In today’s generation, almost everything has been automated ranging from food vending machines to withdrawing money from a bank account. Due to the advantages that an automated process provide to the population, business companies and most career fields in the industry hop to plans that involve in changing manual procedures toward automation. This includes the process of paying employee reimbursements and salaries that are done by the financing and the human resource personnel of a company. Along with the automated process is a specific form that company management must complete, which is known as a direct deposit enrollment form.

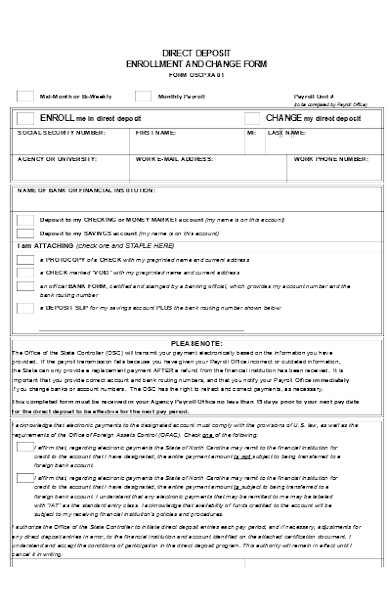

A direct deposit enrollment form is used by banks for companies to enroll themselves and their employees in a direct deposit system that allows the company to send the salary through all their employees with a lesser process to undergo. All the financing personnel needs to accomplish is filling out the enrollment or registration form with the right information and amount, then wait for the updates that will indicate the successful transfer of the employee’s salary to the employee’s bank account.

Direct Deposit Enrollment Form in DOC

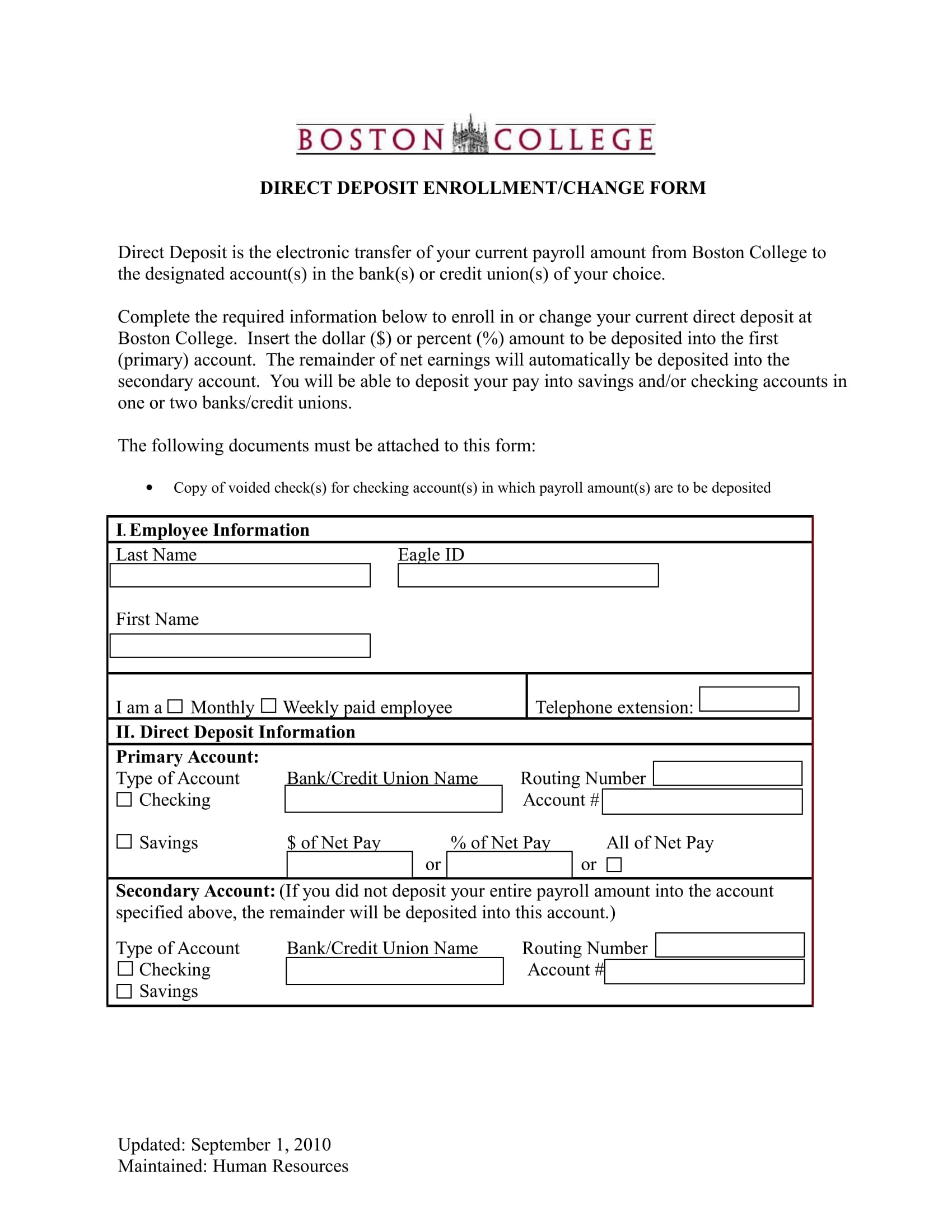

Bank Direct Deposit Enrollment Form

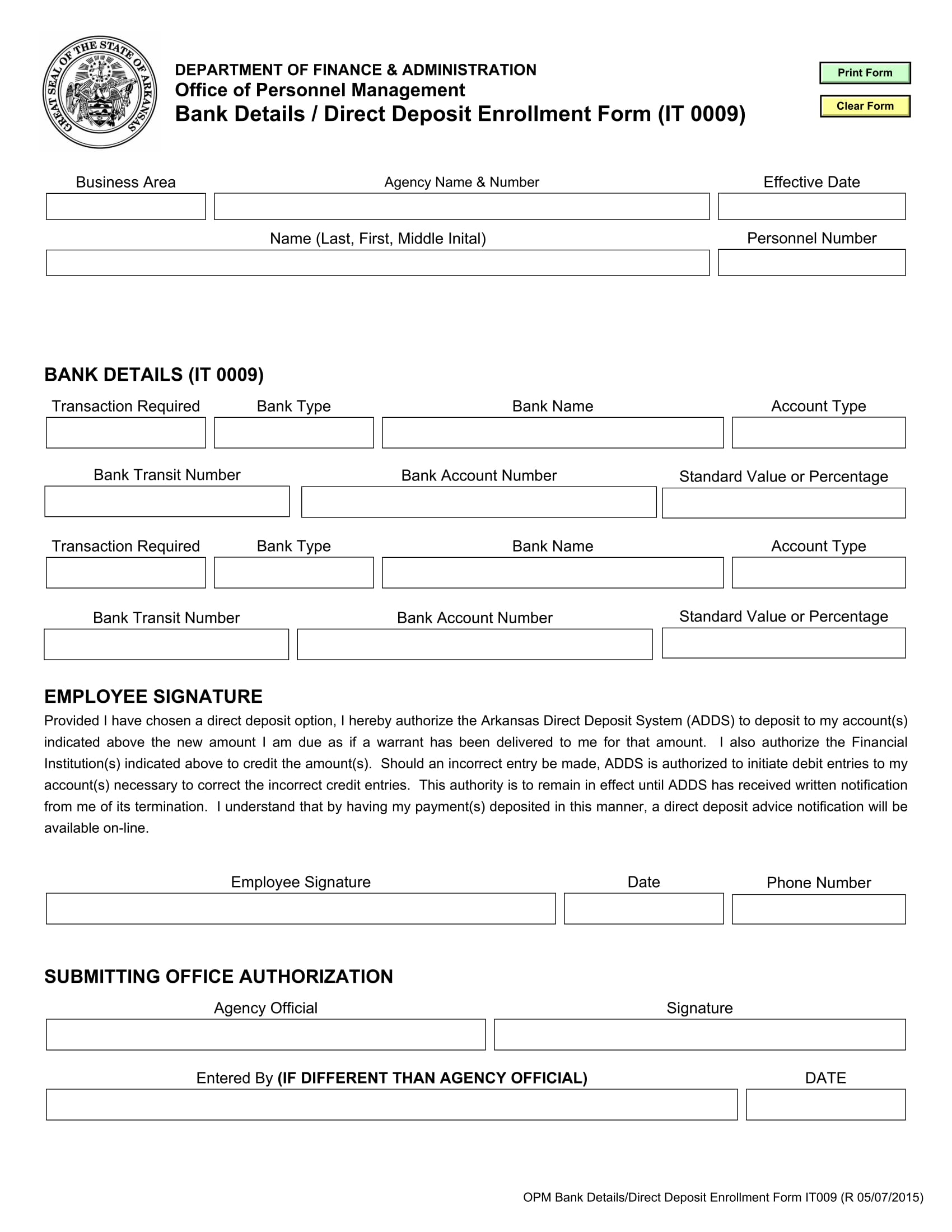

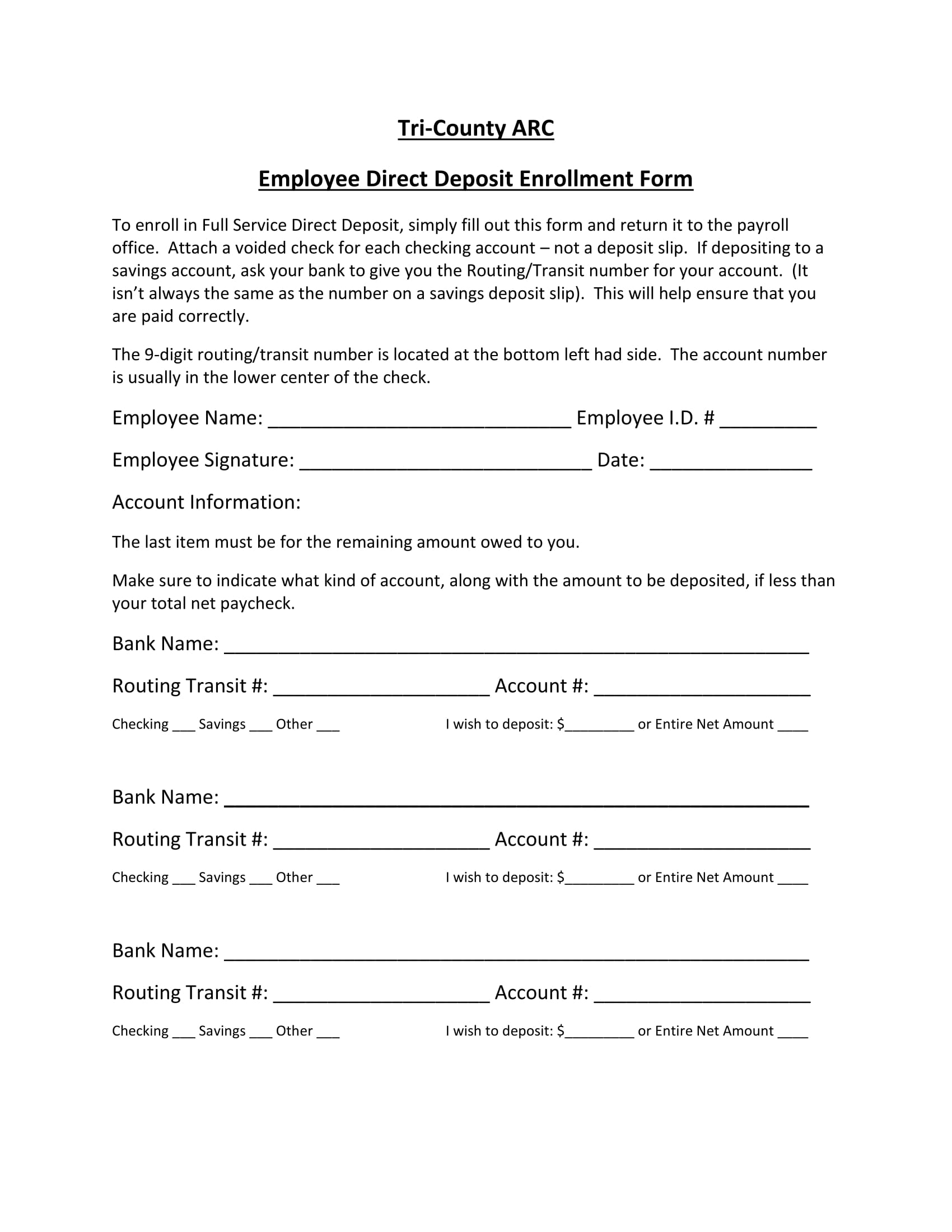

Employee Direct Deposit Enrollment Form

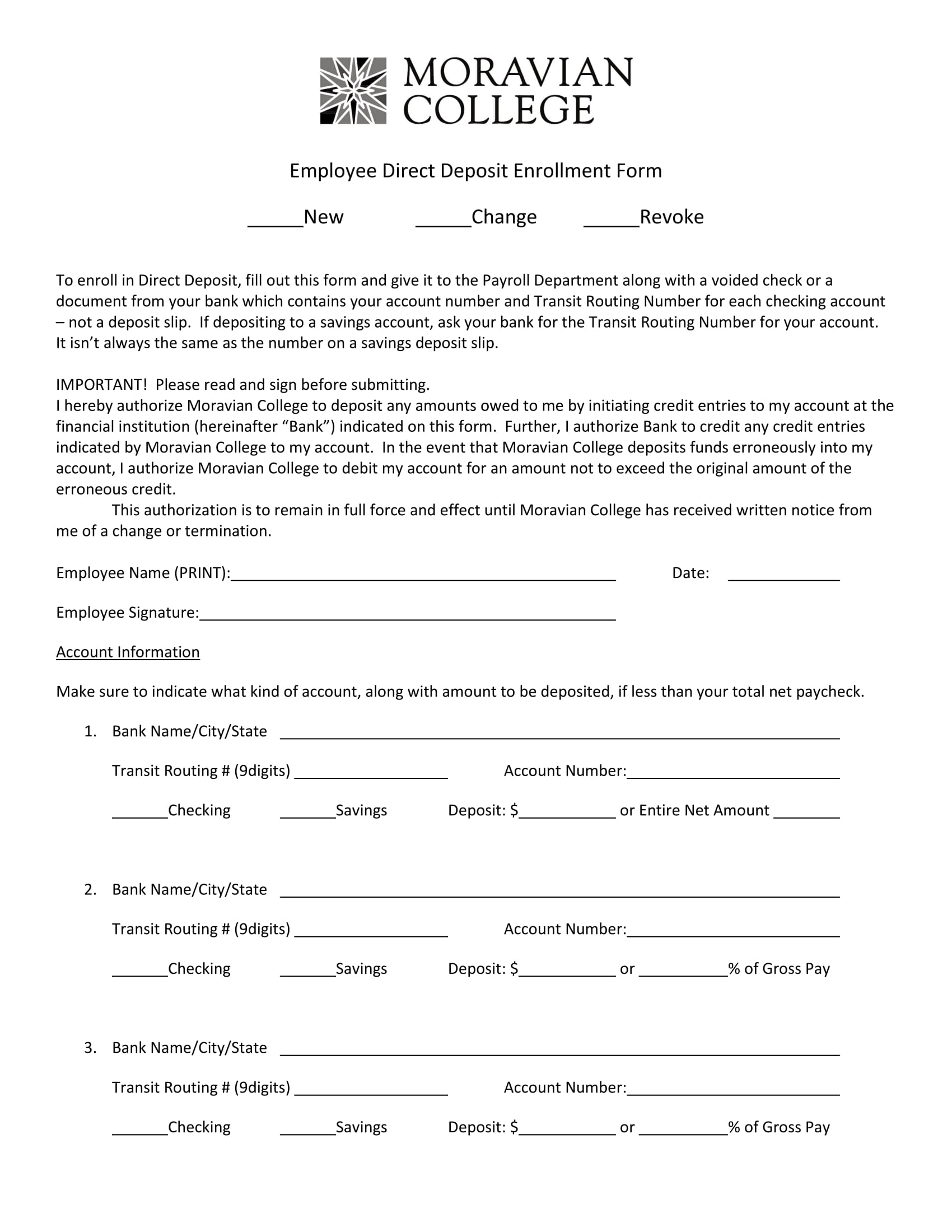

Company Direct Deposit Enrollment Form

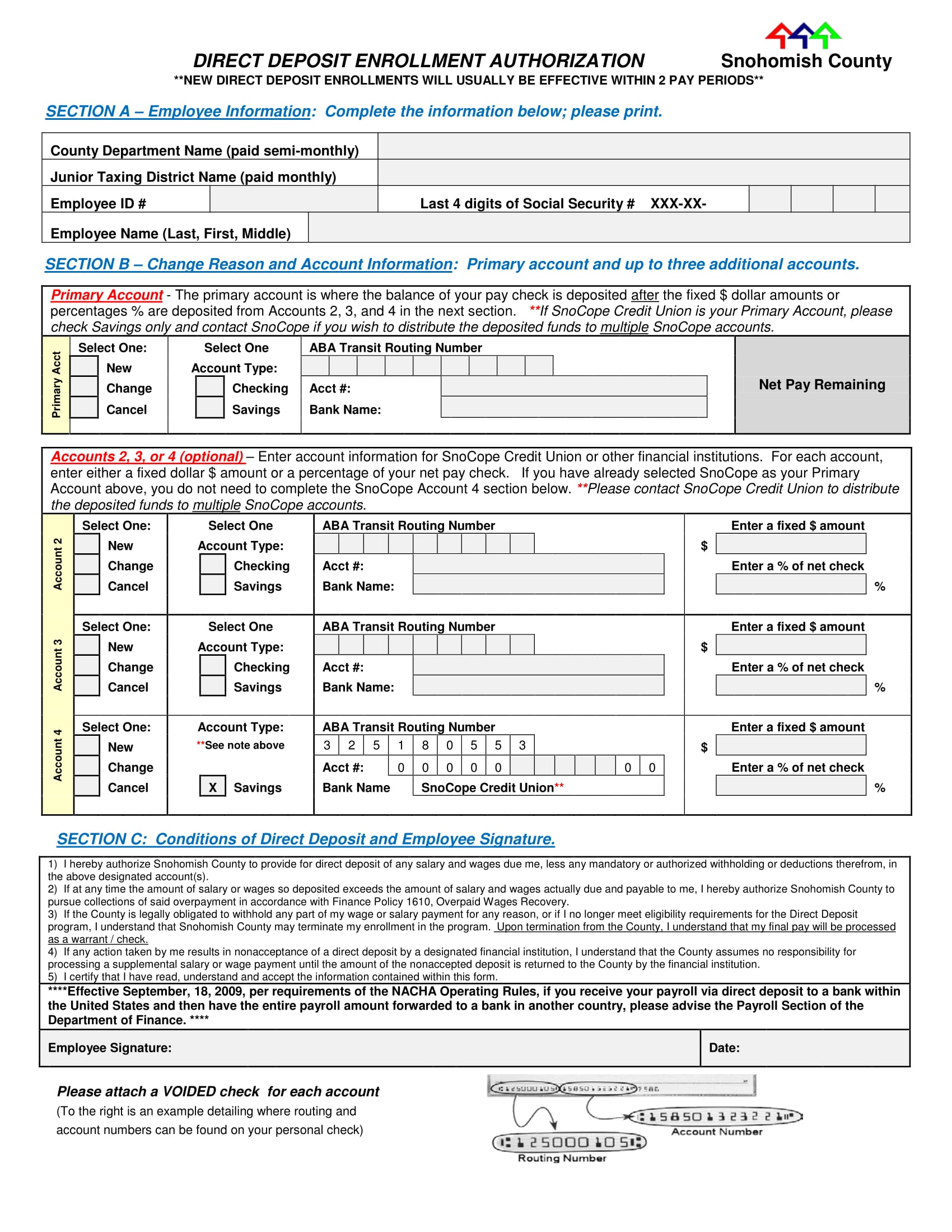

Direct Deposit Enrollment Authorization Form

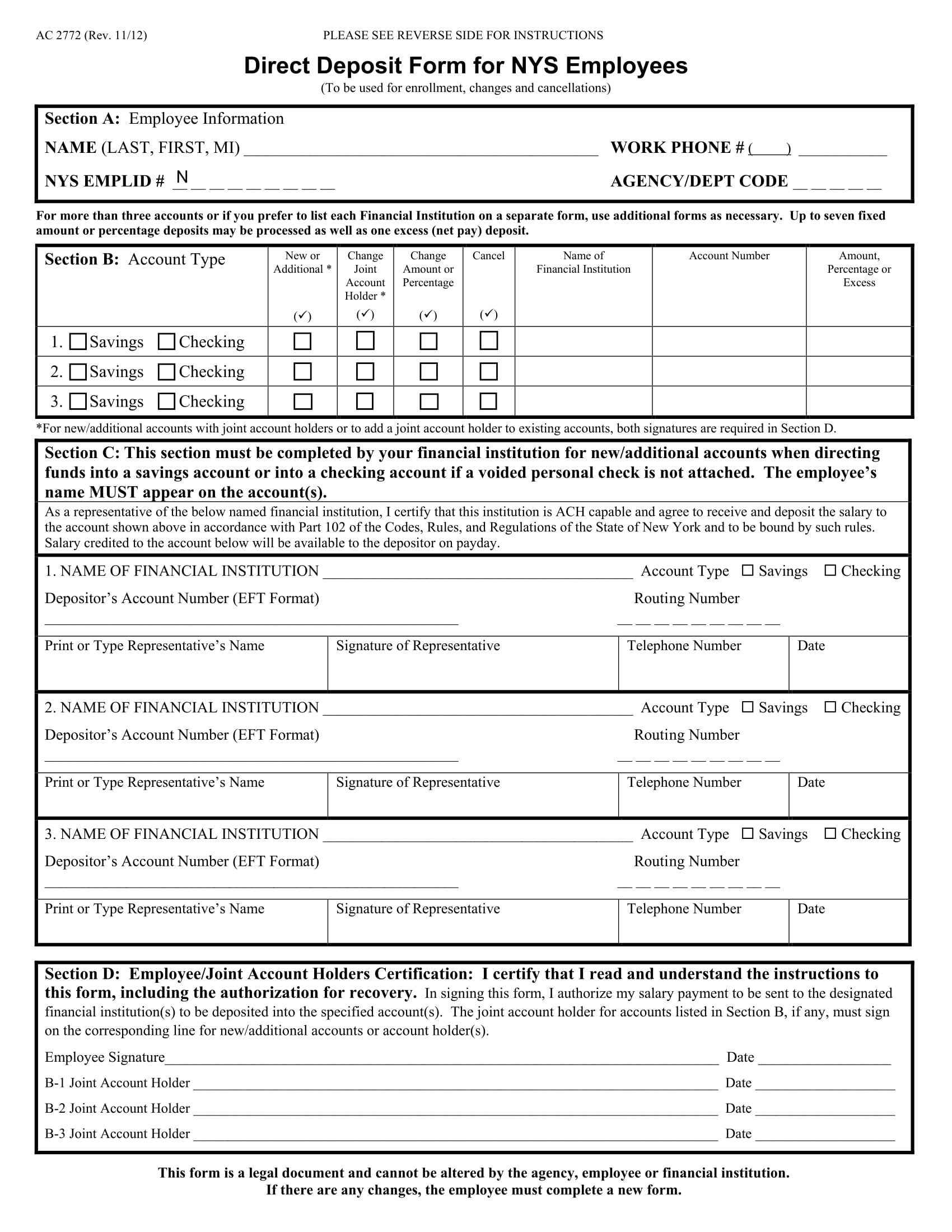

Basic Contents of a Direct Deposit Enrollment Form

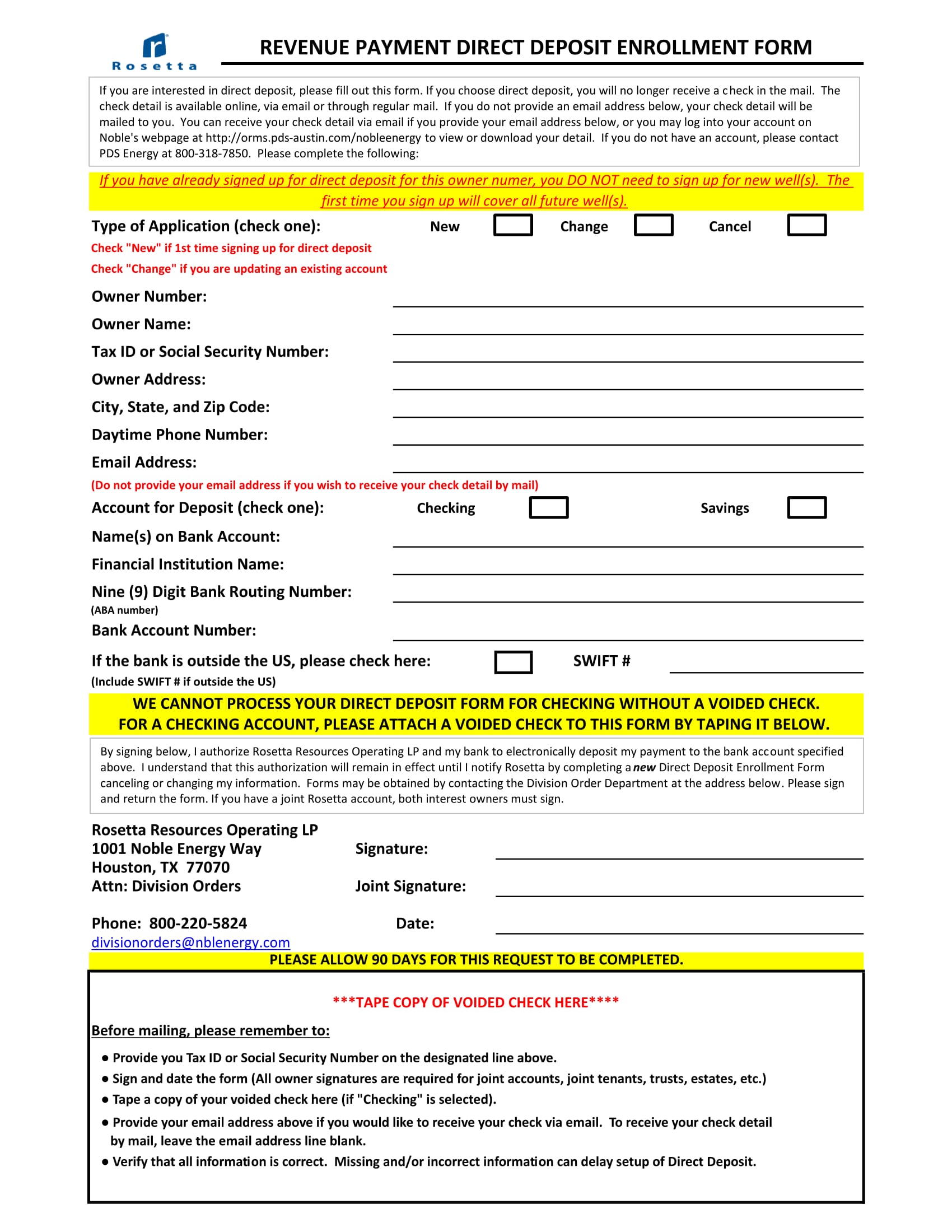

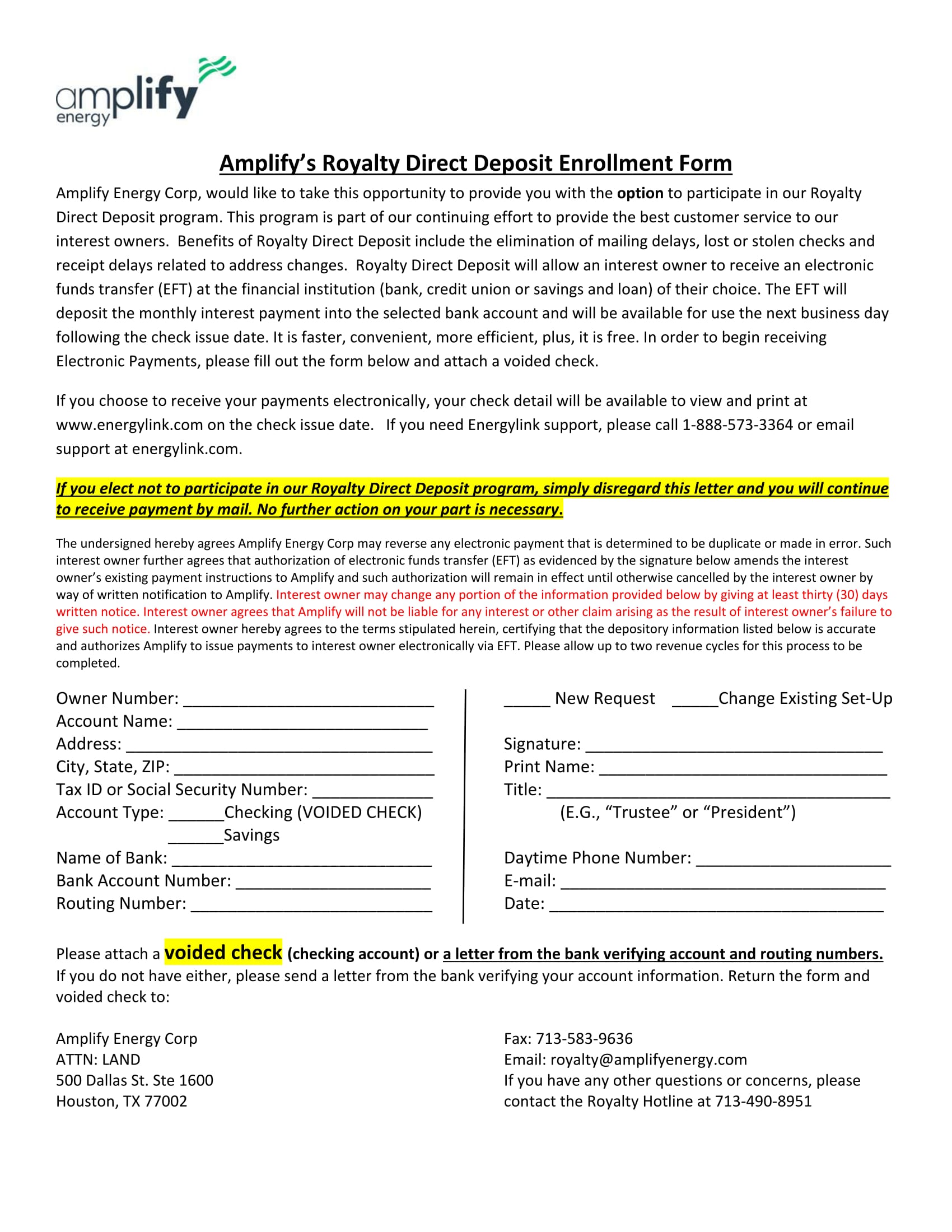

Even in varying banks and companies, a direct deposit enrollment form must have the basic yet necessary sections to meet its purpose of collecting the account and financial matters of an employee. Listed below are the five important sections of this form:

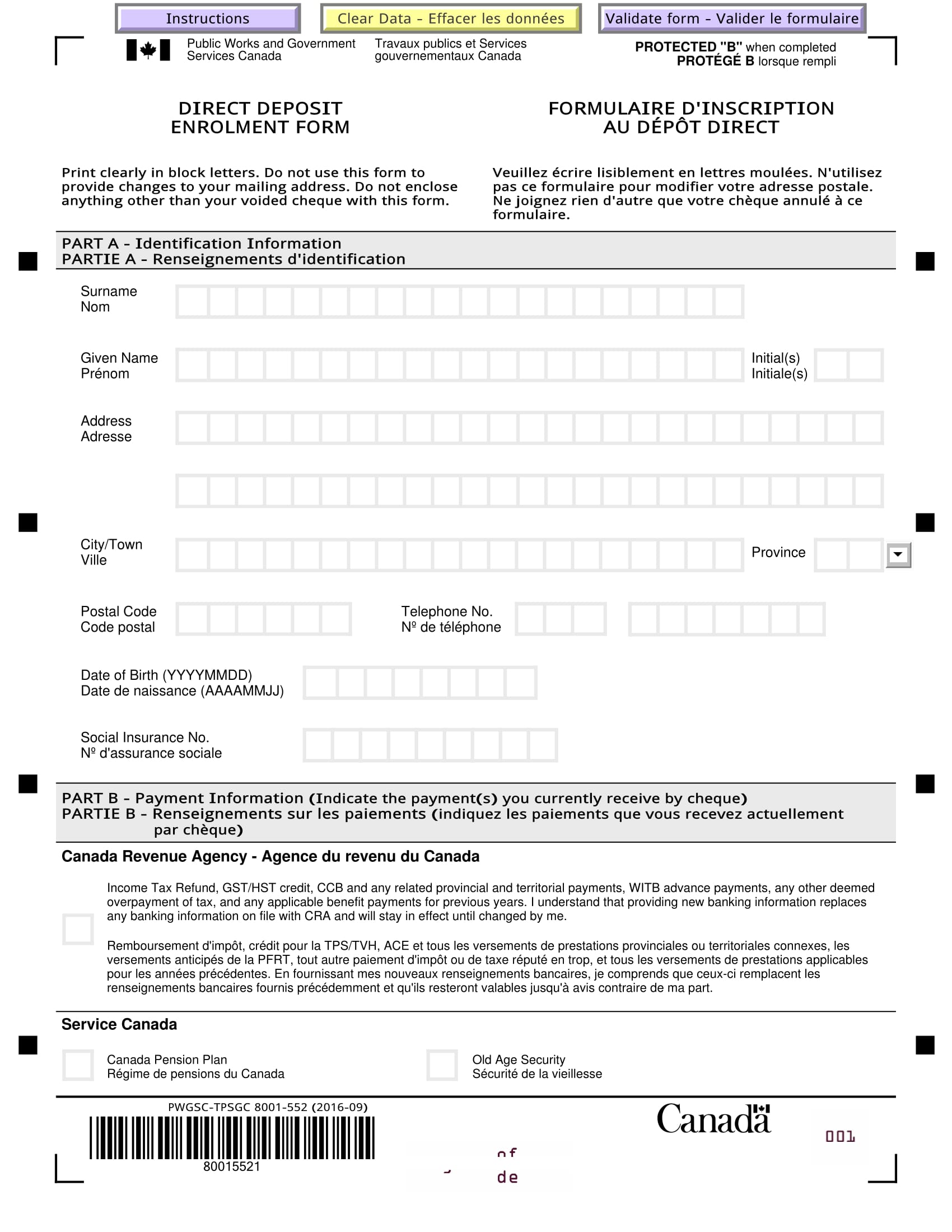

Member Information

This refers to the name, social security number, and the complete address of the employee who will be enrolled in the bank’s deposit program such as his street address, city name, state, and zip code numbers. These pieces of information will serve as the general entries for registering the employee to the bank’s records and database.

Employer Information

The company’s business name, employer number, company address, as well as the type of business that the company is registered in the state will need to be included in this section. Specifically, these data are necessary for determining the sender of the salary amount and the authorized person who is responsible for sending the amount prior to the day of the pay release.

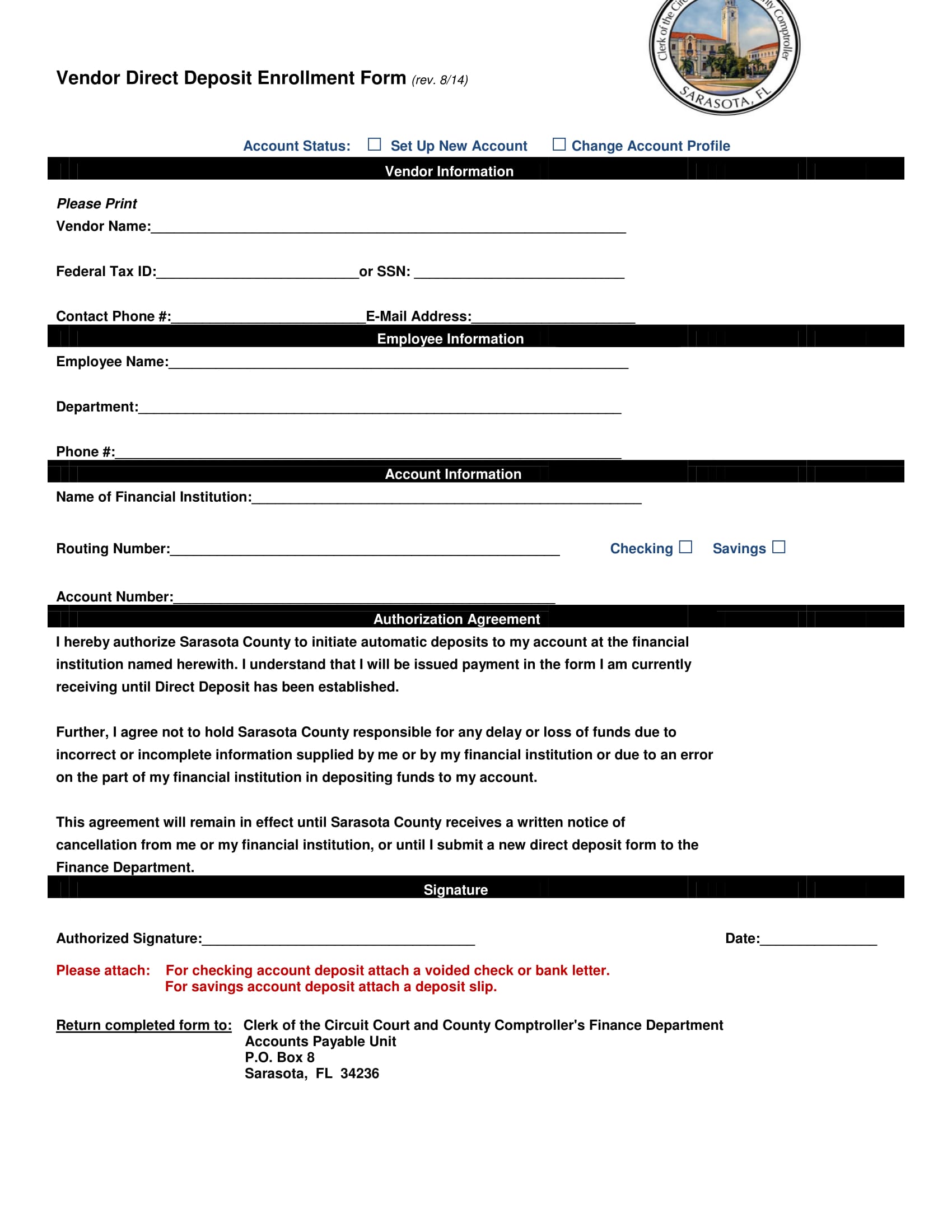

Account Information

This contains the name of the bank who will serve as the bridge for the salary electronic or wire transfer and the type of method to be used for depositing the amount whether a checking or a savings account. Additionally, the account number of the employee, the bank’s routing number, and the amount of deposit are also included in this section for indicating further details about the employee’s account.

Authorization Statement

Some banks provide a separate authorization form for their members or clients when it comes to permitting any money transfer. However, even though the authorization is in a form of a statement or in a different document, the bank must assure that the significant terms and limitations are included to properly highlight the regulations that the company will need to follow when it comes to direct depositing amounts.

Distribution Information

This last section will highlight the total deductions, added and deleted amount, and the specified date when the deductions were implemented in the employee’s account. To complete the document, the employee or the owner of the bank account where the deposit is addressed will have to affix his signature on the form along with his initials right beside it to indicate an approval.

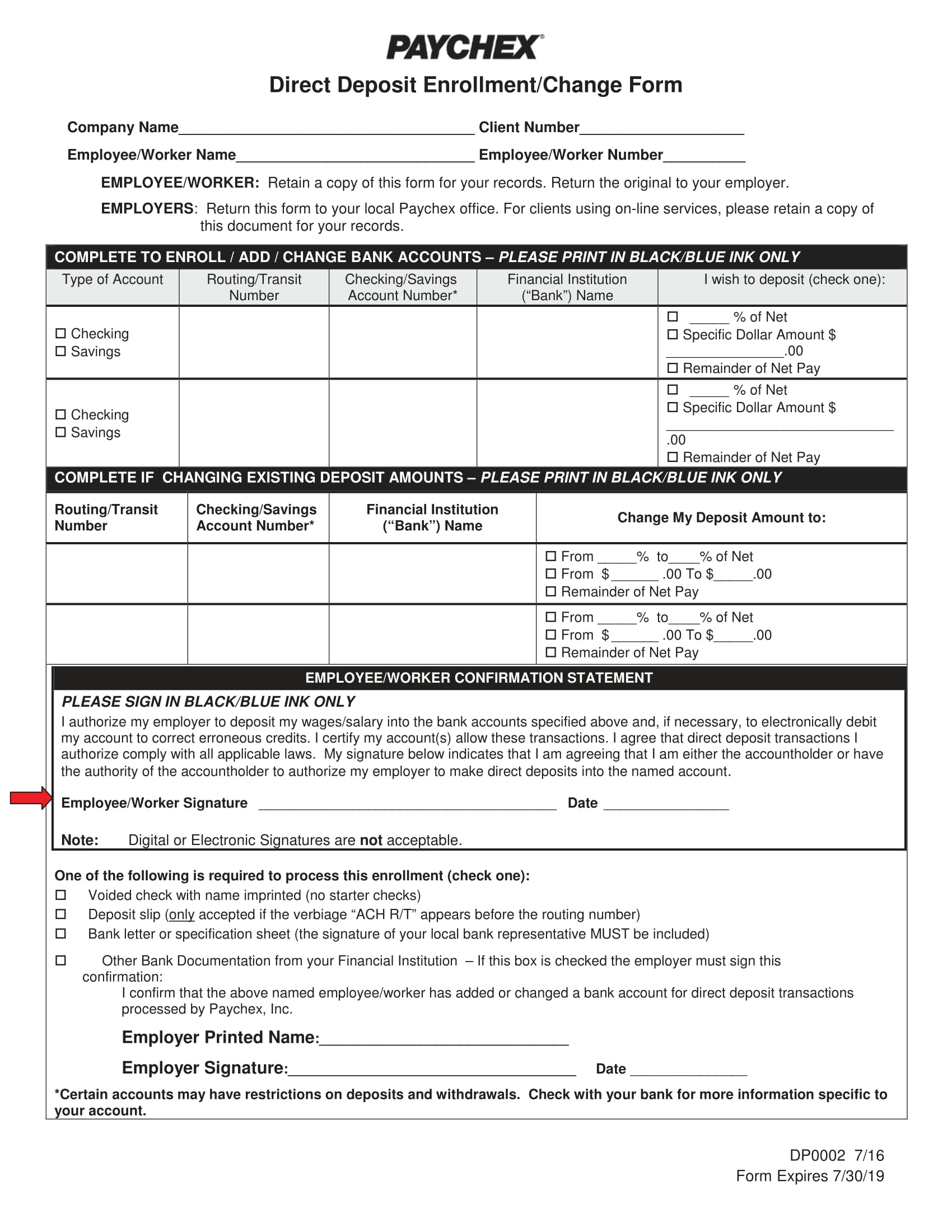

Direct Deposit Enrollment Change Form

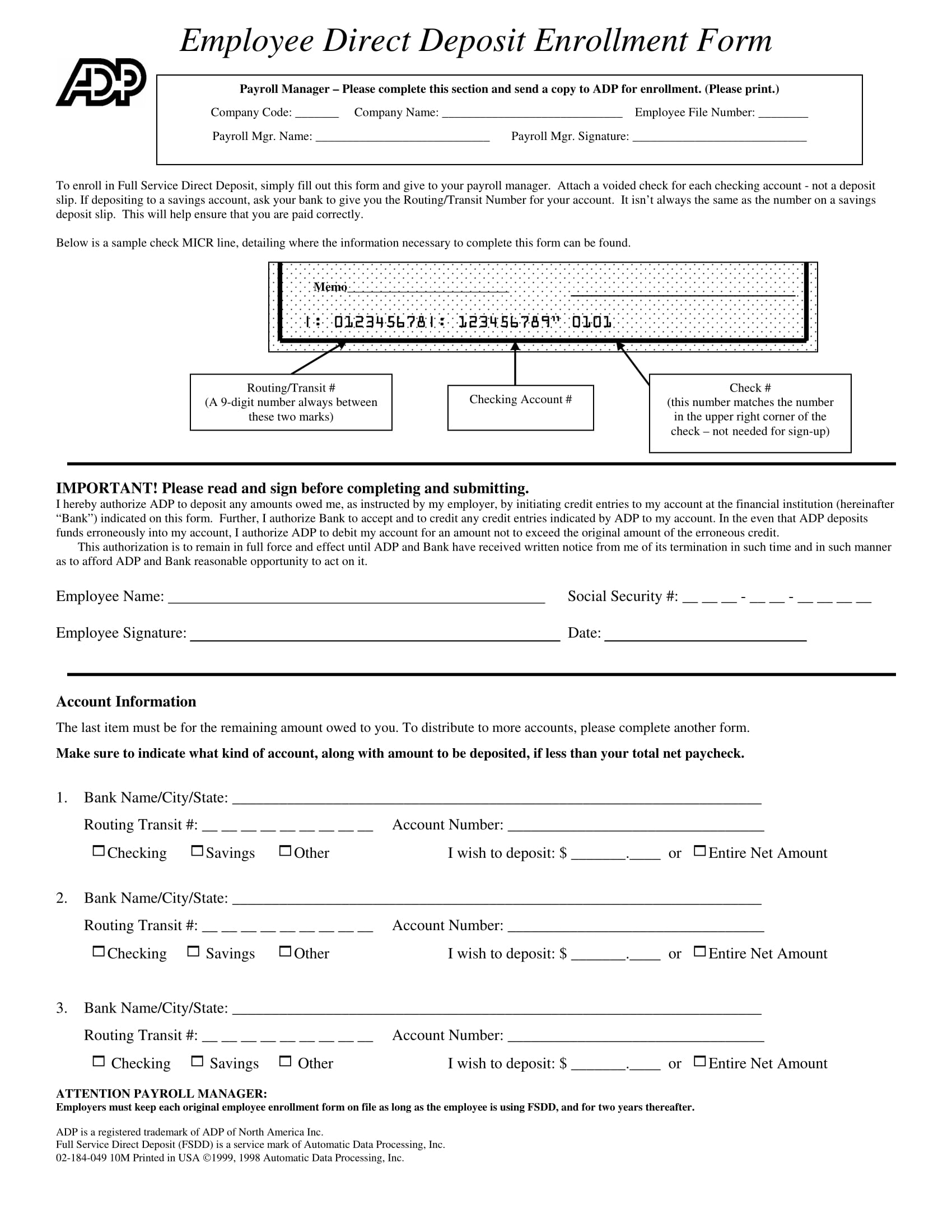

Employee Direct Deposit Enrollment Form

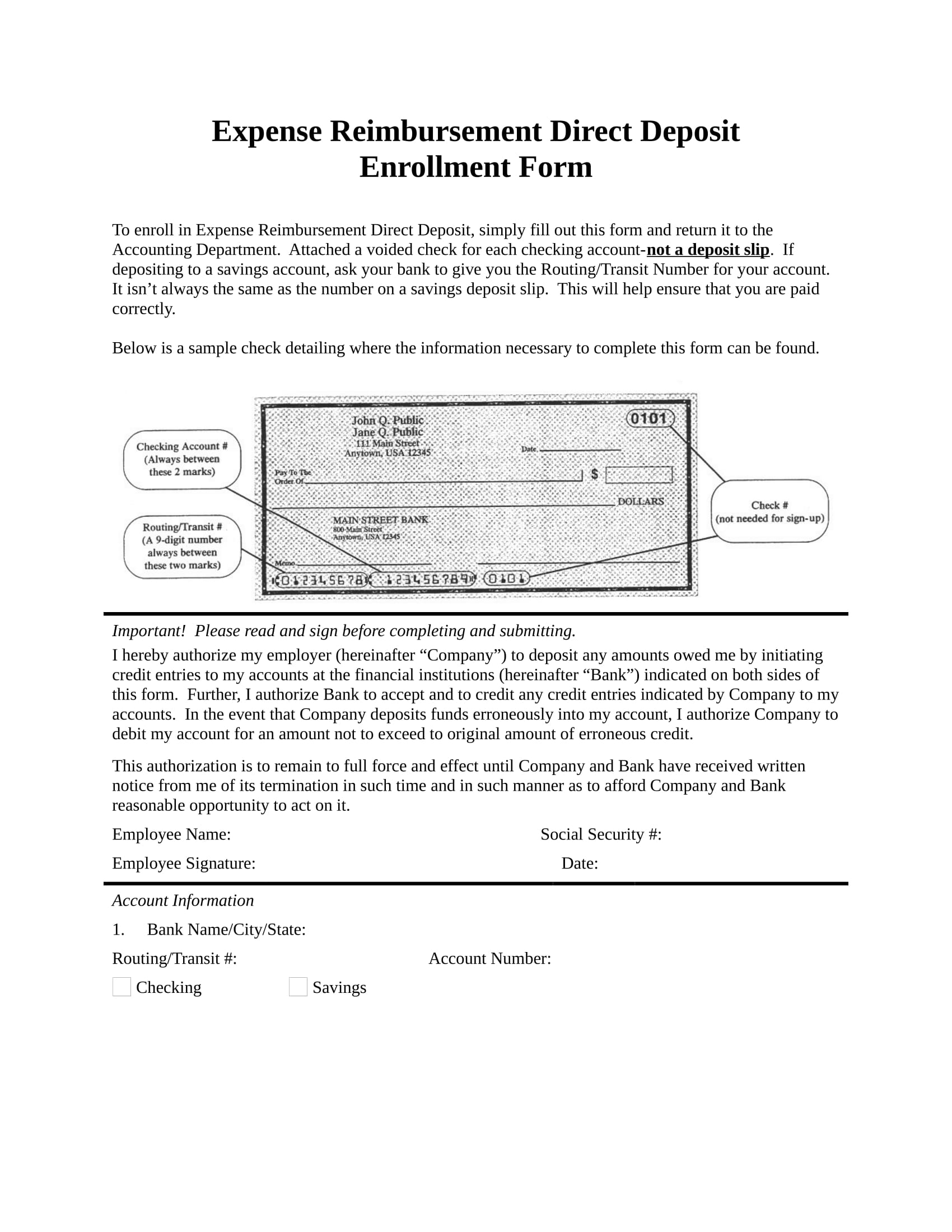

Expense Direct Deposit Enrollment Form

Full Service Direct Deposit Enrollment Form

Interactive Direct Deposit Enrollment Form

When to Use a Direct Deposit Enrollment Form

A direct deposit enrollment form does not only limit its usage to assigning payroll payments for employees but also for paying reimbursements and updating an employee’s financial information. In the event that an employee has been involved in an accident, the employee will have to submit an incident accident report, his medical forms, and a medical reimbursement request form to his employer. These three documents will be used for determining the amount that the employer must deposit into the employee’s account for repaying the expenditure costs the employee spent due to the workplace accident that occurred. However, before the company can send the amount, the employer must complete a reimbursement direct deposit enrollment form to gather an authorization in depositing the employee’s medical reimbursement payment.

Another instance wherein a direct deposit enrollment form will be used is when an employee has some changes in his personal information such as his name and address. Updating the employee’s information is essential for both the company and the employee himself. If a data is not updated in the records of the bank, there is a grave possibility that the employee will not be able to receive or withdraw his savings. On the other hand, the company will also have a tough time in depositing the amount especially if the employee underwent an employee name change without informing them prior to the day of providing the salary.

Payroll Direct Deposit Enrollment Form

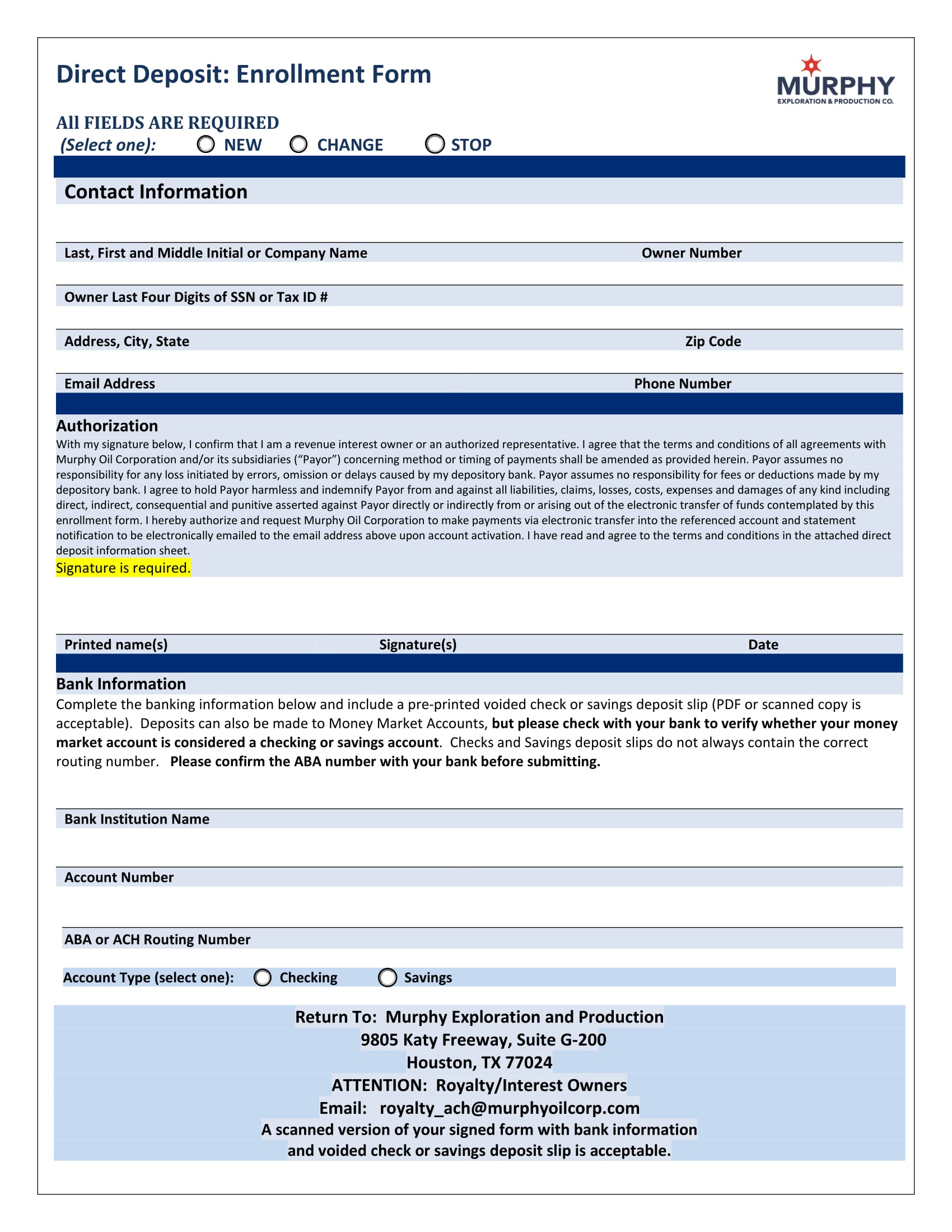

Revenue Direct Deposit Enrollment Form

Royalty Direct Deposit Enrollment Form

State Employee Direct Deposit Enrollment

Vendor Direct Deposit Enrollment Form

Direct Deposit Change Enrollment Form

Benefits of Direct Deposit in Employment

Numerous benefits are observed and acquired when a company considers using the advantages of technology. Below are some of the known benefits that a direct deposit will provide to both the company and their employees once they are enrolled in the system or program:

- Enrolling in a direct deposit will save time for both the employee and the company. This is due to the reason that the employer will no longer have to print out payroll forms for each employee in the company when salary day comes, which will save time from producing copies for the company and the employee. Along with this, the employees will also benefit due to the advantage that the amount will immediately project to their accounts after hours when the employer deposited the amount. This lessens the time for the employees to wait in the premises of the company to receive the paycheck allotted for themselves.

- Direct deposits assure zero delays. Even if an employee is on a vacation or sick leave, he will still be able to receive his salary payment from anywhere as long as there are automated telling machines in the place where he is staying. For the company, if enrolled under a direct deposit, the employer will be able to send the payments instantly after the process of determining the salary that each employee must receive.

- Banks keep accounts safe and secured. Banks are financial aid providers and keepers of their clients, which is why they protect their system with various passwords, protocols, and any safety measure for securing that they will serve their clients well. With this, the company and the employee will be secured that a money transfer will be conducted safely without the fear of having to lose a paycheck or financial form to due varying reasons of not being careful enough. In the event that a case of identity theft and loss of money in a specific account, the bank will be able to determine immediately through an investigation of who is the responsible crook for the issue.

- Helps in money saving. Poverty is rising globally, which is the main reason why most people aim to save money for future intentions. With the aid of a direct deposit enrollment form, the employee will be able to request his company to send a particular percentage of his salary to his other savings account for him to avoid spending the amount that needs to be saved.

- Additionally, the amount that the employee will receive on his salary day will be the amount that was already deducted to be sent for his savings. On the side of the company, they are helping and promoting the effectiveness of saving regularly to all their employees and staff which will then allow the company to satisfy the needs of their employees and earn high rates for their company employee feedback forms.

- Saves not only money but also Mother Nature. Since informing the employees are done via email and through their accounts, the company will no longer need to use paper and ink. With this, the company becomes an immediate advocate for saving Mother Nature, which is essential for the company’s reputation in any business field.

- Fast access to necessary financial information. When an employee or a bank account member who is a recipient of a direct deposit needs to access his financial information for various purposes, he will only need to head to the bank or access his details online through the bank’s website. In comparison, if the company prefers to have a printed paycheck and pay slips, the employee will not be able to acquire a detailed track of his savings and received payments unless his keeps a personal tracking form.

Even though there are a lot of benefits that employees and companies will acquire, it is always necessary to be mindful when conducting the transfer and deposit to assure that the right amount has been sent to the right recipient. Overall, direct deposit forms are important as long as the employer or the sender is informed of the amount to be sent to each employee account involved in the company.

Related Posts

-

FREE 9+ Direct Deposit Revocation Forms in PDF | MS Word

-

FREE 2+ Indemnity for Directors Short Forms in PDF

-

FREE 10+ Reduced Fee Enrollment Application Forms in PDF | MS Word

-

FREE 45+ Work From Home Forms in PDF | MS Word

-

FREE 23+ Employee Leave Request Forms in PDF | MS Word | XLS

-

FREE 53+ Human Resources Forms in PDF | MS Word | Excel

-

FREE 5+ Recruiter Performance Review Forms in PDF | MS Word

-

FREE 7+ Payroll Adjustment Forms in MS Word | PDF | Excel

-

FREE 3+ HR Employee Concern Forms in PDF

-

FREE 6+ Telephone Reference Check Forms in PDF | MS Word

-

FREE 3+ Consultant Bio-Data Forms in PDF | MS Word

-

FREE 7+ Compensation and Benefits Forms in PDF

-

FREE 10+ Name Address Change Forms in PDF | MS Word

-

FREE 11+ Confidential Evaluation Forms in PDF | MS Word

-

FREE 11+ Change of Address Forms in PDF | MS Word | Excel