The process of a verification can go through an informal manner or through a formal manner. The informal way can be distinguished from the formal approach of a verification when there is an absence of the verification form. This type of form is always present in the formal process of a verification.

A verification process can be applied to a number of conditions and aspects. An example would be the verification of an individual’s insurance. There are a number of advantages associated with this process. Information that is relevant to the process are recorded in an insurance verification form which is then submitted to the insurance company.

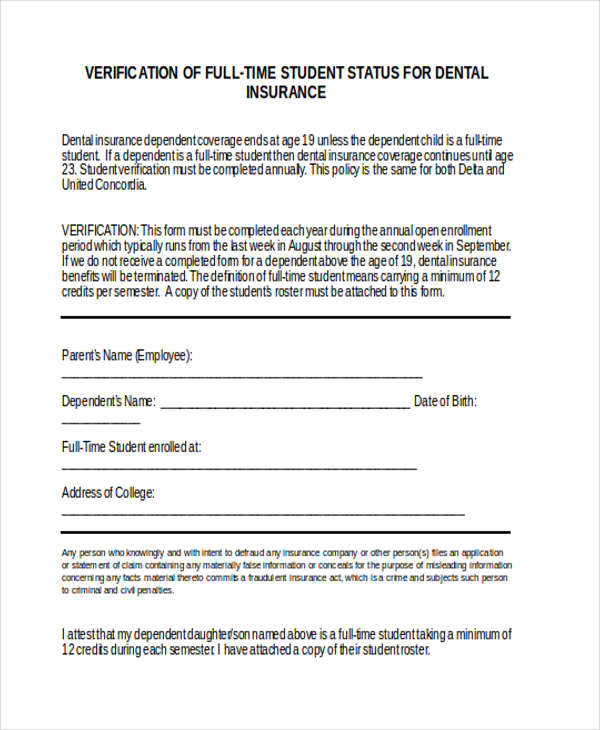

Dental Insurance Verification Form samples

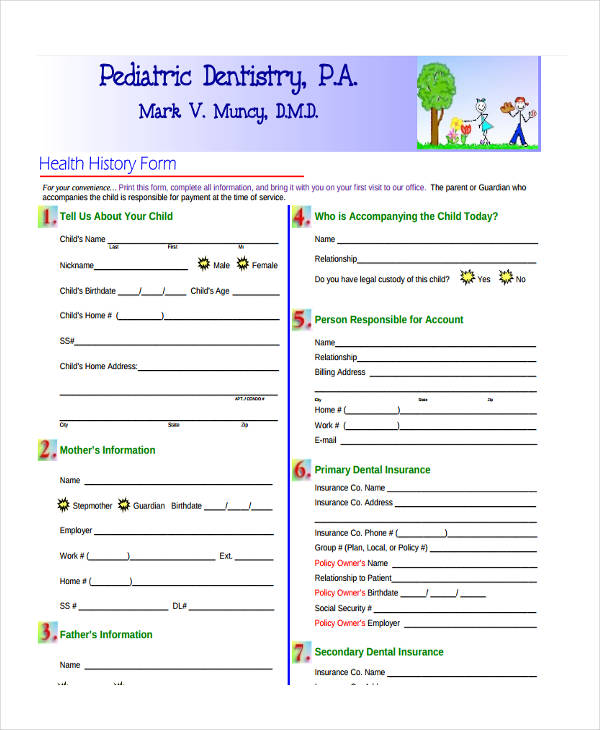

Paediatric Dental Insurance Form

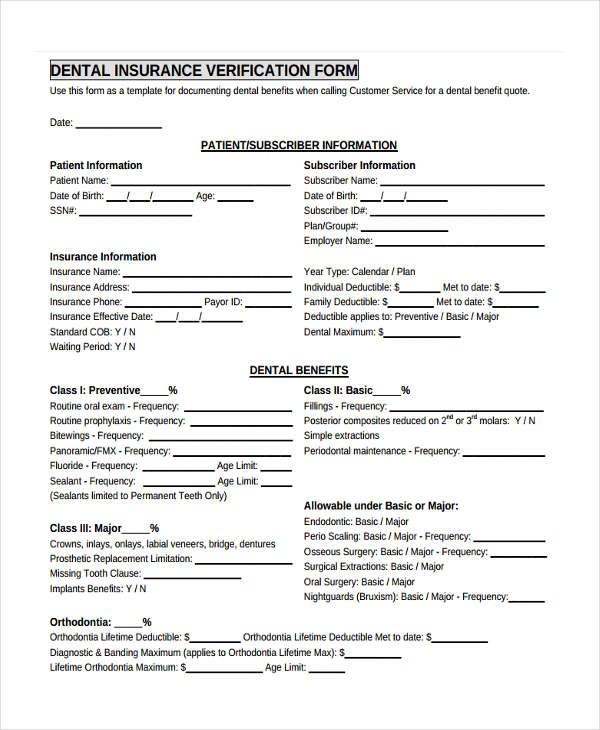

Dental Insurance Verification

Dental Insurance Plan Verification Form

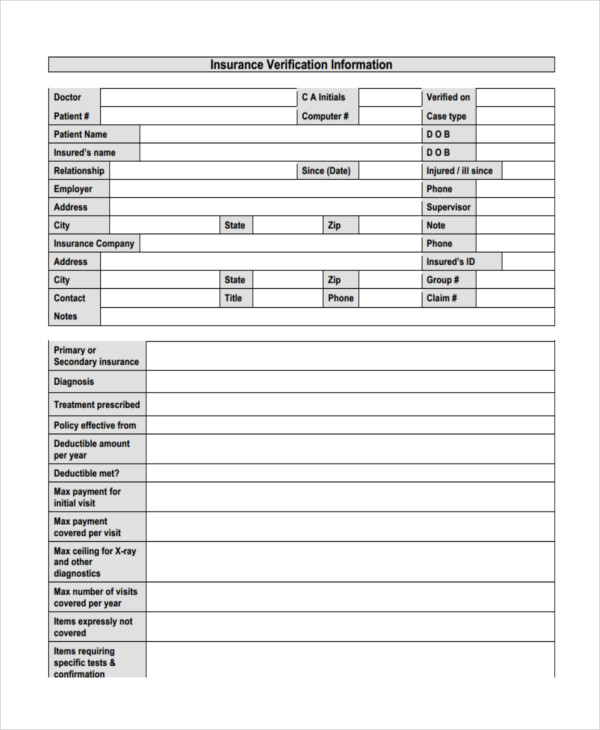

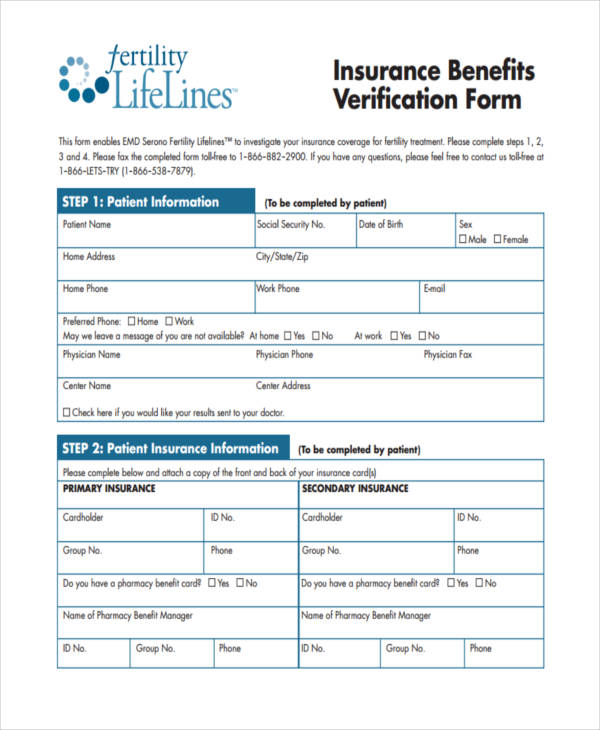

Medical Insurance Verification Forms

Medical Insurance Verification

Medical Insurance Benefit Verification Form

What Is an Insurance Verification Form?

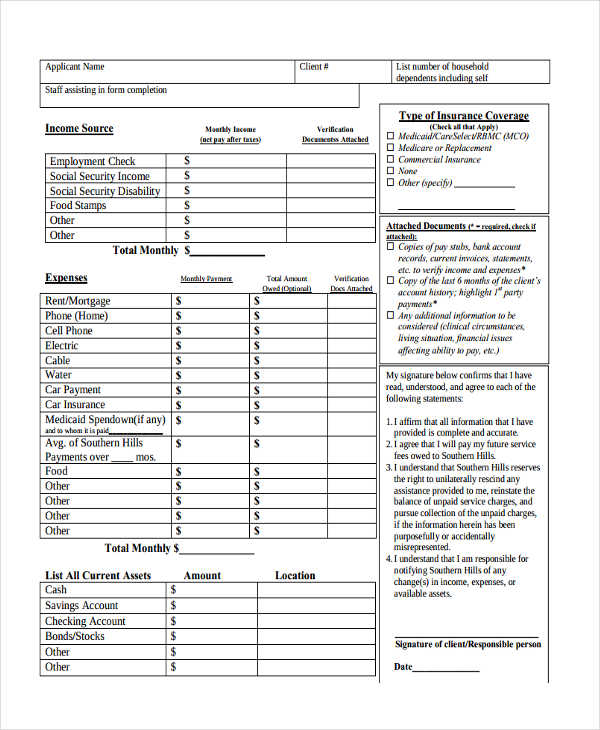

A verification form is a type of document that contains items that help assess the information that is needed to be authorized and checked. For example, a document that is based on sample income verification forms would contain items that are inclined to assess factors of an individual’s income.

Another verification form is an insurance verification form which has content that is directed towards different policies within an insurance plan. The main factor being checked in this type of verification form is the extent of coverage that is has. This process only applies to individuals who have applied for any kind of insurance plan.

What Is an Insurance Verification Specialist?

The process of an insurance verification can entail a number of steps and a seemingly complicated procedure which can be overwhelming process for an inexperienced individual to do on his or her own. There is hope to that problem since the individual in question can seek the assistance of an insurance verification specialist.

Instead of handling documents that are formulated after sample employment verification forms, the insurance verification specialist is delegated with the responsibility of ensuring the individual’s insurance plan has a wide coverage over what needs to be financially covered. The specialist can be considered as a mediator between the individual and his or her insurance company.

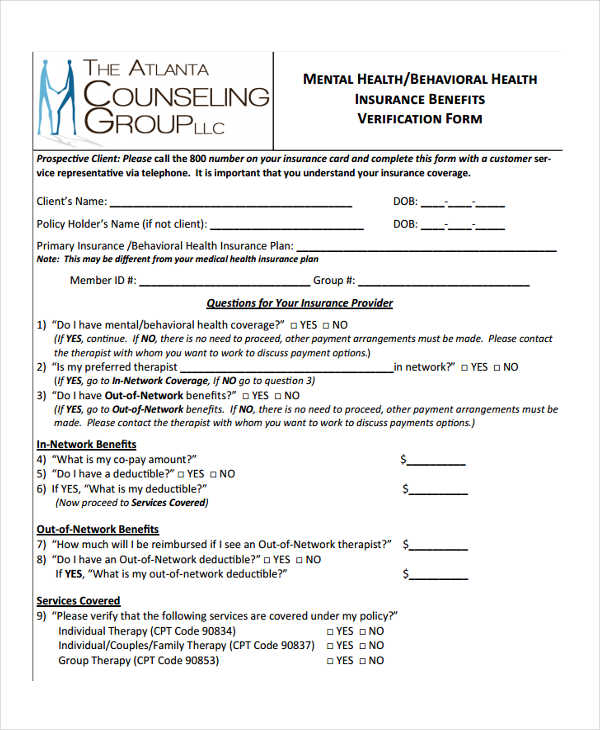

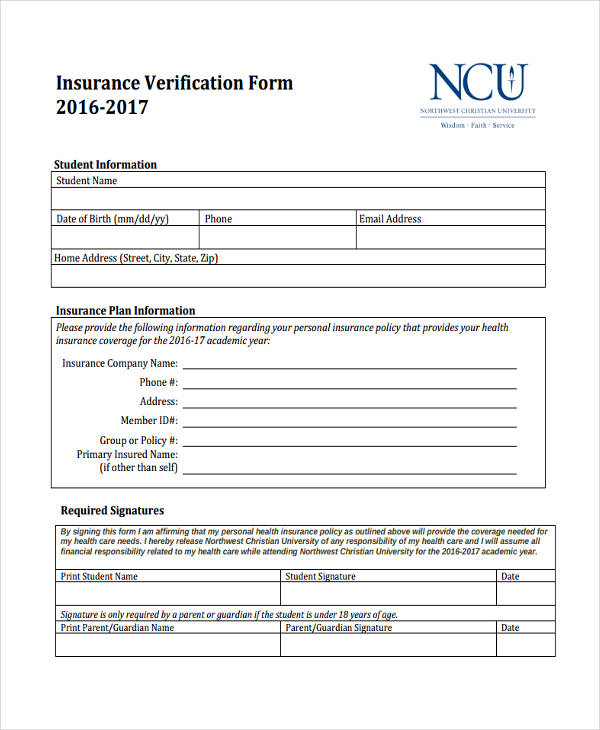

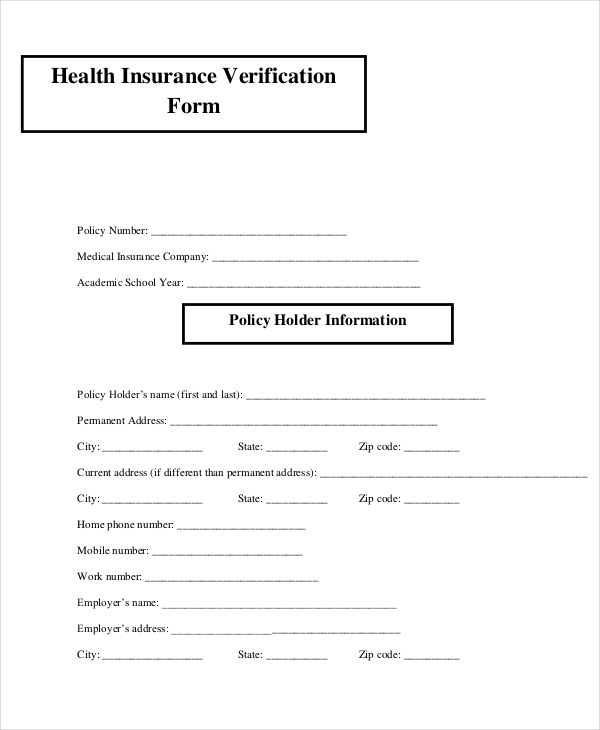

Health Insurance Verification Forms

Mental Health Insurance Benefits Form

Home Health Insurance Verification

Health Insurance Verification Form

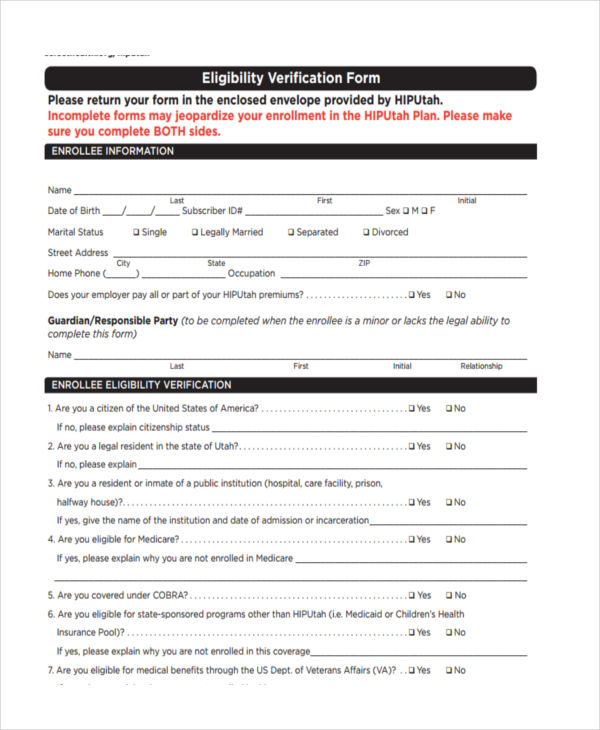

Insurance Eligibility Verification Forms

Dental Insurance Eligibility Verification Form

Medical Insurance Eligibility Verification Form

What Is the Difference Between an Insurance Authorization and Insurance Verification?

The terms insurance authorization and insurance verification may have their meaning interchanged by people or may be seen as the same process by ordinary individuals. It may seem so but both processes have their differences that make them distinguishable from one another.

In terms of insurance authorization, it is a type of process that has been utilized by a number of medical insurance companies in order to know if their respective insurance company will be able to give financial aid to a particular medical procedure, service, or medication that was prescribed by the individual’s health care provider.

The insurance authorization process is known to be an efficient practice within the medical insurance company because it can act as a safety measure as well as a method to save costs. Physicians have been known to have a negative perception of the process since it can accumulate a large amount of costs and take a lot of time in order to complete the whole process.

The insurance authorization process is more likely to be used by the insurance company themselves rather than the individual who has successfully applied for the insurance plan.

The insurance verification process starts off when an individual is in need to verify his or her health insurance, an insurance verification specialist is contacted and hired in order to help in completing the verification process. The specialist is the one who provides the document that is appropriate for the type of insurance being verified like forms of landlord verification form samples for example.

When the insurance verification form has been completed and fully checked, the specialist contacts the insurance company to confirm the verified content of the insurance plan and if there other inconsistencies within the insurance policies or if there are additional conditions to be considered in the financial coverage that the individual needs.

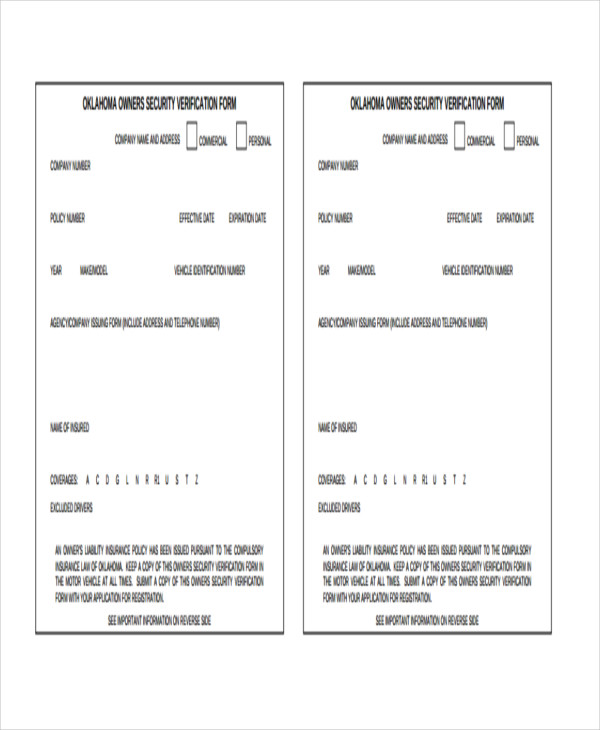

Insurance Security Verification Forms

Insurance Security Verification

Insurance Social Security Verification Form

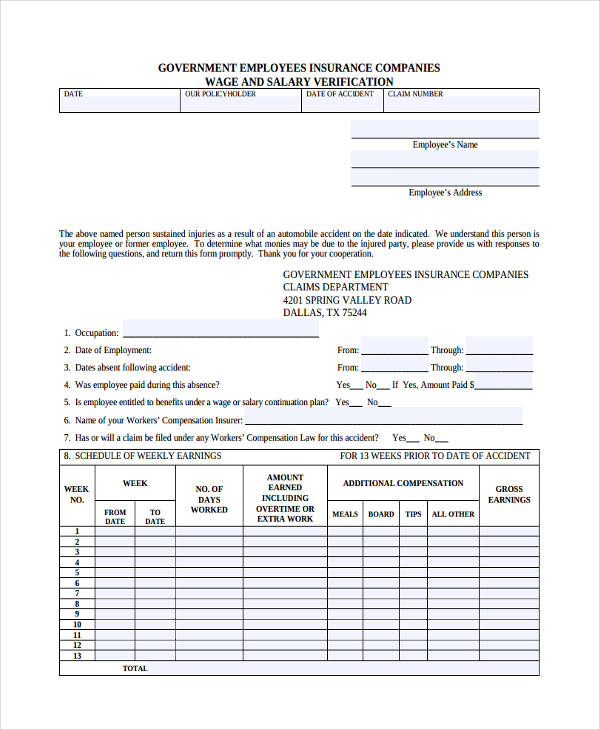

Insurance Wage Verification Form

Insurance Wage Verification Report Form

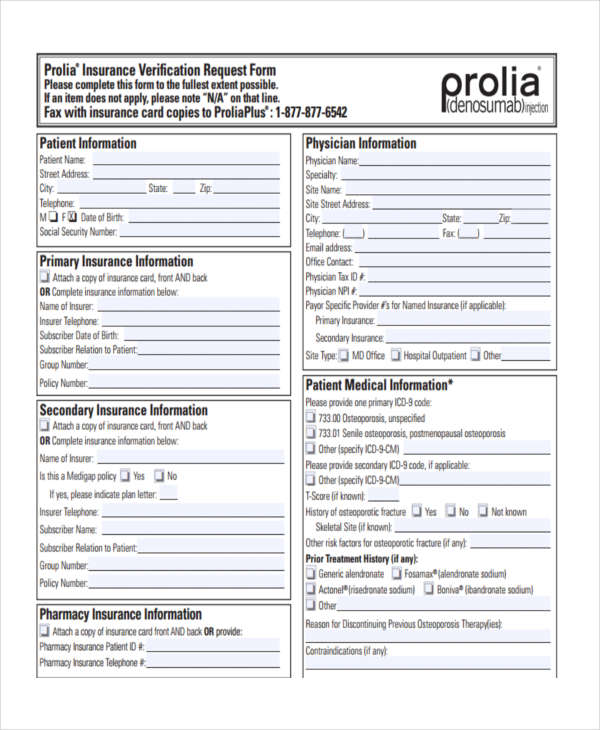

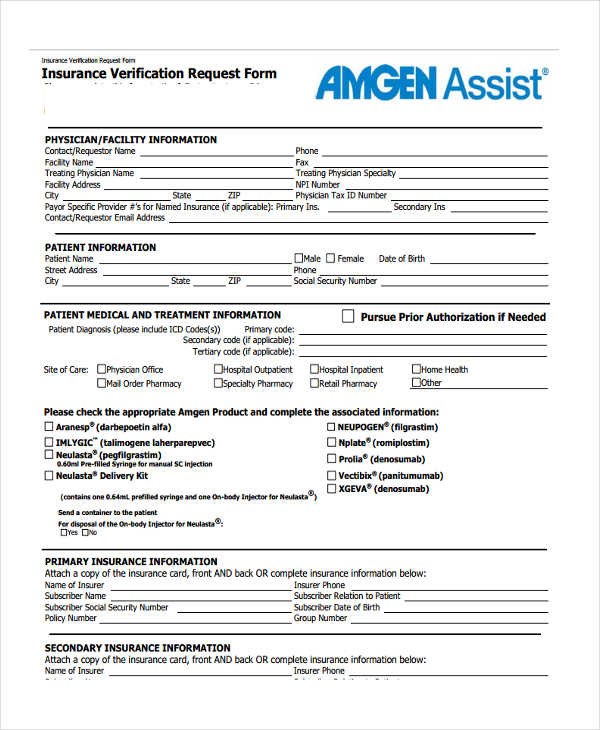

Insurance Verification Request Form

Prolia Insurance Verification Request Form

Assist Insurance Verification Request Form

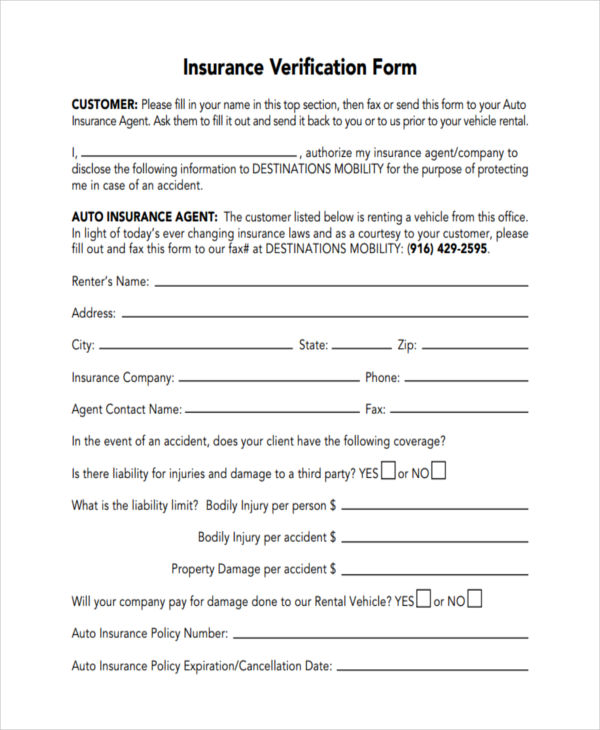

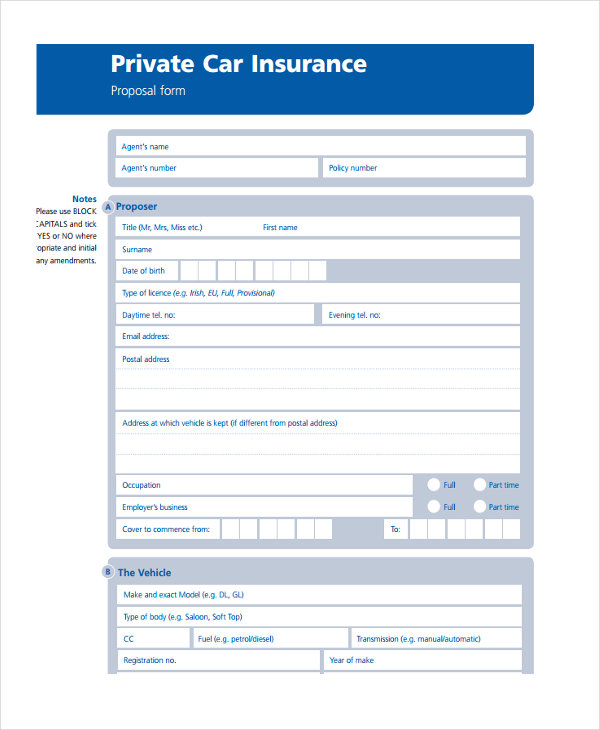

Auto Insurance Form Sample

Blank Auto Insurance Verification

How to Do Insurance Verification

The important step for the individual or specialist to take in order to complete the insurance verification process is completion of the insurance verification form. When the document is formulated after sample tenant verification forms, the landlord and the tenant in question provide the necessary information that is relevant to the items in the tenant verification form.

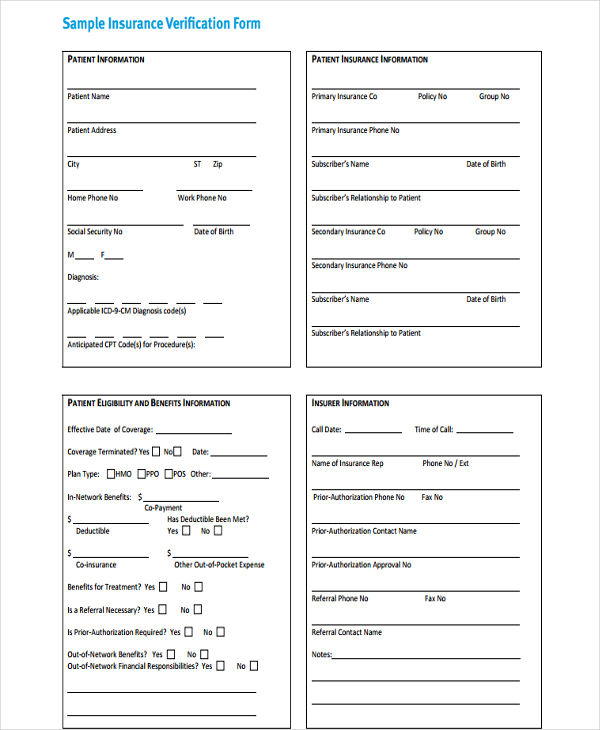

If the insurance verification specialist is tasked with verifying an individual’s medical insurance, the information that he or she must gather and evaluate is the patient’s personal information, government numbers, the patient’s insurance information, the patient’s eligibility and benefits information, and the insurer’s information.

How to Verify Health Insurance

The insurance verification process and verification process such as the sample tenant verification forms can possibly be accomplished by the individual without the assistance of an insurance verification specialist. This can be done if the following steps are done.

In the field of health insurance, the verification process is done when the appropriate health care records are collected which follows tracking the updates that have occurred recently. The individual can call his or her insurance company and inform them of any clarifications to be done and if he or she has found inconsistencies between the insurance policies and the aspects that need to be taken cared of financially.

Patient Insurance Verification Form

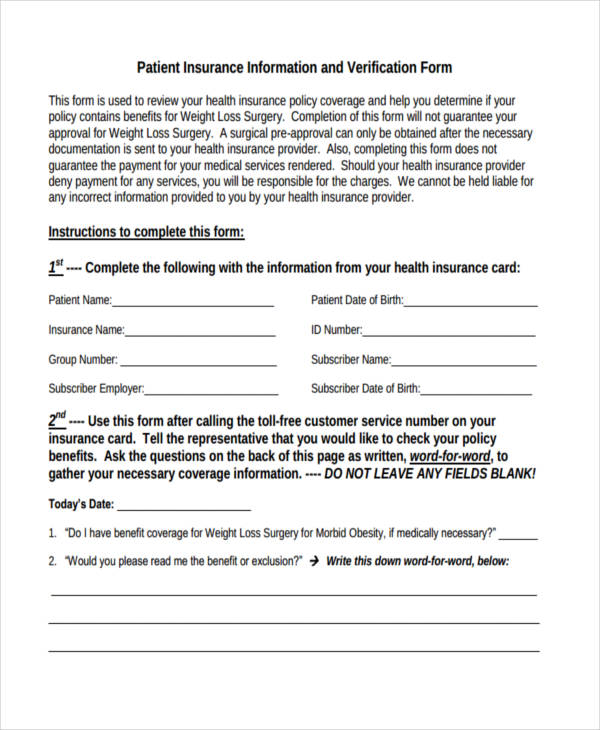

Patient Insurance Information and Verification Form

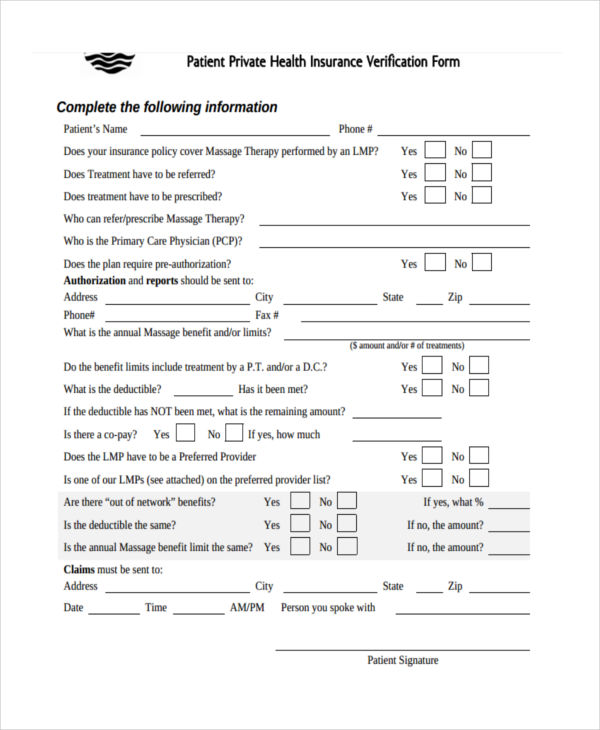

Patient Private Health Insurance Verification

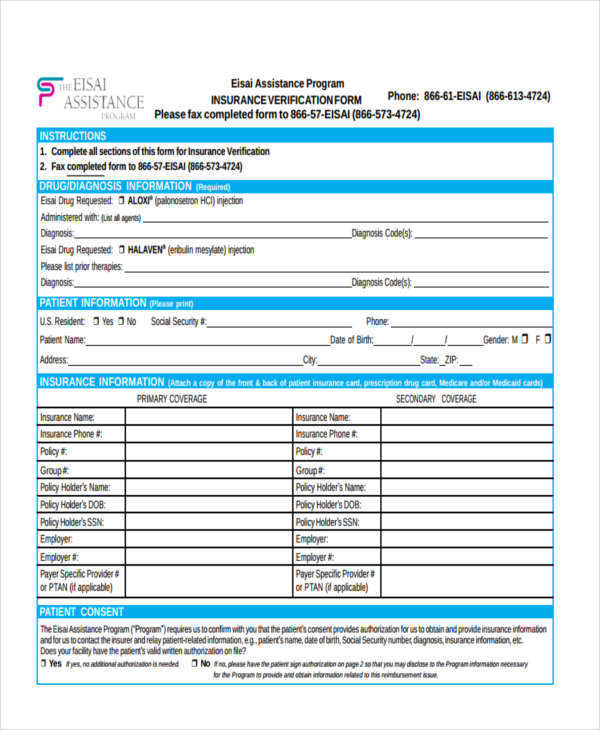

Patient Insurance Assistance Program Verification Form

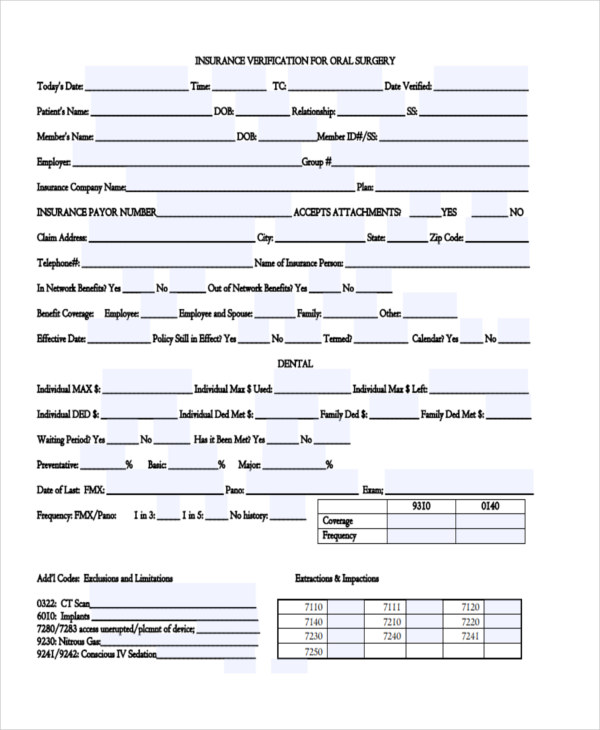

Surgery Insurance Verification Forms

Oral Surgery Insurance Verification Form

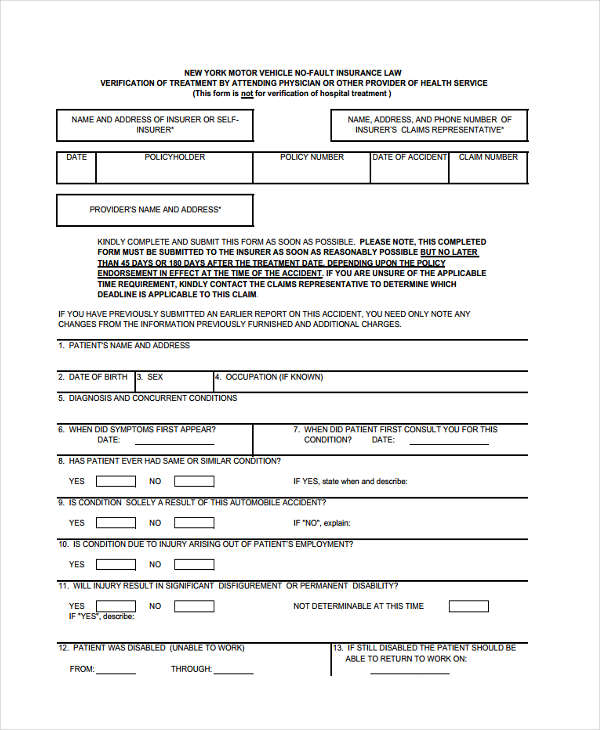

Vehicle Insurance Verification Form

Blank Vehicle No-Fault Insurance Verification

Sample Vehicle Insurance Form

How to Do Medical Insurance Verification

Verification forms such as documents that were based from employee verification form samples can be completed by the individual if he or she is up for the task and challenges it entails. However, the assistance of an insurance verification specialist and the health care provider can make the entire insurance verification process much better for the individual and lift a great burden off their shoulders.

The appointed insurance verification specialist or health care provider starts the insurance verification process by gathering the individual’s health records. The required health records are expected to contain the most up-to-date and most accurate information.

The medical services, procedures, and treatments given to the patient are recorded as well in order to show the medical insurance company what needs to be financially covered by their company. Both of these factors are compared, assessed, and verified before the specialist and provider contacts the medical insurance company.

The individual’s identification card and health insurance card is also asked for the purpose of this process. When the insurance company has been contacted, they should be able to confirm the coverage that the patient or individual needs. The benefits associated with the insurance plan is also clarified by the medical insurance company.

Related Posts

-

What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]

-

Dental Insurance Verification Form

-

Enrollment Verification Form

-

Bank Verification Form

-

What Is a Payroll Verification Form? [ Definition, Importance, Samples ]

-

Notary Verification Form

-

Tenant Employment Verification Form

-

What Is a Volunteer Verification Form? [ Definition, Types, Importance ]

-

What Is a Residential Verification? [ Types, Importance, Samples ]

-

Verification Certificate Form

-

What Is a Training Verification Form? [ Definition, Uses, Significance ]

-

What Is a Shelter Verification Form? [ Types, Tips, Samples ]

-

What Is a Service Verification Form? [ Uses, Samples ]

-

What Is an Identification Verification? [ Definition, Uses, Importance, Inclusions ]

-

FREE 9+ Sample Loan Confirmation Forms in PDF