The Waiver Form plays a vital role in modern real estate and mortgage processes. An Appraisal Form typically requires a detailed property evaluation; however, an Appraisal Waiver Form allows borrowers to bypass this requirement under specific conditions. This form simplifies the loan process, reducing delays and costs, and is especially useful for qualified applicants with low-risk financial profiles. Our guide explores examples, uses, and how to complete this form to maximize its benefits. Whether you’re a first-time homebuyer or a seasoned investor, understanding this form is key to a smoother real estate journey.

Download Appraisal Waiver Form Bundle

What is Appraisal Waiver Form?

An Appraisal Waiver Form is a document that allows lenders to approve a mortgage without requiring a formal property appraisal. It streamlines the loan process by reducing time and costs for eligible borrowers. This waiver is typically offered to low-risk applicants based on financial stability and property data. It helps ensure faster transactions without compromising lending standards.

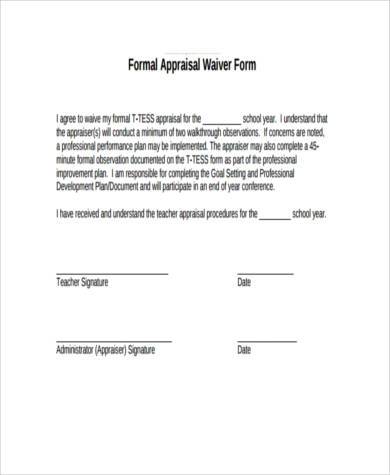

Appraisal Waiver Format

Applicant Information

Name: __________________________

Address: __________________________

Contact Number: __________________________

Email Address: __________________________

Property Details

Property Address: __________________________

Property Type: __________________________

Loan Number (if applicable): __________________________

Waiver Acknowledgment

- Reason for Waiver Request:

- Acknowledgment of Appraisal Waiver Risks:

- Borrower’s Initials for Agreement:

Authorization

Borrower’s Name: __________________________

Signature: __________________________

Date: __________________________

Witness or Notary Information

Name: __________________________

Signature: __________________________

Date: __________________________

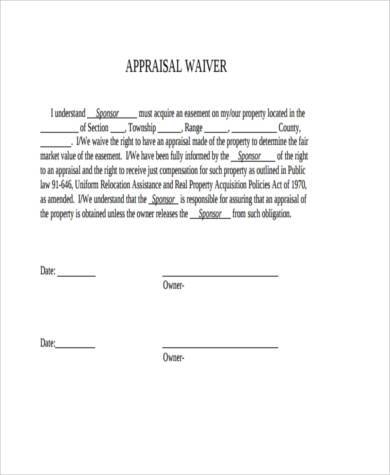

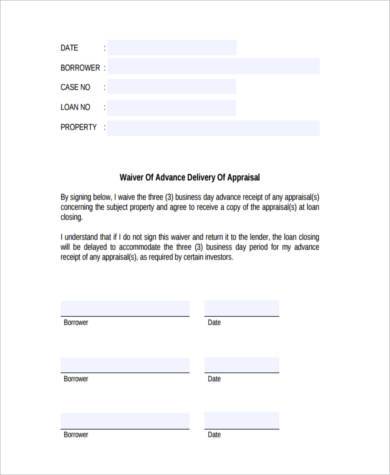

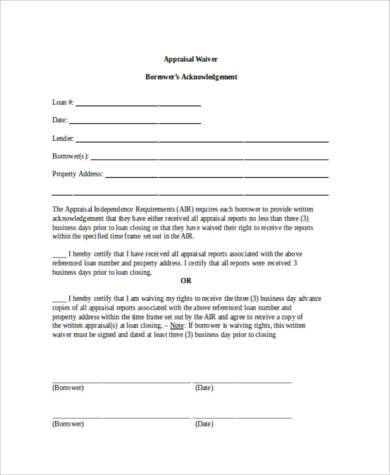

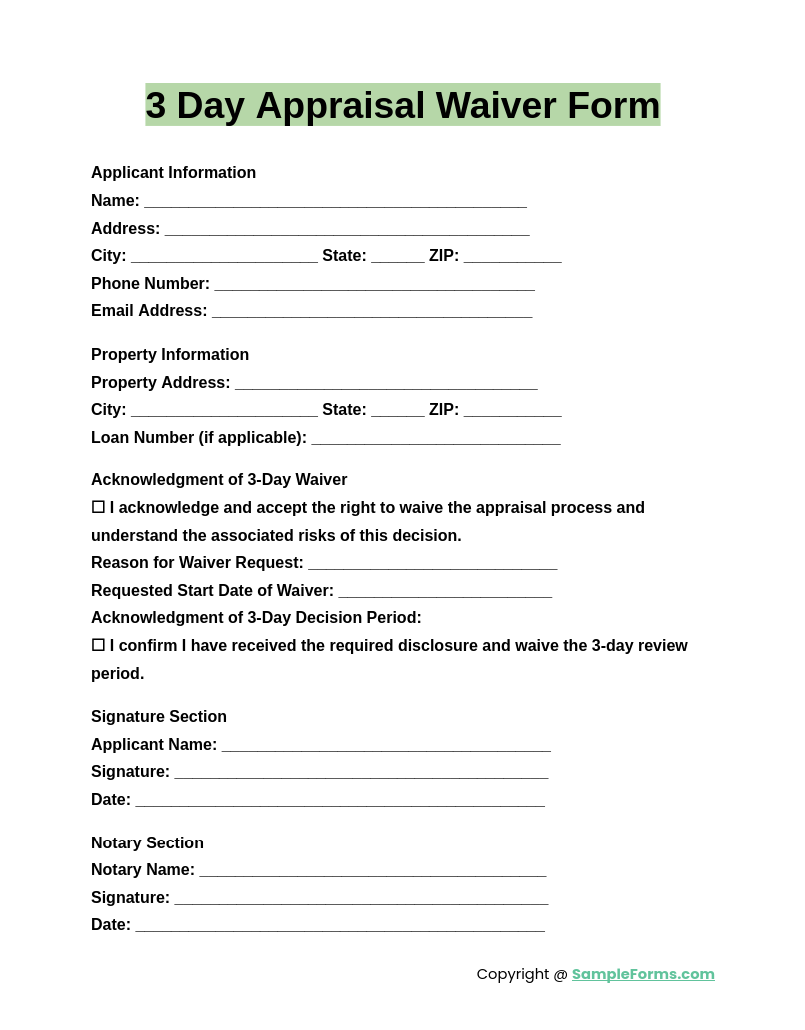

3 Day Appraisal Waiver Form

A 3 Day Appraisal Waiver Form allows borrowers to waive their appraisal rights during a three-day notice period. Similar to a Liability Waiver Form, it streamlines transactions, reducing delays and expediting approvals in time-sensitive situations.

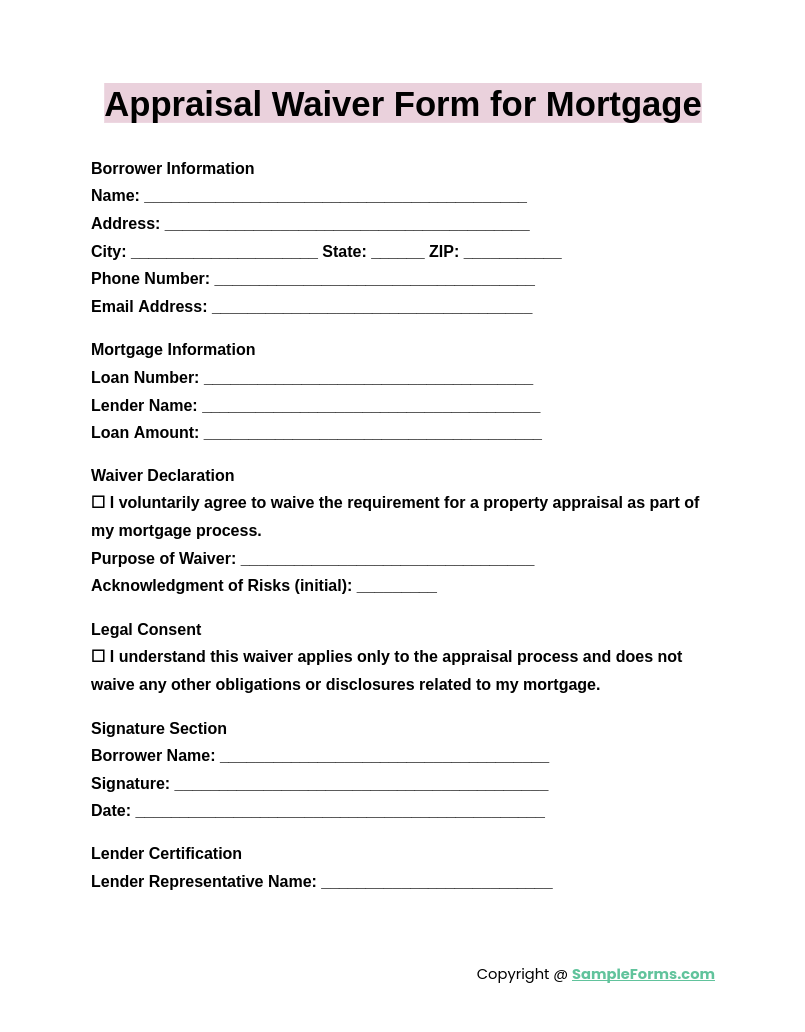

Appraisal Waiver Form for Mortgage

An Appraisal Waiver Form for Mortgage simplifies the lending process by eliminating the need for property appraisals. Much like a Basketball Waiver Form, it ensures transparency, outlining borrower consent and lender requirements for smoother mortgage approvals.

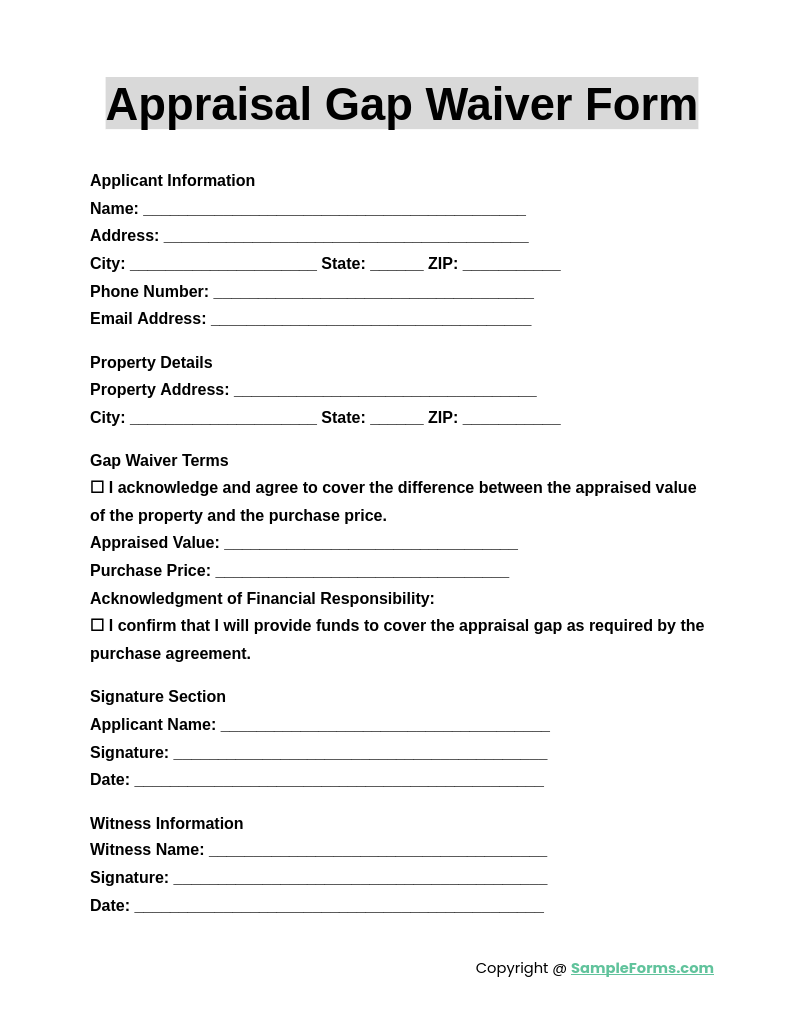

Appraisal Gap Waiver Form

The Appraisal Gap Waiver Form helps address differences between the purchase price and appraised value of a property. Comparable to a Medical Waiver Form, it safeguards parties by documenting mutual agreements and reducing financial disputes.

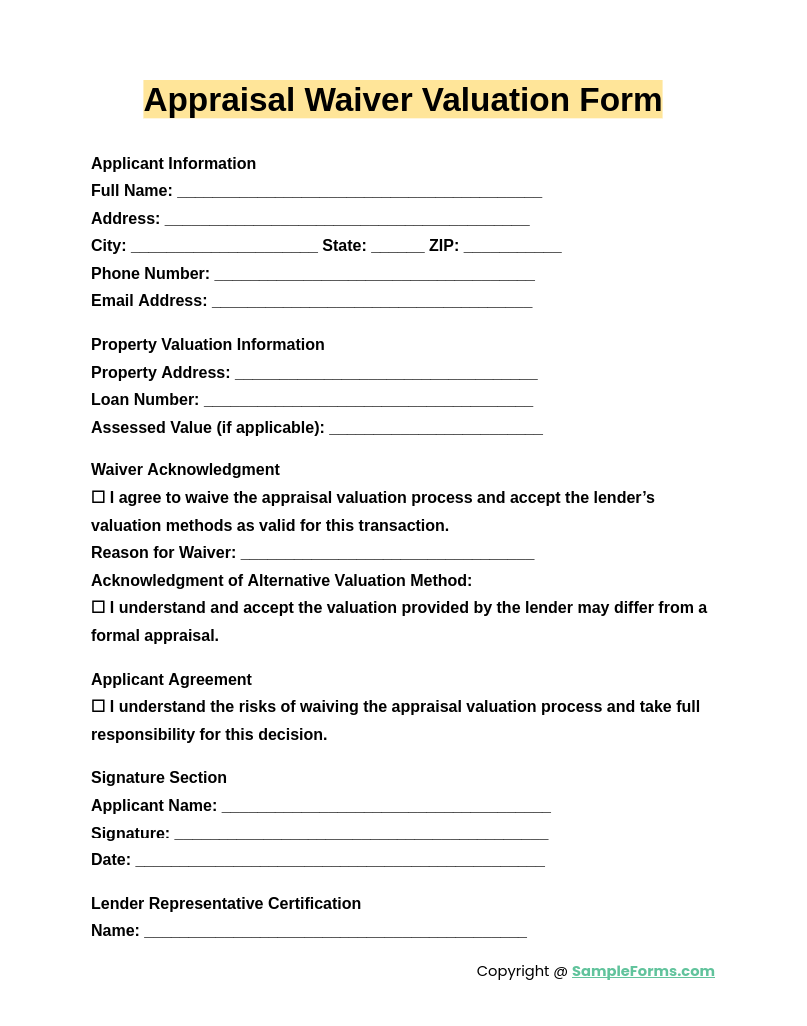

Appraisal Waiver Valuation Form

An Appraisal Waiver Valuation Form is used to waive valuation requirements for specific property loans. Similar to a Sports Waiver Form, it clearly defines terms, ensuring borrowers understand conditions and lenders maintain compliance during the process.

Browse More Appraisal Waiver Forms

Appraisal Waiver Disclosure Form

Property Inspection Waiver Disclosure Form

Sample Appraisal Waiver Form

Appraisal Waiver Disclosure Form in PDF

Appraisal Waiver Form in PDF

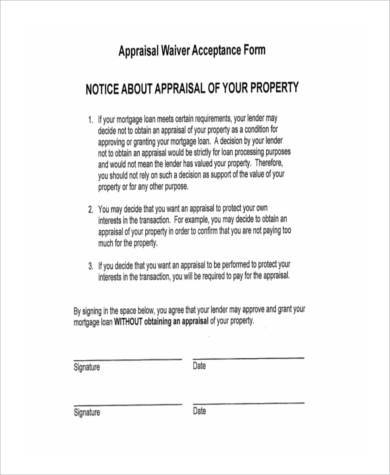

Appraisal Waiver Acceptance Form

Appraisal Waiver Form Example

Appraisal Waiver Form in Word Format

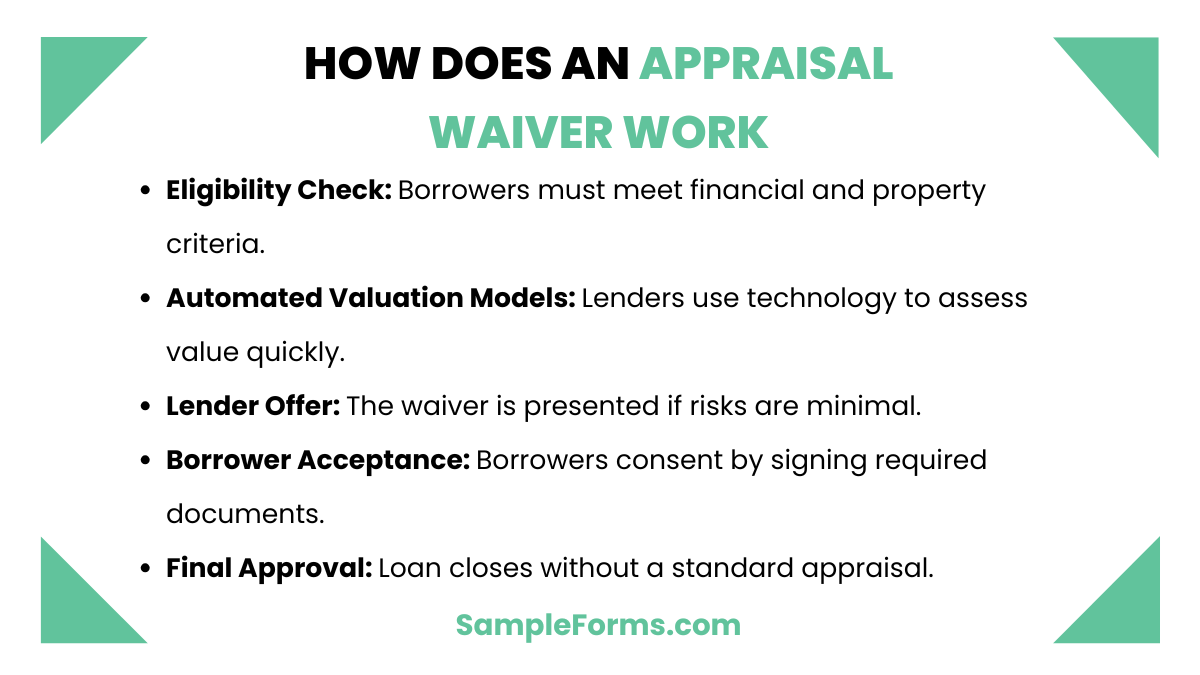

How does an appraisal waiver work?

An appraisal waiver simplifies the loan process by eliminating the need for a formal property evaluation. It works as follows:

- Eligibility Check: Borrowers must qualify based on specific criteria, such as financial stability and property type, akin to a Faculty Appraisal Form process.

- Automated Valuation Models: Lenders use technology to assess the property’s value, saving time and resources.

- Lender Offer: The lender may offer the waiver as part of the loan process, ensuring low-risk transactions.

- Borrower Acceptance: Borrowers must consent to the waiver by signing the required documentation.

- Final Approval: Once accepted, the loan proceeds without a formal property appraisal.

How to get a home equity loan without appraisal?

Obtaining a home equity loan without an appraisal involves meeting specific lender requirements and utilizing alternative valuation methods:

- Research Lenders: Find lenders offering appraisal waivers for home equity loans, similar to a Jewelry Appraisal Form process.

- Meet Qualifications: Ensure your credit score, debt-to-income ratio, and property value meet the lender’s criteria.

- Provide Property Data: Submit property-related information for automated valuation assessments.

- Request Waiver: Explicitly request an appraisal waiver during the loan application process.

- Loan Approval: Once all criteria are satisfied, the lender may approve the loan without a traditional appraisal.

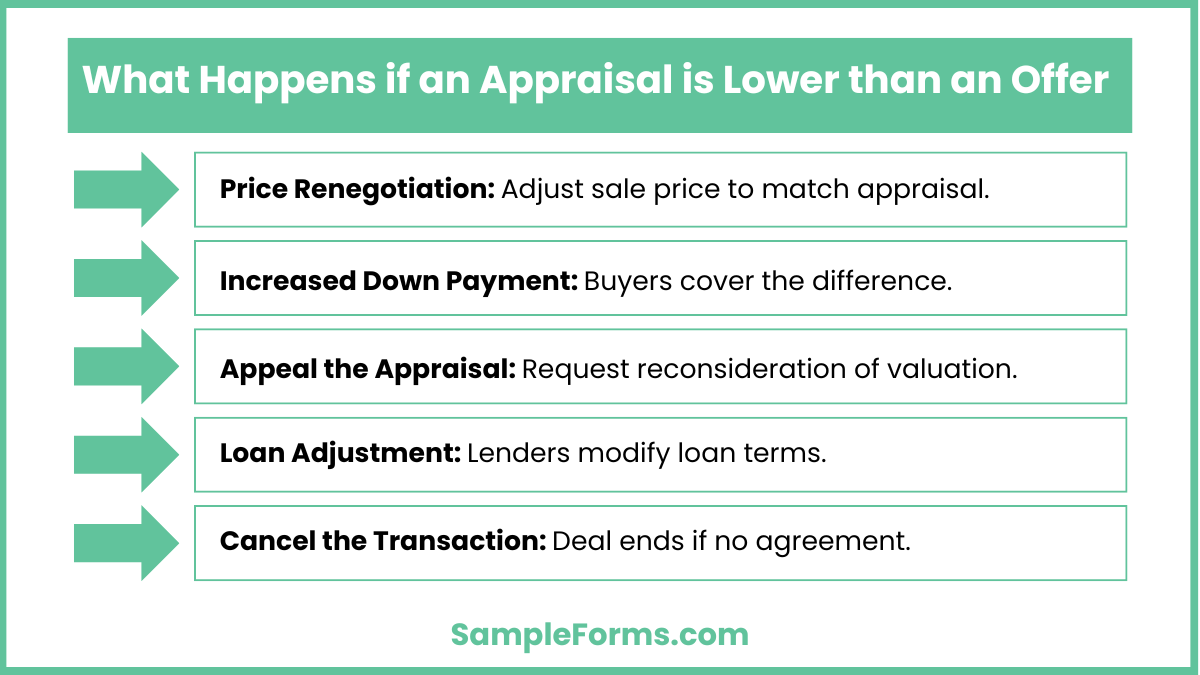

What happens if an appraisal is lower than an offer?

A lower appraisal than the offer can complicate a transaction, potentially requiring adjustments. Here’s what happens:

- Price Renegotiation: Buyers and sellers may renegotiate the price to align with the appraisal, much like an Annual Performance Appraisal Form assessment.

- Increased Down Payment: Buyers may need to cover the difference between the appraisal value and the offer price.

- Appeal the Appraisal: Request a reconsideration if errors or discrepancies are found in the appraisal report.

- Loan Adjustment: The lender might alter the loan terms based on the new appraisal value.

- Cancel the Transaction: If no agreement is reached, the deal may fall through.

What happens if I don’t agree with my appraisal?

Disagreeing with an appraisal can lead to challenges. Here’s how to address the situation effectively:

- Review the Report: Check the appraisal report for errors or inconsistencies, much like reviewing a Residential Appraisal Form for accuracy.

- Provide Additional Data: Submit comparable property sales or documentation to support a higher valuation.

- Request a Reconsideration: Ask the lender for a formal review of the appraisal.

- Order a Second Appraisal: Hire an independent appraiser for a second opinion, if permitted.

- Negotiate with Lender: Work with your lender to resolve discrepancies and find a suitable resolution.

How do you get rid of the appraisal contingency?

Removing an appraisal contingency requires careful planning and confidence in the property’s value. Follow these steps:

- Research Property Value: Ensure the property is priced accurately, akin to completing a Property Appraisal Form for assessment.

- Secure Pre-Approval: Obtain pre-approval for the loan to demonstrate financial stability.

- Increase Down Payment: Offer a larger down payment to offset potential appraisal risks.

- Negotiate Terms: Work with the seller to modify or waive the appraisal contingency in the agreement.

- Provide Written Waiver: Submit a formal waiver to remove the contingency, ensuring all parties agree to the updated terms.

Why did I lose my appraisal waiver?

Losing an appraisal waiver occurs due to changing loan conditions, borrower risk, or property type. Similar to a Waiver of Liability Form, eligibility is conditional and subject to lender assessment.

What is the addendum to waive appraisal?

An addendum to waive appraisal allows buyers to proceed without property valuation, ensuring smoother transactions. It functions like a Construction Lien Waiver Form, reducing potential obstacles in closing the deal.

Why would a seller waive the appraisal?

A seller waives appraisal to attract competitive buyers or expedite sales. Like a Yoga Waiver Form, it shows flexibility while minimizing delays in the transaction process.

Do I have to pay for appraisal if the deal falls through?

Yes, borrowers usually pay appraisal fees even if deals fail. Similar to an Employee Waiver Form, costs are non-refundable since the service was rendered.

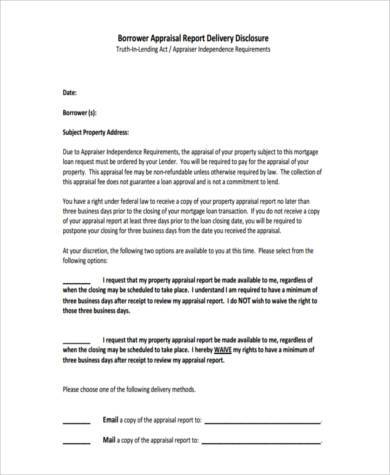

What is the 3-day waiting period after appraisal?

The 3-day waiting period allows buyers to review appraisal reports before finalizing decisions. It resembles a Restaurant Waiver Form, ensuring transparency and informed consent during crucial steps.

Can appraisal be waived for a home equity loan?

Yes, lenders may waive appraisals for low-risk borrowers. Comparable to a Sales Appraisal Form, eligibility depends on financial stability and alternative valuation tools.

Can a loan be approved without an appraisal?

Yes, lenders approve loans without appraisals using automated valuation models, similar to Management Appraisal Form processes for faster and efficient evaluations.

What negatively affects home appraisals?

Factors like poor maintenance, declining market trends, or overpricing can lower appraisals. Similar to a Medical Appraisal Form, accurate assessments depend on quality and condition.

Do sellers usually lower prices after appraisal?

Sellers may reduce prices when appraisals are lower than offers, akin to adjusting a Retail Appraisal Form to align with market value.

How do I get a free appraisal of my home?

Free appraisals can be obtained via online tools or realtor services. Similar to an Appraisal Request Form, they provide a general estimate without formal charges.

The Appraisal Waiver Form is a valuable tool in real estate and mortgage lending, offering convenience and efficiency. By eliminating the need for an appraisal, it saves time and reduces costs for eligible borrowers. Whether it’s for refinancing or purchasing property, understanding how to use this form effectively is essential. If you’re handling a Supervisor Appraisal Form or other related documents, this guide provides practical insights to navigate the process confidently.

Related Posts

-

FREE 5+ Recruiter Performance Review Forms in PDF | MS Word

-

FREE 7+ Sample Internship Appraisal Forms in PDF | MS Word

-

FREE 7+ Sample Supervisor Appraisal Forms in PDF | MS Word

-

FREE 10+ Property Appraisal Forms in PDF | MS Word

-

FREE 9+ Sample Jewelry Appraisal Forms in PDF | MS Word

-

FREE 23+ Staff Appraisal Forms in PDF | MS Word | Excel

-

Appraisal Form

-

FREE 6+ Sample Home Appraisal Forms in PDF

-

FREE 8+ Sample Faculty Appraisal Forms in PDF | MS Word

-

FREE 9+ Sample Staff Performance Appraisal Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Auto Appraisal Forms in PDF

-

FREE 8+ Sample Appraisal Evaluation Forms in PDF | MS Word

-

FREE 8+ Sample Management Appraisal Forms in PDF | MS Word

-

FREE 6+ Sample Customer Appraisal Forms in PDF | MS Word

-

FREE 8+ Sample Appraisal Feedback Forms in PDF | MS Word