In the animal kingdom, it is a competition for survival. Some animals rely on their strength, and some rely on their wits. But some animals depend on forming partnerships with another animal to survive. And the same thing can be said in the business world. There are various methods of surviving business competition. Some companies and businesses go solo and have solidified their grounds, but some enterprises form bonds with the help of partnership forms to survive. Developing business partnerships is a much rewarding endeavor despite the first few moments of struggle. And it might even last longer than big-time sole proprietor-type of businesses.

FREE 36+ Partnership Forms in PDF | MS Word

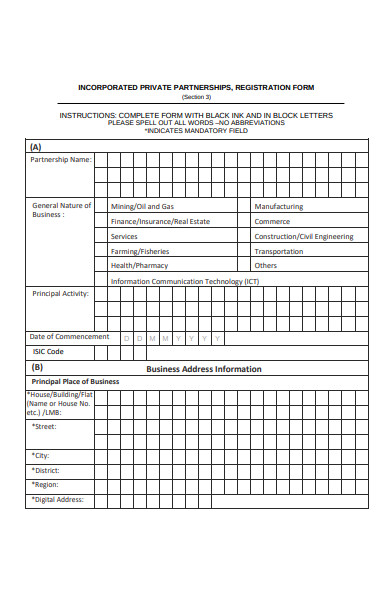

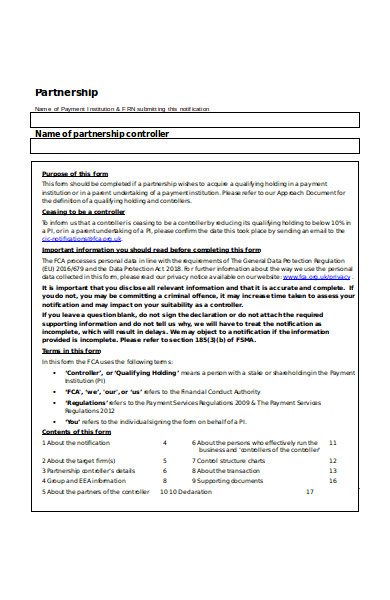

1. Incorporated Private Partnership Form

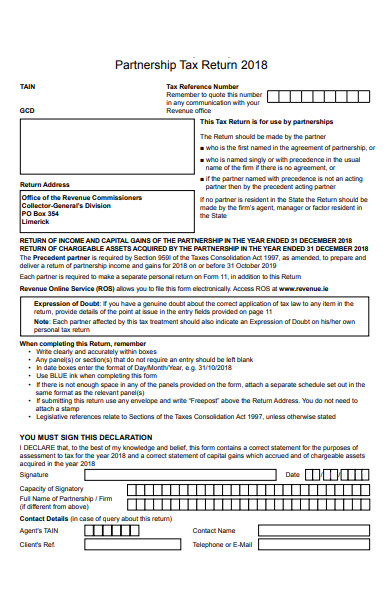

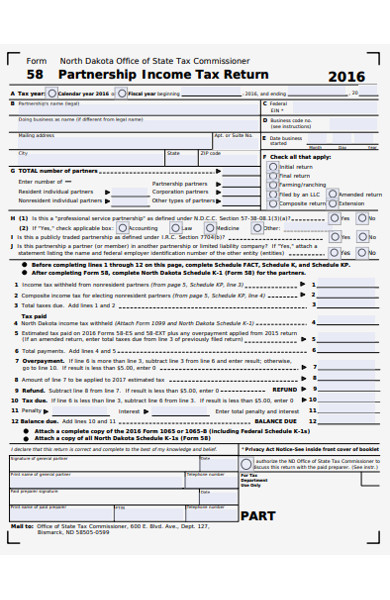

2. Partnership Tax Return Form

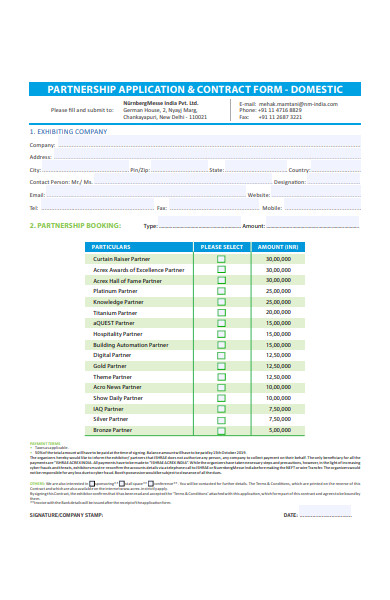

3. Partnership Contract Form

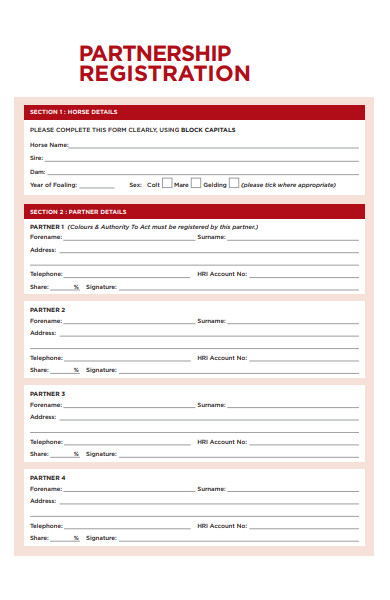

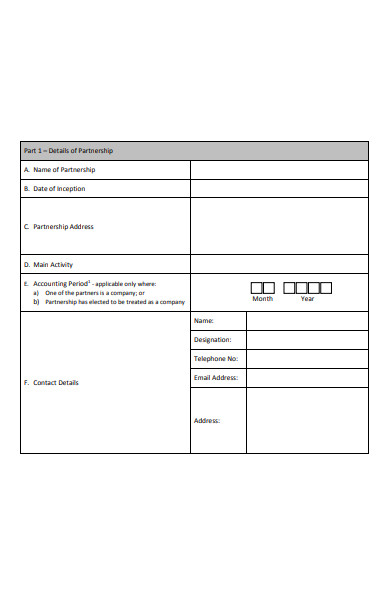

4. Partnership Registration Form

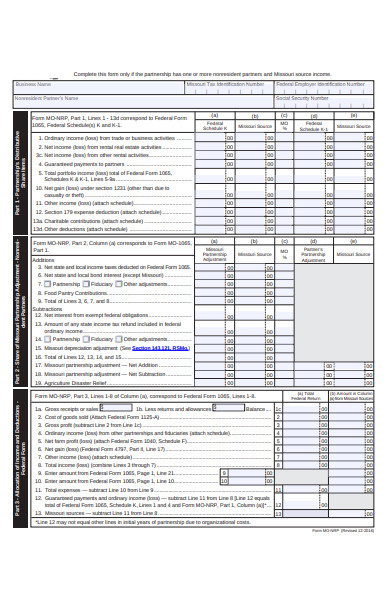

5. Non Resident Partnership Form

6. Limited liability Partnership Form

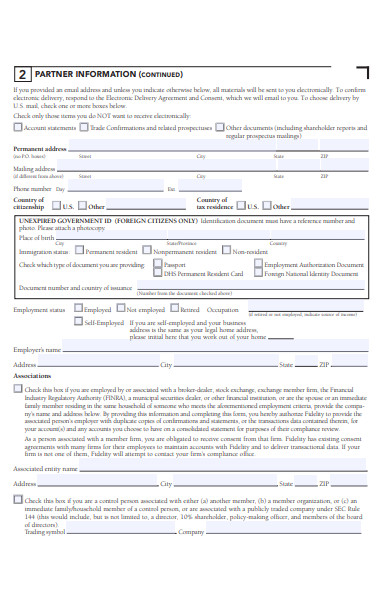

7. Partnership Account Form

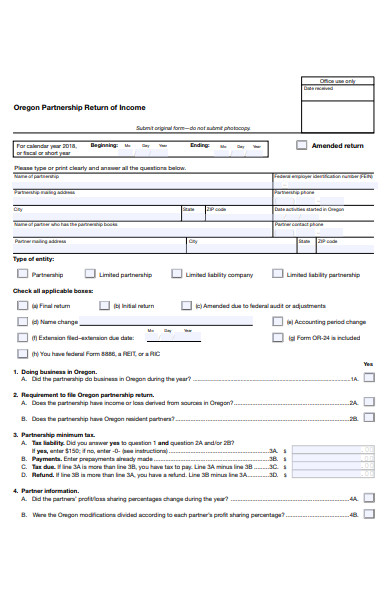

8. Partnership Return of Income Form

9. Sample Partnership Registration Form

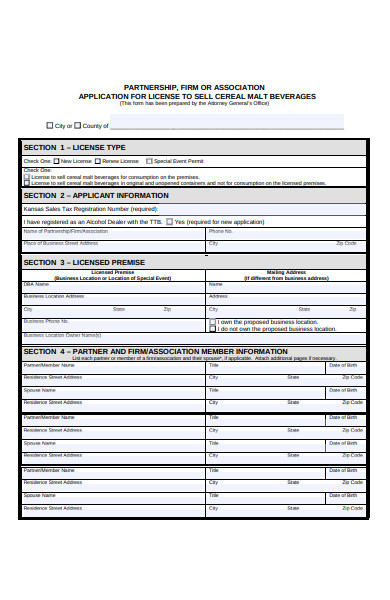

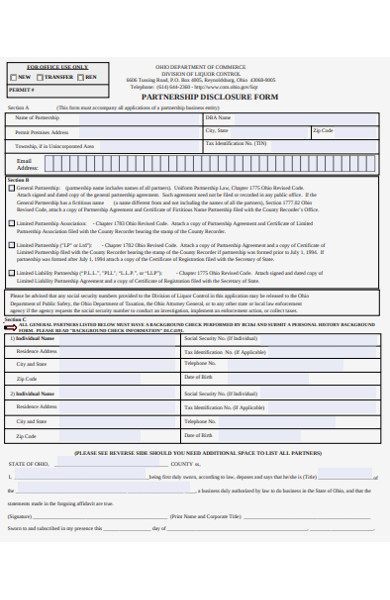

10. Partnership Liquor License Form

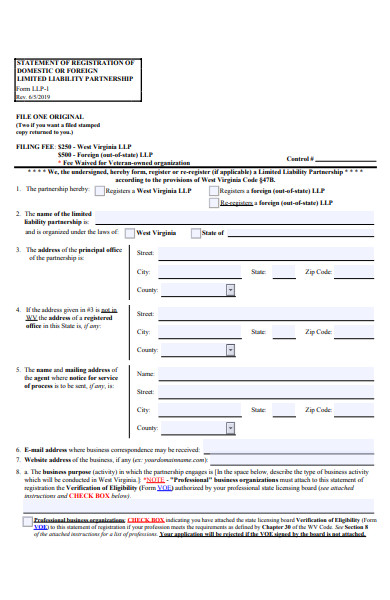

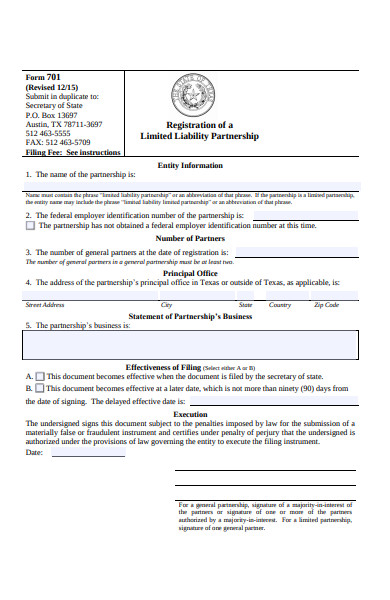

11. Registration of Limited liability Partnership Form

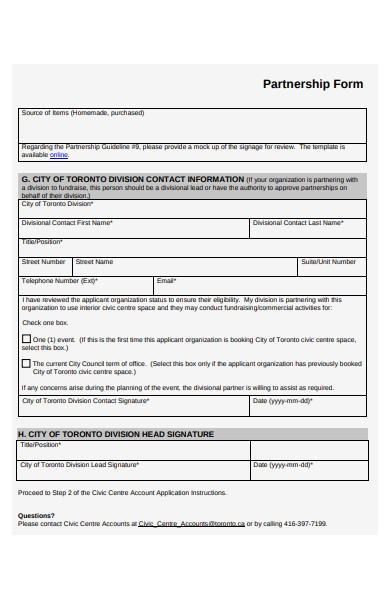

12. Basic Partnership Form

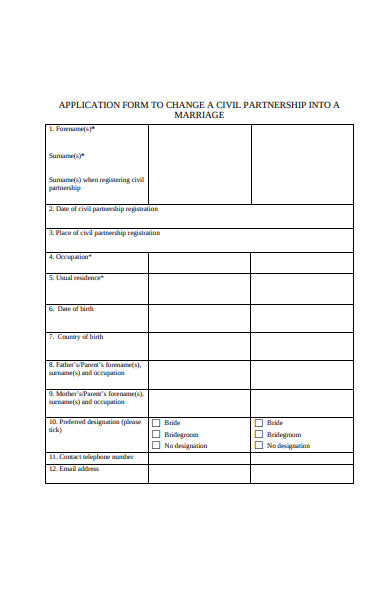

13. Partnership Change Form

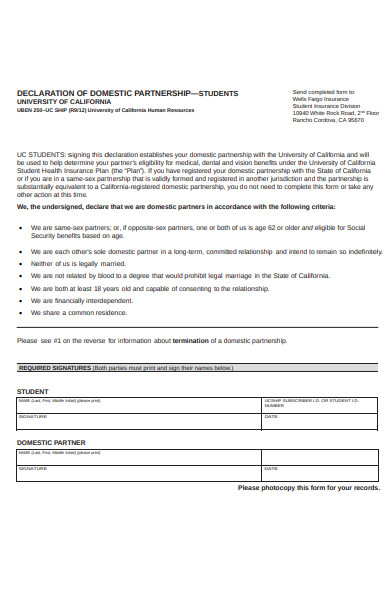

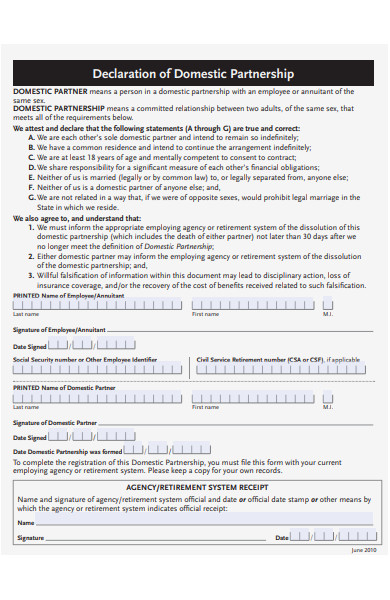

14. Domestic Partnership Form

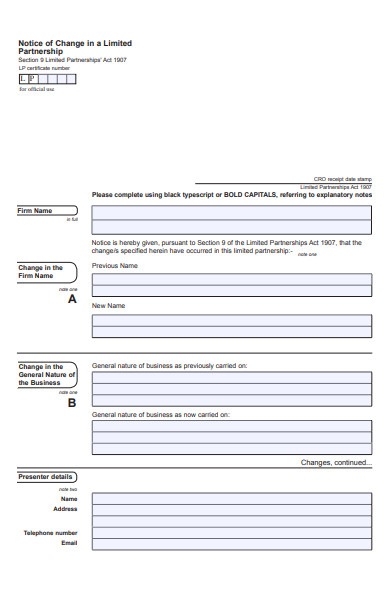

15. Limited Partnership Change Form

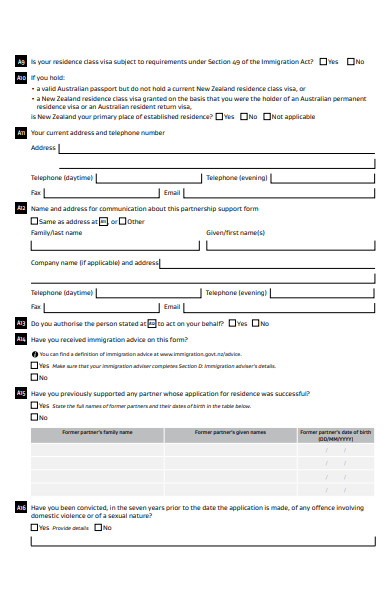

16. Partnership Support Form

17. Partnership Income Tax Return Form

18. Sample Partnership Form

19. Partnership Disclosure Form

20. Sample Domestic Partnership Form

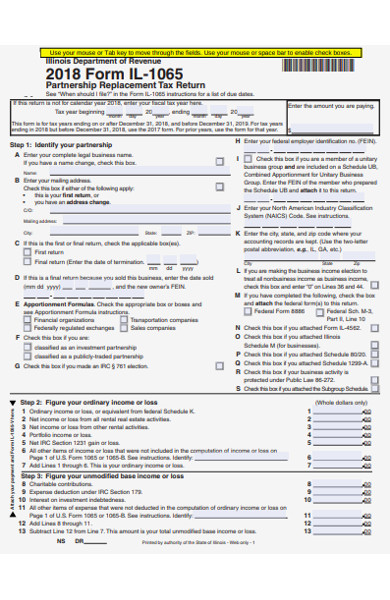

21. Partnership Replacement Tax Return Form

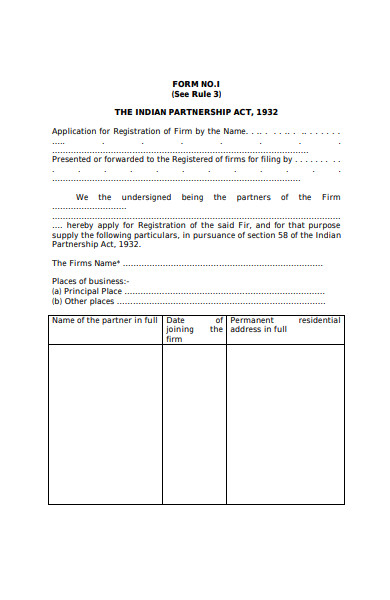

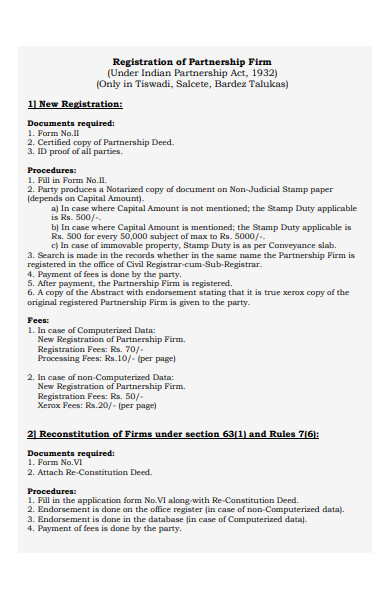

22. Registration of Partnership Firm

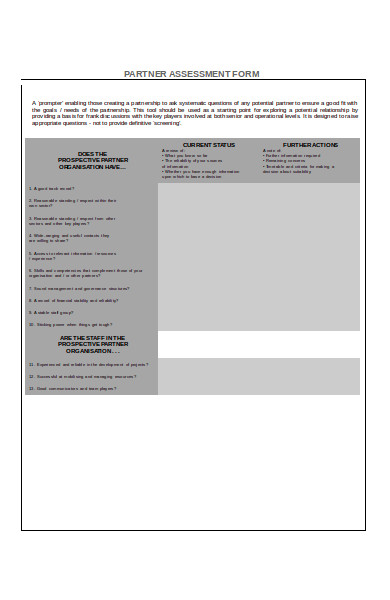

23. Partnership Assessment Form

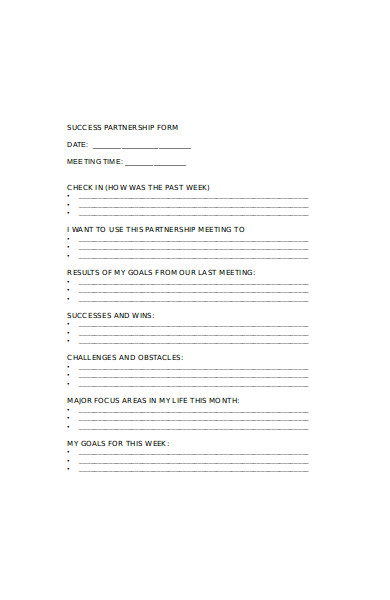

24. Success Partnership Form

25. Simple Partnership Form

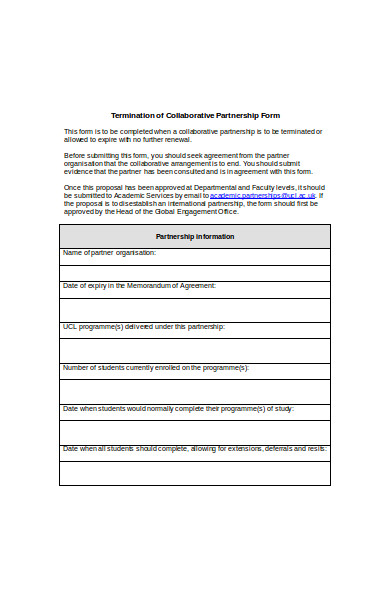

26. Termination of Partnership Form

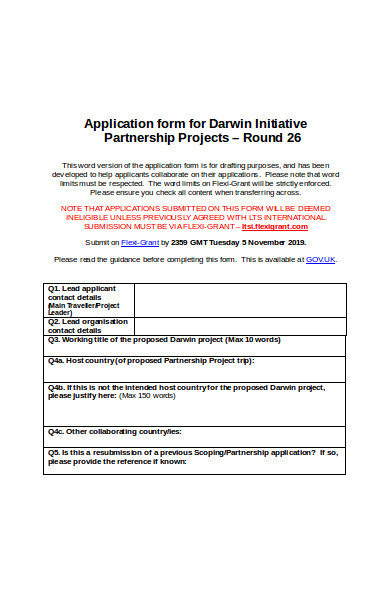

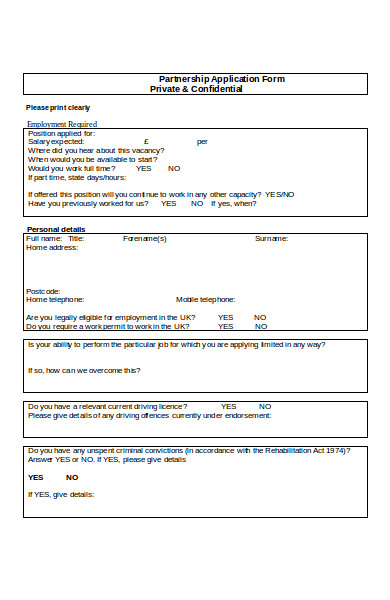

27. Partnership Projects Application Form

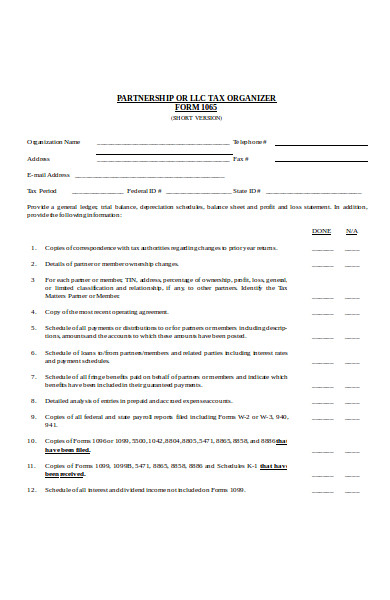

28. Partnership Tax Organizer Form

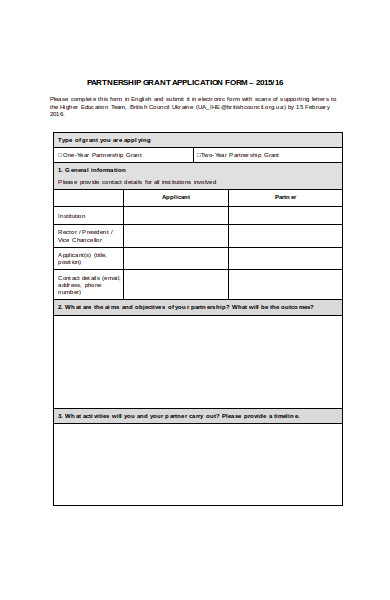

29. Partnership Grant Application Form

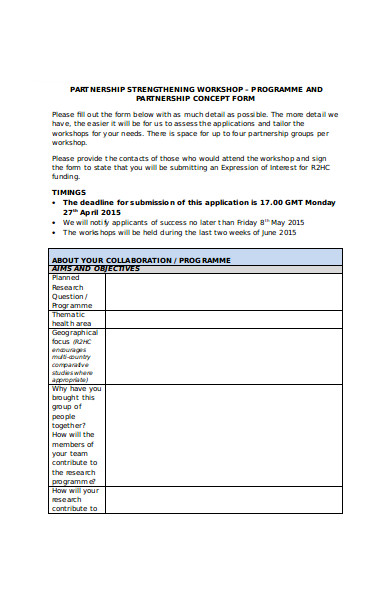

30. Partnership Concept Form

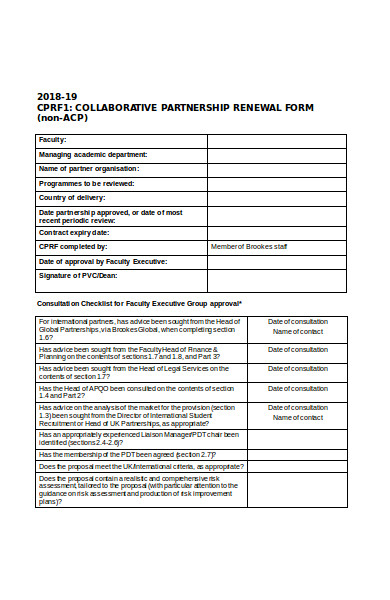

31. Partnership Renewal Form

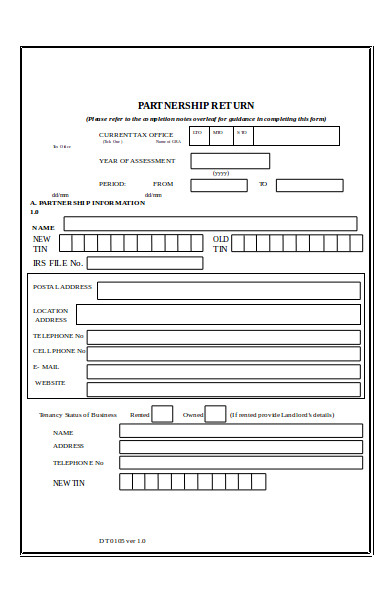

32. Partnership Return Form

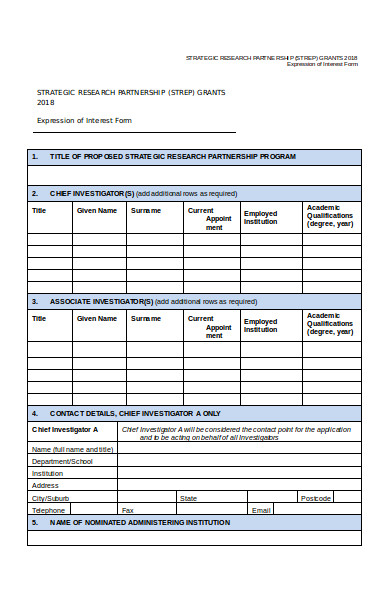

33. Research Partnership Grant Application Form

34. Printable Partnership Form

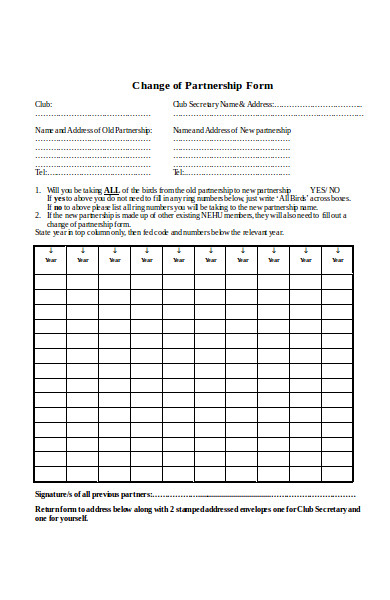

35. Sample Partnership Change Form

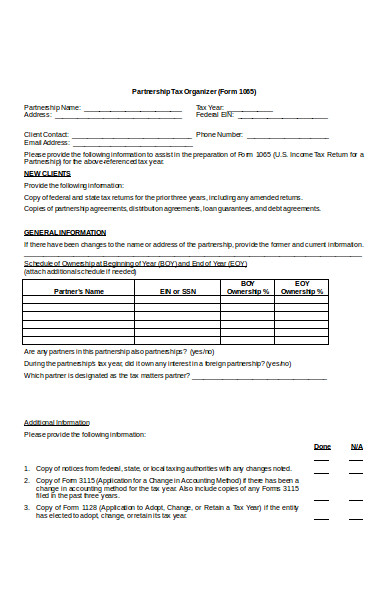

36. Sample Partnership Tax Organizer Form

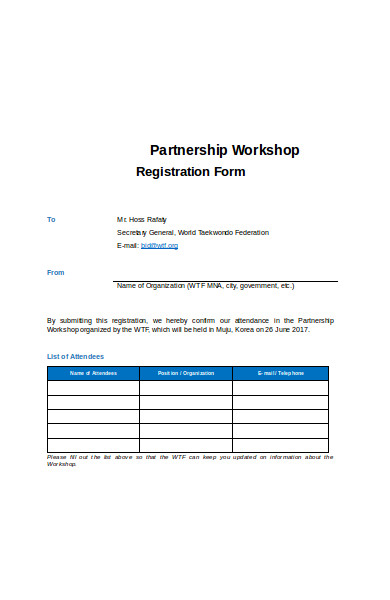

37. Partnership Workshop Registration Form

What Is a Partnership Form?

A partnership agreement form is a business document that presents the legalization of the marriage of two business partners. The agreement form serves to make the legalization process of the union easier. But what does a business partnership entail?

Forming business partnerships is becoming a trend nowadays for most entrepreneurs. This strategic trend stems from the idea that everyone is going digital, and the concept indicates that processing information is much faster than before. It entails a broader scope and more work to be done. And thus, most entrepreneurs are opting to form business partnerships than going solo.

But aside from the practical aspect, forming business partnerships is also about fostering connection and growth. The union denotes that connecting with people is the primary goal of the digital age. In time, if one properly tends to communicate with the business partner, then there will be growth in one’s network and customers. Entrepreneurs are keen on this method of fostering company growth through connection and are looking forward to its positive results.

The Pros and Cons of a Business Partnership

As John Donne once said, “No man is an island.” It is difficult to progress in life when a person is alone. Humans are social by nature and tend to be more productive when with people. In business, entrepreneurs thrive in forming more partnerships with others that they can trust. Gaining more business partners helps entrepreneurs obtain more benefits and more customers.

However, with benefits also come the drawbacks of the union. Before one gets the partnership form notarized, one must be mindful of the results of the unification so an assessment can happen. Listed below are some of the pros and cons that come with a business partnership.

Pros of the Business Partnership

A business partnership is a cornucopia of possibilities. There are many positive outcomes that one can gain from the unity of two entrepreneurial minds. One distinct advantage is the financial aspect. In terms of capital, it is no problem to begin a business since start-up costs are low, and also there is a tremendous amount of money for the business’s capital. And also, the tax is not a problem since the partners can split the payment.

Another advantage is the management of the business and the workers. Managing a business and the workers can be tiresome. But with a business partner, the job becomes much easier to handle. Both partners can agree with another as to which areas and portions of the business will each monitor. But despite these positive possibilities, there are also downsides to the union.

Cons of the Business Partnership

One distinct disadvantage of having a business partner is the sharing of debts. If one of the business partners incurs a debt, all the others share the liability. And this sharing also applies to how a business partner is liable for the actions of the others.

In turn, when one disadvantage occurs after the other, business partners will eventually question the capability of the other, and disagreements happen. And when arguments become a big issue, the business partners will resort to part ways. And the hassle is then the valuing of all the assets and liabilities of the shared business.

Partnerships Come in Various Forms

The nature of an agreement is always never unconditional. When two entrepreneurs come together and form a partnership, there might be terms and conditions that come along with it. Business-minded people may be adventurous with business ideas, but they are also wary and mindful of the consequences and dangers that accompany it. So before agreeing to form a business partnership, both parties converse first.

Each entrepreneur talks about what the terms and conditions that they want to set for the partnership. And because of this, various types of business partnerships formed. And it is highly relevant that both partners must state in a partnership form the nature of their agreement.

- General Partnership – This type of partnership is easy to create since it begins when both parties start the business. This type requires fewer costs since there is no formation filing and ongoing fees involved in the process. But this type requires both of the partners to participate in any business activity actively.

- Limited Partnership – This type of business partnership includes both general and limited partners. In this setup, the limited partners do not need to participate in the activities, for they function merely as investors, who provide monetary help in exchange for acquiring a portion of the business’s profit.

- Limited Liability Partnership – All partners in this type have limited liabilities. Most partners are service-giving businesses such as accountants, doctors, attorneys, architects, and many more professions that the state recognizes.

How to Process a Partnership Form

Forming a relationship with another person is already difficult on its own, but creating a business partnership is harder. The process of filing for the partnership document is not a trip to the candy store as it entails various requirements. If you are new at this, you need not worry, for we got your back. We prepared a helpful guide that is easy to understand. It will help you know and understand the process of filing the document.

Step 1: Converse With Your Business Partner

The very first thing you need to do is to talk to your business partner. Discuss the terms and agreements of the partnership openly and take note of it too. Include in your conversation the business name, location, capital, and many more. And then, once everything is okay, make a partnership agreement, listing all the things that both of you discussed.

If you have no idea how it looks, you can download a template on the Internet. There are loads out there. Make sure that after you created the agreement form, both of you must affix your signatures to state that both parties agree with what is on the paper.

Step 2: Contact a Local Government Office

You must then contact the local government office that deals with business partnerships and ask for an appointment. The agreement form is not the document that will secure your business partnership, but it is a requirement to acquire the partnership forms from the local government office.

You need to obtain the partnership form, for it is proof that the local government acknowledges your business union. Sure enough, the office will ask you to obtain other valid IDs and permits before they will allow you to get a partnership form. So take note of what the local government will say regarding the requirements.

Step 3: Fill Out the Partnership Documents

After you have securely gathered the needed requirements for the partnership forms, then you must fill it out. But before you do, check all the sections of the partnership sample form for any errors that might be evident. By doing so, it will save you the time of having to contact the local government office to ask them regarding the fault.

When all the sections are good to go, fill out the partnership form with all the data the office needs. But do it carefully so you will not make a mistake in placing the wrong information.

Step 4: Have the Partnership Form Notarized

Submit the document to the local government officials so they can check it and then input it into their systems. When they give the material back, always check if the paper has a stamp or any form of legalization on it. The paper must have a signature or seal to present it as valid proof that the state accepts the unity of the business partners.

If it doesn’t, talk to the officials again and ask on how you can have it notarized. There might be a different process for the notarization, so asking is the right way.

Step 5: Pay the Required Amount for the Partnership

Always suspect that there is a fee for the filing and formation process of the business partnership. The process is a legal one, and thus, there must always be a specific amount that you must pay in exchange for the legalization of your business partnership to the public eye.

If you have no idea how much is the payment, ask the local government officials for the exact amount of the legalization process of the business partnership.

The world is changing, and competition is getting fiercer. Some businesses do not last long in the field because in the digital age, for a company to expand and grow, it needs the help of other companies. Some businesses form a pact to help them survive, and with the help of partnership forms, the process becomes more manageable. Survival is critical in the financial world. And it is already a trend that companies merge their ideas and assets to be able to continue in the competition. Because if they don’t, then they too will fall like the other businesses that did not.

Related Posts

-

FREE 32+ Holiday Forms in PDF | MS Word

-

FREE 30+ Nonprofit Forms in PDF | MS Word

-

FREE 31+ Therapy Forms in PDF | MS Word | XLS

-

FREE 52+ Bid Forms in PDF | MS Word | XLS

-

FREE 32+ Communication Forms in PDF | MS Word | XLS

-

FREE 44+ E Commerce Forms in PDF | MS Word

-

FREE 30+ Animal Shelter Forms in PDF | MS Word

-

FREE 34+ Charity Forms in PDF | MS Word | Excel

-

FREE 35+ Advertising Forms in PDF | MS Word | XLS

-

FREE 53+ Sports Forms in PDF | MS Word | Excel

-

FREE 51+ Payment Forms in PDF | MS Word | Excel

-

FREE 52+ Subscription Forms in PDF | MS Word | Excel

-

FREE 50+ RSVP Forms in PDF | MS Word

-

FREE 50+ Recommendation Forms in PDF | MS Word

-

FREE 52+ Abstract Forms in PDF | MS Word | Excel