A Debt Acknowledgment Form is a crucial document for both creditors and debtors, ensuring that all details of a debt are formally recognized and recorded. This form serves as a binding acknowledgment from a debtor that a specific amount of money is owed to the creditor, under agreed terms. It is vital in legal and financial contexts to prevent disputes and ensure transparency in financial dealings. Including both an Acknowledgment of Service Form and a Client Acknowledgment Form, this guide offers detailed insights and practical examples to help you understand and create effective debt acknowledgment forms. Whether for personal or business use, mastering these forms can significantly enhance your financial management strategies>

Download Debt Acknowledgment Form Bundle

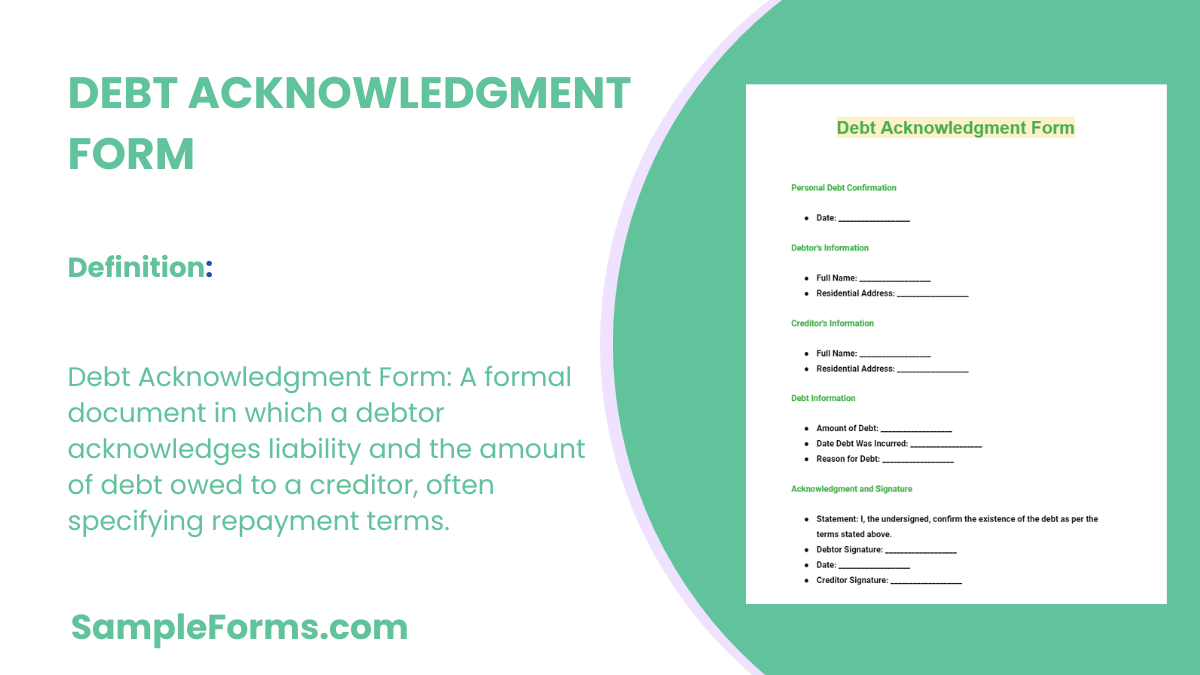

What is a Debt Acknowledgment Form?

A Debt Acknowledgment Form is a formal document in which a debtor confirms in writing their indebtedness to a creditor. This form serves as legal proof of the amount owed and the terms of repayment, crucial for both personal and business financial records. It is often used to clarify the status of a debt, especially in situations where original terms might have been verbal or informally agreed upon. Employing such a form helps protect the rights of the creditor while providing a clear repayment framework for the debtor.

Debt Acknowledgment Format

1. Debtor Information

- Name and Address: Full name and address of the debtor.

2. Creditor Information

- Name and Address: Full name and address of the creditor.

3. Debt Details

- Principal Amount: Original amount of the debt.

- Current Outstanding: Current amount owed, including any interest or fees.

- Interest Rate: The interest rate applicable to the debt.

4. Acknowledgment Statement

- Statement of Acknowledgment: A formal statement where the debtor acknowledges the amount of debt owed to the creditor.

5. Payment Terms

- Repayment Plan: Detailed terms of how the debt will be repaid (e.g., installment amounts and dates).

6. Signatures

- Debtor’s Signature: Debtor’s sign-off, acknowledging the debt.

- Creditor’s Signature: Creditor’s confirmation of the debt acknowledgment.

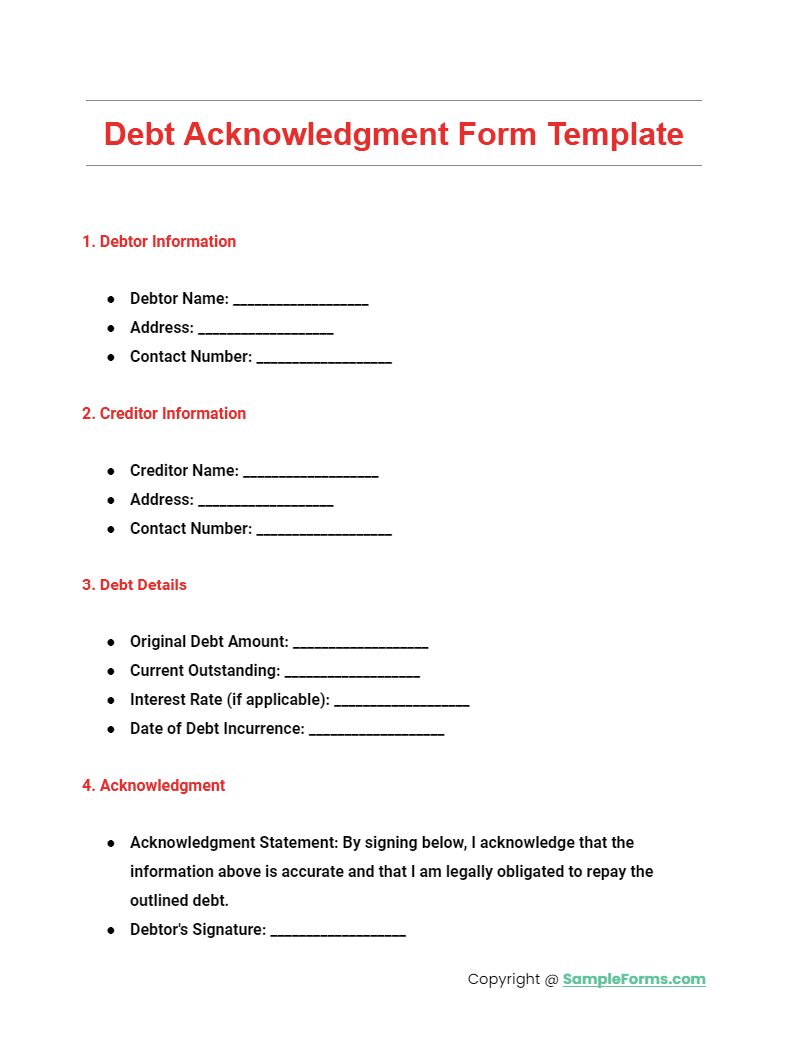

Debt Acknowledgment Form Template

Utilize our Notary Acknowledgment Form template to ensure your debt acknowledgment is legally binding and accurately notarized for enhanced security.

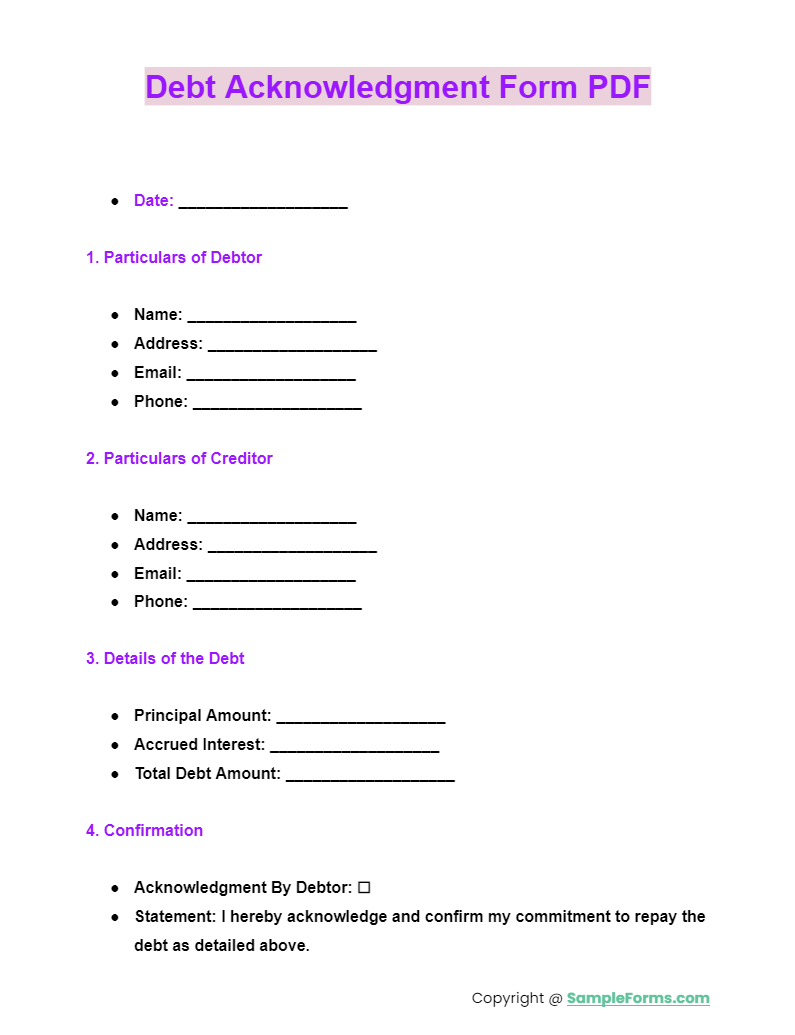

Debt Acknowledgment Form PDF

Download our detailed PDF version tailored as a Training Acknowledgment Form, perfect for educating parties on debt responsibilities and acknowledgments.

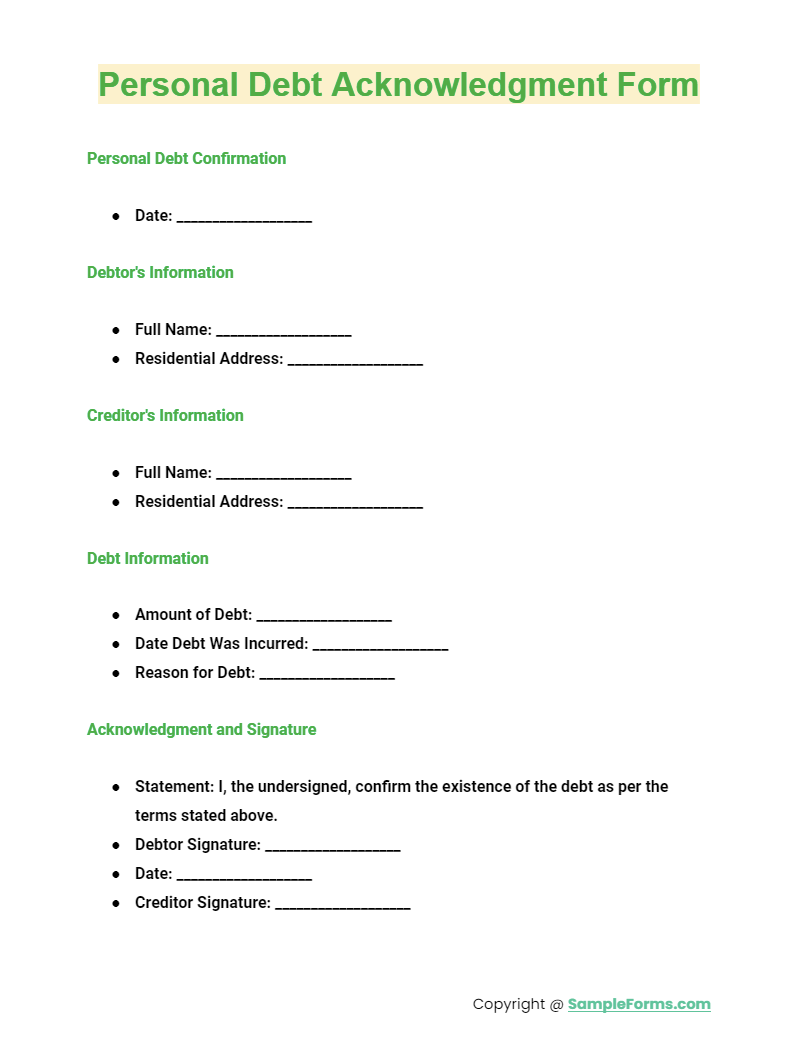

Personal Debt Acknowledgment Form

This form acts as a Policy Acknowledgment Form, ensuring individuals clearly understand and formally agree to the terms of personal debt repayment.

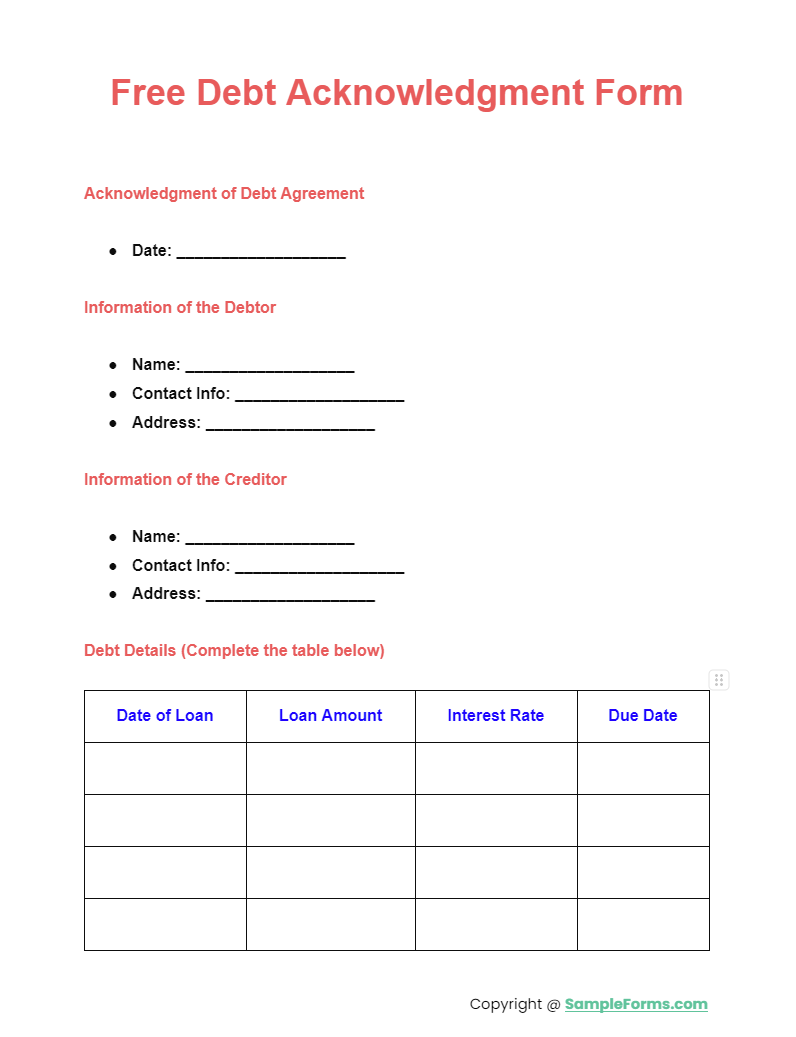

Free Debt Acknowledgment Form

More Debt Acknowledgment Form Samples

Debt Acknowledgment Form Sample

Debt Acknowledgment Form in DOC

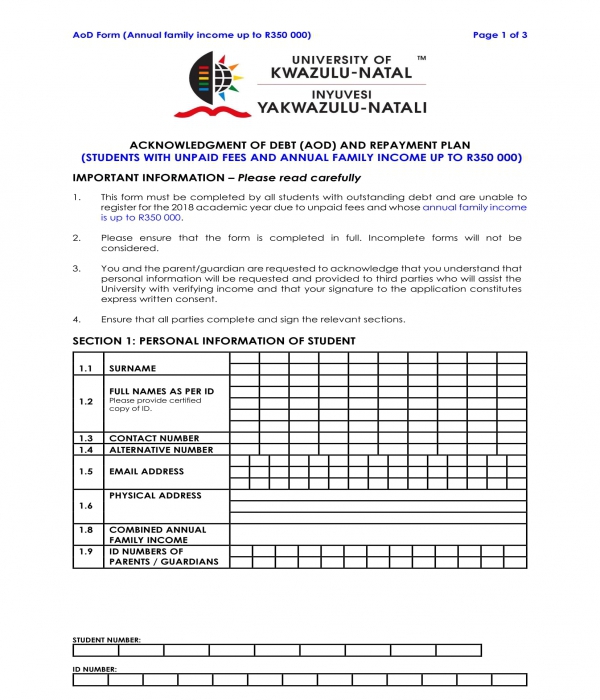

Debt Acknowledgment and Repayment Plan Form

The second section of the form is intended for the details of the acknowledgment of the student’s debts. The information of the student and his parents who will be the payer are some of the data to be stated in this section of the form. Moreover, the total amount to be paid by the payer should be specified as well. The location or the account where the payer must send the payment is also indicated in this section which is the account details of the school. On the other hand, the third section is for the declaration and consent, and the signature block. This is where the parties involved in the debt, the parent and the student, will be declaring that the information they have disclosed in the form was true and correct and that they understand that it will be used for income verification procedures.

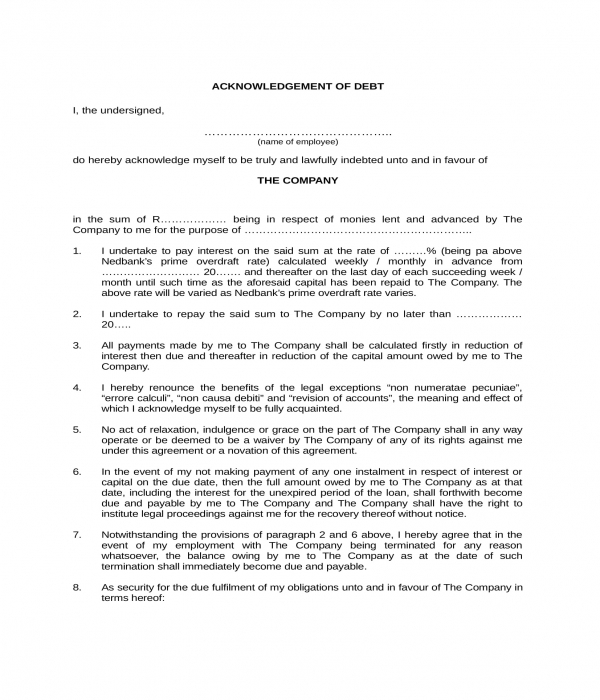

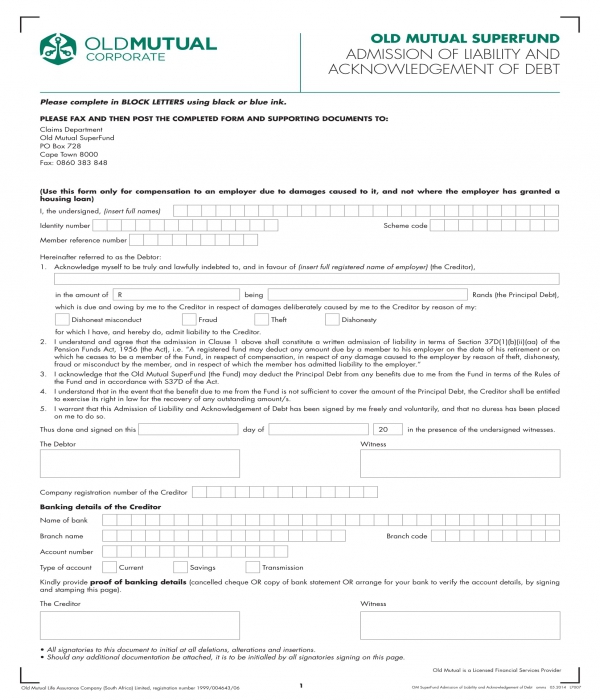

Liability Admission and Debt Acknowledgment Form – A liability admission or an admission of liability form is another document which can be used along with a debt acknowledgment form. In a liability admission and debt acknowledgment form, the debtor will be providing his personal information including his identification number, reference number, and his scheme code in the first section. This will then be followed by the acknowledgment statement of the debtor which must state the amount that he owes from the creditor and his admission to his liabilities and responsibilities in relation to his debts. In the signature block of this form, not only the debtor will be the party who will have to affix his signature on the form but also a witness or an entity who is knowledgeable about the debt that the debtor owes.

Liability Admission and Debt Acknowledgment Form

After the information of the debtor and the debt, a section for the general information of the creditor will have to be filled out as well in order to complete the liability admission and debt acknowledgment form. In this section, the creditor’s banking details will be disclosed such as the name and branch of the bank, the account number of the creditor and its account type along with the signatures of the creditor and his witness. Upon submitting the completed acknowledgment form, the creditor must enclose documents that will prove his disclosed banking details. This includes his bank statement or a canceled cheque from the bank.

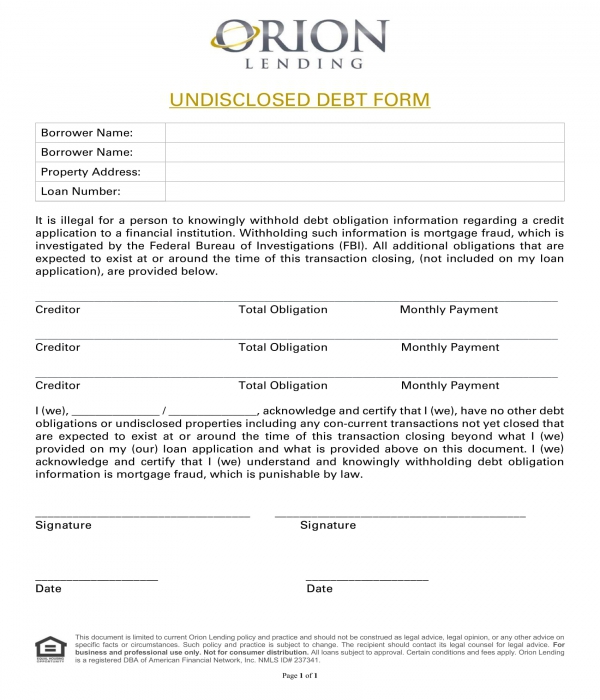

Undisclosed Debt Acknowledgment Form – This form is suitable to be used by lending agencies or financial aid providing companies. In the form, the debtor will be required to state all of his undisclosed debt obligation information to inform the agency of his credit state. The debtor must state his name, his residential address, and his loan number in the form. After the debtor’s information, the list of the creditors where the debtor borrowed his money from will have to be disclosed in the acknowledgment form along with the total obligation or the total amount that he owes from each creditor, and the amount of his monthly payment if the agreed payment method is by installment. And just like any other acknowledgment forms, the debtor must complete the acknowledgment statement with his name and his signature.

Undisclosed Debt Acknowledgment Form

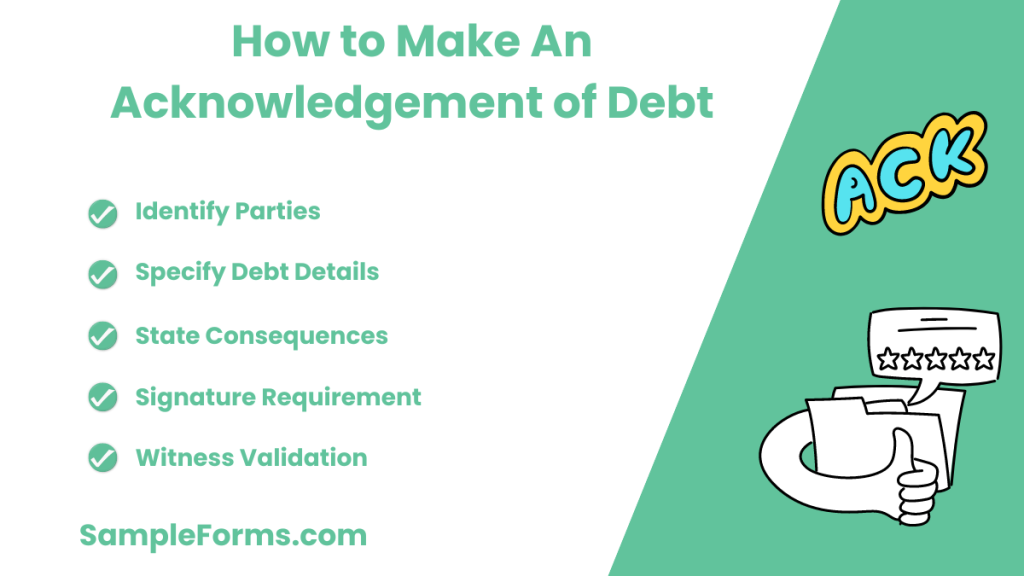

How to Make an Acknowledgement of Debt?

Creating an acknowledgment of debt solidifies an agreement to pay, akin to a SOP Acknowledgment Form for standard operating procedures.

- Identify Parties: List debtor and creditor names clearly.

- Specify Debt Details: Include amount, interest rates, and payment terms.

- State Consequences: Outline repercussions for non-payment.

- Signature Requirement: Ensure all parties sign the document.

- Witness Validation: Have an independent witness sign, if possible.

What Are the Rules for Acknowledgement of Debt?

Rules ensure the acknowledgment of debt is as binding and clear as an Acknowledgment of Paternity Form.

- Written Form Recommended: Ideally, document the acknowledgment in writing.

- Include Full Details: Ensure all debt specifics are comprehensively listed.

- Signatures Are Essential: Both parties must sign the document.

- Witnesses Strengthen the Document: Having witnesses can add legal strength.

- Update Regularly: Adjust the document if terms change.

What Happens if I Don’t Acknowledge a Debt?

Not acknowledging a debt can lead to legal consequences, similar to ignoring a Witness Acknowledgment Form.

- Increased Legal Risk: Risk of legal action for recovery.

- Credit Impact: Potential negative effect on your credit score.

- Accumulating Interest: Possible accumulation of interest and penalties.

- Strained Relationships: Could worsen relations with the creditor.

- Enforcement Actions: Creditor may seek court intervention.

Can Acknowledgement of Debt Be Verbal?

While verbal acknowledgments can be legal, like a Safety Acknowledgment Form, written acknowledgments are more enforceable.

- Legally Valid: Verbal agreements are legally binding but harder to prove.

- Proof Challenge: Difficult to verify terms without witnesses.

- Less Reliable: Prone to misunderstandings and disputes.

- Written Preference: Always advisable to have a written record.

- Formalization Recommended: Formalize verbal agreements in writing promptly.

What Is the Purpose of the Acknowledgement of Debt?

The purpose mirrors that of a HIPAA Employee Acknowledgment Form, ensuring all parties understand and agree to the compliance terms.

- Document Obligation: Clearly outlines debtor’s obligation to repay.

- Legal Clarity: Provides a clear, legal basis for debt recovery.

- Facilitates Agreement: Helps both parties agree on debt terms.

- Prevents Disputes: Reduces potential for future disputes.

- Enforcement: Assists in the enforcement of payment terms.

In Which Document Does the Borrower Acknowledge the Debt?

The borrower acknowledges the debt in a document similar to an Acknowledgment of Risks Form, detailing all terms and potential risks.

- Debt Agreement: Formal agreement stating all terms.

- Loan Contract: Specific contract for borrowed money.

- Mortgage Papers: In case of property loans.

- Promissory Note: Often used for personal loans.

- Credit Agreement: For revolving credit lines.

When to Issue an Acknowledgement Receipt?

Issue an acknowledgment receipt when a transaction is completed, similar to how a Acknowledgment of Receipt Form is used for received documents.

- Upon Payment: Immediately after receiving payment.

- After Delivery: When goods or services are delivered.

- Following Contract Signing: After signing any formal agreement.

- Post-Donation: When accepting donations.

- During Handover: When transferring possession of items.

How to Create a Comprehensive Debt Acknowledgment Form

A comprehensive debt acknowledgment form will have all the important subjects which should be tackled by the debtor and the creditor regarding the debt. To create this form, the steps below must be followed:

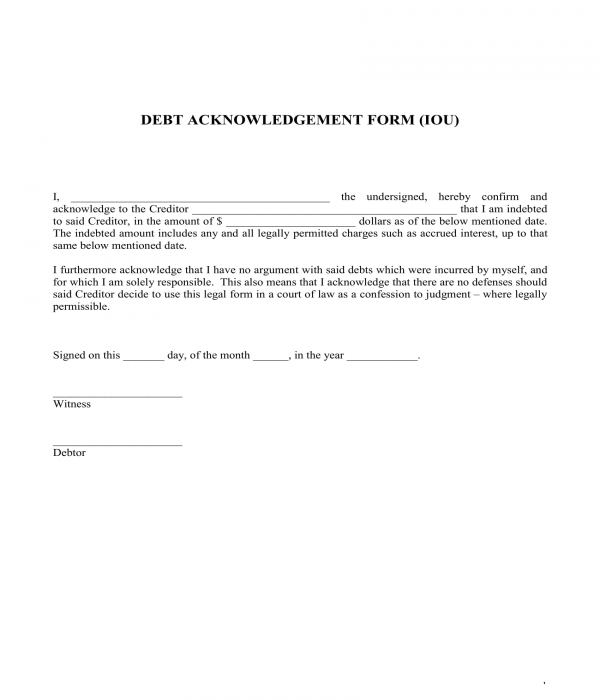

Step 1: Prepare a blank document sheet.

There can be various types of software applications that organizations can choose from in making their non-legal and legal forms including a debt acknowledgment form. Each software application will have different file extensions. For instance, if the application used is Microsoft Word, then the extension will be in “.DOC”, while if the software is made using OpenOffice Writer, then the extension will be “.ODT”. Moreover, after the document sheet is opened in the word processing software application, the margins must be changed depending on the preferences of the organization as well as the font-style or the typefaces to be used for the texts of the document’s content.

Step 2: Name the form and add a section for identifying the debtor.

The name or the title of the form can be placed in all caps or in all capital letters to emphasize it among the other contents of the form. Below the title should be a statement that will introduce who the debtor is such as “I, the undersigned ____ hereby acknowledge…” wherein the underline will be for stating the name of the debtor. Additionally, to whom the debtor owes his borrowed money should also be included in this portion of the form. And if the creditor is a company, then the full name of the company and the name of the representative who approved the credit should be stated in the form as well.

Step 3: Make a paragraph for disclosing the amount owed by the debtor.

The paragraph should include an area where the debtor will be able to state the purpose of why he borrowed the said amount from the creditor.

Step 4: Enlist the promises of the debtor or the inclusions of the debt.

This section will be for indicating what is included in the debt along with the amounts of each inclusion. Additionally, the interests which should be paid by the debtor as well should be disclosed along with the rules and regulations, and the responsibilities of the debtor which should be met. This, however, can be summarized into a few points which will focus on the important items to be acknowledged in the form.

Step 5: Incorporate a certification statement and a signature block.

The certification statement should be the last portion of the form where the date when the form is used will be indicated. Below the statement should be a signature block or area for the names and signatures of the parties involved: the debtor and the creditor.

After the contents of the form are made, the form must be saved for future use. This means that the fields or areas which will be for the information of the debtor and the creditor must be left blank so that filling out the form will be easier without having the need to remove entries or change each data for it to be updated.

Examples of Debt Acknowledgment Forms

Some organizations associate other documents to debt acknowledgment forms resulting in combined documentation to be filled out by a debtor. On the other hand, there are also organizations who make several types of debt acknowledgment forms for each of their varying debts or credits. Nonetheless, below are some of the examples of debt acknowledgment forms that organizations can consider using:

Debt Acknowledgment and Repayment Plan Form – This is an example of a type of debt acknowledgment form which is combined with another document, specifically a repayment plan form. In the example, the form is intended to be used by students of an educational institution who have outstanding school debts ranging from the books that they are required to purchase up to the tuition fees and expenses. The form is composed of three sections along with an area for the instructions and important notice to be read and understood by the student or the debtor. The first section of the form is for the personal information of the student. This is where the student or the debtor will have to state his surname, his first name based on his school identification card, contact numbers, email, and physical addresses, the combined annual income of his family or household, and the identification numbers of his parents or Legal Guardia Form.

Is an Acknowledgement Legally Binding?

Yes, an acknowledgement, much like a signed End User Acknowledgment Form, is legally binding if properly executed and includes all essential elements.

Can Acknowledgement of Debt Be Verbal?

Verbal acknowledgements of debt are legally binding but less enforceable than written ones, akin to verbal agreements in an Contract Form process.

Is an Acknowledgement of Debt a Negotiable Instrument?

No, an acknowledgement of debt is not a negotiable instrument like a check or promissory note; it’s a non-negotiable Declaration Form of debt.

How Not to Acknowledge Debt?

To avoid acknowledging debt improperly, do not sign any documents or make payments before fully understanding the implications, similar to a Joining Report Form.

Is Acknowledged the Same as Notarized?

No, being acknowledged is not the same as being notarized. Acknowledgement means confirmed or admitted, whereas notarization involves a Claim Form by a notary public confirming identity.

Do I Have to Pay a Debt If It Has Been Sold?

Yes, you must still pay a debt even if it has been sold to another collector, similar to obligations detailed in a Primary School Admission Form.

What Happens If a Debt Collector Does Not Validate Debt in 30 Days?

If a debt collector fails to validate a debt within 30 days, they cannot legally continue collection efforts, as per rules like those for an Admission Form.

In conclusion, a Debt Acknowledgment Form is an indispensable tool for documenting and managing debts effectively. By providing a clear, written acknowledgment of debt, this form helps solidify the debtor’s obligation and supports the creditor’s claim, should disputes arise. Utilizing samples, forms, and template letters can aid significantly in drafting documents that meet legal standards and ensure all parties are aligned in understanding and expectation. The proper use of a Debt Acknowledgment Form, akin to an Application Form, is essential for maintaining accurate and undisputed financial records in any business or personal finance context.