Appraisal disclosure forms are routinely used in the real estate industry to assess a property’s market value. These forms are a variant of standard appraisal forms. In an appraisal disclosure form, a property owner acknowledges that a bank or any financial institution will hire an evaluator to survey his or her property.

This evaluation will then aid the bank in making a decision whether to lend him/her money or not. Property owners have the option to receive a copy of the appraisal by mail or email. Some companies will shoulder the valuation fees while others will require the customer to pay for the process.

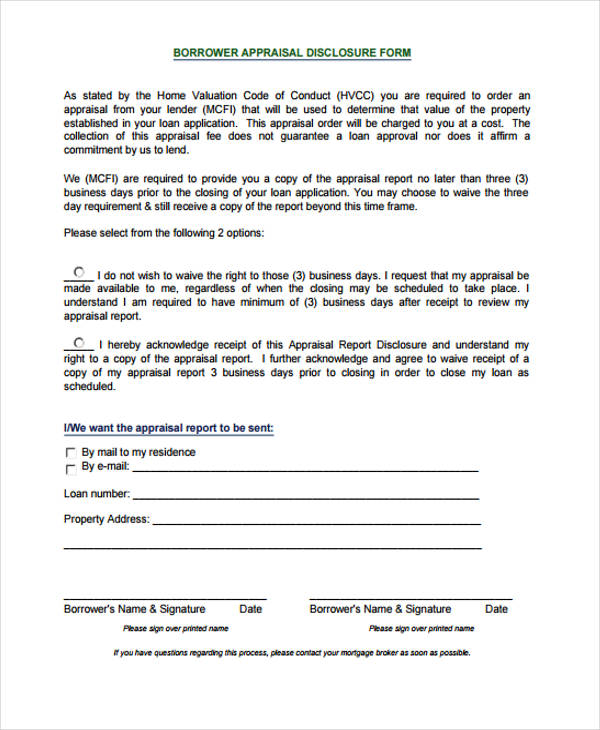

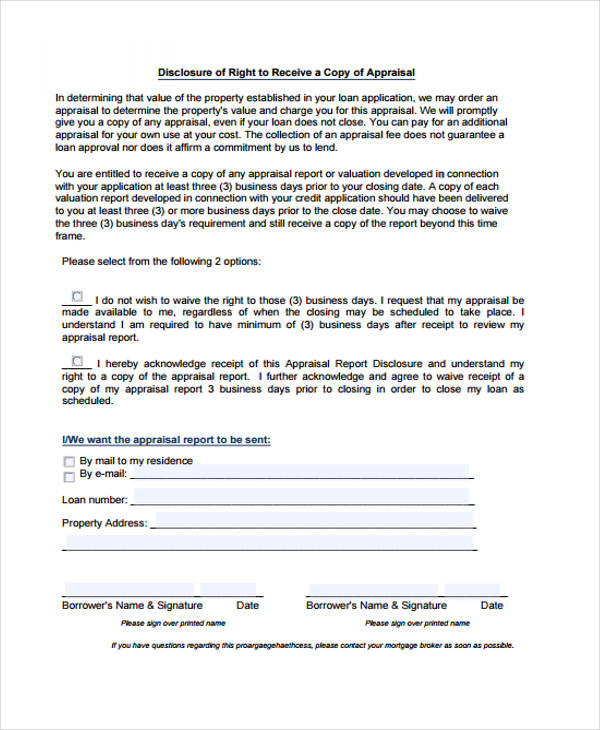

Sample Borrower Appraisal Disclosure

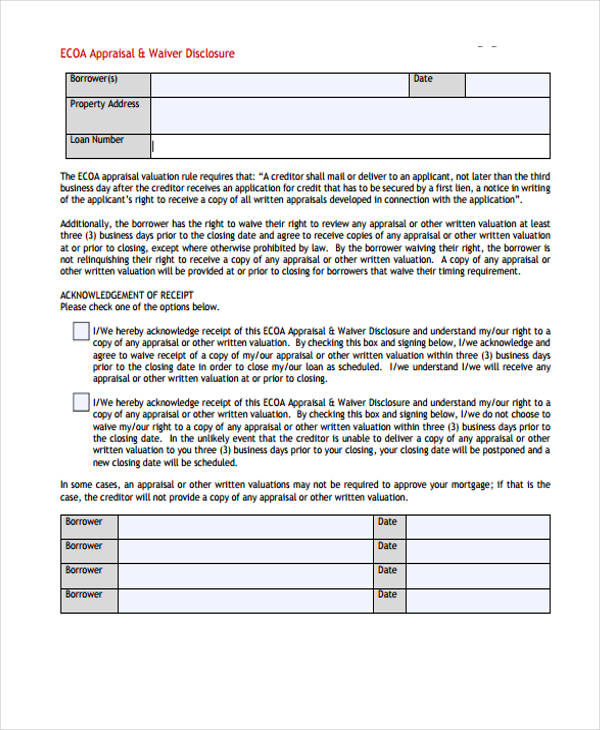

Appraisal Waiver Disclosure in PDF

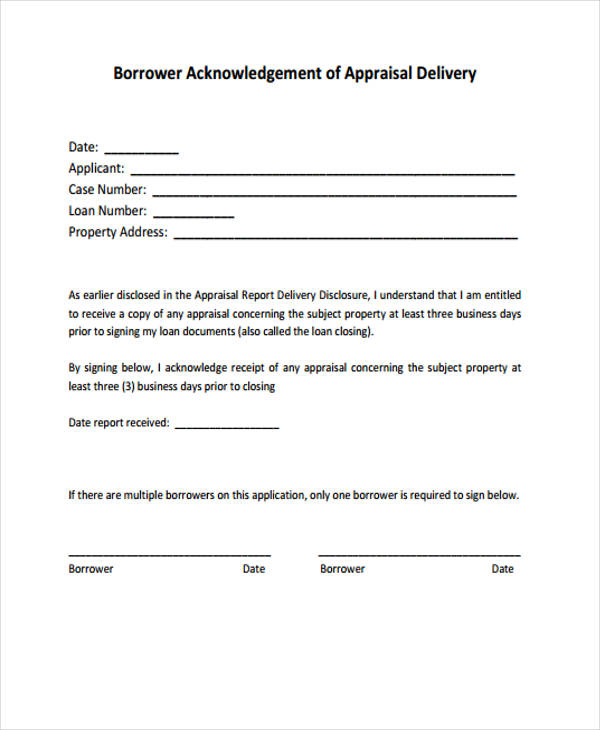

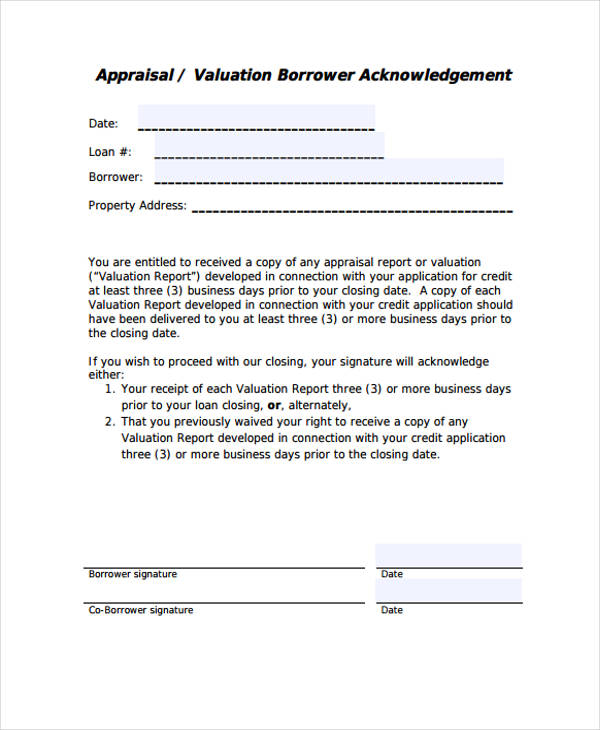

Borrower Acknowledgement of Appraisal Delivery

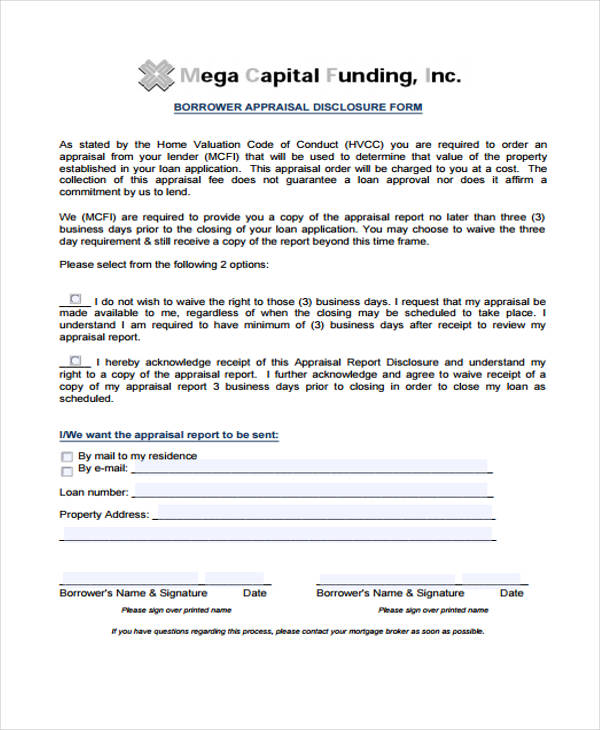

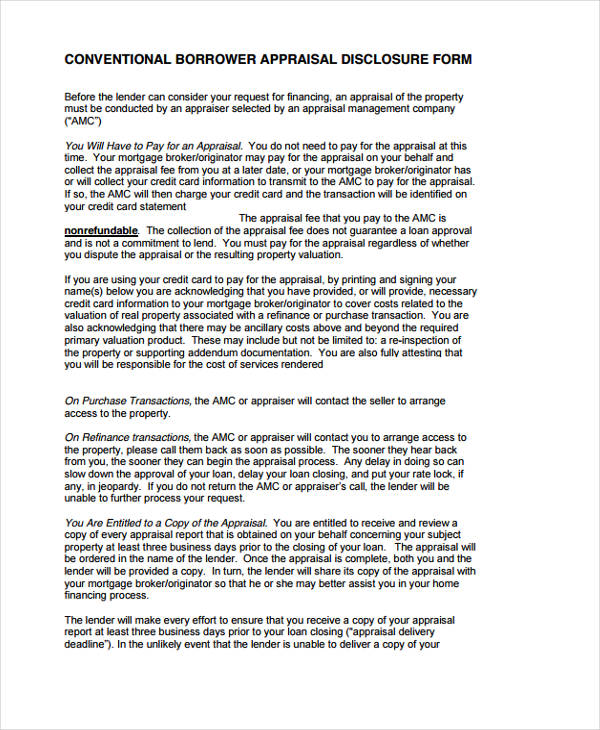

Sample Borrower Appraisal Disclosure Form

Why are Appraisal Disclosure Forms Important?

-

Know your property’s real value. Property appraisal is done when there is an intention of selling a piece of land, building, or home. Appraisal disclosure forms ensure that you receive a copy of the appraisal. This way, you will know your property’s market value.

-

Sell at a gain. Knowledge of your property’s real value allows you to make intelligent business decisions when selling your property. On the other hand, if you are using your property as collateral for a loan, you will have leverage over the bank’s loan terms. You may even be able to negotiate for lower interest rates if you use this knowledge at its fullest.

-

Protect your privacy. Appraisal disclosure forms ensures that information regarding your property valuation is kept confidential. Only you, your bank, and a third party assessor (if hired) will know the full details of the deal you have with the bank. All parties involved in this transaction are required by law to use this information for business only.

-

Streamlines borrowing process. Along with real estate appraisal forms, the use of appraisal disclosure forms is part of a series of steps that occurs when an individual approaches a bank or any financial institution to borrow money or a real estate company to sell a property.

Right to Receive Appraisal Disclosure Form

Conventional Borrower Appraisal Disclosure Form

Appraisal/Valuation Borrower Acknowledgement

Different Kinds of Appraisal Disclosure Forms and When to Use Them

-

Borrower Appraisal Disclosure Form. Just like home appraisal forms, this form is commonly used by lending firms and banks when processing mortgage borrowing, but it may also be applied to other forms of real estate deal. This form contains a checklist portion where the client has to choose whether to receive a copy of valuation report or not and how he/she wishes to receive the appraisal report (by mail or email).

-

Appraisal Waiver Disclosure Form. When signing this form, you waive the right to receive a copy of the appraisal report made by your creditor. Just like the Borrower Appraisal Disclosure Form, this form is also used by mortgage lending companies.

-

Appraisal/Valuation Borrower Acknowledgement and Borrower Acknowledgement of Appraisal Delivery. These two forms are used when the appraisal report has been delivered to you (the borrower). Financial institutions may use any of these forms since they signify the same thing.

Other Things to Remember About Appraisal Disclosure Forms

-

Property owners may be required to pay for the appraisal.

-

A creditor requiring a property appraisal does not guarantee loan approval. Creditors still need to evaluate other things and determine whether or not to approve a loan or not.

-

As the law requires, valuation reports should be sent to you within 3 working days before a loan’s closing date.

Related Posts

-

FREE 9+ Sample Jewelry Appraisal Forms in PDF | MS Word

-

FREE 6+ Sample Home Appraisal Forms in PDF

-

FREE 8+ Sample Faculty Appraisal Forms in PDF | MS Word

-

FREE 9+ Sample Staff Performance Appraisal Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Auto Appraisal Forms in PDF

-

FREE 8+ Sample Appraisal Evaluation Forms in PDF | MS Word

-

FREE 8+ Sample Management Appraisal Forms in PDF | MS Word

-

FREE 6+ Sample Customer Appraisal Forms in PDF | MS Word

-

FREE 8+ Sample Appraisal Feedback Forms in PDF | MS Word

-

FREE 8+ Sample HR Appraisal Forms in MS Word | PDF

-

FREE 6+ Sample Annual Performance Appraisal Forms in PDF | MS Word

-

FREE 29+ Sample Appraisal Formats in PDF | MS Word | Excel

-

Nurse Appraisal Form

-

Performance Appraisal Form

-

FREE 10+ Property Appraisal Forms in PDF | MS Word