Diving into the world of claim submissions can be daunting, but with our Claim Form – Complete Guide with examples, it doesn’t have to be. This all-encompassing resource simplifies the process, incorporating Small Claim Form and answering the pivotal question, “What is a Claim Form?” Whether you’re navigating insurance claims, seeking reimbursements, or filing small claims, our guide equips you with the knowledge and examples you need. Enhance your understanding and confidence in claim filing, ensuring you’re prepared to tackle any claim form that comes your way with precision and ease.

What is a Claim Form? – Meaning

A Claim Form is a document used to formally request compensation or reimbursement from an insurance company, government agency, or another entity. It outlines the details of the claim, including the nature of the claim, the amount being claimed, and any supporting evidence. The form serves as a structured way for individuals to present their case, whether it’s for a small claim or a significant request, ensuring that all necessary information is communicated clearly and efficiently to the reviewing party.

What is the Best Sample Claim Form?

A well-structured Sample Claim Form typically includes the following sections:

Sample Claim Form

Claimant’s Information:

- Name: ___________________________

- Address: ___________________________

- Contact Number: ___________________

- Email Address: ____________________

Claim Details:

- Date of Incident: _________________

- Location of Incident: _______________

- Description of Incident:

Type of Claim:

- Property Damage

- Personal Injury

- Theft or Loss

- Other (Please specify): ___________

Details of Damage or Loss:

- Description of Damage/Loss:

- Estimated Cost/Value: ______________

Supporting Documents:

- Photographs

- Police Report

- Receipts/Invoices

- Other (Please specify): ___________

Bank Details for Payment (if applicable):

- Bank Name: ________________________

- Account Holder: ____________________

- Account Number: ___________________

- Routing Number: ___________________

Declaration: I hereby declare that the information provided is true and accurate to the best of my knowledge.

Signature: __________________________ Date: ______________________________

This template can be customized according to the specific requirements of the claim type and the organization handling the claim. It’s designed to collect all necessary information in a clear and organized manner.

Claim Form Format

Section 1: Claimant Information

- Name, Contact Information, Address

Section 2: Incident/Event Details

- Date, Location, Description

Section 3: Claim Details

- Amount, Documents Attached

Section 4: Declaration and Signature

- Claimant’s declaration of truth and completeness, Signature, and Date

Instructions:

- Ensure all sections are completed fully.

- Attach all necessary documents as listed in the form.

- Review the declaration before signing.

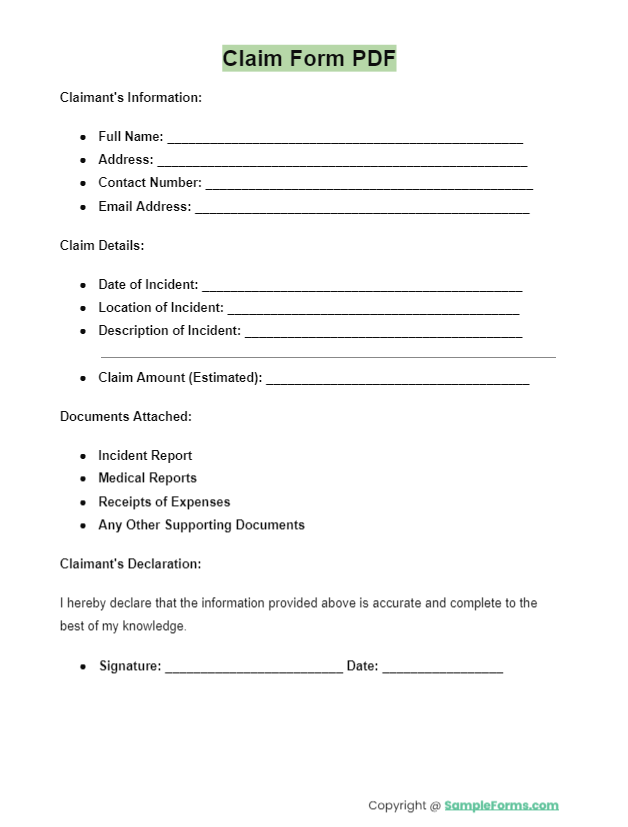

Claim Form PDF

A Claim Form PDF simplifies the submission process, offering a digital format for easy access and completion. Ideal for various claims, including Travel Expense Claim Form, it ensures accurate and efficient processing of requests. You should also take a look at our Quit Claim Deed.

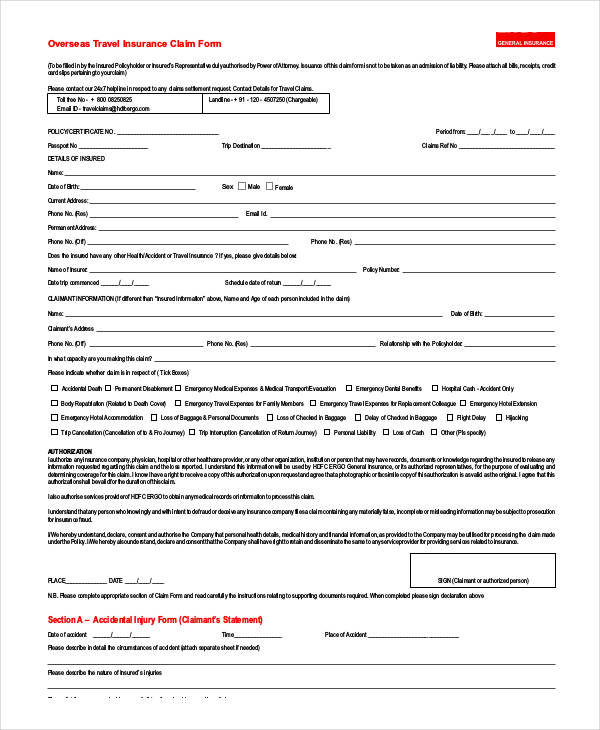

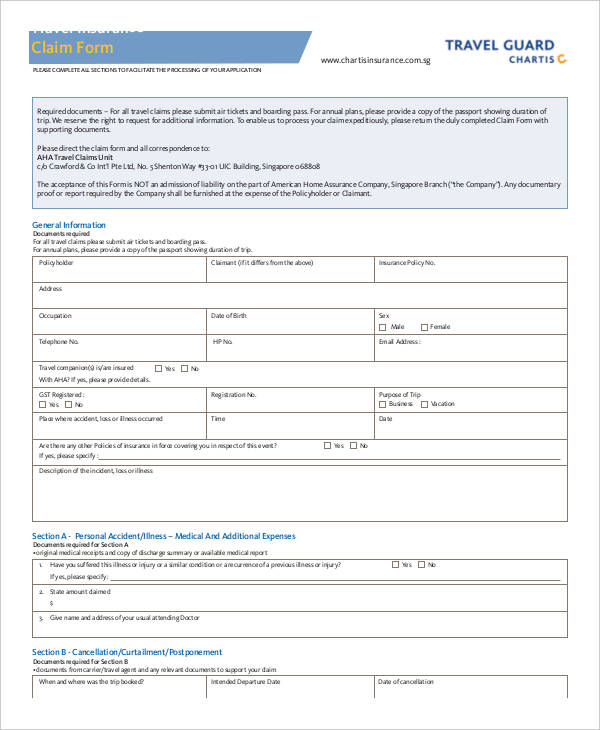

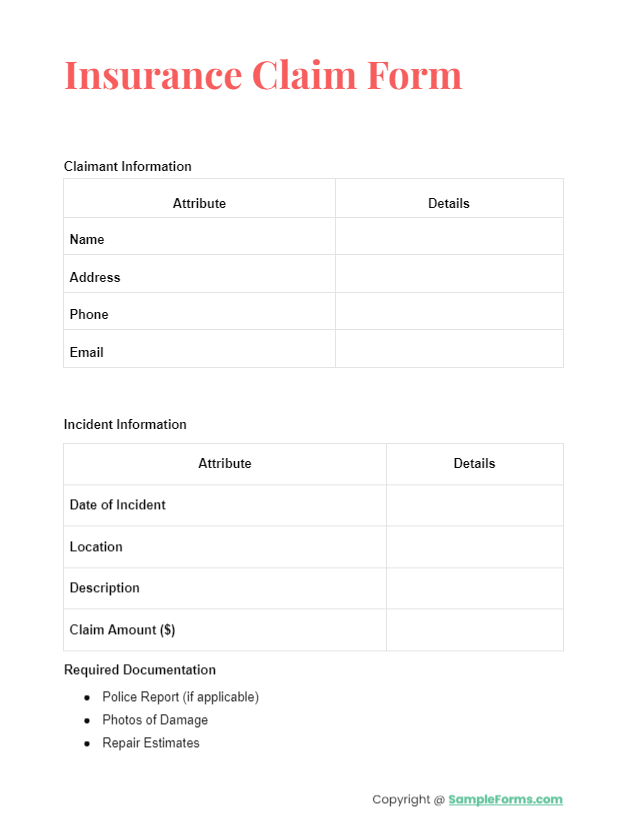

Insurance Claim Form

An Insurance Claim Form is a crucial document for requesting compensation for losses covered under an insurance policy. It includes essential details, such as incident information and damages, pertinent to Travel Insurance Claim Form submissions.

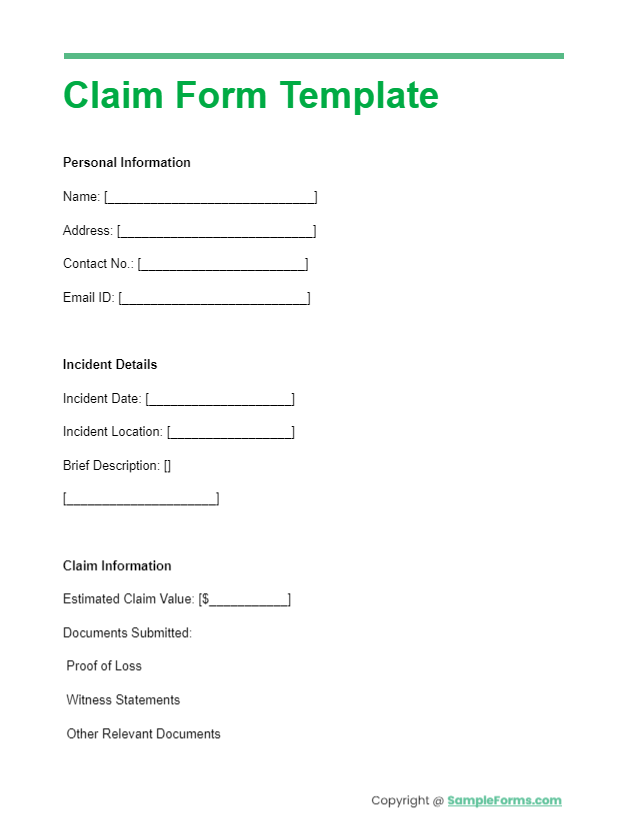

Claim Form Template

A versatile Claim Form Template serves as a foundational blueprint for creating specific claim documents, including Travel Budget Form and Warranty Claim Form. It streamlines the claim submission process by providing a standard format to be customized as per the claim’s nature. You should also take a look at our Quitclaim Deed Form.

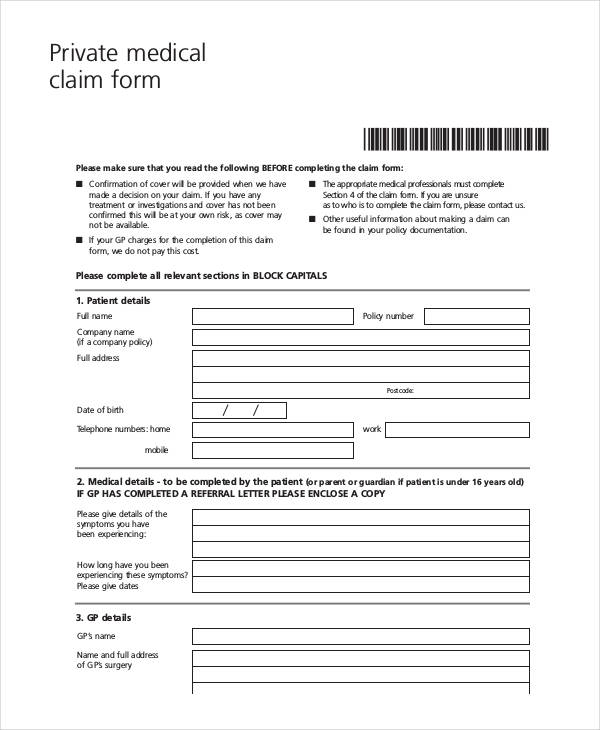

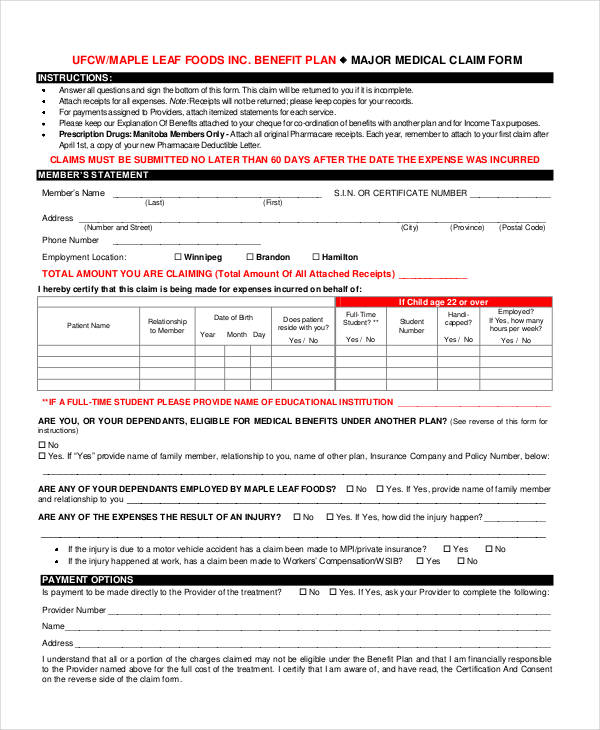

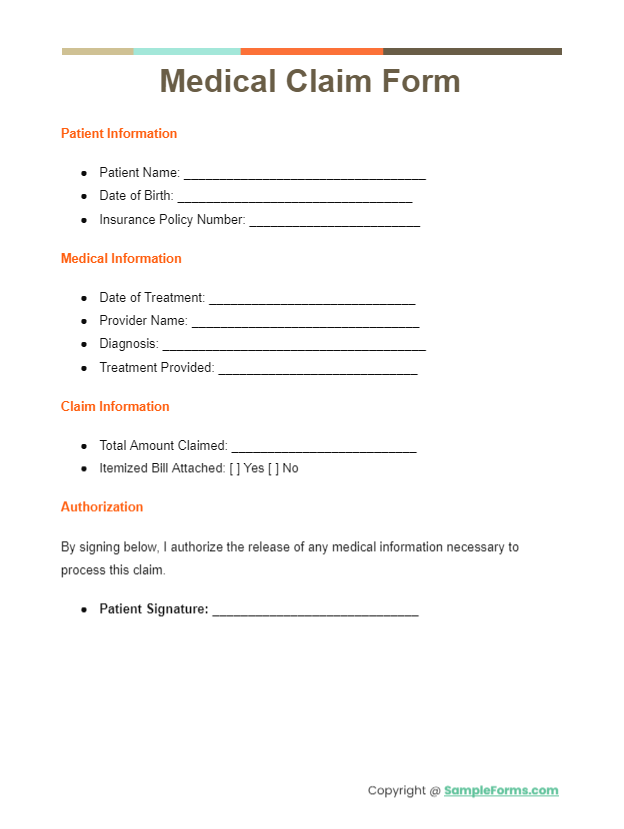

Medical Claim Form

32+ More Claim Form Samples

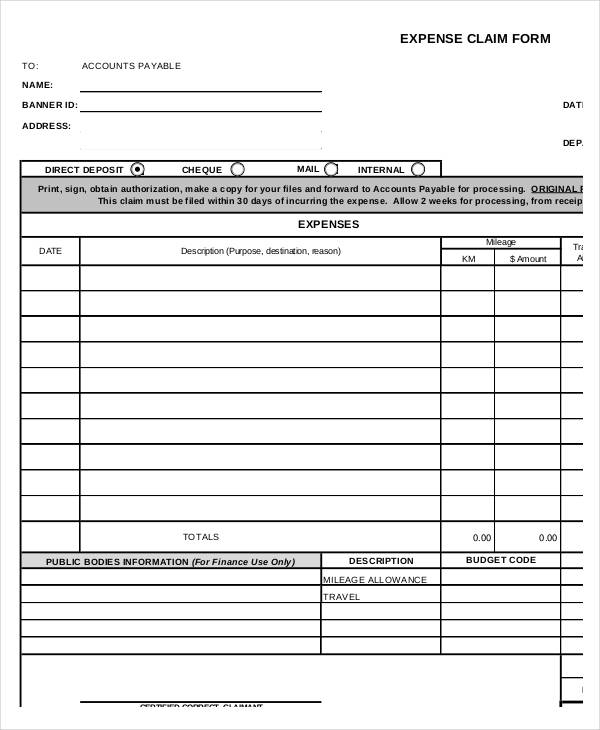

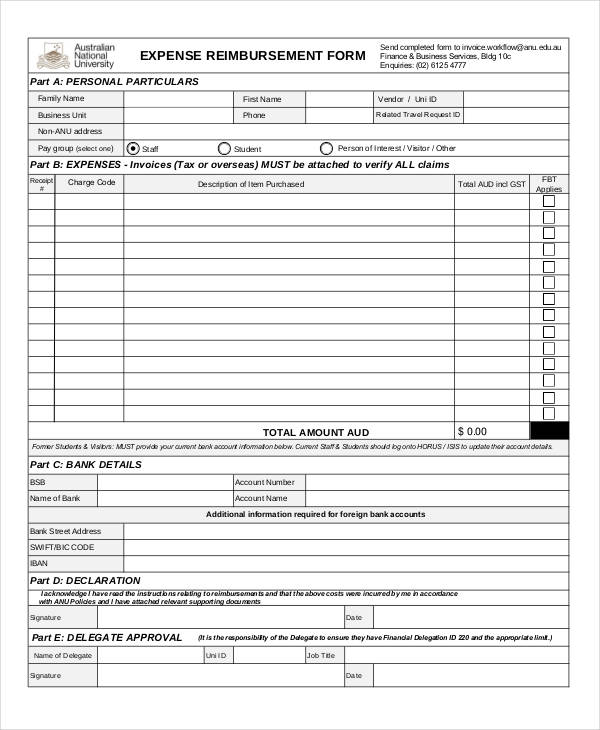

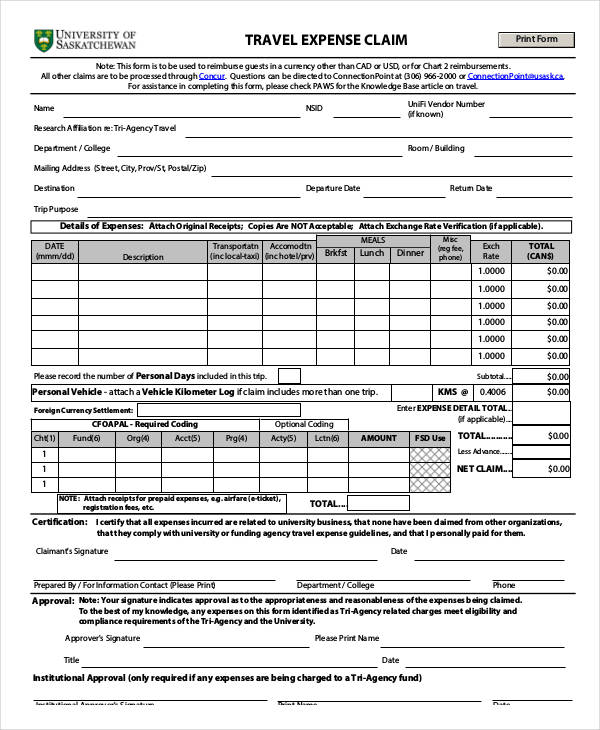

Expense Claim Form Templates

Free Expense Claim

Expense Reimbursement

Travel Expense Claim

Mileage Claim Forms

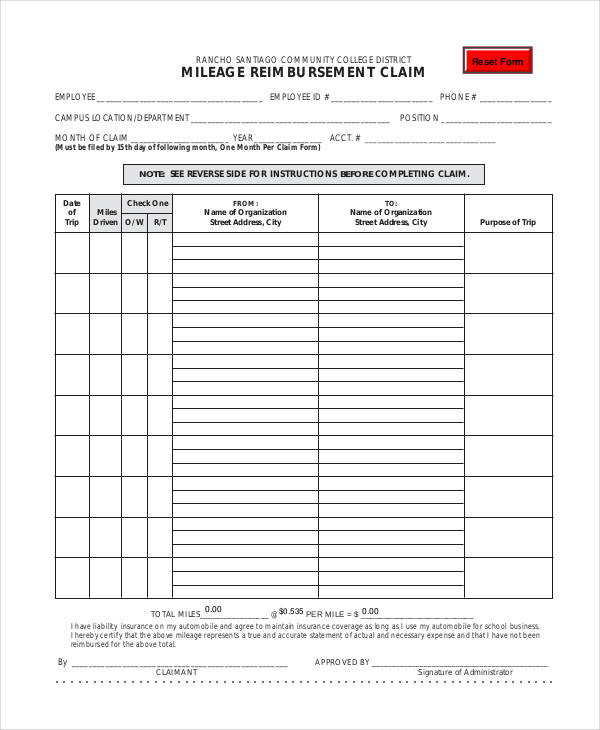

Mileage Reimbursement Claim

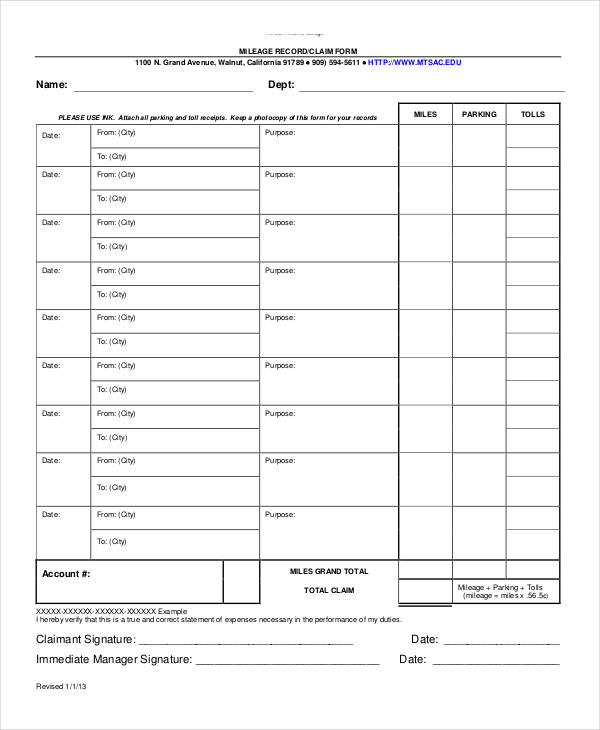

Mileage Record Claim

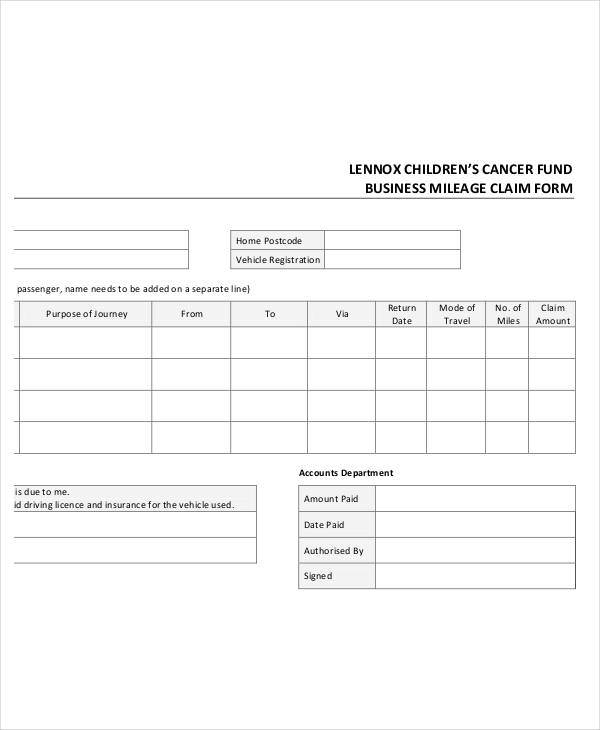

Business Mileage Claim Form

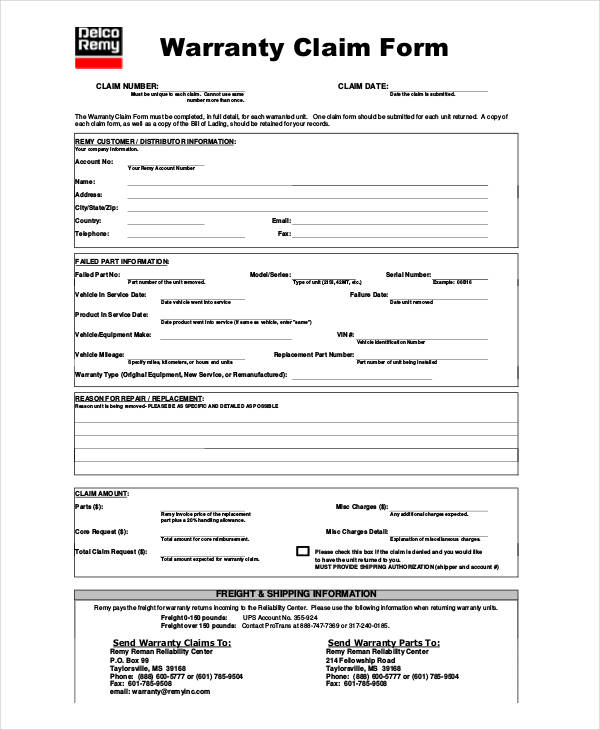

Warranty Claim Forms

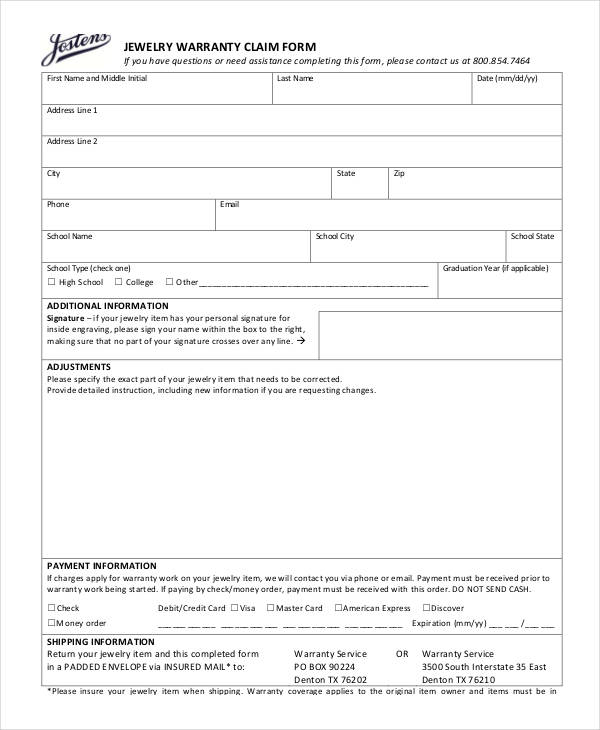

Jewelry Warranty Claim

Warranty Claim Template

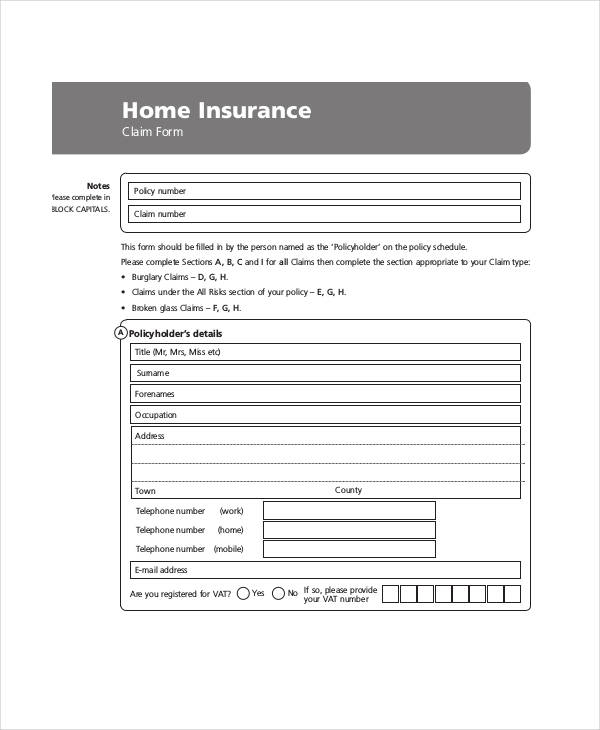

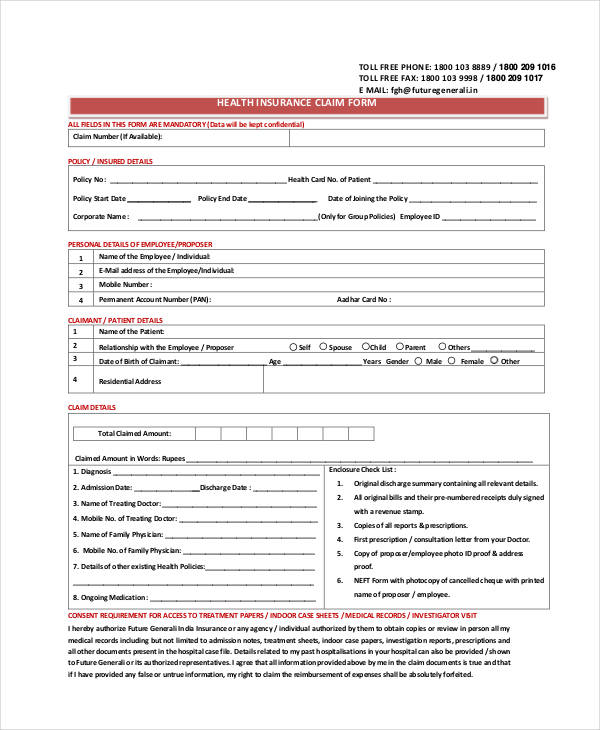

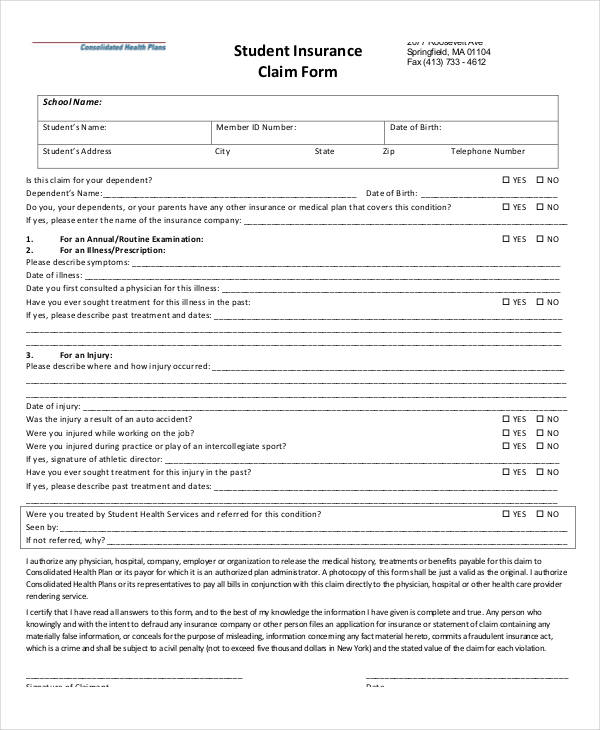

Insurance Claim Forms

Home Insurance Claim Format

Health Insurance Claim

Student Insurance Claim

Travel Claim Forms

Overseas Travel Insurance Claim

Sample Travel Guard Claim

Sample Travel Claim

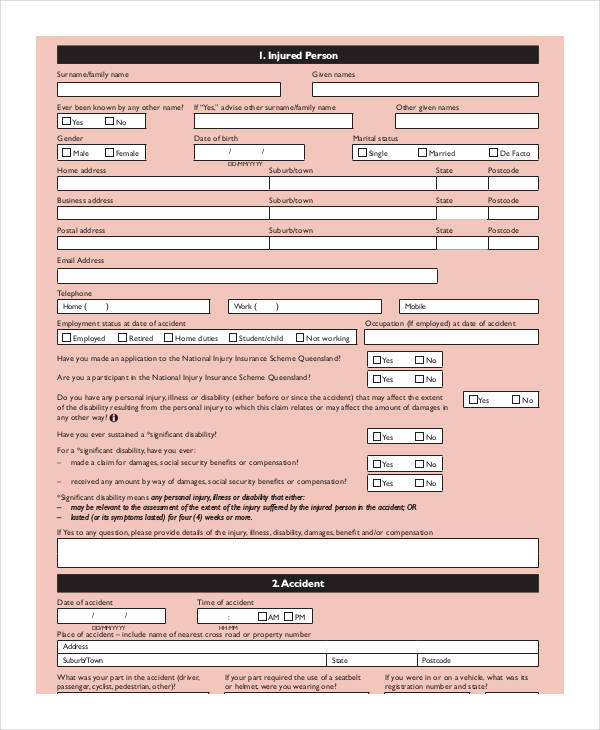

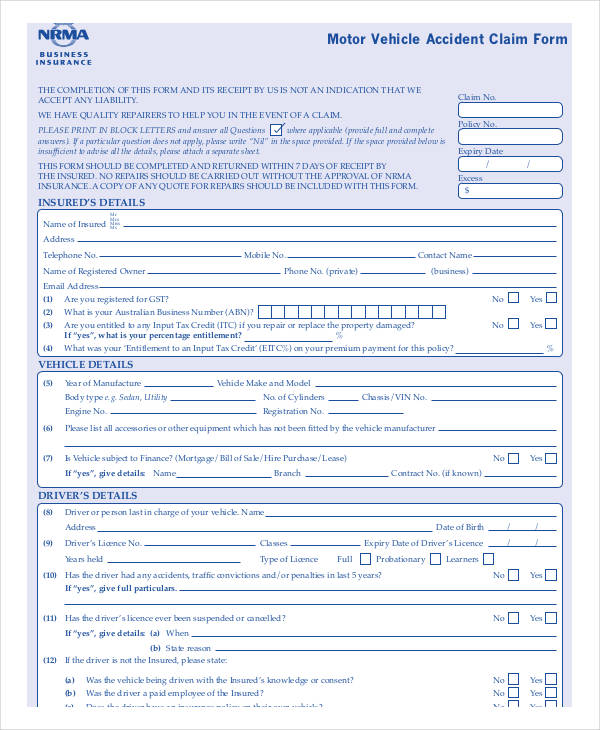

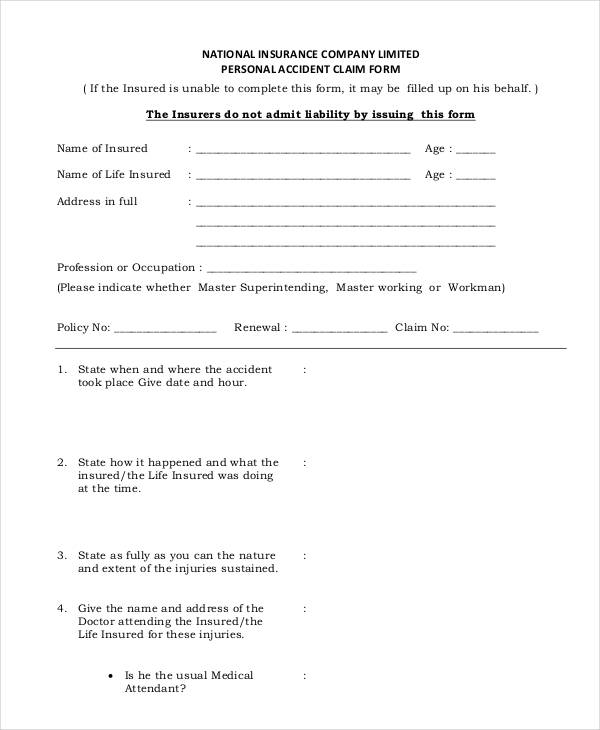

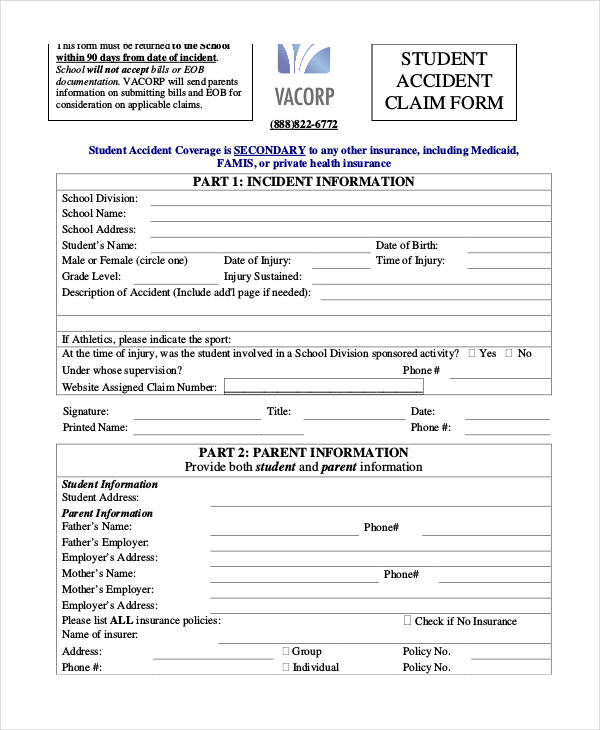

Accident Claim Form Templates

Notice of Accident Claim

Vehicle Accident Claim

Personal Accident Claim

Student Accident Claim

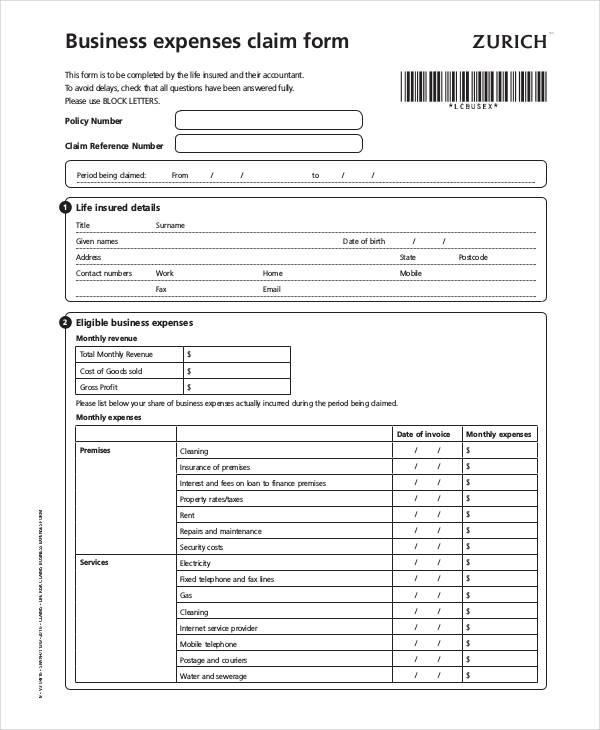

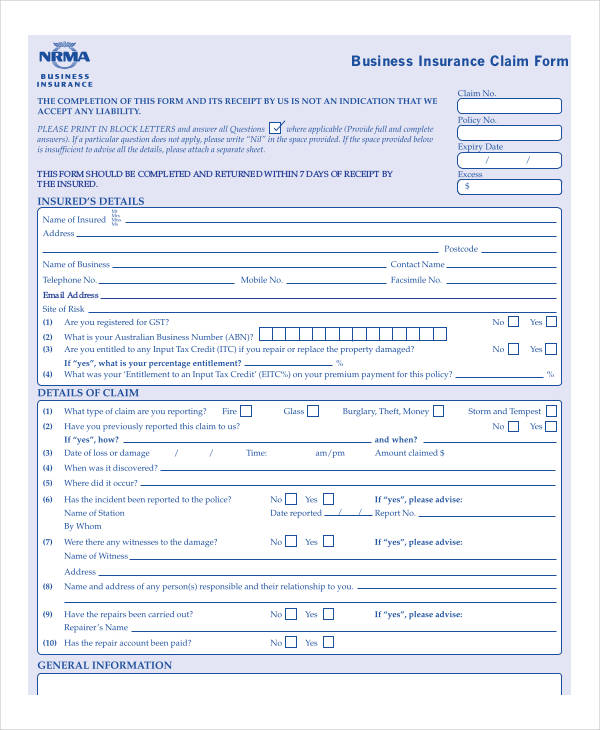

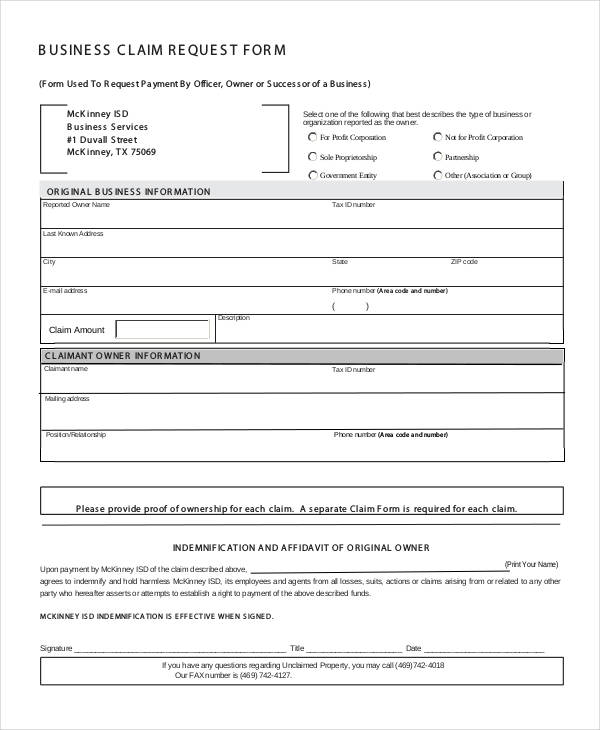

Business Claim Forms

Business Staff Expense Claim

Editable Business Insurance Claim

Business Claim Request

Mileage Claim Forms

There are instances wherein an employee has to use his own car or a company car to travel for a business trip. Either way, a Mileage Claim Form or Mileage Reimbursement Form is used to track the mileage of the car that was used for business purposes. This is because the employee will have to be reimbursed for fuel, parking fees, and toll fees. The reimbursement of the fuel will depend on the number of miles driven for the trip. You may also want to see our article about Mileage Tracker Forms, which can be used to track the number of miles driven for a specific company vehicle over a specified period of time. These records can be used in calculating the expenses for transportation, which would be included in a company’s business financial statement. This can be done annually or quarterly, depending on the preference of the company.

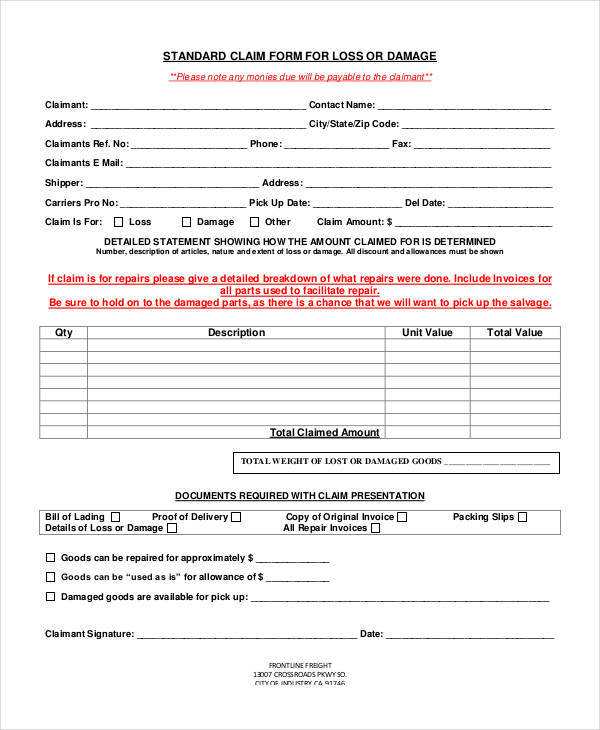

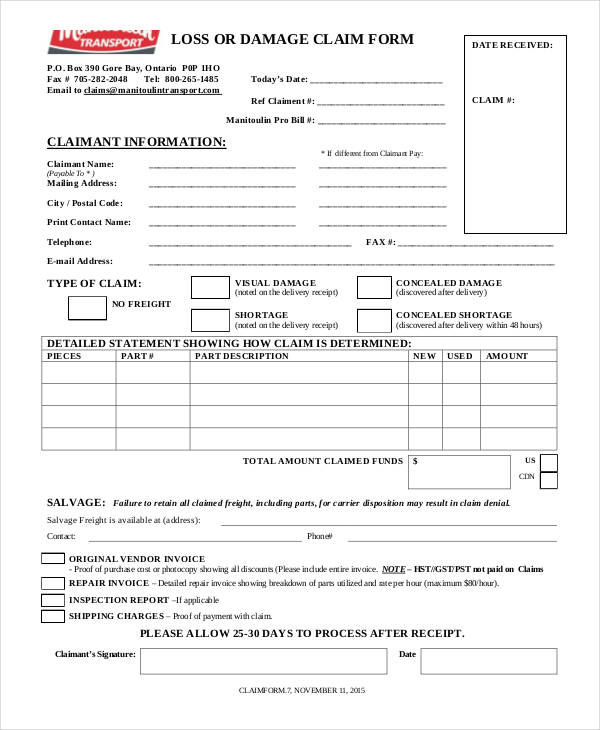

Standard Damage Claim

Damage Claim in PDF

Medical Claim Forms

Medical Expense Claim

Private Medical Claim

Major Medical Claim

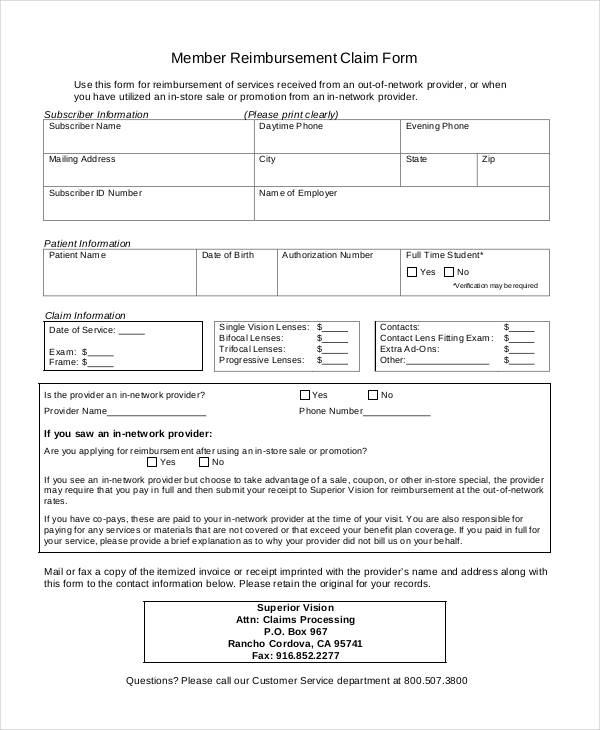

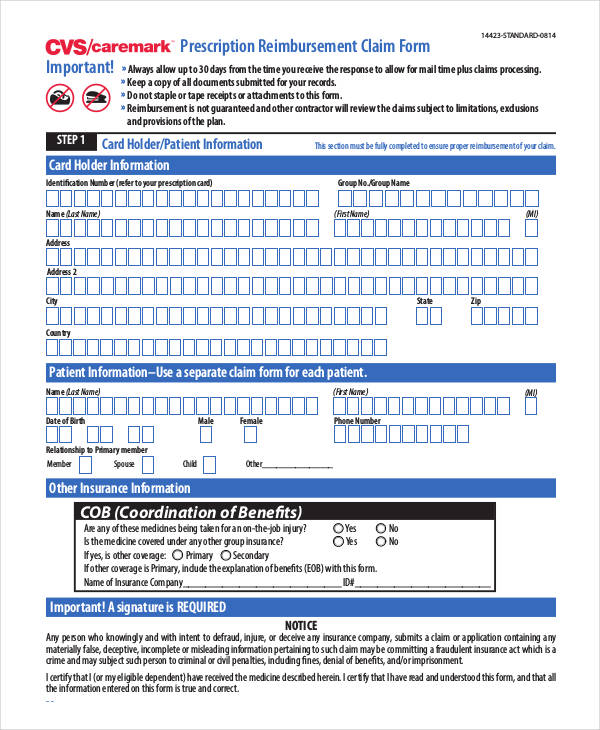

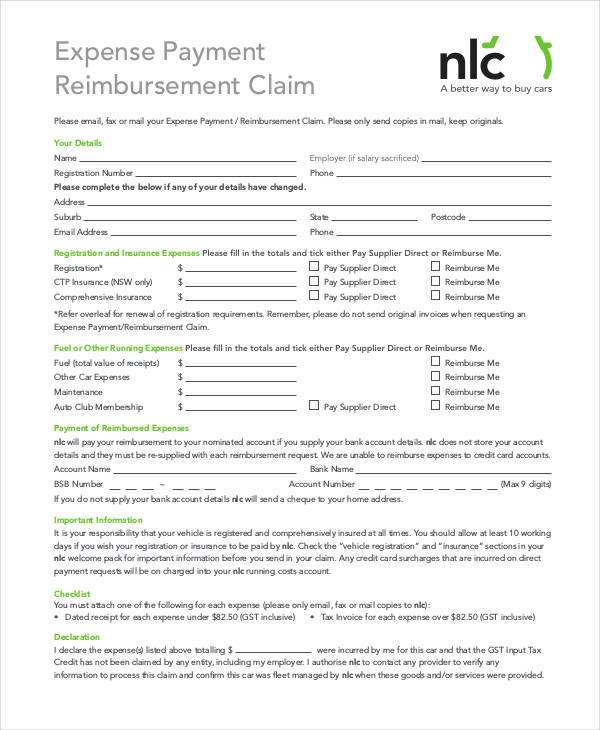

Reimbursement Claim Form Templates

Member Reimbursement Claim

Prescription Reimbursement Claim

Payment Reimbursement Claim

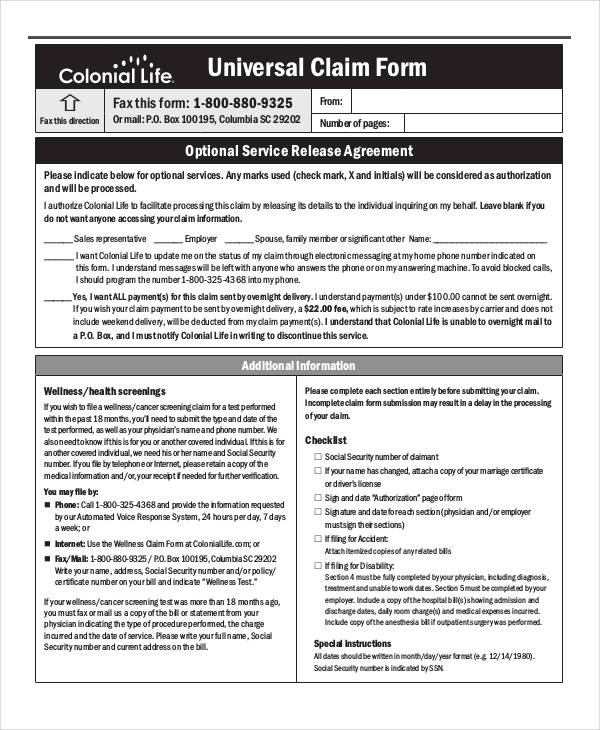

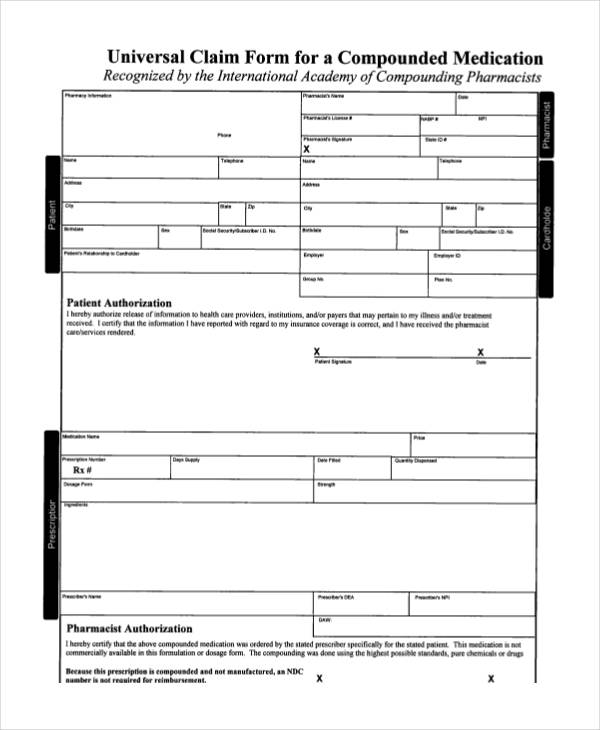

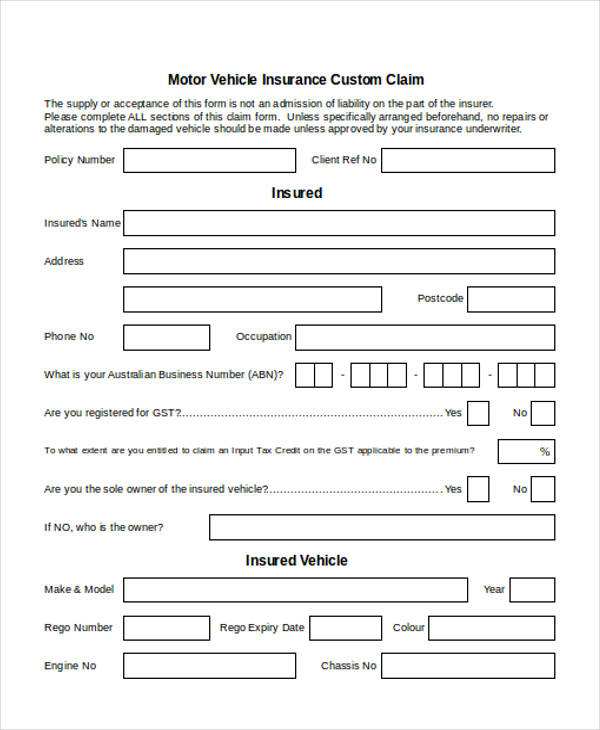

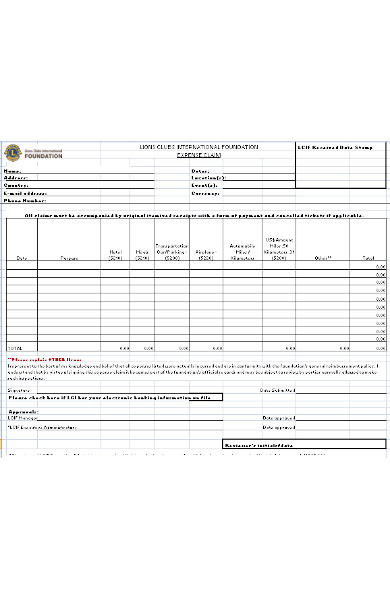

Universal Claim Forms

Free Universal Claim

Universal Claim for Medication

Custom Claim in MS Word

Expense Claim Form in Excel

Tips in Writing a Claim Form

If you are a company that provides insurance or one that provides reimbursement for employee expenses for business purposes, then it is important that you come up with Claim Forms that are user-friendly. This means that the forms you come up with have to be easy to fill out. You can also see our Free Claim Forms for more samples and information on other kinds of Claim Forms.

- Subsections: The information on your Claim Form has to be divided into proper subsections so that the claimant can fill it out easily. Organizing the information on the form will also help you easily understand the claim being filed by the claimant.

- Formatting: Headings should be distinct and in bold format so that they are easily singled out. It can be easy to get confused in a sea of information that has to be filled out, so this step would really help you and your claimants when filling out the forms.

- Instructions: There are Claim Forms that can get very long, and it is easy for anyone filling it out to be confused as to what to do. It would help if general instructions are provided either at the beginning or at the end of the form, or if minor directions are provided within the form to provide further guidance.

What is Warranty Claim Forms

Because of the aim of every business to satisfy their customers, they provide a warranty period for the repair and replacement of their sold items and products. A repair is necessary when the product becomes defective or damaged, and the warranty period varies on what kind of product it is. Typically, larger appliances and equipment have a longer warranty period than most items. In this process, a Warranty Claim Form is used to collect all the necessary information for the repair.

A Warranty Claim Form contains the following information:

- Customer Information: This includes the customer’s name and address, and contact details in case the company would need to call for a follow-up.

- Product Information: This includes the make and model, color, quantity, brand, and serial number of the item or product. Other information on the product may also be included to further identify the product and make sure that the correct item or product is sent back for repair.

- Payment Information: This is necessary for the shipping charges, if ever the company will not take care of the cost. This can also be used if there are charges for parts that have to be replaced and are not included in the terms and conditions of the warranty.

- Shipping Information: When the customer prefers the item to be shipped to her home instead of picking it up from the store, then this information is necessary.

What is Insurance Claim Forms

People are becoming more and more concerned and aware of being prepared during emergencies and accidents. That is why the insurance industry is growing. There are various insurances provided by companies, such as health insurance and travel insurance. An Insurance Claim Form is used by insurance companies to be filled out by their insured members whenever they want to file a claim.

The use of Insurance Claims is important because they allow the insurance company to review the details of the claim to see if it coincides with the terms and conditions of the insured member’s insurance policy. This way, they would not have to expend funds for instances that are not even covered by the member’s insurance policy. Insurance Claim Forms also require supporting documents to be presented to substantiate the claim. This lessens the risk of insurance fraud, which is not very uncommon.

What are the Two Types of Claim Form?

The realm of claim submissions encompasses a wide array of forms, but primarily, they can be classified into two distinct types: the Health Insurance Claim Form and the Business Expense Claim Form. The Health Insurance Claim Form is used by policyholders to request reimbursement or direct payment for medical services received. This form requires detailed information about the medical services provided, including diagnoses and treatment codes. On the other hand, the Business Expense Claim Form is designed for employees or business owners to report and request reimbursement for expenses incurred in the course of business operations. This includes travel, supplies, and other business-related expenses. Both forms serve the critical function of documenting and validating claims for financial transactions.

How to Fill out a Claim Form for Insurance?

Filling out a Claim Reimbursement Form for insurance involves several key steps to ensure accuracy and completeness:

- Review Your Policy: Before starting, understand what is covered under your policy and the documentation required for a claim.

- Gather Necessary Information: Collect all relevant documents, such as medical bills for a Dental Claim Form or receipts for a Business Expense Claim Form.

- Complete the Form: Start by filling in your personal information, policy number, and details of the claim include specific medical service codes and provider information.

- Attach Supporting Documents: Attach all required documents, such as medical reports for a Health Insurance Claim Form or receipts for a Business Expense Claim Form.

- Review and Sign: Double-check all the information for accuracy. Sign the Proof of Claim Form or any other relevant section to validate the submission.

- Submit the Form: Follow the insurance company’s guidelines for submitting the claim. This could be through mail, online, or in person.

- Keep Records: Always keep a copy of the completed form and supporting documents for your records.