Welcome to the world of Trust Declaration Forms! If you’ve ever wondered how to safeguard your assets, ensure a smooth wealth transfer, or plan for the future of your loved ones, you’re in the right place. In this comprehensive guide, we’ll delve into the meaning of Trust Declaration Forms, explore different types, provide real-world examples, offer step-by-step guidance on creating one, and share invaluable tips to help you make the most of this powerful tool in estate planning. Let’s embark on a journey to financial security and peace of mind.

What is a Trust Declaration Form? – Definition

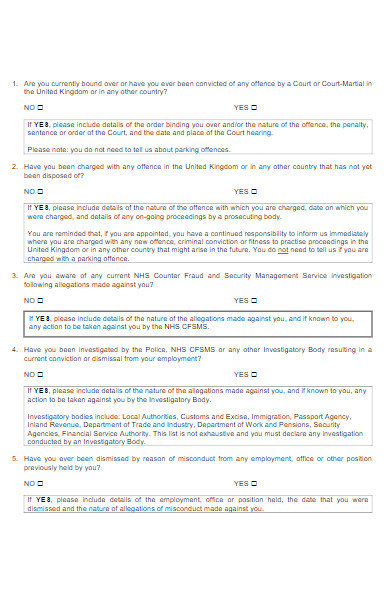

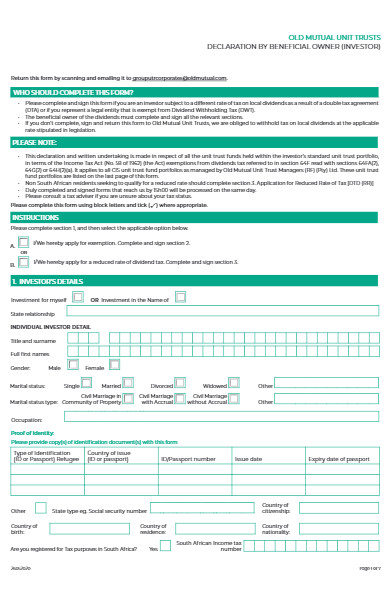

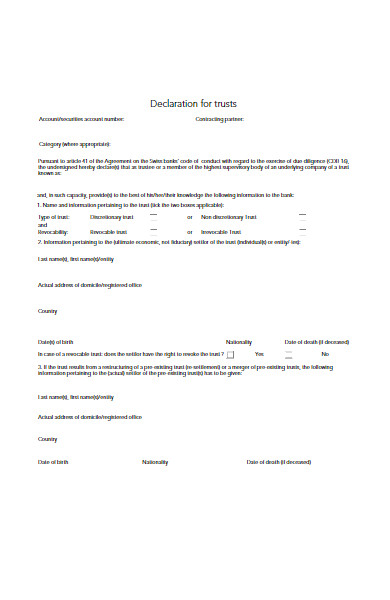

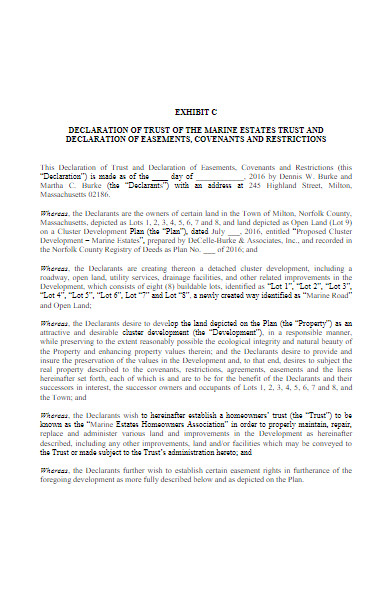

A Trust Declaration Form, also known as a Declaration of Trust or Trust Agreement, is a legal document that defines the terms, conditions, and specifics of a trust. It outlines the roles and responsibilities of the trustee(s), beneficiaries, and grantor (the person creating the trust). This document typically includes details about the trust’s purpose, assets, distribution instructions, and any other relevant provisions. Trust Declaration Forms play a crucial role in estate planning, asset protection, and ensuring that a person’s wishes regarding their assets are carried out as intended.

What is the Meaning of the Trust Declaration Form?

The Trust Declaration Form holds profound significance in the realm of estate planning and asset management. It serves as a legal instrument through which an individual, known as the grantor, expresses their intent to create a trust and outlines the essential terms and conditions governing that trust. This document defines the trustee’s responsibilities, delineates the trust’s purpose, specifies asset details, and sets forth guidelines for distribution to beneficiaries. In essence, the Trust Declaration Form gives life to the trust, ensuring that the grantor’s wishes are meticulously executed, making it a cornerstone of sound financial planning.

What is the Best Sample Trust Declaration Form?

Creating a sample Trust Declaration Form involves careful consideration of your specific needs and the jurisdiction’s legal requirements. While I can’t provide an actual legal document, I can outline a basic template for you to use as a starting point. Please consult an attorney to customize it to your exact situation:

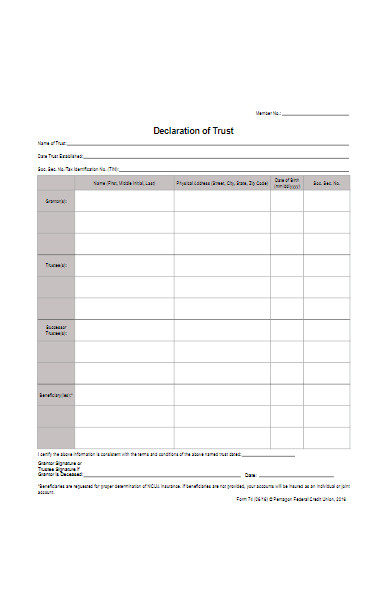

[Your Name] Trust Declaration Form

1. Trust Title:

- [Your Name] Living Trust

2. Grantor Information:

- Full Legal Name: [Your Full Legal Name]

- Address: [Your Address]

- Contact Information: [Your Phone Number, Email]

3. Trustee Information:

- Primary Trustee: [Your Name or Designated Trustee]

- Address: [Trustee’s Address]

- Contact Information: [Trustee’s Phone Number, Email]

- Successor Trustee (if applicable): [Successor Trustee’s Name]

- Address: [Successor Trustee’s Address]

- Contact Information: [Successor Trustee’s Phone Number, Email]

4. Beneficiaries:

- Primary Beneficiary: [Beneficiary’s Full Legal Name]

- Relationship: [Your Relationship to Primary Beneficiary]

- Address: [Beneficiary’s Address]

- Additional Beneficiaries (if applicable):

- [Additional Beneficiary 1’s Full Legal Name]

- Relationship: [Your Relationship to Additional Beneficiary 1]

- Address: [Additional Beneficiary 1’s Address]

- [Additional Beneficiary 2’s Full Legal Name]

- Relationship: [Your Relationship to Additional Beneficiary 2]

- Address: [Additional Beneficiary 2’s Address]

5. Trust Assets:

- List all assets placed within the trust, including:

- Real Estate: [Property Description and Location]

- Financial Accounts: [Account Names and Numbers]

- Personal Property: [Description and Value]

6. Trust Purpose and Terms:

- Clearly state the purpose of the trust and any specific instructions for asset management.

- Address any restrictions, if applicable.

7. Revocability:

- Indicate whether the trust is revocable or irrevocable.

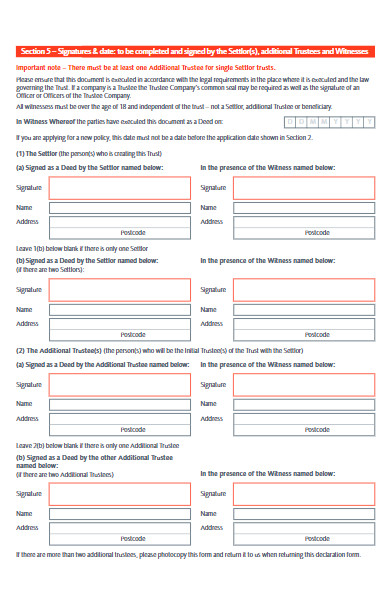

8. Signature and Notarization:

- Require your signature, and possibly the trustee’s and witness’s signatures.

- Consider notarizing the document for validity.

9. Governing Law:

- Specify which state’s laws will govern the trust.

10. Trustee Powers: – Detail the trustee’s powers and limitations, including investment authority and distribution discretion.

11. Amendments and Termination: – Explain how amendments to the trust can be made and the process for terminating the trust.

12. Dispute Resolution: – Address how disputes among beneficiaries or involving the trustee will be resolved, such as through mediation or arbitration.

13. Confidentiality: – Emphasize the importance of confidentiality regarding trust matters.

14. Legal Counsel: – Encourage the involvement of legal counsel to ensure the document’s legality and compliance with relevant laws.

Remember that this is a basic template, and it’s essential to work with an attorney to create a Trust Declaration Form tailored to your specific circumstances and legal requirements.

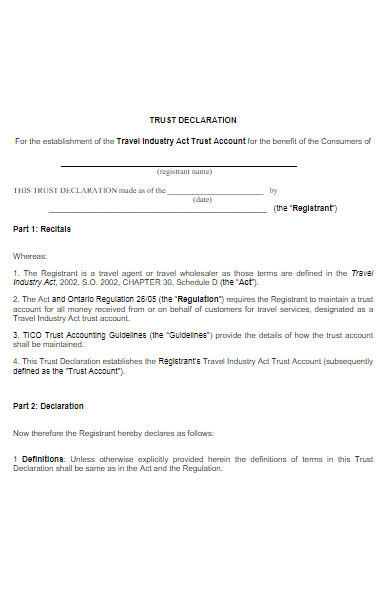

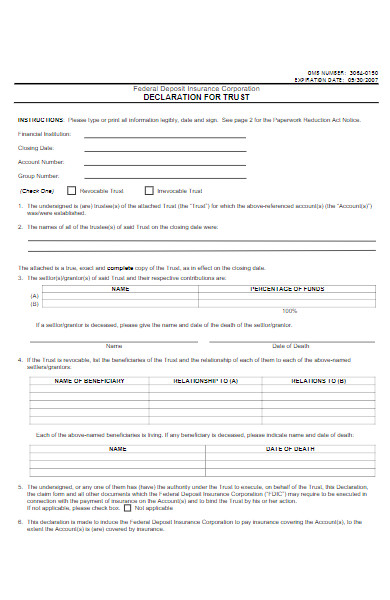

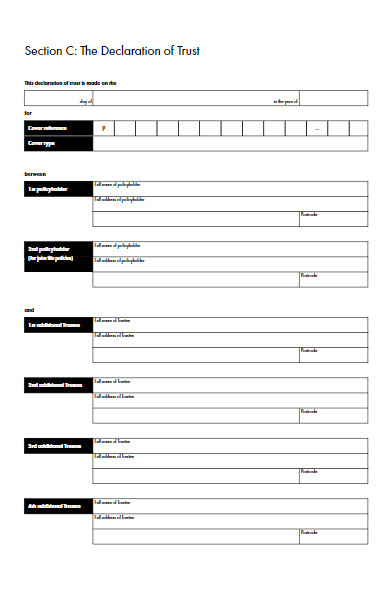

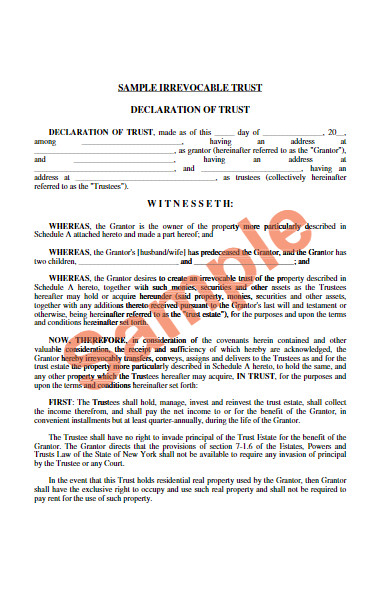

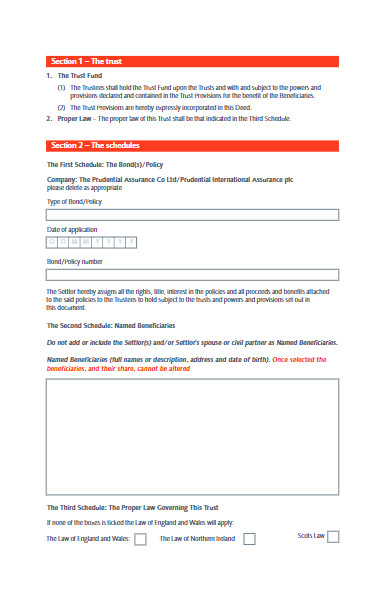

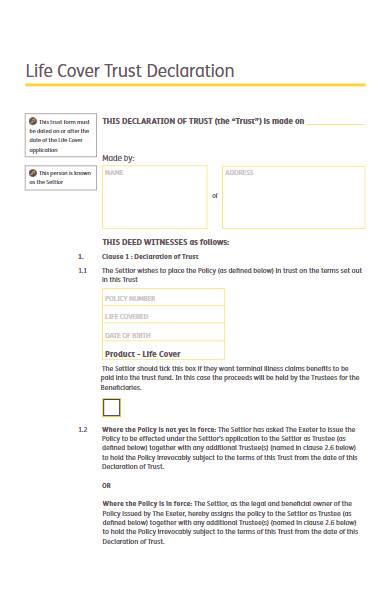

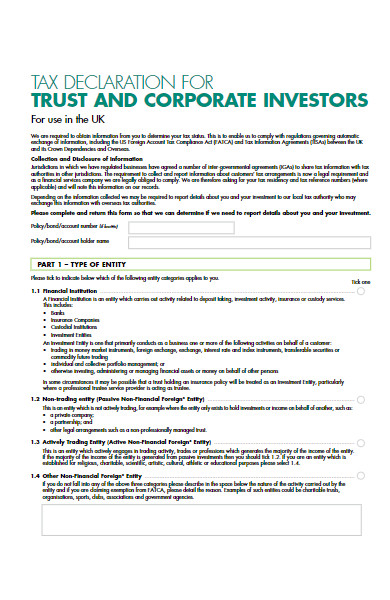

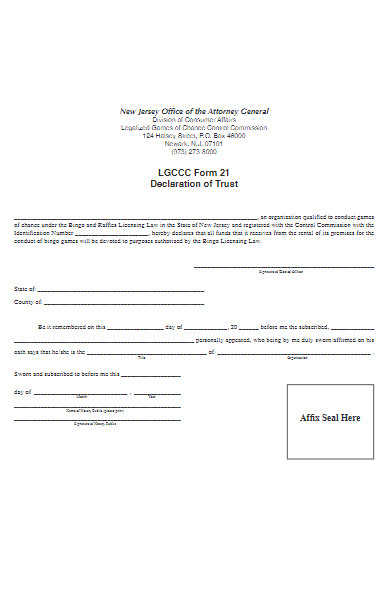

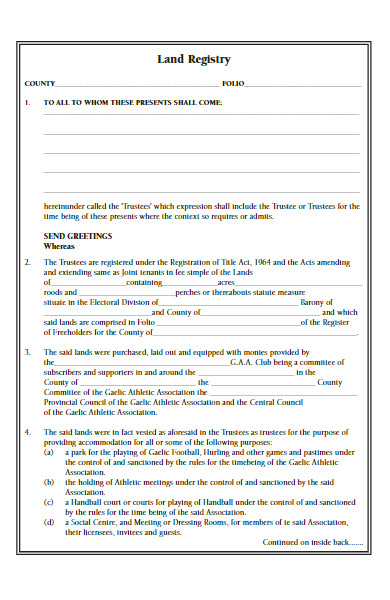

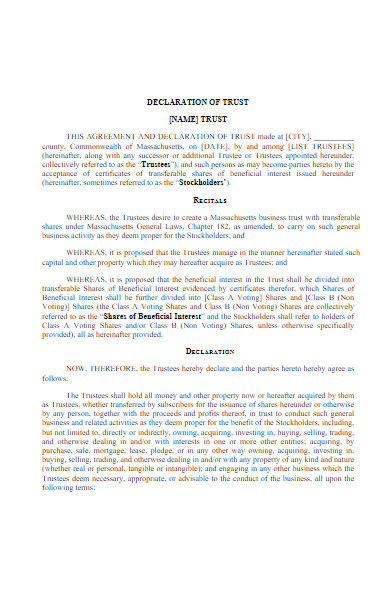

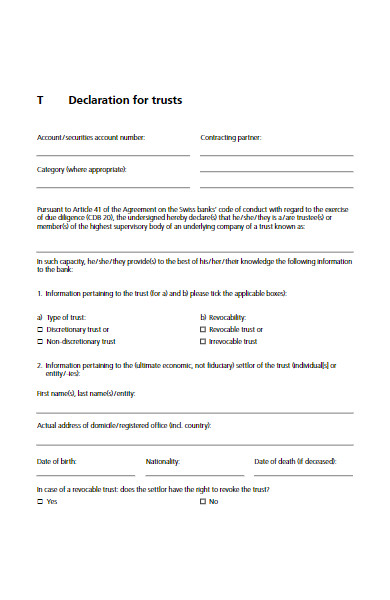

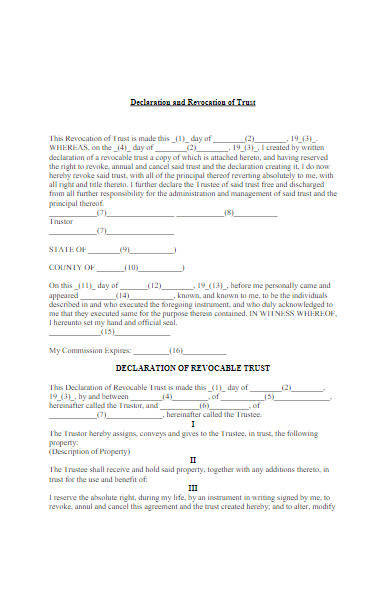

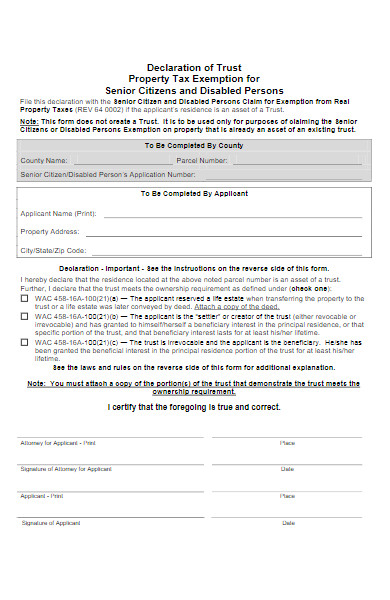

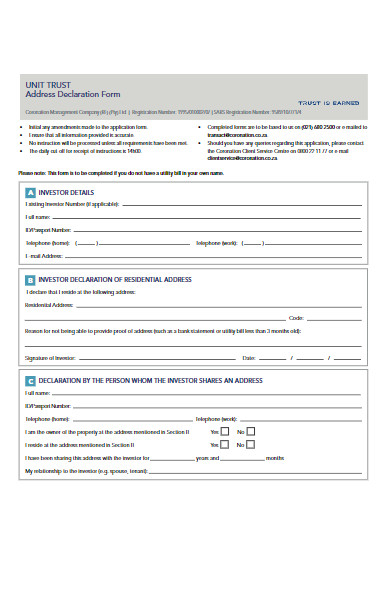

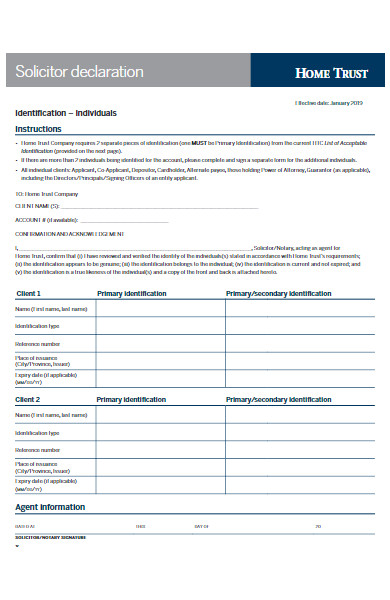

FREE 30+ Trust Declaration Forms in PDF

31. Trust Individual Declaration Form

How does a Trust Declaration Form work?

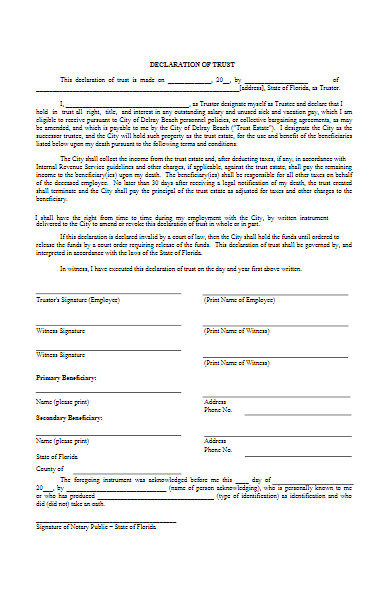

A Trust Declaration Form serves as the foundational document that sets up a trust, which is a legal arrangement allowing one party, known as the grantor or settlor, to transfer assets to another party, called the trustee. Here’s a breakdown of how a Trust Declaration Form works:

- Creation of the Trust:

- The process begins with the grantor, who wishes to establish the trust, drafting the Trust Declaration Form. This document outlines the trust’s terms, conditions, and objectives.

- Identification of Key Parties:

- The Trust Declaration Form identifies key parties involved in the trust:

- Grantor/Settlor: The person who creates the trust and transfers assets into it.

- Trustee: The individual or entity responsible for managing the trust and its assets according to the terms outlined in the form.

- Beneficiaries: Those who stand to benefit from the trust assets. Beneficiaries can include family members, charitable organizations, or others as specified by the grantor.

- The Trust Declaration Form identifies key parties involved in the trust:

- Asset Transfer:

- The grantor transfers ownership of specific assets, such as real estate, financial accounts, or personal property, into the trust. This transfer is often called “funding the trust.”

- Trust Terms and Conditions:

- The Trust Declaration Form details the terms and conditions governing the trust, including:

- The trust’s purpose and objectives.

- How assets should be managed and invested.

- Under what circumstances and how assets will be distributed to beneficiaries.

- Any restrictions or special instructions regarding asset distribution.

- The Trust Declaration Form details the terms and conditions governing the trust, including:

- Revocable or Irrevocable:

- The form specifies whether the trust is revocable or irrevocable.

- Revocable Trust: The grantor retains the ability to amend or revoke the trust during their lifetime.

- Irrevocable Trust: Once established, it is difficult to alter or revoke without the consent of beneficiaries.

- The form specifies whether the trust is revocable or irrevocable.

- Trustee’s Responsibilities:

- The Trust Declaration Form outlines the trustee’s responsibilities, which include managing the assets, making investment decisions, and following the instructions provided in the trust document.

- Notarization and Legal Requirements:

- In some cases, the Trust Declaration Form may need to be notarized to add an extra layer of validity and authenticity.

- Administration and Asset Distribution:

- While the grantor is alive and capable, they may manage the trust themselves if they act as the trustee. If not, the appointed trustee assumes these responsibilities.

- When the grantor passes away or becomes incapacitated (depending on the trust type), the trustee follows the trust’s instructions for asset distribution to beneficiaries.

- Ongoing Management:

- The trustee continues to manage the trust’s assets, make distributions, and fulfill the trust’s objectives in accordance with the instructions outlined in the Trust Declaration Form.

A Trust Declaration Form is a vital tool in estate planning, enabling individuals to protect and manage their assets, provide for loved ones, and achieve specific financial goals. To ensure a trust operates as intended and complies with legal requirements, it’s advisable to seek legal counsel when creating and administering one.

Who are the key players in a Trust Declaration Form?

The key players in a Trust Declaration Form, also known as a Declaration of Trust or Trust Agreement, are:

- Grantor/Settlor:

- The grantor, also referred to as the settlor or trustor, is the individual or entity that creates the trust. They initiate the trust by transferring assets into it and establish the terms and conditions through the Trust Declaration Form. The grantor’s primary role is to set the intentions and objectives of the trust.

- Trustee:

- The trustee is the person or entity responsible for managing and administering the trust as outlined in the Trust Declaration Form. This includes safeguarding trust assets, making investment decisions, and ensuring the trust’s objectives are met. The trustee has a fiduciary duty to act in the best interests of the beneficiaries.

- Beneficiaries:

- Beneficiaries are the individuals or entities designated to receive the benefits or assets from the trust. They may be family members, friends, charities, or any other party specified by the grantor in the Trust Declaration Form. Beneficiaries can receive income generated by trust assets and, eventually, the principal assets themselves.

These three key players work together to ensure the proper administration and fulfillment of the trust’s objectives. The grantor initiates the trust, the trustee manages it, and the beneficiaries ultimately benefit from the trust’s assets and distributions according to the terms established in the Trust Declaration Form.

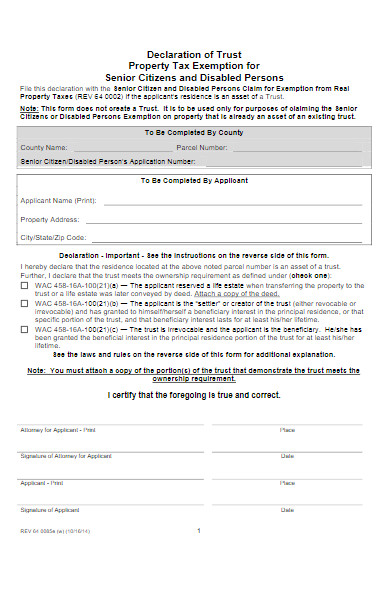

What assets can I include in a Trust Declaration Form?

A Trust Declaration Form allows you to include a wide range of assets, and the specific assets you can place in a trust may vary depending on your goals and the trust’s purpose. Here are some common types of assets that can be included in a Trust Declaration Form:

- Real Estate:

- Residential properties, commercial properties, land, and vacation homes can all be placed in a trust.

- Financial Assets:

- Bank accounts, savings accounts, certificates of deposit (CDs), and brokerage accounts are commonly placed in trusts.

- Investments:

- Stocks, bonds, mutual funds, and other investment instruments can be held in trust.

- Personal Property:

- Valuable items such as artwork, jewelry, antiques, collectibles, and even vehicles can be included in a trust.

- Business Interests:

- Ownership interests in businesses, partnerships, or LLCs can be placed in a trust.

- Intellectual Property:

- Intellectual property rights, such as patents, copyrights, trademarks, and royalties, can be held in trust.

- Life Insurance Policies:

- The proceeds of life insurance policies can be directed to a trust for distribution to beneficiaries.

- Retirement Accounts:

- While not typically placed directly in a trust, you can designate a trust as a beneficiary of your retirement accounts, such as IRAs or 401(k)s.

- Debts and Promissory Notes:

- Loans, debts owed to you, or promissory notes can be included in a trust as assets.

- Cash:

- Liquid assets like cash or cash equivalents can be placed in trust accounts.

- Mineral Rights and Royalties:

- Ownership rights in mineral deposits, oil, gas, or other natural resources, along with associated royalties, can be placed in a trust.

- Income-Generating Assets:

- Assets that generate income, such as rental properties, dividend-paying stocks, or interest-bearing accounts, can be placed in trust for income distribution.

It’s important to note that certain assets may have legal or tax implications when placed in a trust, and the rules can vary by jurisdiction. Consulting with legal and financial professionals is essential when deciding which assets to include in your Trust Declaration Form, as they can provide guidance tailored to your specific goals and circumstances. You should also take a look at our Living Trust Forms.

How do I choose a trustee for my Trust Declaration Form?

Choosing a trustee for your Trust Declaration Form is a critical decision that can significantly impact the administration and success of your trust. Here’s a step-by-step guide on how to choose the right trustee:

- Understand the Role of a Trustee:

- Start by understanding the responsibilities of a trustee. They must manage trust assets, make investment decisions, distribute income or assets to beneficiaries, and act in the best interests of the trust.

- Consider Personal Qualities:

- Look for an individual or entity with integrity, trustworthiness, and a strong sense of responsibility. The trustee should be someone you believe will carry out your wishes diligently.

- Financial Expertise:

- Depending on the complexity of your trust and its assets, it may be beneficial to choose a trustee with financial expertise or experience in managing similar assets.

- Legal Knowledge:

- Familiarity with relevant laws and regulations is essential. A trustee should understand their legal obligations and be able to navigate any legal matters that may arise.

- Impartiality:

- Consider whether the trustee can remain impartial and fair when making decisions that affect beneficiaries. They should prioritize the interests of all beneficiaries, not favoring one over another.

- Availability and Accessibility:

- Ensure the trustee is accessible and available to carry out their duties promptly. This includes being responsive to beneficiary inquiries and managing trust affairs efficiently.

- Conflict of Interest:

- Avoid selecting someone who may have a conflict of interest, such as a family member who could be a beneficiary. This helps prevent disputes and maintains the integrity of the trust.

- Professional Trustee Options:

- You can opt for a professional trustee, such as a bank, trust company, or financial institution, which specializes in trust management. They bring expertise and experience but typically charge fees for their services.

- Successor Trustee:

- Designate a successor trustee in case the primary trustee becomes unable or unwilling to serve. This ensures continuity in trust management.

- Discuss with Potential Trustees:

- Have open and honest conversations with potential trustees about their willingness to take on the role, their understanding of your intentions, and their ability to fulfill the responsibilities.

- Legal and Financial Counsel:

- Consult with legal and financial advisors when selecting a trustee. They can provide insights, recommend suitable candidates or institutions, and help you understand the implications of your choice.

- Trustee Compensation:

- Determine whether the trustee will receive compensation for their services and outline this in the Trust Declaration Form.

Remember that the trustee plays a crucial role in carrying out your wishes and managing trust assets for the benefit of your chosen beneficiaries. Take your time in selecting a trustee, and choose someone you have confidence in to ensure the successful administration of your trust.

Can I change the terms of a Trust Declaration Form once it’s established?

Yes, it is possible to change the terms of a Trust Declaration Form, but the extent to which you can make changes depends on whether the trust is revocable or irrevocable:

1. Revocable Trust:

- In a revocable trust, the grantor typically retains the right to amend or revoke the trust at any time during their lifetime. This includes modifying the trust’s terms, adding or removing beneficiaries, or making changes to asset distribution instructions.

2. Irrevocable Trust:

- In an irrevocable trust, changes are generally more restricted and may require the consent of beneficiaries or court approval. However, some irrevocable trusts may include provisions that allow for limited changes under specific circumstances, such as a “trust protector” with the authority to make amendments.

It’s important to consult with an attorney experienced in trust matters to understand the specific terms of your trust and the procedures for making changes. Keep in mind the following considerations:

- Any changes must comply with state laws and the terms outlined in the Trust Declaration Form.

- Communicate changes clearly and in writing, documenting the amendments to the trust document.

- Notify all relevant parties, including beneficiaries and the trustee, about any modifications.

- Seek legal advice to ensure that changes are made correctly and in accordance with legal requirements.

In summary, while you can modify the terms of a Trust Declaration Form, the ease and extent of making changes depend on whether the trust is revocable or irrevocable, and it’s crucial to follow legal procedures and consult with professionals when considering amendments. Our Deed of Trust Forms is also worth a look at

Is a Trust Declaration Form a private document?

Yes, a Trust Declaration Form is typically a private document. Unlike some other legal documents, such as wills, which may become part of the public record upon the grantor’s death, trust documents often remain private and confidential. Here are some reasons why a Trust Declaration Form is considered a private document:

- Confidentiality: Trusts are designed to protect the privacy and intentions of the grantor. They allow individuals to specify how their assets should be managed and distributed without public scrutiny.

- No Probate Process: Unlike wills, which often go through a probate process that becomes a matter of public record, trusts can bypass probate in many cases. This means that trust assets can be distributed privately and efficiently without court involvement.

- Limited Disclosure: Trustees and beneficiaries may have access to the trust document, but this information is typically not disclosed to the public or third parties unless required by law.

- Asset Protection: Trusts can be used for asset protection purposes, allowing individuals to shield their assets from potential creditors or legal claims while maintaining privacy.

- Minimized Estate Taxes: Certain types of trusts, such as irrevocable life insurance trusts or generation-skipping trusts, can help reduce estate taxes, and the details of these arrangements are typically private.

However, it’s important to note that there may be circumstances in which trust details become known to specific parties, such as beneficiaries or involved professionals (e.g., attorneys, accountants). Additionally, in cases of legal disputes or challenges to the trust’s validity, some trust information may become subject to court proceedings and could be disclosed as part of the legal process.

To ensure the privacy of your trust and to fully understand the confidentiality aspects in your jurisdiction, it’s advisable to consult with a qualified attorney who specializes in trust and estate planning. They can provide guidance tailored to your specific circumstances and legal requirements.

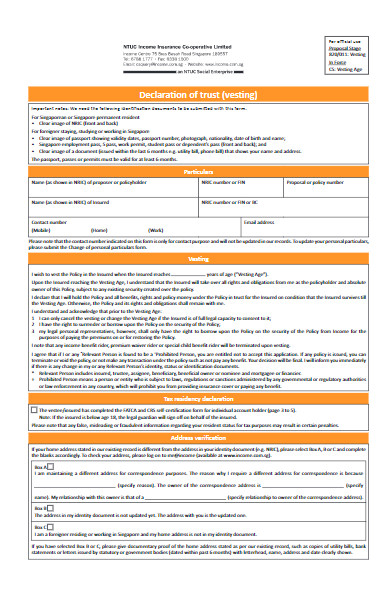

What are the tax implications of a Trust Declaration Form?

The tax implications of a Trust Declaration Form can vary significantly based on several factors, including the type of trust, the assets within the trust, and the specific tax laws in your jurisdiction. Here are some key tax considerations associated with trusts:

1. Income Tax:

- Revocable Trusts: For revocable trusts, the grantor typically continues to report trust income on their personal tax return (Form 1040 in the U.S.). The trust’s income is treated as if it were earned directly by the grantor.

- Irrevocable Trusts: Irrevocable trusts are often separate tax entities. They have their own taxpayer identification number (TIN) and may be subject to income tax. The trust itself may be responsible for filing a separate income tax return (e.g., Form 1041 in the U.S.).

2. Estate and Gift Tax:

- Trusts can be used as a tool for estate and gift tax planning. Assets placed in certain types of irrevocable trusts may be removed from the grantor’s estate for estate tax purposes. This can result in potential estate tax savings.

3. Generation-Skipping Transfer Tax:

- Generation-skipping trusts are designed to transfer assets to beneficiaries who are at least two generations younger than the grantor. These trusts can have specific tax implications, including generation-skipping transfer tax considerations.

4. Capital Gains Tax:

- When assets are sold within a trust, capital gains tax may apply. The tax rate and treatment of capital gains can vary based on factors such as the type of asset, how long it was held, and the trust’s tax status.

5. State Taxes:

- State tax laws can differ significantly, and the tax treatment of trusts may vary from one state to another. It’s essential to consider state tax implications when establishing a trust.

6. Deductions and Exemptions:

- Certain trusts may be eligible for deductions and exemptions, depending on their purpose and the assets held. Qualified charitable trusts, for example, may offer charitable deductions.

7. Reporting Requirements:

- Trusts often have specific reporting requirements, and it’s essential to comply with these to avoid potential penalties. This includes filing income tax returns for the trust, if applicable.

8. Professional Advice:

- Given the complexity of tax laws related to trusts, it is highly advisable to consult with a qualified tax professional or estate planning attorney. They can provide guidance tailored to your specific circumstances, help you minimize tax liabilities, and ensure that your trust complies with all relevant tax regulations.

The tax implications of a Trust Declaration Form can be intricate and multifaceted, and they can have a significant impact on your overall financial and estate planning strategy. Seeking professional advice is crucial to navigate these tax considerations effectively.

How do I ensure my Trust Declaration Form is legally valid?

Ensuring that your Trust Declaration Form is legally valid is crucial to guarantee that your intentions are carried out as you intended. Here are steps to ensure its validity:

- Consult with an Attorney:

- Start by consulting with an experienced attorney who specializes in trusts and estate planning. They can guide you through the legal requirements and ensure your trust complies with relevant laws in your jurisdiction.

- Choose the Right Type of Trust:

- Work with your attorney to determine the most suitable type of trust (revocable, irrevocable, specific-purpose trust, etc.) for your goals and circumstances.

- Clearly Define the Trust’s Terms:

- Your Trust Declaration Form should clearly and precisely outline the terms and conditions of the trust, including the purpose, asset details, trustee’s powers, and beneficiary instructions.

- Properly Fund the Trust:

- To make the trust legally valid, you must transfer ownership of the designated assets into the trust. This process is known as funding the trust and typically involves updating titles, deeds, or account registrations.

- Execute the Document Properly:

- Follow the legal requirements for executing the Trust Declaration Form. This may include signing and notarizing the document as necessary, depending on your jurisdiction’s laws.

- Notify Relevant Parties:

- Inform the trustee, beneficiaries, and any other parties mentioned in the trust document about their roles, responsibilities, and rights.

- Update as Needed:

- Over time, your circumstances and wishes may change. It’s essential to update the trust document when necessary to reflect these changes.

- Comply with Tax Laws:

- Ensure that your trust complies with relevant tax laws. Tax implications can vary depending on the type of trust and assets involved.

- Retain Copies and Records:

- Keep copies of the executed Trust Declaration Form, along with records of any asset transfers or amendments, in a secure and easily accessible location.

- Seek Legal Review Periodically:

- Periodically review your trust with your attorney to ensure it remains aligned with your goals and objectives. Legal and tax laws can change, so it’s essential to stay up-to-date.

- Consider a “Pour-Over Will”:

- If you have assets that were not transferred to the trust, consider creating a “pour-over will” that directs these assets into the trust upon your passing.

- Educate Trustees and Beneficiaries:

- Make sure trustees and beneficiaries are aware of their roles and responsibilities. This can help prevent misunderstandings or disputes in the future.

- Record Keeping:

- Keep detailed records of trust transactions, distributions, and any communications related to the trust. This can be invaluable for future reference and documentation.

By following these steps and working closely with a qualified attorney, you can ensure that your Trust Declaration Form is legally valid, and your trust operates smoothly in accordance with your wishes and the law.

How to Create a Trust Declaration Form?

Creating a Trust Declaration Form is a significant step in estate planning. While it’s advisable to work with an attorney experienced in trusts to ensure legal compliance and accuracy, here is a general outline of the steps to create a Trust Declaration Form:

1. Define the Purpose of the Trust:

- Determine the specific goals and objectives of the trust. What assets do you want to place in the trust, and what is the intended outcome?

2. Choose the Type of Trust:

- Decide whether you need a revocable or irrevocable trust, or if a specific-purpose trust is more appropriate for your needs.

3. Select a Trustee:

- Choose a trustee who will manage the trust assets and fulfill your instructions. Ensure the trustee is willing and capable of taking on this responsibility.

4. Identify Beneficiaries:

- Clearly define the beneficiaries of the trust, specifying who will receive the trust assets and under what circumstances.

5. Create the Trust Document:

- Draft the Trust Declaration Form, including the following essential elements:

- Title: A clear and concise title indicating that it is a Trust Declaration Form.

- Introduction: A brief statement explaining the purpose of the trust and the date of creation.

- Grantor Information: Include your full legal name, address, and contact information.

- Trustee Information: Provide the trustee’s full legal name, address, and contact details.

- Beneficiaries: List the full names, addresses, and relationships to you for all beneficiaries.

- Trust Assets: Enumerate all assets to be placed in the trust, including descriptions and values.

- Trust Terms and Conditions: Clearly outline the terms, conditions, and instructions for the trust, such as distribution guidelines, trustee powers, and any restrictions.

- Revocability: Indicate whether the trust is revocable or irrevocable.

- Successor Trustee: Name a successor trustee who will step in if the primary trustee cannot fulfill their duties.

- Signature and Notarization: Include signature lines for yourself and, if required by your jurisdiction, have the document notarized.

Tips for creating an Effective Trust Declaration Form

Creating an effective Trust Declaration Form is vital to ensure that your intentions are carried out accurately and legally. Here are some valuable tips to help you craft an effective trust document:

- Consult with an Attorney:

- Start by seeking the guidance of an experienced attorney who specializes in trusts and estate planning. They can provide legal advice, ensure compliance with state laws, and help you create a solid document.

- Clearly Define Objectives:

- Begin with a clear understanding of your trust’s purpose and objectives. Define what you want to achieve and how the trust will facilitate those goals.

- Choose the Right Type of Trust:

- Select the most appropriate type of trust (revocable, irrevocable, specific-purpose) based on your specific needs and objectives.

- Select the Trustee Carefully:

- Choose a trustworthy and capable trustee who understands their responsibilities and is willing to fulfill them. Consider their financial and legal expertise.

- Identify Beneficiaries Clearly:

- Specify the names, addresses, and relationships of all beneficiaries to leave no room for confusion.

- Be Specific About Trust Assets:

- Clearly enumerate all assets you intend to place in the trust, providing detailed descriptions, values, and any necessary identifying information (e.g., account numbers, property addresses).

- Detail Trust Terms and Conditions:

- Clearly outline the terms, conditions, and instructions for the trust. This includes distribution guidelines, trustee powers, and any special provisions.

- Revocability or Irrevocability:

- Clearly indicate whether the trust is revocable or irrevocable, as this affects your ability to amend or revoke the trust.

- Consider a Successor Trustee:

- Appoint a successor trustee who can step in if the primary trustee becomes unable or unwilling to serve.

- Review and Update Regularly:

- Periodically review the trust document with your attorney to ensure it remains current and aligned with your intentions.

- Avoid Ambiguity:

- Use precise language and avoid ambiguous terms or instructions that may lead to misunderstandings or disputes.

- Provide for Contingencies:

- Anticipate possible future scenarios and provide clear instructions on how they should be handled within the trust.

- Include a No-Contest Clause (if desired):

- If you want to discourage beneficiaries from contesting the trust, consider including a no-contest clause, but be aware of state-specific rules governing their enforceability.

- Seek Tax Advice:

- Consult with a tax advisor or CPA to understand the potential tax implications of your trust and to maximize tax efficiency.

- Consider Professional Trustees:

- If your trust is complex or involves substantial assets, consider using a professional trustee, such as a trust company, to ensure proper management.

- Keep Meticulous Records:

- Maintain comprehensive records of trust transactions, distributions, and correspondence related to the trust.

- Educate Relevant Parties:

- Ensure that trustees, beneficiaries, and other involved parties are aware of their roles, responsibilities, and rights.

- Store Safely:

- Keep original copies of the executed Trust Declaration Form and related documents in a secure, fireproof location, and provide copies to relevant parties.

Remember that each trust is unique, and the creation of an effective Trust Declaration Form requires careful consideration of your specific goals and circumstances. An attorney’s expertise is invaluable in ensuring that your trust document accurately reflects your wishes and complies with all legal requirements.

In conclusion, a Trust Declaration Form is a powerful legal document used in estate planning to outline the management and distribution of assets. Its types can vary from revocable to irrevocable, serving diverse purposes. Through careful planning, including asset identification, trustee selection, and legal consultation, you can create an effective Trust Declaration Form tailored to your specific goals, ensuring the secure management of your assets and the fulfillment of your wishes. In addition, you should review our trust agreement contract forms.

Related Posts

FREE 8+ Sample Grant Deed Forms in PDF MS Word

FREE 52+ Sample Membership Forms in PDF MS Word | Excel

FREE 8+ Sample Business Declaration Forms in PDF MS Word ...

FREE 40+ Student Application Forms in PDF

FREE 9+ Sample Custom Declaration Forms in PDF MS Word | Excel

FREE 9+ Sample Health Declaration Forms in MS Word PDF | Excel

FREE 9+ Sample Travel Health Forms in PDF MS Word

FREE 9+ Deed Release Forms in PDF MS Word

FREE 8+ Sample Health Consent Forms in PDF MS Word

FREE 10+ Employment Declaration Form Samples in PDF MS Word

FREE 6+ Revocable Living Trust Forms in PDF MS Word

FREE 16+ Sample Will and Trust Forms in PDF MS Word

FREE 52+ Declaration Forms in PDF MS Word | XLS

FREE 8+ Sample Living Trust Forms in PDF MS Word

FREE 11+ Sample Will Forms in PDF MS Word