Nowadays, payslips and salaries are mostly sent electronically by companies to their employees to minimize the use of papers and ink in printing as well as signing payroll forms. Accompanying this choice of payroll transaction, companies must ensure that their records are up to date especially when an employee changes his information and leaves the company. This is why direct deposit revocation forms come in handy for company employees who want to cancel or remove their accounts from the direct deposit procedure.

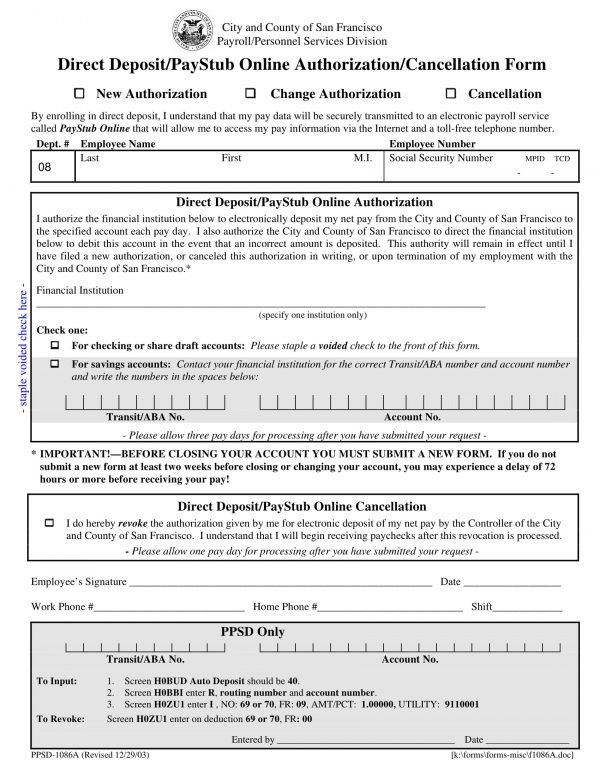

Direct Deposit Online Authorization Revocation Form

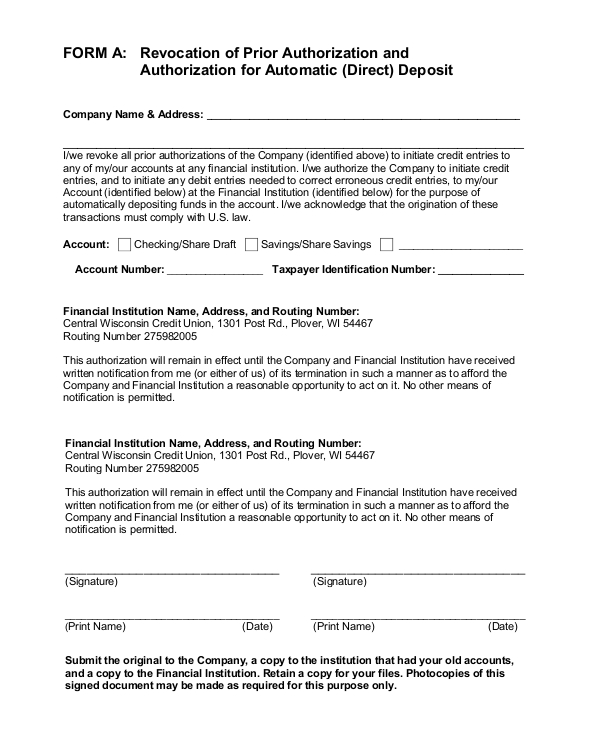

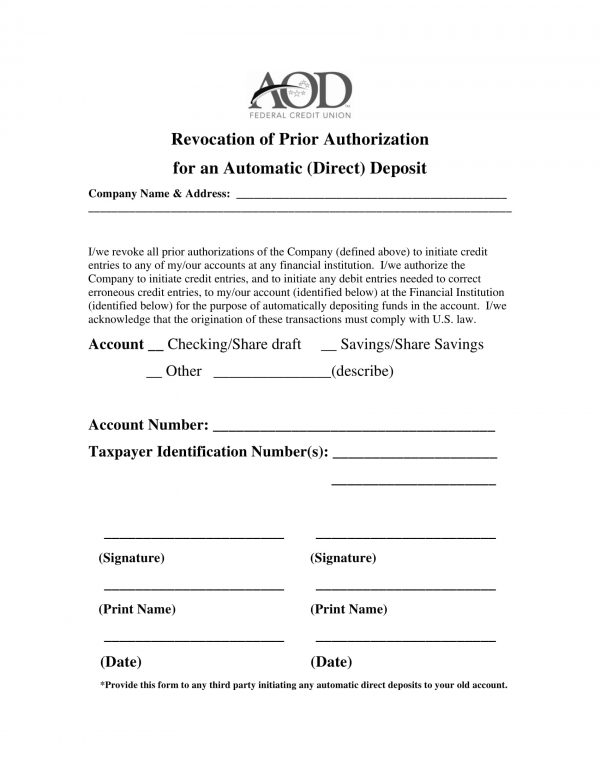

Direct Deposit Revocation of Prior Form

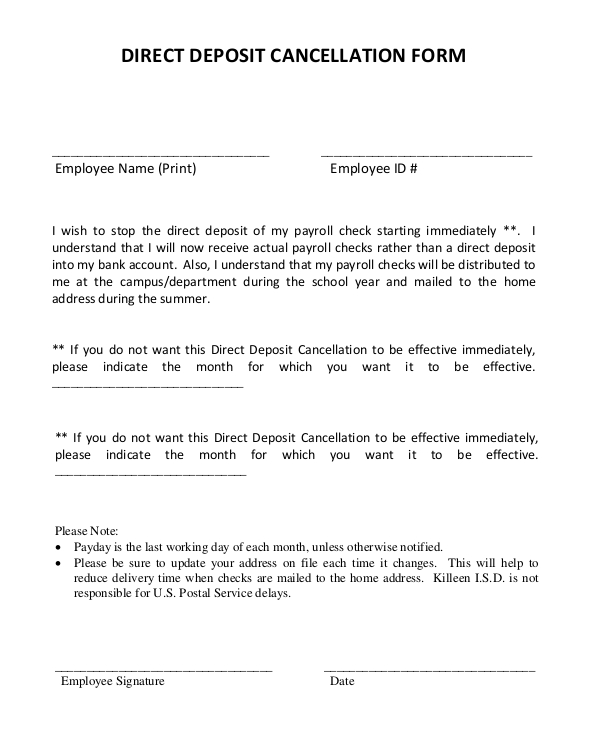

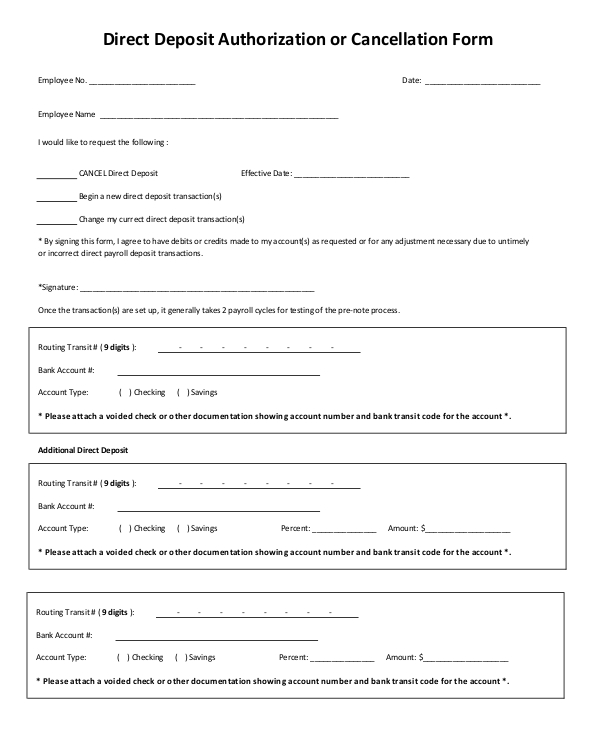

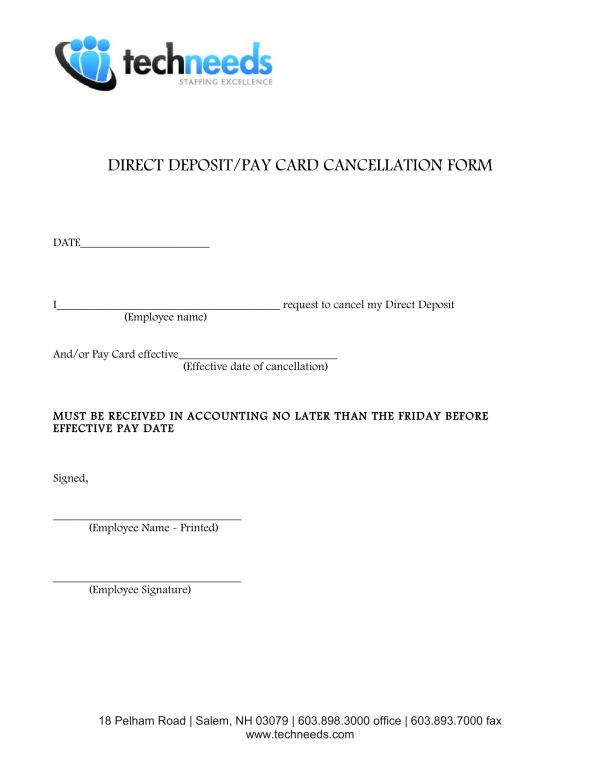

Direct Deposit Cancellation Form

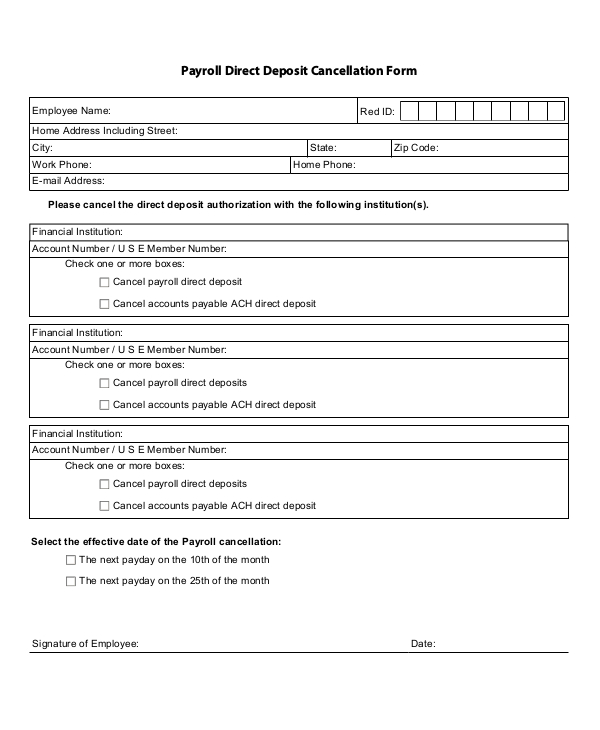

Payroll Direct Deposit Revocation Form

What Is a Direct Deposit Revocation Form?

A direct deposit revocation form is used by companies and organizations for their employees and staff in canceling or revoking the direct deposit authorization that was previously signed in providing the salary and payments periodically for the employee’s services. Moreover, this type of document is also suitable to be used by companies for mandating and informing their affiliated charity groups that their account will no longer be open for automatic donations.

Direct Deposit Prior Authorization Revocation Form

Direct Deposit Authorization or Revocation Form

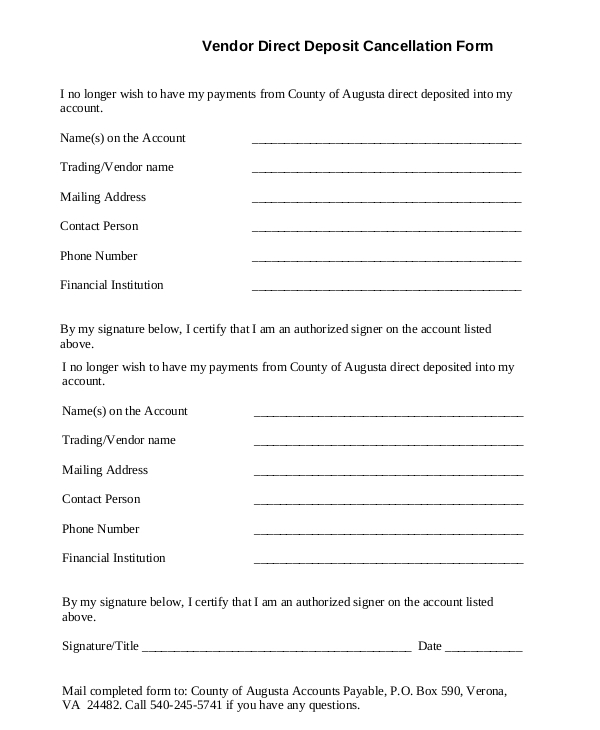

Vendor Direct Deposit Cancellation Form

How to Create a Simple Direct Deposit Revocation Form

Direct deposit revocation forms vary on what layout or format a company and the bank organization prefers to use for their revocation procedures. Nevertheless, below are the steps that can help a company representative such as the human resource and finance personnel of a company to create a vendor direct deposit form from scratch:

1. Name the form and introduce the company

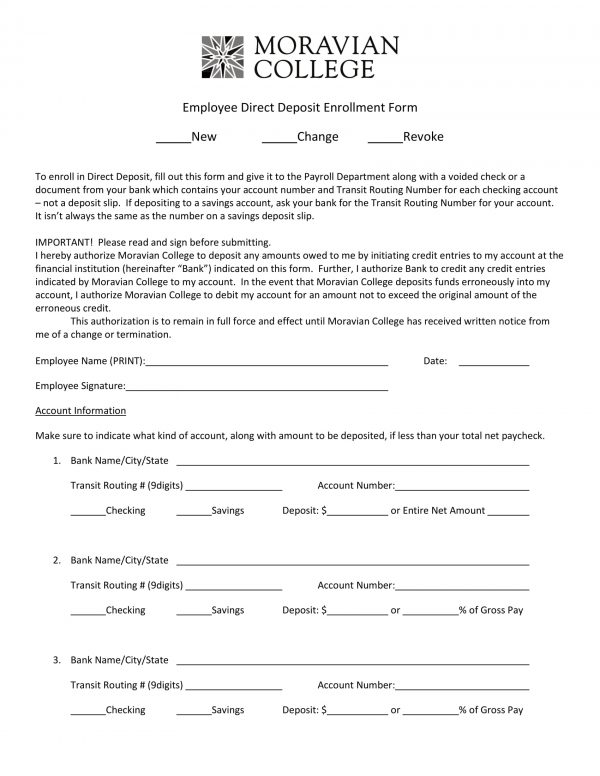

The name of the form must be stated on the topmost part along with the name of the company and its business address. This section is also known as the header of the document that can also be accompanied by the contact information of the company such as its fax and contact numbers.

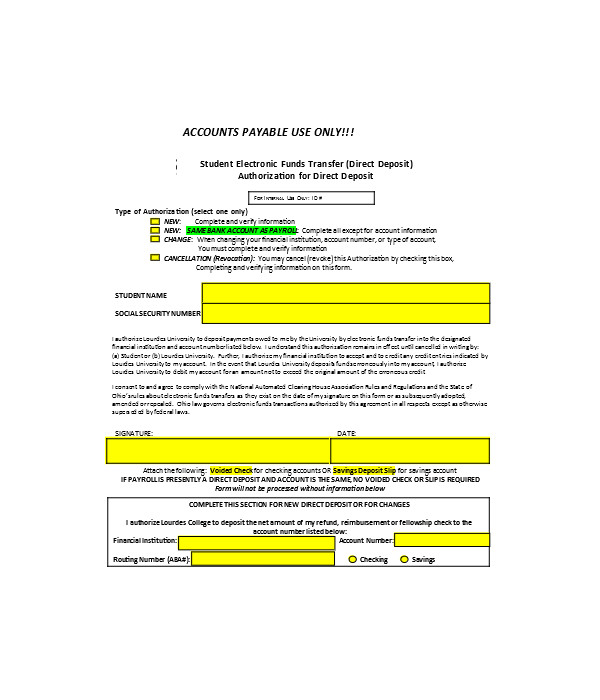

2. Have an account information section

The employee’s or the user’s account information is significant to be disclosed in the form since it will be used for identifying whose account will be revoked from the company’s direct deposit system. Fields to be created in this section should be able to cater the type of account that the user will be revoking whether it’s his savings or his joint accounts, the user’s account number, and the name of the financial institution wherein the account is registered or enrolled in. In addition to this, the amount that the user is expecting prior to the date of when the revocation will be executed can also be included in this section. you may also see Generic Direct Deposit Forms.

3. Incorporate a signature block

The signature block should be able to have the user’s signature and the date of when the form was submitted. However, if the user will be revoking or cancelling direct deposit procedure to a joint account owned by another individual or entity, then the other involved party must also affix his signature and date on the form.

Some companies also include agreements and acknowledgment statement forms as the last section of the form. These agreements center on certifying that the employee has disclosed data and information that are factual and accurate to his knowledge. Moreover, the agreement can also indicate the date of when the employee will no longer allow the company to use his account information for sending the salary to pay for his granted services.

Employee Direct Deposit Enrollment Revocation Form

When to Use a Direct Deposit Revocation Form?

The most common situation that calls for completing a direct deposit revocation form is when an employee will be opening a new account where his salary will be sent. With this, the details of the new account must be informed to the employer or the company in order for the employee to receive his payments in the current account that he will be using. However, some companies also prefer to use payroll change forms if the main concern of the employee is for his pay and salary information for an easier transaction.

Another situation wherein a direct deposit form can be used is when the employee will want to receive his salary physically and not online or through electronic banking. This choice of the employee is often accompanied by a request regarding the need for the company to conduct a bimonthly procedure for handing the salary amount to the employee in a sealed envelope or other preferred materials. Moreover, it will be up to the company if they will allow this request since it will demand an addition for their payroll process and will require them to assign a staff who will be managing the finances and sending the payment on the company’s payday.

Staff Direct Deposit Cancellation Revocation Form

General Direct Deposit Revocation Form

Benefits of Using Direct Deposit Revocation Forms

When a company is prepared with regards to the type of documents already on hand for whoever will be needing a specific form, it allows opportunities for benefits and advantages to be evident in its management. Enlisted below are some of the known benefits that companies will obtain when they will begin using direct deposit revocation forms for their staff, employees, and affiliated bank organizations:

1. Ensures updated account records

The revocation form also acts as an information form since it gathers all the recent data and details of the user or account holder. With this, any company will have an assurance that they are sending the salary amount to the right account and to the right person. Additionally, the form also has a contact information area that allows the company to call the account holder in certain situations wherein the account holder’s authorizations and approvals will be required to fulfill a transaction.

2. Serves as an effective communication tool

Direct deposit revocation forms also collect the reasons and the preferences of the user or the account holder which are all significant for promoting a better communication between the company and the employee. you may also see Deposit Form Samples.

3. Aids in strategizing for the company’s improvement

With the reasons and concerns of the employee, the company will be able to know what they must do in order to meet their employees’ needs as well as keep a smooth flowing transaction during their pay periods. you may also see Deposit Form Templates.

With the aforementioned benefits of using direct deposit revocation forms, companies will be able to decide whether or not they will create, prepare, and include the form as part of their essential payroll form documents or not. Nevertheless, the revocation form must only be provided to the employee or staff whose intentions and situations are suitable and will be addressed by using the form.

Related Posts

-

FREE 2+ Indemnity for Directors Short Forms in PDF

-

FREE 15+ Direct Deposit Enrollment Forms in MS Word | PDF | Excel

-

FREE 45+ Work From Home Forms in PDF | MS Word

-

FREE 23+ Employee Leave Request Forms in PDF | MS Word | XLS

-

FREE 53+ Human Resources Forms in PDF | MS Word | Excel

-

FREE 5+ Recruiter Performance Review Forms in PDF | MS Word

-

FREE 7+ Payroll Adjustment Forms in MS Word | PDF | Excel

-

FREE 3+ HR Employee Concern Forms in PDF

-

FREE 6+ Telephone Reference Check Forms in PDF | MS Word

-

FREE 3+ Consultant Bio-Data Forms in PDF | MS Word

-

FREE 7+ Compensation and Benefits Forms in PDF

-

FREE 10+ Reduced Fee Enrollment Application Forms in PDF | MS Word

-

FREE 10+ Name Address Change Forms in PDF | MS Word

-

FREE 11+ Confidential Evaluation Forms in PDF | MS Word

-

FREE 6+ Recruitment Process Timeline Samples in PDF