A Life Insurance Beneficiary Form is a crucial document that ensures the rightful recipients receive the life insurance payout upon the policyholder’s demise. It provides clarity and specificity, preventing potential disputes and misunderstandings. These printable form can encompass various types, tailored to different needs and situations. Through real-life examples, we’ll delve into its significance, explore its diverse forms, guide you in crafting one, and offer invaluable tips for ensuring its effectiveness. Dive in to safeguard your loved ones’ financial future.

What is a Life Insurance Beneficiary Form ? – Definition

A Life Insurance Beneficiary Form is a formal document associated with a life insurance policy that designates the individual(s) or entity(ies) who will receive the insurance proceeds upon the death of the policyholder. This form ensures that the insurance payout goes to the intended recipients, as specified by the policyholder. The beneficiaries can be family members, friends, trusts, or even organizations. Regularly updating this form is essential, as life circumstances can change, affecting the policyholder’s preferences on who should benefit from the policy.

What is the Meaning of a Life Insurance Beneficiary Form?

The meaning of a Life Insurance Beneficiary Form revolves around its function as a directive. It specifies who will receive the death benefit from a life insurance policy when the insured person passes away. Essentially, it serves as a clear instruction to the insurance company about where the funds should be directed, reducing the risk of disputes or confusion. The form ensures that the policyholder’s wishes concerning the distribution of funds are respected and carried out efficiently upon their demise. The designated recipients, known as beneficiaries, can range from family members and friends to charitable organizations or legal entities.

What is the Best Sample Life Insurance Beneficiary Form?

Policyholder Information:

- Name: [Full Name]

- Policy Number: [Policy Number]

- Address: [Address]

- Date of Birth: [DOB]

- Contact Number: [Contact Number]

Primary Beneficiary(ies):

- Name: [Full Name]

- Relationship: [e.g., Spouse, Child, etc.]

- Address: [Address]

- Date of Birth: [DOB]

- Social Security Number (or Tax ID): [SSN/Tax ID]

- Percentage of Benefits: [e.g., 50%]

(Add more primary beneficiaries as required)

Contingent (Secondary) Beneficiary(ies):

- Name: [Full Name]

- Relationship: [e.g., Spouse, Child, etc.]

- Address: [Address]

- Date of Birth: [DOB]

- Social Security Number (or Tax ID): [SSN/Tax ID]

- Percentage of Benefits: [e.g., 50%]

(Add more contingent beneficiaries as required)

Acknowledgment:

I, [Policyholder’s Full Name], hereby declare that the information provided above is accurate and complete. I understand that this beneficiary designation will supersede any prior designations.

Signature: _____________________________ Date: [Date]

Tips:

- Always consult with your insurance provider, as they may have a specific form or required format.

- Consider specifying both primary and contingent beneficiaries. If a primary beneficiary predeceases you or is unable to claim the insurance, the contingent beneficiary will receive the proceeds.

- Ensure all details, especially names and relationships, are accurate.

- Review and update your beneficiary designations periodically or after major life events like marriage, divorce, the birth of a child, or a death in the family.

- It’s often recommended to consult with a financial advisor or attorney to ensure that your beneficiary designations align with your overall estate plan.

FREE 25+ Life Insurance Beneficiary Forms

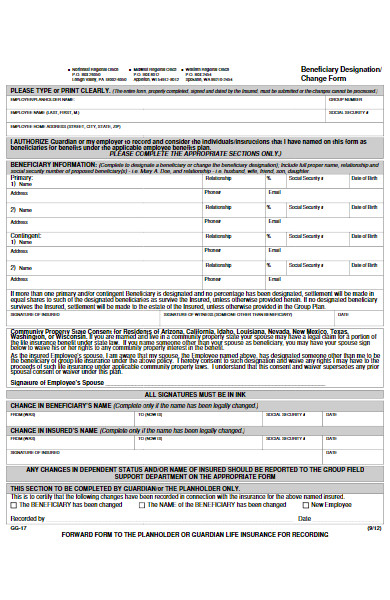

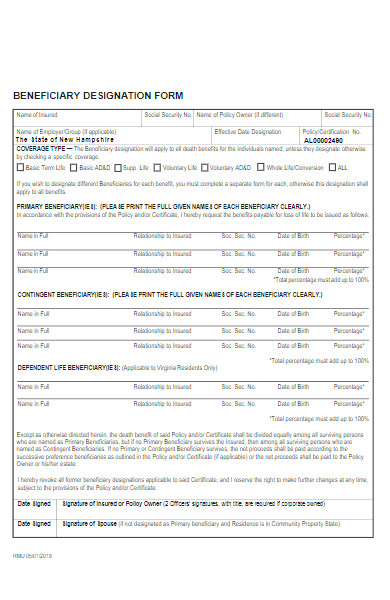

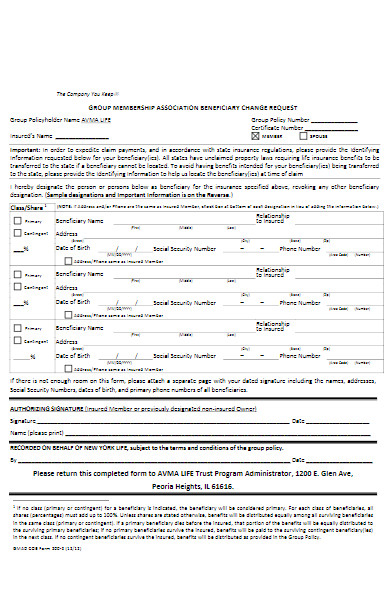

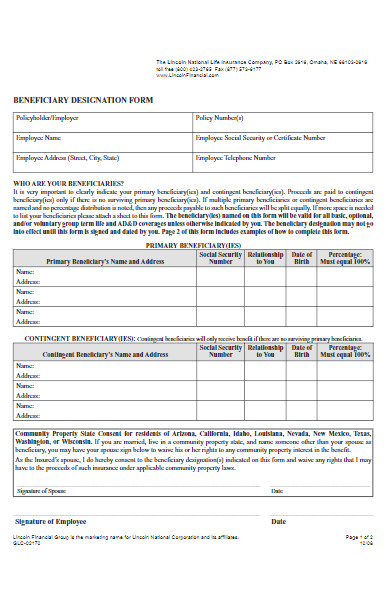

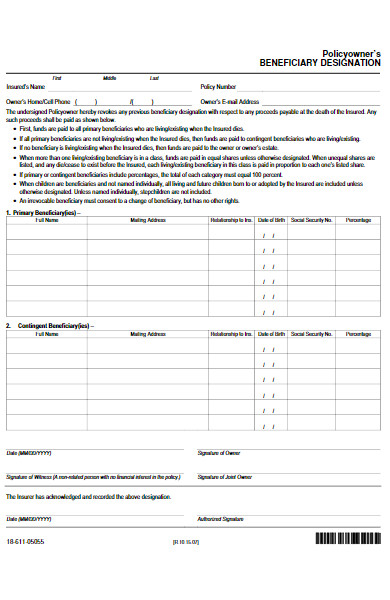

1. Life Insurance Beneficiary Designation Form

2. Basic Life Insurance Designation of Beneficiary Form

3. Retirement Life Insurance Beneficiary Designation Form

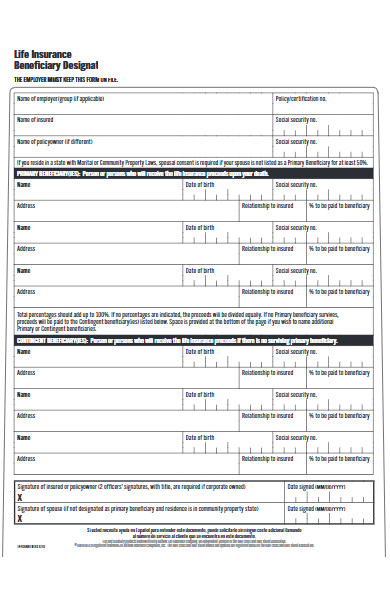

4. Life Insurance Beneficiary Form

5. Life Insurance Beneficiary Form Example

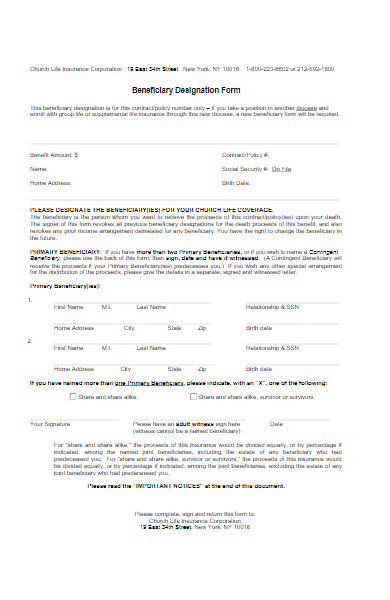

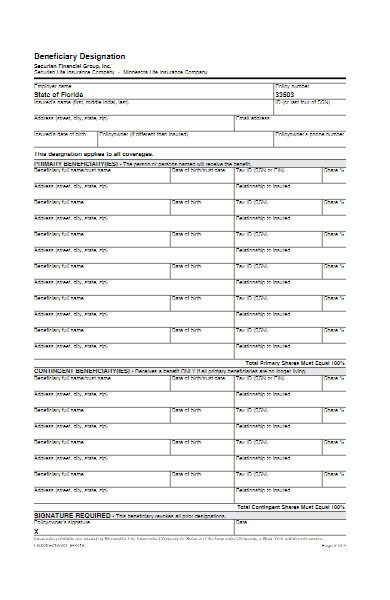

6. Life Insurance Beneficiary Designation Form in PDF

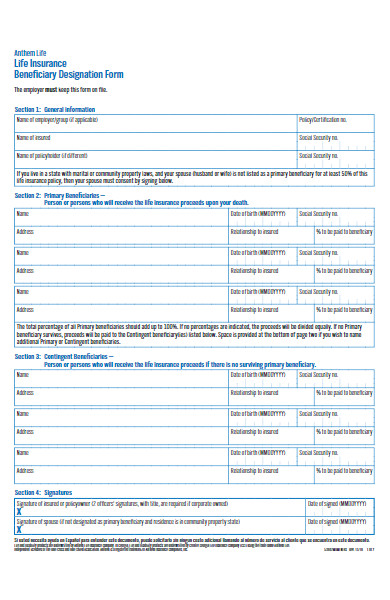

7. Life Insurance Company Beneficiary Designation Form

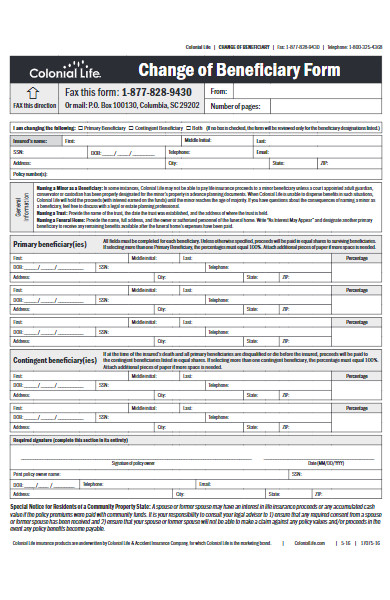

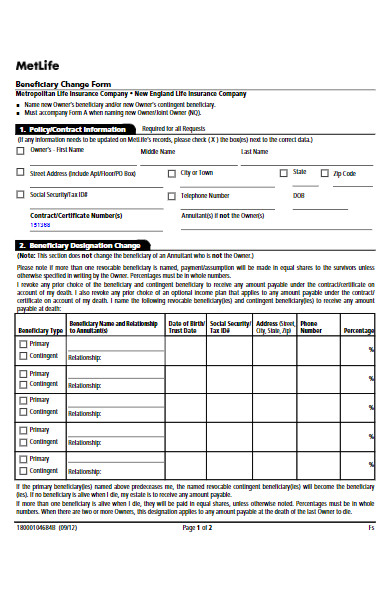

8. Life Insurance Beneficiary Change Form

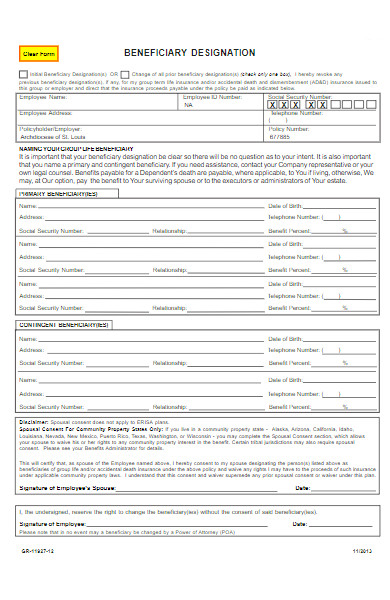

9. Employee Life Insurance Beneficiary Form

10. Life Insurance Change of Beneficiary Form

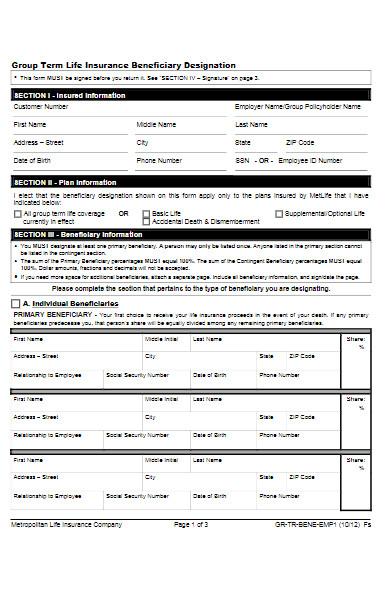

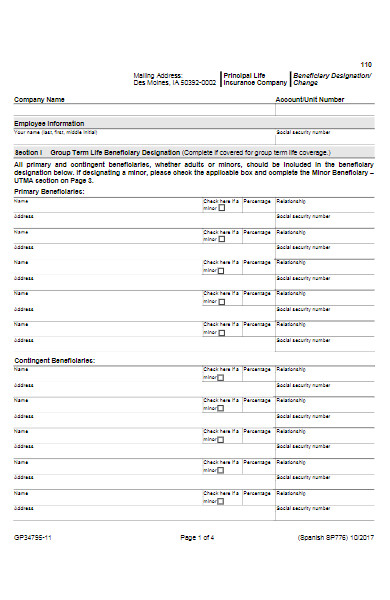

11. Group Term Life Insurance Beneficiary Designation Form

12. Financial Life Insurance Beneficiary Form

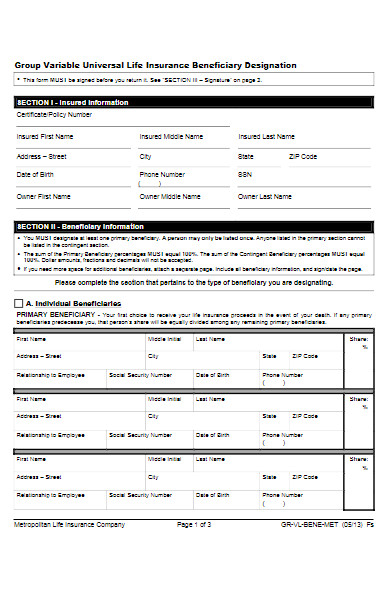

13. Universal Life Insurance Beneficiary Designation Form

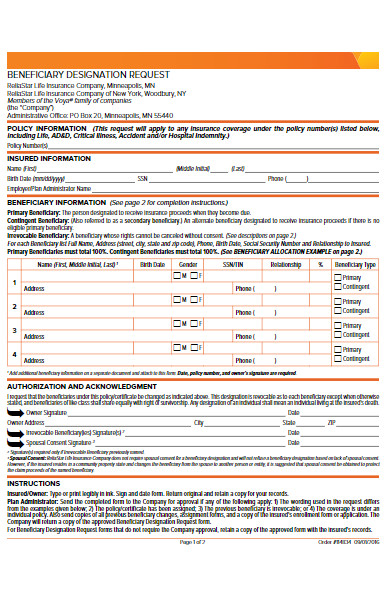

14. Life Insurance Beneficiary Request Form

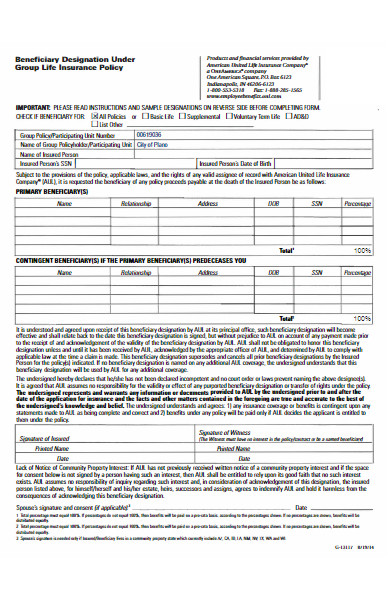

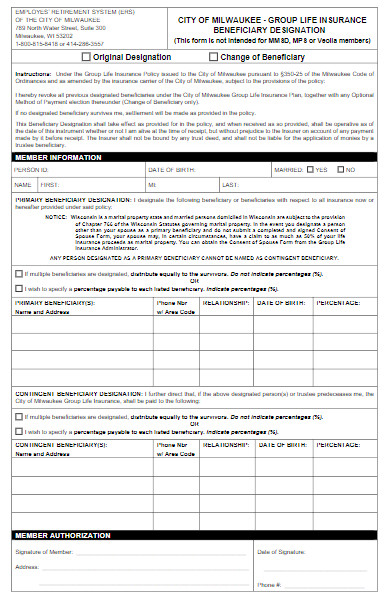

15. Group Life Insurance Beneficiary Designation Form

16. Life Insurance Beneficiary Change Form Example

17. Simple Life Insurance Beneficiary Designation Form

18. Life Insurance Beneficiary Change Request Form

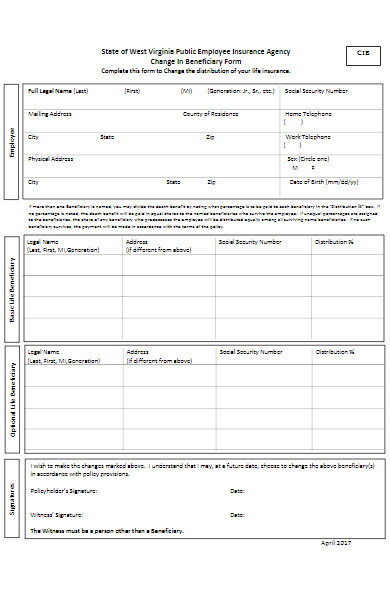

19. Employee Insurance Agency Change In Beneficiary Form

20. Basic Life Insurance Beneficiary Form

21. Group Life Insurance Beneficiary Request Form

22. Life Insurance Beneficiary Change Form in PDF

23. Life Insurance Company Designation of Beneficiary Form

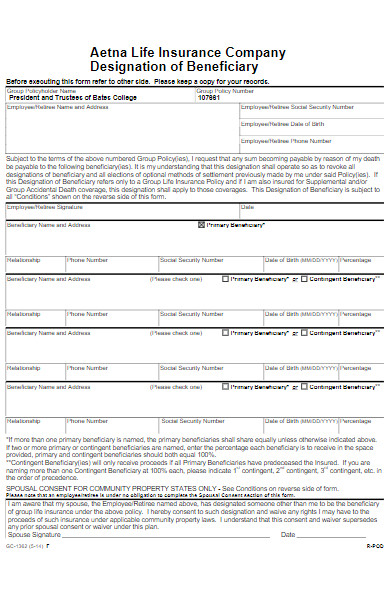

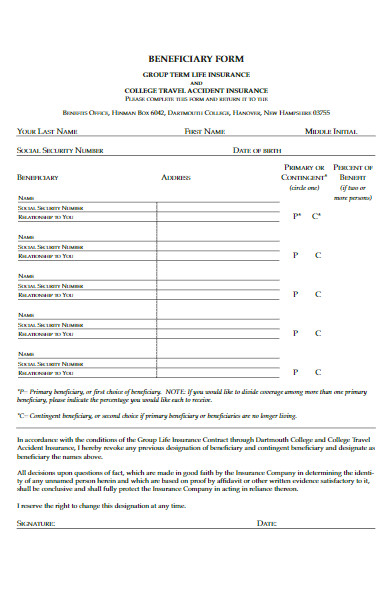

24. College Group Term Life Insurance Beneficiary Form

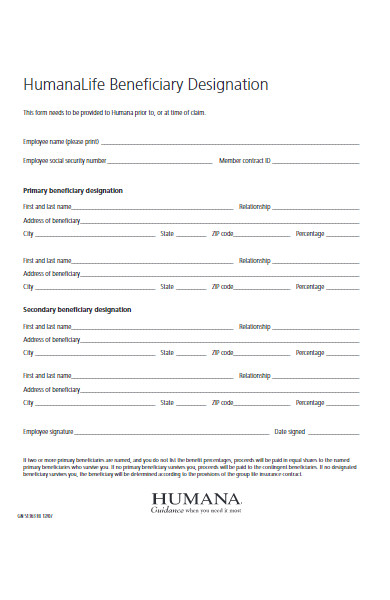

25. Employee Life Insurance Beneficiary Designation Form

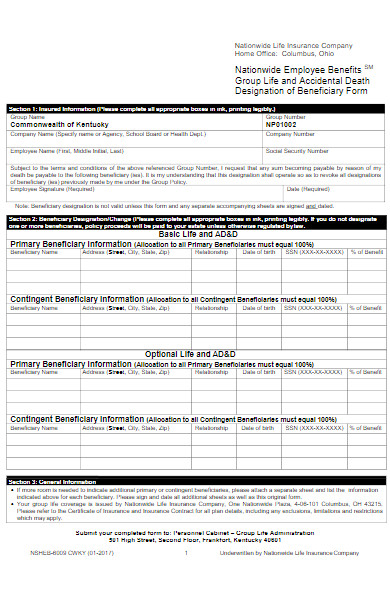

26. Group Life and Accidental Death Insurance of Beneficiary Form

How to fill out a life insurance beneficiary form?

Filling out a life insurance beneficiary form requires careful attention to ensure that the policy payout goes to the intended recipient(s) without any complications. Here’s a step-by-step guide on how to fill out the form:

-

Gather Necessary Information:

Before you begin, have all relevant information at hand, such as:

- The full legal names of your chosen beneficiaries

- Their dates of birth

- Their Social Security Numbers or Tax Identification Numbers

- Their current addresses

-

Personal and Policy Details:

- Enter your full name, date of birth, address, and policy number.

-

Primary Beneficiary:

- List the person or entity you want to receive the death benefit upon your passing.

- If naming multiple primary beneficiaries, specify the percentage each should receive. Ensure that the total equals 100%.

-

Contingent Beneficiary:

- Also known as the secondary beneficiary, this is the person or entity who will receive the death benefit if the primary beneficiary is unable to (for instance, if they predecease you).

- Again, if naming multiple contingent beneficiaries, specify the percentage each should receive, ensuring the total equals 100%.

-

Tertiary Beneficiary (if applicable):

- Some forms may allow for a tertiary (third-level) beneficiary in case both primary and secondary beneficiaries cannot claim the benefit.

-

Relationship to Policyholder:

- Clearly state the relationship of each beneficiary to you, e.g., spouse, child, friend, trust, charity, etc.

-

Special Provisions or Stipulations:

- If the form allows and you have specific conditions or stipulations about the payout, detail them clearly. For complex provisions, you might need a trust or legal guidance.

-

Trust as Beneficiary:

- If you’re naming a trust as the beneficiary, provide the trust’s full name, date of establishment, and the trustee’s contact information.

-

Review for Accuracy:

- Double-check all names, addresses, and numbers for accuracy.

- Ensure that percentage allocations (if applicable) add up to 100% for both primary and contingent beneficiaries.

-

Sign and Date the Form:

- Your signature validates your beneficiary designations.

- Some forms might require a witness or notary, so be sure to follow any such requirements.

-

Submit the Form:

- Return the completed form to your insurance company as directed, keeping a copy for your records.

- You might be able to submit electronically, via mail, or in person, depending on your insurance provider.

-

Inform Your Beneficiaries:

- Let your named beneficiaries know about the policy and their designation. This step ensures they are aware and can act swiftly when needed.

-

Review Periodically:

- Life circumstances change. Review and, if necessary, update your beneficiary designations every few years or after major life events.

Note: Always refer to the specific guidelines provided by your insurance company when filling out a beneficiary Release form. If in doubt, consider consulting a financial planner or attorney for clarity and guidance.

How often should I update my Life Insurance Beneficiary Form?

You should regularly review and potentially update your Life Insurance Beneficiary Form to ensure that it reflects your current wishes and life circumstances. While there’s no fixed rule on how often you should update it, consider doing so under the following circumstances:

-

Major Life Events:

- Marriage or Divorce: If you get married, you might want to add your spouse as a beneficiary. Conversely, if you get divorced, you might wish to remove your ex-spouse.

- Birth or Adoption: When you have a new child or adopt a child, you may want to add them as a beneficiary.

- Death of a Beneficiary: If a beneficiary predeceases you, it’s essential to update the form to reallocate their portion or add a new beneficiary.

- Starting or Dissolving a Business: Business partners might be added or removed based on the formation or dissolution of a business entity.

-

Relationship Changes:

- Over time, relationships with friends, charities, or even family might evolve, leading you to reconsider your beneficiary designations.

-

Financial Changes:

- Significant changes in your financial situation might influence how you want your insurance payout to be distributed.

-

Legal or Policy Changes:

- Laws regarding insurance and estate planning can change. Reviewing your beneficiary forms in light of new legislation is wise.

- If you purchase additional policies or if your insurance provider changes its terms, review the beneficiary settings.

-

Periodic Reviews:

- Even if you don’t experience major life events, it’s good practice to review your designations every 3-5 years. Over time, your priorities or wishes might shift, and a routine review ensures that your designations align with your current intentions.

-

Change in Residence:

- If you move to a different state or country, you should review the form. Different jurisdictions might have varying regulations impacting beneficiary designations.

In conclusion, while you don’t need to update your Life Insurance Beneficiary Form frequently, ensuring it’s current is crucial. It guarantees that the death benefit will be distributed according to your latest wishes and provides peace of mind for both you and your loved ones. Always consult with a financial advisor or attorney if you’re unsure about making changes. You should also take a look at our rsvp form.

Can I list multiple names on my Life Insurance Beneficiary Form?

Yes, you can list multiple names on your Life Insurance Beneficiary Form. When you designate multiple beneficiaries, you have the flexibility to decide how the death benefit of your life insurance policy will be distributed among them. Here’s what you need to know:

-

Primary Beneficiaries:

- These are the first individuals or entities in line to receive the death benefit upon your passing.

- You can specify how the benefit is divided among them. For example, you can split the benefit equally or designate specific percentages for each primary beneficiary.

-

Contingent (or Secondary) Beneficiaries:

- These are the individuals or entities who will receive the death benefit if all primary beneficiaries are unable to claim it (e.g., if they predecease you).

- Like with primary beneficiaries, you can split the benefit in any way you choose among multiple contingent beneficiaries.

-

Tertiary Beneficiaries:

- Some forms may allow you to designate a third level of beneficiaries. They would receive the death benefit if both the primary and secondary beneficiaries cannot.

-

Equal or Unequal Distribution:

- You can decide to distribute the death benefit equally among beneficiaries or in specific percentages. For instance, if you have three children, you could divide the benefit equally (33.33% for each) or unevenly (e.g., 50% to one child and 25% to each of the other two).

-

Consider Potential Complications:

- Clearly mention the full names of all beneficiaries to avoid confusion.

- Consider the implications of listing minor beneficiaries, as insurance companies often cannot pay death benefits directly to minors. Setting up a trust or using the Uniform Transfers to Minors Act (UTMA) accounts can be solutions.

- Think about potential tax implications or issues related to your state’s laws. Consulting with a financial planner or attorney can help navigate these complexities.

-

Regularly Update Your Form:

- With multiple beneficiaries, it’s essential to update your form when life changes occur, ensuring the designations still reflect your wishes.

In conclusion, listing multiple names on your Life Insurance Beneficiary Form gives you the flexibility to distribute the death benefit among several loved ones, charities, or entities. Just ensure that the distribution percentages are clear, and the total allocation sums up to 100%. Always refer to the specific guidelines provided by your insurance company and consider seeking legal advice if you’re uncertain about your designations. Our Sample Emergency Release Forms is also worth a look at

What should I do if I lose my Life Insurance Beneficiary Form?

If you lose your Life Insurance Beneficiary Form, take the following steps to ensure your beneficiaries are protected and your wishes will be followed upon your passing:

-

Contact Your Insurance Provider:

- Reach out to your life insurance company as soon as you realize the form is missing. They will have a record of your most recent beneficiary designation on file.

-

Request a Copy:

- The insurance company can provide you with a copy of the current beneficiary form they have on file. This will help you verify if the designations are up-to-date.

-

Complete a New Form if Needed:

- If you think there might have been changes after the last form was submitted or you simply want to ensure the current designations are accurate, fill out a new beneficiary form. This will supersede any previous forms on file.

-

Safe Storage:

- Once you have a new or duplicate form, store it in a safe place. Consider using a fireproof safe, safety deposit box, or a secure folder with other important documents.

- It’s also wise to keep digital scans or copies, ensuring they’re stored securely due to the personal information they contain.

-

Inform Beneficiaries and Trusted Individuals:

- Let your beneficiaries know about the policy, so they’re aware of its existence and can act when the time comes.

- Inform a trusted family member, friend, or legal advisor about where you’re storing the form so someone knows its location besides you.

-

Review Other Documents:

- If you lost your Life Insurance Beneficiary Form, it’s an opportune time to review and ensure the safety of other essential documents, like your will, power of attorney, and health care directives.

-

Consistent Updates:

- Regularly review and update your beneficiary designations, especially after major life events. Each time you update, consider the security of the document and its storage location.

-

Seek Legal Counsel:

- If there are complexities or concerns regarding your life insurance and beneficiary designations, consult with an attorney specializing in estate planning. They can provide guidance and ensure everything is in order.

Do I need a witness or notary for my Life Insurance Beneficiary Form?

Remember, the Life Insurance Beneficiary Form dictates who will receive the policy’s death benefit, so ensuring its accuracy and safety is paramount. Regular reviews, secure storage, and open communication with trusted individuals will help safeguard your wishes and protect your beneficiaries.

Whether you need a witness or a notary for your Life Insurance Beneficiary Form depends on the insurance provider’s requirements and, in some cases, state or local regulations.

-

Insurance Provider’s Requirements:

- Many insurance companies do not require a witness or notary for beneficiary designation forms. However, some might, either as part of their standard procedure or for added verification, especially in cases with larger policies or unique stipulations.

- Always check with your insurance provider. The form itself usually indicates if a witness or notary signature is required.

-

State or Local Regulations:

- While most states in the U.S. do not require beneficiary forms to be notarized, there are local or state-specific regulations that may apply. These might not directly relate to the beneficiary form itself but could be relevant in case of disputes or challenges to the beneficiary designation later on.

- For example, some states might have specific regulations regarding spousal rights to life insurance proceeds, which could influence how you fill out and validate your beneficiary form.

-

Special Cases:

- If your beneficiary designation involves unique or complex stipulations, it might be wise to have the form notarized, even if not required. This can add an extra layer of legitimacy to the document.

-

International Considerations:

- If you’re living abroad or your designated beneficiary resides in another country, it might be a good idea to have the form notarized to address potential international legal complexities.

-

Added Assurance:

- Even if not required, having a form notarized or witnessed can provide added assurance that the form was completed intentionally and without undue influence. It might also provide peace of mind that the document will withstand potential legal scrutiny.

In conclusion, while many insurance providers and states don’t mandate the use of a notary or witness for Life Insurance Beneficiary Forms, it’s always essential to verify the specific requirements and consider the broader context in which the insurance is being taken. If in doubt, consult with your insurance agent or an attorney who specializes in estate planning or insurance matters. In addition, you should review our Insurance Proposal Form.

What happens if there’s a mistake on my Life Insurance Beneficiary Form?

Mistakes on a Life Insurance Beneficiary Form can lead to complications, delays, or unintended distributions of the death benefit. Here’s what can happen and how to address such mistakes:

-

Benefit Payout Delays:

- If there’s ambiguity or a mistake on the form, the insurance company may need additional time to verify the intended beneficiaries, leading to a delay in disbursing the death benefit.

-

Unintended Beneficiaries:

- If the mistake leads to an incorrect beneficiary designation, the death benefit might be paid out to someone other than your intended recipient. Once the benefit is paid, it’s generally irreversible.

-

Default to Policy Terms or State Law:

- If the beneficiary designation is unclear or invalid, the insurance company might default to the standard beneficiary designation as outlined in the policy, or as stipulated by state law. Typically, this default order is the spouse, children, parents, and then the estate, but it varies by policy and jurisdiction.

-

Legal Disputes:

- Mistakes can lead to disputes among potential beneficiaries, especially if there’s doubt regarding the policyholder’s intentions. This could result in court cases, causing emotional distress to loved ones and potentially consuming a significant portion of the benefit in legal fees.

-

Estate Taxes:

- If the death benefit defaults to the insured’s estate (because of an unclear or invalid beneficiary designation), the benefit might be subject to estate taxes, depending on the size of the estate and current tax laws.

How to Address Mistakes:

-

Regular Reviews:

- Regularly review your beneficiary designations, especially after major life events, to ensure that they accurately reflect your wishes.

-

Clarify and Update:

- If you discover a mistake or ambiguity, promptly contact your insurance company to clarify and update your beneficiary designations. You’ll typically need to fill out a new form to supersede the old one.

-

Keep Detailed Records:

- Store copies of all correspondence and forms related to your life insurance policy. This can be helpful in verifying your intentions if a dispute arises.

-

Consult Professionals:

- If you have complex wishes, multiple policies, or a unique family situation, consider consulting with a financial advisor or attorney who specializes in estate planning. They can help ensure your designations are clear and valid.

-

Inform Beneficiaries:

- Make sure your beneficiaries are aware of the policy and their designation. This can preemptively address potential issues or disputes.

In conclusion, mistakes on a Life Insurance Beneficiary Form can have significant implications. It’s crucial to ensure accuracy and clarity in your designations, both for your peace of mind and to protect the interests and intentions you have for your beneficiaries.

If there’s a dispute about the Life Insurance Beneficiary Form, how is it resolved?

Disputes over a Life Insurance Beneficiary Form can arise for various reasons, from ambiguities in the designation to challenges from family members who feel they were wrongly excluded. Resolving such disputes involves several stages and mechanisms:

-

Insurance Company Investigation:

- Initially, the insurance company will review the claim and the beneficiary form to determine the validity of the dispute. They’ll examine their records and the provided documentation.

- If the insurer determines the claim is straightforward and the form is unambiguous, they’ll proceed with the payout. However, if there’s uncertainty, they might hold off on distributing the death benefit.

-

Interpleader Action:

- If the insurance company cannot determine the rightful beneficiary or fears multiple claims, they may file an “interpleader” action in court. This means the insurer deposits the policy proceeds with the court and requests the court to determine the rightful recipient. The insurance company is then typically released from further liability, and the dispute continues between the contesting parties.

-

Mediation or Arbitration:

- Before or after legal proceedings start, the parties involved might opt for mediation or arbitration. These are alternative dispute resolution mechanisms that can be less adversarial and costly than full-blown litigation.

- Mediation involves a neutral third party helping the disputing parties reach a mutual agreement.

- Arbitration, on the other hand, is a process where a neutral third party (or panel) makes a binding decision after hearing arguments and evidence from both sides.

-

Legal Proceedings:

- If the dispute isn’t resolved through other means, it can escalate to litigation in court.

- The court will examine evidence, which may include the insurance policy, the beneficiary form, any subsequent changes or correspondence, witness testimonies, and other pertinent documents.

- The court will make a determination based on the evidence presented and applicable laws.

-

Factors Courts Consider:

- Courts often consider the policyholder’s intent, the clarity of the beneficiary designation, any subsequent changes or communications regarding beneficiaries, state laws, and other evidence that might shed light on the intended recipient of the death benefit.

-

Potential Complications:

- Disputes can be complex, especially if they involve issues like divorce, remarriage, minor beneficiaries, claims of undue influence, or discrepancies between a will and the beneficiary form.

-

Seek Legal Counsel:

- If you’re involved in a dispute over a life insurance beneficiary designation, it’s crucial to consult with an attorney familiar with insurance and estate laws in your jurisdiction. They can provide guidance on your rights, potential outcomes, and the best course of action.

It’s worth noting that while disputes are resolved, the death benefit is typically held up, which can strain families financially and emotionally. This underscores the importance of regularly reviewing and updating your Life Insurance Beneficiary Form and seeking legal or financial advice when needed. You may also be interested in our Trust Declaration Form.

How do I cancel or nullify a previous Life Insurance Beneficiary Form?

To cancel or nullify a previous Life Insurance Beneficiary Form, you typically need to submit a new form that reflects your updated wishes. Here are steps and considerations to guide you through the process:

-

Contact Your Insurance Provider:

- Begin by reaching out to your life insurance company. Request the necessary form or information to change or update your beneficiary designation.

-

Fill Out a New Beneficiary Form:

- Complete the new beneficiary designation form provided by your insurance company. Ensure all required fields are filled out accurately, and any unwanted designations are clearly omitted or replaced.

-

Specific Instructions:

- If you’re aiming to nullify a previous designation without naming a new beneficiary, you might want to specify “Estate” as the beneficiary. However, be aware this could have tax implications or complicate probate proceedings. It’s wise to consult with an attorney or financial advisor before making such a decision.

-

Submit the Form:

- Once you’ve completed the new form, submit it to your insurance company as per their guidelines. This might involve mailing, faxing, or even uploading it through an online portal, depending on the insurer’s processes.

-

Get Confirmation:

- It’s crucial to receive written confirmation from the insurance company that they’ve processed the change. This confirms that your new designations have replaced the old ones.

-

Store Copies:

- Keep a copy of the new beneficiary form and the confirmation from the insurance company in a safe place. You might also want to give copies to your attorney or trusted family members, ensuring someone else is aware of the change.

-

Inform Beneficiaries:

- Communicate any changes to your current beneficiaries, so they’re informed. This can reduce confusion or potential disputes later on.

-

Review Related Documents:

- If you’ve changed your life insurance beneficiary designations, it might also be a good time to review other related estate planning documents like wills, trusts, and power of attorney forms to ensure consistency in your wishes.

-

Consult Professionals:

- Especially if you’re making significant changes or if there are complex factors at play (like high-value policies, potential tax implications, or intricate family situations), consulting with a financial advisor or estate planning attorney is advisable. They can guide you to make informed decisions that best reflect your wishes and protect your beneficiaries.

Remember, the most recent Life Insurance Beneficiary Form you submit to your insurance company will supersede any previous forms. By ensuring your latest form is filled out accurately and is consistent with your current intentions, you can effectively cancel or nullify prior designations.

How to Create a Life Insurance Beneficiary Form?

Creating a Life Insurance Beneficiary Form is crucial for ensuring that the death benefits from your policy are distributed according to your wishes. Here’s a step-by-step guide to help you create one:

-

Understand Your Policy:

- Before creating the form, familiarize yourself with your life insurance policy. Some policies may have specific guidelines or restrictions regarding beneficiaries.

-

Gather Necessary Information:

- Compile full names, addresses, Social Security numbers (or equivalent identification numbers), birth dates, and contact details of all intended beneficiaries. If you’re designating a trust as a beneficiary, gather the trust’s details and its tax identification number.

-

Determine Beneficiary Types:

- Primary Beneficiary: The main person(s) or entity you want to receive the death benefit.

- Contingent Beneficiary: The person(s) or entity designated to receive the death benefit if the primary beneficiary is deceased or unable to claim the benefit.

- Tertiary Beneficiary: This is a third-level beneficiary, typically used if both primary and contingent beneficiaries cannot claim.

-

Decide on Allocation:

- Determine the percentage or specific amount each beneficiary should receive. Ensure the total allocation adds up to 100% for each category (primary, contingent).

-

Obtain the Official Form:

- Contact your insurance provider to obtain their official Life Insurance Beneficiary Form. Most insurance companies will have a standardized form that policyholders must use.

-

Complete the Form:

- Fill out the form accurately, listing all intended beneficiaries and their details.

- Specify the relationship of each beneficiary to you (e.g., spouse, child, trust).

- Designate the allocation amounts or percentages for each beneficiary.

-

Additional Provisions:

- If you want to include specific stipulations (like holding the benefit in trust for a minor child until they reach a certain age), ensure this is detailed on the form or in an attached document.

-

Sign and Date:

- Once the form is complete, sign and date it. Some insurers may require additional witnesses or notarization, so be sure to adhere to any such requirements.

-

Submit to the Insurance Company:

- Return the completed form to your insurance provider. It’s advisable to send it via a trackable method, like certified mail, to ensure it’s received.

-

Receive Confirmation:

- Ensure you get written confirmation from the insurance company that they’ve processed and updated your beneficiary designations.

-

Store Safely:

- Keep a copy of the completed form in a safe place, such as a safe deposit box or with your other important documents. You might also consider giving a copy to your attorney or a trusted family member.

Remember, the beneficiary designation on the insurance policy will typically override any designations made in a will. It’s imperative to ensure your Life Insurance Beneficiary Form accurately reflects your wishes.

Tips for creating an Effective Life Insurance Beneficiary Form

Creating an effective Life Insurance Beneficiary Form ensures that your death benefits are distributed according to your wishes, minimizing potential disputes or misunderstandings. Here are some tips to guide you:

-

Be Specific:

- Clearly identify each beneficiary using full names, avoiding vague descriptions like “my children.” This specificity reduces ambiguity.

-

Use Percentages Instead of Fixed Amounts:

- Designating percentages rather than specific dollar amounts can be beneficial, especially if the policy value changes over time.

-

Consider Multiple Levels of Beneficiaries:

- Having primary, contingent, and tertiary beneficiaries ensures there’s a clear line of succession if someone predeceases you or can’t claim the benefit.

-

Avoid Naming Minors Directly:

- Insurance companies won’t pay large sums directly to minors. Consider setting up a trust or naming a guardian to manage the funds until the child reaches a certain age.

-

Stay Updated with Life Changes:

- Regularly review and update the form, especially after significant life events like marriage, birth, death, divorce, or if there’s a change in your relationship with a named beneficiary.

-

Be Mindful of Potential Tax Implications:

- In some cases, death benefits may be subject to taxation. Consulting with a tax professional or financial advisor can provide clarity.

-

Clearly State Changes:

- If updating a form, clearly indicate which previous designations are being revoked or changed.

-

Consistency Across Documents:

- Ensure that your beneficiary designations are consistent with other estate planning documents like wills or trusts to avoid potential disputes or confusion.

-

Inform Your Beneficiaries:

- Letting beneficiaries know in advance can prevent surprises and provide them with a roadmap of what to expect and how to claim the benefit.

-

Avoid Automatic Default to Estate:

- Naming your estate as the direct beneficiary can lead to probate complications and potential tax consequences. Instead, name specific individuals or entities.

-

Consider Special Needs Beneficiaries:

- If a beneficiary has special needs, receiving a direct payout could affect their eligibility for certain government assistance programs. A special needs trust might be an appropriate vehicle in such cases.

-

Keep Multiple Copies:

- Store the original form in a safe place and give copies to trusted individuals or your attorney. Having multiple copies ensures that your intentions are known and can be proven if necessary.

-

Consider Periodic Payout Options:

- If you’re concerned about a beneficiary’s ability to manage a lump sum, explore options for periodic payouts or annuities.

-

Seek Professional Guidance:

- Consult with legal or financial professionals to understand the nuances of your situation and to ensure that your form aligns with your broader estate plan.

-

Double-Check Before Submission:

- Errors can lead to delays, disputes, or unintended distributions. Carefully review the form for accuracy before submitting.

By considering these tips, you can craft an effective Life Insurance Beneficiary Form that clearly reflects your wishes, protects your beneficiaries, and ensures a smoother process for all involved after your passing.

A Life Insurance Beneficiary Form determines the recipients of policy benefits upon the policyholder’s death. Essential for clear wealth transition, its significance lies in specifying beneficiaries, whether primary, contingent, or tertiary. With life’s unpredictable nature, regularly reviewing and updating this document ensures alignment with one’s evolving wishes. Expert consultation and a keen understanding of its intricacies provide peace of mind in safeguarding loved ones’ financial futures. In addition, you should review our Disability Form

Related Posts

-

FREE 23+ Employee Leave Request Forms in PDF | MS Word | XLS

-

FREE 53+ Human Resources Forms in PDF | MS Word | Excel

-

FREE 5+ Recruiter Performance Review Forms in PDF | MS Word

-

FREE 7+ Payroll Adjustment Forms in MS Word | PDF | Excel

-

FREE 3+ HR Employee Concern Forms in PDF

-

FREE 6+ Telephone Reference Check Forms in PDF | MS Word

-

FREE 3+ Consultant Bio-Data Forms in PDF | MS Word

-

FREE 7+ Compensation and Benefits Forms in PDF

-

FREE 10+ Reduced Fee Enrollment Application Forms in PDF | MS Word

-

FREE 10+ Name Address Change Forms in PDF | MS Word

-

FREE 11+ Confidential Evaluation Forms in PDF | MS Word

-

FREE 11+ Change of Address Forms in PDF | MS Word | Excel

-

Reclassification Request and Position Information Questionnaire [ How to Create, Questions ]

-

Return to Work Form

-

FREE 6+ Recruitment Process Timeline Samples in PDF