Employment History Forms in PDF | MS Word | Excel

-

FREE 5+ Sample Lease Purchase Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Month-to-Month Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Garage (Parking) Rental Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Receipt of Agreement Forms in PDF

-

FREE 2+ Verbal Agreement Forms in PDF

-

FREE 2+ Bedbug Disclosure Forms in PDF

-

FREE 5+ Condo Lease Forms in PDF

-

FREE 7+ Parking Lease Agreement Forms in PDF | MS Word

-

FREE 7+ Property Enquiry Forms in PDF | MS Word

-

FREE 7+ Release of Earnest Money Forms in PDF