A Certificate of Liability Insurance Form is a crucial document for businesses, acting as proof of insurance coverage to protect against potential liabilities. This guide provides a detailed overview of how to properly fill out and understand the Certificate Form and Insurance Quote Form. We’ll walk you through each section with examples, ensuring you know exactly what information is required and how to verify the details provided by your insurer. Whether you’re a small business owner, contractor, or event organizer, this form is your gateway to demonstrating responsible management and compliance with legal requirements in your industry.

Download Certificate of Liability Insurance Form

What is Certificate of Liability Insurance Form?

A Certificate of Liability Insurance Form is a document provided by an insurance company that summarizes the coverage held by an individual or business. It lists the types of coverages, policy numbers, insurance limits, and the policy’s effective and expiration dates. This form serves as proof that the policyholder has adequate insurance to cover third-party liability claims, making it essential for contractual agreements, compliance with industry standards, and safeguarding against financial loss.

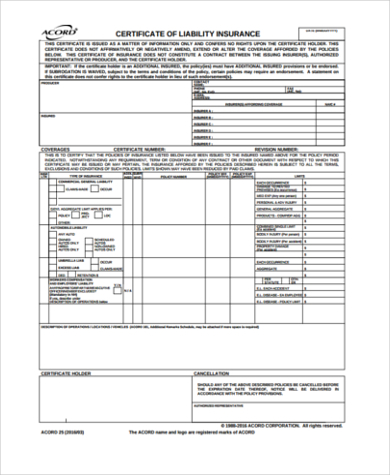

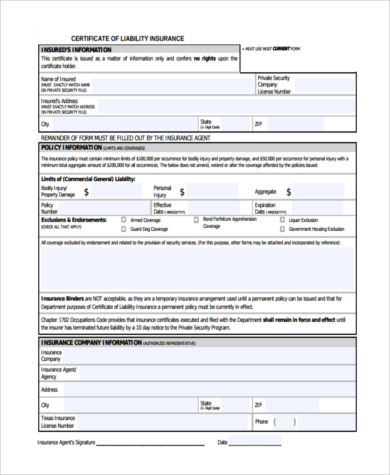

Certificate of Liability Insurance Format

Insurance Information:

- Policy Number:

- Insurance Company:

- Effective Date:

- Expiry Date:

Policyholder Information:

- Policyholder Name:

- Address:

- Contact Information:

Coverage Details:

- General Aggregate Limit:

- Each Occurrence Limit:

- Personal and Advertising Injury:

- Products – Completed Operations:

- Property Damage:

Certificate Holder:

- Name:

- Address:

- Contact Information:

Signature:

- Authorized Representative:

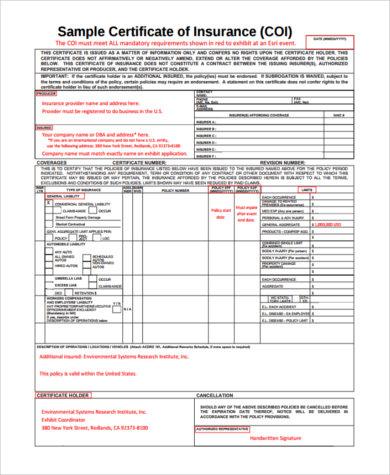

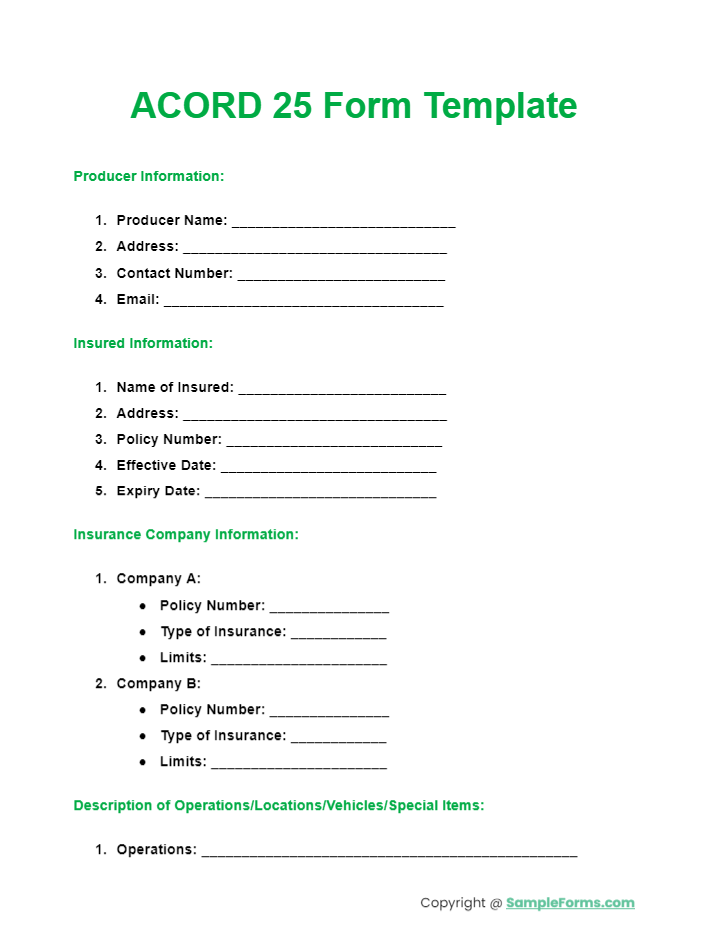

ACORD 25 Form Template

Utilize the ACORD 25 Form Template to streamline your Health Insurance Form submissions, ensuring all pertinent liability coverage details are comprehensively documented and easy to access.

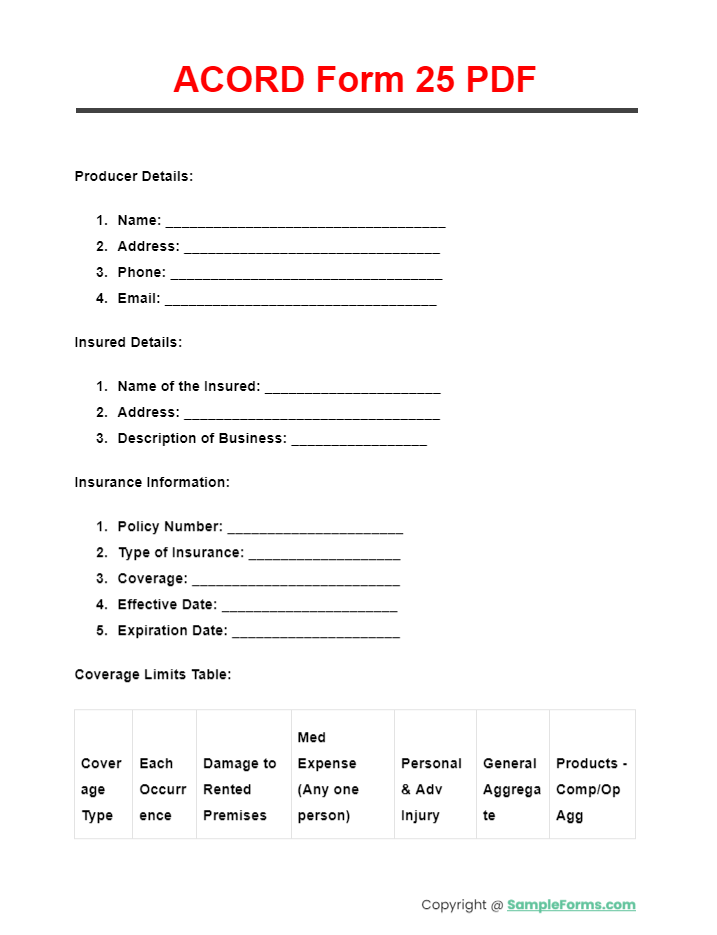

ACORD Form 25 PDF

Download the ACORD Form 25 PDF to securely handle your Insurance Claim Form, providing proof of liability insurance quickly and efficiently in a universally accessible format.

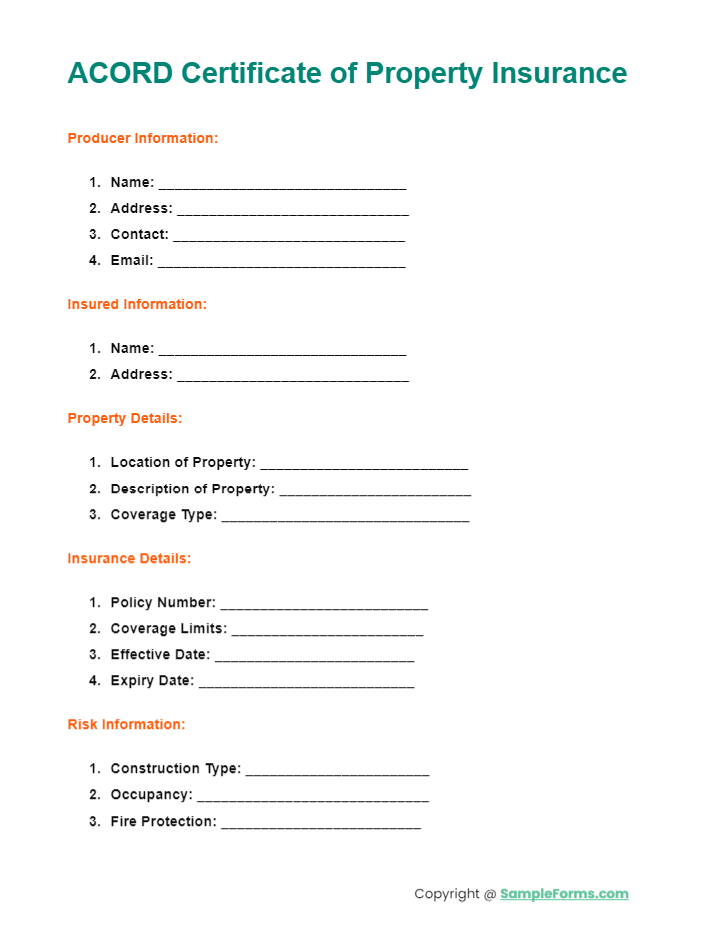

ACORD Certificate of Property Insurance

The ACORD Certificate of Property Insurance is essential when submitting a Travel Insurance Claim Form, offering clear documentation of coverage specifics and limits for property-related incidents.

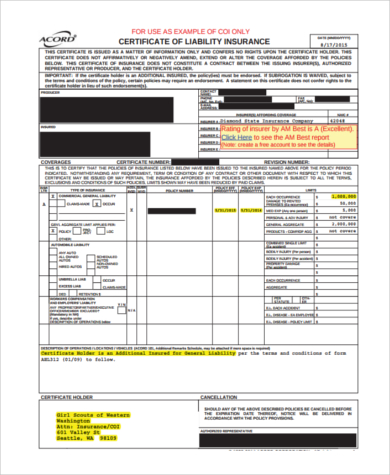

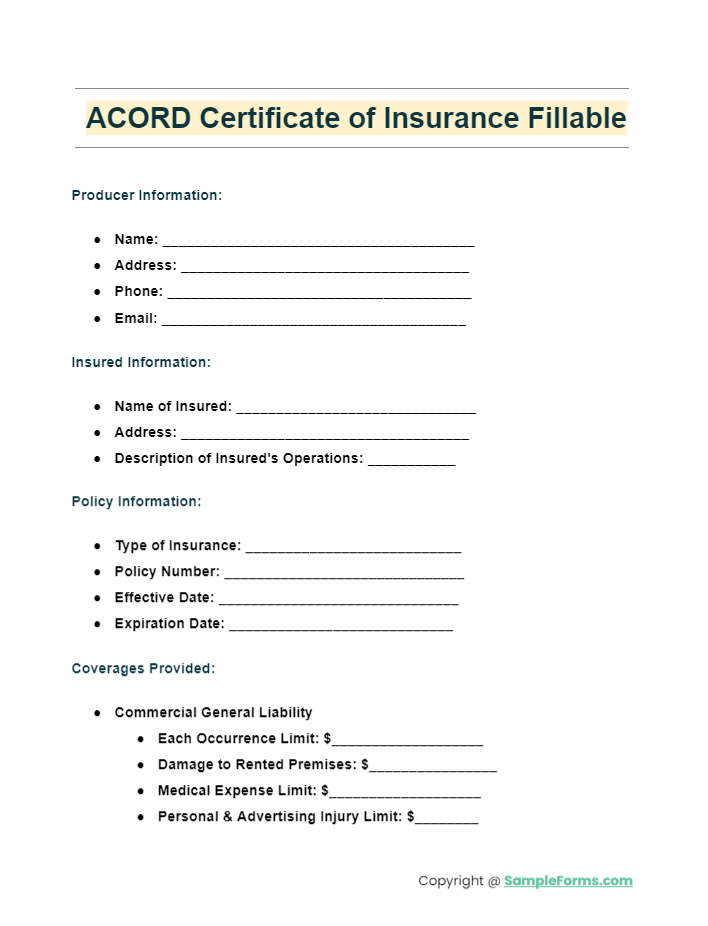

ACORD Certificate of Insurance Fillable

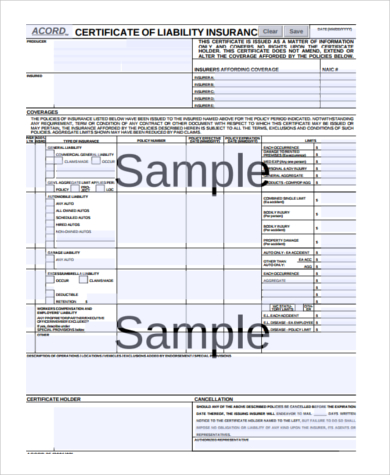

More Certificate of Liability Insurance Form Samples

Blank Certificate of Liability Insurance Form

Certificate of Liability Insurance Sample Form

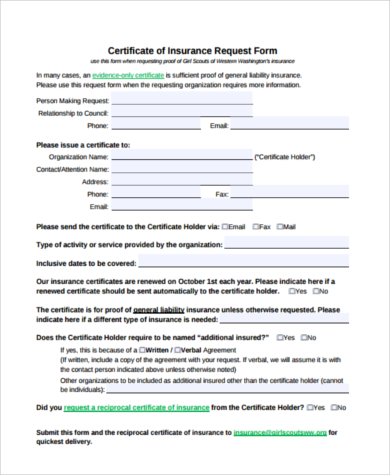

Certificate of Liability Insurance Request Form

Certificate of General Liability Insurance Form

Certificate of Liability Insurance Form Free

Sample Acord Certificate of Liability Insurance Form

Certificate of Liability Insurance Form in PDF

How to Get ACORD Insurance Certificate

To secure an ACORD insurance certificate, streamline the verification process with an Insurance Verification Form.

- Contact your insurance provider to request the form.

- Provide necessary details about your business and coverage needs.

- Review the form for accuracy once received.

- Obtain signatures from your insurer or agent.

How Do I Generate a Certificate of Insurance?

Generating a certificate of insurance involves using an Insurance Transfer Form to document the coverage transition.

- Log in to your insurer’s online portal.

- Select the option to generate a certificate.

- Input the required coverage details.

- Submit the form and download the certificate.

Why Would Someone Ask for a Certificate of Insurance?

A certificate of insurance is often requested to confirm coverage and mitigate risk, typically involving a Health Insurance Quote Form.

- Verify the other party’s insurance requirements.

- Provide your insurance details to demonstrate compliance.

- Submit the certificate as proof of insurance.

- Update the certificate as needed to maintain its validity. You also browse our Physical Certificate Form

Why Does a Company Need a Certificate of Insurance?

>

Companies require a certificate of insurance to safeguard against claims, facilitated by a Health Insurance Claim Form.

- Determine the scope of necessary insurance coverage.

- Acquire a certificate from your insurer showing valid coverage.

- Provide this certificate to stakeholders to prove risk management.

- Keep the certificate updated according to contractual obligations. You also browse our Liability Release Form

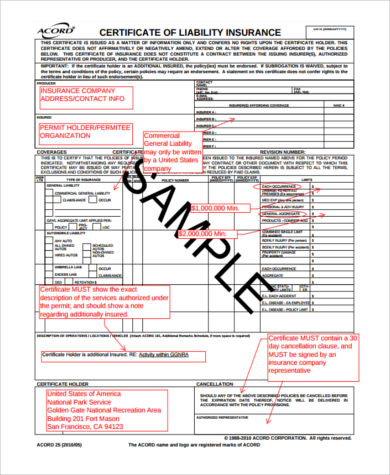

What Are the Four Types of Details Required for the Certificate of Insurance?

A certificate of insurance must include detailed information, akin to filling out an Insurance Waiver Form.

- Policyholder’s name and address.

- Description of coverage including limits and effective dates.

- Insurer’s name and contact details.

- Any endorsements or additional insureds. You also browse our Public Liability Form

Why Do Insurance Companies Use ACORD Forms?

Insurance companies use ACORD forms to standardize data collection and ensure accuracy, similar to a Dental Insurance Verification Form.

- Choose the appropriate ACORD form for the specific insurance transaction.

- Fill out the form using standardized data fields.

- Use these forms to maintain consistency across client interactions.

- Facilitate quicker processing and fewer errors in documentation. You also browse our DMV Release of Liability Form

Is Certificate of Insurance the Same as Liability Insurance?

A certificate of insurance is a document proving coverage that includes, but is not limited to, Liability Insurance Form.

- Understand that the certificate itself is not insurance but a representation of it.

- It should list all types of coverage including liability insurance.

- Use the certificate to prove insurance to third parties.

- Ensure the actual insurance policy backs up the details on the certificate. You also browse our Equipment Liability Form

Tips to Consider in Certificate Liability Insurance Forms

- Consider your type of business. How the business operates will be a variable on the coverage and the limitations of the insurance policy.

- Choose your agent well. Not all insurance companies present quality benefits; therefore, make sure you are working with a company that knows what is best for you. You may also view their company rating to distinguish whether they deserve you or not.

- The form doesn’t insure everything. It is stated in the first tip that there are limitations; therefore, even though you and your client are covered by the certificate, it does not mean that you are fully liable. An example for this is the medical expenses that should contain conditions as to when you are going to be liable for accidents.

- It’s the company that will rule. If the company sees any faults with the insurance policies, they will likely send you a letter of notification that they may cancel your certificate. Remember that it’s still the insurance company that will lay down the final policies for the form.

We know the importance of a Certificate Liability Insurance Form for a professional individual like you, which is why we will gladly aid you with our downloadable templates. You also browse our Waiver of Liability Form

Importance of a Certificate of Liability Insurance Form

Clients often ask for a proof of insurance before signing a contract with you just to make sure that you are a reliable individual. One significance is that the certificate shows all the vital details in an insurance policy, which helps in facilitating effective communication with the client. Another positive aspect of the certificate is that it is a one-page document which will certainly not take up much of your meeting time. Lastly, clients can be a part of the insurance. Though not always the case, some clients will ask you to allow them to note the “additionally insured” status wherein they may have a bit of the benefits associated with the insurance certificate. You also browse our Release of Liability Form

Vital Keys for a Certificate of Liability Insurance Form

- Insurance Company Name and Your Details: Make sure that you do not skip this portion since this is where the two parties are being introduced in the certificate.

- Policy Limits and Insurance Coverage: This will state the medical expense coverage, completed product coverage, and all the limitations associated with it.

- Certificate Expiration: The date of expiration assures the clients that they are not engaged in any illegal business transaction. Hence, do make sure that your certificate is up to date. You also browse our Liability Waiver Form

Is Certificate of Liability the Same as Certificate of Insurance?

No, a Certificate of Liability is a specific type of Certificate of Insurance, focusing solely on liability coverage detailed in the Business Insurance Form.

Are Certificates of Insurance Legal Documents?

Yes, certificates of insurance are legal documents that verify coverage and fulfill contract requirements as outlined in the Insurance Proposal Form.

How Long Do You Have to Keep a Certificate of Insurance?

It’s advisable to keep certificates of insurance for a minimum of five years, as they may need to be referenced in future Insurance Assessment Form evaluations.

Does Certificate of Liability Insurance Expire?

Yes, like the policy it represents, a Certificate of Liability Insurance expires when the underlying policy does, often tracked via an Auto Insurance Verification Form.

Is a Certificate of Insurance a Contract?

A Certificate of Insurance is not a contract but serves as proof of insurance coverage, supporting contractual obligations as highlighted in the Liability Insurance Form.

Are Certificates of Insurance Confidential?

Certificates of insurance are generally not confidential and may be shared with interested parties to confirm coverage, as often requested through Insurance Customer Feedback.

Are Certificates of Insurance Legal Documents?

Yes, certificates of insurance serve as legal documents that provide proof of insurance to third parties, essential for processing Insurance Complaint Form issues.

Our comprehensive guide offers everything you need to understand and utilize the Certificate of Liability Insurance Form effectively. This essential document acts as a Third-Party Liability Form, ensuring that all parties are aware of the insurance protections in place, facilitating smoother business operations and compliance with legal obligations.

Related Posts Here

-

Contract Addendum Form

-

FREE 37+ Sample Claim Forms in PDF | Excel | MS Word

-

Report Form

-

FREE 49+ Budget Forms in PDF | MS Word | Excel

-

Profile Form

-

Menu Form

-

Event Planner Form

-

FREE 16+ Ticket Order Forms in PDF | MS Word | Excel

-

Employee Dress Code Policy Form

-

Rental History Form

-

Advertising Contract Form

-

Service Agreement Form

-

Income Statement Form

-

Accident Statement Form

-

Performance Review Form