It is necessary that information being provided is confirmed in the event that there are no errors. A good example would be providing income confirmation in the event that one wishes to submit information regarding his or her income for employment purposes.

Confirming one’s income information can help you during certain situations such you know your loan interest. So always make sure to provide the necessary information and make sure it has no errors in the event that it needs to be verified for eligibility. Once everything has been looked into and there seem to be no problems, then you may acquire confirmation.

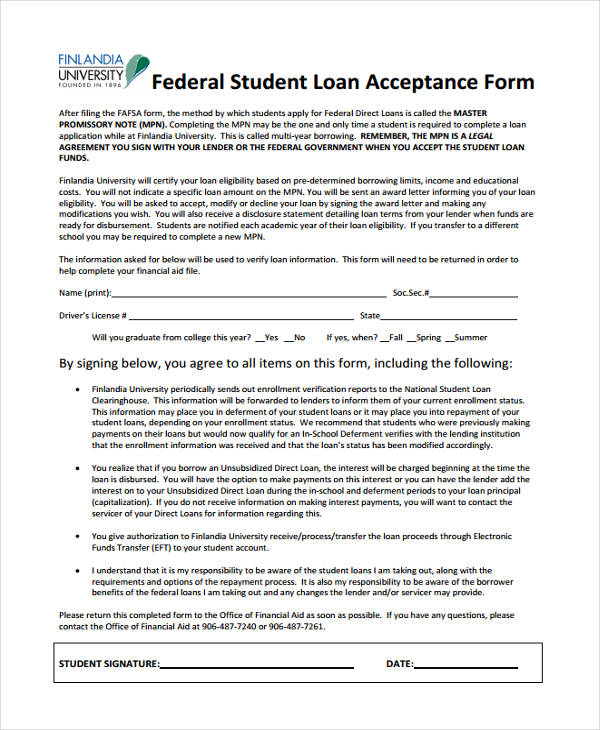

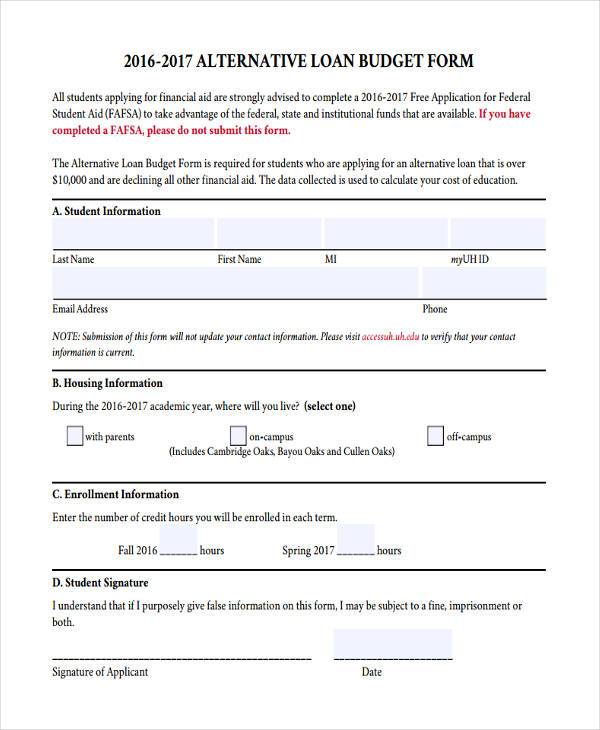

Student Loan Acceptance Confirmation

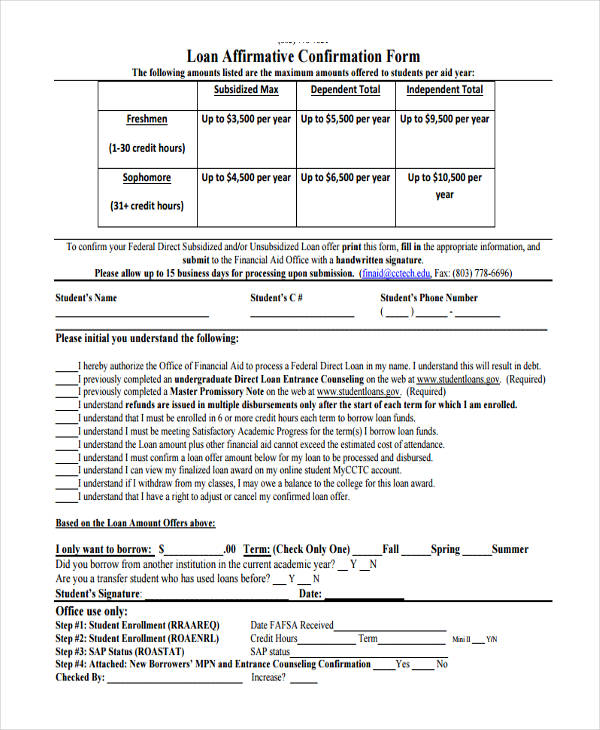

Loan Affirmative Confirmation

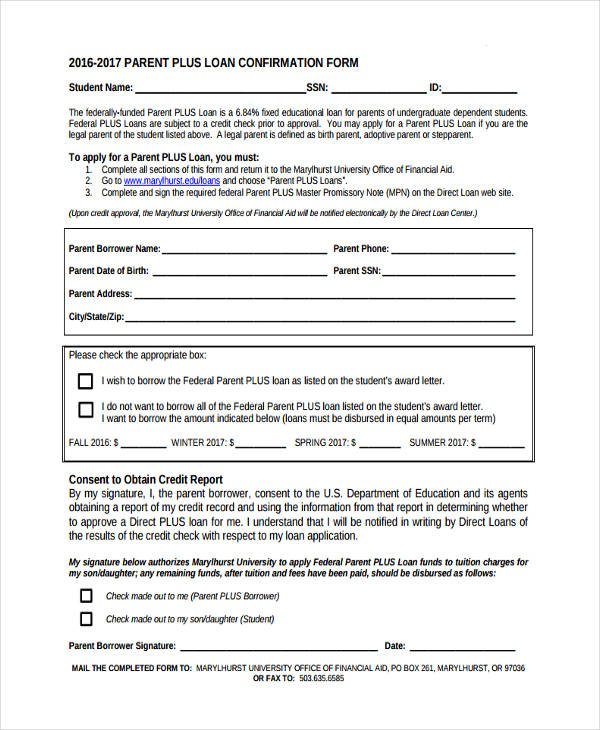

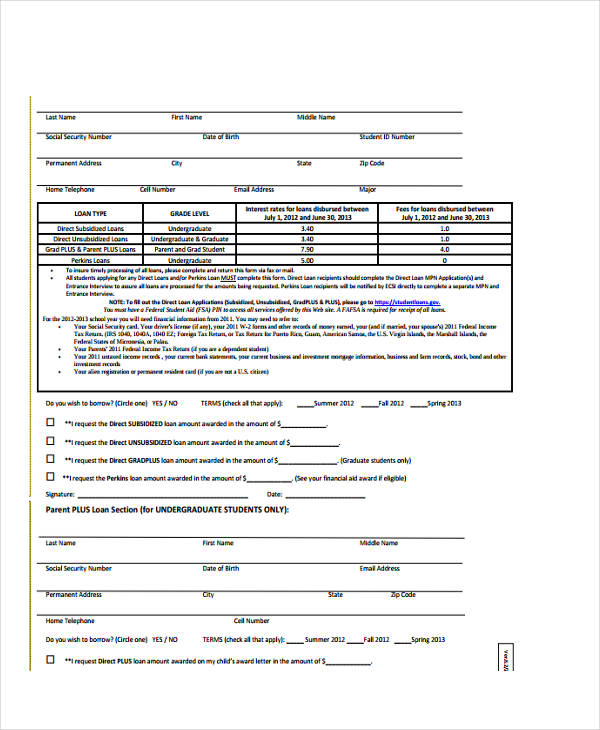

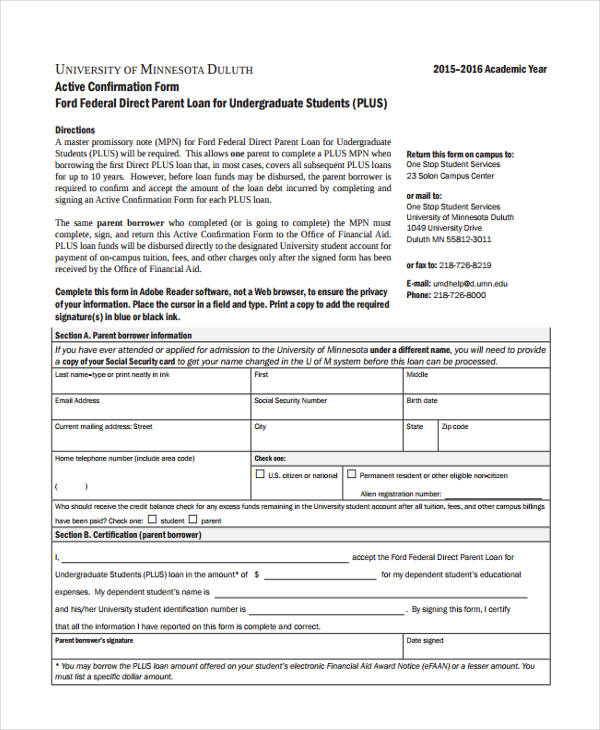

Parent Plus Loan Confirmation

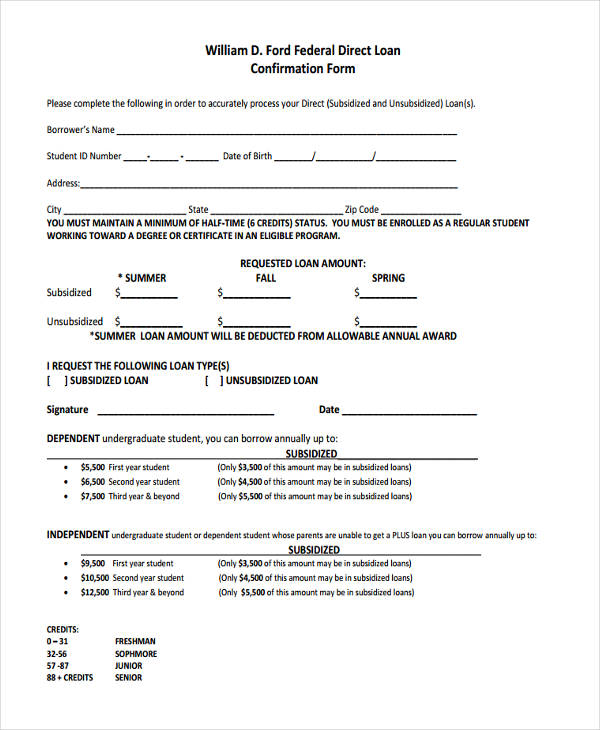

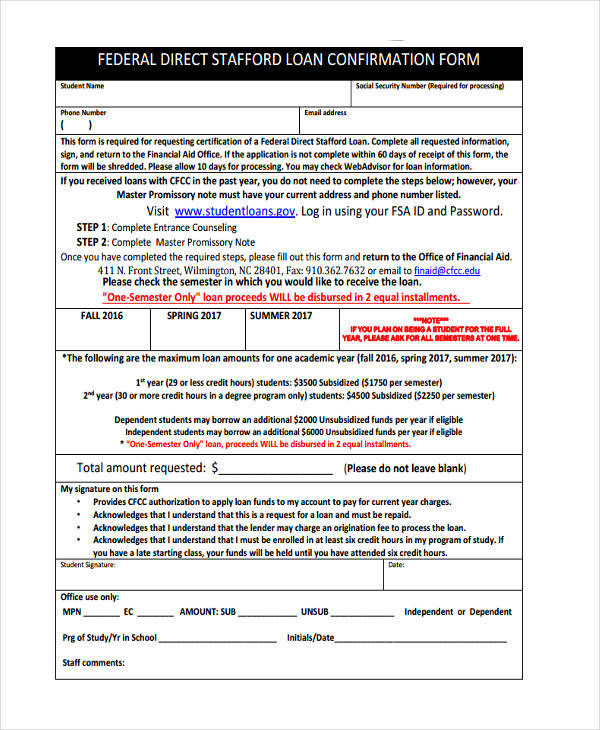

Federal Direct Loan

Loan Request Confirmation

What Is Loan Confirmation?

A loan confirmation is what is granted by a financial institution in the event that a person who wishes to acquire loan is informed that his or her loan amount request has been accepted. It is similar to order confirmation forms where so long as one provides the necessary information.

In this case it is information for one’s salary, then that person is applicable for receiving what he or she wants. So this basically states that the person is eligible for a loan that has been requested for a particular purpose.

How to Print Loan Confirmation in Tally

For those that would like to print out confirmation of loans in tally, then follow these steps:

- Go to Gateway of Tally where you can acquire your loan confirmation

- Choose the display option

- Go to the account books wherein you can find and select the ledger you would like to print

- Print the information by issuing the command “alt + P”

If you would like to know more on how to confirm other pieces of information, such as using employee confirmation forms in the event that employers are required to submit to applicants that all information they have provided has been verified and approved, then go through our other confirmation form samples.

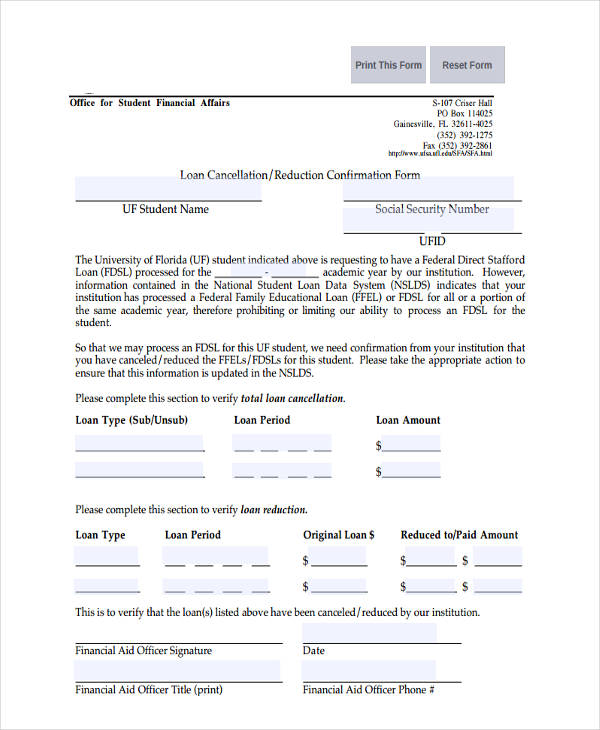

Loan Cancellation Confirmation

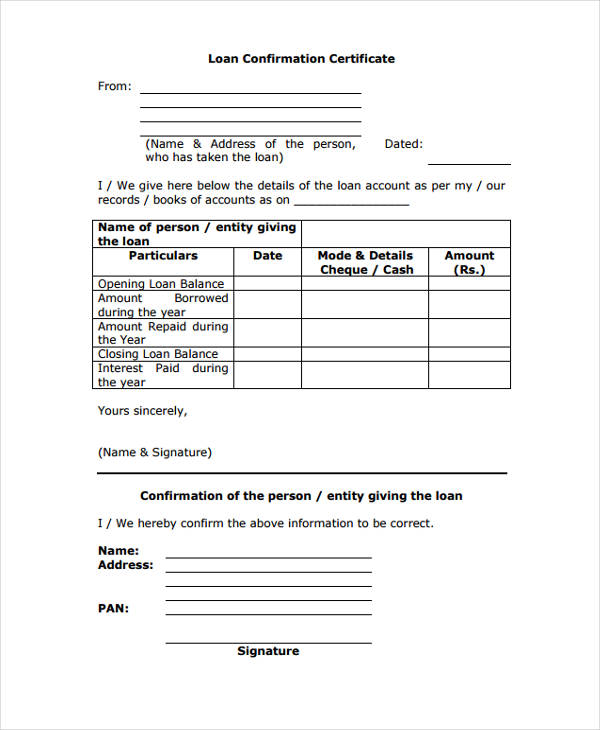

Loan Confirmation Certificate

Student Loan Confirmation

Direct Loan Confirmation

Federal Direct Loan Confirmation

3 Things to Ask Your Lender When Locking a Loan

Whenever you are applying for any kind of loan, you are going to have to make sure that your loan rate has been locked in. Meaning that it is not subject to change by the time you lock it in until the date of its expiration. So here are 3 things you should ask your lender in the event that you wish to lock your loan.

- Ask your lender for ways for you to verify whether your loan is locked or not. Once you get an estimate from your lender, you will be provided with an outline regarding how long your interest rate is good for, how long you have to close, as well as when you should lock your rate.

- Ask how to get an extension on your lock in the event that you need to do so. A lender will always have their own specific guidelines on who has to pay if a lock extension is necessary. Depending on who caused the delay, that person will be in charge of paying to pay for the lock extension.

- Ask whether you can get a lower rate of loan rates drop. This varies between lenders as some might provide you with a lower rate if ever it does go down. But most lenders have a policy which states that should the rate go down, it is still required to close the loan on t the agreed lock date.

So whether you are using delivery confirmation forms to confirm one’s order for a delivery service or using payment confirmation forms to give notice that a buyer has indeed paid for goods or services, always make sure that you properly assess all information and whether or not they should be confirmed.

Related Posts

-

What Is a Payroll Verification Form? [ Definition, Importance, Samples ]

-

What Is a Residential Verification? [ Types, Importance, Samples ]

-

What Is a Shelter Verification Form? [ Types, Tips, Samples ]

-

What Is a Service Verification Form? [ Uses, Samples ]

-

What Is an Insurance Verification Form? [ Uses, Impotance, Samples ]

-

FREE 8+ Sample Tax Verification Forms in PDF

-

FREE 8+ Sample Mortgage Verification Forms in PDF | Ms Word

-

FREE 8+ Sample Reference Verification Forms in PDF

-

FREE 8+ Sample Social Security Verification Forms in PDF | MS Word

-

FREE 9+ Sample Medical Verification Forms in PDF | MS Word

-

FREE 8+ Sample Education Verification Forms in PDF | MS Word

-

FREE 9+ Sample Work Experience Forms in PDF | MS Word

-

What Is a Loan Verification? [ Purpose, Uses ]

-

FREE 6+ Service Confirmation Forms in MS Word | PDF

-

Payment Confirmation Form