Banking forms are essential tools used by financial institutions to manage accounts, process transactions, and verify client information efficiently. This guide dives into various types of banking forms, such as Bank Verification Form and Bank Affidavit Form, detailing their purposes and functionalities. Through practical examples, learn how to correctly fill out these forms to ensure smooth banking operations. Whether you’re opening a new account, applying for a loan, or setting up direct deposits, understanding the specifics of these forms will streamline your financial interactions and enhance your banking experience.

What is a Banking Form?

A Banking Form is a standardized document used by banks to collect necessary information from clients for various financial services. These forms are vital for initiating transactions, verifying customer details, and maintaining accurate and secure financial records. Typical banking forms include account opening forms, loan application forms, and funds transfer forms. They play a crucial role in ensuring compliance with banking regulations and facilitating efficient customer service.

Banking Format

I. Personal Information

- Full Name

- Address

- Contact Information

- Social Security Number

II. Account Details

- Account Type (Checking, Savings, etc.)

- Account Number

III. Transaction Details

- Date of Transaction

- Transaction Type (Deposit, Withdrawal, etc.)

- Amount

IV. Authorization

- Customer Signature

- Date

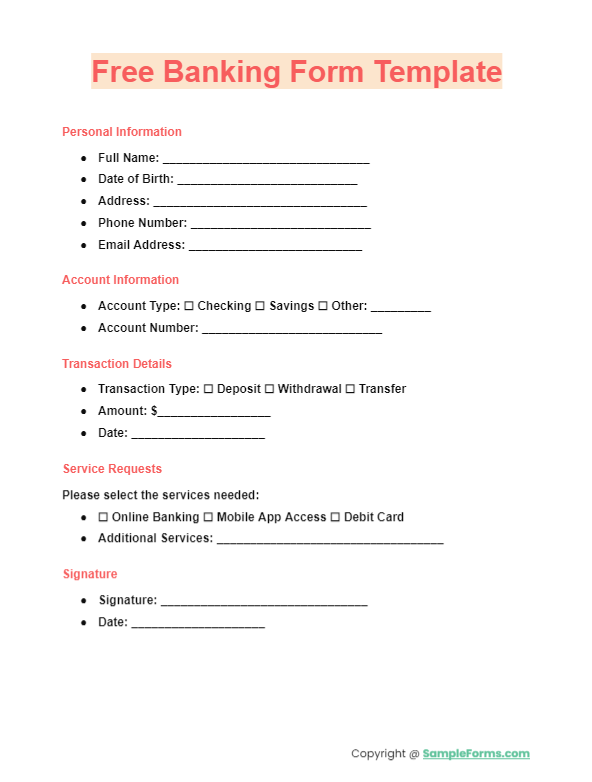

Free Banking Form Template

Download a Witness Statement Form-compatible banking form template for free. Ideal for personal or small business use to streamline financial transactions and record-keeping.

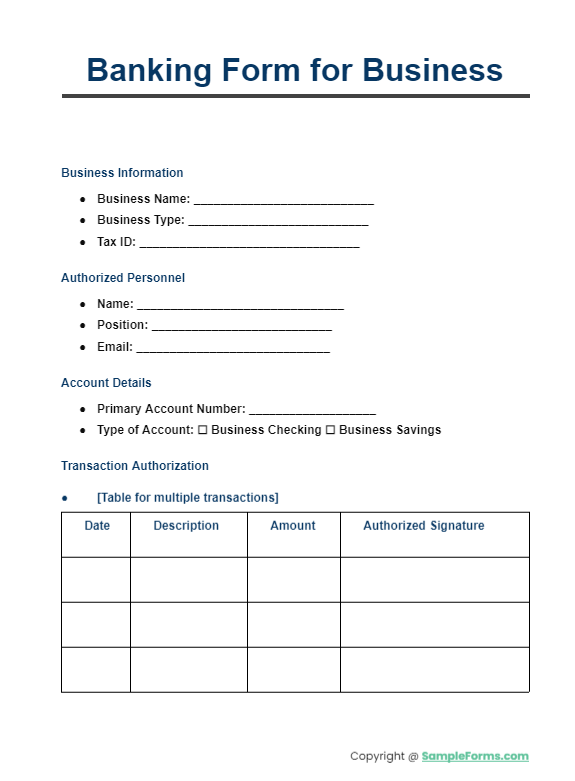

Banking Form for Business

Utilize a specialized Statement of Claim Form for business banking needs. This form is designed to manage business account operations, ensuring compliance and accuracy in financial declarations.

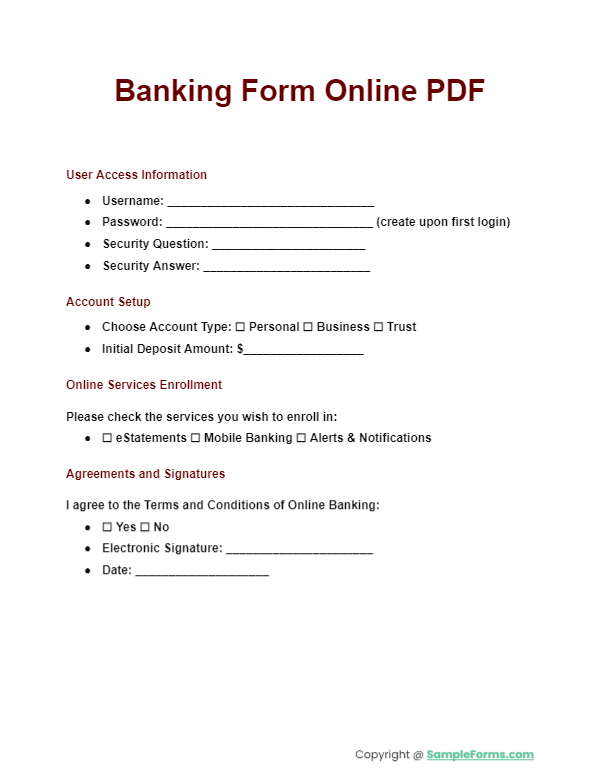

Banking Form Online PDF

Access your banking forms in a convenient online PDF format, integrated with a Statement of Information Form. This ensures easy submission and retrieval of critical financial data securely and efficiently.

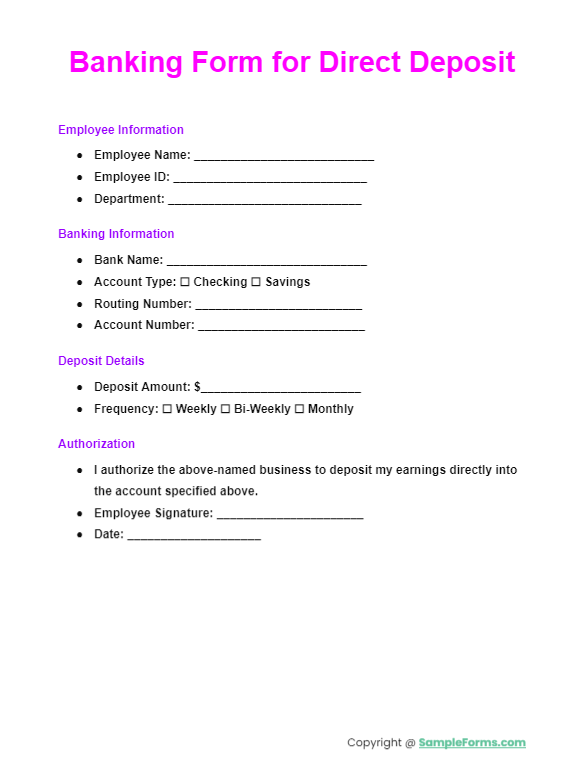

Banking Form for Direct Deposit

Implement a Employee Statement Form equipped banking form for setting up direct deposits. Essential for employers to manage payroll distributions efficiently, ensuring timely and accurate salary payments to employees.

More Banking Form Samples

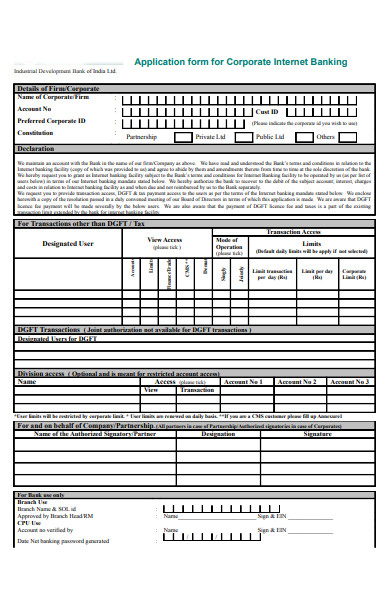

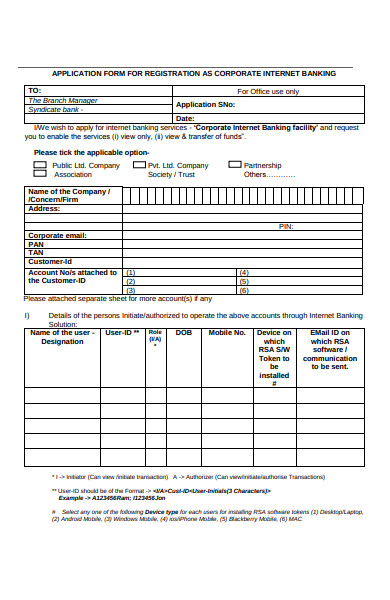

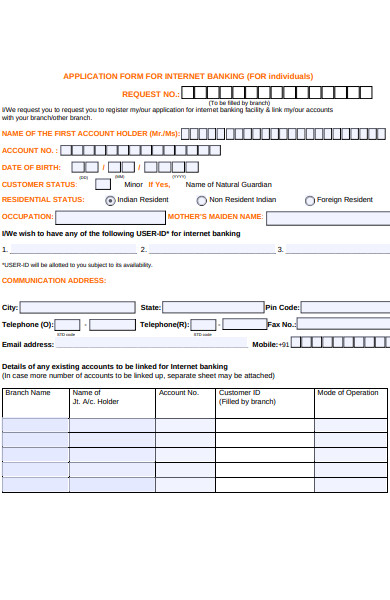

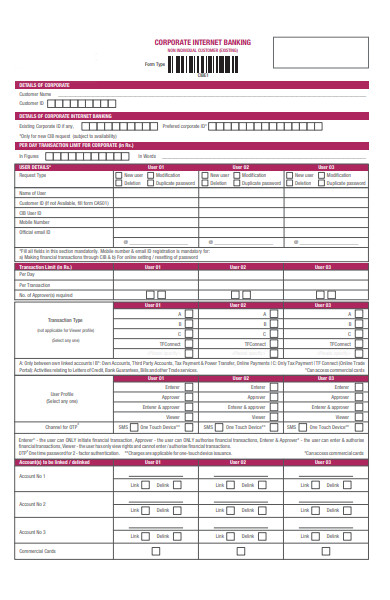

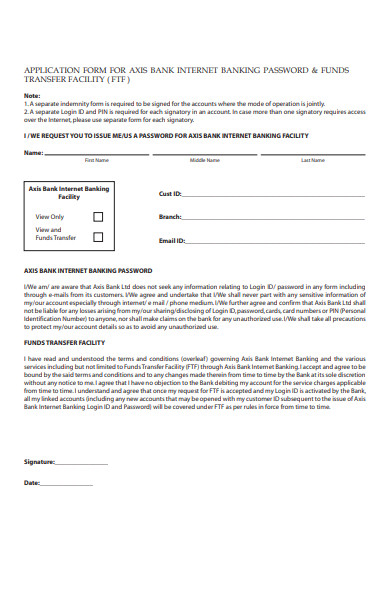

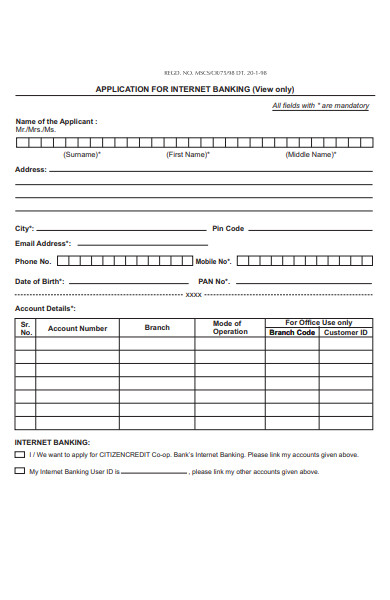

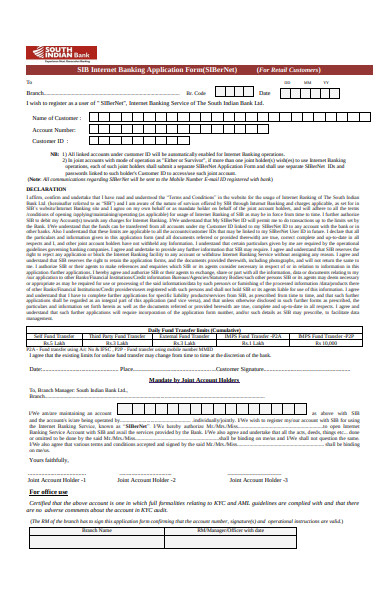

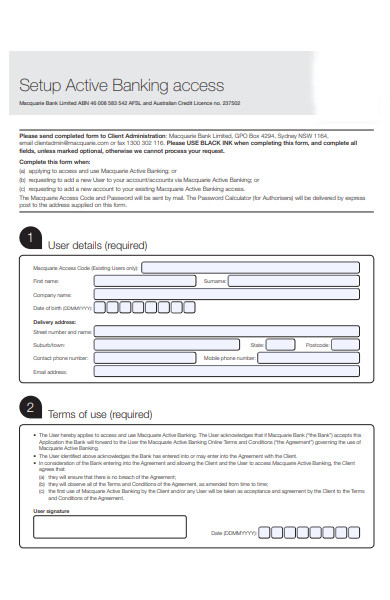

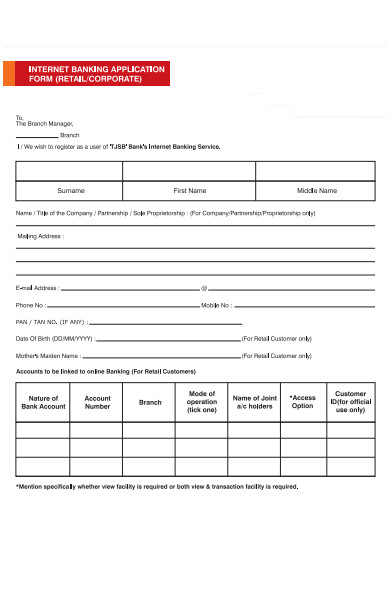

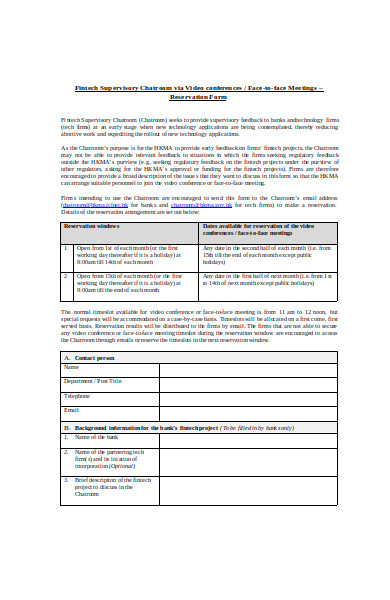

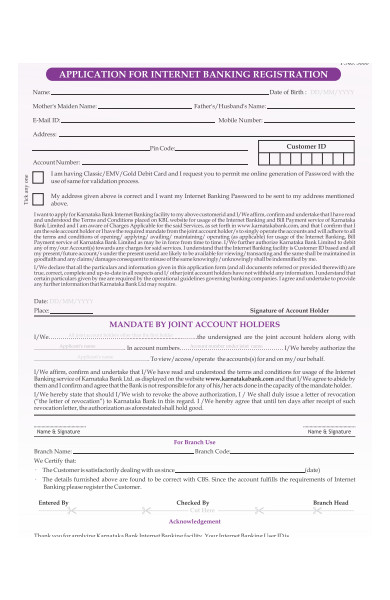

1. Internet Banking Form

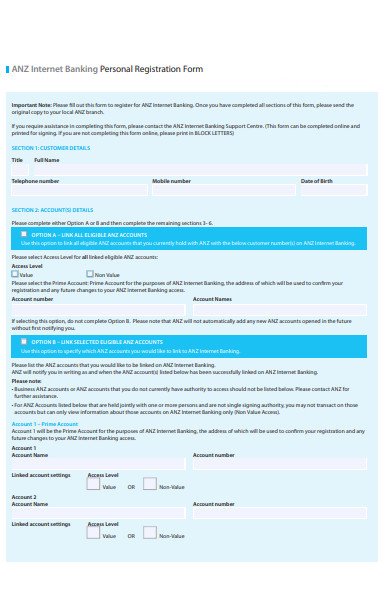

2. Banking Application Form

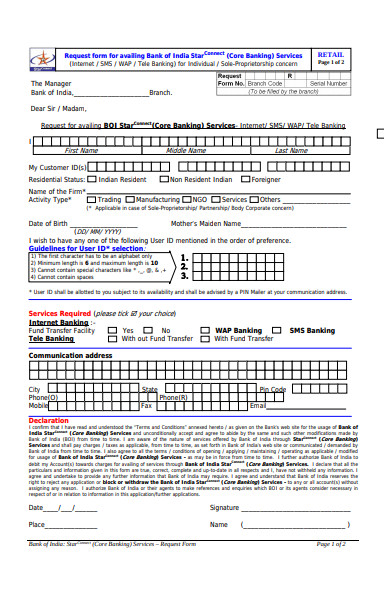

3. Retail Banking Form

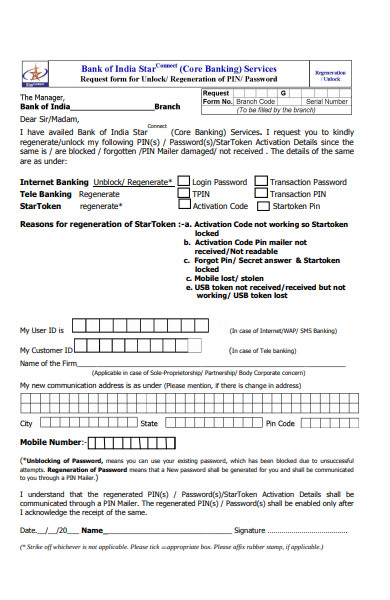

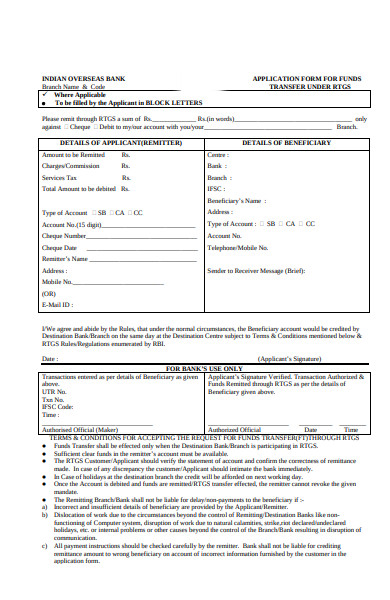

4. Banking Request Form

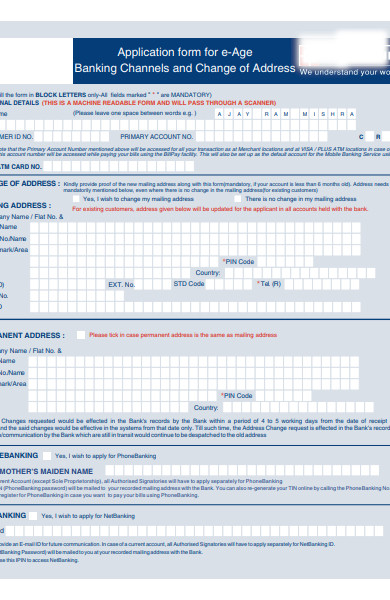

5. Banking Address Form

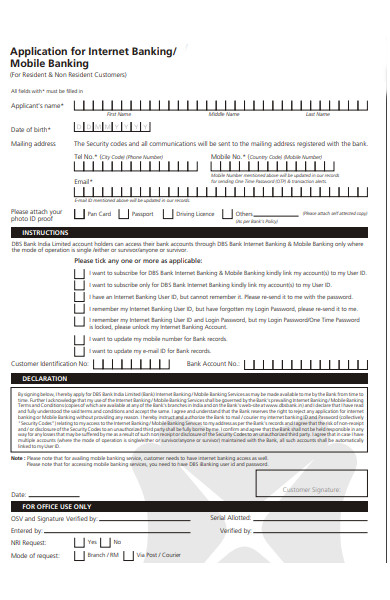

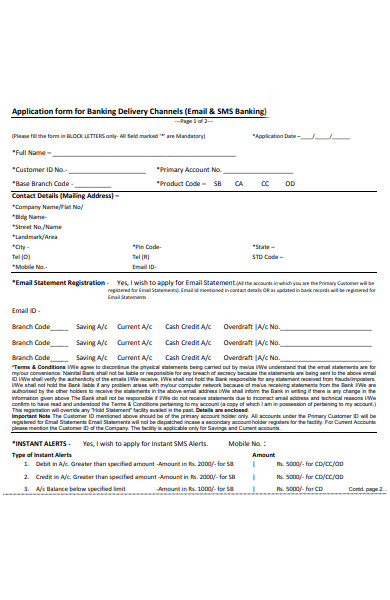

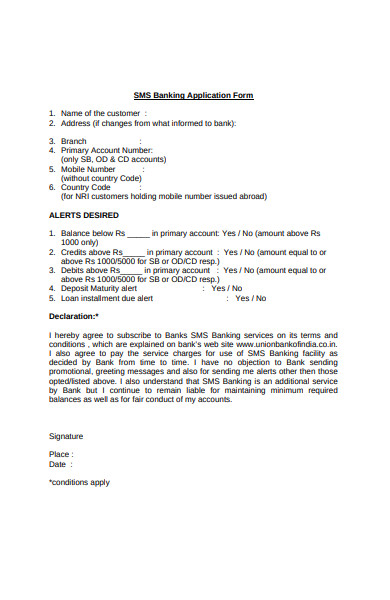

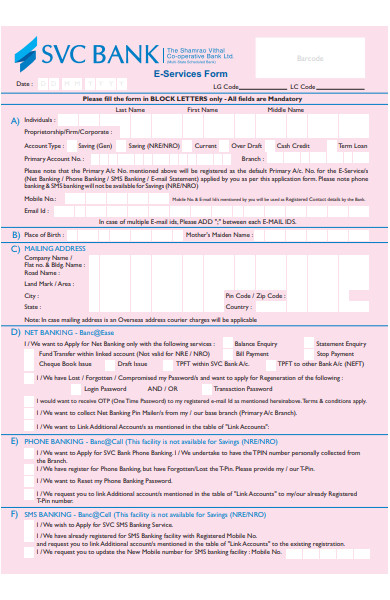

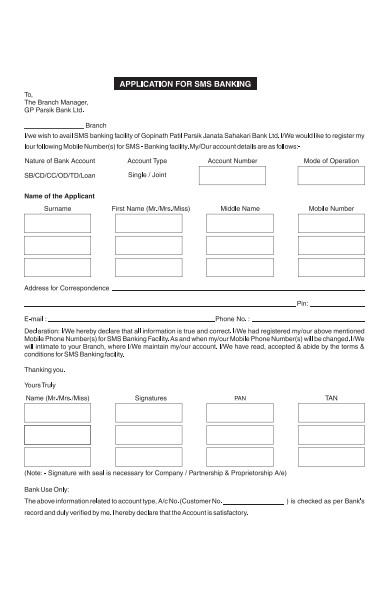

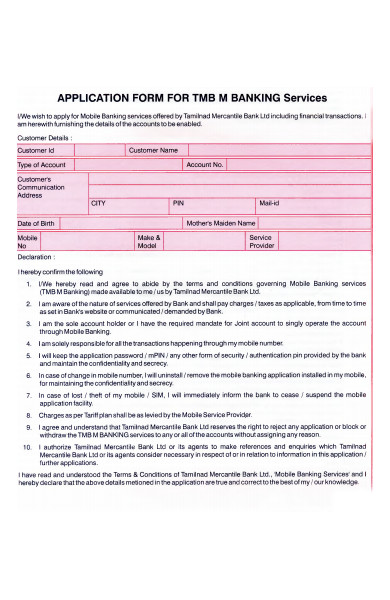

6. Mobile Banking Form

7. Corporate Banking Form

8. Banking Funds Form

9. Banking Delivery Form

10. Banking Related Form

11. Customer Banking Form

12. Simple Banking Form

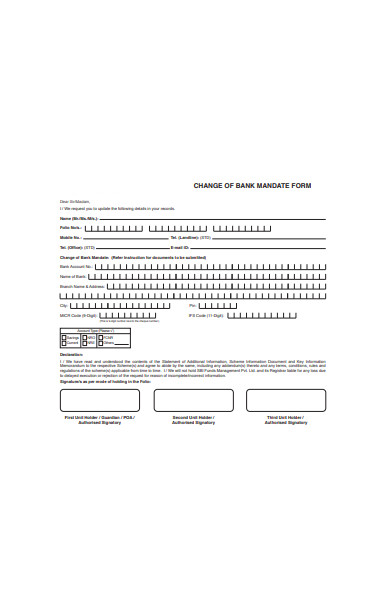

13. Banking Mandate Form

14. Banking Services Form

15. Banking Detail Form

16. Banking Access Form

17. Banking Term Form

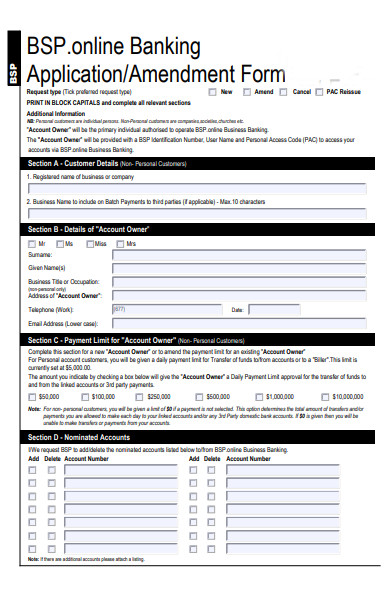

18. Business Banking Form

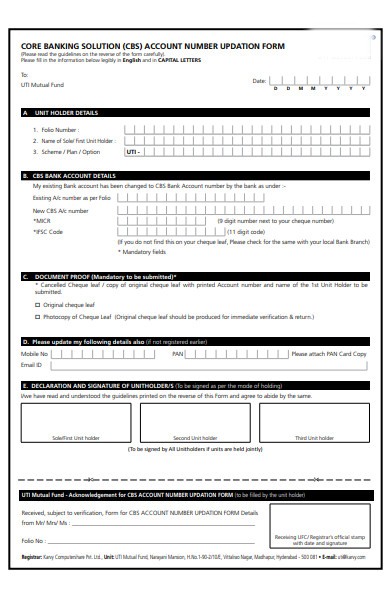

19. Banking Updation Form

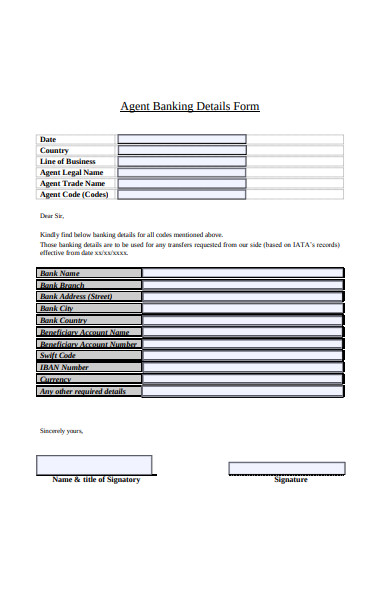

20. Agent Banking Form

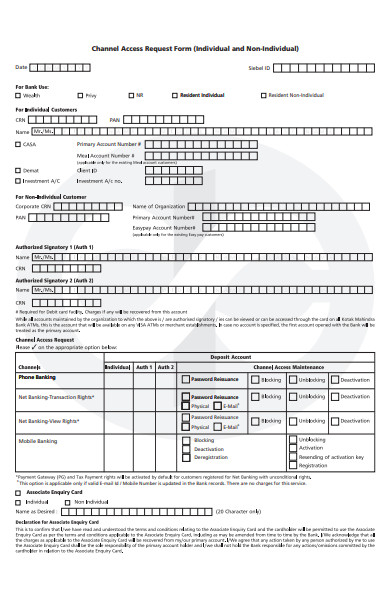

21. Individual Banking Form

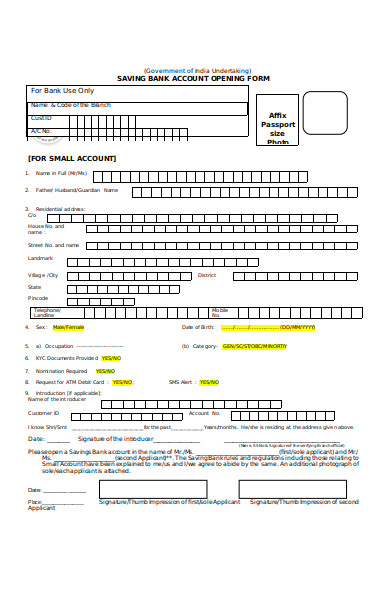

22. Banking Account Form

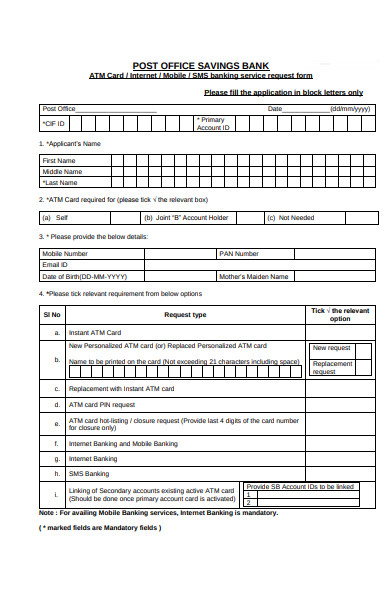

23. Banking Service Request Form

24. ATM Card Banking Form

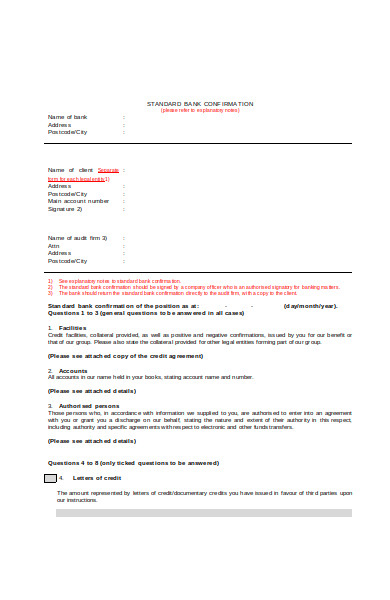

25. Standard Banking Form

26. Banking Opening Form

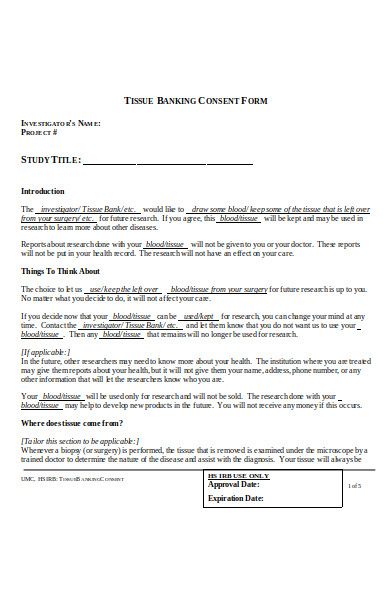

27. Banking Consent Form

28. Self Assessment Banking Form

29. Banking Registration Form

30. Banking Amendment Form

31. Banking Update Form

How to write a bank application form?

Writing a bank application form involves clarity and attention to detail to ensure accuracy.

- Gather Information: Collect all necessary personal and financial details before you start.

- Enter Personal Details: Include your name, address, and contact information.

- Specify Account Details: Clearly state the type of account you want to open.

- Setup Direct Deposit: Use the Direct Deposit Form to arrange for salary or other regular deposits.

- Verification and Signature: Double-check all entries and sign the form to validate. You should also take a look at our Rental Deposit Form

What are the different bank forms?

Banks use a variety of forms to manage customer transactions and accounts.

- Opening New Accounts: Forms for creating checking or savings accounts.

- Handling Real Estate Transactions: Use Earnest Money Deposit Receipt forms to handle initial payments.

- Refunding Deposits: Security Deposit Refund Form is used for returning a renter’s security deposit.

- Loan Processing: Forms specifically designed for personal, auto, or home loans.

- Setting Holding Terms: Holding Deposit Agreement Form for reserving property or other items.

What Is a Bank Statement: Definition and Requirements

A bank statement is an official summary issued periodically listing all transactions in an account.

- Summary of Transactions: Details all credits and debits during the statement period.

- Balance Information: Displays ending balance.

- Account Holder’s Details: Includes your name and account number.

- Periodic Details: Each statement covers a specific period, often monthly.

- Necessary Forms: Occasionally, a Vehicle Deposit Form may accompany statements related to specific transactions.

Types of Bank Statements

The format and detail of bank statements can vary depending on the customer’s needs.

- Traditional Paper Statements: Mailed directly to the customer’s home.

- Electronic Statements: Available for download via online banking.

- Transactional Details: Includes, for specific cases, forms like the Direct Deposit Authorization for legal proceedings.

- Quick Snapshot: Mini statements that show a limited number of recent transactions.

- Comprehensive View: Detailed statements providing a complete financial picture. You should also take a look at our Deposit Receipt Form

Benefits of a Bank Statement

Bank statements are invaluable for managing finances and tracking spending.

- Monitoring Expenses: Helps keep track of where your money goes.

- Budgeting Tool: Assists in financial planning and budgeting.

- Detecting Unauthorized Use: Spot any suspicious account activities.

- Legal Documentation: Useful for legal purposes where a Notice of Deposition Form might also be relevant.

- Historical Reference: Acts as a record of your financial activity.

Requirements for a Bank Statement

Getting a bank statement typically involves a few key steps.

- Be an Account Holder: Only the account holder or authorized persons can request statements.

- Identity Verification: Present a valid ID to verify your identity.

- Form Submission: Fill out the necessary form, sometimes a specialized form like an ADP Direct Deposit Form is required.

- Paying Fees: Some banks charge a fee for detailed or printed statements.

- Accessing Online: Ensure you have secure online access to your banking portal. You should also take a look at our Deposit Form

How Can I Get a Bank Statement?

Receiving your bank statement can be done in several convenient ways.

- Online Access: Log into your online banking to view or download. You should also take a look at our Deposit Agreement Form

- In-Person Request: Visit your local branch to request a printed copy.

- Through Mail: Request to have statements sent directly to your home.

- Use ATMs: Print a mini-statement at an ATM.

- Contact Customer Service: Call your bank’s customer service for assistance. You should also take a look at our Bank Authorization Form

What Are the Benefits of Banking?

The banking industry wasn’t just made for no big reason because not many people would have considered banks until now if that were the case. The business also keeps on improving to adjust to trends and competition. Providing you with smart ways for financial management is already a known fact from a bank, but there are more examples to expect too. You will find various advantages from banking, and you must know of such details first before you fill out any form for awareness reasons. The benefits are as follows:

-

Enhanced Safety Approved

Banks are the safest option to protect your money, especially if you end up saving millions of cash as that requires higher protection. Indeed, you can save at home with a lockbox or a wallet, but it doesn’t personal guarantee form you safety from house fires or even theft. It would be a nightmare to find out your money was stolen, turned into ashes, and other unfortunate situations. Its industry observes strict rules and agreements to ensure identity theft or bank scams get avoided so that no account will be in jeopardy. Not thinking about the security of accounts will only invite numbers of complaints from bank users at some point, and that puts the industry to doom due to lack of security. You should also take a look at our Statement Form

-

Quick Access for Credit or Loans

It’s almost impossible to save up for a considerable amount of money, particularly in housing or a college fund without loaning money. If you need instant funds, then considering an account application for credit and loans is advantageous. It grants you numerous options like the loan cash home credit application, so you need not wait any longer to get that dream home you always wanted. While it can be simple to loan, you can’t ever forget about being serious with your financial responsibilities, so you can’t lose this. With an impressive credit score, you are on a bright path for these opportunities. You should also take a look at our Disclosure Statement Form

-

Convenience Guaranteed

Besides taking manual banking where you line up on banks with lots of clients, you can enjoy the convenience through net or internet banking. Online banking enables users to take transactions where their devices get connected to the internet. You can freely check your account balance, send money, and so forth. This approach saves you time and effort because you can manage finances even while still lying in your bed and wearing only your comfy PJs at home. You can also process this with mobile banking, so you need not turn on laptops or personal computers since doing it via mobile is more convenient. You should also take a look at our Business Financial Statement Form

-

Money Savings

Your account from a bank can hold up to how many amounts of cash, which keeps you secured financially. Saving through banks is a smart strategy compared to saving at home only because you can always access your money anytime at the house. Thus, you will get tempted to use a portion from your savings because the location is just at your home. In banks, you need not withdraw all savings, so it becomes your safety net. At times where you lose a job or meet any financial crisis, you finally have a backup plan thanks to the bank where you kept your savings securely. You should also take a look at our Financial Statement Form

Why Shouldn’t You Rush Banking Forms?

When you have goals for acquiring quick cash and numbers of loans, it turns expected that you will need to take a banking form to start processing immediately. However, rushing the process is discouraged. For example, you could have placed the wrong information into these forms, like the incorrect spelling of names, account info, and the like. Inaccurate details may cause you to receive rejection instead of verification. You also confirm if the document is official or relevant to what you are processing. Authorities might question the validity of that form, and that’s not the kind of impression you want to gain while making these relevant documents. You should also take a look at our Employee Statement Form

While banks bring you numerous services, you will need to avoid confusing one service to another. For example, you don’t expect a cancellation for a loan application to be the same as the account closing. Confirming on that is a must before you regret your wrong decision. Instead of rushing, you find time to read and review all details involved from a form first. Don’t just view what you wrote but also what information gets already set or printed ahead. Maybe the problem lies in the document, so there is still time to complain before signing and submitting that document. This reason is why you review carefully from the available templates to download and edit accordingly. You should also take a look at our Sworn Statement Form

How to Create Banking Forms

It’s already known that you can take a banking form for many procedures like a bank registration, account closing, or credit authorization. However, you must know about the steps in making professional printable banking forms too. This way, you won’t find it difficult to process for your banking needs because you will know about the format, its process, and common considerations. Making these forms without standards would let you end up with invalid or poor results, and nobody wants to receive that impression, especially when banks themselves maintain professionalism at all costs. Here are some of the standard steps to follow:

Step 1. Look for the Suitable Template or Format

Numerous templates and formats are available for you to choose from, may that be in PDF, Google Docs, or anything you prefer. What matters most is that you are comfortable with the experience from such a template. Forms that still have to undergo hectic or challenging processes will only stress you out, particularly when you need to make more of those. Templates are customizable anyway, so you no longer have to stick with a mediocre result as you can make it more professional at the end. Testing out every example from templates lets you notice which one is the best for you. You should also take a look at our Salary Statement Form

Step 2. Specify the Type of Form

Whether the document you make involves an account report, account registration, or anything related to banking, you plainly must specify it. The form type is typically placed on top of the document and in bold letters, so its detail will naturally catch the eyes of whoever views this document. Failure to be specific will only let people get confused at what the text functions. As you search online, you can witness numerous types out there, and you only need to familiarize how each example differs from the other to prevent confusing one thing to another. You should also take a look at our Billing Statement Form

Step 3. Input the Required Information from that Form Type

Just like in most contracts, documents, and paperwork out there, there are details required to answer. Lacking specific info, mainly customer information will make the form incomplete. Names, contact numbers, and addresses are just some of the notable examples required from the details. Details still vary depending on the type of form. What matters most is nothing gets forgotten because an error takes place from incomplete or invalid paperwork. Don’t forget to make the right balance where the outcome doesn’t look that long because there can be a way to simplify it and still possess the crucial points. Thus, space gets saved from making this briefer. You should also take a look at our Closing Statement Form

Step 4. Leave Some Blanks or Spaces for Writing

While putting all details is crucial among forms, it doesn’t mean there is no space for writing too. The thing is there are blanks provided for users to write their identity information, contacts, and so forth. This idea also means you adjust your measurements carefully because some spaces may be too narrow that a person hardly finds space for writing some of the required information. Its blanks should be properly aligned as well because the written detail might not be close to what turns asked, and it will be difficult to distinguish what such a feature is. If an account number is required, then the blank beside it should contain the information for such figures as it’s easy to understand that way. You should also take a look at our Income Statement

Step 5. Improve the Presentation

You can’t miss out on checking how the whole presentation appears. Maybe some parts look messy like if lines weren’t straight or measured well and that spaces failed at getting divided. You focus on enhancing its appeal, too, wherein anyone who checks the form will appreciate its comprehensible and professional output. Improving presentation does not necessarily mean you get creative with colors and designs anyway, but it is more on appearing professional. In doing that practice, you can create a document that observes professional reputation or like an actual official form. You should also take a look at our Profit and Loss Statement Form

Step 6. Adjust for Necessary Changes

People usually need to change some information after the first attempt, so you shouldn’t submit immediately without a review yet. If you find out that your forms look very wordy and space-consuming, then you adjust by observing assessments. This process enables you to evaluate if any mistake is still present because you will have to change it afterward. Don’t submit if errors weren’t corrected yet. A simple read and review of what you made can already let you notice what needs to be changed. Changing for the better should be your goal and not the other way around. You should also take a look at our Direct Deposit Authorization Form

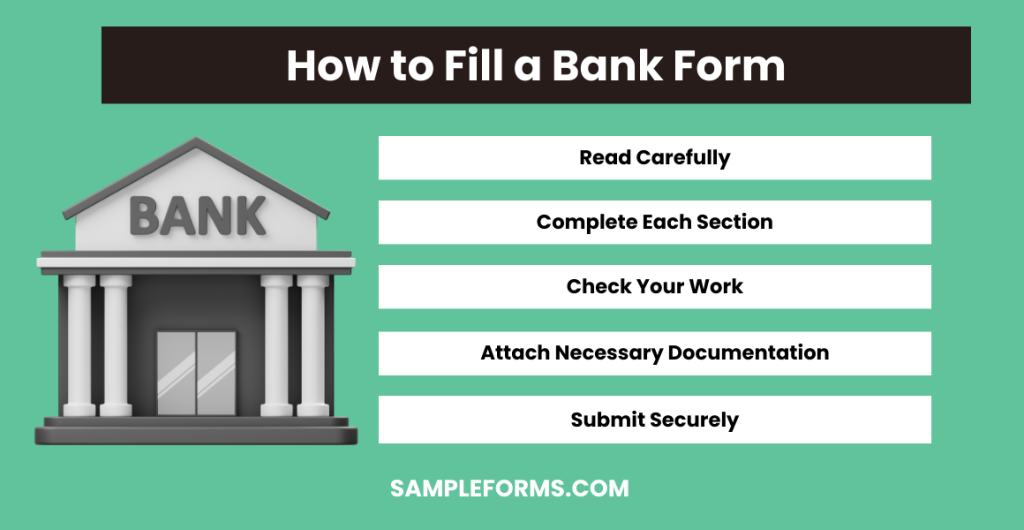

How to fill a bank form?

Properly filling out a bank form is crucial for effective processing.

- Read Carefully: Understand all the instructions before filling out the form. You should also take a look at our Bank Loan Application Form and Checklist Form

- Complete Each Section: Fill every required section accurately.

- Check Your Work: Ensure all personal and financial details are correct.

- Attach Necessary Documentation: Include any necessary attachments or identification.

- Submit Securely: Deliver the form to your bank either in person or online. You should also take a look at our

What is a proof of banking document?

A proof of banking document verifies account existence and status, often using a Security Deposit Receipt Form to confirm transactions or balances.

What is a bank confirmation form?

A bank confirmation form is used to authenticate account details and balance for audit purposes, similar to a Security Deposit Form.

What is a bank verification form?

A bank verification form confirms an individual’s banking details, such as account number and status, crucial for setups like a Vendor Direct Deposit Form.

How can I create a banking application?

To create a banking application, outline your requirements, integrate essential banking features, and ensure compliance with security standards, like those in a Deposit Contract Form.

Can Anyone Check My Bank Statement?

No, bank statements contain private financial information. Access is typically limited to the account holder and entities authorized under a Payroll Direct Deposit Form.

What is internet banking form?

An internet banking form is used to register or modify online banking services, often requiring a Tenancy Deposit Form to initiate or change deposit instructions.

In conclusion, understanding how to effectively use Banking Forms is crucial for both personal and business financial management. These documents, like the Financial Statement Form, are fundamental in documenting transactions, verifying personal or company details, and securing financial operations. By utilizing samples, forms, and templates, individuals and businesses can ensure compliance, streamline financial processes, and maintain thorough records. Proper handling and knowledge of banking forms are indispensable for successful financial management and operations.

Related Posts

-

FREE 36+ Partnership Forms in PDF | MS Word (doc.)

-

FREE 51+ Assignment Forms in PDF | MS Word | XLS

-

FREE 50+ Letter Forms in PDF | MS Word

-

FREE 32+ Holiday Forms in PDF | MS Word

-

Withdrawal Form

-

Visitors Form

-

Delivery Form

-

FREE 30+ Nonprofit Forms in PDF | MS Word

-

FREE 31+ Therapy Forms in PDF | MS Word | XLS

-

FREE 52+ Bid Forms in PDF | MS Word | XLS

-

Shipping Form

-

Vendor Form